10-16 #Respect : TSMC has revealed its plans of building its first chip plant in Japan; TSMC expects the shortage to last through 2022; Sony has teamed up with Meizu; Amazon is allegedly looking to buy used cargo planes that would be able to travel long distances; etc.

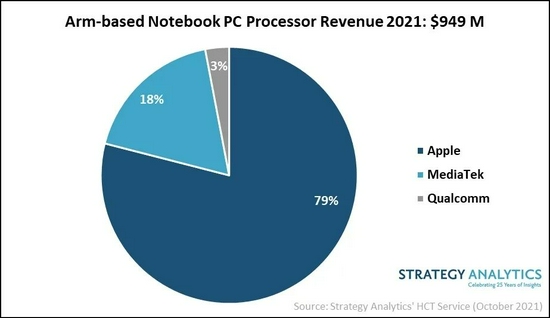

Strategy Analytics estimates that Apple, MediaTek and Qualcomm will capture the top revenue share spots in the Arm-based notebook PC processor market in 2021. After seeing 9-fold revenue growth in 2020, the Arm-based notebook PC processor market will grow over 3-fold to USD949M in 2021. In terms of units, Arm-based notebook PC processor shipments will grow over 2-fold in 2021, capturing over 10% of total notebook PC processor shipments. (Apple Insider, Strategy Analytics, CN Beta)

Taiwan Semiconductor Manufacturing Company (TSMC) has revealed its plans of building its first chip plant in Japan. Meanwhile, TSMC has said the global shortage of automotive chips will be “significantly reduced” from 4Q21. TSMC makes chips for automotive chip designers such as NXP, Infineon and Renesas, and expects to increase output of micro control units, a key vehicle component, by close to 60% over the 2020 level. (Asia Nikkei, Gizmo China)

Taiwan Semiconductor Manufacturing Co (TSMC) CEO C.C. Wei has stated that he remains confident that the fab’s 2nm technology will enter mass production in 2025. He has also stated that TSMC’s N3 process technology family would offer the best power, performance and efficiencies (PPE) and become a driver of the company’s revenue growth. He has claimed that he expects the shortage to last through 2022 due to strong demand from High Performance Computing (HPC) and 5G chips. (Taiwan News, WCCFtech, Laoyaoba, Sina, GVM, UDN)

Hyundai Motor’s COO Jose Munoz has revealed that the company is planning on developing its own chips. Hyundai does not want to get caught without a supply again and needs to be more self-reliant in the space. He has stated that the worst has passed for the industry chip shortage. He has said that the company is also aiming on delivering vehicles at the level of its original business plan in 4Q21. (Gizmo China, Reuters, TechCrunch)

Nothing announces it is collaborating with Qualcomm and its Snapdragon platform to power future tech products. Nothing has also announced that it has completed a Series A extension of USD50M from strategic and private investors. This will be used towards research and development in preparation for the brand’s entry into new product categories as part of its ecosystem. (GSM Arena, Nothing)

MagicCube, a mobile security startup, has raised USD15M in a round led by Mosaik Partners. MagicCube’s software-based technology is aimed at replacing all security chips, which have historically been the standard for safely storing sensitive data and authenticating whoever needs access to it. (TechCrunch, PR Newswire, Silicon Angle)

Toyota Motor will cut its global auto production in Nov 2021 by 15% from its latest output plan, or around 150K vehicles, due to a shortage of semiconductors and the power crunch in China. The move comes after the Japanese automaker cut its production by 40% from its initial plan from Sept to Oct 2021 as the resurgence of COVID-19 infections in Southeast Asia disrupted the supply chain for auto parts. Toyota will maintain its global production plan for fiscal 2021 at 9M vehicles despite the latest output cuts. (Laoyaoba, Asia Nikkei)

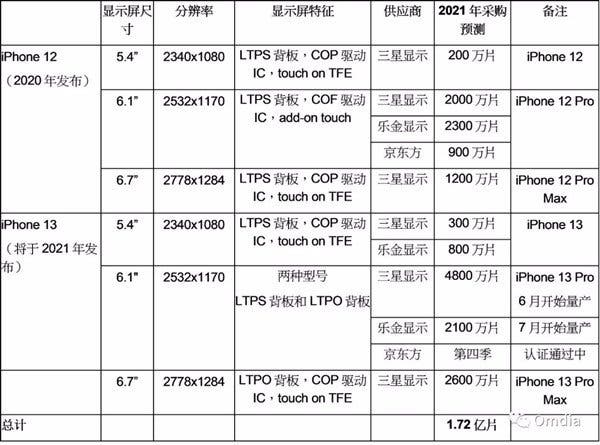

Apple has reportedly added China’s BOE Technology to its list of premium display suppliers for the latest iPhone. BOE has begun shipping a small number of organic light-emitting diode (OLED) displays for the 6.1” iPhone 13 in late Sept 2021 and is scheduled to increase those shipments soon, pending a final verification process. In the first phase, BOE will claim 20% of the supply; but over time hopes to increase the share to 40%. BOE is making the OLED displays for the iPhone 13 at its Mian Yang complex in Sichuan Province, where it already turns out OLED screens for Huawei, Honor, Xiaomi and vivo. (GizChina, Nikkei Asia, The Register)

