10-29 #BizTrip : Samsung Electronics plans to triple its foundry production capacity by 2026; Sony has confirmed that it is in talks with TSMC to build a chip factory in Japan; SK Hynix will acquire South Korea-based Key Foundry; etc.

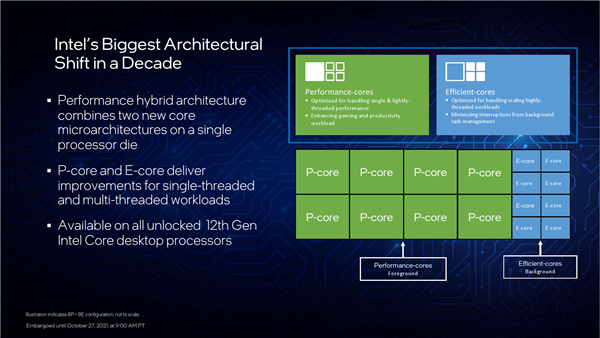

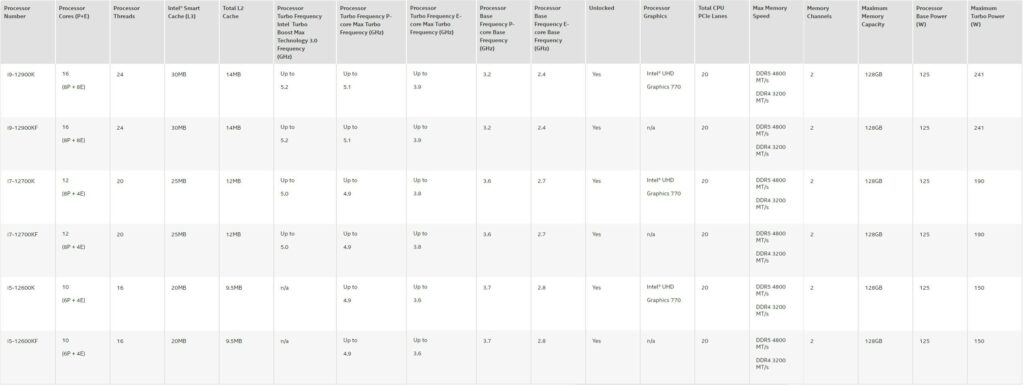

Intel has announced its new 12th Gen Core processors for the desktop. The six new models being announced are the first of Intel’s new generation of processors based on the company’s Alder Lake architecture using a 10nm fabrication process. Three of the six models being launched include the Core i9-12900K, Core i7-12700K, and the Core i5-12600K, with the remaining three being the KF variant of the aforementioned models (the F signifies a lack of an integrated GPU). (GSM Arena, Gizmo China, My Drivers)

GlobalFoundries is expected to launch its initial public offering (IPO). GlobalFoundries was established in 2009 and is owned by Abu Dhabi sovereign wealth fund Mubadala Investment Company. It is a chip foundry based in the United States. The company’s customers include Qualcomm, AMD, Broadcom and STMicroelectronics, etc. (CN Beta, Barron’s, Market Watch, Times Union, NASDAQ)

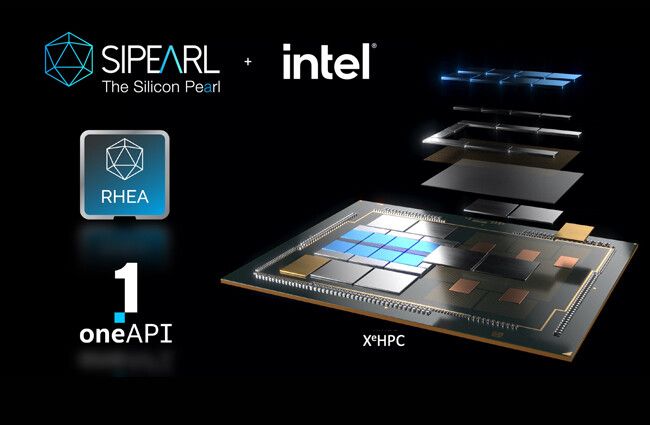

SiPearl, the designer of the high computing power and low consumption microprocessor that will be the heart of European supercomputers, has entered into a partnership with Intel in order to offer a common offer dedicated to the first exascale supercomputers in Europe. This partnership will offer their European customers the possibility of combining Rhea, the high computing power and low consumption microprocessor developed by SiPearl, with Intel’s Ponte Vecchio accelerator, thus creating a high performance computing node that will promote the deployment of the exascale supercomputing in Europe. (CN Beta, EE News, TechPowerUp)

Samsung Electronics plans to triple its foundry production capacity by 2026 amid a global chip shortage disrupting production in key industries from autos to smartphones. Han Seung-hoon, a Samsung executive, has indicated that the company plans to expand our capacity about three times by 2026 to meet customers’ needs as much as possible by expanding capacity in Pyeongtaek as well as considering establishing a new plant in the U.S. Lee Su-bin, an analyst at Daishin Securities, has revealed that Samsung’s client numbers are increasing sharply, reaching more than 100 this year from 35 in 2017. Lee expects that to hit over 300 in 2026. (Asia Nikkei, CN Beta, Money DJ)

