9-27 #Weird : MediaTek has already denied in talk with AMD to form a joint venture; Fabless chipmakers are looking to step up their deployments in the 5G RF front-end module (RF FEM); Toshiba, Sojitz, and CBMM have entered into a joint development agreement for the commercialization of next generation lithium-ion batteries; etc.

AMD and MediaTek are rumored in talks to form a joint venture that will be dedicated to developing SoC solutions combining Wi-Fi, 5G and high transmission technologies for notebook applications. However, MediaTek has already denied such rumor. (Laoyaoba, CN Beta, OfWeek, Tom’s Hardware, Digitimes)

Omdia has predicted that Samsung Electronics’ semiconductor sales share in 3Q21 recorded 14.11%, ranking first in the world. This is more than 2ppt higher than Intel’s share (12.09%), which is second. (Archyde, News Directory 3, Laoyaoba)

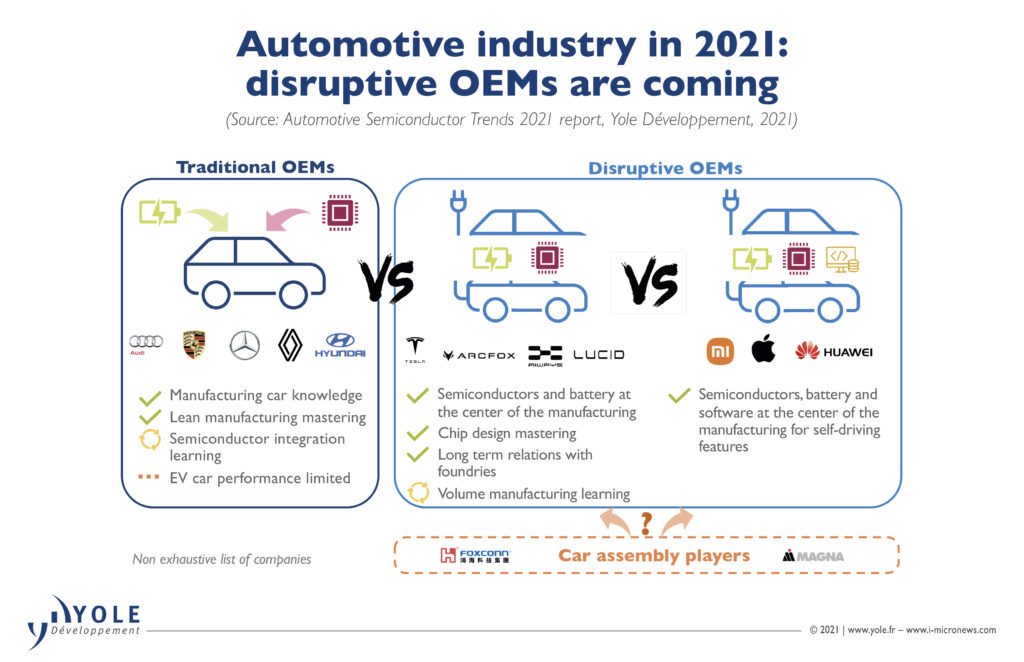

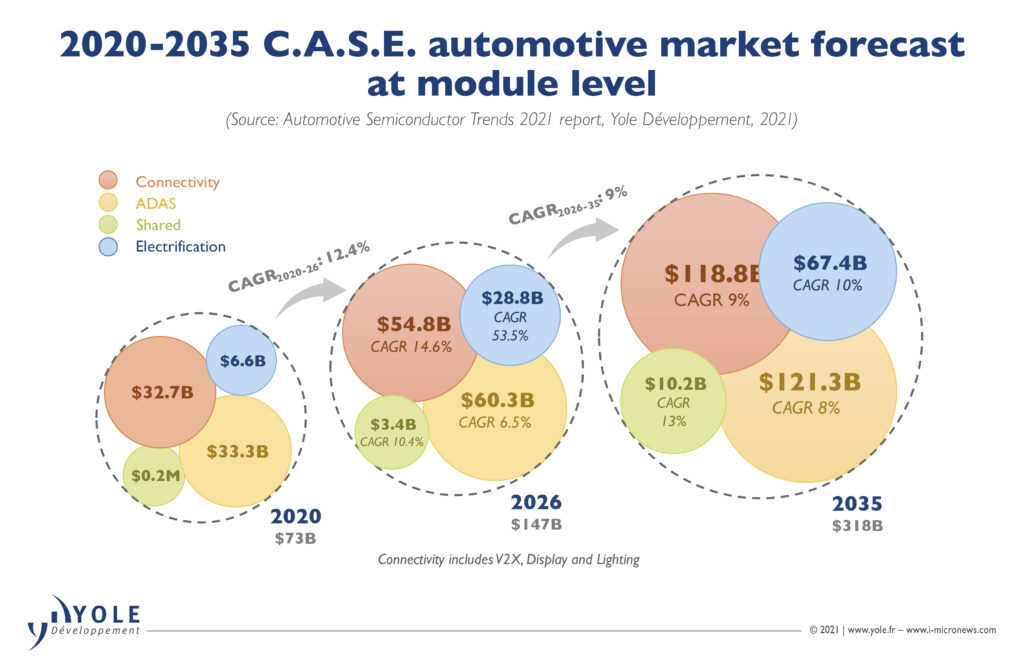

According to Yole Development, the semiconductor value in a car will reach USD78.5B in 2026, with a 14.75% CAGR 2020-2026. A car has today, on average, USD450 worth of semiconductors. In 2026, it will be USD700. OEMs have announced their electrification