11-16 #InstantNoodle : Qualcomm says it is working on its “Next-generation CPU”; TD Tech is entrusted to carry Huawei’s products to the masses; Samsung is reportedly planning to restructure its global smartphone production in 2022; etc.

Qualcomm says it is working on its “Next-generation CPU”. The chips will be ARM-compatible CPUs that will offer an Apple’s “M-series competitive solution for the PC”. The chips will be designed by the Nuvia team that Qualcomm acquired for USD1.4 B in Jan 2021. The company’s chief technology officer, Dr. James Thompson, intends for hardware samples to be shipped to device vendors in 9 months, with the first devices using the chips being sold to consumers in 2023. (Apple Insider, Twitter)

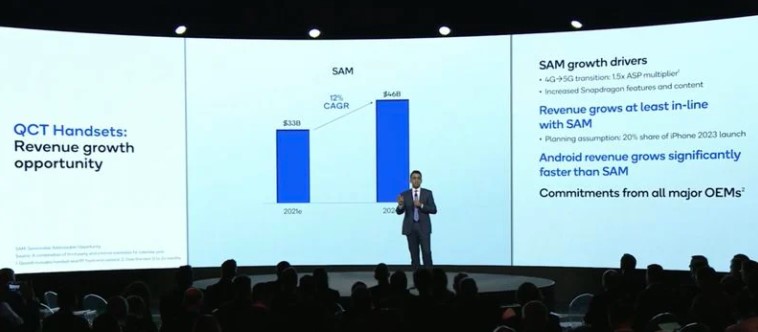

Qualcomm is preparing for the launch of Apple’s own modem chips, which will cut into Qualcomm’s modem business starting in 2023. Qualcomm CFO Akash Palkhiwala has said that Qualcomm expects to supply just 20% of Apple’s modem chips in 2023. (Gizmo China, MacRumors, Apple Today)

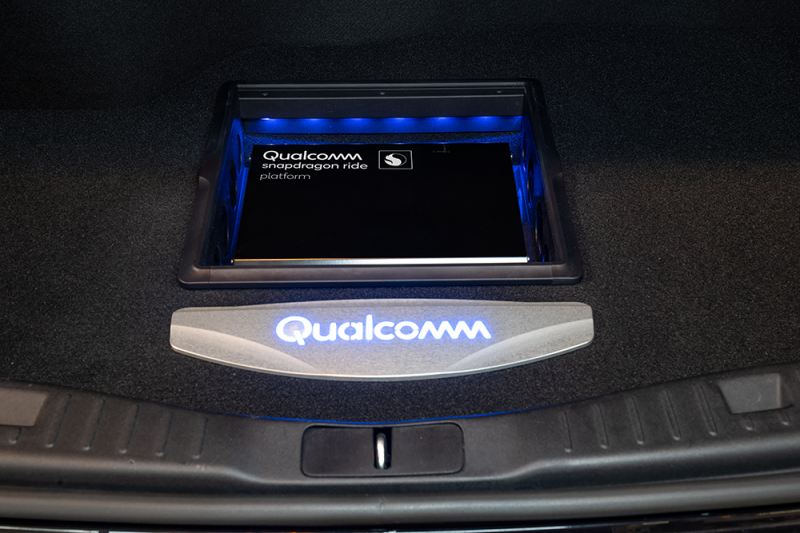

Qualcomm has announced a collaboration to bring the latest advancements in driver assistance technologies, and products of its Snapdragon Ride Platform, to BMW Group’s next generation of advanced driver-assistance systems (ADAS) and automated driving (AD) platforms. BMW’s next generation Automated Driving stack will be based on the Snapdragon Ride vision system-on-chip (SoC), vision perception and ADAS central compute SoC controllers managed by Qualcomm Car-2-Cloud services platform. (Future Car, Fortune, Qualcomm)

Morgan Stanley has stated that with the increase in chip production in Malaysia in Oct 2021, the fab returned to full production. Car production and cloud data center server shipments should improve in the near future. Global car production has also begun to gradually recover. Morgan Stanley believes that when automakers change their inventory policy from “just in time” to “just in case”, demand for automotive chips is expected to remain strong in the next few quarters. (CN Beta, GizChina, CNBCTV, Forexlive)

