12-24 #ChristmasEve : Intel and Italy are intensifying talks over investments expected to be worth around EUR8B; CATL is reportedly planning to build a EUR2B worth of battery plant in Poland; Apple has filed a lawsuit against cellular technology company Ericsson; etc.

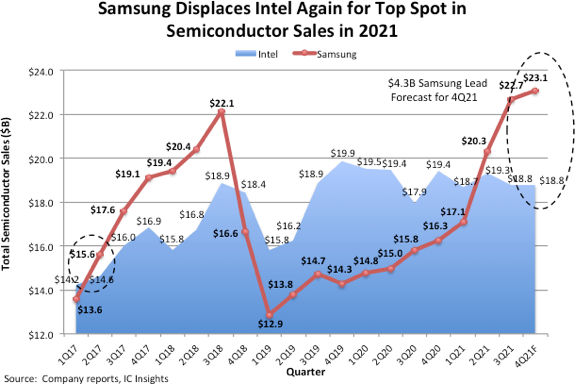

IC Insights has listed the 17 companies forecast to have worldwide semiconductor (IC and O S D—optoelectronic, sensor, and discrete) sales of >USD10.0B in 2021. Three semiconductor companies—AMD, NXP, and Analog Devices—are expected to join the noteworthy “megasuppliers” list in 2021. The list includes six fabless companies (Qualcomm, Nvidia, Broadcom, MediaTek, AMD, and Apple) and one pure-play foundry (TSMC). (CN Beta, IC Insights)

Apple reportedly intends to release updates to its Mac and iPad Pro Apple Silicon chips every 18 months. Apple’s “M2” lineup will start off in 1H22, with a chip codenamed “Staten”. The “M2 Pro” and “M2 Max” versions will apparently arrive as part of an M2X architecture codenamed “Rhodes” in 1H23. M2 will allegedly be produced using a 4nm process, which is also allegedly rumored to be used in the “A16” in the 2022 “iPhone 14”. The following “M3” series would arrive 18 months after the M2, and will employ TSMC’s 3nm process. (Apple Insider, CTEE)

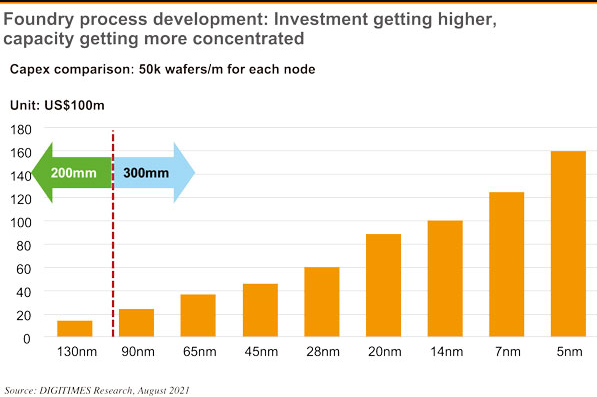

DIGITIMES estimates that it costs USD2.4B to build a 12” wafer fab using the 90nm process node with a monthly output of 50,000 wafers. The investment can reach USD6B for a 28nm fab and USD16B for the currently most advanced 5nm fab. Many products using the mature processes will still be facing shortages in 2022. Spurred by a variety of innovative needs, the semiconductor market size will easily cross the threshold of USD500B in 2021. The USD1T milestone by 2030 seems far but reachable for the global semiconductor market. (CN Beta, Digitimes, Digitimes, press)

Intel’s subsidy Mobileye has announced that it is adding Paris, France, to its autonomous vehicle testing program and adding its autonomous on-demand service to the city in collaboration with RAPT Group, the world’s third-largest public transportation operator. Mobileye’s permit allows the company to drive its autonomous robotaxis across the streets of Paris. (Laoyaoba, Intel, Bloomberg, CTech)

Intel and Italy are intensifying talks over investments expected to be worth around EUR8B (USD9B) to build an advanced semiconductor packaging plant. Intel and the Italian government of Prime Minister Mario Draghi are discussing an overall investment of EUR9B over 10 years from when construction begins. (CN Beta, Reuters, RTE)

Delivery lead times for Wi-Fi 6/6E core chips still last 6 months to 1 year although such chips are given shipment priority at vendors amid tight foundry capacity, and migrating to 16nm manufacturing process may help ease the tight supply, according to Broadcom’s China Taiwan Senior Director Alex Chou. Wi-Fi 6/6E chips are currently mainly produced at 28nm nodes, which is currently the most competitive link among chip manufacturers, and Wi-Fi 6/6E chips have a lower priority than those chips with larger sizes or larger shipments. (Laoyaoba, Digitimes, IT Home)

