12-28 #Freezing : TSMC plans to begin commercial production of chips built on its 3nm process in 4Q22; HiSilicon has unveiled the new image signal processor (ISP), Yueying ISP; Samsung allegedly expects to release about 80M orders for smartphones and tablets to ODM manufacturers in 2022; etc.

An international team of researchers led by QUT Center for Materials Science co-director Professor Dmitri Golberg has used a unique tool inserted into an electron microscope to create a transistor that’s 25,000 times smaller than the width of a human hair. They have created the tiny transistor by simultaneously applying a force and low voltage which heated a carbon nanotube made up of a few layers until outer tube shells separate, leaving just a single-layer nanotube. The heat and strain then changed the “chilarity” of the nanotube, meaning the pattern in which the carbon atoms joined together to form the single-atomic layer of the nanotube wall was rearranged. The result of the new structure connecting the carbon atoms was that the nanotube was transformed into a transistor. (CN Beta, EurekAlert, Science, SciTechDaily)

Samsung Electro-Mechanics (SEMC) is spending USD850M (KRW1.1T), in equipment and infrastructure to manufacture flip-chip ball grid array (FC-BGA) at Vietnam. The company will spend the amount up to 2023 to build the new FC-BGA production line. FC-BGAs are mostly used for CPUs aimed at servers and PCs, while FC-CSP is used mostly for application processors aimed at smartphones. FC-BGAs for processors aimed at servers are the most highly-priced among them. (CN Beta, The Elec)

TSMC plans to begin commercial production of chips built on its 3nm process in 4Q22. Apple is expected to release its first devices with 3nm chips fabricated by TSMC in 2023, including Macs with M3 chips and iPhone 15 models with A17 chips. (CN Beta, MacRumors)

TSMC’s CEO CC Wei has visited Taichung, indicating that TSMC is planning to build a 2nm process manufacturing plant in Taichung. The 2nm factory investment is estimated about NTD800B-1,000B (USD102.58B-128.22B). (My Drivers, IT Home, CN Beta, China Times, UDN, WCCFtech, Focus Taiwan)

HiSilicon, the chip designing unit of Huawei, has unveiled the new image signal processor (ISP), Yueying ISP Engine. The AI in the new ISP Engine is deeply integrated to ensure image quality whilst also establishing a new benchmark for AI powered imaging. It is built with an NPU (Neural Network Processing Unit) and VPU (Vector Processing Unit), both of which are closely integrated with another to better supplement different functions while offering end to end AI solutions. (Gizmo China, CN Beta)

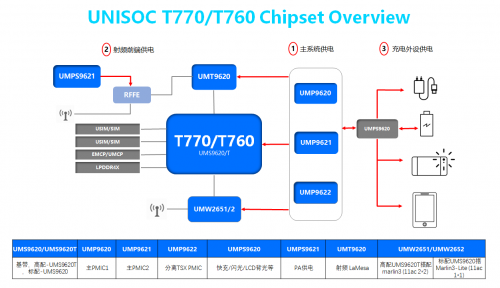

UNISOC has announced its second-generation 5G chip platforms Tanggula T770 and Tanggula T760 have entered mass production of customer products. The chips use a 6nm manufacturing process. UNISOC’s second-generation 5G platform supports cutting-edge technologies such as 5G R16 and 5G network slicing. (CN Beta, Sohu, NBD, Sina)

Toyota Motor has recently stated that “it is willing to use worn or defective parts from suppliers without affecting the performance and safety of the vehicle”. The reason for this move is, to solve the problems caused by the shortage of chips and the rising cost of raw materials. However, Toyota has officially explained that the so-called defective parts do not mean defective products. The company explains that these are just parts that are slightly worn or scratched. (GizChina, IT Home)

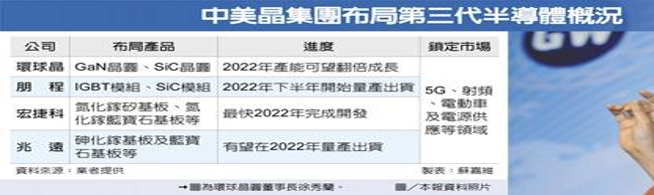

GlobalWafers is expanding its compound semiconductor layout and its 6” silicon carbide (SiC) substrates have been supplied to major European automotive semiconductor manufacturers such as STMicroelectronics. With Production capacity is expected to increase significantly in 20223. Currently, GlobalWafers’ monthly production capacity of 6” SiC substrates is about 2,000 pieces. The production capacity of 6” SiC substrates in 2022 will not only “double”, but will show “multiple growth”, with expected to be expanded to 5,000 pieces, and there is a chance to further increase to 8,000 pieces. The world’s leading supplier of SiC substrates is Wolfspeed, which has a market share of 60%, followed by Rohm Semiconductor and II-VI, with a total market share of about 35%, which is equivalent to the top 3 manufacturers accounting for 95% of the world’s SiC substrate capacity. (Laoyaoba, CNYES, CSIA, EET, Digitimes)

