9-18 #Home : TCL will invest more than CNY20B (USD3.1B) in the next 5 years; Infineon has announced the opening of its new EUR1.6B, 300mm, or 12” wafer semiconductor factory; Samsung SDI is reviewing potential ways to secure funding to invest in its battery business; etc.

As Mexico aims to boost its manufacturing of semiconductors, it may build production facilities in its southern states, where much-needed water is available, according to Economy Minister Tatiana Clouthier. Mexico and the United States have agreed to create bilateral working groups on supply chains for semiconductors, as well as on medical devices and pharmaceuticals. (Laoyaoba, Reuters, US News, Yahoo)

Song Chunxiao, a business analyst at Baidu Kunlun, has said that Kunlun is the only chip in China that has been tempered by a large-scale core algorithm on the Internet, with more than 20,000 chips produced. He has said that the front-end and back-end design of a chip takes 1-3 years, and the tape-out process after the design is completed takes 3-6 months. If the tapeout is successful, it still needs 3-12 months of testing and tuning to achieve the final mass production. (Laoyaoba, IEEE)

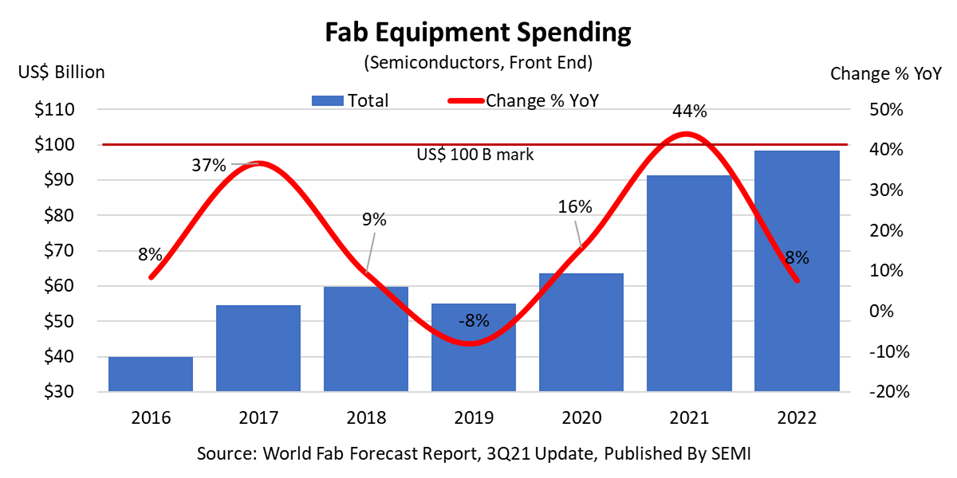

Powered by digital transformation and other secular technology trends, global semiconductor equipment investments for front end fabs in 2022 are expected to reach nearly USD100B to meet soaring demand for electronics after topping a projected USD90B in 2021, both new records, according to SEMI. The foundry sector will account for the bulk of fab equipment investments in 2022, with more than USD44B in spending, followed by the memory sector at over USD38B. Both DRAM and NAND also show large increases in 2022 with jumps in spending to USD17B and USD21B, respectively. (Digitimes, press, SEMI)

US chip vendors have increasingly shifted their orders away from China-based foundries to mitigate potential risks arising from the ongoing trade tensions between the US and China, according to Digitimes. Despite the changes in orders, mainland Chinese foundries have managed to allow other fabless customers (mainly customers in mainland China and Taiwan) to immediately fill the capacity gap left by American customers. (Laoyaoba,UDN, Digitimes)

China-based Vanchip Technologies, a subsidiary of MediaTek, is partnering with IC distributor WPG and GaAs foundry Win Semiconductors to promote its Wi-Fi 6 RF front-end modules (RF FEM) including power amplifier (PA), according to Digitimes. WPG will channel sales of Vanchip’s new RF-FEM offerings through its affiliated distributor AIT, and Win Semi will fabricate Wi-Fi 6PA devices for the chip vendor. Vanchip’s RF FEM modules can be paired with mainstream MCU chips offered by Qualcomm, Broadcom, MediaTek, Intel and HiSilicon. (Digitimes, press, SEMI.org)