Samsung Electronics is developing the technology to keep the distance between pixels to early-0.5mm for MicroLED TVs that are under 100” in size. This allows the company to reduce the distance between pixels by over 10% — the distance between pixels for its 110” MicroLED TV is 0.63mm. Samsung’s LED chip — each one acting as one pixel on the MicroLED TV — is around 35×60µm in size for the MicroLED TVs that will be under 100” in size. (CN Beta, The Elec)

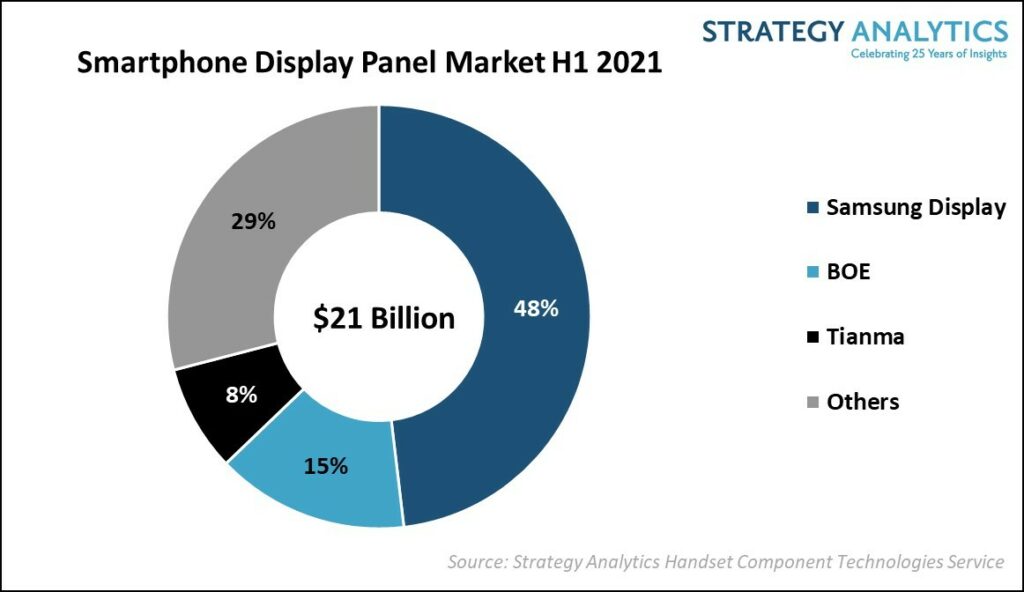

According to Strategy Analytics, the global smartphone display panel market posted a revenue of USD21B in 1H21. The smartphone display panel market witnessed a double-digit revenue growth as Samsung Display led the market with 48% revenue share followed by BOE Technology with 15% and Tianma Microelectronics with 8% in 1H21. (Laoyaoba, Strategy Analytics)

Despite uncertainty emerging over the demand outlook for the fourth quarter, Taiwan-based display driver IC (DDI) specialists are all poised to generate significant revenue increases in 2021 thanks to impressive performance thus far in 2021, according to Digitimes. Taiwan-based DDI suppliers including Fitipower Integrated Technology, FocalTech Systems, Novatek Microelectronics, Raydium Semiconductor and Sitronix Technology have all seen their cumulative 2021 revenues through Sept 2021 surge over 65% from a year earlier. Sales at Fitipower, in particular, hiked over 100% on year in the first 9 months of 2021. With the adoption of OLED panels among handset displays rising, demand for OLED DDIs is expected to surge and play a driver of related DDI suppliers’ revenue growth in 2022. (Digitimes, press, Laoyaoba)

LG InnoTek is reportedly supplying its 3D time of flight (ToF) module to Apple and Microsoft for their virtual reality (VR) headsets that are planned to launch in 2022. It is highly likely that LG InnoTek will be supplying its modules for Apple’s AR glass that is expected to launch in 2023. (CN Beta, The Elec)

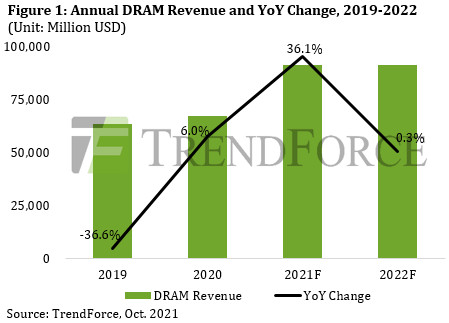

DRAM contract prices are likely to exit a bullish period that lasted 3 quarters and be on the downswing in 4Q21 at a QoQ decline of 3-8%, according to TrendForce. This decline can be attributed to not only the declining procurement activities of DRAM buyers going forward, but also the drop in DRAM spot prices ahead of contract prices. While the buying and selling sides attempt to gain the advantage in future transactions, the DRAM market’s movement in 2022 will primarily be determined by suppliers’ capacity expansion strategies in conjunction with potential growths in demand. (TrendForce, TrendForce, Laoyaoba)

