1-27 #VIP : Samsung has indicated that its semiconductor manufacturing facilities in Xian, have returned to normal operation; SK Hynix to supply NVMe SSDs to Meta; General Motors and LG are building a third Ultium factory in the US; etc.

Merck has announced that it will invest at least CNY1B (about EUR130M) in China’s electronic technology business by 2025. Merck has said that the investment is mainly used for the production, research and development of electronic materials, and the localization and expansion of the supply chain. The investment of CNY1B will be concentrated in the Yangtze River Delta region with Shanghai as the center, and these investments will be used for the expansion plan of the factory. From the perspective of the investment direction of funds, 60% of the funds are used for local high-tech manufacturing, 20% for the construction of local supply chains, and the remaining 20% for R&D.(CN Beta, Sina, CN Stock)

Nvidia has responded to rumors of abandoning its acquisition of ARM, saying they continue to hold the view detailed in the latest regulatory filing that the deal would provide an opportunity to accelerate ARM and foster competition and innovation. According to Nvidia’s plan, the acquisition of ARM should be completed in Mar 2022. However, global regulators are still reviewing the deal, and Nvidia is likely to miss the March 2022 “deadline”.(CN Beta, Yicai)

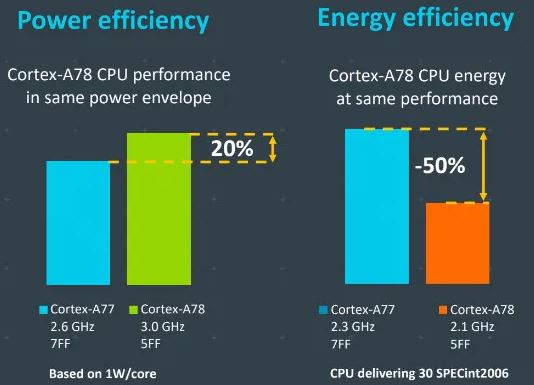

MediaTek has announced its new Kompanio 1380 chip, which offers a new level of performance and best-in-class features for premium Chromebook. Kompanio 1380 features an octa-core CPU with four high-performance Arm Cortex-A78 cores with speeds up to 3GHz for improved responsiveness. For gamers, its five-core Arm Mali-G57 GPU supports fast and vivid visuals, while the quad-channel 2133MHz LPDDR4X ensures there is plenty of data bandwidth. MediaTek APU 3.0 is a powerful multi-core AI processor that accelerates AI-camera and AI-voice applications while also optimizing battery life. (CN Beta, Liliputing, MediaTek, About Chromebook)

PQShield, a cybersecurity company specializing in post-quantum cryptography, has raised USD20M in Series A. The investment will be used to fuel further product development, hiring and international expansion for PQShield, which has already experienced strong demand for its quantum-ready cryptographic solutions for hardware, software and communications.(VentureBeat, TechCrunch, Finextra)

DSCC predicts that the panel capacity area will increase by only 7% in 2022, and the growth rate will be around 5% in the next 3 years. As Korean factories gradually withdraw from production capacity, their market share will gradually drop to single digits. The market share of mainland Chinese manufacturers will exceed 70% in 2022, while Taiwanese manufacturers will drop slightly to below 20%. In terms of applications, the TV panel production area accounts for the highest proportion, reaching 72%-74%, and the CAGR from 2021 to 2026 is about 4.8%. During the same period, the proportion of OLED TV increased from 2% to 6% under the investment of Samsung Display and LG Display, CAGR reaching 18%. The CAGR of OLED in mobile phone IT applications is 14%, and the CAGR of LCD panels in mobile device applications is only 3%. (Laoyaoba, China Times)

