10-27 #Angel : TSMC has announced its N4P process; The shortage of foundry production capacity will continue throughout 2022; Jio and Google have worked together to create Pragati OS; etc.

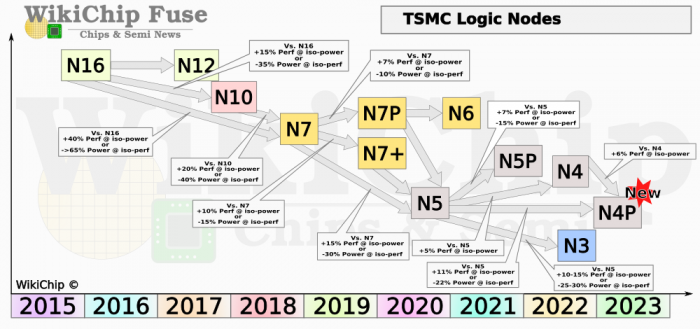

TSMC has announced its N4P process, which is an enhanced version of the company’s 5nm platform. This new N4P process marks the third enhancement of TSMC’s 5nm process and is claimed to offer around an 11% hike in performance over the original N5 technology and around 6% improvement over the N4 process. As for the power efficiency, the company claims 22% better efficiency compared to the original N5 technology and the transistor density is also said to be 6% higher. TSMC is expected to release the first tape-outs on N4P by 2H22. TSMC has previously disclosed that the N3 3nm process will be risky trial production in 2021, 2H22 mass production, 1Q23 real income, N3E 2024 mass production, N2 2nm mass production in 2025. (CN Beta, Tom’s Hardware, WCCFTech, TSMC, Gizmo China)

Qualcomm has introduced 4 new mobile platforms – Snapdragon 778G Plus 5G, 695 5G, 480 Plus 5G, and 680 4G. Snapdragon 778G Plus, a follow-on to Snapdragon 778G with boosted GPU and CPU performance. Snapdragon 695 5G Mobile Platform delivers truly global 5G with support for both mmWave and sub-6 GHz. Snapdragon 480 Plus will continue to help drive further proliferation of 5G. The new Snapdragon 680 4G Mobile Platform, which is built on 6nm process technology. (CN Beta, Liliputing, Android Authority, Qualcomm)

Intel CEO Pat Gelsinger says the ball is in Intel’s court to win back lost business from the Mac making Apple. Recall it was late 2020 when Apple made the long-expected decision to use chips designed in-house for its Macs. Apple’s M1 chips are based on Arm architecture as opposed to Intel’s x86 chips. The decision effectively ended Apple’s roughly 15-year relationship with Intel. (CN Beta, Yahoo)

The shortage of foundry production capacity will continue throughout 2022. Following TSMC, UMC, Powerchip and VIS have reportedly notified customers that they will increase prices by more than 10% in 1Q22, and have emphasized that 1H22 capacity has been fully booked and orders are visible up to 2H22. (CN Beta, CTEE, LTN, China Times, Digitimes)

