12-1 #Sleep : Samsung is reportedly aiming to secure a share of 21.9% in the global smartphone market for 2022; At least 4 Samsung Galaxy A models will feature water-resistance in 2022; Nissan will invest JPY2T (USD17.6B) over the next 5 years developing new EVs and battery technology; etc.

Apple and Google reportedly want to reduce their dependence on Qualcomm chips. Apple is already developing its own baseband chip, while Google has used a custom chip Tensor on its latest generation Pixel 6 series. Samsung will reportedly increase the proportion of Exynos chips used in its own models in 2022 to reduce its dependence on Qualcomm chips. (GizChina, My Drivers)

IDC projects customer spend for quantum computing to grow from USD412M in 2020 to USD8.6B in 2027. This represents a 6-year compound annual growth rate (CAGR) of 50.9% over the 2021-2027 forecast period. The forecast includes core quantum computing as a service as well as enabling and adjacent quantum computing as a service. IDC also expects investments in the quantum computing market will grow at a 6-year CAGR (2021-2027) of 11.3% and reach nearly USD16.4B by the end of 2027. (IDC, Neowin)

Unisoc has launched a new solution for smartwatches W117. W117 is a RTOS cellular watch platform with strong battery life. It adopts 22nm process, has the advantages of high integration, small size, low power consumption, etc., and supports lightweight RTOS systems. W117 adopts AP+CP chip design architecture, supports 4G full Netcom, Cat.4 and Cat.1, VoLTE high-definition voice calls, and can realize online payment, online music, voice assistant etc. (My Drivers, CN Beta, UNISOC, 163)

Baidu, smart EV company JiDU Auto and Qualcomm have announced that JiDU’s first production electric vehicle will feature an intelligent digital cockpit system assisted by technology from Baidu and Qualcomm. The system is based on Qualcomm’s 4th generation Snapdragon Automotive Digital Cockpit Platform 8295, which features the next generation of intelligent cockpit systems and software solutions developed by JiDU and Baidu. The chip is manufactured on a 5nm process. (163, Sina, Auto Home, My Drivers, Gasgoo, Global Times, FutureCar)

