10-18 #CoExist : Global chip manufacturing leaders have successively announced huge investment plan; Microsoft is on the hunt for a Director of SoC Architecture; Apple is reportedly considering to launch its own cloud-based gaming service; etc.

Takashi Yunogami, director of the Japan Precision Machining Research Institute, has systematically analyzed that under the background of an unstable supply chain, the semiconductor investment boom set off around the world may be accompanied by a potential crisis. In the past year, global chip manufacturing leaders such as TSMC, Samsung, and Intel have successively announced huge investment plans. In his view, this abnormal capital investment and factory-rich phenomenon is like a mouse manipulated by the “Magic Flute”, walking towards the cliff step by step. At the bottom of the cliff is waiting for the collapse of semiconductor prices and the semiconductor depression to come down. Major semiconductor manufacturers have invested more than JPY12T (USD105.1B), and the construction of 29 factories has begun. However, the mass production of semiconductors in these factories seems to be in 2H22 at the earliest, and will not be completed until 2023 under normal circumstances. However, there are signs that global semiconductor production has begun to increase substantially. Global semiconductor quarterly shipments and shipments reached a peak of USD265.8B and USD124.9B when the memory bubble burst in 3Q18. (EE Times, IT Home, CN Beta)

Renesas Electronics, one of the world’s largest automotive chipmakers, says it will outsource more of its production, even as the Japanese government pushes to revive local semiconductor manufacturing. The company can only produce chips with a transistor size of 40nm or larger, a level considered a mature technology in the chip industry. The company has been aggressively diversifying beyond automotive chips, with 3 acquisitions in 4 years: Intersil in 2017, Integrated Device Technology in 2019 and Dialog Semiconductor in 2021. Renesas has been aggressively expanding beyond the stable yet not too profitable business of automotive chips, into an area called analog semiconductors. The shift has brought Renesas into competition with such top U.S. players as Texas Instruments, Analog Devices and Broadcom. (Laoyaoba, Asia Nikkei)

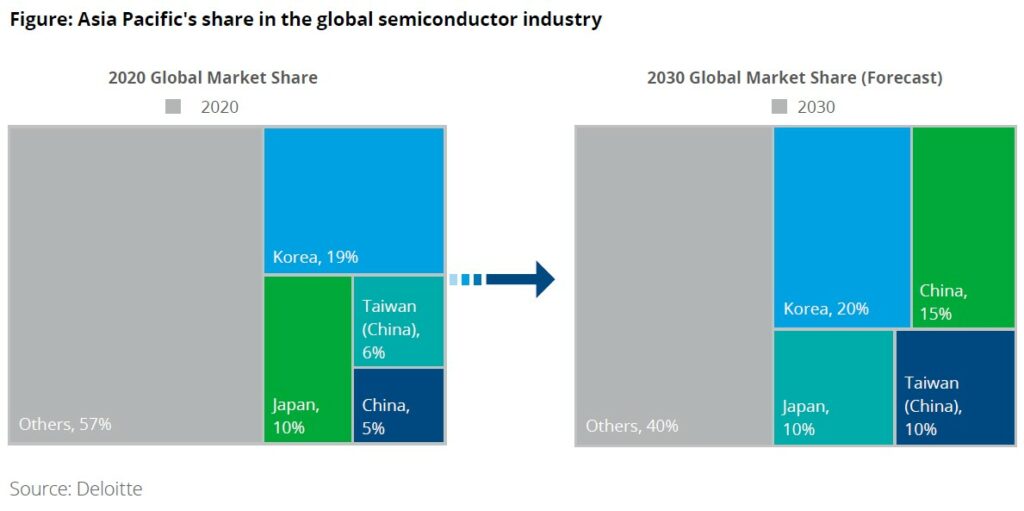

South Korea, Japan, Mainland China and Taiwan (China) have each played a critical role in the development of the semiconductor industry, from upstream to downstream. A series of black swan events have made the Asia Pacific semiconductor market strategically critical. Deloitte expects that the semiconductor industry in the Asia Pacific will grow its global share to 62% by 2030, and the global market of semiconductors will exceed USD1T. (Deloitte report, report)