Sony has confirmed that it is in talks with Taiwan Semiconductor Manufacturing Co (TSMC) to build a chip factory in the western Japanese prefecture of Kumamoto. The company’s CFO Hiroki Totoki has revealed that Sony and TSMC are also discussing how the companies can deepen their partnership. (CN Beta, Asia Nikkei, Asia Financial)

Apple has announced that it has joined Sustainable Semiconductor Technologies and Systems (SSTS), a new research program launched by Belgium-based R&D organization Interuniversity Microelectronics Centre (Imec), to reduce the environmental impact of “choices made at chip technology’s definition phase”. SSTS will use models and greenhouse gas footprint analyses to help the integrated circuit-making (IC) industry cut back on its ecological footprint as part of the global fight against climate change, resources depletion, and pollution. (VentureBeat, imec, iMore, Apple Insider)

Google’s APK teardowns on Pixel 6 have revealed references to what could be a Tensor 2 processor. The chipset will likely appear inside the Pixel 7 range in 2022. It seems highly likely that the company is preparing for this second-generation Google Tensor GS201 chip. (Android Authority, CN Beta, 9to5Google)

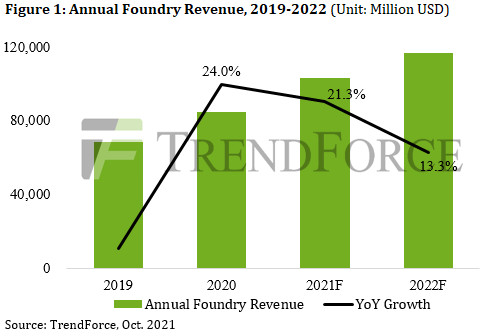

While the global electronics supply chain experienced a chip shortage, the corresponding shortage of foundry capacities also led various foundries to raise their quotes, resulting in an over 20% YoY increase in the total annual revenues of the top 10 foundries for both 2020 and 2021, according to TrendForce. The top 10 foundries’ annual revenue for 2021 is now expected to surpass USD100B. As TSMC leads yet another round of price hikes across the industry, annual foundry revenue for 2022 will likely reach USD117.69B, a 13.3% YoY increase. TrendForce indicates that the combined CAPEX of the top 10 foundries surpassed USD50B in 2021, a 43% YoY increase. (TrendForce, TrendForce)

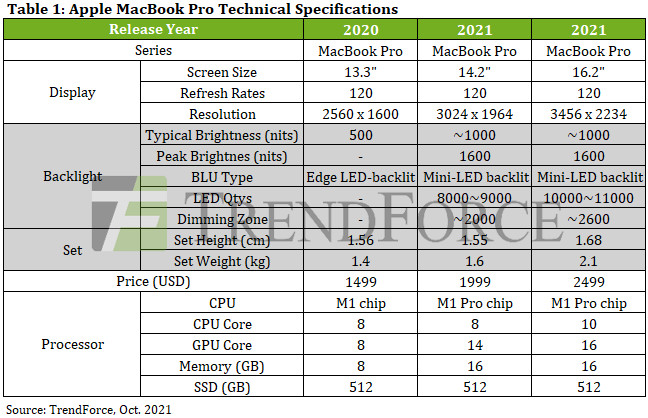

TrendForce’s latest investigations indicate that, in light of Apple’s foray into the high-end notebook computer market with the latest generation of MacBook Pro, annual shipment of notebook computers equipped with Mini LED backlight for 2022 will likely reach 5M units, a 213% YoY increase. TrendForce is revising its forecast of annual shipment of notebooks with Mini LED backlight for 2021 from 2.4M units down to 1.65M units.(Laoyaoba, TrendForce, TrendForce)

Innodisk has released the first-of-its-kind Ultra Temperature DDR4 DRAM module that can operate from a chilling -40ºC to a scorching 125ºC. Firstly, a robust 45mu” gold finger provides a tougher, more reliable connection than the typical 30mu” gold finger found on most industrial-grade DRAM. There’s also side fill technology that protects and strengthens delicate solder joints against thermal and mechanical stress. (CN Beta, Innodisk, PR Newswire)