Nvidia has unveiled Omniverse Avatar, a platform for generating immersive AI-driven avatars. The platform enables users to leverage speech AI, computer vision, natural language understanding, and simulation to create avatars that recognize speech and communicate with human users within real-world simulation and collaboration platforms like Nvidia Omniverse, and other digital worlds. (VentureBeat, Nvidia, Engadget)

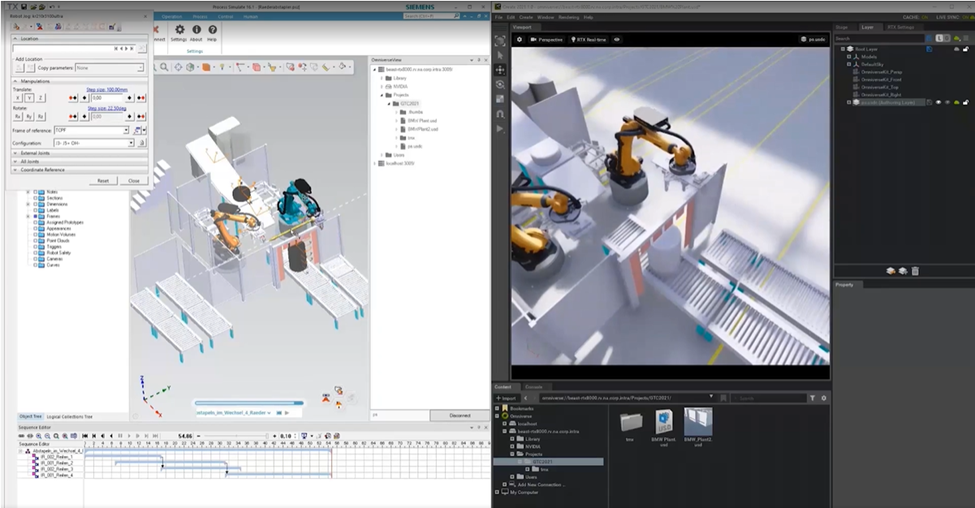

BMW has standardized on a new technology unveiled by Nvidia, the Omniverse, to simulate every aspect of its manufacturing operations, in an effort to push the envelope on smart manufacturing. BMW has done this down to work order instructions for factory workers from 31 factories in its production network, reducing production planning time by 30%. (VentureBeat, Nvidia, Business Insider)

Sony is reportedly cutting production of its PlayStation 5 gaming console due to a global chip shortage and shipping issues plaguing the technology industry. The company has previously planned to have built more than 16M consoles within the first year, but reduced the number to 15M – a move that puts its target of 14.8M PS5 sales by Mar 2021 near impossible. (Engadget, Bloomberg, Daily Mail)

ASML has agreed to enhance cooperation for resilient supply chains of semiconductors and other key materials and equipment. In May 2021, ASML announced its plan to invest KRW240B (USD212M) in establishing a high-tech cluster for extreme ultraviolet (EUV) and deep ultraviolet (DUV) lithography equipment in Hwaseong by 2025, which will include manufacturing plants and training centers. (My Drivers, YNA, The Elec)

TCL CSOT has demonstrated the world’s first 8.01” non-polarizer AMOLED folding screen with a resolution of 2480×1860. At the same time, it integrates the leading technology of in-folding and out-folding flexible screen technology and 360° Stress free self-compensating hinge, and has passed 200,000 bending inspections. (CN Beta, Sina, My Drivers)

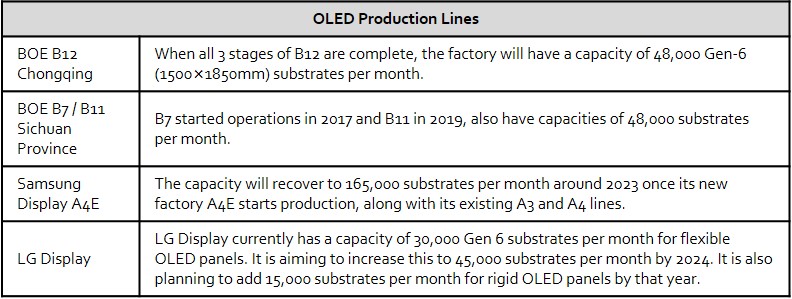

BOE’s Gen-6 B12 line at Chongqing, China has started production. B12 line consists of three stages: the first stage has started production. The second stage will start operations during the first half of 2022. The third stage is expected to start operations during the 2H22 or early-2023. The first stage of B12 is initially expected to start operation in Oct 2021. The second and third stages were also expected to start around Mar and Oct, respectively, in 2022. (CN Beta, My Drivers, The Elec)

