9-8 #WTH : vivo has officially launched its first self-developed ISP chip vivo V1; Qualcomm is working with Google and Renault to design an in-vehicle experience; LG Chem has developed Real Folding Window technology; etc.

Huawei has reportedly got access to two other Qualcomm Snapdragon platforms other than Snapdragon 888. These are Snapdragon 778G and the upcoming SM8450 (or Snapdragon 898). (Gizmo China, Weibo, IT Home)

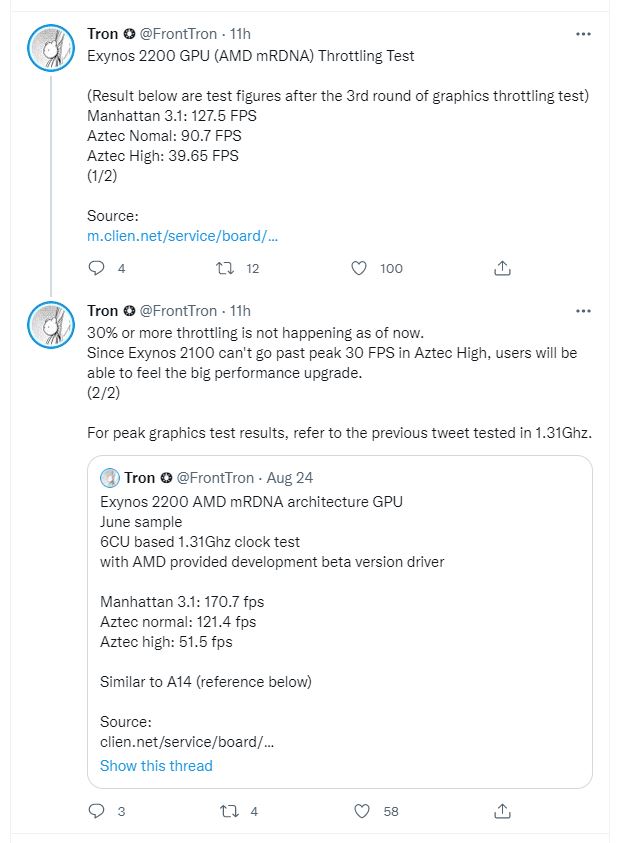

Samsung’s Galaxy flagship phones from the S series will launch with AMD’s GPU. This Exynos x AMD collaboration might not only be limited to the S series and could also come to the future Galaxy A phones as well. Samsung will couple a mid-range Exynos chipset with mRDNA graphics from AMD. (CN Beta, WCCFtech, Clien, Notebook Chek)

According to the latest data from Auto Forecast Solutions (AFS), due to the intensified global automotive chip shortage, as of 29 Aug 2021, the global auto production has been reduced by 6.887M units, an increase of 445,000 units from last week. AFS also predicts that car production will be reduced in 2021 by 8.107M vehicles. In mid-Aug, AFS estimated that this number was still 7.1M vehicles. Among them, North America is expected to reduce production by 2.465M vehicles, Europe is expected to reduce production by 2.293M vehicles, and China is expected to reduce production by 1.66M vehicles. (Auto News, Auto Bala, CN Beta)

Daimler AG’s chief executive officer Ola Källenius has cautioned that the global semiconductor shortage may not entirely go away in 2022 and could take until 2023 to be resolved. Daimler has recently cut its annual sales forecast for its car division, projecting deliveries will be roughly in line with 2020, rather than up significantly. (CN Beta, Reuters, Bloomberg)

Quantum Machines, an Israeli startup that is building the classical hardware and software infrastructure to help run quantum machines, has announced a USD50M Series B investment. The company has now raised approximately USD83M. The funding would help the company to expand its growth into quantum cloud computing and drive its worldwide distribution for its key products–the Quantum Orchestration Platform (QOP) and the QUA programming language. (TechCrunch, Quantum Computing, Fierce Electronics)