TCL has indicated that over the next five years it will invest more than CNY20B (USD3.1B) in the fields of smart terminals, semiconductor display and materials, semiconductor photovoltaics and semiconductor materials. It is understood that the CNY20B investment covers the three core businesses of TCL Industrial, TCL CSOT, and Zhonghuan Semiconductor. In 2025, smart device business revenue will reach CNY250B, overseas revenue will account for 60%, and innovation business will account for 30%. (Laoyaoba, Sina, EET China, Pandaily, 163)

Infineon has announced the opening of its new EUR1.6B, 300mm, or 12” wafer semiconductor factory. The fab is in Villach, Austria and has taken 3 years to build. In the first stage of expansion, the chips will primarily be used to meet demand from the automotive industry, data centers and renewable energy generation of solar and wind power. (CN Beta, Tech Power Up, Reuters, Electronics Weekly)

Advanced Micro Devices (AMD) CFO Devinder Kumar has recently commented that AMD stands ready to manufacture ARM chips if needed, noting that the company’s customers want to work with AMD on Arm-based solutions. He has indicated that the company knows compute really well, and they believe x86 is dominant strength in that area. (My Drivers, Tom’s Hardware, TechRadar, Seeking Alpha)

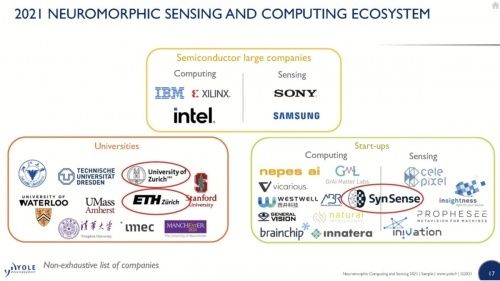

SynSense, a brain-like chip company, has announced that it has completed a pre-B round of financing of nearly CNY200M. This round of financing is mainly used to accelerate the research and development of brain-like chip products and promote the industrialization of brain-like technology in the field of artificial intelligence (AI) edge computing. In Jul 2021, SynSense released Speck, the world’s first dynamic visual intelligence SoC based on brain-like technology, and a development kit. This single-chip SoC chip integrates the DVS sensor array and the unique DYNAP-CNN AI computing core of Time Vision Technology, providing a complete solution for sub-milliwatt-level visual edge AI computing. (Laoyaoba, Deal Street Asia)

SemiDrive has stated that the company has reached a strategic cooperation with TINNOVE. In the future, the two parties will cooperate in the field of smart cockpits. Both companies will rely on the X9 series of smart cockpit chips from SemiDrive and TINNOVE’s leading technology and development experience in the fields of technology base TINNOVE OpenOS, integrated solutions, etc. (Laoyaoba, 36Kr, Sohu, SemiDrive)

King Long Technology (KLT) has held a signing ceremony for the high-end chip test project. This project is the first project to be settled in the Demonstration Zone of Open Innovation and Cooperative Development in Dushu Lake, Suzhou City. The project invests CNY4B, and will introduce advanced test product lines for high-end products such as CMOS image sensors, high-end system-level AI chips, radio frequency/wireless chips, car-regulated autopilot chips, 5G base station chips, etc., to further meet the domestic 5G and ICT new infrastructure markets need. (Laoyaoba, 163, EET-China)

Anhui-based FerroTec’s 12” recycled wafer project has begun mass production. The company has become the first 12” wafer regenerative manufacturing specialized factory in China to enter mass production. The project invests CNY1B, and the realization of mass production will help meet the needs of the semiconductor wafer recycling market at home and abroad. (Laoyaoba, Semiinsights)