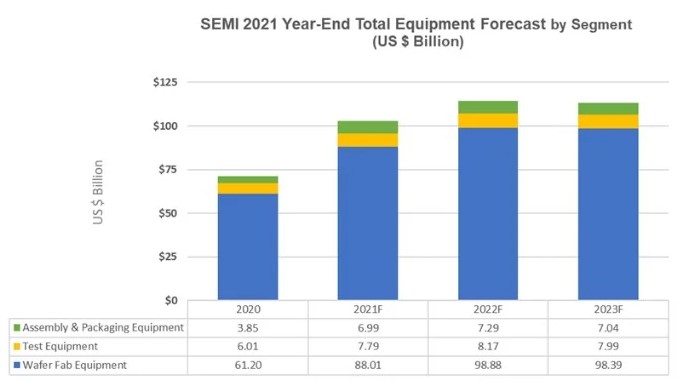

According to SEMI, global sales of total semiconductor manufacturing equipment by original equipment manufacturers are forecast to reach a new high of USD103B in 2021, surging 44.7% from the previous industry record of USD71B in 2020. The growth is expected to continue with the global total semiconductor manufacturing equipment market expanding to USD114B by 2022. (Digitimes, Electronics360, SEMI)

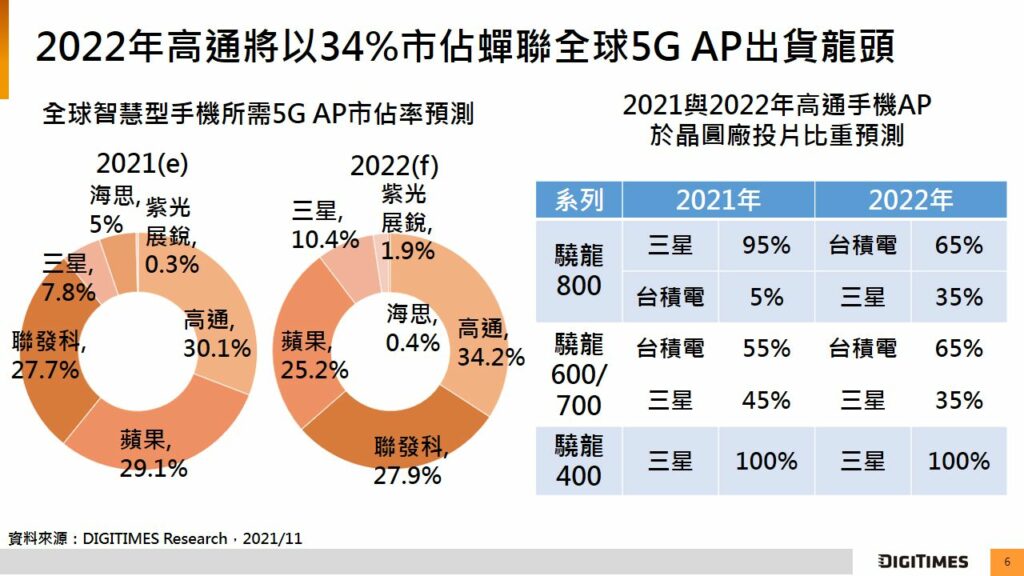

DIGITIMES Research predicts that the total shipments of application processors (APs) required by global smartphones will be 1.54B units in 2022, an increase of 5%. DIGITIMES Research predicts that Qualcomm will continue to lead the global 5G AP shipments with a 34% market share in 2022. (Digitimes)

North America-based semiconductor equipment manufacturers posted USD3.93B in billings worldwide in Nov 2021 (3-month moving average basis), according to SEMI. The billings figure is 5.0% higher than final Oct 2021 billings of USD3.74B and 50.6% higher than Nov 2020 billings of USD2.61B. (SEMI.org, EET Taiwan, Design Reuse, Laoyaoba)

Samsung “Exynos 2200 is expected to arrive before Feb 2022 with a focus on gaming. The new chip will be built on the 4nm FiNFET process technology with Radeon mobile GPU. It should bring HDR gaming, ray-tracing and Variable Rate Shading to mobile games. (CN Beta, GSM Arena, Twitter)

Genesis Photonics has filed patent infringement lawsuit in Taiwan accusing Apple of infringing on a total of nine LED patents. The patents relate to both LED and Mini LED, largely in the context of packaging, referring to how chips and wires are encased and protected. The lawsuit asks for Apple to cease infringement of the patents and to pay compensation to the tune of NTD210M (USD7.5M) to the company. (Apple Insider, IT Home)