Most of the world’s top chip design companies today rely on manufacturers in the Asia Pacific region to manufacture semiconductor chips. The two most influential manufacturers are TSMC and Samsung, which collectively own over 70% of the total manufacturing market, they have in recent years become the only suppliers of cutting-edge chips. In particular, the total volume of semiconductor chips made in Taiwan (China) accounts for over 50% of the global total. The reason being that semiconductor manufacturing is capital (up to tens of billions of dollars) and research intensive. To maintain its dominance in the future, Taiwan (China) is rapidly reinventing its techniques, proposing the most advanced 3nm technology which is planned to be implemented in 2H22. (Deloitte report, report)

The Asia-Pacific semiconductor “Big 4” have their own advantages: South Korea——from Samsung Electronics’ Yongin and Hwaseong wafer production bases in Gyeonggi-do to SK Hynix’s wafer production bases in Chungcheongbuk-do; Japan——nearly 40% semiconductor products come from Kyushu Island; Taiwan, China——the semiconductor industry cluster forms 3 major science parks in Hsinchu, southern and central China; China——the Yangtze River Delta with Shanghai as the center, the Bohai Sea with Beijing as the center, and Shenzhen as the center The Pan-Pearl River Delta and the central and western regions represented by Wuhan and Chengdu. (Deloitte report, report)

Exports of semiconductors play an important role in the top four Asia Pacific regions. Compared to all 3 other regions, Taiwan has maintained a relatively high export volume, followed by Mainland China, South Korea and Japan. The semiconductor industries in South Korea and Taiwan (China) constitute a large proportion of their respective GDPs. (Deloitte report, report)

A recent job listing shows Microsoft is on the hunt for a Director of SoC Architecture, a full-time position within its Surface division. Microsoft could be working on its own chips for future Surface devices, the LinkedIn job listing suggests. (Phone Arena, Hot Hardware)

Recently, Japanese auto companies have revealed their Sept 2021 sales. Under the continuing impact of the insufficient supply of semiconductor chips, the sales of Japanese car companies in Sept fell by 20-30% YoY. Specifically, in Sept, Toyota’s new car sales in China fell 35.9% YoY to 115K units, showing a YoY decline for two consecutive months. In terms of domestic joint ventures, FAW Toyota and GAC Toyota’s sales fell by more than 30% YoY; Lexus’ sales fell by about 50%. Toyota has explained that the worsening of the new crown epidemic in Southeast Asia led to insufficient supply of parts and components, which in turn affected new car inventories. (Laoyaoba, Nikkei, Nikkei)

Volkswagen AG’s Skoda unit will produce 250,000 fewer cars than planned in 2021 due to the global chip shortage, more than double the number that the company estimated in Sept 2021. Skoda CEO Thomas Schäfer expects the company to produce 100,000 fewer cars than planned. The chip shortage might last until 2H22 before stabilizing again as the latest rise in Covid-19 cases in Asia pressures production. (CN Beta, Bloomberg, Bloomberg Quint, Sina)

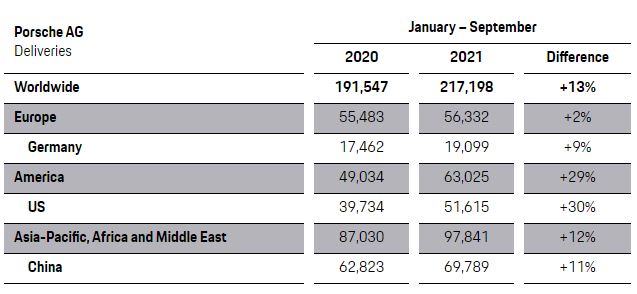

The global chip shortage has affected most automakers, leading to reduced shipments and production stalls. Although most automakers’ deliveries are declining, Porsche’s deliveries have increased by 13% in the first 3 quarters of Jan-Sept 2021. Porsche says it has delivered 217,198 cars worldwide. (CN Beta, Porsche, TechCrunch)

