12-4 #Icecream : Samsung Group has decided to invest USD1,00B over the 3 years from 2021; Samsung Display is reportedly planning to add 3 more foldable module lines at its factory in Vietnam by 2022; Square is renaming itself Block as it focuses on technologies such as blockchain; etc.

Qualcomm has introduced two new SoCs for Always-On, Always-Connected PCs. Qualcomm’s new Snapdragon 8cx Gen 3 is built to deliver “breakthrough performance per watt”, enhanced AI-acceleration, multi-day battery life, and fast 5G connectivity in ultra-thin laptops with fanless designs. Qualcomm claims the chip delivers 60% greater performance per watt compared to rival x86 platforms. The new Snapdragon 7c Gen 3 platform has been designed for entry-tier Chromebooks and Windows PCs. It is a 6nm chip that promises an impressive 60% improvement in CPU performance and up to 70% faster GPU performance. The Qualcomm AI Engine allows the chip to deliver 6.5 TOPS of performance, which is significantly higher than other entry-level platforms. (Android Central, Liliputing, Android Authority, Hardware Zone)

Qualcomm has announced a collaboration with Google Cloud to bring the latter’s Neural Architecture Search to Qualcomm platforms. The move is designed to speed up the development of AI models at the edge. Qualcomm claims the announcement will make it the first system-on-a-chip (SoC) customer to offer the Google Cloud Vertex AI Neural Architecture Search services. (VentureBeat, Business Standard, TechNews)

Qualcomm has introduced its Snapdragon G3x Gen 1 gaming platform to power a new generation of dedicated gaming devices. The gaming lifestyle brand Razer has partnered with Qualcomm on a handheld gaming developer kit powered by the G3x processor. The Snapdragon G3x Gen 1 Gaming Platform is a purpose-built platform for leveling up gaming on mobile devices. (VentureBeat, Pocket-Lint, TechRadar)

Qualcomm CEO Cristiano Amon has said that the global chip shortage was easing and the situation is expected to improve in 2022. Supply has improved this year over 2020 and the situation is expected to improve even more in 2022, especially compared to 2020. Multiple smartphone makers could not procure enough processors from Qualcomm which affected their smartphone production. (CN Beta, The Elec)

Qualcomm CEO Cristiano Amon has confirmed that Snapdragon 8 Gen 1 is manufactured by using Samsung Foundry 4nm process. Meanwhile, Alex Katouzian, the senior vice president and general manager of the Mobile has also revealed that the company is not using TSMC to manufacture Snapdragon 8 Gen 1. (CN Beta, Korea Times, The Elec, Sam Mobile)

Samsung Group has decided to invest KRW240T (USD1,00B) over the 3 years from 2021, KRW180T at home and KRW60T overseas. Of the KRW60T set aside for overseas, KRW20T will be used to build a new foundry in Taylor, Texas of the United States. Samsung may have a pocket of nearly USD100B for M&A for multiple semiconductor companies, including Texas Instruments, Renesas, NXP, Infineon, and STMicroelectronics. (WCCFtech, UDN, UDN, Mashdigi, Business Korea, CN Beta)

Amazon has announced Elastic Compute Cloud (Amazon EC2) Trn1 instances, which it claims will deliver the best price performance for training deep learning models in the cloud for use cases such as natural language processing (NLP), computer vision, search, recommendation, ranking, and more. Trn1 instances are powered by AWS Trainium, the second machine learning (ML) chip built by AWS that is optimized for high-performance deep learning training. (TechCrunch, CN Beta, Amazon, Amazon)

According to TrendForce, demand has continued to outstrip supply in the foundry market during 3Q21. Foundries have been gradually taking on new production capacity in the recent period and gaining from the ongoing rise in the ASP. Thanks to robust demand, new production capacity, and rising wafer prices, the quarterly total foundry revenue rose by 11.8% QoQ to reach a new record high of USD27.28B for 3Q21. This result indicated 9 consecutive quarters of revenue growth. (CN Beta, TrendForce, TrendForce)

SiFive has revealed its new Performance P650 processor. According to SiFive its latest offering is 50% more powerful than the Performance P550, which was just launched in Jun 2021. The 64-bit Performance P650 utilizes the same “thirteen-stage, triple-issue, out-of-order pipeline” as the P550. Instruction-issue width has been increased on the P650, which SiFive has increased performance per clock cycle by 40%. (Liliputing, Tom’s Hardware, VentureBeat)

RISC-V International, a global open hardware standards organization, has announced that RISC-V members have ratified 15 new specifications – representing more than 40 extensions – for the free and open RISC-V instruction set architecture (ISA). The organization has highlighted 3 of those specifications — Vector, Scalar Cryptography, and Hypervisor. (HPC Wire, RISC-V, Liliputing)