LG Display’s VP Cho Min-woo has been frequently travelling overseas for business purpose. He is reportedly pushing the company’s T-OLED (transparent organic light emitting semiconductor) technology to Europe and the United States. LGD’s T-OLED panel is not only a window, but also a screen for projecting advertisements and other information. LGD has launched this product 2.5 years ago, and it is tested on subways / tourist trains in some cities in China and Japan in 2021. (CN Beta, Nikkei)

LG Display (LGD) will be supplying low-temperature polycrystalline oxide (LTPO) thin-film transistor (TFT) OLED panels for Apple’s iPhones launching in 2022. Samsung Display, which dominates the supply of OLED panels to Apple, provided the LTPO TFT OLED panel used in the Pro models of the iPhone 13 series in 2021. Meanwhile, BOE is also developing its own LTPO TFT technology but is yet to commercialize them. (Apple Insider, The Elec)

According to TF Securities analyst Ming-Chi Kuo, Apple’s “iPhone 14” to be launched in 2H22 will use a 48MP camera, and “iPhone 15” in 2H23 will get a better optical zoom with a periscope camera. He predicts that in the coming 2 years, iPhone camera will continue to drive the growth of Largan Precision. (CN Beta, GizChina, TF Securities, Apple Insider)

Rio Tinto has entered into a binding agreement to acquire the Rincon lithium project in Argentina from Rincon Mining, a company owned by funds managed by the private equity group Sentient Equity Partners, for USD825M. Rincon is a large undeveloped lithium brine project located in the heart of the lithium triangle in the Salta Province of Argentina, an emerging hub for greenfield projects. The total resources of the salt lake reached 11.77M tons of LCE, and the total reserves reached 1.98M tons of LCE. The reserves will support the 40-year service life of a lithium carbonate plant with an annual output of 50,000 tons. (CN Beta, Green Car Congress, Reuters, Rio Tinto, Mining)

Contemporary Amperex Technology (CATL) is reportedly planning to build a EUR2B worth of battery plant in Poland and has scouted two locations for it. The company has visited two locations in the southwestern city of Jawor and Gorzow Wielkopolski in western Poland. U.S. commercial electric vehicle maker Electric Last Mile Solutions (ELMS) have has signed a battery supply deal with CATL. (CN Beta, Gasgoo, Yicai Global, CN EVPost, Reuters)

AT&T has agreed to sell its global programmatic advertising marketplace, Xandr, to Microsoft. The agreement builds on a decade-long relationship between Xandr, including its predecessor companies, and Microsoft for delivering global digital media solutions for advertisers. As the digital landscape evolves in a post-cookie world, Microsoft and Xandr can shape the digital ad marketplace of the future. (CN Beta, PR Newswire, Variety)

Huawei has announced that it reached a patent license agreement with Buffalo. The agreement provides Buffalo coverage for certain Wi-Fi 6 enabled products under Huawei’s portfolio of Wi-Fi 6 standard essential patents (SEPs). Buffalo joins the growing list of global vendors authorized to access and implement Huawei’s Wi-Fi SEPs and technologies. (CN Beta, Huawei, Telecom Paper)