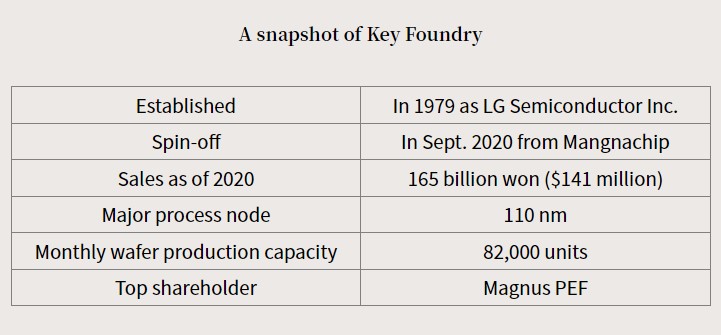

SK Hynix will acquire South Korea-based Key Foundry, a chip contract manufacturer, for KRW576B (USD492.41M). The 8” wafer foundry manufactures chips such as power management, display driver and microcontroller unit semiconductors. Located in Cheongju, North Chungcheong Province, Key Foundry has the capacity to produce 82,000 wafers a month. SK Hynix, which currently runs a foundry business through its subsidiary SK Hynix System IC, said the acquisition will double the company’s total foundry capacity to about 200,000 wafers. (Laoyaoba, Korea Herald, Asia Nikkei, Reuters)

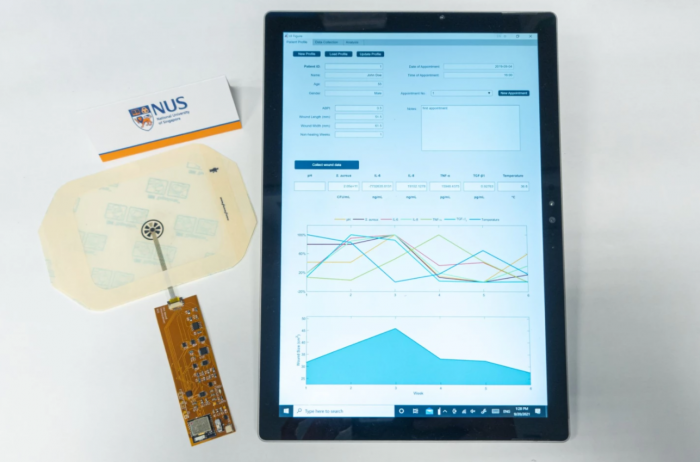

National University of Singapore is developing electronically enhanced bandage technology known as VeCare. The actual single-use bandage itself is made up of four layers. There’s a bottom layer that lies against the wound, followed by a flat microfluidic collection device, a flexible electrochemical immunosensor, and a breathable protective outer layer. As the bandage sits against the wound, fluid from the injury is drawn into the microfluidic device via capillary action. When a separate reusable battery-powered chip is plugged into a lead extending from the immunosensor, the latter automatically begins analyzing the fluid. Within 15 minutes, it’s able to measure the pH and temperature of the wound site, which can in turn be used to determine if any infection is occurring. (CN Beta, New Atlas, Straits Times)

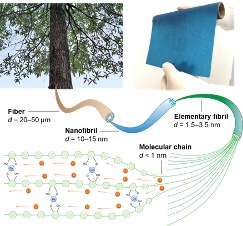

Brown University has developed a tree-derived material to be used in solid-state batteries, which are safer and less environmentally damaging than current batteries. They have developed a material to be used as a solid electrolyte which is composed of a combination of copper and polymer tubes that are derived from wood and are called cellulose nanofibrils. The polymer material the researchers developed is extremely thin and flexible, like a sheet of paper, which makes it easier to use in manufacturing. Yet its ion conductivity is as good as thicker, more brittle materials like ceramics. (Digital Trends, Nature, Brown University)

Samsung Electronics and Ciena have entered into an agreement to deliver 5G network solutions to the market. The agreement enables Samsung to couple Ciena’s xHaul solutions with its own 5G solutions to support the next-generation of high-bandwidth applications and services driven by expanding 5G networks. (CN Beta, Samsung, Fierce Wireless)

Google has announced that its MNVO Google Fi will be enabling enhanced protection for calls with end-to-end encryption on Android smartphones. However, the feature will only work for calls between Google Fi customers. The end-to-end encryption for a call will include audio and visual cues so that users know immediately that their calls are end-to-end encrypted. (Gizmo China, Engadget, The Verge, Google)

