1-15 #Accompany : TSMC has earmarked USD40-44B in 2022 order for increasing its manufacturing capabilities; Samsung is aiming to ship 334M units of smartphones in 2022; Magic Leap has announced the participation of key healthcare technology companies in the Early Access Program for Magic Leap 2; etc.

Sony will continue producing PlayStation 4 consoles throughout 2022 as it navigates disruptions to the global supply chain that have limited output of its pricier PlayStation 5 (PS5). Sony, whose flagship PS5 console has been in scarce supply since its debut in Nov 2020, told assembly partners in late 2021 that it would continue making its earlier-generation machine through 2022. While Sony has never officially announced when it would stop making the PS4, it had previously planned to discontinue assembly at the end of 2021. The strategy would add about a 1M PS4 units in 2022 to help offset some of the pressure on the company’s PS5 production, a figure that will be adjusted in response to demand. (CN Beta, Bloomberg, The Verge)

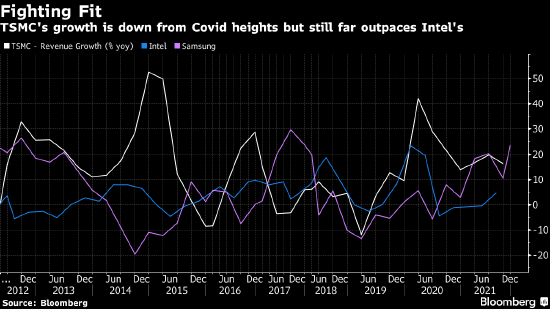

TSMC has earmarked USD40-44B in 2022 order for increasing its manufacturing capabilities, which is up from USD30B in 2021. TSMC expects a ‘multi-year industry megatrend’ for strong chip demand, boosted by technologies such as AI and 5G, and the need for high-speed silicon in smartphones, computers, cars, and all sorts of machines.(GSM Arena, Reuters, CN Beta, Sina, UDN)

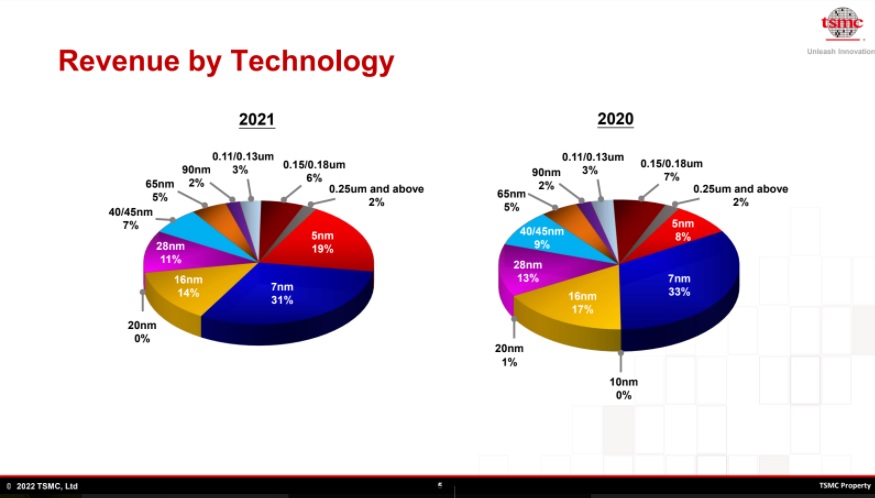

TSMC VP and CFO Wendell Huang has indicated that the company has earmarked USD40B-44B for capital expenditure this year, much higher than its already record-breaking spending of USD30B for 2021. TSMC CEO C.C. Wei said the overall foundry industry, as the business making chips for the others is known, will grow 20% on the year in revenue terms, and that TSMC will outperform this with growth in the mid- to high-20% range. Shipments of 5nm accounted for 23% of total revenue, an increase from the 18% in 4q21, while 7nm accounted for 27%, which is 7 percentage points lower than 3Q21. Meanwhile, advanced technologies, defined as 7nm and below, accounted for 50% of total revenue.(CN Beta, Yahoo, ETToday, TechNews, ZDNet, Asia Nikkei)

