12-12 #Monday : TSMC is in early talks with the German government about potentially establishing a plant in the European country; BMW has signed an agreement with INOVA Semiconductors and GlobalFoundries; Xiaomi has revealed a new battery tech the R&D team has been working on;

SiEngine Technology has officially released the automotive chip brands “Dragon Eagle” and “Dragon Eagle One” smart cockpit chips. “Dragon Eagle One” is a 7nm chip produced by TSMC in China. It will be mass-produced in 3Q22, and will be installed vehicles before the end of the year as planned. The first model to be mass-produced will be Geely’s models. (CN Beta, EET China, CNR)

U.S. officials are reportedly considering discussing a Defense Department proposal to close regulatory loopholes that have allowed Chinese chipmaker Semiconductor Manufacturing International Corp (SMIC) to buy critical U.S. technology. Some Commerce Department officials are trying to block the Defense Department’s proposal. SMIC was added to a U.S. blacklist in 2020 that denies it access to advanced manufacturing equipment from U.S. suppliers due to its alleged ties to China’s military, claims that the company rejects. (Gizmo China, Yahoo, Reuters, US News, WSJ, WSJ, VOA)

TSMC’s Senior Vice President of Europe and Asia Sales Lora Ho has revealed that the company is in early talks with the German government about potentially establishing a plant in the European country. The discussions come as the European Union and others seek to increase domestic chip production to mitigate future supply chain disruptions. (CN Beta, Bloomberg, Taiwan News)

Xiaomi has founded a new company in Shanghai, Xuanjie Technology, which specializes in the design of IC chips with an investment of CNY1.5B. The business scope of the company includes technical services, development and consultation in the fields of electronic technology, communication technology, information technology and semiconductor technology. (CN Beta, EET China, Sina, AA Stock, Pandaily)

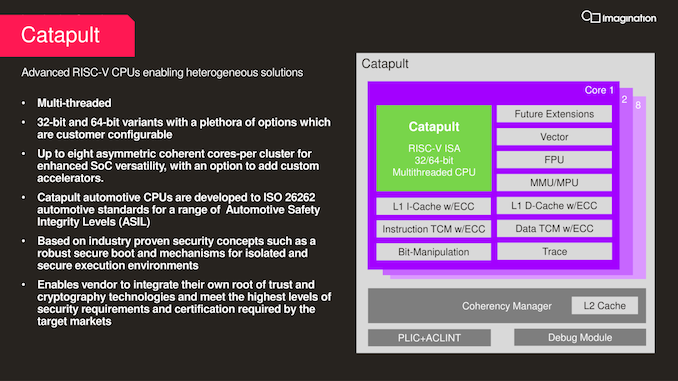

Imagination Technologies has announced Catapult, a new family of RISC-V central processing unit (CPU) designs aimed at the next generation of computing. Catapult CPUs are available in four distinct families: dynamic microcontrollers; real-time embedded CPUs; high-performance application CPUs; and functionally safe automotive CPUs. Catapult CPUs are aimed at markets including 5G modems, storage, ADAS / autonomous vehicles, data center, and high-performance computing. They are multi-threaded and come in both 32-bit and 64-bit variants and have a plethora of customer configurable options, as per application need. (CN Beta, AnandTech, VentureBeat, Tom’s Hardware)

Imagination Technologies announces that its ultra-efficient BXM-4-64 GPU has been licensed by YADRO Microprocessors, a fabless IC design house, subsidiary of YADRO, a leader in enterprise server and storage solutions in the Russian market. The processor will be implemented in YADRO Microprocessors’ EL Construct T RISC-V based System-on-Chip (SoC), targeting enterprise tablet application and is expected to ship in 2023. (Laoyaoba, Imagination, Telecom Paper)

BMW has signed an agreement with Munich-based microchip maker INOVA Semiconductors and U.S.-based foundry GlobalFoundries to supply the carmaker with several million semiconductors per year. The semiconductors will first be deployed in the BMW iX model and then rolled out to other models. (Laoyaoba, BMW, Reuters)

DAGANG NeXchange (DNeX) is currently in talks with Foxconn Singapore and Beijing Integrated Circuit Advanced Manufacturing and High-End Equipment Equity Investment Fund Centre (CGP Fund) regarding the expansion plans for SilTerra Malaysia, following efforts and initiatives undertaken to stabilise Malaysia’s biggest chipmaker. (Laoyaoba, The Edge Markets, UDN)