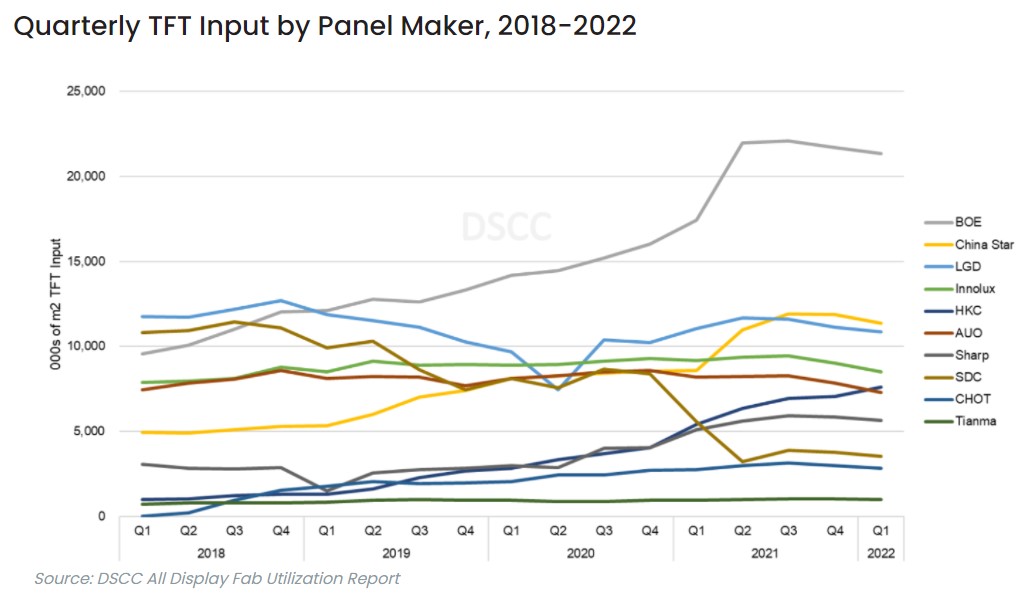

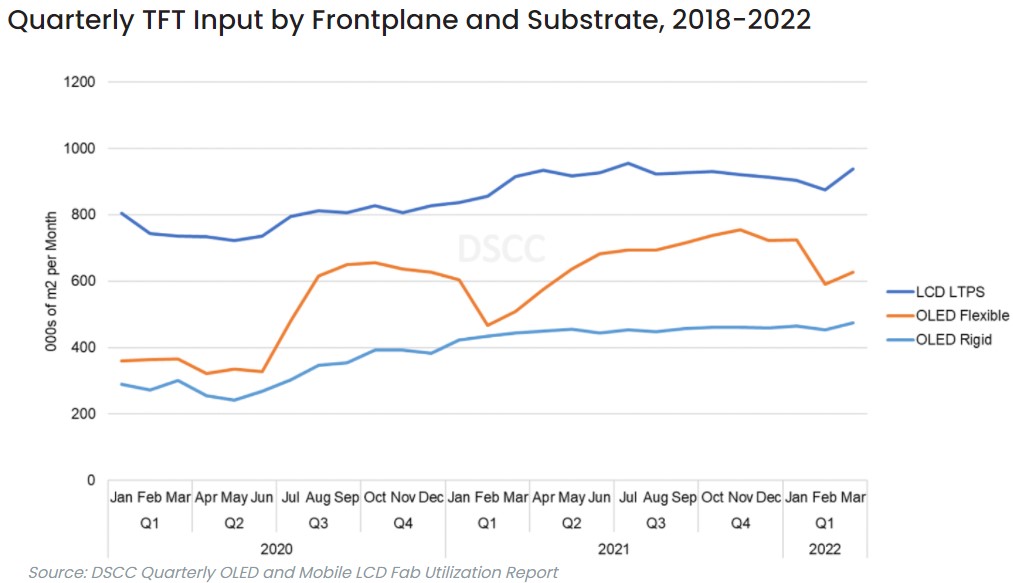

DSCC says that 2021 will see strong growth in OLED production. Flexible OLED production glass input is expected to grow by 36% in 2021, while rigid OLED input will grow even stronger at 42%. The utilization rates at OLED production lines are still relatively low, especially at BOE’s flexible OLED lines. As of the end of 2021, flexible OLED utilization rates are around 70%, rigid OLED utilization is at about 77% while OLED TV utilization is higher at around 85%. LG Display’s utilization rates are lower than earlier in 2021, which DSCC says is intentional to support prices. (CN Beta, IT Home, Business Korea, OLED-Info, DSCC)