Samsung Electronics has decided to put off the Exynos 2200 unveiling, which was initially scheduled for 11 Jan 2022, in consideration of the customer’s schedule. Samsung Electronics is expected to introduce the Exynos 2200 at the end of Jan or early Feb 2022 in time for the launch of the Galaxy S22. Samsung Electronics is planning to use the Exynos 2200 for the Galaxy S22 series to be released in Europe and Korea, while installing the Qualcomm Snapdragon 8 into devices for North America, China and India.(Laoyaoba, PCGamer, SamMobile, Business Korea)

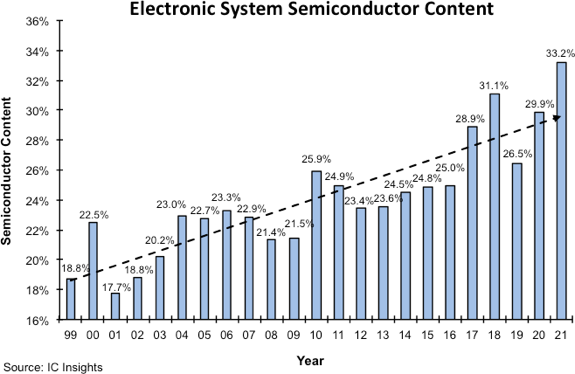

With global unit shipment growth rates of cellphones, automobiles, and PCs showing maturity and slowing over the past 10 years, the disparity between the 3.5% 2011-2021 CAGR registered in the electronic systems market and 6.5% 2011-2021 CAGR displayed by the semiconductor market is directly due to the increasing content/value of semiconductors in electronic systems, according to IC Insights. The first year on record that showed an increase in semiconductor content in electronic systems during a year when the semiconductor market declined was 2009. This situation repeated itself once again in 2015. The total semiconductor market declined by 1% but the semiconductor content figure rose from 24.5% in 2014 to 24.8% in 2015. Until 2017, 2010 was the all-time high for semiconductor content in electronic systems at 25.9%. That mark was easily surpassed in 2017 with a 28.9% figure. (Laoyaoba, IC Insights)

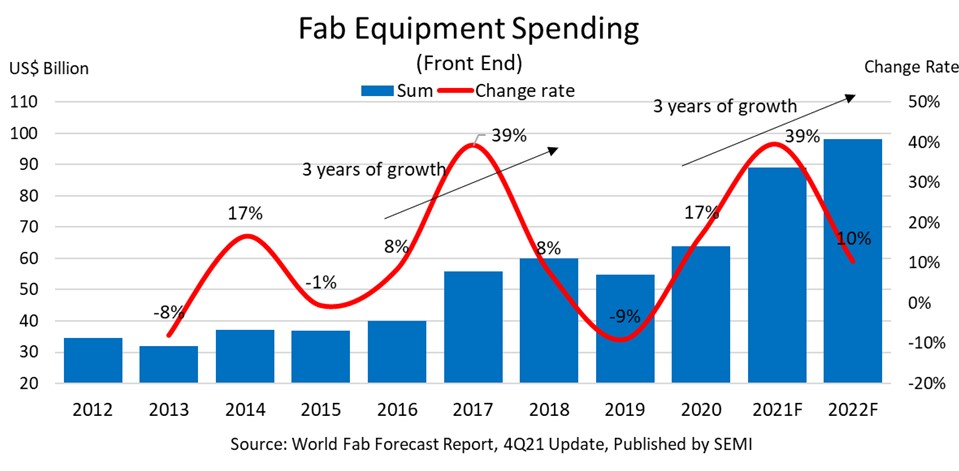

Global fab equipment spending for front end facilities is expected to rise 10% YoY in 2022 to a new all-time high of over USD98B, marking a third consecutive year of growth, according to SEMI. SEMI logoThe fab equipment spending increase in 2022 would follow a 39% jump in 2021 and 17% in 2020. The industry last saw 3 consecutive years of growth from 2016 to 2018, more than 20 years after logging a three-year run in the mid-1990s. (Laoyaoba, SEMI, SEMI, Yahoo)