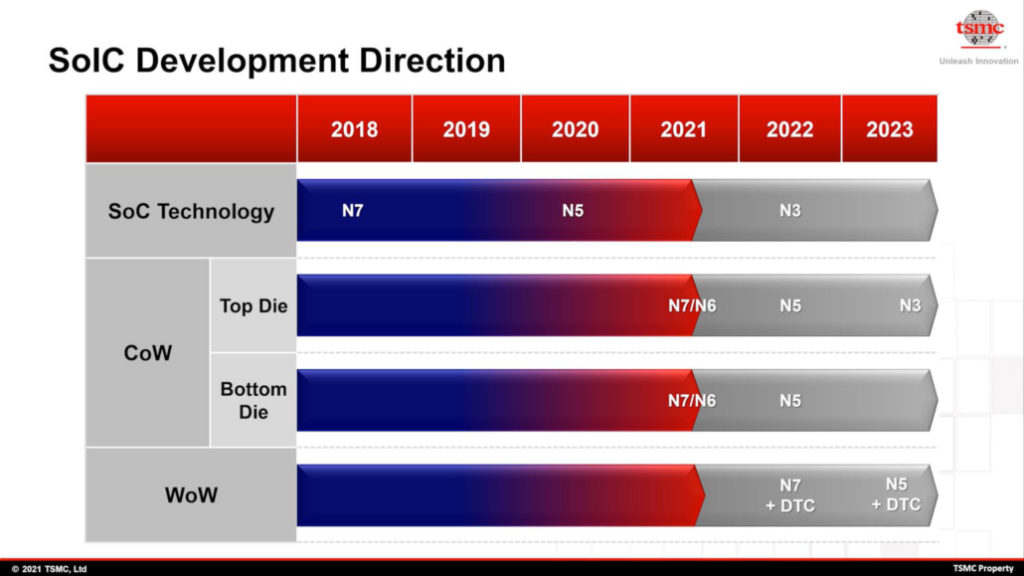

TSMC has kicked off pilot production of chips built using N3 (namely 3nm process technology) at its Fab 18 in southern Taiwan, and will move the process to volume production by 4Q22, according to Digitimes. (Apple Insider, Digitimes, MacRumors)

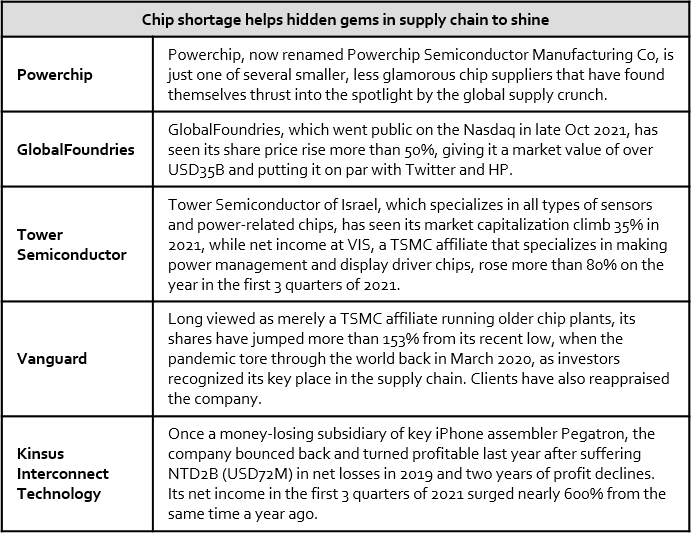

The global chip shortage that emerged late 2020 has sparked unprecedented demand for precisely the type of peripheral chips that are now Powerchip’s stock in trade. These parts, which include image sensors, display driver chips and power-management components, are less expensive and cutting edge than, say, modem chips, central processing units or graphic processing units. But device makers have learned the hard way that they are just as essential. (Laoyaoba, Asia Nikkei)

