11-1 #Busy : GlobalFoundries has debuted on the Nasdaq, valued at over USD25B; Robert Bosch GmbH has said that it would invest more than EUR400M in its semiconductor facilities; Microsoft has passed Apple in market cap; etc.

German auto supplier and technology company Robert Bosch GmbH has said that it would invest more than EUR400M (USD467.3M) in its semiconductor facilities in 2022 in response to the growing demand for chips. Bosch plans to invest in expanding its chip facilities in Dresden and Reutlingen, Germany, and its semiconductor operations in Penang, Malaysia. Most of the company’s capital expenditure has been allocated to the company’s new 300mm wafer fabrication plant in Dresden, which will expand its manufacturing capacity in 2022. About EUR50M will be spent on the Reutlingen wafer fab. Bosch will also invest EUR150M in additional clean-room space through 2023. (CN Beta, S&P, Market Watch)

Semiconductor manufacturer GlobalFoundries has debuted on the Nasdaq, valued at over USD25B, as it became increasingly evident that a global chip shortage could persist through 2023 or later, and they are sold out of semiconductor chip capacity through 2023. The company CEO Tom Caulfield thinks for the better part of the next 5 -10 years, they going to be chasing supply not demand. (CN Beta, CNBC, Market Watch)

Two of the seven potential investors that are rumored to participate in the reorganization of Tsinghua Unigroup have entered the next round of bidding, namely the Zhejiang State-owned Assets and Alibaba Consortium and Beijing’s Zhilu Jianguang Consortium. In Jul 2021, Tsinghua Unigroup confirmed that one of its creditors has asked a court to begin bankruptcy proceedings for the group. The creditor is the Hong Kong-listed Huishang Bank, a midsize state-owned bank based in Anhui Province. (Laoyaoba, UDN, Yicai, Asia Nikkei)

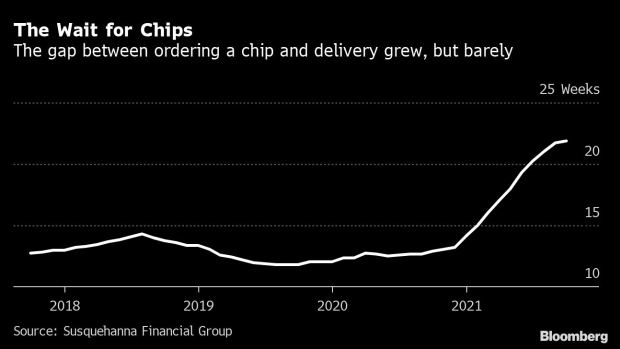

The global chip shortage is continuing to get worse, with firms dependent on new chips seeing delays in production and delivery lengthen to over a year, and in some cases until 2024. Susquehanna Financial Group has said chip wait times climbed from a typical 9-12 weeks to 19 weeks in the summer 2021, rising to 22 weeks in Oct 2021. In some cases, such as power-management components, it is 25 weeks on average, while microcontrollers used by the auto industry can take up to 38 weeks to arrive. (Bloomberg, WSJ, Apple Insider, CN Beta)

Geely Auto has announced the first self-developed SoC “Intelligent Cockpit Chip” built with 7nm technology, the new powertrain technology brand “Leishen Powertrain” and the “Smart Geely 2025” strategy. The chip will be mass-produced soon. In 2023, the company will launch the first 7nm, high computing power autonomous driving chip. It planned to launch an autonomous driving chip built with 5nm technology in 2025, and master the Level 5 full driving automation technology to realize the commercial application of Level 4 driving automation. (My Drivers, EDN China, CN Beta, Breaking Latest News, Pandaily)

Raja Koduri, Intel’s SVP and GM of the Accelerated Computing Systems and Graphics (AXG) Group, has revealed that Intel has dropped their plans to bring their Xe-HP series of server GPUs to the commercial market. Xe-HP has been leveraged as a development vehicle for Aurora and Intel’s oneAPI. Citing that Xe-HP has evolved into the Xe-HPC (Ponte Vecchio) and Xe-HPG (Intel Arc) families within Intel’s GPU group, the company seemingly no longer sees a need to release a second set of server GPU. (CN Beta, AnandTech)