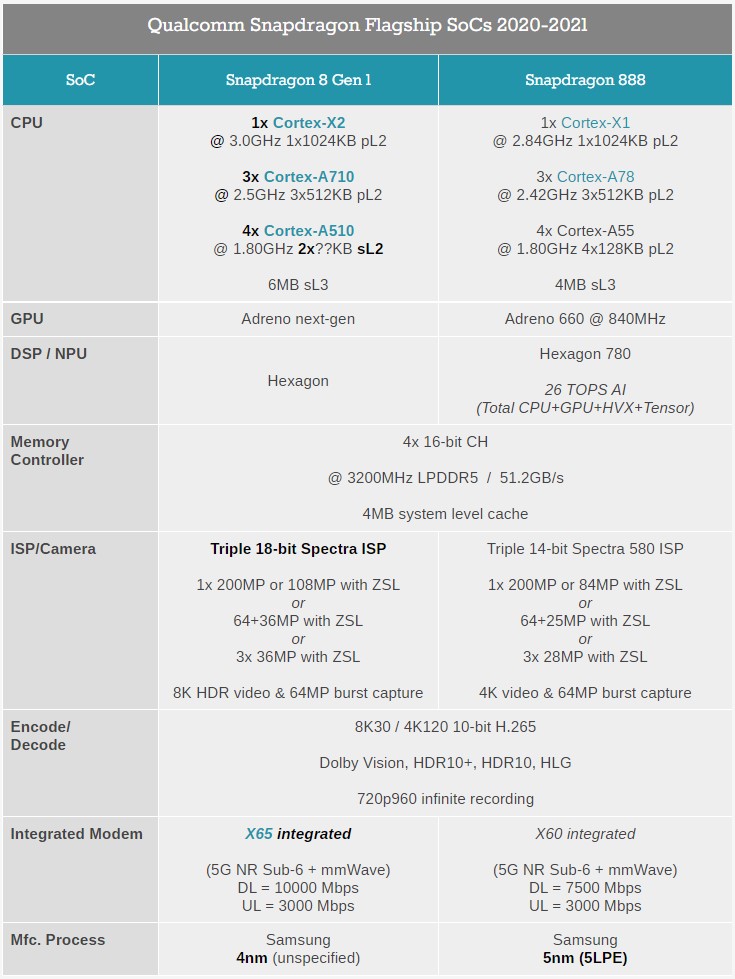

Qualcomm has announced Snapdragon 8 Gen 1 with better performance, camera technology, AI capabilities, security, and 5G. It is built with 4nm process, and is the first chip from Qualcomm to use the latest Armv9 architecture from Arm. Specifically, the new octa-core Kryo CPU will feature a single prime core based on the Cortex-X2 at 3.0GHz, along with three performance cores based on Cortex-A710 at 2.5GHz, and a quartet of efficiency cores based on the Cortex-A510 design at 1.8GHz. (GSM Arena, The Verge, AnandTech, Qualcomm)

Qualcomm Snapdragon 8 Gen 1 processor features Snapdragon Sight Technology, which is a 18-bit image signal processor (ISP) onboard the chipset. In total, the ISP can process up to 3.2 gigapixels per second, 4 times more data than its predecessor. That kind of bandwidth can capture up to 200MP photos from a single camera module or up to 36MP photographs from 3 camera modules at once. It also means 8K HDR and HDR10+ video will be possible. (GSM Arena, Qualcomm, Peta Pixel, DP Review)

Samsung has introduced 3 of its latest automotive chip solutions; Exynos Auto T5123 for 5G connectivity, the Exynos Auto V7 for comprehensive in-vehicle infotainment systems and the ASIL-B certified S2VPS01 power management IC (PMIC) for the Auto V series. (GSM Arena, Samsung)

Deloitte Global predicts that many types of chips will still be in short supply throughout 2022, and with some component lead times pushing into 2023, meaning that the shortage will have lasted 24 months before it recedes, similar to the duration of the 2008–2009 chip shortage. Global semiconductor sales were up by 25% in 2021 despite ongoing shortages, and they are predicted to rise further 10% to USD606B in 2022. This is almost 10 times greater than the 1990 figure of USD58B. When measured as a percentage of global GDP, 2021 chip revenues were 130% larger than they were 30 years ago. (CN Beta, ZDNet, PR Newswire, Deloitte, report)

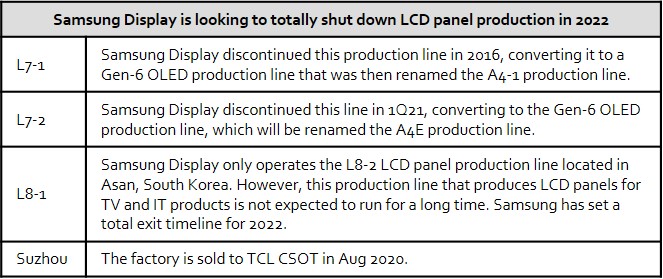

Samsung Display planned to withdraw entirely from the LCD panel market in 2020 but the company shifted its withdrawal date due to a surge in LCD panel demands. The company later set Mar 2021 to shut down the LCD business but that also does not materialize, perhaps due to demands. The company is now looking to totally shut down LCD panel production in 2022 and has commenced steps to actualize the plan. (CN Beta, Gizmo China, Business Korea)