For Sapeon, SK Telecom, SK hynix and SK Square will invest a combined KRW50B (USD41.5M) to form the new entity and hold 62.5%, 25% and 12.5% stakes respectively. Sapeon is the name of an AI chip developed by SK Telecom. To enable AI, chips have to process massive calculations at high speeds. Currently, graphics processing units, or GPUs, are widely used for AI, but they consume too much electricity. SK Telecom claims that its Sapeon AI chip consumes 20% less power but computes 1.5 times faster than a typical GPU. Also, it is almost 50% cheaper. (CN Beta, Korea Herald, Pulse News)

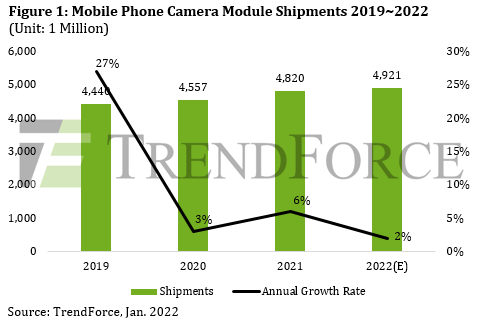

According to TrendForce, triple camera modules surpassed dual camera modules to become mainstream in 2020 and drove the continued growth of smartphone camera module shipments. Annual smartphone camera module shipments in 2022 are expected to reach 4.92B units, or 2% growth YoY. The current mainstream of primary camera design is 13-48MP, accounting for more than 50% of cameras in 2021. In second place are products featuring 49-64MP which accounted for more than 20% of cameras last year with penetration rate expected to increase to 23% in 2022. The third highest portion is 12MP products, currently dominated by the iPhone and Samsung’s flagship series. However, a 48MP primary camera is expected to be introduced to the iPhone 14 Pro series (tentative name) that Apple will release this year, further reducing 12MP products to a 15% share in 2022.In addition to the original Samsung and Xiaomi brands employing 108MP cameras, Vivo and Honor also introduced similar resolution cameras in 2021. There is a chance 200MP products will be ready for commercial use in 2022, driving the penetration rate of ultra-high pixel products to an expected level in excess of 5% in 2022. (GSM Arena, TrendForce, TrendForce, Apple Insider)

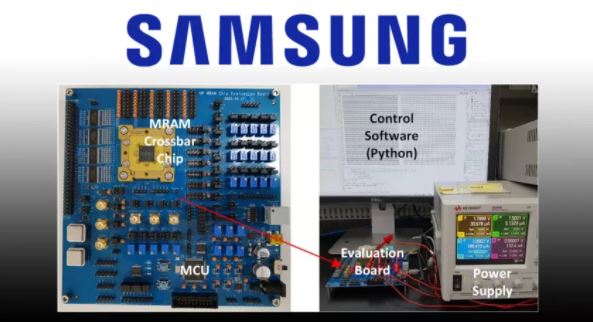

Samsung Electronics has announced its demonstration of the world’s first in-memory computing based on MRAM (Magnetoresistive Random Access Memory). The research was led by Samsung Advanced Institute of Technology (SAIT) in close collaboration with Samsung Electronics Foundry Business and Semiconductor R&D Center. In the standard computer architecture, data is stored in memory chips and data computing is executed in separate processor chips. In contrast, in-memory computing is a new computing paradigm that seeks to perform both data storage and data computing in a memory network. Since this scheme can process a large amount of data stored within the memory network itself without having to move the data, and also because the data processing in the memory network is executed in a highly parallel manner, power consumption is substantially reduced. In-memory computing has thus emerged as one of the promising technologies to realize next-generation low-power AI semiconductor chips.(GizChina, Digital Trends, Samsung, Tech Powerup, Nature, Tom’s Hardware, IT Home)