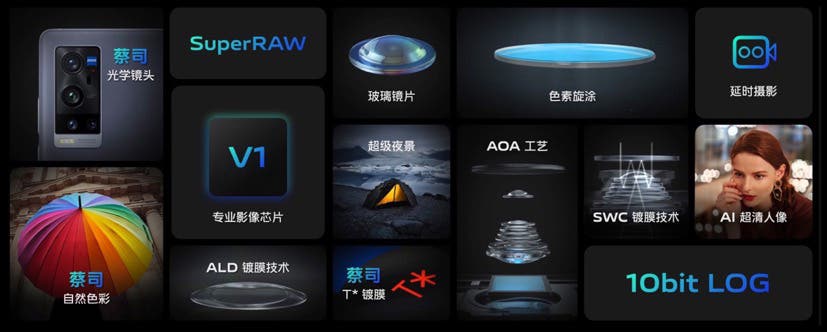

vivo has officially launched its first self-developed image signal processor (ISP) chip vivo V1. The company claims that the new V1 chip offers high computing power, low latency, and low power consumption. It can process complex calculations at high speed like CPU, but also complete parallel processing of data like GPU and DSP. vivo has optimized the data storage architecture as well as the high-speed read and write circuits inside the chip to maximize simultaneous processing capacity. It can achieve an equivalent of 32MB large cache with on-chip storage. (GizChina, Gizmo China, IT Home, My Drivers)

The price of chips, and the electronic devices they power, are on track to rise into 2022 as the world’s biggest contract chipmaker joins its rivals in ramping up production fees. Prices of semiconductors have been climbing since 4Q20 amid a global supply crunch. TSMC was reportedly preparing its biggest price hike in a decade still came as a shock to some, bringing home just how entrenched chip price inflation has become. According to Dale Gai, research director of Counterpoint Research, chip developers are paying 40% higher production fees for legacy chips that are in the shortest supply. (CN Beta, Nikkei Asia, article)

Qualcomm has announced that the company is working with Google and Renault to design an in-vehicle experience for Renault’s next-generation electric vehicle, the new Mégane E-TECH Electric. Renault Group will utilize the 3rd Generation Snapdragon Automotive Cockpit Platforms from Qualcomm Technologies to power the vehicle’s technically advanced infotainment system. (Gizmo China, Reuters, Qualcomm)

According to BMW CEO Oliver Zipse, BMW expects supply chains to remain tight well into 2022. He expects that the general tightness of the supply chains will continue in the next 6 to 12 months. (CN Beta, Reuters, Bloomberg, Motor1)

The city of Taylor, Texas — one of two locations in the state under consideration by Samsung Electronics for a USD17B chip plant – plans to offer extensive property tax breaks if it is chosen by Samsung. Samsung has also said it is looking at other potential sites in Arizona and New York. (Neowin, Reuters)

Intel CEO Pat Gelsinger says Intel could invest as much as EUR80B (USD95B) in Europe to expand chip production. He has also indicated the chip giant could open its chip plant in Ireland to car makers, to help ease the pain and shortages the car industry continues to feel. (CN Beta, Reuters, Silicon)

Intel CEO Pat Gelsinger predicts the “digitization of everything” will push the share of semiconductors in the total new premium vehicle bill of materials (BOM) to more than 20% by 2030 – up more than 5X from 4% in 2019. The total addressable market (TAM) for automotive silicon will more than double by the end of the decade to USD115B – approximately 11% of the entire silicon market. (CN Beta, Intel, Sina)

Driven by the rapid growth of 5G smartphones, global smartphone AP (Application Processor) / SoC (System on Chip) chipset shipments grew 31% YoY in 2Q21, according to Counterpoint Research. In 2Q21, 5G smartphone shipments grew almost 4 times compared to the same period a year ago. MediaTek has dominated the smartphone SoC market with its highest ever share of 43%, driven by a competitive 5G portfolio in the low-mid segment and without major supply constraints. (GSM Arena, Counterpoint Research)

Mosun Semiconductor is established with a registered capital of CNY100M, and its business scope includes integrated circuit design, IC chip design and services, integrated circuit chip and product sales, etc. The company is indirectly wholly owned by TCL Technology. (Laoyaoba, EET China)