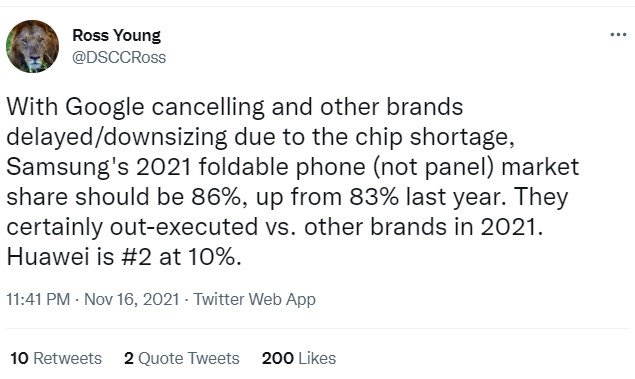

According to DSCC’s Ross Young, Google’s cancellation and other brands either delaying or downsizing their foldable phone production due to chip shortage will have Samsung’s share in the market go up from 83% in 2020 to 86% in 2021. Huawei is still the second largest foldable smartphone maker with just 10% market share. (Gizmo China, Twitter)

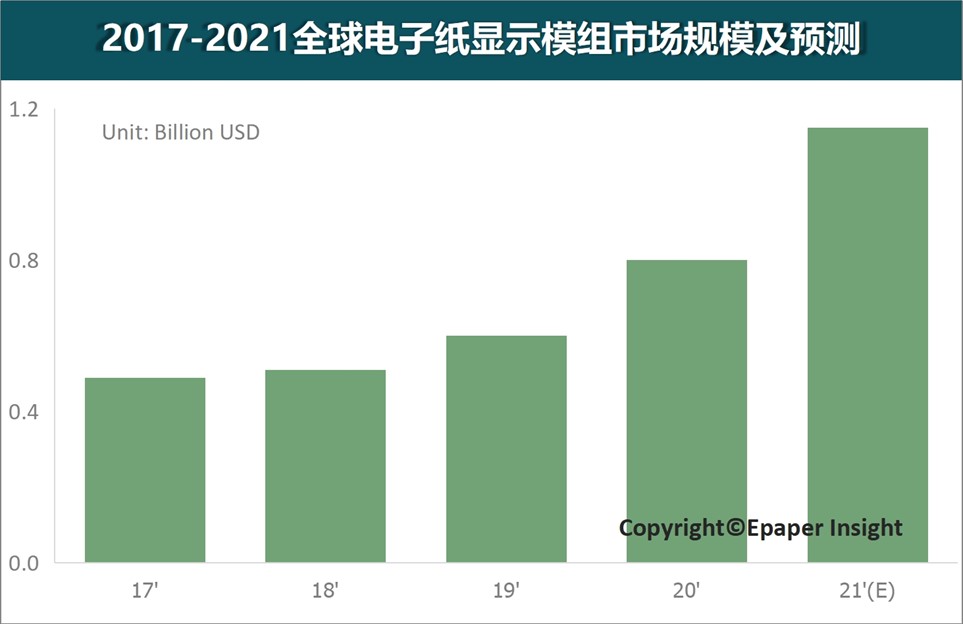

According to CINNO, the global e-paper display module product market in 2020 will be approximately USD800M, and the top 3 application fields will account for more than 95% of the market. Epaper Insight predicts that the global e-paper display module market will exceed USD1.1B in 2021, with a YoY growth rate of more than 40%. With the widespread popularity of electronic display products, the impact of electronic products and equipment on human health, especially vision health, is getting more and more attention. (CN Beta, CINNO)