According to TrendForce, the capacity expansion plans of the three largest DRAM suppliers (Samsung, SK hynix, and Micron) for 2022 are expected to remain conservative, resulting in a 17.9% growth in total DRAM bit supply in 2022. On the demand side, inventory levels at the moment are relatively high. Hence, DRAM bit demand is expected to grow by 16.3% in 2022 and lag behind bit supply growth. TrendForce therefore forecasts a shift in the DRAM market in 2022 from shortage to surplus. (TrendForce, TrendForce, Laoyaoba)

Madhav Sheth, VP of realme and CEO of Realme India, has revealed that the company will commercialize 125W UltraDart charging in 2022. The tech can fill a 4,000mAh battery from flat to 33% in just 3 minutes and is also compatible with multiple charging protocols, including 125W PPS, 65W PD, and 36W QC. (Gizmo China, GSM Arena, CN Beta)

U.S. commercial electric vehicle maker Electric Last Mile Solutions (ELMS) has signed a battery supply deal with China’s Contemporary Amperex Technology Co (CATL). CATL will provide its cell-to-pack technology to startup ELMS for use in its Indiana-assembled electric delivery vans. ELMS is also partnering with startup Ample to use the latter’s modular battery-swapping system. A battery-supply agreement will see CATL supply a 42kwh lithium iron phosphate (LFP) battery pack for the ELMS Urban Delivery Class 1 commercial van. The agreement runs through 2025. (Laoyaoba, Electrive, Reuters, Green Car Reports)

Verizon, Samsung and Qualcomm continue to push the limits of 5G technology, using innovation to continuously drive greater performance from this transformational technology. Recently, the companies reached upload speeds of 711Mbps in a lab trial using aggregated bands of mmWave spectrum. (CN Beta, Samsung, Fierce Wireless)

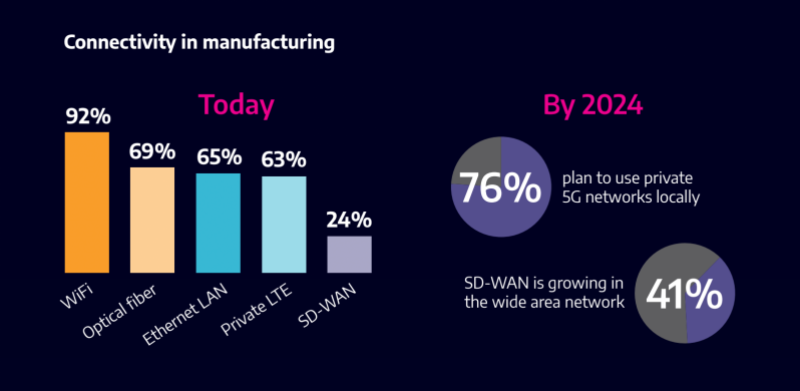

According Accedian, while 76% of manufacturers plan to use private 5G locally by 2024, key barriers to adoption include management complexity, difficulty of deployment and high costs. Manufacturing holds extreme promise in being transformed through 5G network adoption. Most manufacturers agree that high reliability (82%), security (78%) and support for low-latency applications (75%) make a 5G private network an attractive choice. (VentureBeat, Accedian, Csion)

Samsung has updated its Global Goals app in partnership with the United Nations Development Programme (UNDP). The Samsung Global Goals app was launched in 2019 to offer simple ways to help raise awareness about the goals. The aim is to empower Galaxy smartphone users in India to donate to India-specific projects. All projects are linked to causes that help further the United Nations Sustainable Development Goals (SDGs) or Global Goals. (CN Beta, Samsung, Money Control)