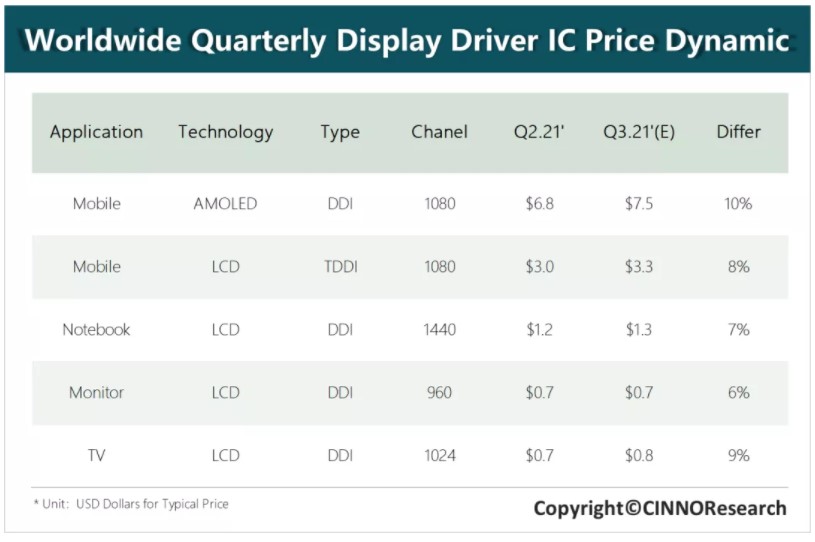

According to CINNO Research, the upstream foundry capacity of OLED driver chips is monopolized by South Korea and Taiwan, and the 3 major fabs of Samsung, TSMC and UMC provide 90% of the wafer capacity supply. In mature processes such as 40nm and 28nm, SMIC, Huali Micro and other new production capacity cannot be released in the short term. More importantly, due to the impact of gross profit margin, CMOS image sensors, radio frequency components, Bluetooth chips and other products have squeezed out OLED driver chips production capacity, the OLED mobile phone panel driver chip market is still facing supply and demand problems. The growth rate of driver chip prices in 3Q21 has slowed overall. Among them, the price of mobile OLED DDIC increased by 10% month-on-month, the price of IT-side driver chips increased by 6%-7%, and the price of TV-side driver chips maintained a month-on-month increase of about 9%. (CN Beta, CINNO)

LG Chem has developed Real Folding Window technology. It takes the form of a specially developed coating atop thin polyethylene terephthalate (PET) plastic film. LG Chem adds that the material is thinner than existing tempered glass but has the same hardness while being as flexible as plastic. LG Chem says durability is “maintained completely” after the Real Folding Window is folded 200,000 times. (Android Authority, The Verge, LG, CN Beta)

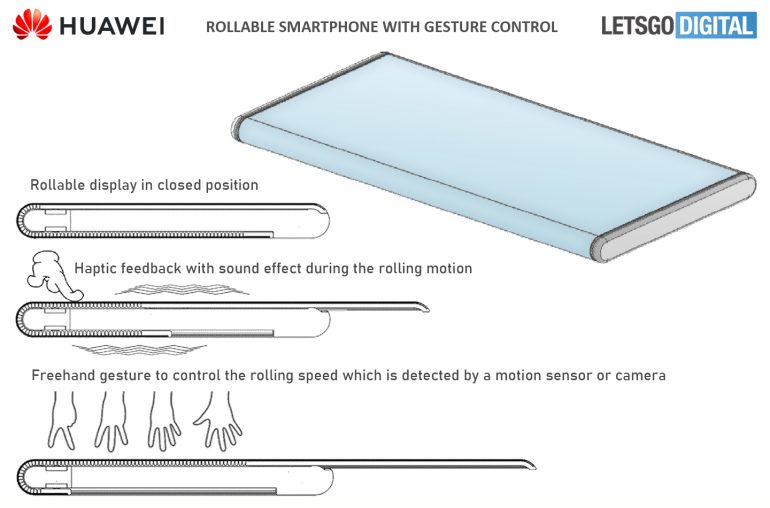

Huawei has filed a patent with the World Intellectual Property Organization (WIPO) for a new method for a “controllable foldable display with haptic and sound effect”. The patent outlines a method that allows users to operate this rolling out or extending panel mechanism, through the use of touch movements (or hand gestures on the screen), which Huawei has subbed as “freehand gesture control”. (Gizmo China, LetsGoDigital)