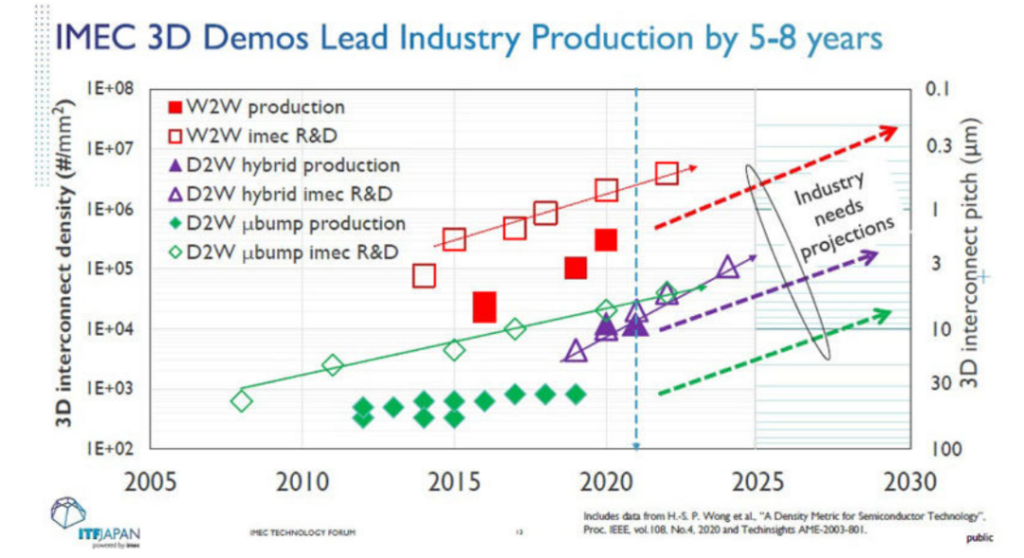

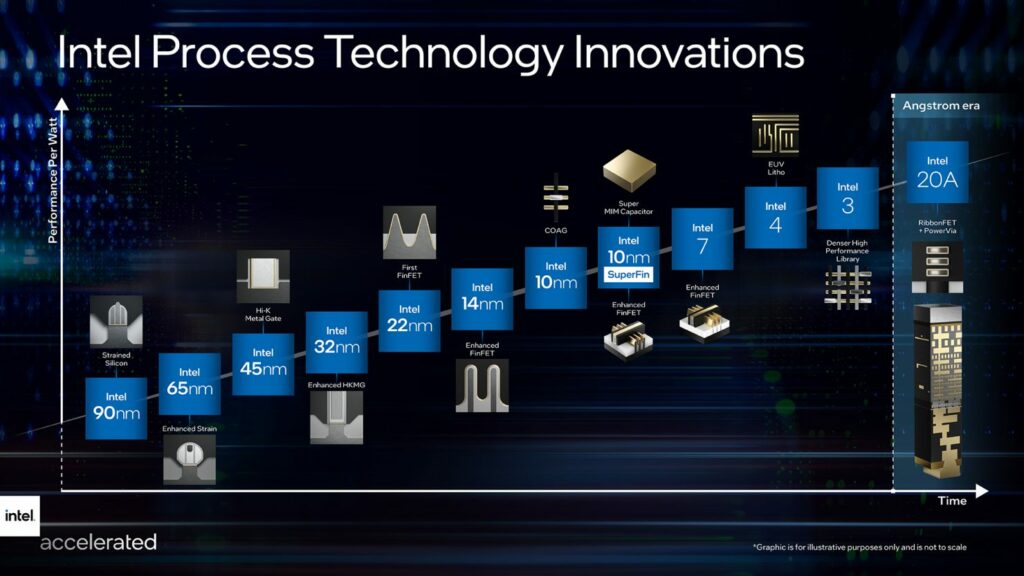

In recent years, the argument that Moore’s Law is moving towards the physical limit has been rampant, but the Belgian Interuniversity Microelectronics Centre (IMEC) has stated that the 1nm process can be put into practical use in 2027, and the further 0.7nm process is expected to be mass-produced after 2029. According to CEO Luc van den hove, the EUV machine research and development work between IMEC and ASML is currently underway, and Japan’s TEL is also participating. It is expected that the test machine will be completed in early 2023, and some companies plan to put into mass production in 2026. (CN Beta, Laoyaoba, EET China)

Taiwan Semiconductor Manufacturing Company (TSMC) has commenced pilot production of its next-generation 3nm semiconductor manufacturing node. Intel is allegedly eager to make sure that it is the first in line when it comes to procuring TSMC’s 3nm products. Samsung expects that its 3nm process will be ready during 1H22, TSMC has outlined that it will enter mass production during 2H22. Intel will also reportedly discuss cooperating with TSMC for the 2nm process, since Intel also has plans for its own 2nm node. Dubbed as 20A (angstrom), this technology might make its way to the production line in 2024. (CN Beta, Digitimes, WCCFTech)

The Federal Trade Commission (FTC) has sued to block Nvidia’s USD40B acquisition of Arm, halting what would be the biggest semiconductor industry deal in history, as federal regulators push to rein in corporate consolidation. The F.T.C. has said the deal between Nvidia, which makes chips, and Arm, which licenses chip technology, would stifle competition and harm consumers. The proposed deal would give Nvidia control over computing technology and designs that rival firms rely on to develop competing chips. (Laoyaoba, FTC, NY Times)