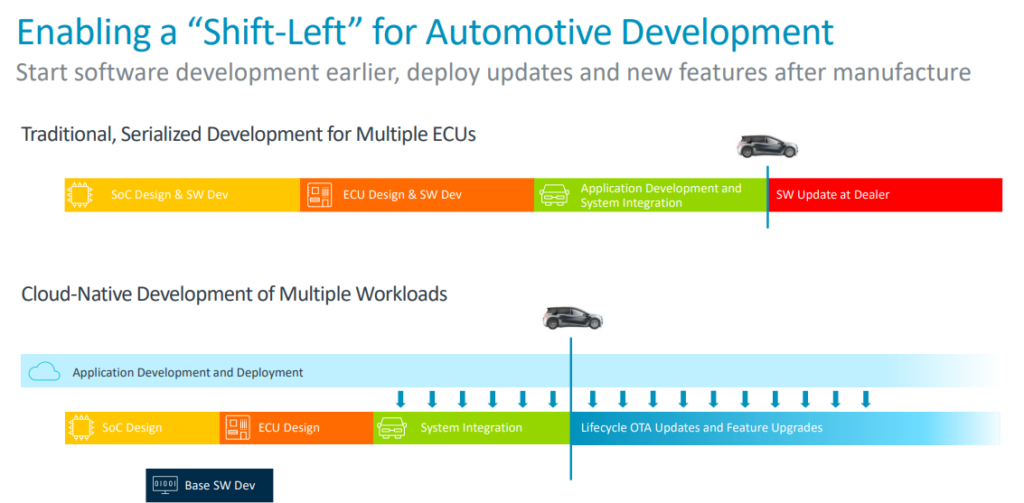

ARM has unveiled new tools to help chipmakers and carmakers develop the “software-defined” automobiles of the future. Software-defined cars are those that can be reprogrammed for different functions using software, even after the vehicles ship to owners. ARM is working with major automobile suppliers and tech firms, including AWS, Continental, Cariad, and more. The car features range from driver-assisted safety measures to self-driving cars. (VentureBeat, ZDNet, ARM)

General Motors (GM) CEO Mary Barra has indicated that the company plans to make changes in its supply chain as it works to address the continuing semiconductor chip crisis that has forced significant production cuts. While GM generally does not buy chips directly, the company is now “building direct relationships” with manufacturers. (CN Beta, Reuters, Detroit News)

Some Taiwan-based LCD driver IC suppliers have claimed their book-to-bill ratios remain above one with clear order visibility through the end of 2021 and even 2022, in response to recent reports indicating LCD panel prices have started falling due to a slowdown in TV and other end-market device demand. Order visibility for 4Q21 stays brisk. The chip suppliers remain optimistic about sales for the rest of 2021. However, the persistently tight foundry capacity has still led to insufficient fab capacities for LCD driver IC suppliers, which may continue to encourage downstream companies to stockpile more available chips. (Digitimes, press, C114, MoneyDJ, Laoyaoba)

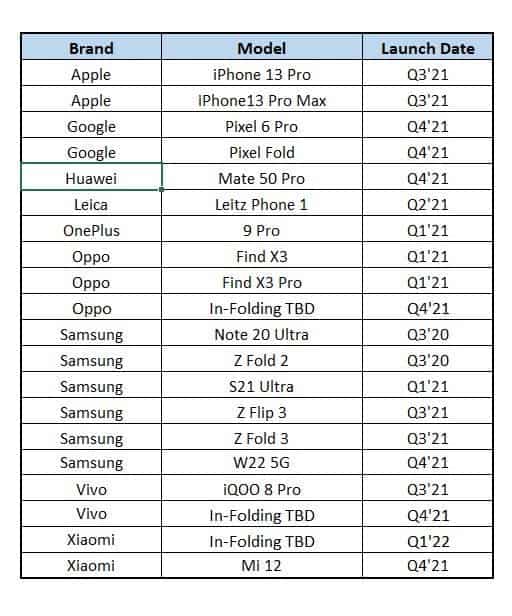

DSCC analyst David Naranjo has posted a list of devices with adaptive 120Hz OLED displays with an indication of their release time. It is noteworthy that foldable smartphones from Google, vivo, Xiaomi and OPPO are among the premieres of 4Q21. (Twitter, GizChina)