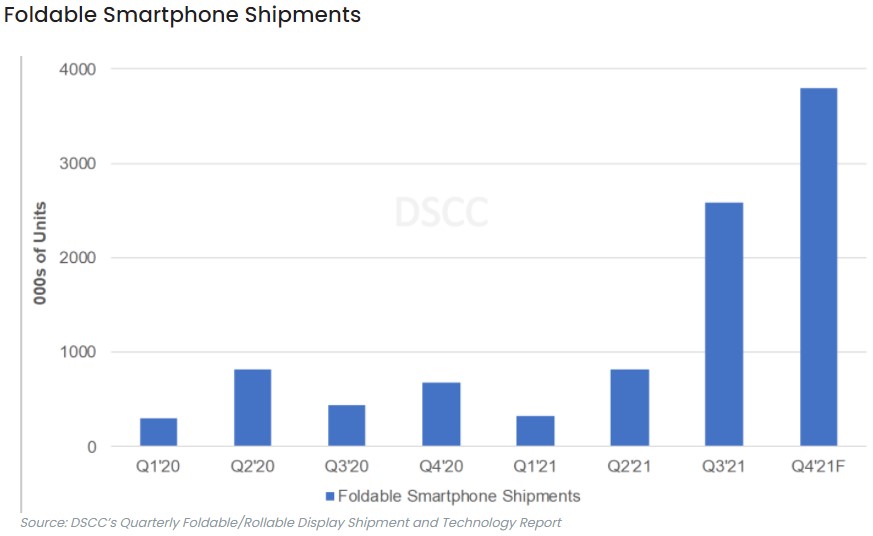

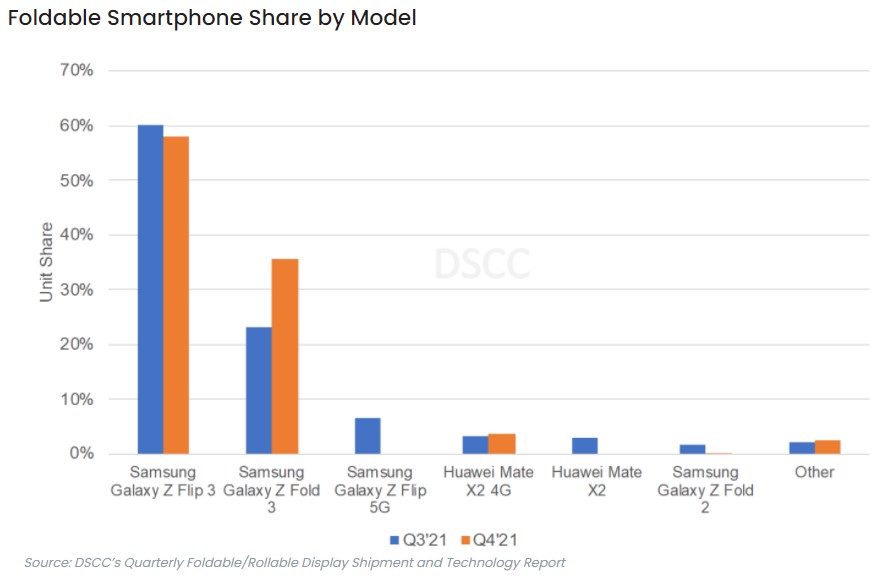

According to DSCC, 3Q21 is a record quarter for foldable smartphone shipments as expected, given the successful launch of the Samsung Galaxy Z Flip3 and Z Fold3. Furthermore, 4Q21 will also be a record for foldable smartphone shipments, which are expected to rise another 47% QoQ and over 450% YoY to 3.8M units. Samsung’s share is expected to reach 95% in 4Q21 on its big marketing push, boosting awareness and improving affordability of the rapidly emerging category. The Z Flip3 is expected to remain dominant in 4Q21 with a 58% share followed by the Z Fold3 rising to 36% and Huawei Mate X2 4G at 4%. (Android Headlines, DSCC, Android Central)