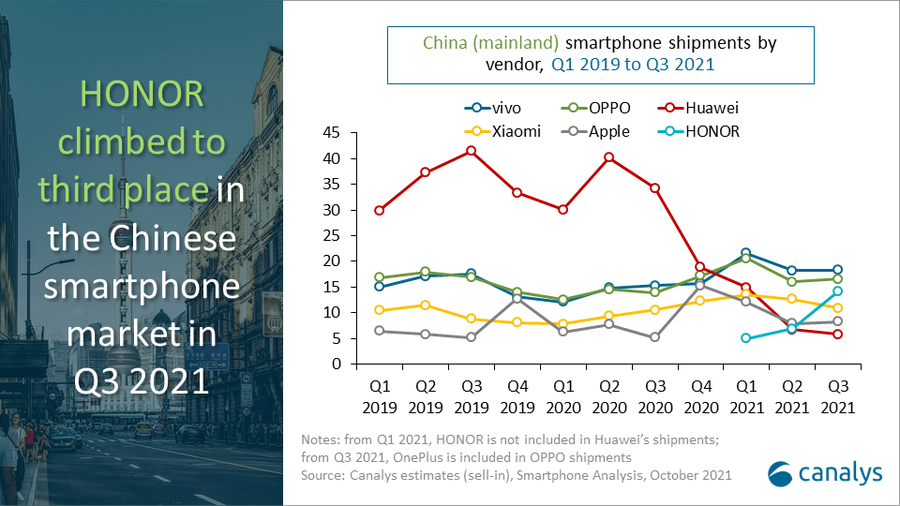

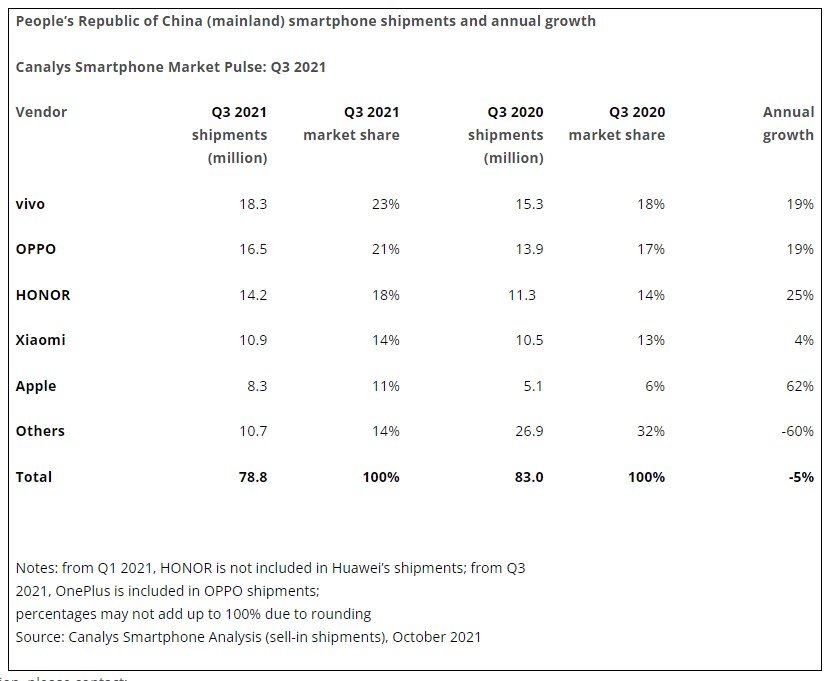

Smartphone shipments fell 5% year on year in Mainland China in 3Q21, reaching 78.8M units. Market leader vivo solidified its position, shipping 18.3M units for a 23% share. OPPO, which has now merged with OnePlus, stayed in second place with 16.5M shipments. Honor entered the top 3 for the first time, with its market share soaring from 9% in 3Q21 to 18% in 3Q21. Xiaomi ranked fourth with 10.9M units shipped amid supply constraints, while Apple completed the top five, shipping 8.3M units. (GSM Arena, Canalys)

China’s smartphone sales in 3Q21 declined 9% YoY but increased 3% QoQ to reach 76.5M units, according to Counterpoint Research. Due to weak consumer demand and component shortages, especially 4G SoCs, the country’s smartphone market failed to see any major improvement in sales in 3Q21. Honor’s share rose quickly to the third spot, marginally surpassing that of Xiaomi. (Gizmo China, Counterpoint Research)