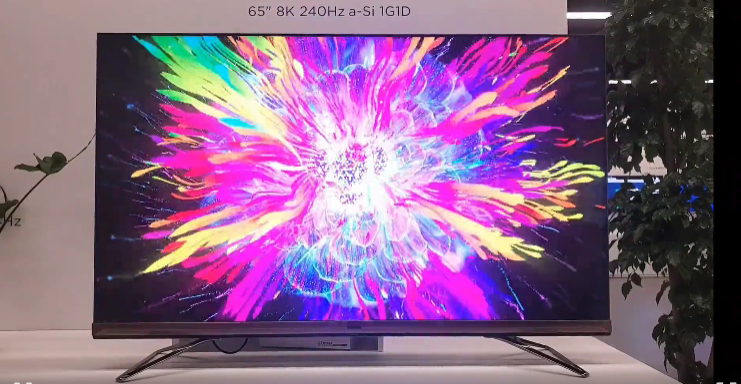

BOE has announced that it has developed 8K 240Hz a-Si 1G1D large-size display technology. BOE has recently developed a 65” 8K 240Hz ultra-high resolution and high refresh rate display product, which is another technological breakthrough of BOE’s wide-view ADS Pro hard screen technology. Compared with conventional 8K 60Hz products, this technology has improved transmittance by nearly 30% and contrast improved by nearly 2 times. (CN Beta, The Clare People, IT Home)

CATL has announced a strategic partnership with China Huadian, one of the largest state-owned power generation enterprises in China. Prior to the signing of the new deal, both companies have agreed to collaborate on a centralized electrochemical energy storage project in Tengzhou, Shandong province. Covering an area of around about 26,700m2, it is designed to develop a 100MW / 200MWh lithium ion battery energy storage base. (CN Beta, Yicai, Jiemian, Gasgoo)

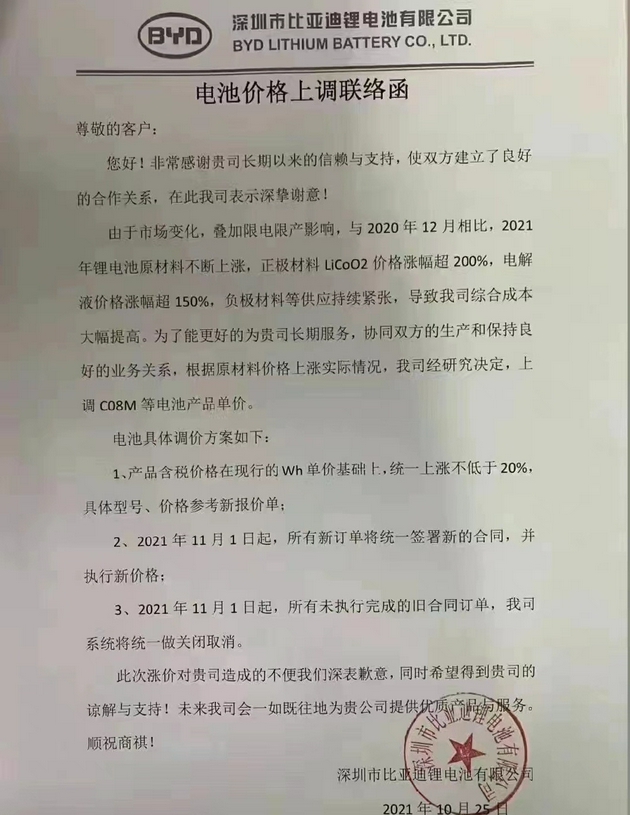

BYD’s contact letter on battery price increases mentioned that due to market changes and the impact of power cuts and production restrictions, compared with Dec 2020, the price of raw materials used for lithium batteries continued to rise in 2021, with the price of positive electrode material LiCoO2 increasing by over 200% and electrolyte prices increasing by over 150%. Meanwhile, the supply of negative electrode materials continued to be tight, resulting in a substantial increase in comprehensive costs. Shenzhen BYD Lithium Battery, therefore, decided to raise the unit price of battery products such as CO8M. The price of products (including tax) will increase by no less than 20% on the basis of the current Wh unit price. (CN Beta, Caixing Global, Pandaily)