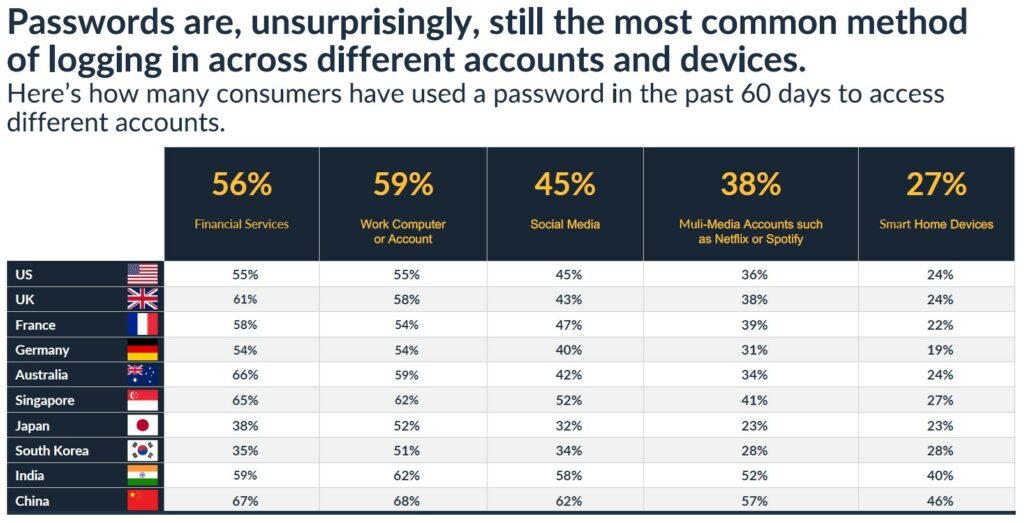

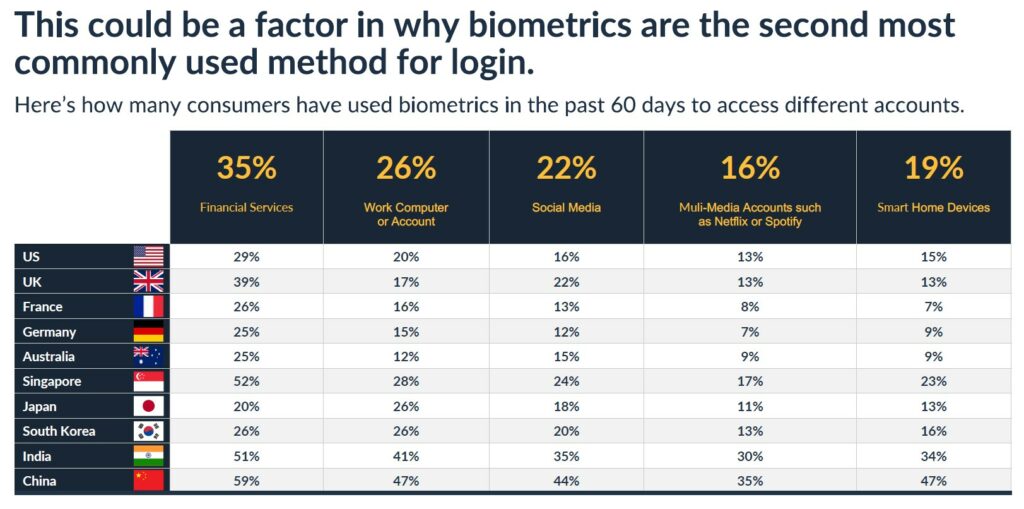

Biometrics are beginning to move mainstream for online authentication, with at least 25% of consumers now using biometrics in some capacity, according to the FIDO Alliance’s Online Authentication Barometer report. The report found passwords still prevailed over other, more secure authentication methods, with 59% of people using them to log into a work account or computer in the last 60 days. (VentureBeat, FIDO Alliance, report)

Factorial Energy, Hyundai Motor and Kia Corporation (collectively “Hyundai”) are partnering to test Factorial’s novel solid-state battery technology and its integration in Hyundai electric vehicles. Factorial’s advances are based on FEST (Factorial Electrolyte System Technology), which leverages a proprietary solid electrolyte material that enables safe and reliable cell performance with high-voltage and high-capacity electrodes and has been scaled in 40Ah cells that perform at room temperature. FEST is safer than conventional lithium-ion technology, extends driving range by 20-50%. (CN Beta, Inside EVs, Globe Newswire)

The “Yichun Era” new lithium-ion battery making base project located in Yichun, which is invested by CATL, has laid its foundation in Yichun Economic Development Zone. The first phase of the project costs CNY13.5B to build a 50GWh new-type lithium battery manufacturing base project. (CN Beta, My Drivers, Sohu)