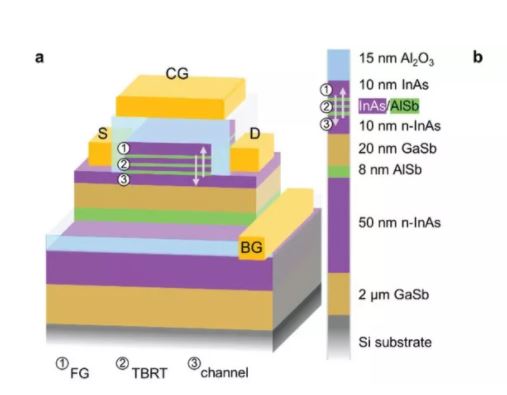

Physics and Engineering Department of the U’’s Lancaster University detail a breakthrough in the mass production of UltraRAM. UltraRAM is described as a memory technology which “combines the non-volatility of a data storage memory, like flash, with the speed, energy-efficiency, and endurance of a working memory, like DRAM”. UltraRAM on silicon could be the universal memory type that will one day cater to all the memory needs (both RAM and storage) of PCs and devices. The fundamental science behind UltraRAM is that it uses the unique properties of compound semiconductors, commonly used in photonic devices such as LEDs, lasers, and infrared detectors can now be mass-produced on silicon. (CN Beta, PC World, Gizmodo, Tom’s Hardware, Online Library)

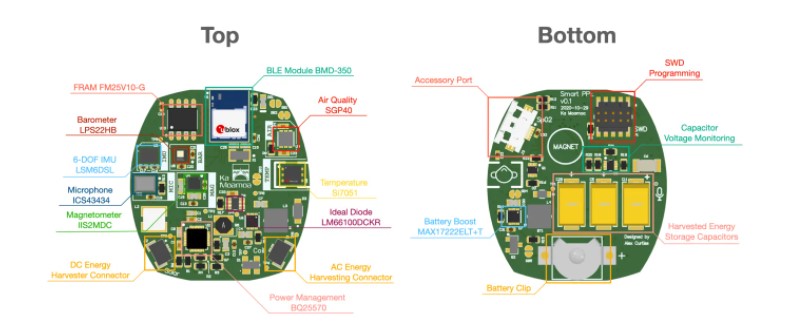

Northwestern University has developed a new smart sensor platform for face masks that they are calling a FaceBit (“Fitbit for the face”). It is the lightweight, quarter-sized sensor uses a tiny magnet to attach to any N95, cloth or surgical face mask. Not only can it sense the user’s real-time respiration rate, heart rate and mask wear time, it also may be able to replace cumbersome tests by measuring mask fit. All this information is then wirelessly transmitted to a smartphone app, which contains a dashboard for real-time health monitoring. (CN Beta, Slash Gear, Daily Mail, ACM, NorthWestern University)