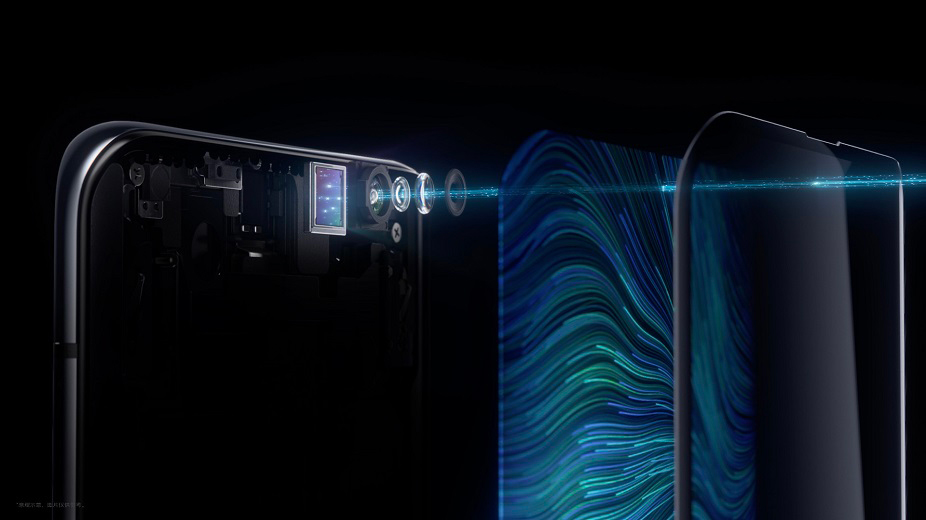

As manufacturers represented by ZTE continue to promote technology optimization and commercial use, Zhou Hua, chief analyst of CINNO Research, shas aid that the penetration rate of under-screen cameras in China’s domestic smartphone market is expected to increase to nearly 5% by 2025. (CINNO)

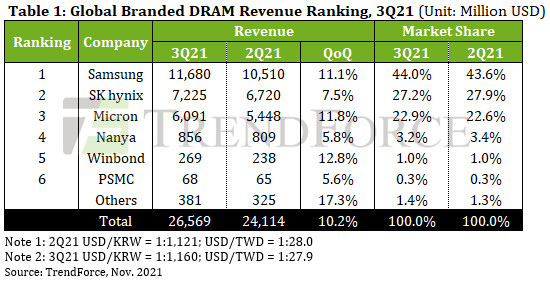

DRAM buyers were aggressively stocking up during 1H21 because quotes began to rise at the start of the year, and there were concerns about shortages in the supply chain, according to TrendForces. To avoid the risk of a supply crunch, most DRAM buyers kept raising their demand until the middle of the year. Moving into 2H21, the COVID-19 pandemic has exacerbated component gaps, the adverse effect of which on OEMs’ ability to assemble their end products has widened as well. Due to having a glut of memory and a shortage of other key components, some OEMs have opted to scale back DRAM procurement. PC OEMs have especially become noticeably restrained in this regard. Fortunately, the server-related segment of the market has been propping up the overall demand; and because of this, most DRAM suppliers were able to post a marginal growth in shipments for 3Q21. Additionally, quotes for DRAM product also kept rising in 3Q21. On account of these factors, the quarterly total DRAM revenue rose again by 10.2% QoQ to USD26.6B for 3Q21. (TrendForce, TrendForce, CN Beta)

With the listing of Intel Z690 motherboard and the 12th generation Core K series processors, memory manufacturers have also released DDR5 memory, the main models are DDR5-4800 standard memory sticks and DDR5-5200, DDR5-5600 and other overclocking memory sticks. Currently, there is a shortage of DDR5 memory sticks in the market, and sources from Boardchannels say that the main reason for the shortage is that the DDR5 memory is equipped with a power management chip PMIC, which is currently in very short supply. (Neowin, 12Chip)

According to Digitimes, starting from Nov 2021, ChangXin Memory Technologies (CXMT) will begin to provide capacity for Nor Flash supplier GigaDevice’s innovative DDR3 products, and the both companies plan to cooperate in the DDR3 field. CXMT will mainly use the 17nm process technology to produce DDR3 memory. The products are still being verified at the OSAT factory in China. It is expected that from 2H22, the OSAT factory will increase the output of DDR3. In addition to GigaDevice, ESMT and Etron in Taiwan have also cooperated with foundries such as PowerChip to produce DDR3 products, while Nanya and Winbond are producing DDR3 products on their own. (Digitimes, Laoyaoba)

Meta’s Reality Labs Research teams is developing haptic gloves that are comfortable, customizable, and most importantly, capable of reproducing a range of sensations in virtual worlds including texture, pressure, and vibration. Meta hopes to sell these gloves allowing users to pair them with AR / VR headwears. (Neowin, Facebook)