investment plans for the next 5 years which exceed USD250B worldwide. The timeline for automotive electrification is very aggressive, as in 15 years OEMs will have to develop an entire car portfolio that will be fully electric. (Laoyaoba, Electronics Weekly, CN Beta, Yole)

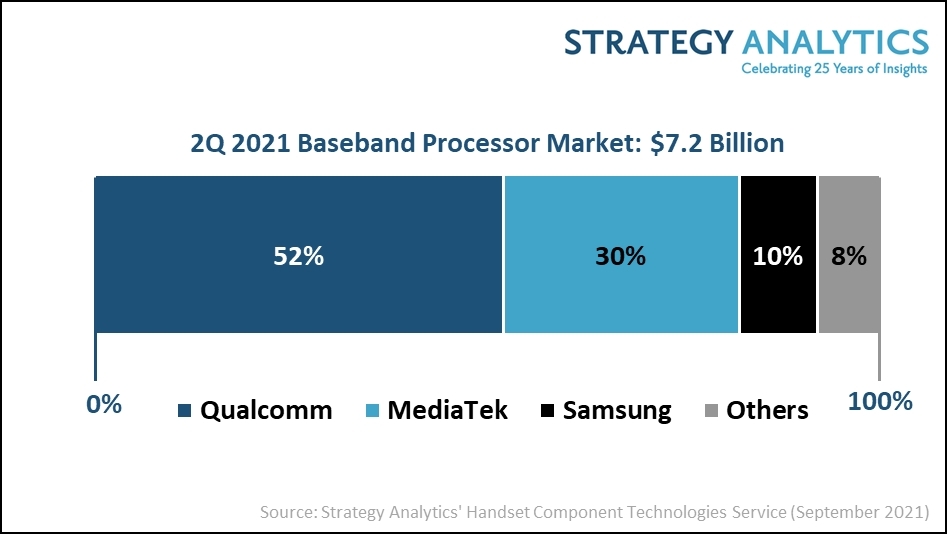

According to Strategy Analytics, the global smartphone AP market grew 18% on year to USD7B in 2Q21, when 5G AP shipments jumped 140% from a year earlier with an 8% rise in ASP. Qualcomm led the smartphone AP market in 2Q21 with a 36% revenue share, followed by MediaTek with 29% and Apple with 21%. (Digitimes, press, Strategy Analytics)

Lite-On CEO Anson Chiu has indicated that the supply chain shortage has not seen any relief in 2021, particularly when it entered the third-quarter traditional electronic peak season. He has further added that market demand has increased, but overall production capacity has not. In order to guarantee the stable and steady supply of goods and early signing of long-term contracts, upstream suppliers should prepare to expand their production capacity sooner. This wave of semiconductor chip shortage is expected to ease in 2H22. (Digitimes, press, Digitimes)