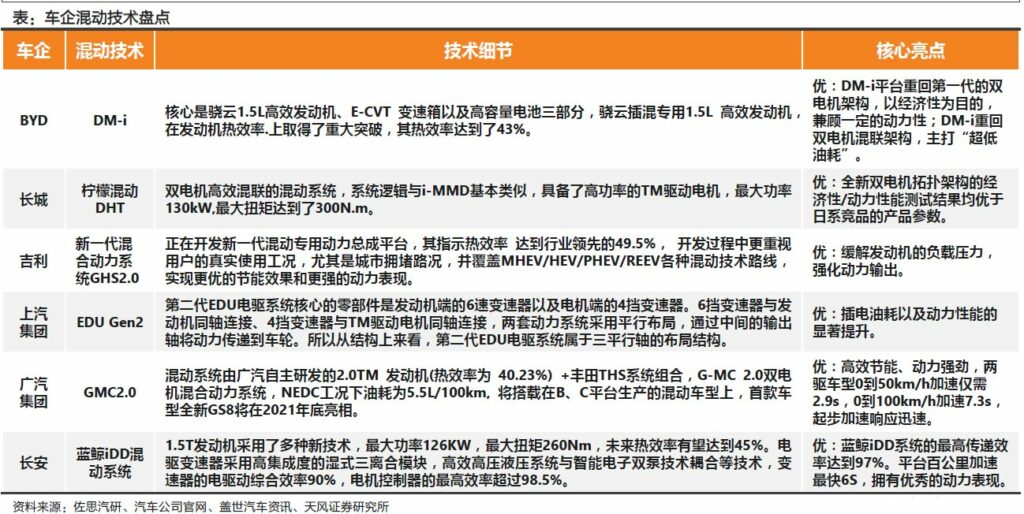

Currently, independent car companies deploy plug-in hybrid power: BYD DM-i, Great Wall Lemon Hybrid DHT, Geely’s new generation hybrid system GHS2.0, GAC Group GMC2.0, Changan Blue Whale iDD Hybrid System, SAIC EDU Gen2, etc. (TF Securities report)

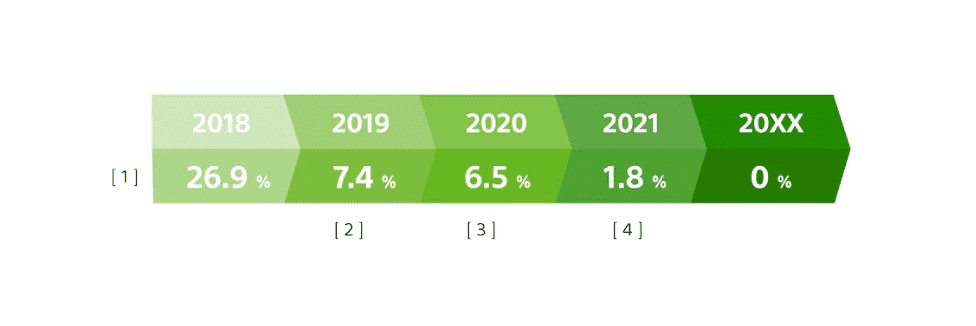

The mobile industry is making continued progress on disclosing climate data (rather than performance) and setting targets for emissions reductions. At the end of 2020, 69% of operators by connections and 80% by revenue disclosed their climate impacts, while 31% of operators by connections and 36% by revenue had set carbon reduction targets to be net zero by 2050. (GSMA report)