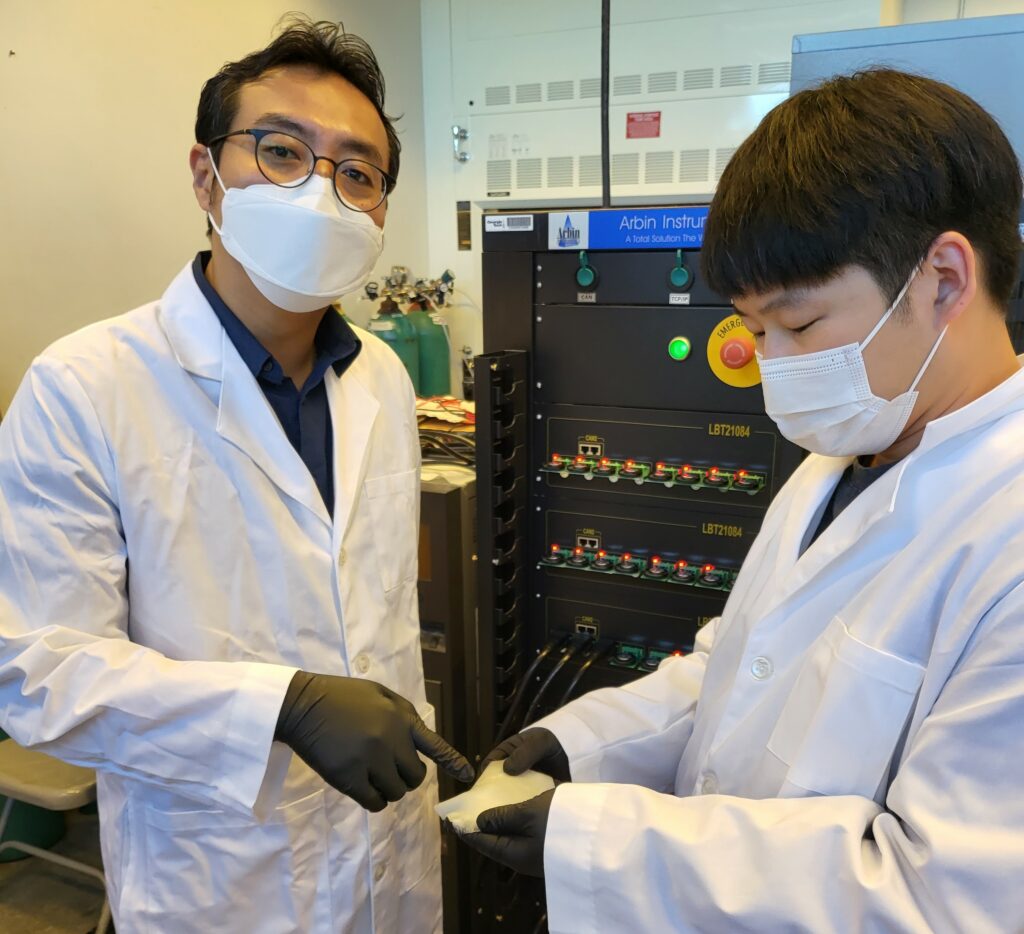

Georgia Institute of Technology believe that they have identified rubber — a common material — as a possible and beneficial alternative to the existing lithium-ion batteries in rubber. Using rubber electrolytes, engineers from Georgia Tech have fixed common issues like slow lithium-ion transport and poor mechanical properties. The ability of the material to form a three-dimensional (3D) interconnected plastic crystal phase inside the sturdy rubber matrix was a major advancement. Thus, increased ionic conductivity, excellent mechanical properties and electrochemical stability have all been achieved as a result of this one-of-a-kind structure. (My Drivers, ESCN, AZOM, Georgia Tech)

South Korean battery maker LG Energy Solution (LGES) reportedly plans to build a battery joint venture (JV) with Japan’s Honda Motor in the United States. The potential battery JV between LGES and Honda could cost as much as KRW4T (USD3.4B) and have an annual production capacity of up to 40 gigawatt hours (GWh) of batteries, enough to power 600,000 EVs. LGES has confirmed initial shares priced at KRW300,000 (USD252.63) at the top end of guidance for South Korea’s historical IPO of KRW12.75T (USD11B) that drew staggering institutional bids of near USD13T. (Laoyaoba, Reuters, Reuters, Inside EVs, Auto News, Pulse News)

Comcast has announced the successful test of a prototype 10G modem using the core technology that will deliver multigigabit speeds to tens of millions of homes. In a world-first lab test, a Full Duplex DOCSIS 4.0 system-on-chip (SoC) cable modem built by Broadcom delivered upload and download speeds faster than 4 gigabits per second (Gbps) powered by 10G network technology. A key component of 10G, DOCSIS 4.0 is an evolutionary leap forward in the ability to deliver multigigabit upload and download speeds over the connections already installed in hundreds of millions of homes worldwide. (CN Beta, Engadget, ZDNet, Business Wire)

Samsung reportedly manufactured 238.88M units smartphones in-house in 2021. Over 60M units were manufactured through joint development manufacturers such as Wingtech and Huaqin. In total, Samsung made slightly over 300M smartphones. The production volume indicates that Samsung shipped late-200M units of smartphones in 2021. Samsung is aiming to ship 334M units of smartphones in 2022: 285M units from its own production and the rest will be from joint development manufacturers. (Gizmo China, GSM Arena, The Elec)