Fabless chipmakers are looking to step up their deployments in the 5G RF front-end module (RF FEM) and other device markets by working closely with their manufacturing partners, according to Digitimes. Major fabless chip manufacturers (Fabless) of RF FEM, including Qualcomm, Qorvo and Skyworks, are seeking to strengthen their 5G RF FEM. For the deployment of other equipment markets, major packaging and testing vendors such as ASE, Amkor, and Changjiang Electronics Technology have all turned to heterogeneous integration technologies such as SiP and antenna packaging (AiP). (Digitimes, iFeng, Min.news, Laoyaoba)

According to Cinda Securities, there are 3 generations of semiconductor materials. The 1st-gen semiconductors are led by silicon-based and germanium-based semiconductors, with mature technology and extensive applications. The emergence of the 1st gen of semiconductor materials replaced electron tubes, leading the development of the microelectronics industry centered on integrated circuits and a leap in the IT industry. The 2nd-gen semiconductors are represented by gallium arsenide (GaAs) and indium phosphide (InP). The 3rd-gen semiconductor materials, mainly including SiC, GaN, diamond, etc., are also called wide-bandgap semiconductor materials because their band gap (Eg) is greater than or equal to 2.3 electron volts (eV). (Cinda Securities report)

According to Yole data, the market size of 3rd-gen semiconductors with SiC and GaN in 2020 is USD1.49B, but according to Mordor Intelligence data, the market size of semiconductor silicon wafers in 2020 has reached USD10.79B. From the perspective of market size, silicon wafers are still the absolute mainstream of semiconductor materials. (Cinda Securities report)