General Motors (GM) has revealed that it would install up to 40,000 electric-vehicle charging stations in the United States and Canada, as part of the automaker’s USD750M commitments to bolster its presence in the rapidly growing sector. GM will give each dealer up to 10 Ultium charging stations to deploy in their community. (TechCrunch, Reuters, The Verge)

TF Securities analyst Ming-Chi Kuo has indicated that Wi-Fi 6 / 6E / 7 is the key to the wirelessization of Metaverse devices. He has pointed out that wireless is the key to improving Metaverse user experience and hardware growth. Meta to ship 9M VR devices in 2021, and the most popular Oculus Quest series all use the latest Wi-Fi specifications to support wireless technology Oculus Air Link. Meta predicts that within 10 years, Metaverse users will reach 1B people, and the Wi-Fi supply chain will significantly benefit from this trend. It is believed that these companies will benefit, including Skyworks, Qorvo, Maxscend Technologies, RichWave, Murata, TDK, Advanced Ceramic X, TXC and TKD Science. (CN Beta, TF Securities)

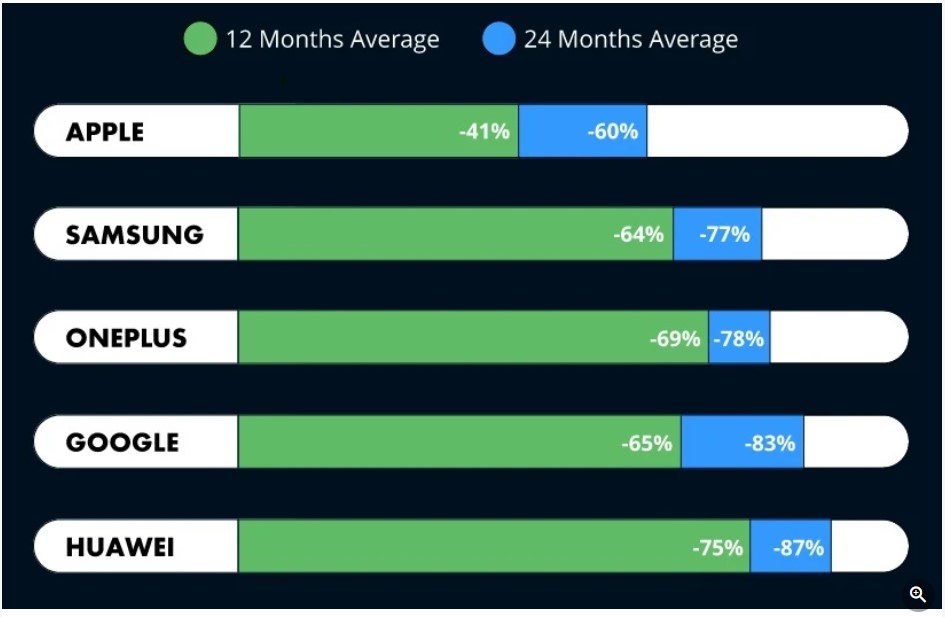

Britain’s musicMagpie, an online retailer of refurbished electronics and used video games, has released its annual phone depreciation report. A total of 2,093 U.K. mobile phone users are asked about how they usually handle trade-ins and 61% do not trade in a device at the same time they upgrade. On average, they wait 16 months to do so. While waiting that long, the value of their trade drops in half. Considering that the average consumer upgrades his phone 35 times during his lifetime, GBP3,400 (currently worth USD4,656) is lost simply by delaying trading in their old phone. Apple iPhone holds the most value. After 12 months, an iPhone loses 41% of its initial value, and after a 24-month contract expires, the value of an average iPhone is 60% lower than it was at launch. (musicMagpie, Phone Arena)

Microsoft has passed Apple in market cap, making it the world’s most valuable publicly traded company. (Apple Insider, CNBC, Reuters)

Apple has said its products compete as gaming platform against traditional game companies like Sony, Microsoft, and Nintendo. Previously, Apple said it only competed with Google’s Android and Microsoft’s Windows. Gaming is an important revenue stream for Apple — the company earns more from gaming on its platforms than Sony, Nintendo, Microsoft, and Activision combined. (Apple Insider, Apple)

Lu Weibing, president of Xiaomi China and general manager of Redmi, has revealed that by the end of Oct 2021, the number of Xiaomi’s stores will exceed 10,000. He has said that Mi Home (“Mijia”) currently covers more than 2,200 counties, with a coverage rate of over 80%. (Laoyaoba, Sohu, C114)