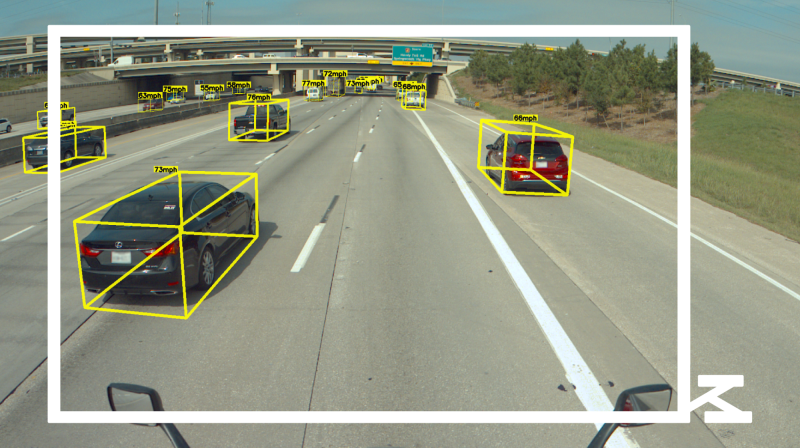

Kodiak Robotics, a startup developing self-driving truck technologies, has announced that it raised USD125M in an oversubscribed series B round for a total of USD165M to date. Kodiak’s self-driving platform uses a combination of light detection and ranging radar known as lidar as well as camera and radar hardware. A custom computer processes sensor data and plans the truck’s path. Overseen by a safety driver, the brakes, steering column, and throttle are controlled by the computer to move the truck to its destination. (VentureBeat, Cheddar, PR Newswire)

BBK Electronics subsidiaries OPPO, realme, and OnePlus are known for being the first ones to bring 65W fast charging to the masses, offering it even on midrange phones. The trio is now looking to make 100W the new normal and deem 65W fast charging the lowest standard in the fast-charge range. OPPO has switched from a 3c cell battery to a 6c one along with upgrading the tab center to multi-tab technology. On the input end, OPPO’s 125W charging tech uses ‘three parallel charge pumps’ that convert the total of 20V 6.25A current from the charger into 10V 12.5A. (My Drivers, Gizmo China)

Volkswagen plans to double staff numbers at its charging and energy division, roll out new payment technology next year and strike more alliances to take on Tesla in a key electric vehicle (EV) battleground: power infrastructure. (CN Beta, Reuters, Business Hala)

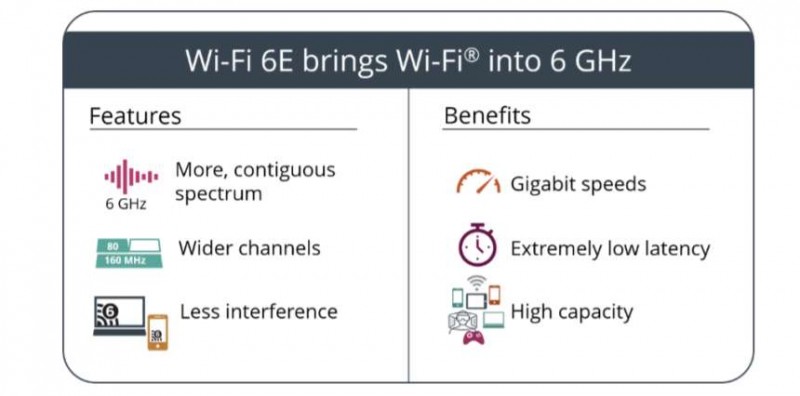

According to TF Securities, Wi-Fi 6E‘s LTCC usage is generally more than 2–3 times more than previous Wi-Fi specifications. This will cause LTCC supply to become tight again in 2022. Therefore, Advanced Ceramic X (ACXC) accelerates Wi-Fi specifications for metaverse and Apple’s new products. The number of channels supported by Wi-Fi 6E is 2–3 times that of Wi-Fi 6. If it is a 3×3 / 4×4 MIMO design, each channel needs 2–4 LTCCs, so the LTCC usage of Wi-Fi 6E is 10-20 or more than Wi-Fi 6. (GSM Arena, TF Securities, MyFixGuide, UDN)

