12-7 #Nose : TCL CSOT has showcased a prototype of the “Fold’n Roll”; Samsung has announced the merger of its two consumer-facing businesses into one; Samsung is developing its first ISOCELL camera with an RGBW color filter pattern; etc.

Qualcomm released a limited-edition device known as the “Smartphone for Snapdragon Insiders” earlier 2021. The chipmaker is now hinting at taking this concept further by releasing “Snapdragon Editions” of existing devices. Qualcomm’s Chief Marketing Officer, Don McGuire has said that the company is still evaluating the success of its existing product, the Smartphone for Snapdragon Insiders. (TechRadar, Android Headlines)

Don McGuire, senior vice president, and chief marketing officer of Qualcomm, has explained the name change stating that the number naming is no longer used purely because there are not enough numbers. In 2021 , it was Snapdragon 888, and to use numbers, only Snapdragon 899 will be available. (Gizmo China, My Drivers)

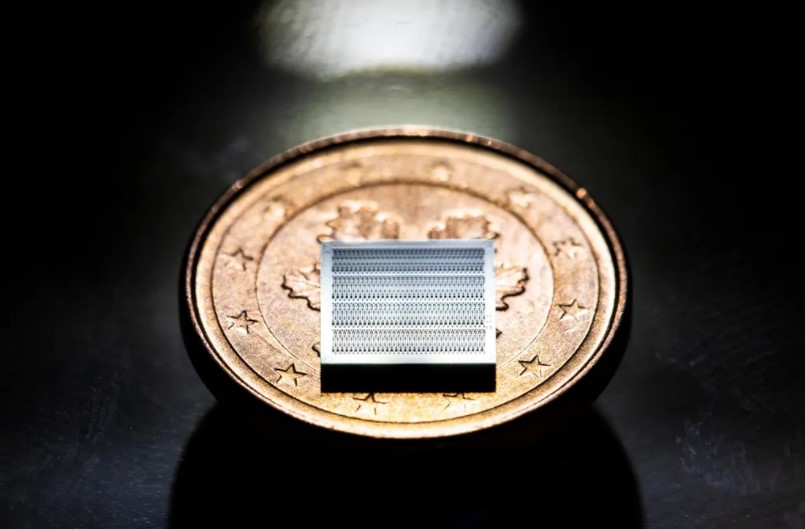

According to Digitimes, Samsung is actively seeking orders for its 3nm GAA chip process. AMD and Qualcomm might be among the first customers of its new cutting edge process. Samsung is also aiming on receiving orders from Nvidia as well. Notably, this marks the increasing intensity of the 3nm chip race, as both TSMC and Samsung are pushing to launch their respective technology into the market. (Digitimes, Gizmo China)

Unsatisfactory manufacturing yield rates (around 30%) for Samsung’s 4nm process technology are prompting Qualcomm to diversify its foundry sources for high-end Snapdragon SoC, according to Digitimes. Only TSMC and Samsung Electronics are currently mass-producing chips with 4nm process technology. (Digitimes, ATP, Laoyaoba)

Just 2 weeks after announcing it would no longer take orders for its a7 II series, a6400 and a6100 camera systems, Sony Japan has announced the next casualty of the ongoing chip shortage is its ZV-E10 compact camera system. Sony Japan has said that ‘there is a delay in procurement of parts for digital imaging products due to the global shortage of semiconductors’. (The Verge, DP Review, Sony)

Derek Yu, President of Huawei’s Consumer Business in Central and Eastern Europe, Northern Europe, and Canada has revealed that Shanghai R&D Center is also working on a solution for 5G chips which means that Huawei’s flagship smartphone could again come with support for 5G connectivity one day. He has also confirmed that the Huawei Mate 50 series smartphones are all set to be officially launched in 2022. (GizChina, Gizmo China, My Drivers, UDN)