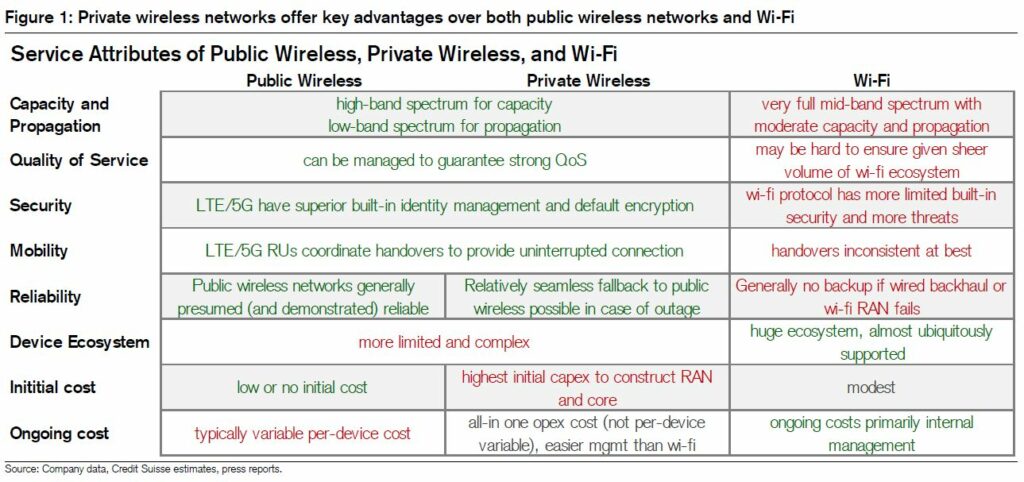

Private wireless networks offer enterprises the opportunity to use a dedicated wireless network with several key advantages over Wi-Fi in capacity and propagation, security, and reliability. Most private wireless networks today are in manufacturing, energy, or logistics, but significant opportunities exist for professional use in healthcare and education. (Credit Suisse report)

Verizon has mentioned a USD7-8B 2025 TAM, and Credit Suisse finds this estimate reasonable given the Industrial Ethernet and Enterprise Wi-Fi markets are each similarly sized. The global private wireless TAM today is low-single-digit billions, and even if it quadruples between now and 2025 to USD16B (twice Verizon’s estimate), it will be only a few bps annual tailwind to wireless service revenue growth given the sheer scale of the consumer wireless market. (Credit Suisse report)

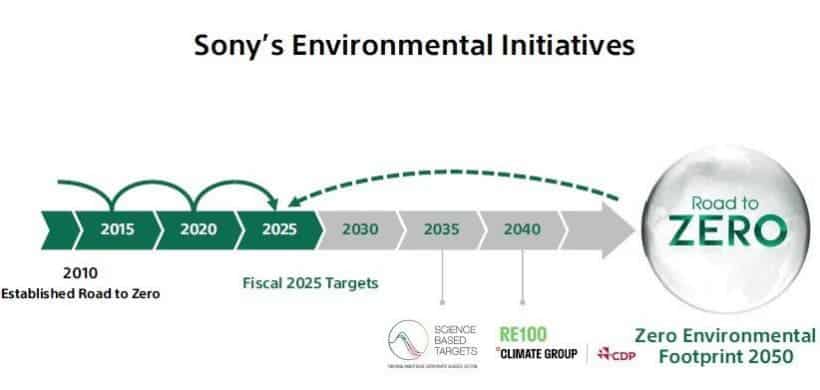

Sony has officially started the “Green Management 2025” (GM2025) in Apr 2021. It is a 5-year plan to achieve Sony’s Road to Zero plan (to 2050). GM2025 has a goal to gradually reduce the amount of plastic in portable product packaging until the use of plastic reaches 0%. For every year, Sony has set mid-term environmental goals. (GizChina, Sony)

Apple is reportedly considering to launch its own cloud-based gaming service in parallel with Apple Arcade, similar to Nvidia’s GeForce Now and Google’s Stadia, according to Bloomberg’s Mark Gurman. (Apple Insider, 9to5Mac, Bloomberg)