Hisense has announced the world’s first rollable screen laser TV. The TV features a big 77” display panel and is powered by the company’s own rolling or curled screen technology and full-color laser technology. It supports 4K ultra-high HDR resolution, 107% BT.2020 ultra-wide color gamut, and 350nits of peak brightness. (Gizmo China, EET China, SMZDM)

OnePlus 9 and OnePlus 9 Pro are getting a major camera update. OnePlus is introducing Hasselblad Xpan mode, which simulates the desirable look of that company’s classic film cameras. The Hassleblad Xpan was an innovative camera that allowed photographers to shoot either standard-format images or ultrawide panoramic images without having to switch film. (Android Authority, Digital Trends)

OPPO has filed a patent that describes a smartphone with a unique camera module that is capable of taking images from the side of the device as well. To take images from the side, the company has a cut out on one side of the device, which will allow the primary lens to basically shift its focus to the side through the use of a mirror. (Gizmo China, LetsGoDigital)

Kioxia has announced it is sampling its FL6 Series enterprise NVMe SCM SSDs. Featuring Kioxia’s SCM solution, XL-FLASH, the dual-port and PCIe 4.0-compliant FL6 Series SSDs bridge the gap between DRAM and TLC-based drives. Based on Kioxia’s BiCS FLASH 3D flash memory technology with 1-bit-per-cell SLC, XL-FLASH SCM brings low latency and high performance to data center and enterprise storage. (Digitimes, KIOXIA, Business Wire, 163)

Xiaomi has partnered with Elliptic Labs and created an AI Virtual Proximity Sensor INNER BEAUTY that has been featured on the new Xiaomi 11T smartphone. The sensor essentially makes use of the AI Virtual Smart Sensor Platform that helps enable software-only sensor solutions that either replace or augment existing hardware sensors. (Gizmo China, Yahoo, Elliptic Labs)

Samsung SDI is reviewing potential ways to secure funding to invest in its battery business. It is reviewing the possibility of splitting off the battery business, called Energy Solution business by the firm. Samsung SDI is planning to spend up to KRW2T in 2021 in its production facilities. (Laoyaoba, Korea Times, The Elec)

SK Innovation has signed a deal worth KRW10.11T with EcoPro BM to procure battery cathode. The pair will also collaborate in the development of cathode material and battery recycling. The pair’s contract will last from 2024 to 2026. The new deal is an addition to their existing deal. In Feb 2020, SK Innovation had said it will procure KRW2.7T worth of high-nickel NCM cathode from EcoPro BM up to 2023. (The Elec)

Apple has redesigned the packaging for the iPhone 13 lineup to eliminate the traditional outer plastic wrap on the box, a change that will avoid creating 600 metric tons of plastic waste. Belkin is announcing that its new lineup of screen protectors for the iPhone 13 family will arrive in packaging made entirely of recycled plastic water bottles and forest certified paper. (MacRumors, Belkin)

Harman International, a wholly-owned subsidiary of Samsung Electronics, focused on connected technologies for automotive, consumer and enterprise markets, has announced the launch of a new line of non-audio products and power accessories under the brand InfinityLab. Built with sustainability in mind, the core range of InfinityLab products are made from 90% recycled plastic and include eco-friendly wall chargers, power banks, wireless stands and a speakerphone for crystal-clear calling. USB-A, USB-C and Lightning cables woven from recycled polyester yarn will also be available. (Gizmo China, Business Wire, Engadget)

Infinix HOT 11S and 11 are launched in India: 11S – 6.78” 1080×2400 FHD+ HiD IPS LCD 90Hz, MediaTek Helio G88, rear tri 50MP-2MP depth-AI lens + front 8MP, 4+64GB, Android 11.0, rear fingerprint, 5000mAh 18W, INR10,999 (USD150). 11 – 6.6” 1080×2400 FHD+ v-notch IPS LCD, MediaTek Helio G70, rear dual 13MP-2MP depth + front 8MP, 4+64GB, Android 11.0, rear fingerprint, 5200mAh 10W, INR8,999 (USD122). (Gizmo China, NDTV, Flipkart)