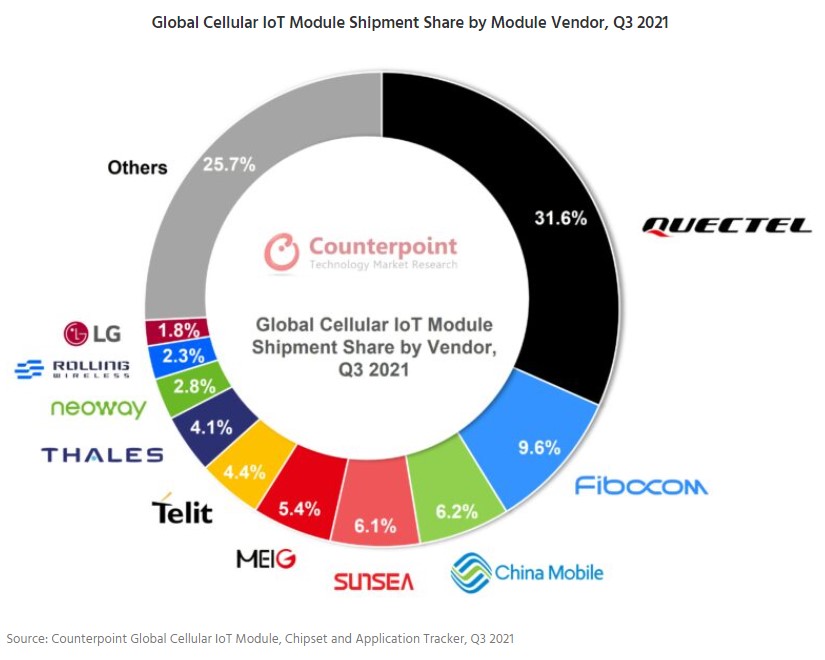

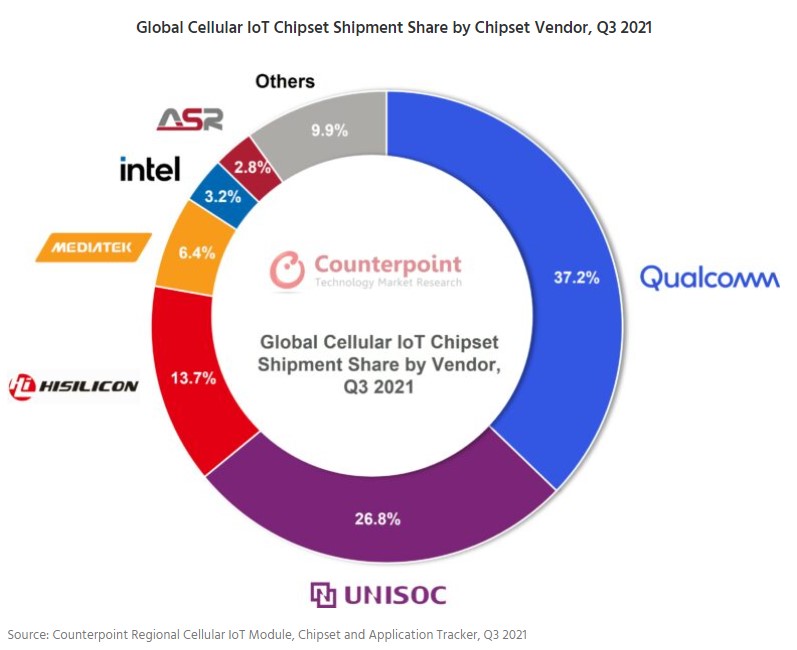

Global cellular IoT module shipments grew 70% YoY in 3Q21, according to Counterpoint Research. In terms of overall revenue, the market crossed the USD1.5B mark during the quarter. Quectel’s cellular IoT module shipments grew nearly 80% YoY in 3Q21. NB-IoT and 4G Cat 1 modules were major drivers for this immense growth. UNISOC, the second-largest cellular IoT chipset player, surpassed Qualcomm to lead in the 4G Cat 1 market. (Counterpoint Research, Laoyaoba0)