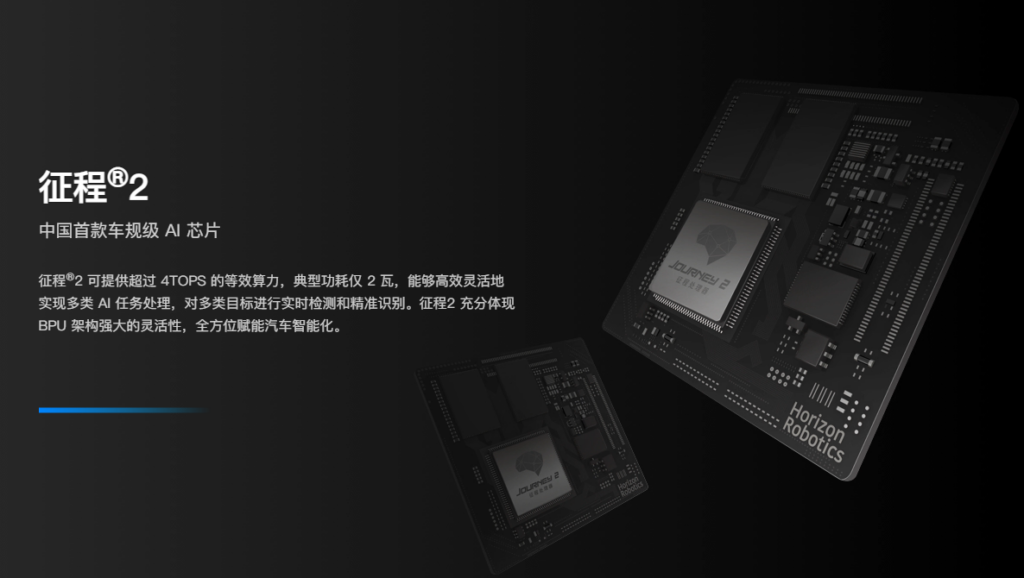

Horizon Robotics has said that there are two Journey 2 chips on the officially-unveiled Changan UNI-V model. Changan UNI-V is positioned as an A+ five-door hatchback Coupe. At the same time, in terms of intelligence, it implements intelligent assisted driving and intelligent interactive functions based on two Journey 2 chips, which can provide users with a new intelligent experience both inside and outside. (Laoyaoba, IT Home, Gasgoo)

China’s edge-AI chip developer, Horizon Robotics, has announced its strategic partnership with autonomous driving solution provider ZongmuTech to create mass-producible autonomous driving solutions. Horizon Robotics has reliable Journey series auto-grade chips, mobile visual perception algorithms, while ZongmuTech’s strong suits lie in parking algorithms, millimeter-wave radars, ultrasonic radars, cameras, and comprehensive systematic design capabilities. (Gasgoo, East Money, Sina)

Samsung Display is reportedly planning to add 3 more foldable module lines at its factory in Vietnam by 2022 to expand its foldable panel production capacity. Once the addition is complete, the number of company’s foldable module lines will increase from 7 to 10. This will expand its foldable panel production capacity from the current 1.4M to 1.5M units per month to 2M units per month. (CN Beta, The Elec)

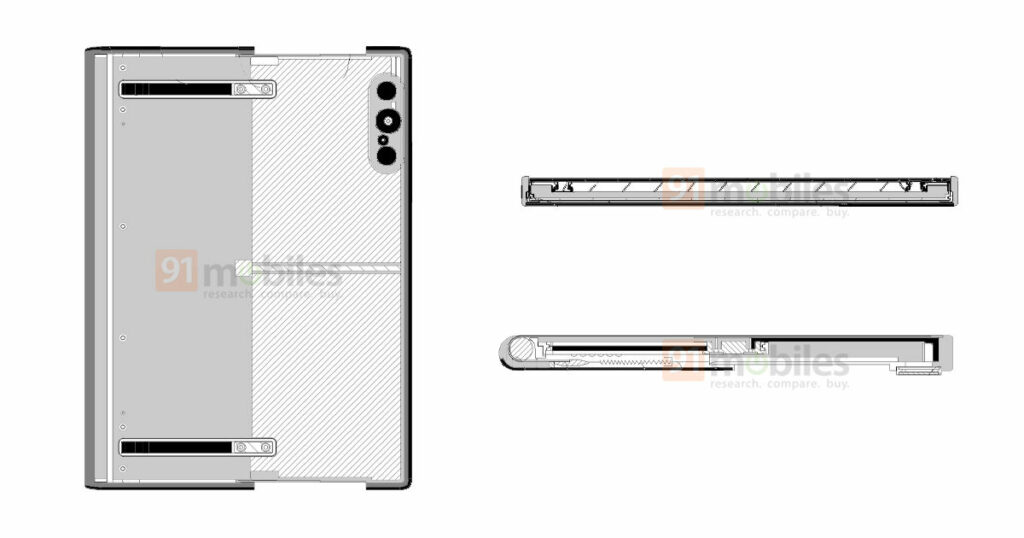

vivo’s patent drawings show the phone will have an extendable display that extends from right to left and provide the user with additional screen real estate. The extendable phone expands from the right spine and clips back in when not in use. The phone is equipped with a motor that when triggered automatically brings out the screen. The screen might be manually expandable with the help of a touch or a physical trigger. (Gizmo China, 91Mobiles)