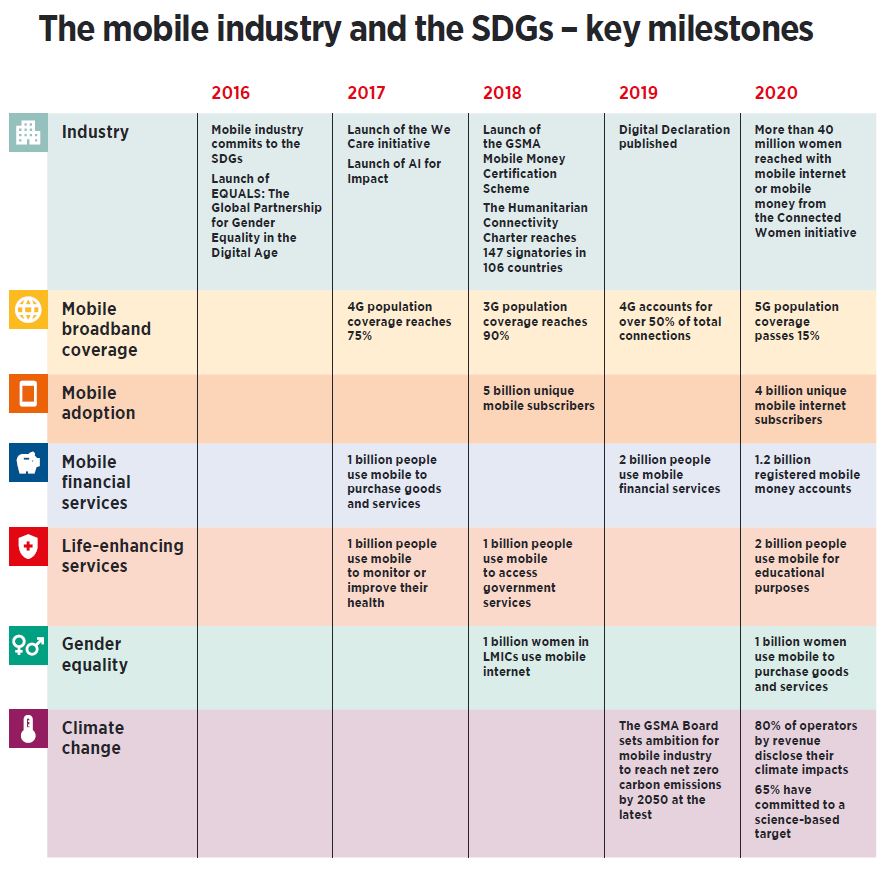

According to GSMA, In 2020, the mobile industry increased its impact for each of the 17 Sustainable Development Goals (SDGs), achieving an average SDG impact score of 50. This means the industry is achieving 50% of its potential contribution to the SDGs – up from 48% in 2019 and 33% in 2015. The mobile industry is halfway to maximizing its potential impact on the SDGs. (GSMA report)

Li Xiang Motors Beijing Green Smart Factory officially started construction in Shunyi District, Beijing. The entire project has invested more than CNY6B. It is planned to be put into operation at the end of 2023 and will be used to produce new pure electric products in the future. The factory plans to start production at the end of 2023, and the first phase will achieve an annual production capacity of 100,000 pure electric vehicles. The company is currently developing two high-voltage pure electric vehicle platforms——Whale and Shark. The official said that from 2023, it plans to launch at least 2 high-voltage pure electric vehicles each year. (My Drivers, Auto Home, Sina)