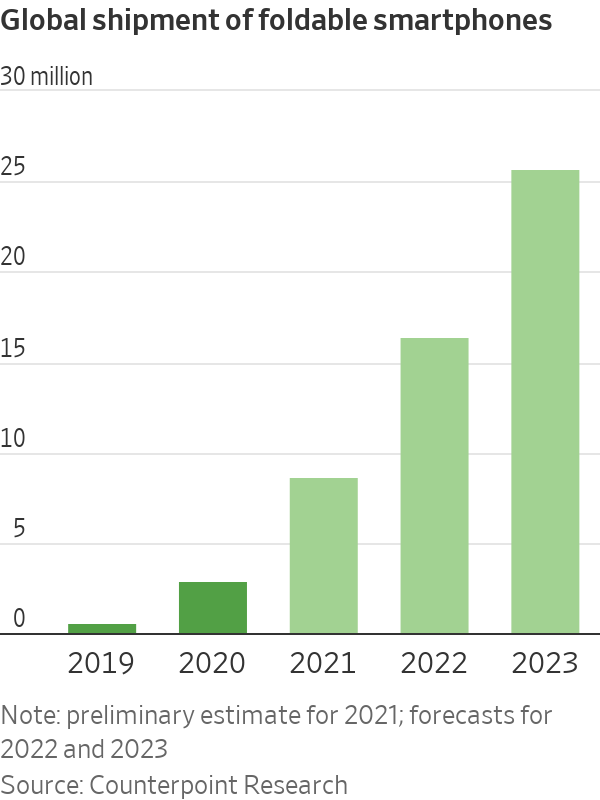

Samsung has said the number of Galaxy Z Fold 3 and Z Flip 3 phones it sold in the month after their Aug 2021 launch exceeded the total number of foldable devices it sold in all of 2020. In 2021 as a whole it shipped 4 times as many foldables as in the previous year. Samsung had around 84% of the foldable market, according to Counterpoint Research. Counterpoint estimates foldable smartphones represented just 8.6M of total smartphone shipments of around 1.4B in 2021. However, the flip side of being small is that the market could grow fast: 2021 foldable shipments were nearly 3 times those of the year before, and Counterpoint expects them to triple again to 25.7M in 2023. (Laoyaoba, WSJ, Live-Mint)

LG Nova is LG’s relatively new North American Innovation Center. Based out of Santa Clara in Silicon Valley, California, the LG business unit is finding new and interesting ways to work with startups to further LGs mission in some of its core growth areas. LG Nova is aiming to be the center of the Venn diagram of the entire startup ecosystem, including the startups, of course. It wants to unite this with LG’s own strengths and advantages, including the wider investor landscape, big tech, academia, the entrepreneur community and LG’s own sales and marketing channels, where appropriate. (TechCrunch, TechCrunch, LG, CN Beta)

Honor Magic V is unveiled in China – 7.9” 1984×2272 Foldable OLED 90Hz + 6.45” 1080×2560 FHD+ HiD OLED 120Hz, Qualcomm Snapdragon 8 Gen 1, rear tri 50MP-50MP-50MP ultrawide + front 42MP, 12+256 / 12+512GB, Android 12.0 (GMS), side fingerprint, 4750mAh 66W, 5W reverse charging, CNY9,999 (USD1,570) / CNY10.999 (USD1,725). (GSM Arena, Honor)

OPPO A16K is launched in India – 6.52” 720×1600 HD+ v-notch, MediaTek Helio G35, rear 13MP + front 5MP, 3+32GB, Android 11.0, no fingerprint scanner, 4230mAh 10W, INR10,490 (USD141). (Gizmo China, Money Control, NDTV)