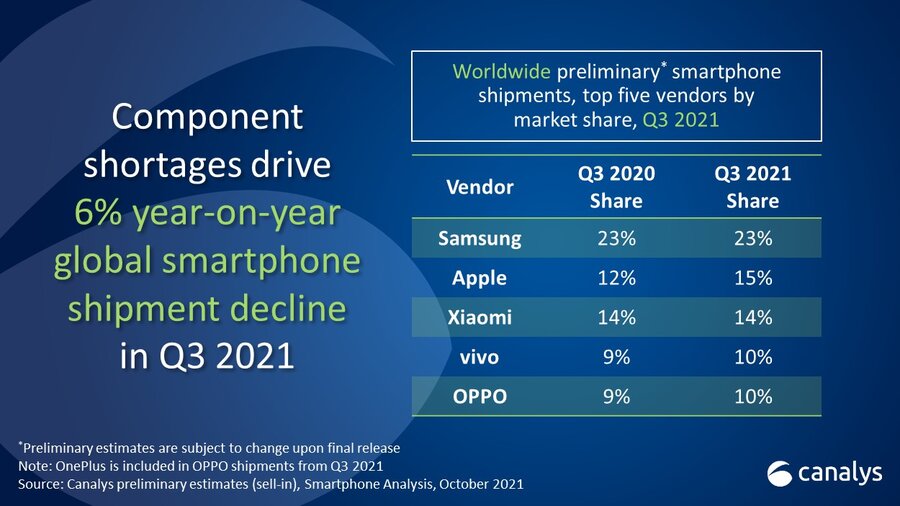

According to Canalys, in 3Q21, global smartphone shipments fell 6%, as vendors struggled to meet demand for devices amid component shortages. Samsung is the leading vendor with 23% share. The smartphone industry is striving to maximize production of devices as best it can. On the supply side, chipset manufacturers are increasing prices to disincentivize over-ordering, in an attempt to close the gap between demand and supply. Despite this, shortages will not ease until well into 2022. As a result, as well as high costs of global freight, smartphone brands have reluctantly pushed up device retail pricing. (GSM Arena, Canalys, CN Beta)

Sony has teamed up with Meizu. The partnership will see several Meizu apps and services being available on the Xperia 1 III. This is limited to China only for now. (Android Headlines, Android Authority, GSM Arena, Weibo)

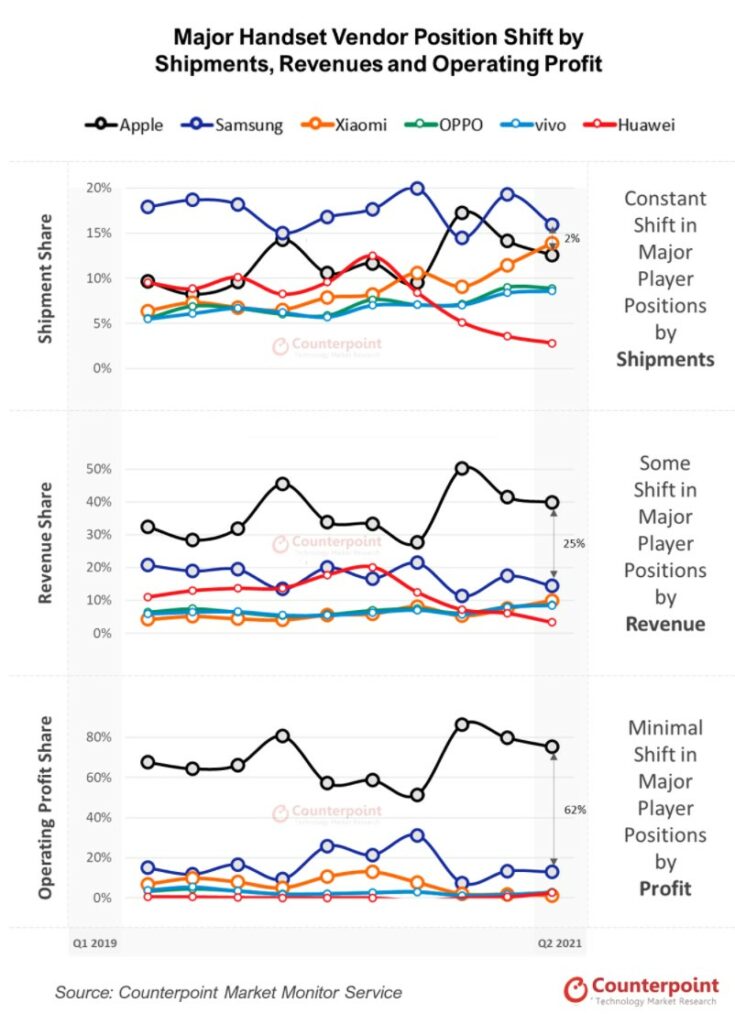

According to Counterpoint Research, Apple has been the biggest profit and revenue generator in the handset business. In 2Q21, it captures 75% of the overall handset market operating profit and 40% of the revenue despite contributing a relatively moderate 13% to global handset shipments. While this performance shows the power of the Apple brand, it is still lower than the peak of 4Q20 when its revenue share reached a staggering 50%, up from 28% in 3Q20, and its profit share reached an unprecedented 86%, up from 51% in the previous quarter. (CN Beta, Apple Insider, Counterpoint Research)