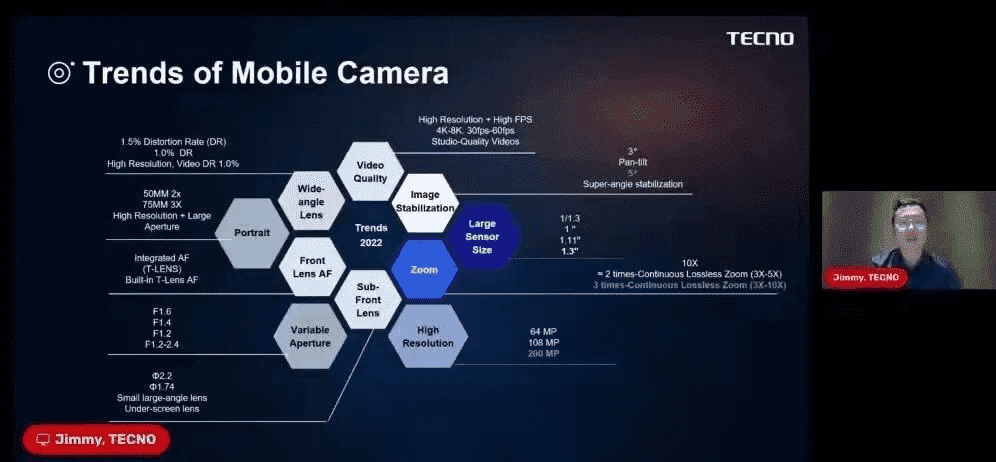

Tecno has unveiled some of its latest innovations and achievements in imaging technologies. With advances in dark complexion imaging aimed at users across key markets in Africa, India, and other regions, Tecno has discussed recent achievements and breakthroughs regarding light sensitivity, image and video stabilization, zoom, and high-resolution – powered by technologies such as RGBW and G+P, Sensor-Shift and telescopic lenses. Tecno has promised some of these new technologies will be available in their 2022 product lineup. (GizChina, Gizmo China, 163, Sohu)

Niche-market DDR3 memory prices are poised to stop falling and begin to rise as early as 1Q22 and will be rising through 2023, according to Digitimes. Since 2H21, as the overall demand in the market has been weak, the price of DDR3 memory chips has been dragged down by the price reduction of DDR4. However, as Wi-Fi 6 is about to lead the upgrade and the demand for high-end networks and AIoT-related equipment increases, DDR3 is about to come to the turning point. The overall supply of DDR3 is still approaching and may not improve until 2023. (Digitimes, My Drivers)

Apple is reportedly working on a multi-device charger, with short and long-distance wireless charging tech for the company’s future vision, wherein all of the products can charge each other. Apple is also continuing to work on the short and long-distance wireless charging solutions, which is actually truly wireless charging. (GizChina, Phone Arena, Bloomberg)

Vulcan Energy Resources has entered into a binding lithium offtake agreement with Stellantis. Vulcan will supply Stellantis with a minimum of 81,000 tonnes and a maximum of 99,000 tonnes of lithium hydroxide during the five-year contract period. The agreed delivery start date is 2026. Stellantis plans to invest more than EUR30B through 2025 in electrification and software development, while targeting to continue to be 30% more efficient than the industry with respect to total Capex and R&D spend versus revenues. (CN Beta, Reuters, Stellanis, Electrive)

At least 4 Samsung Galaxy A models will feature water-resistance in 2022. Samsung’s Galaxy A73 and A53 models could pick up their predecessors’ IP67 ratings. Galaxy A33 is now in line for the upgrade, which could be Samsung’s cheapest phone with an IP rating when it lands in 2022. (Android Authority, The Elec)

Margrethe Vestager, the EU’s competition and digital policy chief, has urged the European Parliament and European Council to approve rules to curb the power of Big Tech as a matter of urgency, even if they are imperfect. Ms Vestager’s appeal comes after almost a year of discussions among EU regulators and legislators, who have struggled to agree on the fine print of the Digital Markets Act (DMA) and the Digital Services Act (DSA). (Apple Insider, Irish Times)

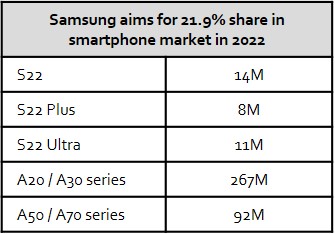

Samsung is reportedly aiming to secure a share of 21.9% in the global smartphone market for the entire year of 2022. Samsung is expecting that a total of 1.52B smartphones will be sold in 2022, which will be a 7.6% YoY increase. (Digital Trends, The Elec)