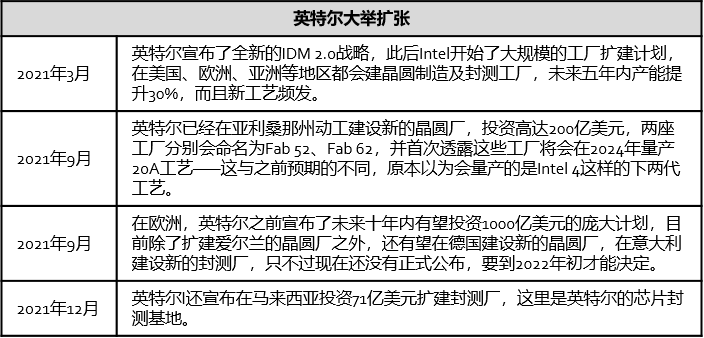

The industry estimates that Intel’s massive expansion is expected to increase its production capacity by more than 30% in 5 years, that is, by 2026, which is expected to catch up with TSMC. In addition to the increase in production capacity, Intel’s chip technology will also advance by leaps and bounds. Starting from the Intel 7 technology used by the 12th generation Core at the end of 2021, the 5 generations of technology will be upgraded in the 4 years to 2025 —— Intel 7, Intel 4, Intel 3, Intel 20A, and Intel 18A, among which the first 3 generations of processes are still based on FinFET transistors, starting from Intel 4, they fully embrace EUV lithography process. (CN Beta, My Drivers, ZOL)

Cost of mass transferring micro-LED chips from epitaxial wafers onto backplanes will keep dropping to NTD10 (USD0.36) per square meter in 2025, according to chairman and CEO Charles Li for PlayNitride. (Digitimes, Digitimes, LED Inside, Laoyaoba)

DBG Technology has stated that in the field of smartphone manufacturing, as the world’s leading EMS company, the company is fully capable of producing foldable phones. (Laoyaoba, IT Home)

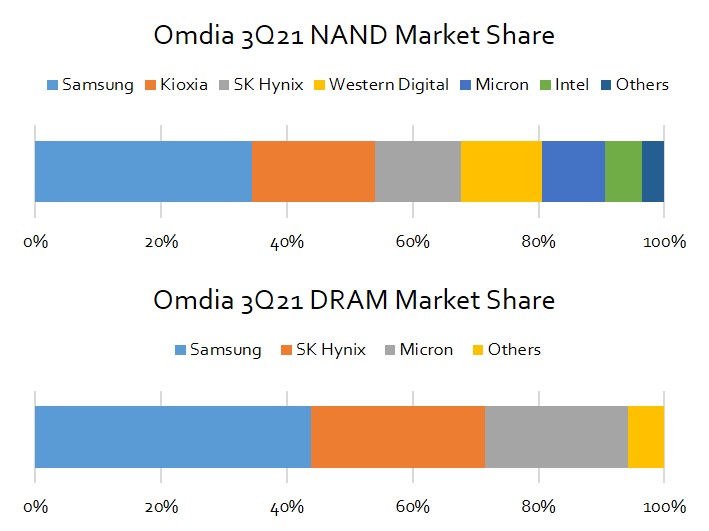

According to Omdia, memory chip revenue rose 12% in 3Q21 from the previous quarter, as demand for the chips used in applications and infrastructure for remote working and virtual learning has contributed to the growth. And the segment made up 29% of all semiconductor revenue. Samsung’s share of the global NAND flash memory market reached 34.5%, maintaining the No. 1 position for many years in a row. In the DRAM sector, Samsung’s market share rose to 43.9% from 43.2% in 2Q21, while SK hynix took up 27.6%, down 0.6 percentage point, and Micron stayed put at 22.7%. The NAND market logged a record-high quarterly revenue of USD18.7B, up 13.8% from USD16.4B in 2Q21. (Laoyaoba, 199IT, JoongAng Daily)