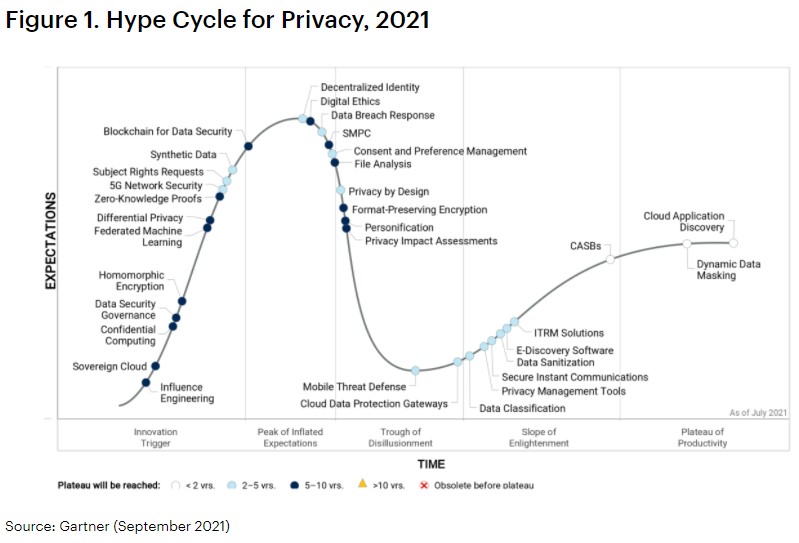

Digital ethics sits at the peak of the Gartner’s Hype Cycle for Privacy 2021, as people become increasingly aware of the value of their personal information and frustrated by lack of transparency and continuing misuse. Gartner predicts that by the end of 2023, more than 80% of companies worldwide will be facing at least one privacy-focused data protection regulation. Gartner predicts that by 2024, worldwide privacy-driven spending on data protection and compliance technology will exceed USD15B annually. (CN Beta, Gartner)

Microsoft has announced that it will pull its professional social network LinkedIn from the Chinese market later in 2021. Microsoft purchased LinkedIn for more than USD26B back in 2016. Linkedin has stated that it is now “facing a significantly more challenging operating environment and greater compliance requirements in China”. (TechCrunch, Linkedin)

From defective household electronics to old smartphones: the total amount of e-waste generated around the world in 2021 is estimated to reach a record 57.4M tonnes — that is, more than the weight of the heaviest artificial object on Earth, the Great Wall of China, according to WEEE Forum. World Economic Forum guessed global e-waste is worth about USD62.5B annually, more than many nations’ GPDs. WEEE Forum director Pascal Leroy presses manufacturers to acknowledge their role in this problem, citing electronics’ shrinking lifespans and the fight these companies are waging against consumers’ right to repair. (CN Beta, WEEE Forum, BBC, ZDNet, Fast Company)

Spotify’s in-car entertainment system known as just “Car Thing” is now becoming more broadly available. The company has announced Car Thing will become available to U.S. users at USD79.99. The device requires a Spotify Premium membership. (CN Beta, TechCrunch)

Nothing will allegedly launch its first phone by early 2022. This indicates that the manufacturer is already developing this phone. There are hints of this development after the recently announced partnership between Nothing and Qualcomm. (Android Headlines, Android Authority, 91Mobiles)

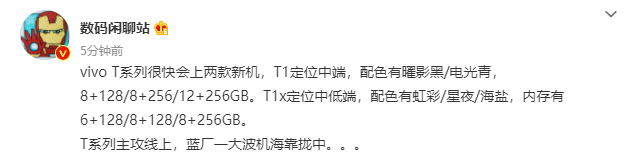

vivo T series will have two new models, the T1 will be positioned at the mid-range, and the T1x will be at the low-end. In addition, the vivo T series will focus on online channel. The positioning of the series is oriented towards gaming performance. It is a continuation of the Z series. Compared with the S series for female users, it is relatively more cost-effective, but it is not as good as the X series and NEX series. The estimated price is around CNY2000-2500. (Laoyaoba, Gizmo China, IT Home)

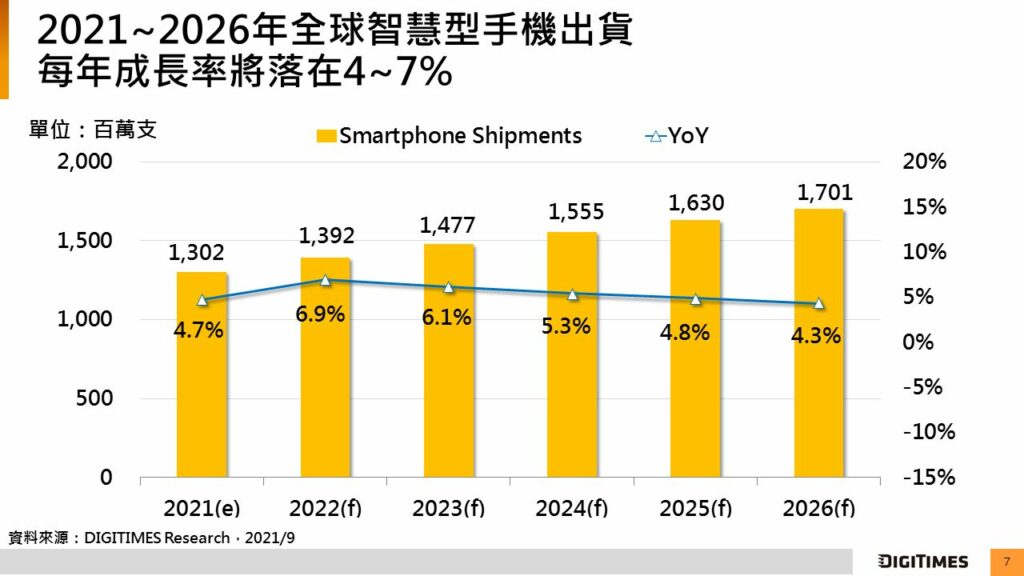

Judging from the status of the upstream supply chain, regional markets and the COVID-19 pandemic, Digitimes Research expects global smartphone shipments to increase 4.7% on year and arrive at 1.3B units in 2021 and will see on-year growths between 4-7% every year in the next 5 years. In other words, annual shipment would increase about 70-90M units. (Digitimes, Digitimes, CTEE, Digitimes)