Xiaomi has established Wuhan Yibayiling Corporate Management in China with a registered capital of CNY2B (USD313M). The information states that the business scope includes enterprise management, enterprise management consulting, and information consulting services. (Gizmo China, Pandaily, Sina)

Redmi Note 11T 5G is launched in India – 6.6” 1080×2400 FHD+ HiD 90Hz, MediaTek Dimensity 810 5G, rear dual 50MP-8MP ultrawide + front 16MP, 6+64 / 6+128 / 8+128GB, Android 11.0, side fingerprint, 5000mAh 33W, INR16,999 (USD226) / INR17,999 (USD240) / INR19,999 (USD266). (Android Central, GSM Arena)

Honor 60 series is announced in China, powered by Qualcomm Snapdragon 778G+ 5G: 60 – 6.67” 1080×2340 FHD+ HiD 2-curved OLED 120Hz, rear tri 108MP-8MP ultrawide-2MP macro + front 32MP, 8+128 / 8+256 / 12+256GB, Android 11.0 (with GMS), fingerprint on display, 4800mAh 68W, 8mm thick, CNY2,699 (USD425) / CNY2,999 (USD471) / CNY3,299 (USD518). 60 Pro – 6.78” 1200×2652 FHD+ HiD ‘4-curve’ OLED 120Hz, rear tri 108MP-8MP ultrawide-2MP macro + front 50MP, 8+256 / 12+256GB, Android 11.0 (with GMS), fingerprint on display, 4800mAh 68W, reverse charging 5W, 8.2mm thick, CNY3,699 (USD581) / CNY3,999 (USD628). (My Drivers, GSM Arena, GSM Arena)

India’s Reliance Jio is rumoured working on Jio Tablet and Jio TV, which are to be launched in 2022. The Jio tablet could run on PragatiOS out of the box, which is the company’s in-house OS that was built in association with Google for the Jio Phone Next. Jio TV could have smart features like support for OTT apps. (GizChina, 91Mobiles, Xinhuatone)

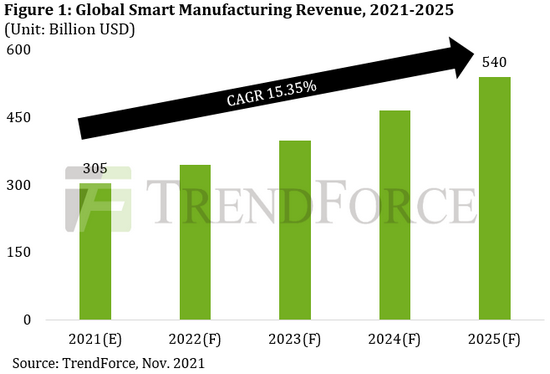

In light of the metaverse’s ability to satisfy the demands of WFH, virtual reality, and simulations, the smart manufacturing industry will also likely capitalize on the rise of the metaverse and undergo an accelerated growth of related technologies, according to TrendForce. Global smart manufacturing revenue is expected to increase at a 15.35% CAGR across the 2021-2025 period and surpass USD540B in 2025. This growth can primarily be attributed to several factors. First, industrial applications take place in closed environments, and companies that utilize such applications have generally made good progress in terms of digital transformation. Furthermore, by utilizing simulation technologies, companies can significantly cut down on their labor costs, project time, and wasted resources. (TrendForce, TrendForce, Neowin)

Nissan will invest JPY2T (USD17.6B) over the next 5 years developing new EVs and battery technology as part of a grand plan it calls “Ambition 2030”. It aims to release 15 new EVs total by 2030, with electrified vehicles making up half its vehicle lineup at that point. It will develop 23 electrified vehicles in total over the next 8 years, with 20 of those coming in the next 5 years alone. (Engadget, Nissan)