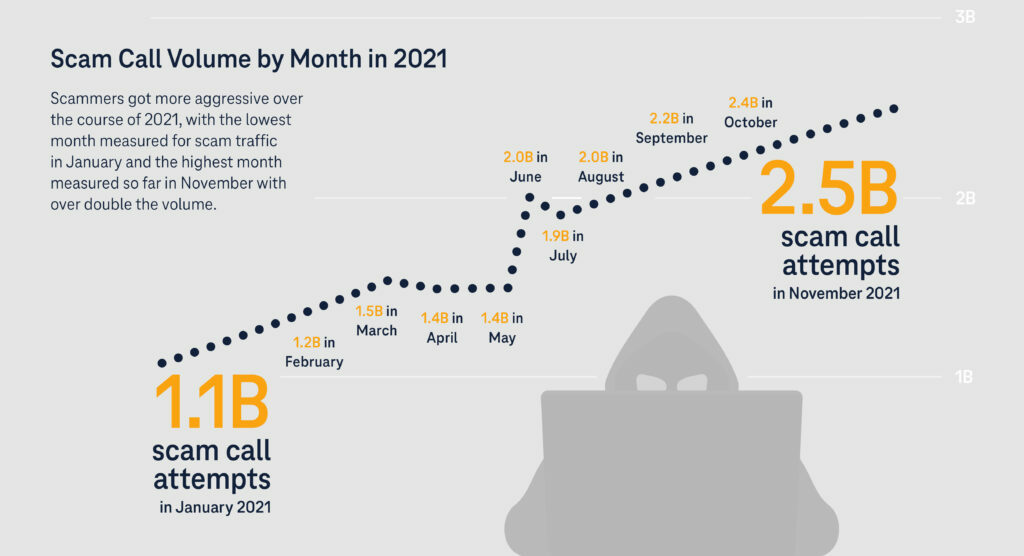

T-Mobile says that its Scam Shield service managed to block 21B scam calls, which translates to 700 calls identified or blocked every second. The gathered data by T-Mobile shows an over 116% increase in scam call attempts from 2020. The most frequent scam was related to fake vehicle warranties, which accounted for 51% of all the call scams. In other popular scams, the scammers were posing as Social Security office workers (up to 10%) and wireless providers (up to 9%). (CN Beta, Phone Arena, T-Mobile)

Apple has filed a lawsuit against cellular technology company Ericsson, accusing the firm of using “strong-arm tactics” in telecommunication patent licensing negotiations. The lawsuit alleges that Ericsson in violation of its obligation to license patents that are “critical” to industry telecommunications standards at fair rates. (Apple Insider, Foss Patents, CN Beta)

Apple supplier Foxconn’s plant near Chennai in southern India will remain shut in early Dec 2021 following protests sparked by a food poisoning incident. It has also recently started trial production of the iPhone 13, with the goal of beginning mass production by Feb 2022. (Gizmo China, Reuters, 9to5Mac, ETToday, CNA)

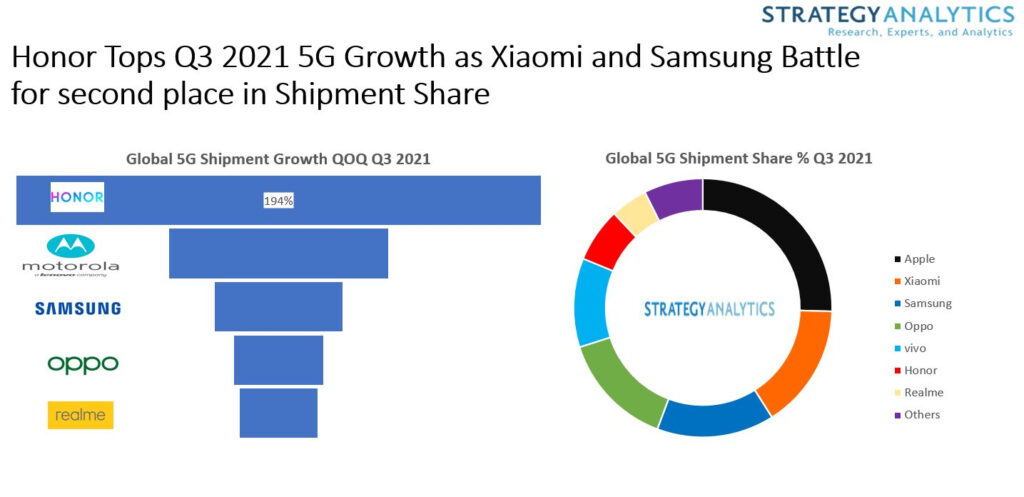

According to Strategy Analytics, Xiaomi’s global 5G smartphone shipments growth stalled in 3Q21. Samsung continued to grow its share of 5G smartphone shipments. Samsung has returned to positive territory following 3 prior quarters of negative sequential shipment growth. Honor led as shipments growth leader. (Strategy Analytics, GizChina)