OnePlus 9RT 5G is launched in China – 6.62” 1080×2400 FHD+ HiD AMOLED 120Hz, Qualcomm Snapdragon 888 5G, rear tri 50MP OIS-16MP ultrawide-2MP macro + front 16MP, 8+128 / 8+256 / 12+256GB, Android 11.0, fingerprint on display, 4500mAh 65W, start from CNY3,300 (USD510). (GSM Arena, OnePlus)

Infinix Note 11 Pro is launched in US – 6.95” 1080×2460 FHD+ HiD 120Hz, MediaTek Helio G96, rear tri 64MP-13MP telephoto-2MP depth + front 16MP, 8+128GB, Android 11.0, side fingerprint, dual speakers, 5000mAh 33W, USD249. (GizChina, Infinix, GSM Arena, News Bytes)

Tecno Spark 8P is unveiled– 6.6” 1080×2400 FHD+ v-notch 90Hz, MediaTek Helio G70, rear tri 50MP-8MP ultrawide-2MP portrait + front 8MP, 4+128GB, Android 11.0, side fingerprint, 5000mAh 10W, no pricing yet. (Gizmo China, GizBot)

Black Shark 4S and 4S Pro are announced, featuring 6.67” 1080×2400 FHD+ HiD Super AMOLED 144Hz, side fingerprint, physical pop-up gaming triggers, 4500mAh 120W: 4S – Qualcomm Snapdragon 870 5G, rear tri 48MP-8MP ultrawide-5MP macro + front 20MP, 8+128 / 12+128 / 12+256GB, Android 11.0, CNY2,699 (USD420) / CNY2,999 (USD465) / CNY3,299 (USD510). 4S Pro – Qualcomm Snapdragon 888+ 5G, rear tri 64MP-8MP ultrawide-5MP macro + front 20MP, 12+256 / 16+512GB, Android 11.0, CNY4,799 (USD755) / CNY5,499 (USD855). (Gizmo China, Gizmo China, GSM Arena, Black Shark, Black Shark, IT Home)