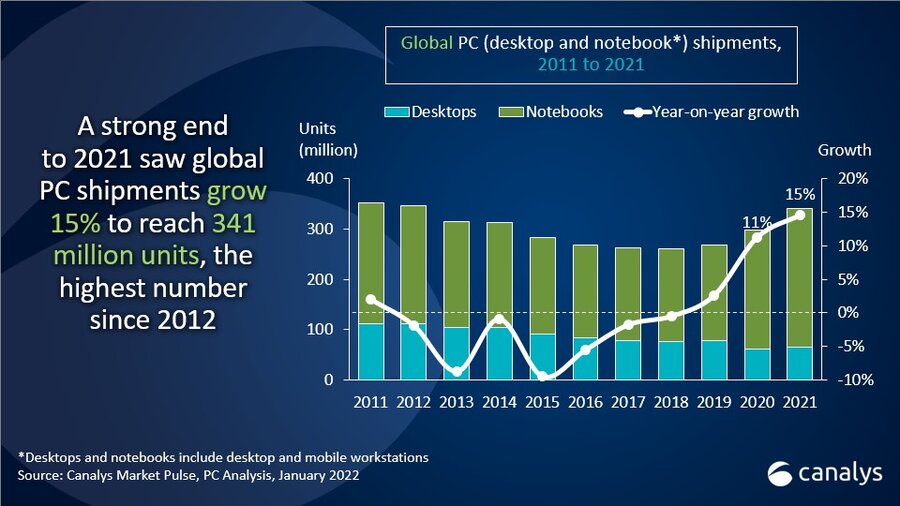

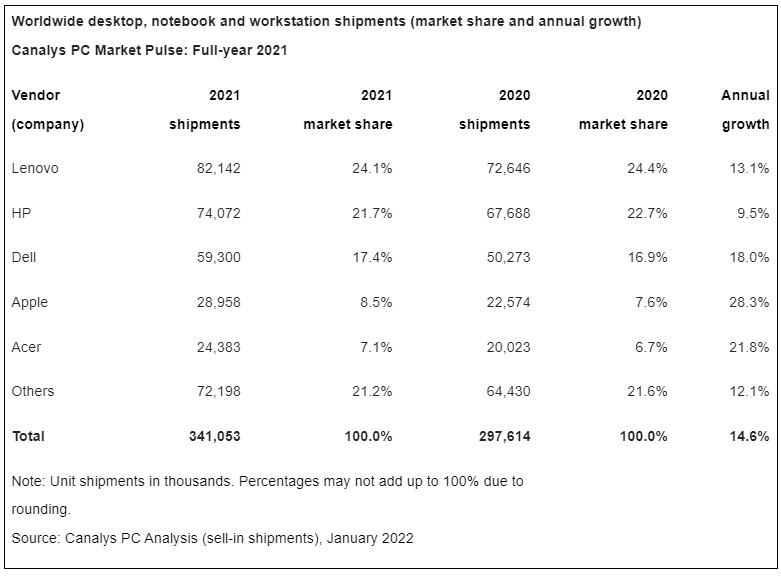

According to Canalys, worldwide shipments of desktops, notebooks and workstations grew 1% YoY to 92M units over 91M a year ago. This pulled up total shipments for full-year 2021 to 341M units, 15% higher than 2021, 27% higher than 2019 and the largest shipment total since 2012. Furthermore, the industry saw strong revenue gains, with the total value of 4Q21 shipments estimated at USD70B, an annual increase of 11% over 4Q20. For the full year, revenue passed USD250B in 2021 against USD220B in 2020, up 15%, highlighting the seismic transformation in the industry. (Laoyaoba, Canalys)

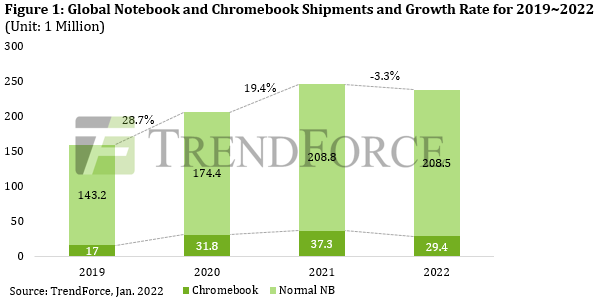

Due to the pandemic, laptops shipments reached a record high of 240M units in 2021, according to TrendForce. However, the market has been abuzz recently and, as the global population of the fully vaccinated has exceeded 50%, relevant demand driven by the pandemic is expected to gradually weaken. Shipment volume will decrease by 3.3% year-on-year, revised down slightly to 238M units. Chromebooks will account for approximately 12.3% of shipment volume, though it accounted for approximately 15.2% in 2021. The momentum of shipments has slowed down significantly which indicates that demand derived from the economic effect of remote working and teaching has subsided. (TrendForce, TrendForce, CN Beta)