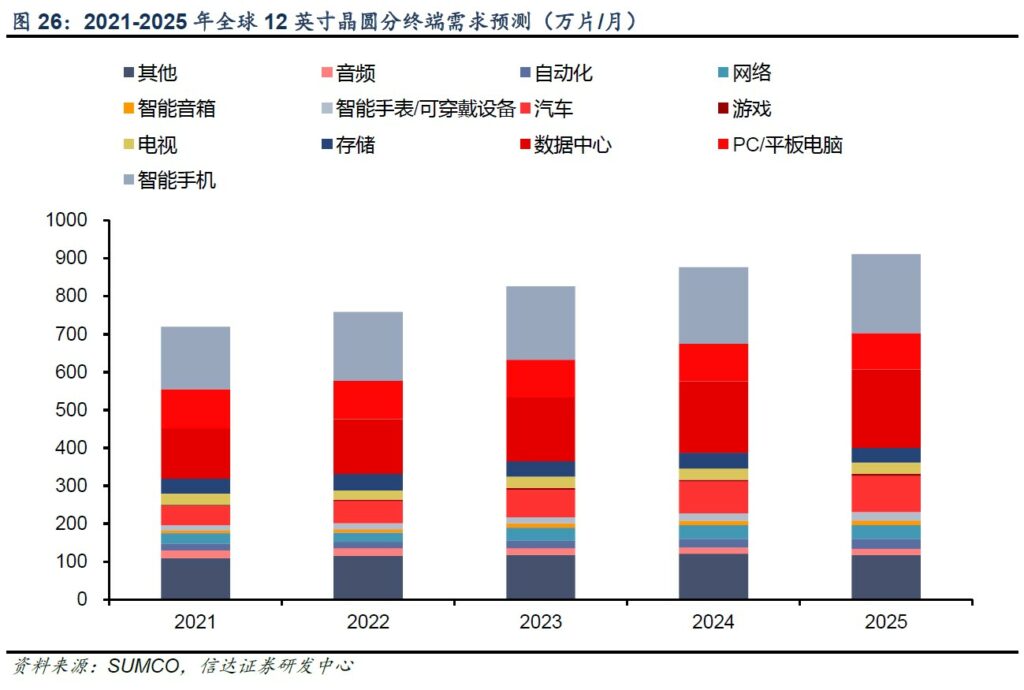

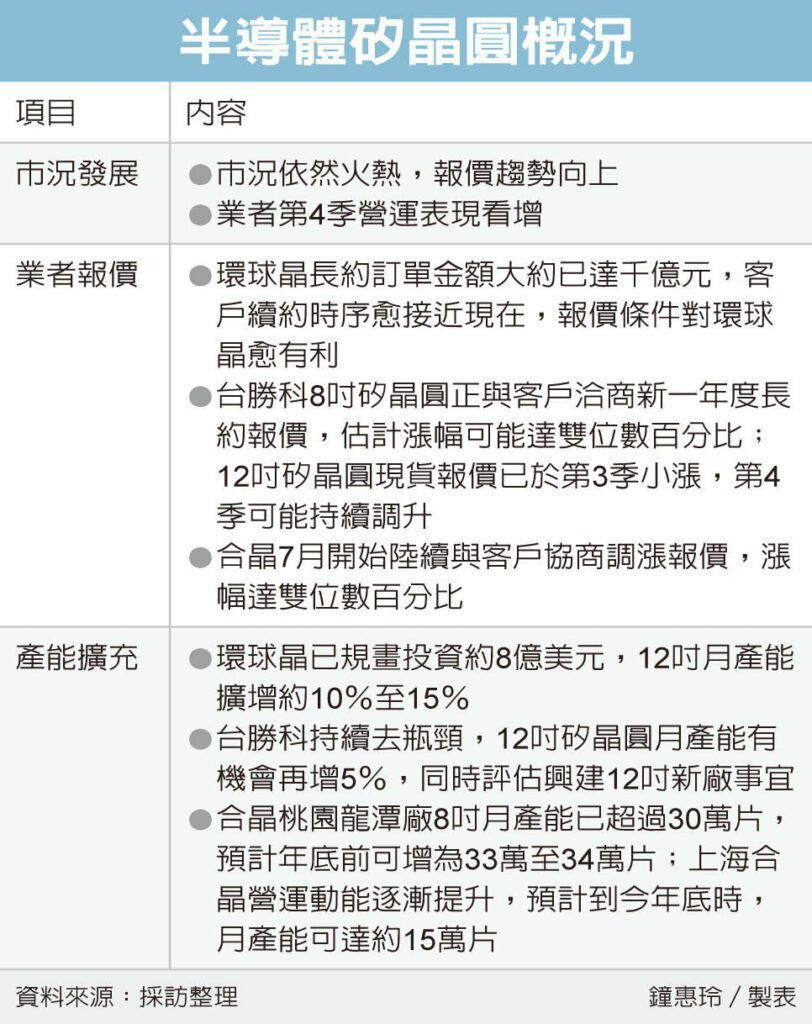

According to the global 12” round demand forecast data released by SUMCO, the global demand for 12” wafers will reach 7.2M wafers/month in 2021 and 9.1M wafers/month by 2025. The terminal application with the largest demand is smartphones. , Followed by data centers, PC/tablet computers, automobiles, data centers and automobiles have the fastest growth in demand for 12” wafers. (Cinda Securities report)

According to SUMCO data, the global demand for 8” wafers in 2Q21 reached 5.9M wafers/month. The scale of market segments such as analog devices, power discrete devices, and CMOS image sensors will grow steadily, reaching 8” wafers. Demand growth provides long-term stable driving force. According to SEMI’s Feb 2019 outlook on global 8” wafer production capacity, Cinda Securities predicts that the global 8” wafer production capacity will reach 6.2M wafers/month in 2021 and 6.4M wafers/month in 2022. (Cinda Securities report)