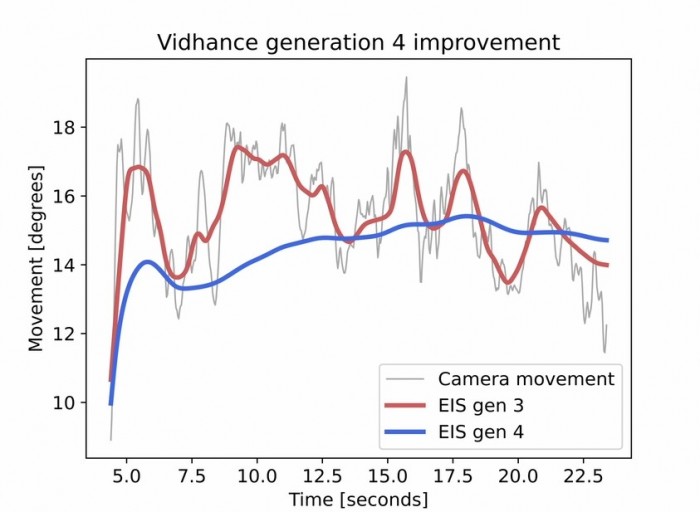

Imint, the Sweden-based company that specializes in video software solutions for smartphones, has unveiled the Vidhance Video Stabiltization 4. The fourth-generation video stabilization engine builds upon the company’s previous solutions and offers various improvements including better motion detection, lower power consumption, improved memory handling, and more. (GSM Arena, Imint, XDA-Developers)

The chairman of Macronix Miin Wu has indicated that the demand for memory will continue to expand, and the market will continue to grow. It is expected that 3D NAND Flash (storage flash memory) will replace DRAM and become the mainstream of the market. He also believes that innovation will continue to expand the market for NOR Flash. Macronix plans to adjust upward its NOR flash chip prices by 5-10% in 1Q22, while fellow company Winbond Electronics is looking to maintain its quotes, according to Digitimes. (Laoyaoba, ETToday, China Times, LTN)

Affected by the decline in the price of core component NAND flash memory, the price of SSD for PC, which has risen for one year in a row, ushered in its first decline, and the industry expects that the decline will continue until 1Q22. In 4Q21, the wholesale price of TLC 256GB, a benchmark SSD product for PC, fell by about 5% compared with 3Q21, showing a decline for the first time in a year. The main reasons are the decline in the price of core components NAND flash memory and the temporary suspension of demand for home and office PCs. As SSD is equipped with several NAND flash memory, its price is easily affected by the price of NAND flash memory. In Nov 2021, the wholesale price of TLC 256Gb, a benchmark NAND flash memory product, dropped by about 3% from Oct 2021. According to Techno Systems Research, notebook SSD shipments in 2021 are estimated to be 197M units, which will be much higher than the 34M HDD units. (Laoyaoba, 163, MoneyDJ)

Micron Technology’s recently-unveiled deal with pure-play foundry United Microelectronics (UMC) is to secure sufficient 28nm fab capacity for its eMMC device controller suppliers, such as Phison Electronics, according to Digitimes. (Laoyaoba, Digitimes)

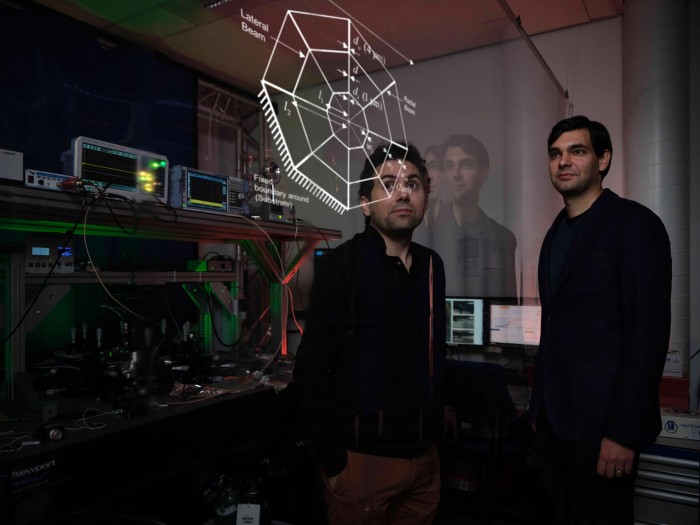

TU Delft managed to design one of the world’s most precise microchip sensors; the device can function at room temperature – a ‘holy grail’ for quantum technologies and sensing. Combining nanotechnology and machine learning inspired by nature’s spiderwebs, they were able to make a nanomechanical sensor vibrate in extreme isolation from everyday noise. (CN Beta, Delft, SciTechDaily)