Stellantis, the parent company of Chrysler, Dodge and Jeep, has announced that it’s forming a joint venture with Samsung SDI, the Korean giant’s battery division, to manufacture battery cells in North America, pending regulatory approval. This tie-up is expected to yield fruit starting in 2025, when their first plant comes online. The location of this facility has not been determined, but annual capacity is expected to start at 23 gigawatt-hours per year, but based on demand, that could be increased to 40GWh. (CN Beta, CNET, Reuters, Auto News)

American EV startup Canoo has announced that it has reached an agreement with Panasonic to supply the batteries for its upcoming Lifestyle Vehicle. Canoo’s Lifestyle Vehicle utilizes maximum cabin space, sitting in the footprint of a compact electric vehicle, with the interior of an SUV. The exterior features 22 windows, offering enhanced light and visibility for passengers and drivers. (CN Beta, Electrek, Inside EVs, Canoo, Green Car)

SoftBank will stop collecting penalties at the end of Jan 2022 from users who cancel their subscription contracts before expiration. Among rival companies, NTT Docomo has abolished such cancellation fees, while KDDI is planning to follow suit by Mar 2022. The moves are expected to enable subscribers to switch carriers more easily. (CN Beta, Japan News, Japan Times)

Amazon’s Project Kuiper and Verizon Communications will collaborate on connectivity solutions that capitalize on Kuiper’s future broadband satellite constellation as well as Verizon’s terrestrial 4G/LTE and 5G data networks. In 2020, Last year, Amazon received the Federal Communications Commission’s conditional go-ahead to deploy 3,236 satellites that would provide broadband internet access across the globe from low Earth orbit (LEO). (CN Beta, CNBC, Geek Wire, Space News)

Jio and Google have worked together to create Pragati OS – an Android customization that is designed for the Indian market with many features aimed at specific issues (“pragati” means “progress”). “Translate Now” will help users cross the language barrier. They can talk into the phone in their language to have it translated into another language. “Read Aloud” does what it says, it can read out any text from any app to the user. The phone will also run the full suite of Jio apps. (GSM Arena, Fonearena, India Times, India Today)

OPPO A56 5G is official in China – 6.5” 720×1600 HD+ v-notch IPS LCD, MediaTek Dimensity 700 5G, rear dual 13MP-2MP depth + front 8MP, 6+128GB, Android 11.0, side fingerprint, 5000mAh 10W, CNY1,599 (USD250). (GSM Arena, NDTV, Gizmo China)

Sony Xperia Pro-I is announced – 6.5” 1644×3840 QHD+ 21:9 OLED 120Hz, Qualcomm Snapdragon 888 5G, Zeiss optics / Zeiss T* lens coating, rear quad 12MP 1.0-type 2.4µm OIS-12MP telephoto 2x optical zoom OIS-12MP ultrawide-o.3MP 3D ToF + front 8MP, 12+512GB, Android 11.0, side fingerprint, 4500mAh 30W, USD1,799 / EUR1,799. (GSM Arena, The Verge, Sony)

Honor Play5 Youth is announced in China – 6.67” 1080×2376 FHD+ 2xHiD IPS LCD 120Hz, MediaTek Dimensity 900 5G, rear dual 64MP-2MP depth + front 16MP, 8+128 / 8+256GB, Android 11.0, side fingerprint, 4300mAh 66W, CNY1,799 (USD280) / CNY1,999 (USD315). (GSM Arena, Weibo, HiHonor)

Infinix Smart 6 is launched in select markets – 6.67” 720×1600 HD+ v-notch IPS LCD, Unisoc SC9863A, rear dual 8MP-AI lens + front 5MP, 2+32GB, Android 11.0 Go, rear fingerprint, 5000mAh 10W, micro-USB port, USD120. (Gizmo China, NDTV, Infinix, 91Mobiles)

Palm Buds Pro is announced, priced at USD129. Each earbud has a studio-grade 10mm dynamic driver that provides “big thumping bass, enhanced mids, and crisp highs”. There is Active Noise Cancellation (ANC) thanks to a 6-microphone system. There is also Ambient mode so users can hear announcements, voices, and street traffic while playback is on. (Gizmo China, Palm, The Verge, ZDNet)