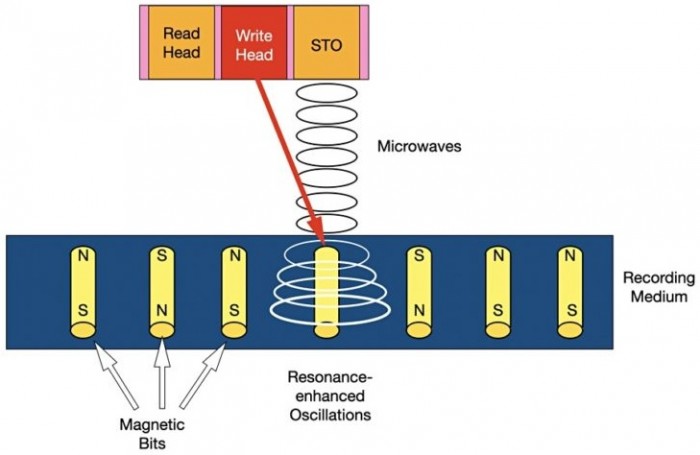

Toshiba has developed a technology that can greatly increase the storage capacity of digital equipment storage devices “HDD”, which will be used in data center products as its main force. The goal is to develop a storage capacity that is 1.7 times higher than the current 30TB product. Toshiba has verified the use of microwave technology to improve storage capacity. Mechanical hard disks write data by changing the direction of the magnet on the disk. By irradiating the disk with microwaves, the magnet can be easily reversed, thereby increasing the storage capacity. (CN Beta, Tech Spot, Gamingsys)

Tesla battery supplier Panasonic has announced today that it intends to build a new campus in Reno. It is located just 25 miles from Gigafactory Nevada. According to Panasonic Energy of North America (PENA), a Division of Panasonic Corporation of North America, the new multi-function facility is anticipated to open in Spring 2022. (CN Beta, KOLO8, InsideEVs, Teslarati)

Farasis Energy has stated that the company has successfully cooperated with Geely for its passenger vehicle and commercial vehicle platforms, and plans to mass-produce and supply Geely batteries in 2023. Farasis Energy has also stated that the 330wh/kg high-energy density battery developed by the company has already sent samples to vehicle manufacturers. (Laoyaoba, IT Home)

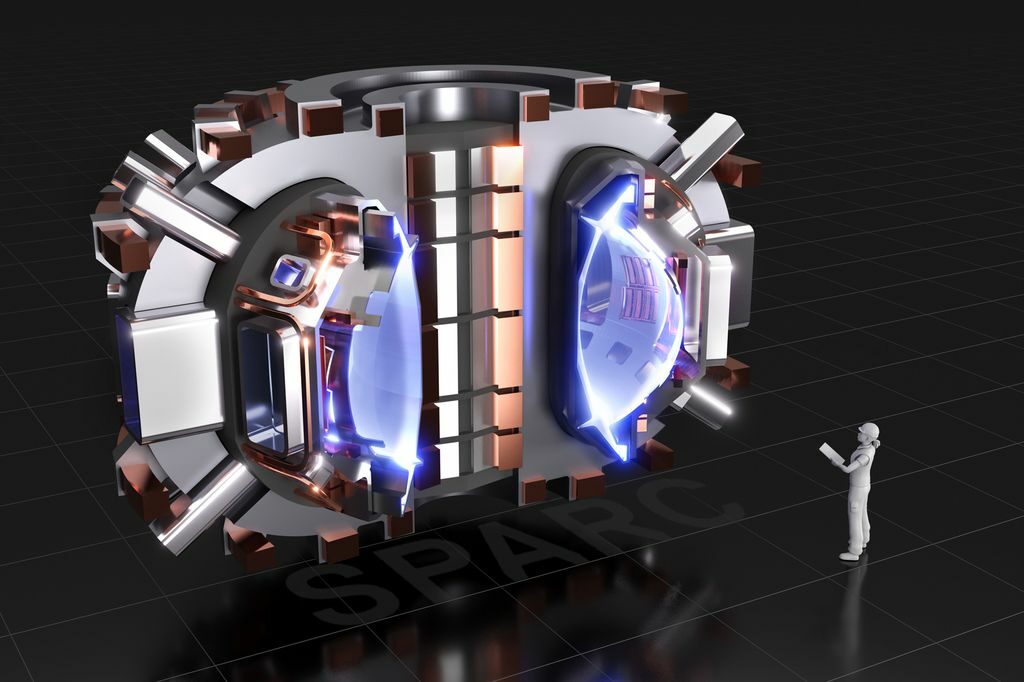

Commonwealth Fusion Systems (CFS), an MIT spinoff in Cambridge, is using a whopping USD1.8B it raised in recent months from investors such as Bill Gates, Google, and a host of private equity firms to build a prototype of a specially designed fusion reactor on a former Superfund site in Devens, dubbed SPARC. The company predicts SPARC will achieve net fusion power in deuterium–tritium fuel in 2025. The prototype is similar in size and construction to the 18 torroidal field magnets that will be components of SPARC. (CN Beta, My Drivers, Boston Globe, CFS, Physics Today)