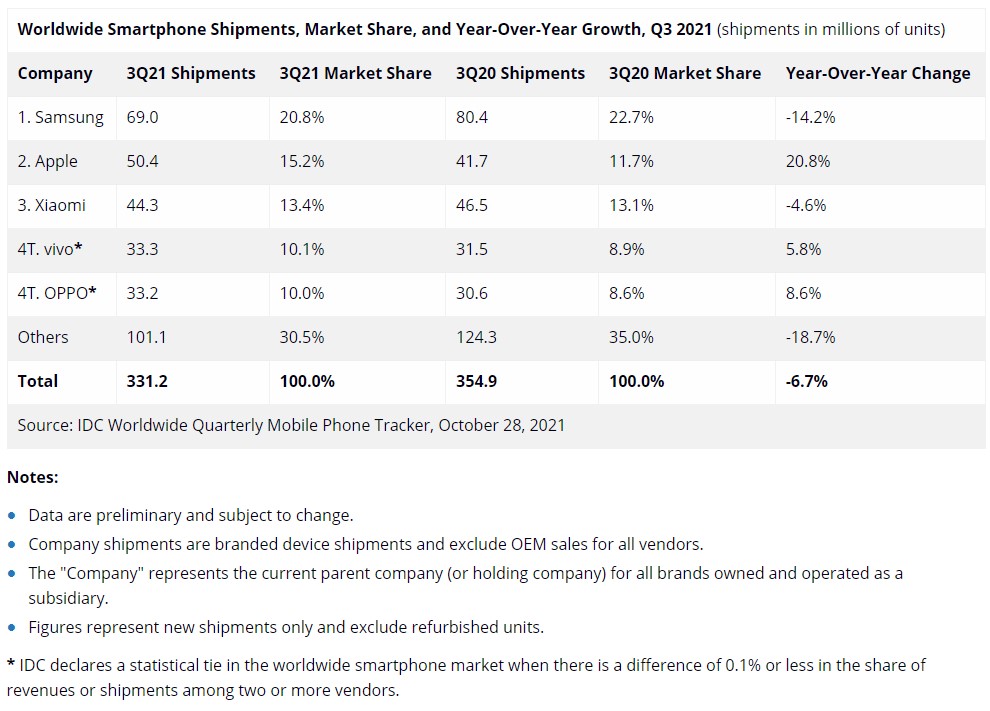

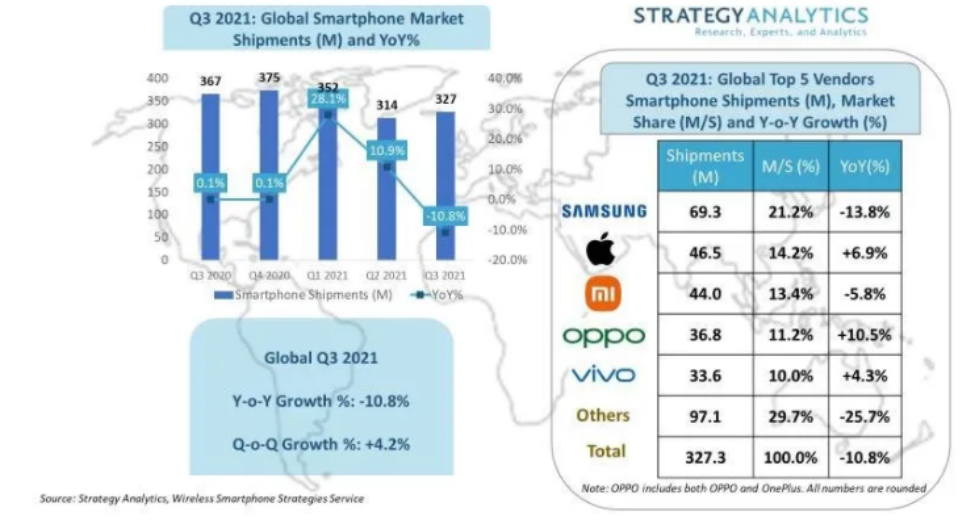

The double-digit growth in the smartphone market in 1H21 came to an end in 3Q21 as worldwide shipments declined 6.7% YoY. According to IDC, smartphone vendors shipped a total of 331.2M units during the quarter. Although a slight decline was expected in the seasonally low third quarter, the actual decline were over twice the forecast of -2.9% growth. Samsung finished in the top position with 69.0M units shipped and 20.8% market share. This was a YoY decline of 14.2% largely due to supply constraints. (Gizmo China, My Drivers, IDC)

Apple has announced that it is adding 10 new projects for its “Power for Impact” initiative, which looks to bring clean energy solutions to communities around the world, and has more than doubled the number of its suppliers committed to using 100% clean energy over the past year. Apple announced its Power for Impact initiative in 2019, designed to provide communities with renewable energy while promoting economic and social growth. (MacRumors, Apple, CN Beta)

Apple CEO Tim Cook says that industrywide silicon shortages and COVID-related manufacturing disruptions cost Apple USD6B in the Sept 2021 quarter. Apple has said revenues and profits for 3Q21 are USD83.4B. (Apple Insider, CNBC, Asia Nikkei, Reuters)

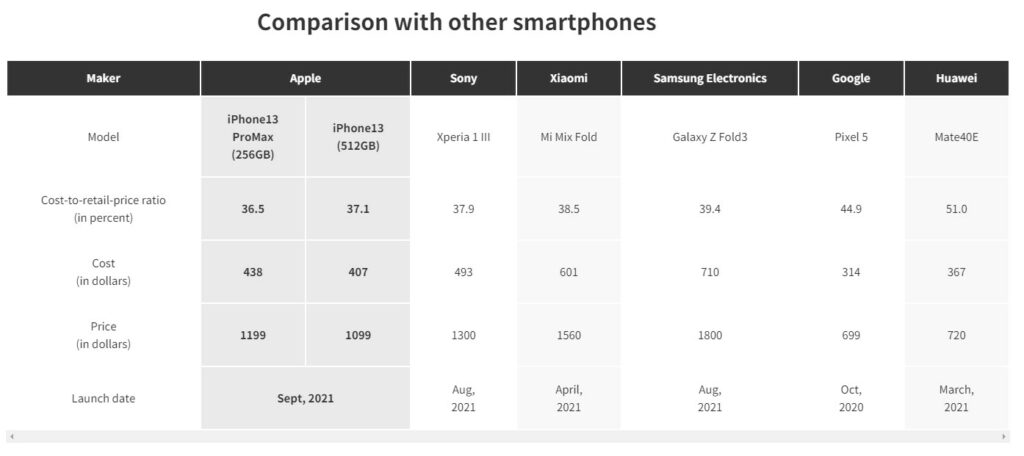

Nikkei and the Financial Times have collaborated with teardown specialist Fomalhaut Techno Solutions to analyze the BOM of Apple iPhone 13 Pro Max. The teardown reveals that the display is the most expensive component, at USD105, followed by the camera module at USD77 and the main semiconductor at USD45. The cost of Pro Max, estimated by adding the cost of the components, is USD438, or 36.5% of the handset’s retail price. (Laoyaoba, Asia Nikkei, Nikkei)