General Motors (GM) has announced that it will construct a new cathode factory in North America for its electric vehicle batteries. The factory, which will be built under a joint venture with South Korea’s Posco Chemical, will process cathode active material (CAM), which represents about 40% of the cost of an EV battery cell. GM is racing to boost its EV offerings, vowing to spend USD35B on the development and production of 30 new electric vehicles by 2025. (The Verge, CNBC, Forbes)

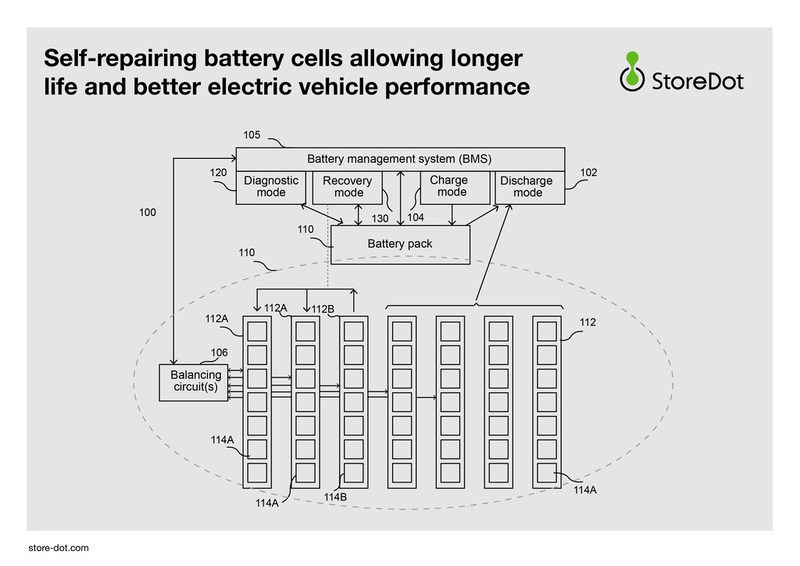

StoreDot has revealed new patented technology that will allow battery cells to regenerate while they are in use, through a seamless background repair mechanism. The newly developed system includes a suite of software algorithms with corresponding hardware, furthering StoreDot’s leadership in advancing the entire battery ecosystem. The self-repairing system identifies a cell or string of cells that are underperforming or overheating, temporarily disabling them in order to proactively recondition them back to 100% performance, without the driver experiencing any driving interruption or loss of performance in their electric vehicle. (CN Beta, Electrive, StoreDot)

Albemarle’s lithium division head Eric Norris and Livent’s CEO Paul Graves think that automakers must work closer with lithium producers to guarantee supply of specialized types of the white metal that boost an electric vehicle (EV)’s range and performance. As EVs go mainstream, automakers are planning models that can run longer before recharging and handle different weather conditions. Batteries for such EVs typically are made with a type of lithium known as hydroxide that cannot be stored for long periods of time and thus must be made in custom batches. As such, producing it requires extensive investment and planning, which lithium producers are hesitant to do even as prices rise unless automakers sign long-term contracts and share development plans. (Laoyaoba, Reuters, US News, Benzinga)

Digital metal casting startup Foundry Lab has announced a USD8M Series A raise led by Blackbird and showcasing their ability to create functional metal parts in less than a day. Foundry Lab has developed microwave casting technology that makes same-day turnaround of metal castings possible. These production-identical parts have applications in mass manufacturing industries where metal 3D printing cannot reach. (TechCrunch, 3D Printing Industry, PR Newswire, CN Beta)