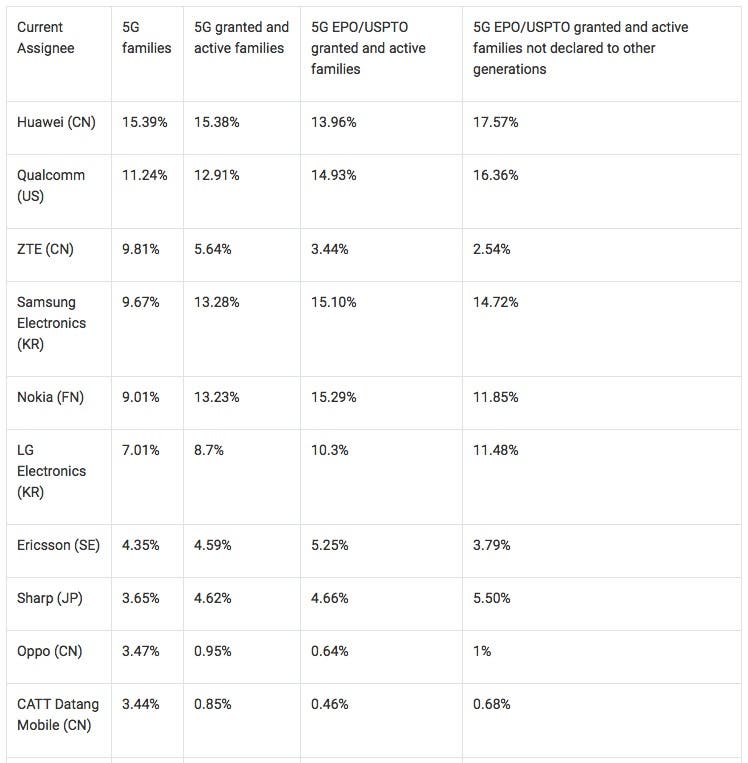

Nokia has announced that it has reached the milestone of 4,000 patent families declared as essential to 5G standards. In Feb 2021, IPLytics captured major organizations that report to ETSI (European Telecommunications Standards Institute) on their number of 5G standard-essential patents (SEPs). (GizChina, Nokia)

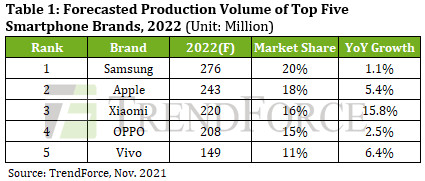

Smartphones are essential to people’s daily lives and constitute a basic necessity. TrendForce therefore expects the smartphone industry to rebound and post marginal growth next year, assuming that economic activities worldwide will mostly return to normal by then. The main trend drivers in the smartphone market next year are still going to be the usual device replacement cycle and the additional demand from emerging markets. TrendForce expects annual smartphone production for 2022 to reach about 1.39B units and the YoY growth rate hitting 3.8%. (GizChina, TrendForce, TrendForce)

Wedbush lead analyst Daniel Ives believes that delivery times for Apple‘s iPhone 13 Pro are continuing to extend. Thus, he believes demand is outstripping supply by about 15%. Apple could sell more than 80M iPhone devices in the busy holiday shopping quarter despite ongoing supply issues. The analyst believes that Apple is on-track to sell around 40M iPhone units between Black Friday and Christmas. (CN Beta, Apple Insider, Business Standard)

Apple has announced Self Service Repair, which will allow customers who are comfortable with completing their own repairs access to Apple genuine parts and tools. Available first for the iPhone 12 and iPhone 13 lineups, and soon to be followed by Mac computers featuring M1 chips, Self Service Repair will be available early 2022 in the US and expand to additional countries throughout 2022. (Phone Arena, Apple)