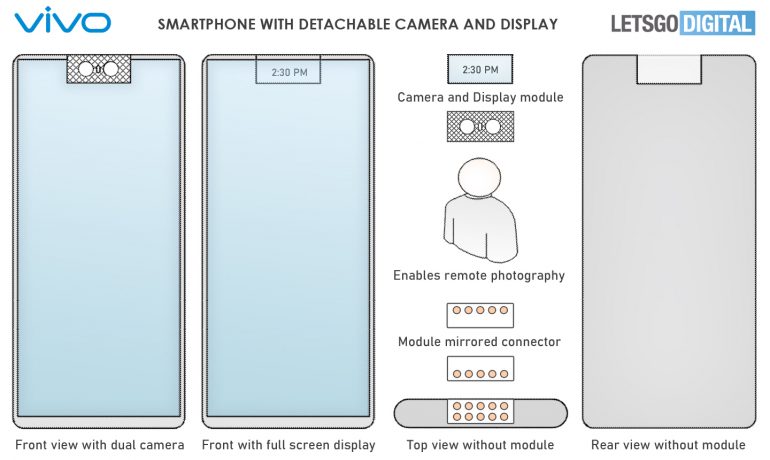

vivo has filed a new patent of a phone with detachable camera module with touch display. The module sports a touch enabled display on one side, while the other sports a dual cameras along with a flash in between the two image sensors. This detachable module is housed on the top center of the smartphone’s notch area and is magnetically held in place. (Gizmo China, LetsGoDigital, CN Beta)

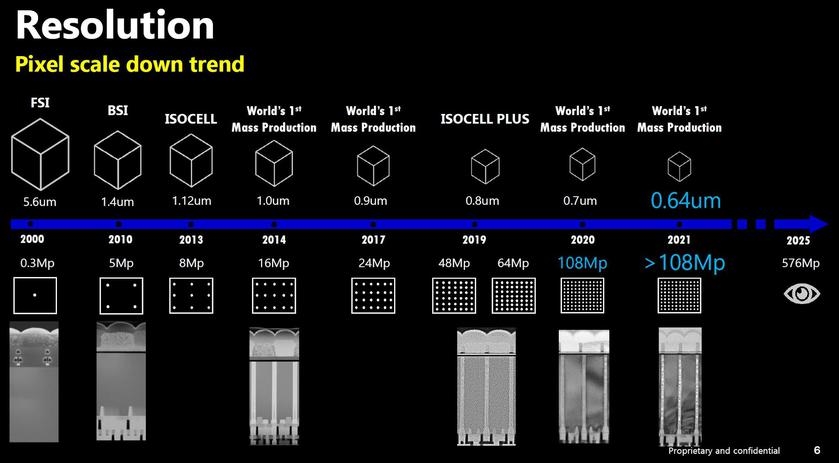

Samsung released the world’s first mass-produced 108MP mobile camera sensor in 2019. The company has recently unveiled the world’s first 200MP mobile camera sensor, the ISOCELL HP1. Samsung’s Senior Vice President and Head of Automotive Sensors, Haechang Lee, has unveiled plans to release a 576MP smartphone sensor by 2025. (CN Beta, SamMobile, DP Review, Image Sensors World)

LG InnoTek will take over some of the supply volume from Sharp for camera modules provided to Apple. This is from the Sharp’s factory in Ho Chi Minh, Vietnam being shut down recently due to the outbreak of COVID-19 there. Meanwhile, LG InnoTek’s factory at Haiphong, Vietnam has not been affected. Apple has also ordered 20% more components for the iPhone 13 compared to iPhone 12. (My Drivers, CN Beta, The Elec)