ArcherMind and Huawei have formally signed a HarmonyOS Connect-related cooperation agreement, marking that ArcherMind has officially become a HarmonyOS Connect ISV (Harmony Intelligent Alliance Independent Software Vendor), which has opened up the in-depth cooperation between the two parties in the Harmony ecosystem. ArcherMind will obtain relevant authorization from Huawei to enhance Harmony’s ecological solution capabilities. (Laoyaoba, Sina, 10JQKA, EE World)

A coalition of tech companies have teamed up with researchers to form the “Catalyze Tech” coalition to improve representation of minority groups in Silicon Valley. Over 30 CEOs and executives from leading technology organizations, including Airbnb, Apple, Dropbox, Etsy, Google, LinkedIn, Twitter, Salesforce, Spotify, and Uber, have committed to being founding signatories of the ACT Report, pledging to hold themselves and their companies accountable. (Apple Insider, The ACT Report)

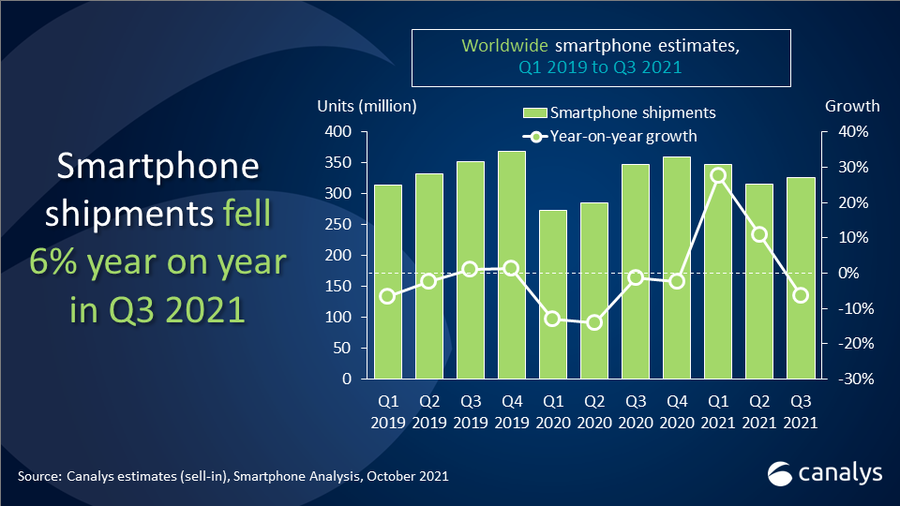

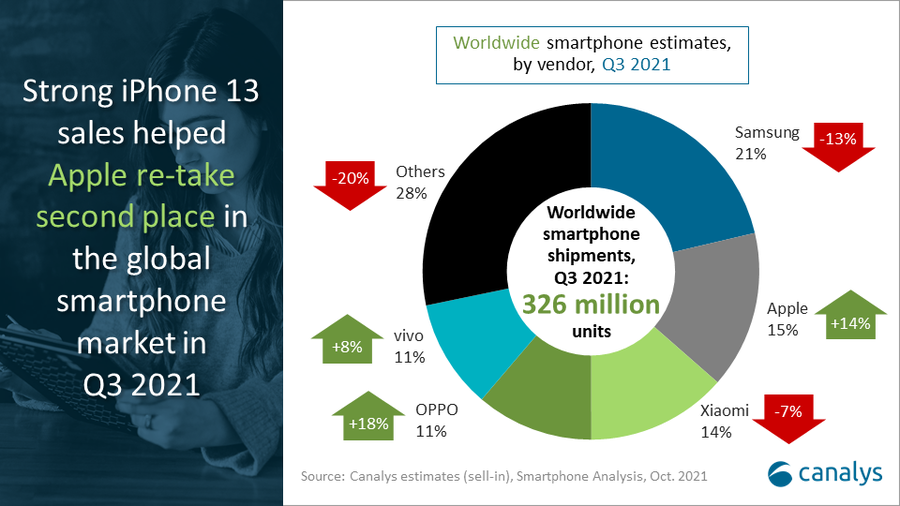

Global chipset shortages caused smartphone shipments to fall 6% in 3Q21. Samsung was once again the leading vendor, shipping 69.4M units for a 21% share. Apple re-took second place with the launch of the iPhone 13, shipping 49.2M smartphones and growing 14%. Xiaomi took third place, with 44.0M units and a 14% share. (CN Beta, Canalys)