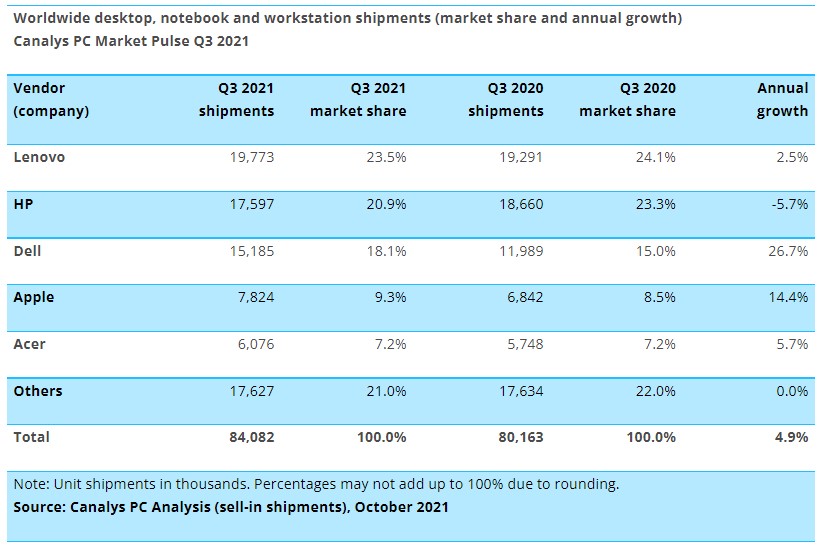

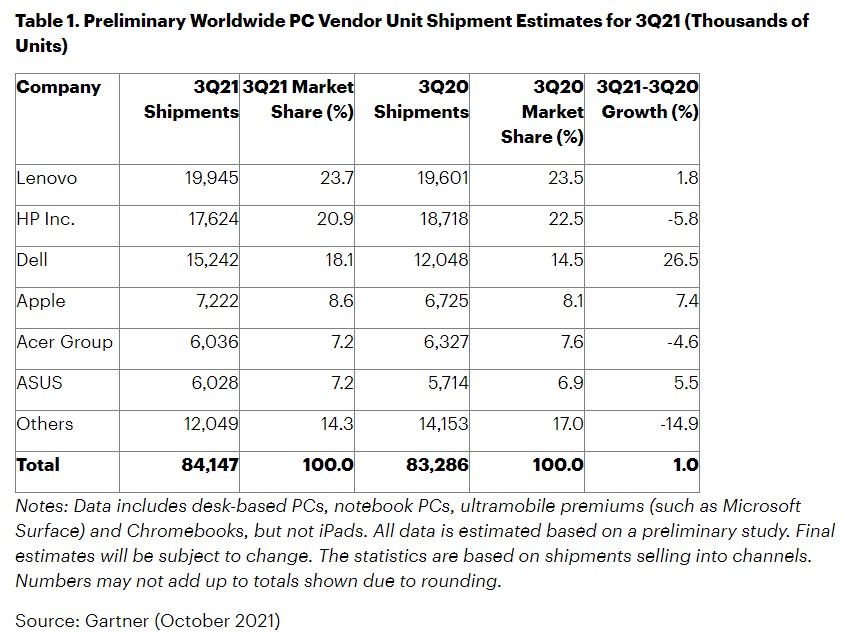

According to Canalys, following 5 quarters of double-digit growth, the global PC market saw annual growth drop to 5% in 3Q21, with shipments of desktops and notebooks, including workstations settling at 84.1M units. Vendors and channel partners are still having difficulty fulfilling orders as backlogs persist. Notebooks and mobile workstation shipments grew 3% year-on-year to hit 67.4M units, while shipments of desktops and desktop workstations rose 12% to 16.6M units. (Gizmo China, GSM Arena, Canalys)

Worldwide PC shipments totaled 84.1M units in the 3Q21, an increase of 1% from 3Q20, according to preliminary results by Gartner. As COVID-19 vaccines become more widely available, consumer and educational spending began to shift away from PCs to other priorities, slowing momentum in the market. (Gartner)

Lenovo TAB6 5G is announced in Japan – 10.3” 1200×1920 FHD+ TFT, Qualcomm Snapdragon 690, rear 8MP + front 8MP, 4+64GB, Android 11.0, USB Type-C, IP53 rated, 7500mAh, pricing not yet announced. (Gizmo China, Liliputing, Lenovo)

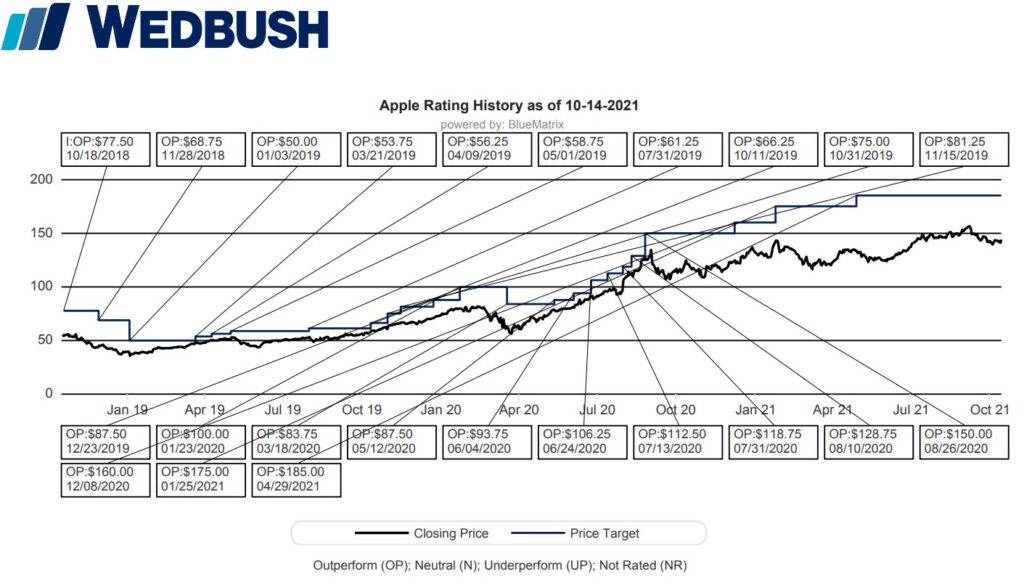

Wedbush analyst Daniel Ives has estimated that Apple’s upcoming launch of the 2021 MacBook Pro with M1X chip will result in almost a third of current owners upgrading to one of the new models. With Apple’s new Silicon chips front and center Apple continues to refresh its hardware ecosystem across the board. Apple is launching new M1X- powered MacBook Pros with 14” and 16” models. CN Beta, 9to5Mac, TechRadar, Wedbush)

OnePlus Buds Z2 is official in China, priced at CNY499 (USD77). It features active noise cancelation, Dolby Atmos support and are rated at 38 hours of battery life including the case and without ANC turned on. It pack 11mm dynamic drivers and pair over Bluetooth 5.2. (GSM Arena, Android Authority, TechRadar)

The SenseGlove Nova gloves allow wearers to get a feel for shapes and textures in virtual reality (VR) applications, and determine such things as stiffness, resistance and impact force. There are 4 magnetic friction brakes in the force-feedback system in each glove, one for the thumb and then one each for first, second and third finger. These brakes apply resistance to emulate a virtual object’s density and size, and each brake can deliver up to 20N of force within 20ms, which is equivalent to the weight of a 2kg (4.4lb) brick. The force applied by the brakes is transferred to the fingertips via mechanical wires. (CN Beta, NewAtlas, SenseGlove)