Samsung Display is planning to add 3 more foldable module lines at its factory in Vietnam by 2022 to expand its foldable panel production capacity. This will expand its foldable panel production capacity from the current 1.4-1.5M units per month to 2M units per month. Samsung Display’s expansion of its foldable display panel production capacity is aimed at meeting its annual shipment target of 18M units in 2022. Out of the 18M units, Samsung Display will be supplying over 14M units to Samsung Electronics, which is aiming to ship 13M foldable phones in 2022. (Phone Arena, The Elec)

TCL CSOT has showcased a prototype of the “Fold’n Roll”, where hinges and mechanics were combined in one device. The device can fold in half, and if necessary to obtain a large screen area, it “stretches” to the left and moves it with special motors. TCL CSOT is working on a flexible, foldable display that packs HDR 1000 support with 95% coverage of the DCI-P3 color gamut, a peak brightness of 1,000 nits, and an effective 5,120×1,440 resolution when fully extended. Refresh rates range 48-240Hz. (GizChina, Android Authority, Device Specification, Twitter)

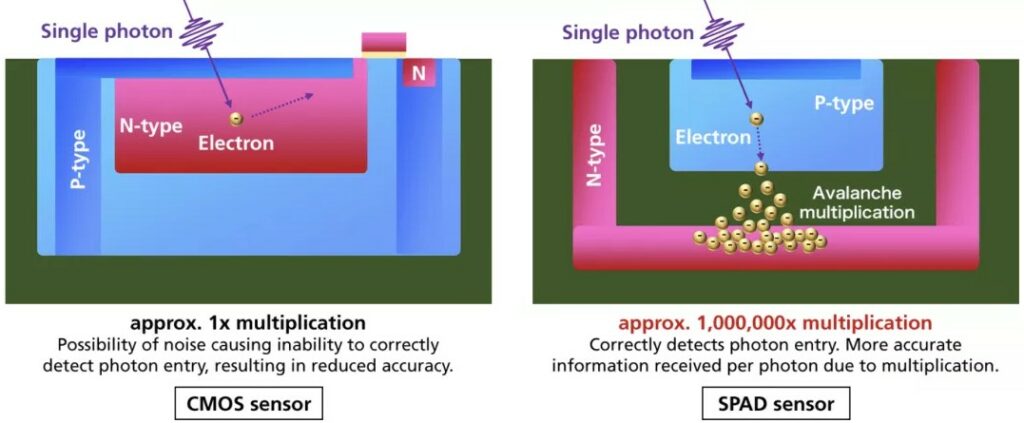

Canon has developed an image sensor that can take high-quality color photographs even in the dark, a big stride toward automated driving and augmented reality (AR). Canon has opted for single-photon avalanche diode (SPAD), which amplifies a single photon entering the sensor into a large number of electrons. This allows for object detection even in minute amounts of light. The number of pixels in a sensor is key to image clarity, and Canon’s SPAD sensor boasts 3.2M. Canon’s factory in Kawasaki will begin mass-producing the new sensor in 2H22. The company plans to install the sensors in its own security cameras that it is to introduce by the end of 2022. In 2023, Canon will invest more than JPY21B (USD185M) to build a new image sensor plant in the Kanagawa Prefecture city of Hiratsuka, where it plans to gradually increase production of the sensor. (My Drivers, PC Mag, Asia Nikkei, Techspot)