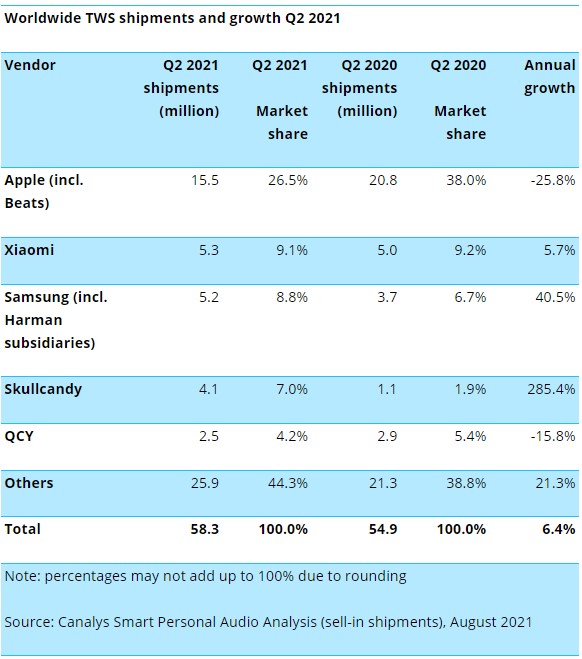

After strong double digit shipment growth in the past quarters, TWS shipments seem to be reaching a peak, with growth at 6.4%, reaching 58.3M units shipped in 2Q21, the lowest figure in 3 years. The global smart personal audio market grew 4.7% overall as shipments reached 99.8M units in 2Q21. Apple, the leader in the smart personal audio market saw its first decline ever showing clear signs of a slowdown. Shipments of AirPods TWS devices fell 25.7% to reach 15.0M units in 2Q21, contributing to the slower than usual growth of the overall TWS market this quarter. (Laoyaoba, Canalys)

GoPro has announced HERO10 Black. The main update for the camera is a brand new processor inside, called the GP2, which enables big improvements to image quality and video captures, including recording at 5.3K revolution at up to 60 frames per second, 4K video capture bumped to a max of 120 FPS and 2.7K video at 240 FPS, which enables awesome slow-mo capabilities. It is priced at USD399.98 with a bundled one-year GoPro subscription or for existing subscribers. (Pocket-Lint, CN Beta, TechCrunch)

Denon has launched two new sets of TWS, AH-C630W and AH-C830NCW. The main difference between the two is that the AH-C830NCW has active noise reduction, insertion detection and Google quick pairing functions while the latter does not. The AH-C830NCW has an unusual oval shape with a size of 11×10 mm. All have built-in 10mm dynamic drivers, but the latter has also been made into an oval shape. The retail price of AH-C630W is expected to be approximately USD95, and the price of AH-C830NCW is approximately USD185. (CN Beta, Techspot, PR Times)

Marshall releases 2 new sets of TWS. Motif ANC buds, priced at USD199, have 6mm dynamic drivers with driver sensitivity of 106(plus or minus 2) dB SPL, 16 Ω impedance, and frequency response between 20Hz-20kHz. These buds have 2 microphones in each earbud for ANC, and 1 in each earbud ready for phone calls. Minor III, priced at USD129, work with 12mm dynamic drivers with driver sensitivity of 93 dB SPL, 32 Ω impedance, and frequency response between 20Hz-20kHz. They’re ready to roll with one microphone and remote in each earbud and Bluetooth 5.2 with a Bluetooth range of 10m. (CN Beta, Engadget, What HiFi, SlashGear)