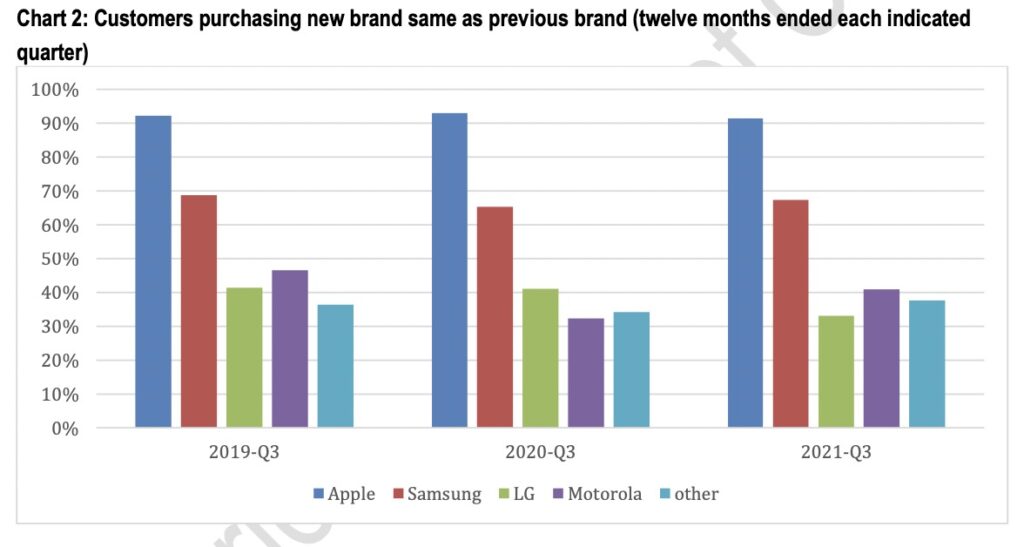

Consumer Intelligence Research Partners shows that Apple users in the US continue to remain loyal to Apple, with 90% of iPhone buyers remaining with Apple. Apple accounts for just under half of all US smartphone sales in the past 3 years. In the same period, Samsung captured a little more than half of Android sales. Apple has accounted for 43% of US smartphone sales over the past 3 years, compared to Samsung at 31% and LG at 9%. (Apple Insider, 9to5Mac)

According to Strategy Analytics, in 3Q21, global smartphone shipments decreased by 10.8% YoY to 327.3M units. It ended the recovery phase experienced by the industry in the past 4 quarters. Supply constraints have hit the smartphone market hard, and many suppliers are unable to meet the strong demand in the upcoming holiday season. Strategy Analytics expects supply constraints to continue until 1H22. Samsung has maintained a leading position – its global smartphone shipment was 69.3M, with a market share of 21%. However, shipments fell 14% YoY. (Laoyaoba, Record Trend, iPhone Wired)

Google has revealed that Call Screen capabilities, which use Google Assistant and transcription to block spam and other unwanted callers, are coming to 7 more countries. (Android Authority, 9to5Google, Google)

General manager of Redmi, Lu Weibing has revealed that the Redmi Note series has sold over 240M units globally. It is 140M in Nov 2020 and 100M in Oct 2019. So, in the last 5 months Xiaomi has managed to sell 40M units, i.e., 8M a month on average. (GizChina, GSM Arena, Jiemian, CNMO)

Redmi Note 11 is announced in China – 6.6” 1080×2400 FHD+ HiD IPS LCD 90Hz, MediaTek Dimensity 810 5G, rear dual 50MP-8MP ultrawide + front 16MP, 4+128 / 6+128 / 8+128 / 8+256GB, Android 11.0, side fingerprint, 5000mAh 33W, start from CNY1,199 (USD187). (GizChina, GSM Arena, GizChina, Mi.com, Mi.com)

Redmi Note 11 Pro / Pro+ are announced in China, featuring 6.67” 1080×2400 FHD+ HiD AMOLED 120Hz, MediaTek Dimensity 920 5G, rear tri 108MP-8MP ultrawide-2MP telephoto macro + front 16MP: 11 Pro – 6+128 / 8+128 / 8+256GB, Android 11.0, side fingerprint, 5160mAh 67W, start from CNY1,699 (USD265). 11 Pro+ – 6+128 / 8+128 / 8+256GB, Android 11.0, side fingerprint, 4500mAh 120W, start from CNY1,999 (USD310). (GizChina, GSM Arena, GizChina, Mi.com, Mi.com)