OPPO is allegedly working with Kodak to produce a smartphone that pays tribute to the classic Kodak camera design. It features Sony IMX766 50MP 1/1.5” sensor with 13MP telephoto for 2x optical zoom and 3MP microscope camera. (GSM Arena, Weibo)

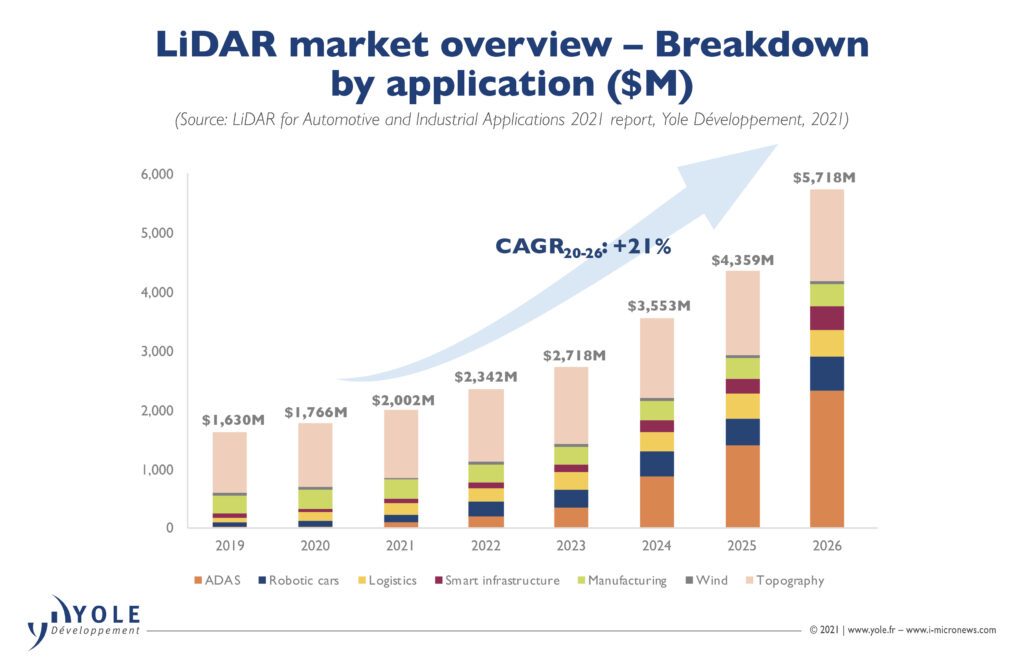

According to Yole Development, the lidar market for automotive and industrial applications is expected to reach USD5.7B by 2026, with a compound annual growth rate of 21% from 2020 to 2026. In 2020, lidar in advanced driver assistance systems (ADAS) will only account for 1.5% of the automotive and industrial lidar markets, but by 2026, the proportion of ADAS is expected to reach 41%. (Huawei Update, Laoyaoba, Yole Development, press)

Hyundai Motor Group plans to offer hydrogen fuel cell versions for all its commercial vehicles by 2028 and will cut the price of fuel cell vehicles to battery electric levels 2 years later. The group, which comprises Hyundai Motor and Kia Corp currently has one fuel cell bus and one fuel cell truck, the Xcient Hyundai, on the market. There are 115 of the buses on the road in South Korea and 45 of the trucks in operation after they were rolled out in Switzerland in 2020. (TechCrunch, CNBC, Reuters)

SK Innovation has signed on to supply Xpeng Motors with batteries containing 80% nickel. SK Innovation has seized the opportunity to increase the supply of ‘Nickel, Cobalt, Manganese’ (NCM) batteries, which have increased the proportion of nickel, along with the expansion of the Chinese EV battery market. SK Innovation’s batteries for Xpeng will be produced at factories in Huizhou, Guangdong Province. The Huizhou plant is SK Innovation’s third battery plant in China. It has an annual capacity of 10GWh. (CN Beta, KrAsia, ET News)