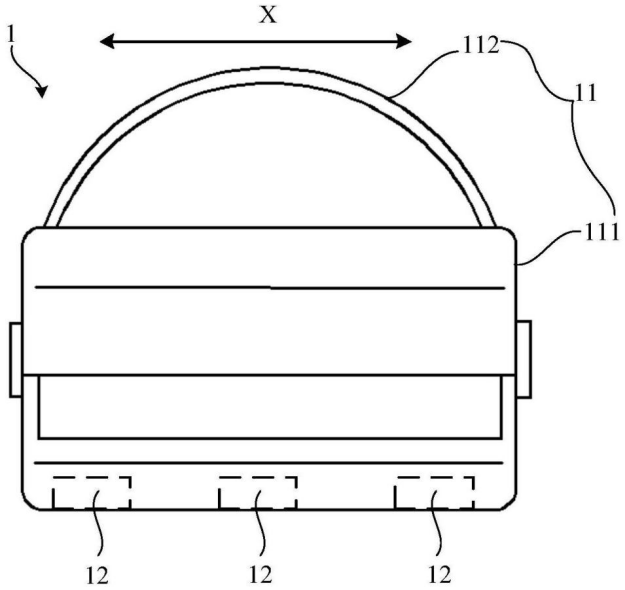

Huawei has filed a patent titled “a head-mounted display and virtual reality system”. The head-mounted display (VR) includes a head-mounted display main body and a first magnetic structure fixed to the head-mounted display main body, and the first magnetic structure is configured to be independent of the head-mounted display. The second magnetic structure attracts or repels, so that the head-mounted display receives an upward magnetic force. (Laoyaoba, Sina, Sohu, Huawei Update)

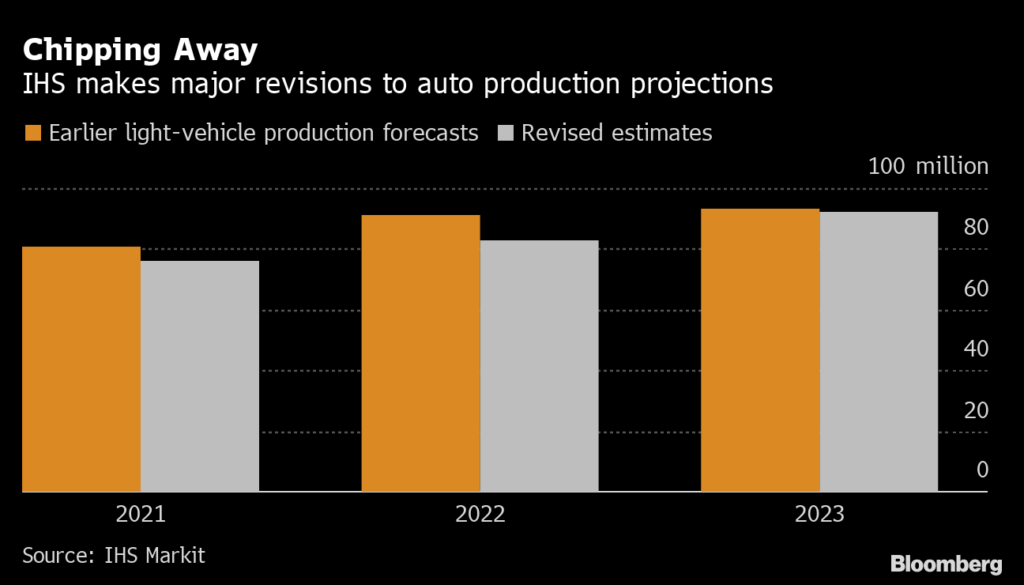

The IHS Markit forecast has been cut by 6.2% or 5.02M units in 2021, and by 9.3% or 8.45M units in 2022, to stand at 75.8M units and 82.6M units, respectively. For 2023 they have reduced the forecast by 1.05M units or 1.1% to 92.0M units; this is a front-loaded adjustment and from 2Q21 they expect output levels will be able to accelerate as supply chains return to normal. (CN Beta, IHS Markit, Bloomberg)

According to LMC Automotive, Volkswagen is expected to surpass Tesla’s global market share in 2025. Volkswagen CEO Herbert Diess has indicated that the company plans to gain market share from Tesla, and eventually, surpass Tesla as the world’s top seller of EVs by 2025. (CN Beta, Inside EVs, Autobala, Auto News)

According to EV startup Volta Trucks, in London, large commercial vehicles cause around 26% of pedestrian fatalities and around 80% of cyclist fatalities, and account for an outsized portion of carbon emissions. Volta’s solution is to electrify and redesign the large cargo vehicle — called Heavy Goods Vehicles (HGVs) in Europe — for middle- and last-mile delivery in urban centers. Volta Trucks has raised a EUR37M (USD44M) funding round to accelerate its plans, starting with a fleet of pilot vehicles in London and Paris. (CN Beta, TechCrunch, Electrek)