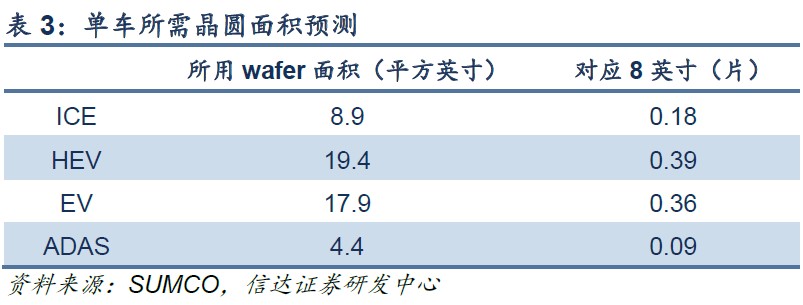

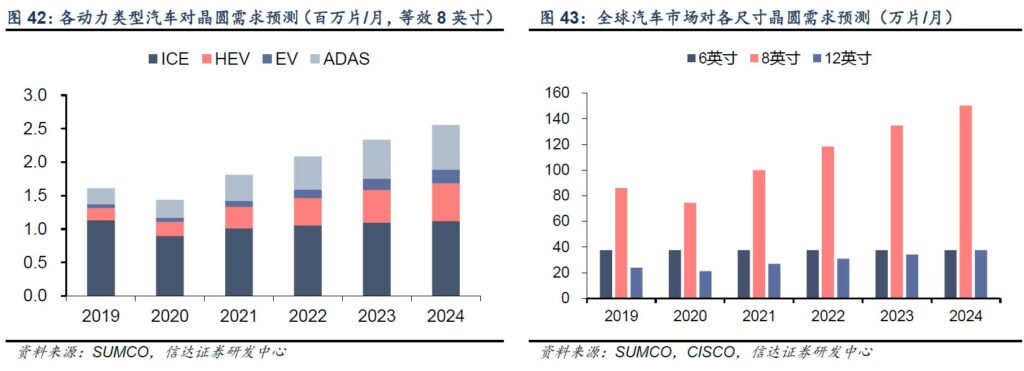

From the perspective of the whole vehicle, the demand for silicon wafer area of the new energy vehicle will be twice that of the internal combustion engine vehicle. According to SUMCO’s data, internal combustion engine vehicles require about 8.9 square inches of silicon wafer area, hybrid vehicles require about 19.4 square inches of silicon wafer area, and pure electric vehicles require about 17.9 square inches of silicon wafer area. ADAS requires about 4.4 square inches. (Cinda Securities report)

According to SUMCO forecast data, it is estimated that by 2024, the demand for silicon wafers in the global automotive market will exceed 2.5M pieces/month of equivalent 8” wafers. In terms of wafer size, the demand for 8” wafers will increase the most, reaching 1.5M pieces/month in 2024; while the demand for 12” wafers will reach 370,000 pieces/month in 2024. (Cinda Securities report)