Volkswagen CEO Herbert Diess is optimistic it has enough funding, internal or external, to meet its ambitious plan to build 6 large battery factories across Europe with partners by the end of the decade. Swedish battery cell maker Northvolt, in which Volkswagen holds a 20% stake, raised USD2.8B in Jun 2021 in one of the largest private placements in Europe, led by four Swedish pension funds and OMERS Capital Markets. (CN Beta, Reuters, Business Hala)

Toyota Motor Corp has said it expected to spend more than USD13.5B by 2030 to develop batteries and its battery supply system, in a bid to take a lead in the key automotive technology over the next decade. Recognized as a leader in battery development for electric vehicles Toyota aims to reduce battery costs by more than 30% by working on the materials used and the structure of the cells. (Laoyaoba, Reuters, Autobala)

Solid Power, a battery developer backed by Ford and BMW, is expanding its Colorado-based factory footprint as it prepares pilot production of its solid state batteries early 2022. The new production facility will be dedicated to manufacturing one of the company’s flagship products, a sulfide-based solid electrolyte material, by up to 25 times its current output. (CN Beta, Globe Newswire, TechCrunch)

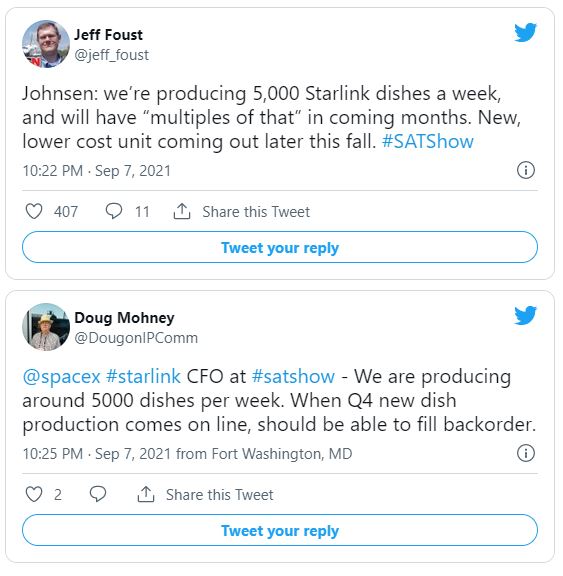

SpaceX’s chief financial officer and president of its strategic acquisition group Bret Johnsen has revealed that arlink is currently manufacturing 5,000 user terminals in a week and will introduce newer and cheaper terminals later 2021. (CN Beta, Space News, PC Mag, WCCFTech)

The German federal government is pushing the European Union to require 7 years of security updates and spare parts for smartphones as part of negotiations with the European Commission (EU). That is 2 years longer than a recent EU’s proposal. The EU’s proposal, potentially in effect by 2023, is meant to help the environment by letting you keep phones for longer. They would stay protected and functional for roughly twice the 2.5-3.5 years of today. (Engadget, C’t, GizChina)

According to a Uswitch study which polled 2,000 UK adults in Aug 2021, an estimated 10M Brits are planning to buy Apple’s upcoming iPhone 13 over the course of the next 12 months. One of the most important features for the new iPhone 13 is a longer-lasting battery (35%), while a lower price than last year’s model is the next most desirable (34%). The study has also found that over a third (38%) of Brits have a loyalty to buying Apple phones, with 42% impressed with the ease of using an iOS device. (Apple Insider, Mobile News, CN Beta)

TCL 20Y is announced in Republic of Ghana – 6.52” 720×1600 HD+ v-notch, MediaTek Helio A25, rear tri 48MP-2MP macro-2MP depth + front 8MP, 4+64GB, Android 11.0, rear fingerprint, 4000mAh, GHS799 (USD132). (Gizmo China, TCL)

vivo Y21s is launched in Indonesia – 6.5” 720×1600 HD+ v-notch, MediaTek Helio G80, rear tri 50MP-2MP macro-2MP depth + front 8MP, 4+128GB, Android 11.0, 5000mAh 18W, side fingerprint, IDR2.799M (USD197). (Gizmo China, vivo, MySmartPrice)