Wang Zhiqing, vice minister of China’s Ministry of Transport, has revealed that by 2025, the proportion of new energy vehicles in China’s public transport will reach 72%. The Ministry of Transport will explore the research on the carbon emission accounting method of new energy road transport vehicles, increase the construction of expressway charging service facilities, and strive to realize the interconnection of parking and charging data. By 2025, China’s expressway fast charging coverage rate will reach 80%. (Laoyaoba, Sina, The Paper)

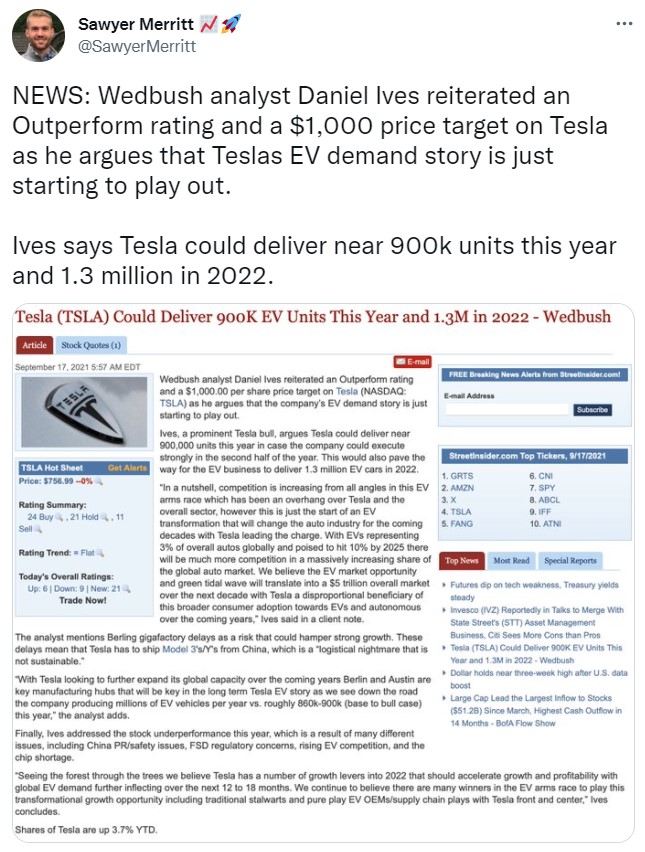

Wedbush analyst Daniel Ives believes the electrical vehicles (EVs) market opportunity and green tidal wave will translate into a USD5T overall market over the next decade with Tesla a disproportional beneficiary of this broader consumer adoption towards EVs and autonomous over the coming years. Ives has forecast a production target of 860K-900K for Tesla in 2021 and more than 1M for 2022. (Laoyaoba, Investopedia, Street Insider, Twitter)

Ford will invest another USD250M and add 450 jobs to increase production capacity of its upcoming F-150 Lightning to 80,000 all-electric trucks annually. The announcement comes after receiving more than 150K pre-orders for the all-electric pickup truck. The additional funds and jobs will be spread out across its new Rouge Electric Vehicle Center in Dearborn, Michigan, Van Dyke Electric Powertrain Center and Rawsonville Components Plant. (TechCrunch, CNBC, Electrek)

Hyundai Motor Group has introduced ‘Factory Safety Service Robot, a robot for industrial site safety, and announced its pilot operation at Kia’s plant in South Korea. The Robot is based on Boston Dynamics’ quadruped robot, Spot, with applied artificial intelligence (AI), autonomous navigation, teleoperation technologies, and computing payload (AI Processing Service Unit) developed by the Group’s Robotics Lab for the Robot’s usage in various industrial tasks. (TechCrunch, CNET, Hyundai)