Magic Leap has announced the participation of a number of key healthcare technology companies in the Early Access Program for Magic Leap 2, its second generation enterprise-focused augmented reality (AR) platform. Early access to Magic Leap 2 devices will provide these healthcare technology companies the opportunity to finalize development of their Magic Leap 2 platform solutions, ahead of general commercial availability, which is scheduled for mid-2022. Magic Leap has named 4 healthcare partners that are getting access to the device: clinical data visualization company SentiAR, neurotechnology company SyncThink, diagnostics company Heru, and surgical software tool Brainlab.(The Verge, TechCrunch, MagicLeap)

Newzoo predicts what gaming trends to watch in 2022. The metaverse will play a big part in 2022. Many game developers and publishers are preoccupied with the metaverse. They’re creating metaverse-based marketplaces and avatars. Newzoo also predicts this will drive VR sales, and points out that several major tech companies are working on new headsets. Another winner in 2022 will likely be the play-to-earn business model. Things such as NFTs are currently facing a lot of scrutiny from gamers, and Newzoo cites news stories such as Valve’s bans and the Stalker 2’s NFT pushback. However, Newzoo also points out other reports that suggest a large contingent of gamers are curious about the ability to trade in-game items, and that publishers are certainly interested in the tech. (VentureBeat, Newzoo)

Apple reportedly visited South Korea in Dec 2021 to meet with companies Interested in an electronic parts manufacturers with experience in mass production. Some companies have formed a ‘Task Force’ and are actively responding. The domestic parts industry has started a war to enter the supply chain management (SCM) of Apple’s self-driving electric vehicle ‘Apple Car’. Apple is expected to complete the selection of an Apple Car supplier within 2022, and start its full-scale development. Apple is highly interested in South Korean companies in the field of its core parts. (Phone Arena, Apple Insider, ET News)

General Motors (GM) has introduced CarBravo, a new way to shop for used vehicles. CarBravo will elevate the shopping, buying and ownership experience by offering used-vehicle customers access to an expansive inventory, an omnichannel shopping experience and exclusive ownership benefits. CarBravo will also deliver a seamless customer experience through GM’s new digital retail platform (DRP).(The Verge, General Motors)

The startup EVage already has 5 EV trucks on the road for a range of e-commerce customers, including Amazon India’s Delivery Service Partner, with plans to provide “in the thousands” more to Amazon by the end of 2022. EVage just raised a USD28M seed round, led by new U.S.-based VC RedBlue Capital, and will use the funds to complete its production-ready factory outside of Delhi in 1Q22 and scale up production to meet growing demand. (TechCrunch, India Times, Live Mint)

Thailand-based HG Robotics has unveiled Vetal drone, pricing starts at USD23K. Designed for tasks such as agricultural surveying and general surveillance, it features a 1,300mm wingspan and a foam-core/carbon-fiber-shell body, with the whole aircraft reportedly tipping the scales at just 3.8 kg (8.4 lb). Its two motors are powered by a quick-swappable 12Ah lithium-polymer battery, one charge of which is reportedly good for a flight time of up to 60 minutes. In forward flight, the drone has a top speed of 90km/h and a cruising speed of 54km/h. It can carry a payload of up to 800g. (CN Beta, New Atlas, HG Robotics)

Sea-Air Integrated Drone system, developed by a partnership between Japanese telecommunications operator KDDI, aerial drone manufacturer Prodrone, and underwater robotics firm Qysea, uses an aerial drone to transport and deploy an underwater drone. One of Prodrone’s all-weather multicopters is used in the system, along with one of Qysea’s Fifish Pro V6 Plus underwater drones. The latter could also be described as a small ROV (remotely operated vehicle), and it’s carried in a quick-release cage on the underside of the copter. A shore-based human operator utilizes long-range mobile communications to initially fly the system out to its offshore destination – they’re guided by both GPS and a real-time feed from the multicopter’s onboard cameras. (CN Beta, Marine Technology, DroneDJ, New Atlas)

Gap is selling NFTs (non-fungible token), following other clothing retailers like Adidas, Nike, and Macy’s that in recent months have jumped into the NFT space. The NFTs are built on the Tezos blockchain, which touts itself as a more energy-efficient option. The NFTs come in the form of a series of digital hoodie art, with different levels of rarity at different price points. Common level pieces starting at roughly USD8.30, or 2 tez, are on sale. (CN Beta, Complex, Reuters, The Verge)