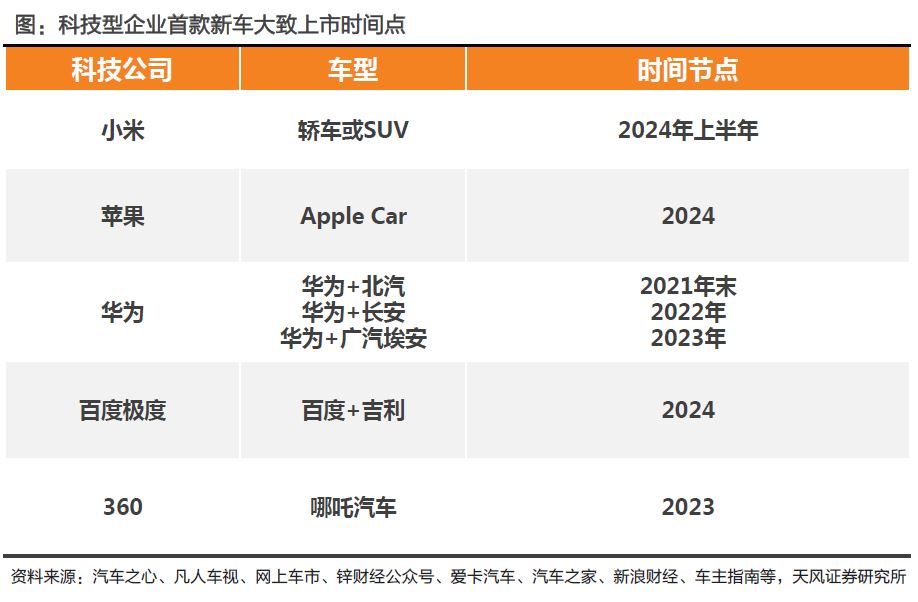

Internet technology giants have entered the joined the car-making industry in a variety of ways. Tencent, Alibaba, Meituan, and 360 concentrate on participating in new car-making forces; Huawei has in-depth cooperation with independent brand car companies such as BAIC, GAC, and Changan; Xiaomi builds its own cars and plans to release them in 2024; Tech companies such as Didi and DJI have also joined the car-making segment. (TF Securities report)

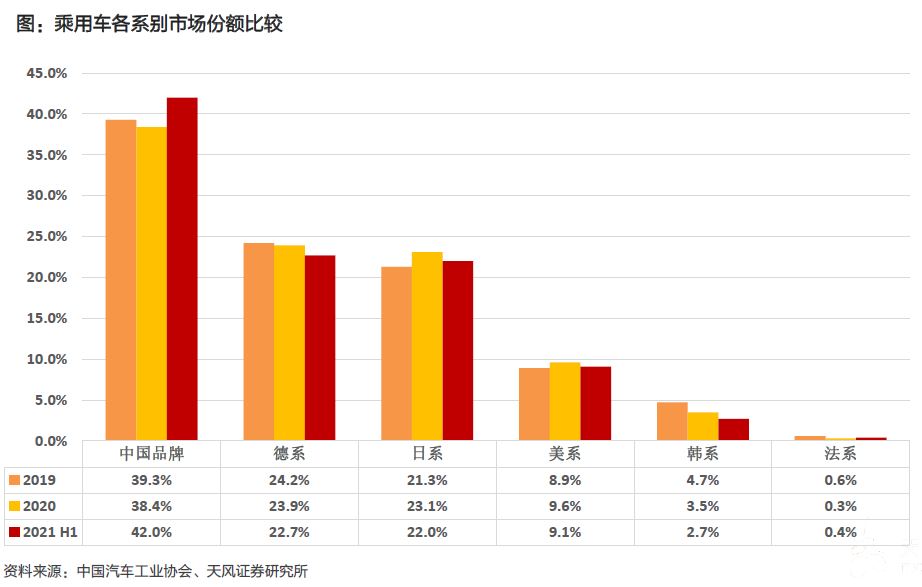

In recent years, the sales of French, Italian and Korean joint venture brands have been sluggish and showing a downward trend. Opel and Suzuki have withdrawn from the Chinese market. After years of intensive cultivation and precipitation, Chinese independent brands have gradually surpassed joint venture brands in the fierce global automotive market competition by relying on hard power such as manufacturing technology and soft power such as national culture and art. (TF Securities report)

Most of the first new cars of technology companies will be launched around 2024. Xiaomi, Apple, Huawei, Didi, Baidu Extreme, etc. may successively launch new cars in the next few years. Considering brand promotion and new models and new capacity ramp-ups, Tianfeng Securities predicts that traditional car companies, new forces, and technology companies will be in full competition from 2024. (TF Securities report)