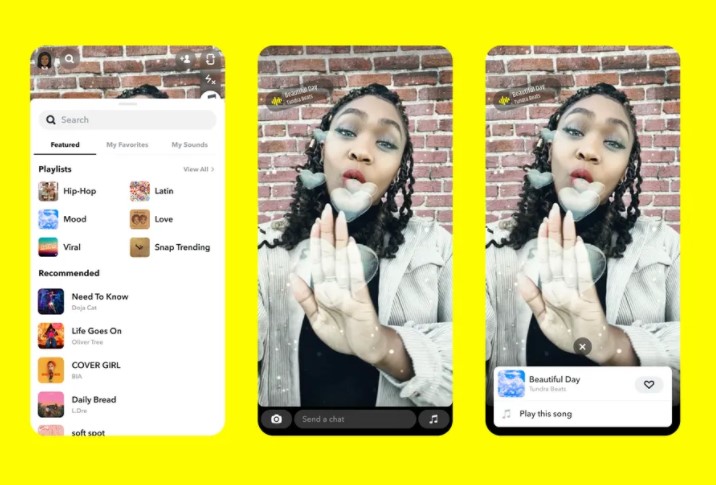

Snapchat is adding audio from Sony Music Entertainment to its Sounds library. Snap has now inked deals with all three major music labels: Sony Music Entertainment, Universal Music Group, and Warner Music Group. Aside from the Big Three, the platform also partners with Warner Chappell, BMG, Kobalt, and more. (The Verge, Snap, Variety, TechCrunch)

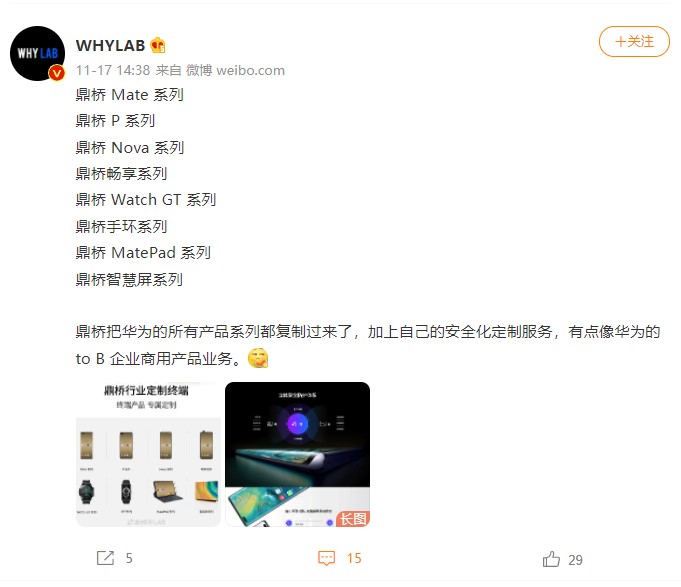

TD Tech is entrusted to carry Huawei’s products to the masses, and everything is furnished so that it receives a license to use Huawei’s developments. Currently, the company has only one smartphone – TD Tech N8 Pro, which is essentially Huawei Nova 8 Pro. The company will also re-release the Huawei Mate 40E 5G under its own brand. All current Huawei smartphones of the Mate, P, Nova and Enjoy series will be released under the TD Tech brand. (GizChina, Weibo, MoneyDJ, 163, Sohu, EET-China)

Samsung is reportedly planning to restructure its global smartphone production in 2022. It is planning to shift some of its smartphone production capacity at Vietnam to India and Indonesia. Samsung has 2 smartphone factories in Vietnam, one at Bac Ninh province (called SEV) and Thai Nguyen province (called SEVT). These together had an annual capacity of 182M units as of 2020, accounting for 61% of Samsung’s total smartphone production. There are 19M units will be moved sequentially to India and Indonesia, where the company is planning to expand manufacturing facilities. (Laoyaoba, The Elec)

Disney is teaming up with TikTok to add official character voices to the popular social media app’s text-to-speech feature. Using the voices works similarly to the regular text-to-speech voices on TikTok; after recording a video, tap the text button on the screen, and type whatever the text-to-speech voice to read. (The Verge, Twitter)

vivo Y54s 5G is announced in China – 6.51” 720×1600 HD+ v-notch IPS, MediaTek Dimensity 700 5G, rear dual 13MP-2MP depth + front 8MP, 6+128GB, Android 11.0, side fingerprint, 5000mAh 18W, CNY1,699 (USD266). (GizChina, Gizmo China, GSM Arena)

Huawei MateBook E 2-in-1 tablet is launched – 12.6” 1600×2560 OLED display, Intel 11th Generation Core i7 / i5, rear 13MP + front 8MP, fingerprint enabled power button, 42Wh battery with 65W charging adapter, NFC, supports keyboard, Huawei M-Pencil, 8+256 / 16+512GB, start from CNY5,999 (USD940). (Liliputing, GizChina, Huawei, CN Beta)

Morgan Stanley believes that Apple’s entry into the eyewear market will be the game changer for all participants as the technology gets normalized and popularized. Apple’s patent portfolio is beginning to mirror the period prior to the Watch launch. (Apple Insider, Investors)