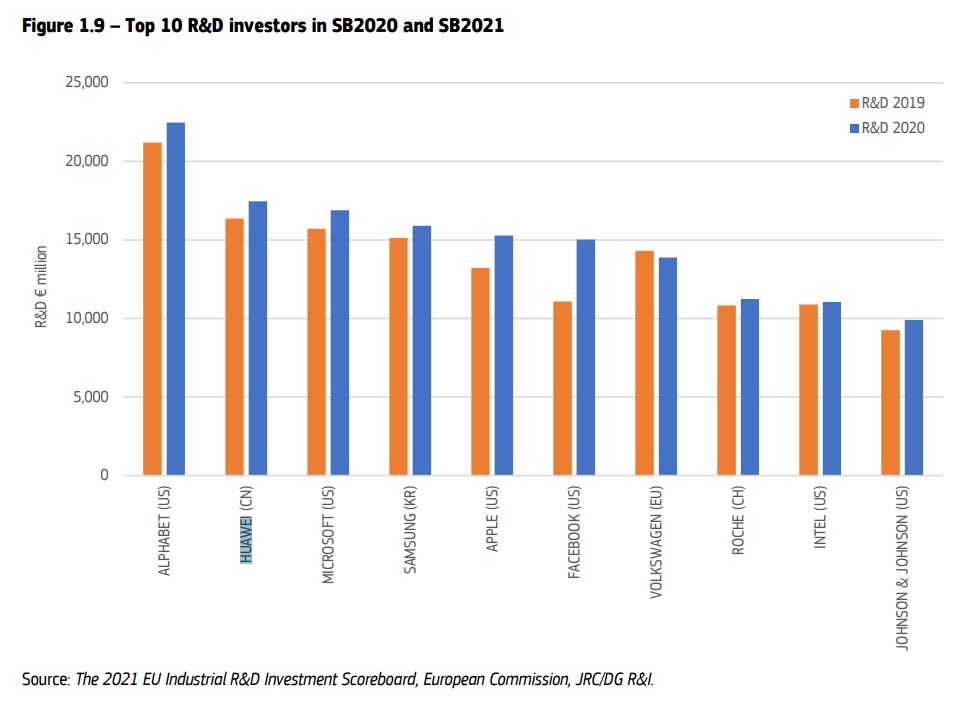

Huawei ranks second in the 2021 EU Industrial R&D Investment Scoreboard. The 2021 EU Industrial R&D Investment Scoreboard is a European Commission publication. It ranks the research investment levels of 2500 companies around the world that comprise 90% of the world’s business-funded R&D. The report was prepared by the EU Joint Research Centre (JRC). (GizChina, Huawei)

The Income Tax (I-T) department of India has conducted search operations at the premises of Xiaomi and OPPO. The department has also carried out similar operations at the Southern India factories of Foxconn India’s unit, Bharat FIH, and Dixon, both leading contract manufacturers. The raids follow by similar moves by the Enforcement Directorate (ED) and I-T authorities recently amid continuing border tensions between India and China. (Gizmo China, India Times)

vivo S12 series is launched in China: S12 – 6.44” 1080×2400 FHD+ notch AMOLED 90Hz, MediaTek Dimensity 1100 5G, rear tri 108MP-8MP ultrawide-2MP macro + front dual 44MP-8MP ultrawide, 8+256 / 12+256GB, Android 11.0, fingerprint on display, 4200mAh 44W, CNY2,799 (USD439) / CNY2,999 (USD471). S12 Pro – 6.56” 1080×2400 FHD+ notch AMOLED 90Hz, MediaTek Dimensity 1200 5G, rear tri 108MP-8MP ultrawide-2MP macro + front dual 50MP-8MP ultrawide, 8+256 / 12+256GB, Android 11.0, fingerprint on display, 4300mAh 44W, CNY3,399 (USD533) / CNY3,699 (USD581). (Gizmo China, GSM Arena, vivo, vivo)

Huawei P50 Pocket is announced in China – 6.9” 1188×2790 Foldable OLED 120Hz + 1.04” 340×340 OLED, Qualcomm Snapdragon 888 4G, rear tri 40MP-13MP ultrawide-32MP + front 10.7MP, 8+256 / 12+512GB, HarmonyOS 2.0, side fingerprint, 4000mAh 40W, 5W reverse charging, CNY8,988 (USD1,410) / CNY10,988 (USD1,725). (GSM Arena, Pocket-Lint, CN Beta)

Huawei Watch D is launched. It features 1.64” 326×326 display, supports ECG reading, blood pressure monitoring, heart rate monitoring, sleep tracking, IP68 water / dust resistance and recognizes over 70 exercises. It costs CNY2,988 (USD470). (Gizmo China, Pocket-Lint, IT Home, My Drivers)

Huawei smart glasses are announced running HarmonyOS. They come with powerful 128mm speakers and microphones which allow hands-free access to Huawei’s Celia assistant. The glasses come in three styles with Boston-style, Wellington and Aviator frames and prescription lenses or sunshades. The smart glasses start at CNY1,699 (USD266). (GSM Arena, Liliputing, CN Beta)

Apple’s first electric car “Apple Car” may allegedly be launched in Sept 2022, least two years ahead of schedule, and the prototype car has been tested on the road in California. Apple has recently put forward stock preparation requirements to Taiwan auto parts factories such as Hota Industrial, BizLink-KY, Heqin, Fukuta Motor, other Taiwan auto parts factories in accordance with the practice of iPhone material preparation and hastening, and included relevant industry companies in the first batch of the supply chain. (Laoyaoba, My Drivers, Bloomberg)