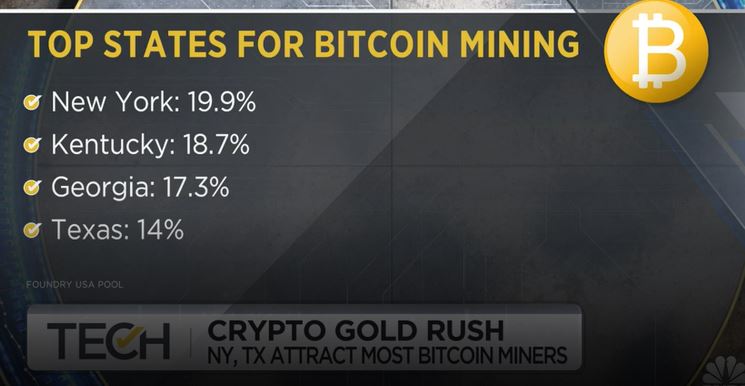

Square CEO Jack Dorsey has revealed that the company is looking to build a bitcoin mining system based on custom silicon and open source for individuals as well as businesses. This would add to Square’s existing bitcoin-focused projects including a business to build an open developer platform, as well as a hardware wallet for the cryptocurrency. (CN Beta, CNBC, Engadget, Reuters)

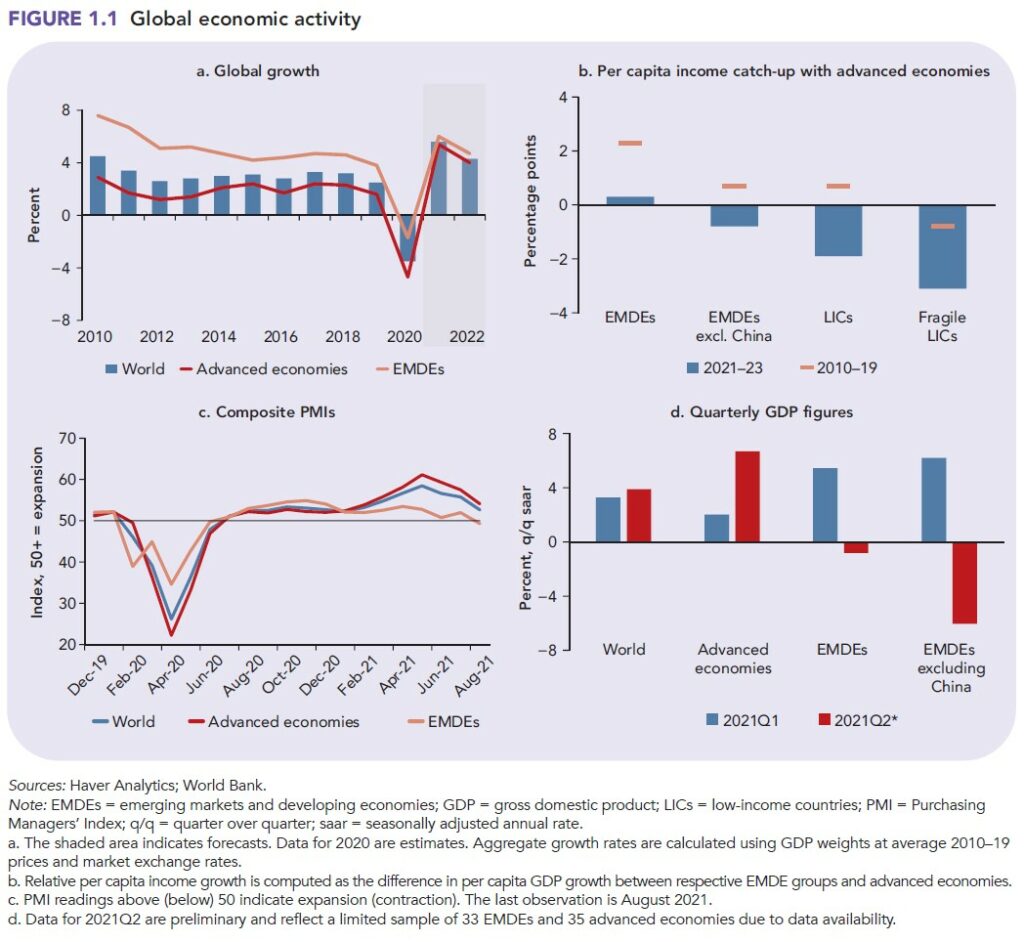

After the COVID-19 pandemic triggered an estimated 3.4% contraction in 2020, global economic activity has rebounded but remains well below pre-pandemic projections. The baseline forecast envisioned that the global economy would expand 5.6% in 2021. The global recovery had then been forecast to continue into 2022, with global growth moderating