While global tech giants now see the metaverse as the next thing for growth, Google CEO Sundar Pichai sees the future of the company in its oldest product, Internet search. He predicts that consumers will ask computers more questions through voice and “multimodal interaction”. He has noted that new Google products will increasingly be developed and tested in Asia, but not in China. (CN Beta, Deccan Herald, GizChina, Bloomberg)

India’s wearable market grew by 93.8% YoY in 3Q21, shipping 23.8M units, according to IDC. Despite the logistic challenges and increase in freight costs, vendors remained aggressive in their shipments and were able to manage the inventory for the upcoming month-long festival sales. Shipments in Sept 2021 surpassed 10M, growing two-fold from the same month last year, resulting in a record quarter for wearable devices in India. (GSM Arena, IDC, Fonearena)

Denon has launched Noise Cancelling Earbuds (AH-C830NCW) for USD159 and Wireless Earbuds (AH-C630W) for USD99. Both offer IPX4 protection from water and sweat, and both have what Denon describes as “astonishing levels of detail, dimensionality and dynamics never before experienced with conventional earbuds”. (Digital Trends, Denon, Denon)

Huawei’s COO of consumer BG, He Gang, has revealed that Huawei’s cumulative global shipments of smart wearable devices had exceeded 80M units. He further added that Huawei is still first in China when it comes to wrist-worn wearable devices. Huawei has served more than 320M users worldwide, and Huawei’s sports health App has reached 83M monthly active users worldwide. (Gizmo China, SEMI, IT Home, Sina)

JPMorgan has sued Tesla, claiming that the electric car company owes the bank USD162M related to a 2014 stock warrant agreement. The lawsuit is filed in the Southern District of New York. JPMorgan has purchased a number of warrants from Tesla in 2014 — back when the company was still trying to fund the construction of the original Gigafactory. (The Verge, Reuters, US Court)

Apollo Go, Baidu’s robotaxi service, aims to be in 65 cities by 2025 and 100 cities by 2030, according to the company’s co-founder and CEO Robin Li. In terms of improving its driving tech, Baidu has so far racked up over 16Mkm (10M miles) of L4, self-driven distance. That is up from 6.2M miles reported in its 1Q21 results. (TechCrunch, Motley Fool, CNBC)

Mobility 54 Investment SAS, a corporate venture capital subsidiary of Toyota Tsusho Corporation and CFAO group, DOB Equity and InfraCo Africa have invested USD3.4M (EUR3M) in electric motorcycle startup Zembo to help it grow its business. Zembo, a French startup with operations in Uganda, was founded in 2018 and sells electric motorcycles through a lease-to-own program. It also operates a network of solar charging and battery swapping stations in the East African country. (TechCrunch, ESI-Africa, All Africa, TechNext)

Swedish startup Volta Trucks has launched an electric 16-tonne truck featuring a cab with large expanses of glass to offer safer and less polluting freight distribution in city centers. Billed a “world first” by its developers, the Volta Zero vehicle was developed in collaboration with Warwick-based design consultancy Astheimer. The vehicle contains 160-200 kilowatt-hour (kWh) batteries that are capable of a range of up to 200km (124 miles). (CN Beta, Dezeen, Inside EVs)

Rivian Automotive is in late-stage discussions to open a vehicle manufacturing and battery plant east of Atlanta along Interstate 20. It will not be profitable until it adds more models and exceed production/sales volume of its first and only plant in Normal, Illinois (currently equipped for 150,000/year with an intention to increase to 200,000/year in a few years). The long-term plan is to reach 1M units per year by 2030, with probably four plants globally (as we understand – two in the U.S., one in Europe and one in China). (CN Beta, AJC, Inside EVs, Auto News)

Nommi, which is backed by Wavemaker Labs, a robotic incubator, is building a standalone robotic kitchen that is able to produce and dispense any grain-, noodle- or lettuce-based dish through a fully integrated cooking system. Along with lead innovation partner, C3 (Creating Culinary Communities), Nommi will offer consumers a more efficient way to access healthy and fresh food. Each Nommi machine is able to hold 330 bowls and lids before needing to be refilled. It moves forward and back to collect ingredients and allows for multiple bowls to be prepared simultaneously given its holding functionality. (CN Beta, PR Newswire, The Spoon)