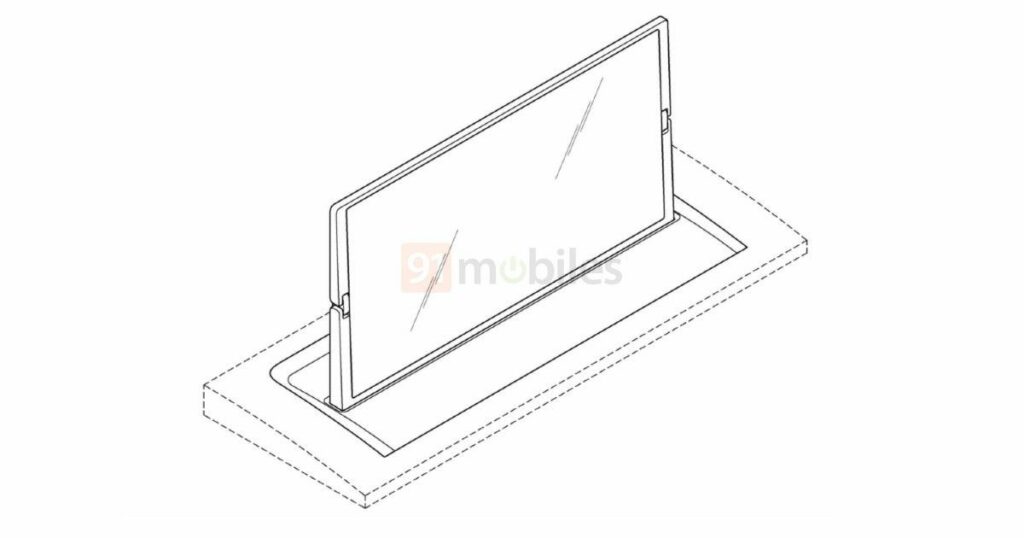

LG has filed a new patent application for a foldable display for the infotainment system in cars. The display panel of the foldable car infotainment system unfolds from a smaller screen to a larger display. The panel can display content even when it’s folded or unfolded. It is touted to be using the rollable display technology. (CN Beta, Gizmo China, 91Mobiles)

Robotic Research, a self-driving technology company that has spent the last two decades developing on and off-road autonomous vehicles for the Department of Defense, raised a USD228M Series A round. RR.AI, as the company has branded its commercial arm, currently has its vehicle-agnostic autonomy kits, called AutoDrive, in about 150 heavy-duty transit buses, Class 8 trucks and yard trucks operating on roads across the United States, Canada, Australia, Europe and Saudi Arabia, according to Alberto Lacaze, CEO of Robotic Research. Now, it is just a matter of scaling. The company’s autonomy stack also adds sensors that commercial autonomous vehicles usually do not use, such as stereo and structure for motion, a range imaging technique for estimating 3D structures from 2D image sequences. (CN Beta, Robot Report, Business Insider, Business Wire, TechCrunch)

Xiaomi has revealed a new battery tech the R&D team has been working on and it should be made available in 2022. Xiaomi could increase the silicon content inside the battery about 3 times. In the same size, the new battery can fit about 10% more mAh and provide up 100 minutes of additional runtime on a single charge. The PCM (protection circuit module) has been angled at 90° and no longer lies flat, ultimately saving some space. Xiaomi has also equipped the new battery with a fuel gauge chip that relies on advanced algorithms improving safety and the life span of the cells as it monitors overnight charging. (Gizmo China, GSM Arena, Weibo, My Drivers)