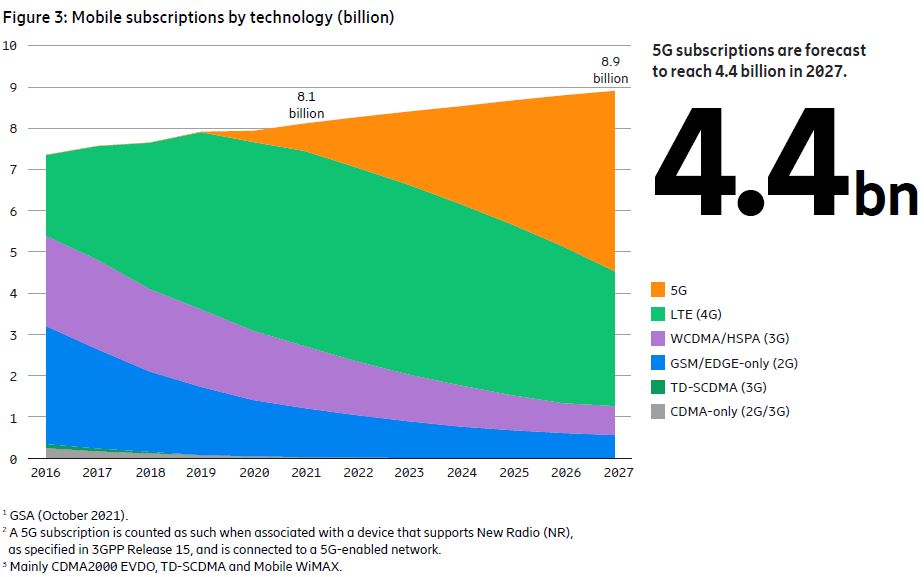

According to Ericsson, service providers continue to switch on 5G and more than 180 have launched commercial 5G services globally. 5G subscriptions grew by 9M during 3Q21, to around 570M. By the end of 2021 Ericsson estimates more than 660M 5G subscriptions. By the end of 2027, Ericsson forecast 4.4B 5G subscriptions globally, accounting for 49% of all mobile subscriptions. 5G will become the dominant mobile access technology by subscriptions in 2027. (Neowin, Ericsson, report)

Verizon is rolling out its fast 5G Home Internet and 5G Business Internet to two more cities today with Dayton, Ohio, and Jacksonville, Florida. With the expansion, the 5G Home Internet is available in 62 cities with the business service available in 59. (Phone Arena, Verizon, 9to5Mac)

Google announces multiple new Android features: new widgets, Emoji Kitchen combos, digital car keys. Digital car key is paired with an update to Android Auto, which can now be set to launch automatically when an Android phone is connected to a compatible car. It is only available in select countries on the Pixel 6, Pixel 6 Pro, and the Samsung Galaxy S21 for compatible BMW cars for now. Three Google apps are getting new widgets, namely Google Play Books, YouTube Music, and Google Photos. (Gizmo China, GSM Arena, Google)

Apple has reportedly cut production targets by up to 10M units of iPhone 13 series because of chip shortages spurred by a spike in COVID-19 cases globally, as well as power usage restrictions in China. Apple was expected to deliver up to 90M iPhone 13 devices before the end of 2021. this would have corresponded with about a 20% increase YoY. (GSM Arena, Apple Insider, Bloomberg)

According to Counterpoint Research, the global smartphone market grew 6% QoQ but declined 6% YoY in 3Q21, clocking shipments of 342M units, down from 365.6M in 3Q20. Samsung retained the number one spot in 3Q21 with its smartphone shipments increasing 20% QoQ to 69.3M units. Apple’s global shipments increased by about 15% YoY to 48M units in 3Q21 driven by persistent demand for the iPhone 12 series and the launch of iPhone 13 series. (Laoyaoba, Counterpoint Research)

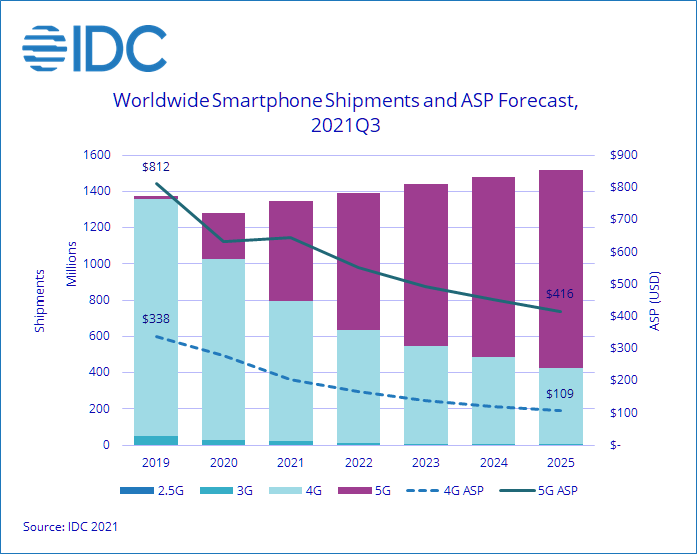

According to IDC, shipments of smartphones will grow 5.3% year over year in 2021, reaching 1.35B shipments. However, due to the lower than expected 3Q21 and the continued component shortages and logistical challenges, which may not improve until mid-2022, IDC has lowered its growth forecast for 2021 and 2022 from 7.4% and 3.4% to 5.3% and 3.0% respectively. Looking at 2023 and beyond, IDC continues to expect a modest but healthy 3.5% five-year compound annual growth rate (CAGR) fueled by pent-up demand, declining average sale prices (ASPs), and continued transition from feature phones to smartphones. (IDC, CN Beta)