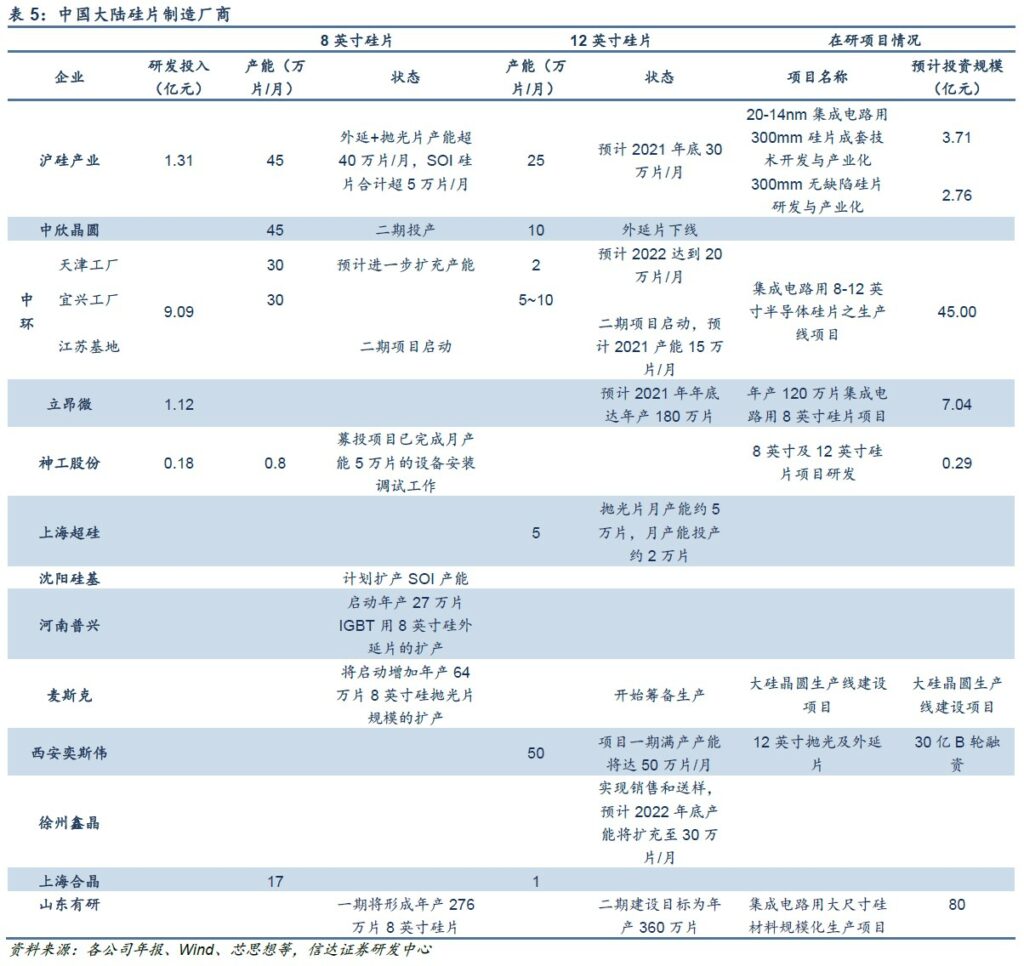

The overall production capacity of silicon wafers in mainland China has been increased. Currently, more than ten manufacturers engaged in silicon wafer production include Shanghai National Silicon Industry, Zhonghuan Semiconductor, Li-On Microelectronics, CCMC, AST, and Thinkon Semiconductor. Various silicon wafer manufacturers have started to produce 8” and 12” large silicon wafer projects. (Cinda Securities report)

Taiwan’s makers of RF and PA devices hope MediaTek can lead the local supply chain to meet competition from Qualcomm in tapping the mmWave 5G market, according to Digitimes. Qualcomm currently mainly uses silicon-based CMOS to produce millimeter wave 5G PA products in a 12” wafer fab, and provides a comprehensive 5G core chip and a variety of chip solutions. (Digitimes, Digitimes, UDN, CN Beta)

With the large-scale expansion of major wafer foundries and the noise of some demand, the market has begun to worry about whether the foundry capacity is oversupply. The big factories all work together to expand production after confirming the real needs of the customers, so as to avoid the situation where no one pays the bill in the end. In terms of advanced manufacturing process, the foundry can pay back if only one or two target customers ship more than hundreds of millions of chips per year. TSMC and Samsung are actively establishing long-term cooperative relationships with customers. Among them, TSMC’s advanced process customer product lines exceed 100 types thus the cost can be recovered in half a year. (UDN, UDN, Sohu, Laoyaoba)

Shinhan Investment expects SK Hynix to post operating profit of KRW4.1T (+52.2% QoQ) on sales of KRW11.84T (+14.7% QoQ) for 3Q21. Strong earnings growth was likely driven by ASP hikes for both DRAM (+8% QoQ) and NAND (+8% QoQ). (Laoyaoba, Business Korea, Pulse News)

NAND flash prices are expected to stay stable in 2022, but the supply of such chips is likely to turn tight in 2H22, according to Wallace Kou, president of Taiwan-based NAND controller vendor Silicon Motion Technology. (Digitimes, ZOL, Yahoo)

Apple is reportedly working on ways to help detect and diagnose conditions such as depression, anxiety and cognitive decline using an iPhone. The first project, codenamed “Seabreeze”, is with the University of California on the study of stress, anxiety and depression. The second is a partnership with pharmaceutical company Biogen on the study of mild cognitive impairment, which are conditions that can lead to Alzheimer’s disease. UCLA has been working with Apple Watch and iPhone data since Dec 2020, acquiring data from 150 people, which will rise to 3000 later in 2021. (Pocket-Lint, WSJ, New Daily, TechCrunch)

Toshiba, Sojitz, and CBMM have entered into a joint development agreement for the commercialization of next generation lithium-ion batteries using niobium titanium oxide (NTO) as the anode material. One of the major requirements for rechargeable battery development is greater energy density and faster charging. (CN Beta, Toshiba, Green Car Congress)

ZTE and China Mobile Beijing have signed an innovative technology cooperation agreement and jointly released the industry’s first RIS (Reconfigurable Intelligent hypersurface) cascade prototype verification results based on 2.6GHz commercial network. (Laoyaoba, Sina, ZTE)