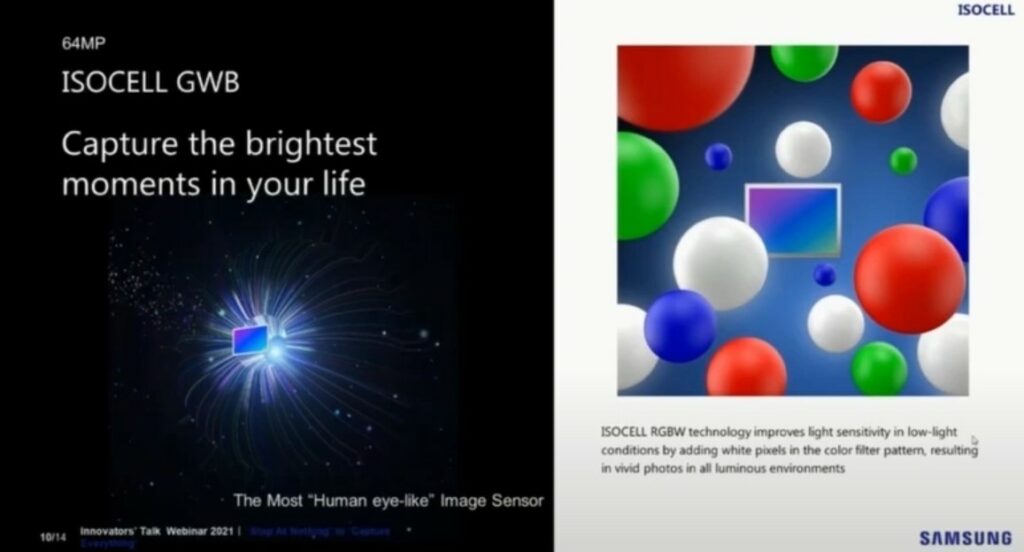

Samsung is developing its first ISOCELL camera with an RGBW color filter pattern. The camera sensor is called the ISOCELL GWB, which has a 64MP resolution. The addition of a white pixel in the RGB color filter pattern improves the sensor’s light sensitivity. This clever sub-pixel arrangement leads to brighter images and better color accuracy when taking photos, even in low light conditions. Samsung has developed the ISOCELL GWB sensor in partnership with Transsion’s TECNO Mobile. This partnership indicates that the ISOCELL GWB will debut on an upcoming TECNO smartphone in 2022. (Gizmo China, Sammobile, Tweakers, CN Beta)

SK Hynix is the largest foreign-invested company in Jiangsu Province and completed its DRAM plant in Wuxi in 2006. In 2019, the company invested KRW950B to improve its production facilities, doubling production. In Oct 2021, it also announced that it would jointly invest CNY2B (about KRW369B) with China’s Sinpa Group to create a semiconductor industrial complex in Wuxi. However, SK Hynix is facing U.S. opposition in implementing its plan to introduce extreme ultraviolet (EUV) lithography equipment to its DRAM memory semiconductor plant in Wuxi. (Laoyaoba, Business Korea)

Micron will open a design center in Atlanta, US in Jan 2022. The company wants its design center for memory chips to be near Georgia Tech and other Atlanta-area colleges. (CN Beta, Biz Journals, US News)

The microspeakers for wireless in-ear headphones from Arioso Systems GmbH, a spin-off of the Fraunhofer Institute for Photonic Microsystems IPMS, are up to 10 times smaller than conventional microspeakers and are made entirely from silicon. The microspeakers measure just 10-20 mm2. The speakers use a new, power-efficient sound transducer principle. This is based on Nanoscopic Electrostatic Drive (NED) technology. The new MEMS sound transducer has no membrane. It has been replaced by a large number of thin bending beams, each measuring 20μm, contained within the silicon chip. The application of an audio signal voltage causes these NED actuators to bend. The vibrations are then heard as sound. (CN Beta, Fraunhofer Institute, New Atlas)

Huawei president of CB for Central and Eastern Europe, Northen Cananda and Turkey, Derek Yu has revealed that the company could launch HarmonyOS for global users in 2022. As of 2 Dec 2021, Huawei has installed this mobile OS on 141 smartphones, tablets, and smart screen devices. (Laoyaoba, Hardware Zone, Android Authority, Gizmo China, Huawei Central)

Apple has allegedly stated that the iPhone shipment target value for 1H22 was set at 170M units. This is about 30% higher than 130M units in 2021. The company’s annual shipment will exceed 300M units for the first time in 2022. Furthermore, the company has notified its major component suppliers to adapt to supply and demand plans. Currently, more than 80M units of iPhone 13 series have been sold. (Laoyaoba, WCCFTech, Digitimes, GizChina)