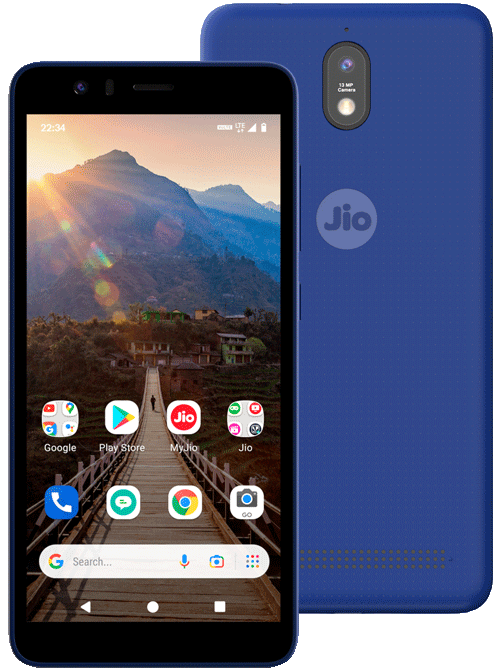

JioPhone Next is launched in India – 5.45” 720×1440 HD+ TFT, Qualcomm Snapdragon 215, rear 13MP + front 8MP, 2+32GB, Pragati OS (optimized Android), no fingerprint, microUSB, 3500mAh, INR6,499 (USD87). (Liliputing, GSM Arena, Jio)

TCL 20 XE and 20A 5G are launched in US, featuring 6.52” 720×1600 HD+ v-notch: 20 XE – MediaTek Helio P22, rear tri 13MP-2MP macro-2MP depth + front 5MP, 3+32GB, Android 11.0, rear fingerprint, 5000mAh, USD160 (Metro by T-Mobile) / USD120 (Boost Mobile). 20A 5G – Qualcomm Snapdragon 480 5G, rear tri 16MP-5MP macro-2MP depth + front 13MP, 4+64GB, Android 11.0, rear fingerprint, 4500mAh, USD199 (Visible). (Digital Trends, Phone Arena, TCL)

Tecno Camon 18i is launched in Nigeria – 6.6” 720×1640 HD+ HiD LCD 90Hz, MediaTek Helio G85, rear tri 48MP-2MP macro-2MP depth + front 16MP, 4+128GB, Android 11.0, rear fingerprint, 5000mAh 18W, NGN84,500 (USD206). (GizChina, Droid Africa)

Nothing CEO Carl Pei has indicated that the company has secured over 320K orders of the Ear 1 earbuds. Although only 180K of those orders have shipped, Pei is confident the rest will come soon. He also says the goal is to push 600K orders. He also heavily suggests that one of the reasons Nothing has not been able to meet order demand is because an unnamed competitor of attacking Nothing’s supply chain. (Nothing, Phone Arena, Android Authority)

Redmi Smart Band Pro is announced, featuring 1.47” 194×368 AMOLED Touch display, Apollo 3.5 SoC, 200mAh battery, 5ATM water resistance. It adopts the usual accelerometer, gyroscope and PPG heart rate monitor, and supports SpO2 (blood oxygen) tracking. The device can detect more than 110 types of workouts and 15 of those are professional modes. (GSM Arena, Mi.com)

Meta (formerly Facebook) has announced its sixth VR studio acquisition. This time it is Within, the studio behind the popular Quest exclusive VR fitness app Supernatural. Meta has announced the acquisition of Within saying that the studio will be run under Meta Reality Labs, the company’s XR organization. (CN Beta, TechCrunch, The Guardian, RoadToVR, Oculus)

Bloomberg’s Mark Gurman claims Apple is planning to unleash its own pricey device with advanced chips, displays, sensor, and avatar-based features as early as 2022. The device will be a headset that includes “both AR and VR capabilities”, which could offer a “mixed reality experience that can handle games in high-quality virtual reality”. (CN Beta, Apple Insider, Bloomberg)