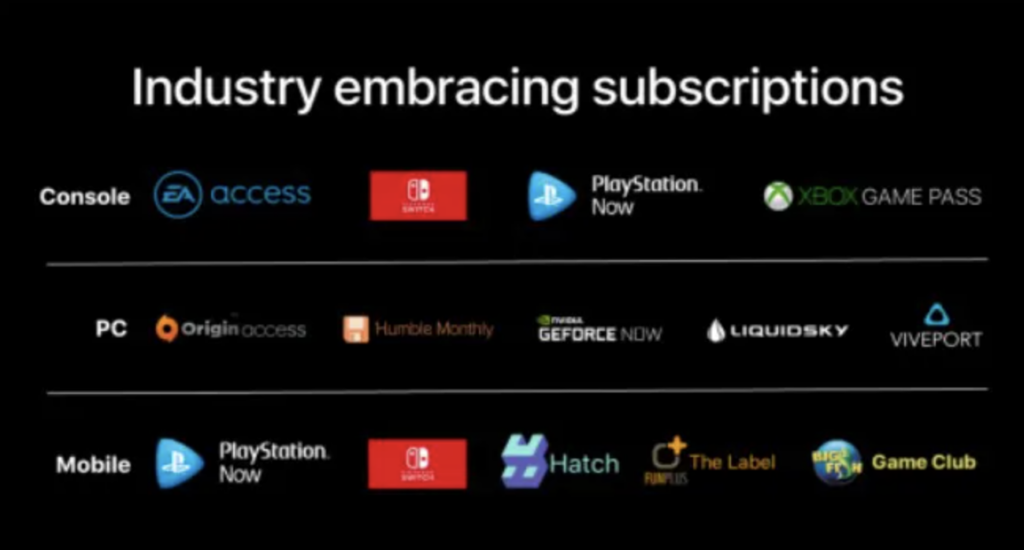

A series of internal documents reveal that Sony had planned to bring its PlayStation Now service to mobile devices. Sony’s PlayStation Now service is a cloud gaming subscription service that allows members to stream PlayStation 2, Playstation 3, and PlayStation 4 on select devices. However, in 2017, Sony had planned on launching on one additional platform mobile phones. According to a confidential document, Apple knew that Sony had been looking to make the move to mobile cloud-enabled gaming. (Apple Insider, The Verge)

Twitter has announced that it acquired the company Quill to help boost its messaging platform. Quill is a messaging app for collaboration and communication with teams, one that competed with other productivity messaging platforms like Slack. (Android Headlines, Twitter, The Verge, GSM Arena)

Apple CEO Tim Cook paid a visit to China in 2016 and allegedly signed an agreement with the Chinese government. The deal would have Apple working to improve China’s economy and technological profile with investments, training up its workforce, and various beneficial business deals. It is alleged that the total value of the 5-year agreement is worth USD275B. (The Information, Apple Insider)

OnePlus is reportedly developing a tablet called the OnePlus Pad. OnePlus plans to launch the OnePlus Pad tablet in India in 1H22. Several models could be in development, with some of them going to China, as well. OnePlus Pad will not launch alongside the OnePlus 10 series, which is expected to be unveiled at a separate event in 1Q22. (Pocket-Lint, 91Mobiles)

Apple is reportedly working on a refreshed design for its iPad Pro, high end iMacs, Mac Pro, and more products as well. Apple is planning to launch a new iPad Pro design that features built in support for wireless charging. Apple will be releasing a redesigned MacBook Air in 2022, which will be launched next to a “revamped, high end iMac with Apple Silicon”. (Gizmo China, Bloomberg)

Braave system uses 3D printing and scanning technology to produce client-specific custom-fit “Fusion Bras”. After initially placing an order, customers receive a link to download Braave’s BreastID iOS app. Utilizing the app, along with the phone’s depth-mapping camera, users proceed to perform a 2-minute 3D scan of their bare upper body. Their face is not in the shot. The image which is obtained is a 3D depth map. The encrypted depth map is used to create the Fusion Bra. The Fusion Bra is available now priced at USD75. (CN Beta, Braave, New Atlas)