OPPO has teamed up with Ericsson to pursue advances in 5G technology, with the goal to fill the void left by US-blacklisted rival Huawei in the mobile industry. In partnership with Ericsson, OPPO has unveiled what it describes as an upgraded communications laboratory in Shenzhen. (Gizmo China, SCMP, Yahoo)

Huawei’s rotating chairman, Xu Zhijun, has revealed that currently its 5G users now exceed 490M with 176 commercial 5G networks. The world has explored more than 10,000 projects for the application of 5G for industry digitization. (IT Home, C114, GizChina, Huawei)

OPPO K9 Pro is launched in China – 6.43” 1080×2400 FHD+ HiD Super AMOLED 120Hz, MediaTek Dimensity 1200 5G, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 8+128 / 12+256GB, Android 11.0, fingerprint on display, 4400mAh 65W, CNY2,199 (USD340) / CNY2,699 (USD417). (OPPO, Sohu, Gizmo China, NDTV)

Foxconn Electronics (Hon Hai) and Japan-based Nidec will set up a joint venture specifically for developing, producing and marketing motor-based power trains for use in electric vehicles (EVs), and this will bring competitive pressure on Taiwan-based motor makers Tatung, TECO, and Shihlin Electric may be the first to be challenged. Lu Mingguang, chairman of Tatung, has indicated that Nidec is indeed a very good motor factory that it can make both large and small motors for the entire EV. The global EV market is rapidly rising. By 2030, it may account for 30-40% of the total annual global sales of new vehicles. If approximately 90M new vehicles are sold a year, EVs will account for approximately 27M vehicles. In fact, Nidec also plans to reach 40% of the global market share of EV motors. Therefore, Foxconn’s cooperation with Nidec Motors does not have the “big threat” to the Taiwan-based motor makers. (Digitimes, press, FT Chinese, Digitimes)

Eli Electric Vehicles, an early-stage compact EV manufacturer, has announced the start of production on its flagship Eli Zero, a micro “neighborhood electric vehicle” that is built for city commuting. The company plans to roll out small batches of the two-seater EV to distributors across 10 European countries over the next few months, with a starting price of USD11,999. (CN Beta, New Atlas, TechCrunch)

According to Shawn Kerrigan, the COO and co-founder of autonomous truck developer Plus, driverless vehicles are more efficient than human-powered trucks, slashing fuel expenses and reducing carbon emissions. Plus’s autonomous driving system, PlusDrive, uses Level 4 autonomous driving technology, but a driver remains on board to ensure the system is operating safely. For example, Plus has shown in its pilot programs that PlusDrive can help fleets save around 10% in fuel costs. This is due to AI-generated algorithms that teach the truck how to control itself in the most fuel-efficient way. (VentureBeat, The Trucker)

Tesla’s Shanghai factory is expected to produce 300,000 cars in the first 9 months of 2021, capped by a delivery rush in the end of 3Q21, despite a global semiconductor shortage. Around 240,000 vehicles were shipped from the factory in the first 8 months, including many for export, according to data from the China Passenger Car Association. Tesla has not announced details on the factory’s production. (Laoyaoba, Reuters, Euro News)

Digital pathology and AI-based diagnostic solution developer AetherAI has cooperated with Chang Gung Memorial Hospital and Novartis Taiwan to develop application for hemopathological interpretation. It is meant to provide quantitative data to help pathologists diagnose myeloproliferative neoplasm. (Digitimes, press, Digitimes, UDN)

Altana AI, a startup building a database for global supply chain networks, has announced that it has raised USD15M in a series A funding round. The proceeds, which bring the company’s total raised to USD22M to date, will be used to further develop Altana’s data and AI systems and launch new machine learning and network analysis tools, according to CEO Evan Smith. (VentureBeat, PR Newswire)

Amazon and Global Optimism have announced that more than 200 companies have now signed The Climate Pledge. The 86 new signatories joining The Climate Pledge include Procter & Gamble, HP, Salesforce, ASOS, and Nespresso. Pledge signatories in total generate over USD1.8T in global annual revenues and have more than 7M employees across 26 industries in 21 countries. (CN Beta, Amazon, Forbes)