OPPO A54s is launched in UK – 6.52” 720×1600 HD+ v-notch IPS LCD, MediaTek Helio G35, rear tri 50MP-2MP macro-2MP depth + front 8MP, 4+128GB, Android 11.0, side fingerprint, 5000mAh, IPX4 rated, GBP230. (GSM Arena, OPPO)

Honor X30 series is unveiled in China: X30i 5G – 6.7” 1080×2388 FHD+ HiD IPS LCD 90Hz, MediaTek Dimensity 810 5G, rear tri 48MP-2MP macro-2MP depth + front 8MP, 6+128 / 8+128 / 8+256GB, Android 11.0, side fingerprint, 4000mAh 22.5W, CNY1,399 (USD218) / CNY1,699 (USD265) / CNY1,899 (USD296). X30 Max 5G – 7.09” 1080×2280 FHD+ u-notch IPS LCD, MediaTek Dimensity 900 5G, rear dual 64MP-2MP depth + front 8MP, 8+128 / 8+256GB, Android 11.0, side fingerprint, 5000mAh 22.5W, CNY2,399 (USD375) / CNY2,699 (USD422). (GizChina, GSM Arena, CN Beta)

Google unveils Android 12L, tailored to tablets, foldables, and ChromeOS devices. Android 12L will become available early 2022, “in time for the next wave of Android 12 tablets and foldables”. The UI has been refined for use on large screens. For enhanced multitasking, Android 12L has a new taskbar that allows for quick switching between favorite apps on the fly. (GSM Arena, Android, Engadget)

Wingtech has entered the Apple supply chain after taking over the business of O-Film’s Guangzhou Delta. The factory used to manufacture camera modules for Apple. Now the business has been transferred to Wingtech. The 14” and 16” MacBook Pros of Apple’s 2021 are all manufactured by Quanta Computer. The Mac computer product line is also the only one that is monopolized by Taiwanese manufacturers. However, Apple has always hoped to distribute orders. Introduced domestic foundries, and even orders gradually surpassed Taiwanese manufacturers to become the main force. In the Mac computer product line, Wingtech is reported to have been favored by Apple, becoming the foundry of 2022 MacBook computers, replacing Apple’s partners such as Quanta and Hon Hai for many years. (My Drivers, CN Beta, UDN, Pandaily, iPhone Wired)

Lenovo Tab K10 is launched in India – 10.3” 1920×1200 IPS LCD TUV-certified, MediaTek Helio P22T, rear 8MP + front 5MP, 3+32 / 4+64GB, Android 11.0 (upgradable to Android 12.0), 4G LTE / Wi-Fi 5G, supports active stylus pen, 7500mAh, INR13,999 (USD187) / INR15,999 (USD214). (GizChina, Lenovo, India Today)

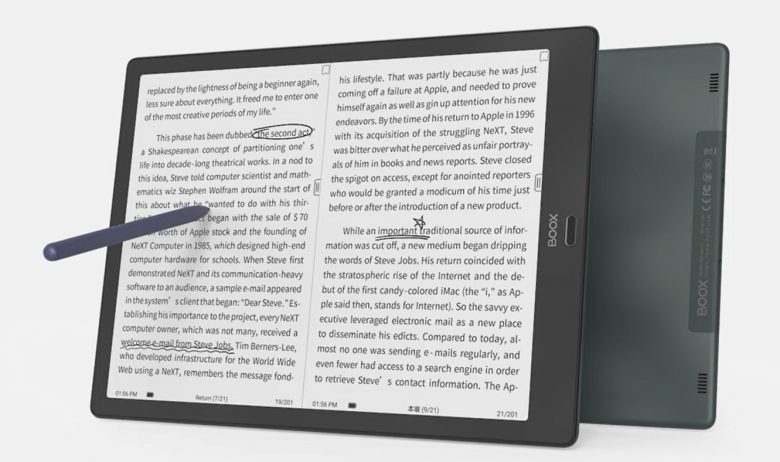

Onyx BOOX Max Lumi 2 is announced – 13.3” 2200×1650 E Ink Carta display with MOON Light 2, Qualcomm Snapdragon 662, 6+128GB, Android 11.0, stereo speakers, 4300mAh, supports stylus pen, USD880. (Liliputing, Onyx, Good E Reader)

Nokia T20 is launched in US – 10.4” 2000×1200 IPS LCD display, Unisoc T610, rear 8MP + front 5MP, 4+64GB, Android 11.0, IP52 rated, Wi-Fi 5 (ac), 8200mAh 15W, USD250. (Gizmo China, Nokia, Phone Arena)

Redmi Watch 2 is launched in China – 1.6” 320×360 AMOLED, Apollo 3.5 SoC, supports 117 different sports modes, sleep tracking, heart rate monitoring, blood-oxygen (SpO2) sensor, 5ATM (50m) water resistance, NFC, supports four global positioning systems – GPS, GLONASS, Galileo and BeiDou, CNY400 (USD63). (GizChina, GSM Arena, CN Beta)