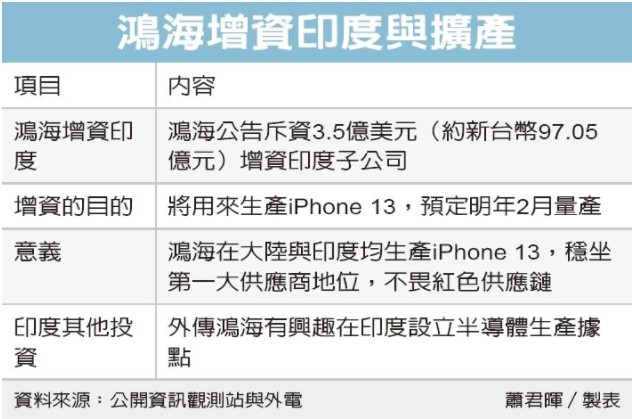

Hon Hai, also known as Foxconn on the global market, has said that it has raised its stake in Foxconn Hon Hai Technology India Mega Development Private Ltd. by spending USD350M, describing the new investment as part of its long-term development in India. Hon Hai is also expanding production capacity in its plant located in Chennai, India, to allocate a new production line exclusively for the assembly of iPhone 13s. (TechNews, CN Beta, Taipei Times, Focus Taiwan)

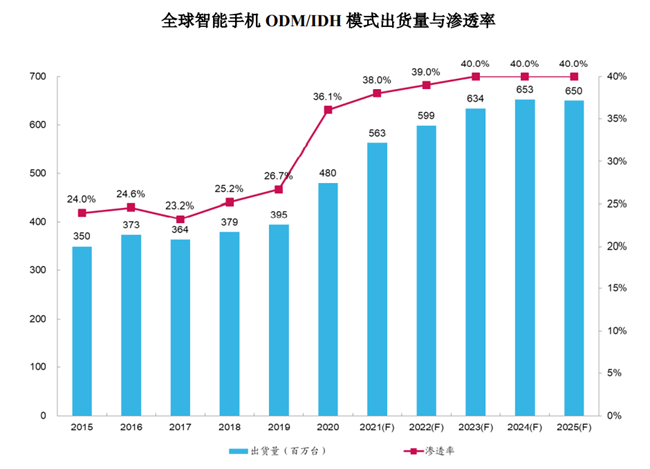

Samsung allegedly expects to release about 80M orders for smartphones and tablets to ODM manufacturers in 2022, and will be divided among 3 ODM manufacturers, namely Huaqin, Wingtech and Longcheer. As of now, Wingtech has received orders for 30M units. According to Counterpoint Research, in terms of shipments, smartphones shipped in the ODM / IDH model accounted for the proportion of global smartphone shipments from 24% in 2015 to 36% in 2020. It is estimated that smartphone shipment from ODM / IDH in 2025 would reach 650M units, and the penetration rate will reach 40%. (CN Beta, Laoyaoba)

OPPO A11s is launched in China – 6.5” 720×1200 HD+ HiD 90Hz, Qualcomm Snapdragon 460, rear tri 13MP-2MP macro-2MP depth + front 8MP, 4+128 / 8+128GB, Android 10.0, rear fingerprint, 5000mAh 18W, CNY999 (USD156) / CNY1,199 (USD188). (GSM Arena, OPPO)

Vuzix, a leading supplier of Smart Glasses and Augmented Reality (AR) technology and products, has announced that the company has entered into an agreement with Verizon to leverage the power of Verizon’s 5G and edge computing technologies to deliver a first-of-its-kind AR experience for sports and gaming. The partnership will combine Vuzix’s new Shield smart glasses and the capabilities of Verizon’s 5G network. (Engadget, Vuzix)

BYD Auto Industry, a subsidiary of BYD Company, and Daimler Greater China, have signed an agreement for the stake transfer in Shenzhen DENZA New Energy Automotive. After the deal, BYD will have a stake of 90% in DENZA New Energy while Daimler will hold the rest 10%. The deal is expected to be closed in mid-2022 as it is subject to the approval by relevant regulators. DENZA brand plans to launch new models in 2022 to increase market share. (CN Beta, Reuters, Bloomberg, Caixing Global, Daimler, Gasgoo)

Baidu founder, chairman and CEO Robin Li has revealed that Baidu’s car-building unit JiDU Auto will unveil its first concept robot car in 1H22, with mass production and delivery in 2023. In Mar 2021, Baidu established JiDU, an independent intelligent electric vehicle (EV) making company, which is building robot cars with 3 product concepts. (My Drivers, QQ, Leikeji, CNEVPost)

BYD and autonomous driving startup Momenta have established a CNY100M joint venture to deploy autonomous driving capabilities across certain BYD car model lines. The new venture, DiPi Intelligent Mobility and located in Shenzhen, combines BYD’s capabilities as an automaker with Momenta’s experience in intelligent driving. (NDTV, Laoyaba, Reuters,)