to 4.3% — a pace insufficient to bring output levels in line with pre-pandemic projections. The per capita income catch-up with advanced economies has slowed and even reversed in some cases. By end-2021, about 100M people are expected to fall back into extreme poverty. (World Bank Group report)

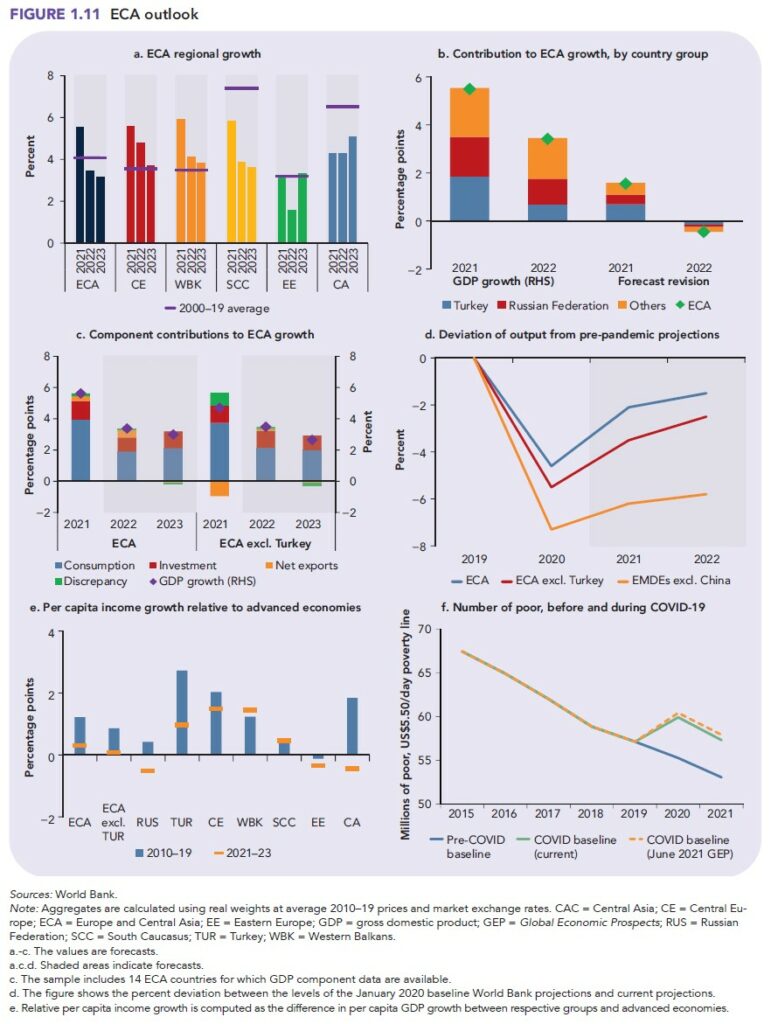

East Asia and the Pacific (ECA)’s economy is expected to expand 5.5% in 2021—insufficient to return output to its pre-pandemic projection. Nevertheless, the outlook for 2021 is considerably stronger than previously envisioned, reflecting a release of pent-up demand in the region’s largest economies. The improvement is broad-based, with growth in 2021 upwardly revised in about 90% of ECA’s economies on the back of strengthening domestic demand. (World Bank Group report)