Redmi Buds 3 Lite is launched in China, featuring a “cat’s ear” design intended to make the buds sit more comfortably and more securely in user’s ears. The earbuds promise 18 hours of battery life. They have basic IP54 water resistance. The earbuds are priced at CNY100 (USD16). (CN Beta, GizChina, GSM Arena)

Facebook (newly named as Meta) is planning a high-end virtual and augmented reality headset codenamed “Project Cambria”. Facebook CEO Mark Zuckerberg says it’s a “completely new” product that will sit at the “high end of the price spectrum,” and the device is to released in 2022.The device is focused on mixed reality applications and will include face and eye tracking. (CN Beta, Engadget, The Verge, Road to VR)

Facebook has officially changed its company name to Meta, announced by the CEO Mark Zuckerberg. He says he hopes the new name will “reflect who we are and what we hope to build”. (Liliputing, Apple Insider, CN Beta)

Facebook is looking to grow the availability of content for VR learning as part of its efforts to shift its focus on the metaverse, and it has created a USD150M fund to achieve that goal. (Engadget, Facbeook, Bloomberg, Variety)

Facebook CTO Andrew Bosworth has revealed that the company plans to retire its Oculus branding, including for the Oculus Quest virtual reality headset and product line. Starting 2022, the Oculus Quest will be called the Meta Quest, and the Oculus App will turn into the Meta Quest App. (Pocket-Lint, The Verge, CNET)

MIT’s Computer Science and Artificial Intelligence Laboratory (CSAIL) is ready to deploy the autonomous passenger boat it has been developing over the past 6 years. The vehicle, Roboat has been through multiple iterations. CSAIL is launching its full-scale version, which can carry up to 5 passengers, collect waste and deliver goods, in Amsterdam. Its fully electric with 10 hours of battery life on a single charge and has wireless charging capabilities. (Engadget, Roboat)

Mercedes-Benz has developed a new electric delivery van concept that goes beyond just reducing carbon emissions. Dubbed the Sustaineer, the new concept centers around creating a more sustainable future in logistics. The vehicle can actually purify the air surrounding it through fine particulate filters placed on both the front of the van and its underbody. It also utilizes cast iron, ceramic-coated disc brakes to limit how much dust is produced in the air. (CN Beta, Auto Motive World, Motor1, Mercedes-Benz, Hype Beast)

General Motors CEO Mary Barra is “pretty confident” that the driver will be out of Cruise vehicles by 2022, as the company looks to enter early commercial operations for autonomous robotaxi and delivery services. (CN Beta, TechCrunch)

Baidu and GAC AION, the wholly-owned NEV subsidiary of GAC Group, have announced the launch of a new version of the Apollo Moon Robotaxi, which is based on GAC AION’s all-electric vehicles and Baidu’s factory-installed autonomous driving system. On the basis of the ANP (Apollo Navigation Pilot) independent closed loop, the Apollo Moon AION version is capable of the driverless running under specific conditions and the autonomous driving in complex urban traffic scenarios thanks to a tailor-made LiDAR unit and self-driving redundancy design. (My Drivers, Gasgoo)

BMW will stop making internal combustion engines at its main plant in Munich by 2024, according to its head of production Milan Nedeljkovic at a conference marking the start of production of its electric i4 model. The ICE engines currently made in Munich will be produced in BMW’s factories in Austria and the UK in future, though cars using the engines will still be assembled at the Munich plant. Still, by 2023 at least half the vehicles produced in Munich would be electrified – either battery electric or plug-in hybrid. (Laoyaoba, Euronews, Reuters)

Ford’s hands-free highway driving system, BlueCruise, over-the-air update will not be ready to launch until 1Q22. Ford is still delivering the vehicles equipped with BlueCruise from the factory, i.e., the F-150 and Mustang Mach-E. However, the OTA update is intended for customers with one of the eligible vehicles that took delivery before BlueCruise is ready. (The Verge, CNET, Motor Illustrated)

Mercedes-Benz has announced that Dolby Atmos will be coming to select models in its range. Dolby Atmos will be supported by Mercedes Burmester sound system, an optional extra on select models, and initially, Atmos will be integrated into the Maybach and the S-Class, the company’s most luxurious models. (The Verge, Pocket-Lint, Forbes)

Paytm, one of India’s most valuable startups, is seeking to raise as much as USD2.4B in what is shaping up to be the biggest initial public offering (IPO) in the country at a valuation of USD20B. Paytm, which is backed by Alibaba, Berkshire Hathaway and SoftBank among others, launched in 2009 to help users easily make digital payments from their phones and top up credit. (CN Beta, TechCrunch)

Swap, a São Paulo-based Banking-as-a-Service (BaaS) startup, has announced that it has raised USD25M in a Series A led by Tiger Global Management. Swap aims to empower companies to transform their financial operations via its APIs, which it says offers users “the infrastructure for various financial solutions, allowing them to monetize their platforms”. (TechCrunch, LATAM Fintech)