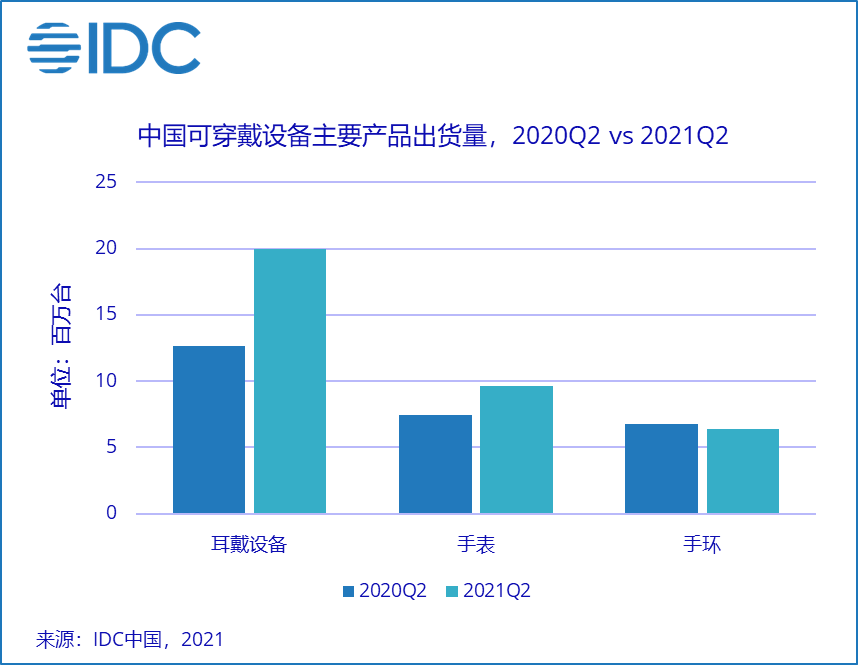

According to IDC, the China market shipped 35.28M units in 3Q21. This marked an overall growth of just 5 percent year on year and signified a decline in the growth rate of the market. The hearables category, which includes earphones, headphones, and earbuds, saw sales reaching nearly 20M units. This showcased a growth of a sizeable 40%. The smartwatch shipments hit just 10.68M units, which saw the market decline by a modest 2.3% YoY. (Gizmo China, IDC)

Apple could reveal a refreshed Apple Watch SE and a new “rugged” model alongside the Apple Watch Series 8 in 2022. The “rugged” model is expected to target athletes as well as outdoor fitness enthusiasts. It is aimed at athletes, hikers, and other use cases involving extreme conditions. (Laoyaoba, Business Standard, MacRumors, Tom’s Guide, Bloomberg)

Eve, the makers of high-end Apple HomeKit smart home devices for home security, energy, and lighting, has been leading the charge for the new Matter standard for a while now, specifically, its primary protocol Thread. Eve says its switchover from Bluetooth to Thread has already been “a spectacular success” for the company, helping improve its sensors’ speed, range, reliability, and battery life. (The Verge, The News Motion, Eve)

Ford CEO Jim Farley has indicated that the company is increasing production of the Mach-E to 200,000 vehicles per year in the US starting in 2022 and in Europe by 2023. That is triple the units the company manufactured in 2021. (Engadget, TechCrunch)

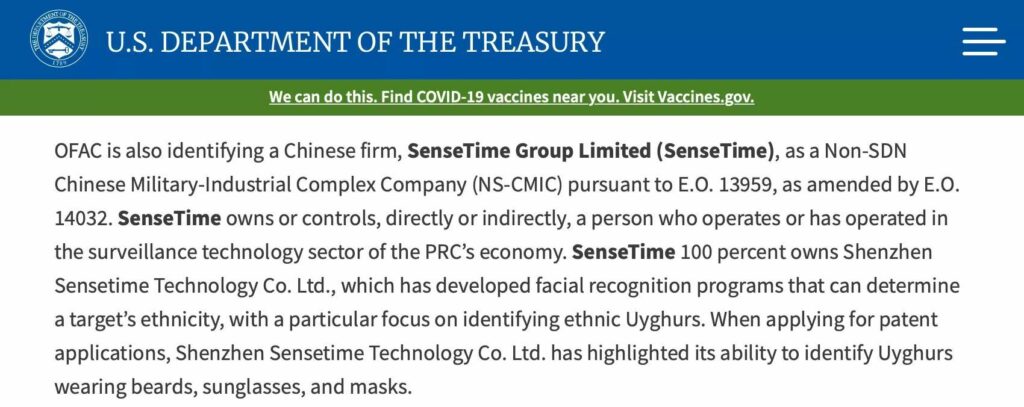

The US Treasury department confirmed that it has decided to place SenseTime Group on a list of “Chinese military-industrial complex companies”, in which US President Joe Biden has banned Americans from investing. The company has said they strongly oppose the designation and accusations that have been made in connection with it. (CN Beta, CNN, FT, Financial Times, Reuters)

Microsoft is set to secure unconditional EU antitrust approval for its USD16B bid for artificial intelligence and speech technology company Nuance Communications. Microsoft has announced the Nuance deal, which would boost its presence in cloud services for healthcare, in April and it has already received regulatory approval in the United States and Australia, without remedies given. (IT Home, Reuters, GizChina)

European Central Bank Executive Board member Fabio Panetta has indicated that crypto-assets show no signs of benefiting society or the wider economy. While advocates frequently hail their ability to serve the unbanked segment of the population or strip out third parties, the ECB official has argued “there is no sign that crypto-assets have performed, or are performing, socially or economically useful functions”. (CN Beta, European Central Bank, Bloomberg)