TCL 20 R 5G is announced in Europe – 6.52” 720×1600 HD+ v-notch 90Hz, MediaTek Dimensity 700 5G, rear tri 13MP-2MP depth-2MP macro + front 8MP, 4+64 / 4+128GB, Android 11.0, rear fingerprint, 4500mAh 10W, from EUR179. (GSM Arena, Mobile World Live, Gizmo China)

Feng Xingya, general manager of GAC Group, has said that the company plans to achieve 3.5M vehicle sales in 2025, and the sales of new energy vehicles account for more than 25%; Among them, the sales volume of independent brands has reached 1M, fully realize electrification, strive for new energy vehicles to account for 50% of independent brands, and the proportion of vehicle networking carried by new energy vehicles to reach 100%. (My Drivers, Sina, CN EV Post, Equal Ocean)

The Mercedes-Benz G-Class will gain an electric variant by 2025 in the rugged SUV’s most radical transformation since it first appeared in 1979. Mercedes-Benz has revealed an electric concept version of its boxy luxury off-roader, the G-Wagen, which is officially known as the Concept EQG. (The Verge, Mercedes-Benz, Daimler, CNET, Autocar)

Volkswagen Commercial Vehicles, a standalone VW brand responsible for the development and sales of light commercial vehicles, and Argo AI, an autonomous driving technology company, have unveiled the first version of the ID Buzz AD (Autonomous Driving). (TechCrunch, Forbes, Bloomberg)

Volkswagen has showcased ID LIFE, a fully electric small car to be launched in 2025 at a cost of around EUR20,000 euros (USD23,730) in a bid to make battery-powered cars affordable for the masses and younger generations. (Engadget, Motor1, Volkswagen, Reuters)

Intel subsidiary Mobileye and rental car giant Sixt SE plan to launch a robotaxi service in Munich in 2022. The robotaxi service is leveraging all of Intel’s, and more specifically Mobileye’s, assets that have been in development or purchased in recent years, including the USD900M acquisition in 2020 of Moovit, an Israeli startup that analyzes urban traffic patterns and provides transportation recommendations with a focus on public transit. (CN Beta, The Verge, TechCrunch, Intel)

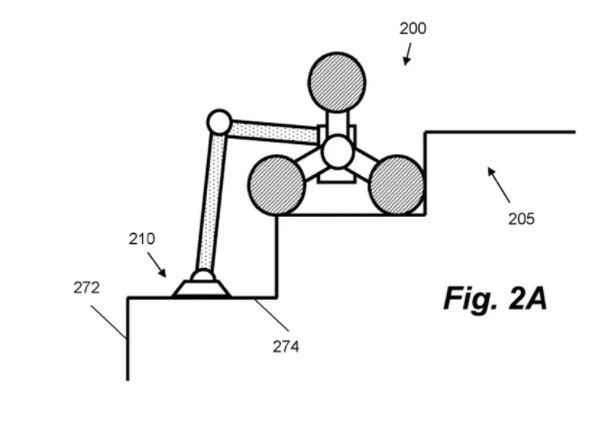

Dyson has patented designs for robots that look like they could climb and clean stairs, and open drawers. Dyson’s robotic unit has been working on a robot to interact with other home appliances. (The Verge, Bloomberg, IPO)

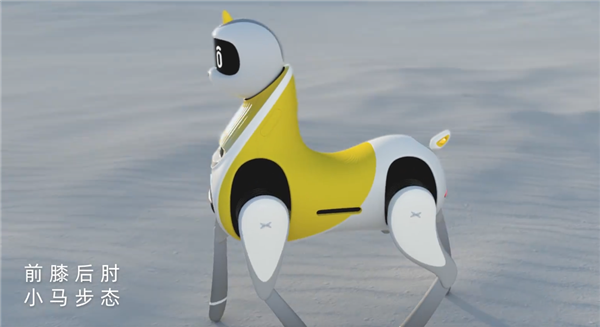

Xpeng Motors has said it plans to release a four-legged robot pony for children, which it hoped would become their first smart vehicle. The company has said that Xpeng Robotics, which designed the robot, will also help build a robotic ecosystem based on the start-up’s smart EV business. The smart pony, called Little White Dragon, is equipped with power modules, motion control, intelligent navigation and intelligent emotional interaction capabilities. (My Drivers, IT Home, iFanr, Engadget, SCMP)