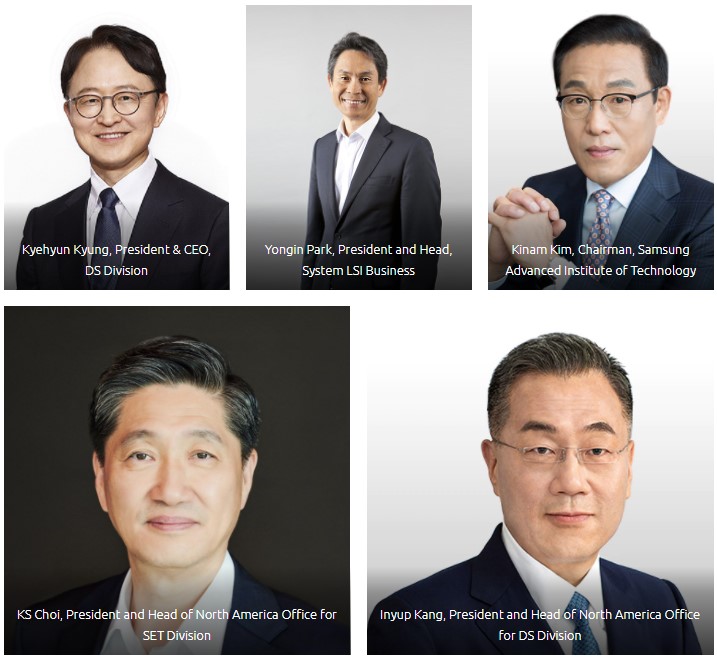

Samsung has announced the merger of its two consumer-facing businesses into one. Consumer Electronics (CE) and IT & Mobile Communications (IM) will now be under a new business division called Set Division (SET). The division includes products like smartphones, laptops, tablets, TVs and home appliances and the amalgamation will help Samsung compete in the market efficiently and create synergies between its products. (GizChina, Samsung, Sammy Hub)

Google is reportedly working on a smartwatch codenamed Rohan, and it is being worked on by Google’s Pixel hardware group, which is separate from Fitbit. Google bought Fitbit for USD2.1B earlier in 2021. Google and Samsung are merging the Tizen platform into Google’s Wear OS. (CN Beta, Pocket-Lint, Business Insider)

Global shipments for wearables grew 9.9% during 3Q21 reaching 138.4M units, according to IDC. Hearables led the growth as the category grew 26.5% compared to last year and accounted for 64.7% of wearable device shipments. Following hearables were wrist-worn wearables, the category most often associated with health and fitness tracking, which captured 34.7% of the market. (IDC, Neowin)

Toyota has reportedly partnered with China’s BYD to build a new affordable electric car to launch in 2022. The partnership between Toyota and BYD is seen as a move by the Japanese company to fast track its development of electric vehicle models in line with industry trends. (Gizmo China, Electrek, Reuters)

Tesla has launched a USD1,900 four-wheel ATV for kids, which is designed for kids 8 years old and above. It includes a steel frame, cushioned seat, and adjustable suspension with rear disk braking. It has a top speed of 10mph, and the battery will power up to 15 miles of range. (The Verge, Tesla)

Umamicart announced USD6M in seed capital in a round co-led by M13 and FJ Labs. Umamicart aims to be a one-stop shop for home cooks, offering staple products and pantry essentials, recipe inspirations and occasion-specific kits for cooking activities. This brings the company’s total funding raised to USD7M, including a USD1M seed round. (TechCrunch, Yahoo)

The crypto exchange BitMart has lost the equivalent of USD196M (originally estimated at USD150M) to a hack. The intruder breached Ethereum and Binance wallets with a flood of transfers starting around 4 Dec 2021, followed by an exodus of tokens later that included Shiba and USDC. (Engadget, Coindesk)