HTC has announced True Wireless Earbuds Plus, supporting active noise cancellation (ANC). The earbuds utilize an in-ear design with silicon tips making it gentle on the ears. They are priced at GBP69 in United Kingdom. (CN Beta, GSM Arena, Gizmo China)

Sony has announced Xperia View VR headset, which only works with Sony Xperia 1 II and Xperia 1 III. The device offers 120º of horizontal vision to support the 6.5” display of compatible Xperia smartphones. Sony claims that the VR headset is capable of decoding 8K video data and 360º video. The headset will cost JPY29,700 (USD260). (CN Beta, Gizmo China, NDTV)

Samsung has announced that it is entering the cloud gaming arena with an offering for its Tizen smart TV platform. Samsung has not provided any more details about what games would be available, what other platforms it would be available on, if any, or when it will launch. (CN Beta, The Verge, YouTube)

Samsung has announced a complete adoption of Matter across Samsung’s Galaxy devices, televisions, Family Hub appliances, and SmartThings hubs. A founding member of the Matter group (formerly known as Project ChiP), Samsung has also announced that it has joined the Thread Group Board of Directors, where it will sit alongside the likes of Apple, Google / Nest, Lutron, Qualcomm, and Silicon Labs to shape the future of the primary protocol that Matter devices will run on. (The Verge, Android Headlines, Samsung)

Xiaomi has announced that it has sold over 7M units of Mi and Redmi-branded smart TVs in India since their introduction. The sales figure from Xiaomi Data Center accounts from Mar 2018 to Sept 2021. Redmi Smart TV X 50”, Mi TV 4AA 32”, Mi TV 5X 43” have witnessed maximum demand from consumers. (Gizmo China, MySmartPrice)

Xpeng plans to unveil its updated Xpilot 4.0 system in 2023, providing drivers with full-scenario support by then. Xpeng is ranked first in a JD Power survey in Aug 2021 of car owners on their experience with 42 in-vehicle technologies. The current 3.0 version, unveiled earlier this year, has navigation guided pilot (NGP) functions on highways and has recorded 11.98Mkm of driving. (Gizmo China, SCMP, TechNews, Sohu)

XPeng has officially unveiled the 6th-generation of its “flying car” from HT Aero. HT Aero’s 5th-generation prototype, the X2 is currently undergoing testing at high altitudes – part of HT Aero’s running tally of over 15,000 safe flights. This new flying car with road capabilities is currently scheduled to arrive sometime in 2024 and should cost below CNY1M (~USD156,600). (CN Beta, Caixing Global, Electrek, Auto Evolution)

Australian company AMSL Aero claims its Vertiia will be the world’s most efficient eVTOL design, and one of the most affordable. The Vertiia will travel up to 1,000 km on a tank of hydrogen, carrying 5 people or 500 kg of cargo at a quick cruise speed of 300km/h. (CN Beta, AMSL Aero, New Atlas)

OPPO has announced its own official smart car solution dubbed Carlink and the company aims on shipping the technology in about 15M cars by 2022. OPPO Carlink is an all-scenario mobility solution, which offers functions like digital car keys, vehicle management tools through a smartwatch, and even an in car smart screen solution as well. (Gizmo China, Sunnews.cc, Sina, IT Home)

360 has previously disclosed that it intends to invest in Hezhong New Energy Automobile. The investment will exceed CNY2.9B (USD450M). 360 has confirmed that it will spend CNY2.9B to buy a stake in Nezha Automobile. 360 has previously stated that the company’s strategic investment in Nezha Motors intends to use intelligent networked car safety as the cornerstone. (GizChina, My Drivers)

PayPal has stated that it is “not pursuing an acquisition of Pinterest at this time”, effectively denying rumors of an imminent USD45B acquisition. PayPal has recently acquired buy now, pay later provider Paidy and has gotten into cryptocurrency trading. (Engadget, Bloomberg, PayPal)