Anker is introducing a pair of smart audio glasses under its Soundcore brand, Soundcore Frames. The glasses are priced at USD199. The Soundcore Frames feature four speakers positioned to provide “spacious surround sound” while keeping you aware of your surroundings. There are two microphones for calls and to block out ambient noise, and the frames feature a “local voice assistant” for controls. (Pocket-Lint, Android Central, Soundcore)

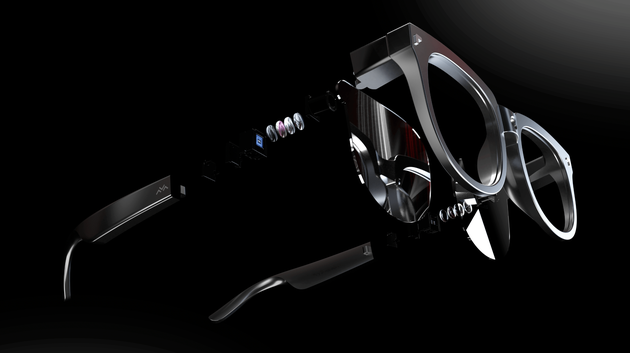

TCL unveils Thunderbird Smart Glasses, featuring micro-LED display with a wave guide that is developed in-house over the last 3 years. It is a transparent color display, so these look and feel like regular glasses. The demo also shows that the glasses have a built-in camera (which sits on the bridge of the nose). (GSM Arena, Weibo, Sparrow News, Sina, IT Home)

HTC announces Vive Flow, a compact VR headset that pairs with phone for USD499. It features dual 1600×1600 75Hz 100º FoV displays, a built-in fan that pulls air around the user and push warm air out of the top vent. It is powered by USB-C at 7.5W. It has dual-built-in speakers, dual microphones with echo and noise cancellation, and support for Bluetooth audio. It features 4GB RAM and 64GB memory on-board. (GSM Arena, CN Beta, Vive)

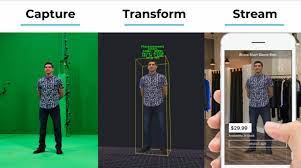

8i, a provider of technology for the capture, transformation and streaming of holograms (i.e., volumetric video or 3D video), and 8th Wall, a provider of an augmented reality (AR) platform for the creation of frictionless AR content for the mobile web (WebAR), have debuted their integrated hologram solution “Real-time Holograms” as part of an event that featured the world’s first live streamed hologram interview in WebAR. (VentureBeat, MarTech Series, Auganix, Csion)

Aurora has announced that its autonomous trucks and taxis will be available to customers via subscriptions. Aurora does not expect to roll out its self-driving trucks and ride-hailing vehicles until 2023 and 2024, respectively, but the company is providing more detail about how it plans on putting them into commercial operation. Aurora’s trucking service will be called “Aurora Horizon”, in which the company says it will provide trucking carriers and private fleets “with a reliable and scalable driver supply powered by the Aurora Driver.” The Aurora Driver is the name the company uses to describe the hardware and software it uses to enable a vehicle to drive itself under certain conditions. (CN Beta, Business Wire, The Verge)

Volvo has teamed up with Swedish steel producer SSAB to develop a type of steel it can use for its vehicles that does not use fossil fuels. Volvo has revealed what it says is the world’s first vehicle made of fossil-free steel: A 4-wheeled fully electric load carrier made for quarrying and mining. In addition to having no greenhouse gas emission, it is also autonomous and can follow a pre-programmed route to transport materials at a job site. (Engadget, SSAB)

ABB E-mobility and Lilium, positioned to be a global leader in regional electric air mobility, have announced plans for ABB to provide the charging infrastructure for Lilium’s high speed regional air network, scheduled for commercial launch in 2024. The ABB charging points are designed to be capable of fully charging batteries in about 30 minutes, and charging up to 80% in 15 minutes, enabling the 20-25 flights per aircraft per day planned across Lilium’s global vertiport network. (CN Beta, Lilium)

Reliable Robotics has announced its USD100M Series C funding, led by Coatue Management. The funds will go toward scaling the team and supporting its first aircraft certification program — working toward commercial cargo operations. In the first instance, the company is working on automation systems for existing aircraft. They have been experimenting and developing using a Cessna 172, which started flying unmanned flights a couple of years ago. (TechCrunch, CN Beta, Independent)

Amazon is allegedly looking to buy used cargo planes that would be able to travel long distances. The company is shopping for 10 refurbished Airbus’s A330-300 aircraft and an unspecified number of used Boeing 777-300ER cargo planes. The move would be a major step in allowing the e-commerce giant to move goods from Asia to the US on its own and it would help the company avoid supply-chain bottlenecks at key US ports. (CN Beta, Bloomberg, Business Insider)

South Korean travel tech startup Yanolja has acquired a 70% stake in a listed South Korean e-commerce pioneer, Interpark, for about USD250M. The company plans to use the acquisition to make further inroads into the overseas tourism industry. Interpark offers online travel booking services and international shipping to more than 230 countries, and targets Korean, English, Chinese and Japanese-speaking customers. (TechCrunch, Korea Herald)