Samsung Galaxy A13 5G is launched in US (AT&T and T-Mobile) – 6.5” 720×1600 HD+ v-notch 90Hz, MediaTek Dimensity 700 5G, rear tri 50MP-2MP macro-2MP depth + front 5MP, 4+64GB, Android 11.0, side fingerprint, 5000mAh 15W, USD249. (GSM Arena, Android Authority, Samsung)

Samsung Galaxy A03s is launched in US – 6.5” 720×1600 HD+ v-notch IPS, MediaTek Helio P35, rear tri 13MP-2MP macro-2MP depth + front 5MP, 3+32 / 4+64GB, Android 11.0, side fingerprint, 5000mAh 15W, starts from USD159. (GSM Arena, GSM Arena, The Verge)

Coolpad Cool 20 Pro is official in China – 6.58” 1080×2400 FHD+ v-notch 120Hz, MediaTek Dimensity 900 5G, rear tri 50MP-8MP ultrawide-2MP macro + front 8MP, 6+128 / 8+128GB, Android 11.0, side fingerprint, 4500mAh 33W, starting CNY1,799 (USD280). (GSM Arena, GizChina, Coolpad)

Tecno Camon 18T is launched in Pakistan – 6.8” 1080×2460 FHD+ HiD IPS, MediaTek Helio G80, rear tri 48MP-2MP macro-2MP depth + front 48MP, 4+128GB, Android 11.0, side fingerprint, 5000mAh 18W, PKR28,999 (USD165). (GSM Arena, Tecno)

The UK’s competition regulator has officially ruled that Facebook parent company Meta’s acquisition of Giphy should be unwound, a year and a half after Meta first said it is acquiring the popular GIF-making and sharing website. The Competition and Markets Authority (CMA) has said that it had come to the decision after its investigation found an acquisition could harm competition between social media platforms, and that its concerns “can only be addressed by Facebook selling Giphy in its entirety to an approved buyer”. (CN Beta, The Verge, UK Gov)

A Xiaomi affiliated company, Hanxing Venture Capital, has invested in a VR company, Sky Limit Entertainment. As of right now, the company’s registered capital had increased by a CNY75.7M (USD11.8M). Sky Limit Entertainment is a VR based service provider that integrates IP operation, content production, and digital real-life entertainment. (Gizmo China, Pandaily, Sina, Sohu)

Self-driving tech startup Nuro has said that it is rolling out California’s first commercial autonomous delivery service in partnership with 7-Eleven, a convenience store operator. The service will start with Toyota Priuses converted into autonomous vehicles and include a safety driver to monitor the technology. (Engadget, TechCrunch, Reuters, PR Newswire)

Segway is partnering with Los Angeles-based delivery robot startup Coco to build 1,000 partially automated, remotely piloted sidewalk robots. Coco will begin deploying the robots in Los Angeles and two other U.S. cities during 1Q22. This new shipment of Coco Ones will add to its existing fleet of 100 Coco Zeroes, a “box on wheels” that the company first built to prove out its business model. (CN Beta, TechCrunch)

A German consortium is developing AMU-Bot weed-killing robot. It utilizes onboard LiDAR scanners to stay between those rows, and to see where each row ends so it can turn around and head down the next one. And although the AMU-Bot is not capable of identifying specific types of plants, it is able to differentiate between crop plants and others which shouldn’t be there – weeds, in other words. When one of the latter is spotted, the robot lowers down a rotary harrow (kind of like a toothed version of the reel on a push-lawnmower) which churns up the soil and uproots the offending plant. (CN Beta, New Atlas)

ETH Zurich’s ANYmal robot is already impressive back when it simply walked on four legs. It got more interesting when wheels were added to those legs, letting it both walk and roll. That wheeled version is now also able to stand up, and could soon be used for urban deliveries. This latest incarnation of the ANYmal is being developed by ETH Zurich spinoff company Swiss-Mile, and is thus known as the Swiss-Mile Robot. (CN Beta, New Atlas, Log.com.tr)

Square is renaming itself Block as it focuses on technologies such as blockchain and expands beyond its original credit card-reader business. Square has added a peer-to-peer digital banking app and small business lending, received a bank charter and begun offering crypto and stock trading. Square has acquired buy-now-pay-later provider Afterpay and music streaming service Tidal. It is also doubling down on bitcoin with a crypto-focused business called TBD. Square Crypto, a separate part of the company “dedicated to advancing Bitcoin”, will change its name to Spiral. (CN Beta, Apple Insider, CNBC)

Meta is backing away from its longstanding ban on cryptocurrency ads. Meta has expanded the number of regulatory licenses it accepts from 3 to 27. The company has indicated that the crypto landscape has “matured and stabilized” enough to justify the change of heart, including an increased amount of government regulation that sets “clearer responsibilities and expectations”. (Engadget, CNBC, Facebook)