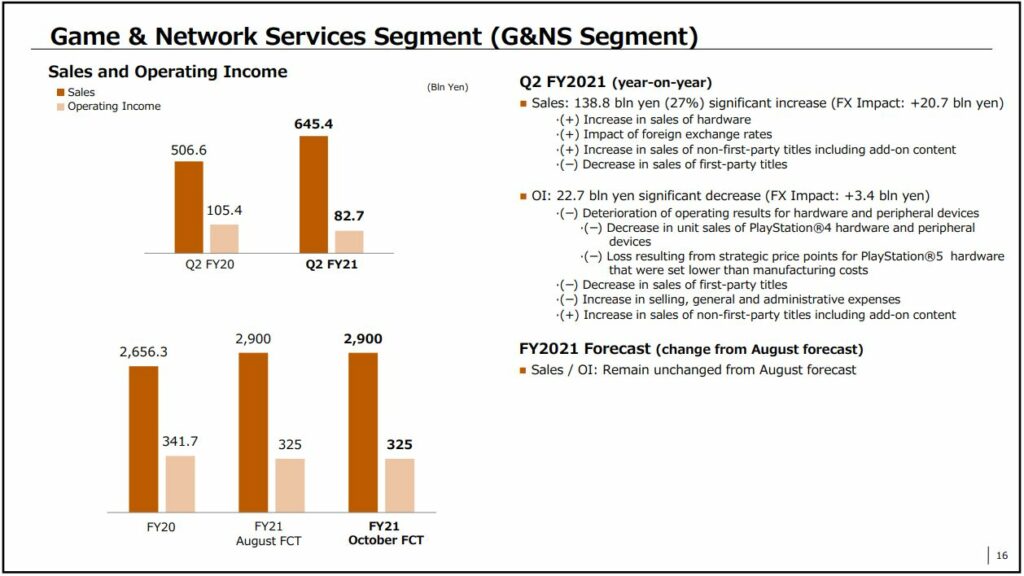

Sony has revealed that the company’s Playstation 5 has crossed 13.4M units sold worldwide, with additional 3.3M units added in 3Q21. Additionally, Sony has shared that PlayStation Plus reached 47.2M subscribers after a dip last quarter, while the digital ratio for full games reached 62%. (Engadget, Sony, Android Central)

Amazon’s next step into the US health system is equipping hospitals with Alexa, its virtual assistant. Amazon has said that hospitals including Boston Children’s Hospital, Cedars-Sinai in California, BayCare in Florida, and Houston Methodist would soon use Alexa-enabled devices, which include its Amazon Echo speaker, to help patients communicate with health staff and control devices in their room. (The Verge, PYMNTS, Business Insider, Amazon)

The self-driving eVTOL manned aircraft V1500M independently developed by AutoFlight Technology in Shanghai Jinshan has successfully completed its first flight test recently. As an electric vertical take-off and landing fixed-wing manned aircraft, the V1500M has a maximum take-off weight of 1500kg, is equipped with a pure electric power system, and has a passenger flight range of 250km and a maximum number of 3-4 passengers. (CN Beta, CAACNews)

To address higher-speed crashes that continue to cause fatalities, the Insurance Institute for Highway Safety (IIHS) introduces a tougher side crash test. However, the first set of small SUVs tested for the new segment returned disappointing results, with only one model garnering a Good rating out of the 20 entries. (CN Beta, IIHS, Motor1)

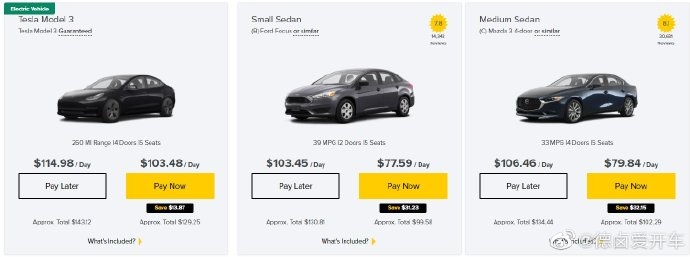

Hertz, the car-rental firm that has recently emerged from bankruptcy, has announced that it had made a deal to buy 100,000 cars from Tesla for estimate to be worth USD4B. Uber has committed to renting up to half of that order for its drivers. Separately, Hertz has signed a deal to provide the used car retailer Carvana with vehicles coming out of its rental fleet. (TechCrunch, The Guardian, NBC News, Vox)

Alphabet’s Wing has said that Walgreens will use its new drones to make deliveries from a store in Texas, in the first use of such vehicles in a major U.S. metro area. Wing said it will launch the effort at a Dallas-Fort Worth area Walgreens store in its parking lot, serving parts of the city of Frisco and town of Little Elm. Prior to this, drone delivery projects have been in smaller U.S. towns. (CN Beta, The Verge, TechCrunch, Reuters)