Toyota Motor has revealed that its global output sank 25.8% in Oct 2021 from a year earlier to 627,452 vehicles for the third straight month of decline, hit by lingering supply constraints, including for semiconductors. With many deliveries of Toyota vehicles postponed, global sales, meanwhile, fell 20.1% to 677,564 units. Total global output by eight major Japanese automakers, including Nissan Motor and Honda Motor, fell 24.2% in Oct 2021 from a year earlier to 1.84M units. Their worldwide sales declined 19.4% to 1.85M vehicles. (CN Beta, Kyodo News, Japan Times, Business Standard)

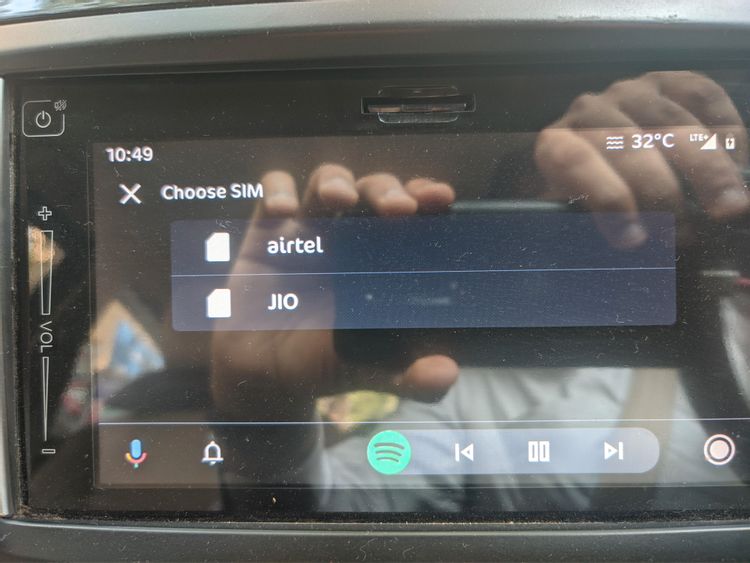

Google is rolling out dual SIM support for Android Auto after adding dual SIM support to its Pixel smartphones with the release of Android 10 in 2019. Users will have the option to select the active SIM card. (Android Headlines, Android Police)

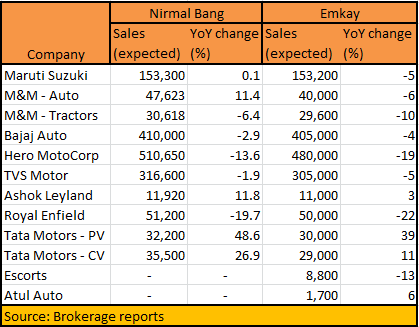

Tata Motors along with other commercial vehicle (CV) players in India, are likely to steal the limelight as the monthly sales data for Nov 2021 show. Tata Motors CV business is likely to show 11-27% YoY sales growth, the most among its competitors. In the passenger vehicle (PV) segment as well, Tata Motors is likely to lead the charts with an expected growth rate in the 39-49% range. (Gizmo China, India Times)

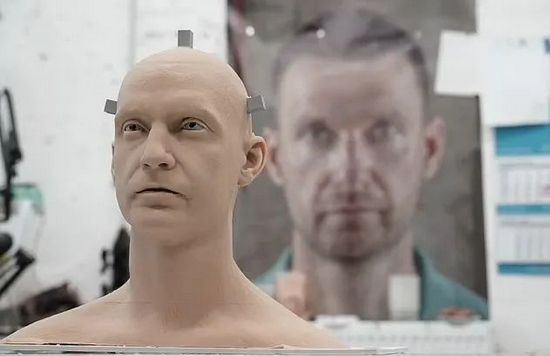

Promobot has launched the “Android Robo-C”, a made-to-order robot that could be modeled after the appearance of anyone. The company is searching for a ‘kind and friendly’ face to be reproduced on potentially thousands of versions of the robots worldwide. The company is ready to pay GBP150,000 (USD200,000) to anybody willing to transfer the rights to their face and voice forever. (CN Beta, Metro, News Week, Gizmodo, Promobot)