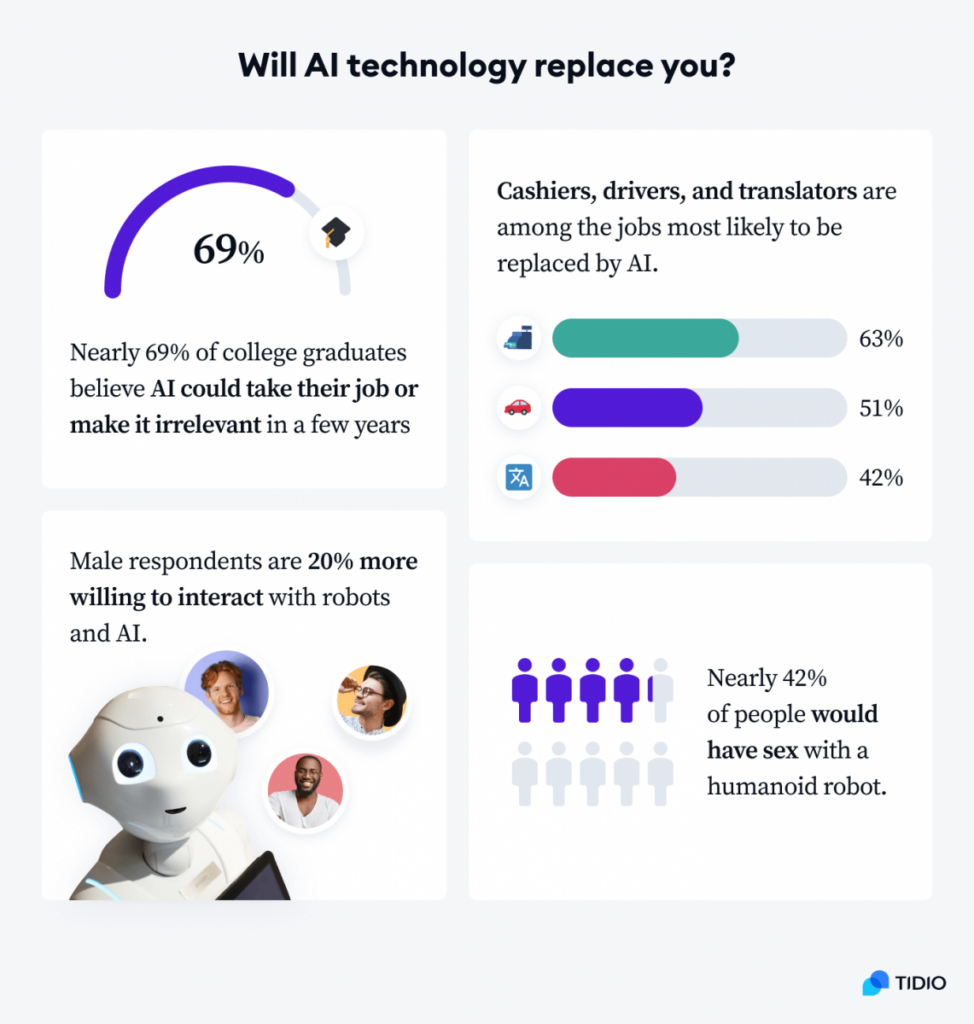

Tidio’s survey with more than 1200 users has revealed that more and more people are open to the idea of incorporating AI into their daily lives. They do not mind AI taking over everyday tasks or being involved in decision-making processes. On the other hand, AI adoption is fraught with doubts and concerns about AI risks. People with graduate degrees are the ones most afraid of losing their jobs due to artificial intelligence development. About 68.5% of them fear being replaced by AI, compared to just 55% of other respondents. (CN Beta, Tidio)

Amazon.com has closed about 3,000 online merchant accounts, backed by about 600 Chinese brands, on its popular platform, as the world’s largest e-commerce company ratchets up its crackdown on consumer review abuses. Cindy Tai, Amazon’s vice-president for Asia Global Selling, has indicated that the company’s campaign is not intended to target China or any other country. She has also said closures did not negatively impact the overall growth of Chinese online merchants on Amazon. (SCMP, Liliputing, Sina, Yicai, The Paper, NBD)