Indian crypto exchange CoinSwitch Kuber is in advanced stages of talks to raise a new financing round at up to USD2B in valuation. If the talks materialize in a deal, CoinSwitch Kuber will become the second crypto startup in the world’s second largest internet market to attain the unicorn status. (TechCrunch, Coin Telegraph)

BP Ventures, the investing arm of oil and gas giant BP, has announced a EUR10M (~USD11.9M) investment in Ryd, a German in-car digital payments provider. The company offers a convenient single digital payment solution for drivers, for services such as fuel purchases, electric vehicle (EV) charging and car washing, via its app or through integration with smart car systems. (TechCrunch, Finextra, BP)

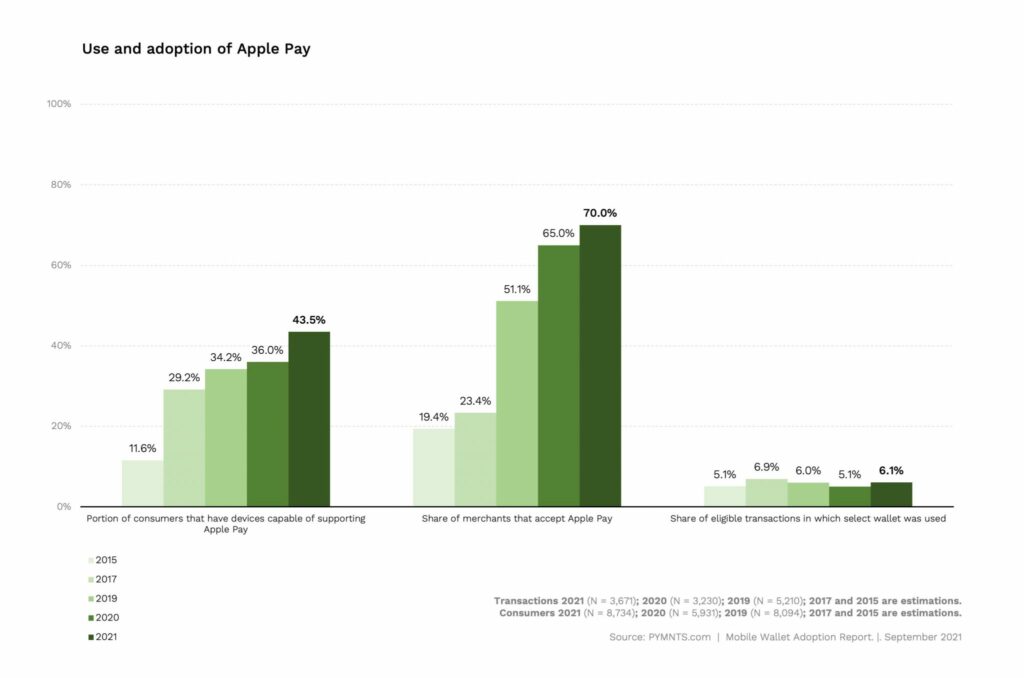

Only 6% of Apple iPhone users in the United States who have Apple Pay set up actually use the feature, according to a detailed study by PYMNTS. Seven years after Apple Pay launched in Sept 2014, 93.9% of consumers with Apple Pay activated on their iPhone do not use it to pay for in-store purchases, meaning that only 6.1% do. (MacRumors, PYMNTS)

PayPal Holdings has announced that it has agreed to acquire Paidy, a leading two-sided payments platform and provider of buy now, pay later solutions in Japan, for JPY300B (USD2.7B, principally in cash. The acquisition will expand PayPal’s capabilities, distribution and relevance in the domestic payments market in Japan, the third largest ecommerce market in the world, complementing the company’s existing cross-border ecommerce business in the country. (Engadget, Bloomberg, CN Beta, PR Newswire)