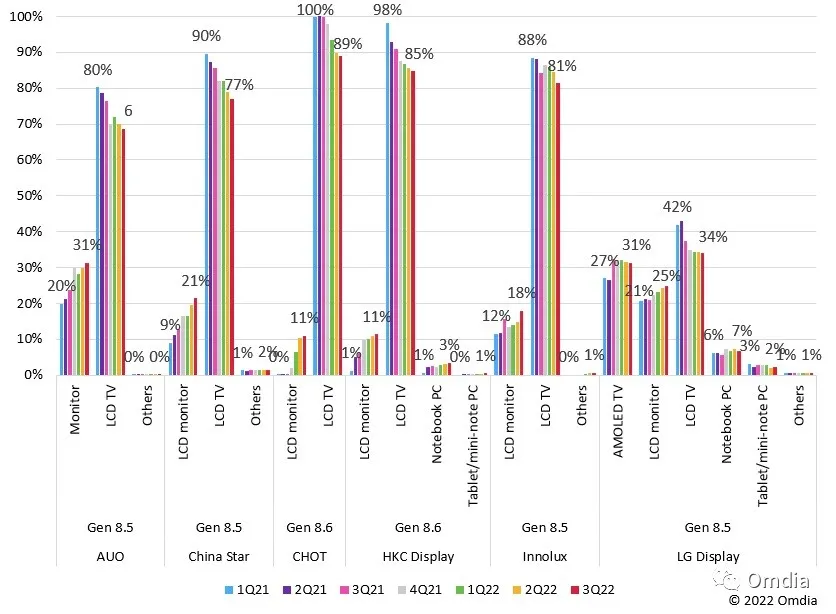

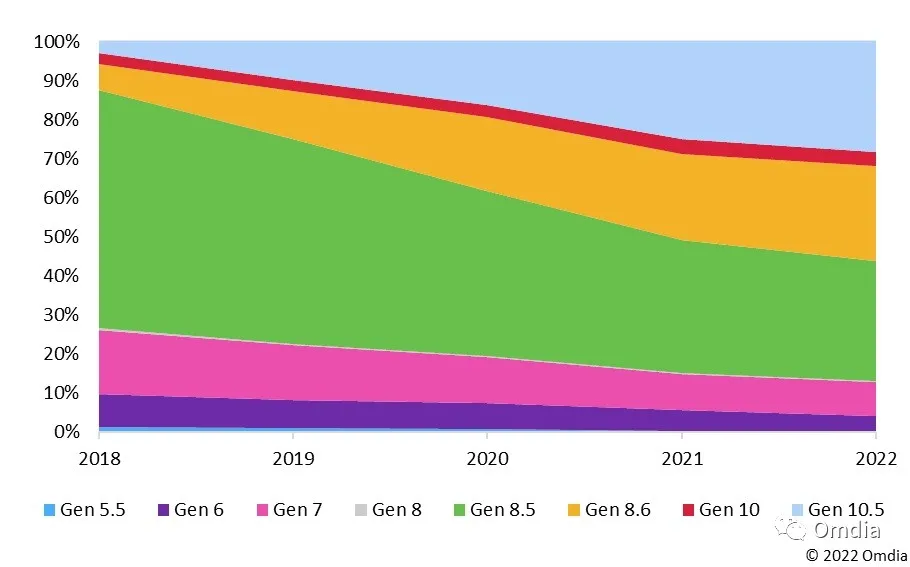

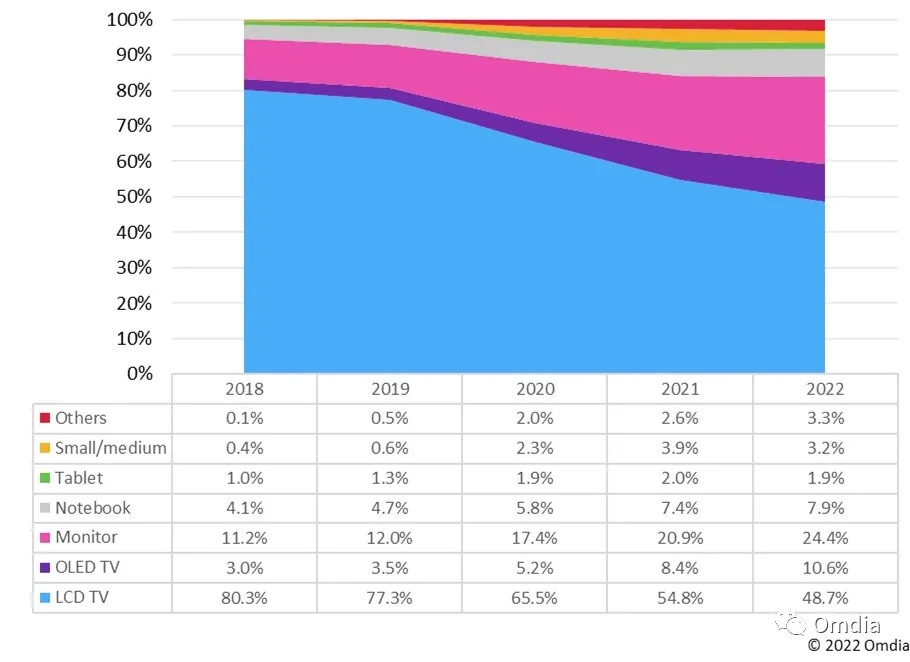

According to Omdia, in 2022, the proportion of TV panels produced on Gen 8.5 and 8.6 lines will be reduced to 60%, while more than 30% of TV panels will be produced by Gen 10 and Gen 10.5 lines. Panel makers will continue to make the following adjustments in their panel production lines: Panel makers continue to shift the production of IT panels, including notebook, desktop monitor panels, and larger size tablet panels, to Gen 8.5 (2200×2500 mm) and Gen 8.6 (2250×2600 / 2250×2620mm) production lines. LCD TVs, once the most important product in the Gen 8.5 panel production line, will shrink to less than 50% of the total output of the Gen 8.5 and 8.6 lines by 2022. This figure is 54.8% in 2021. With new technologies such as metal oxides (IGZO), GOA (gate on the array), high resolution, ultra-thin glass substrate processing, and IPS wide viewing angle, panel makers continue to have new and improved capabilities in their Gen 8.5 and 8.6 panel production lines. Advanced functional laptop and desktop monitor panels. (Laoyaoba, Following this Trend, IT Home)

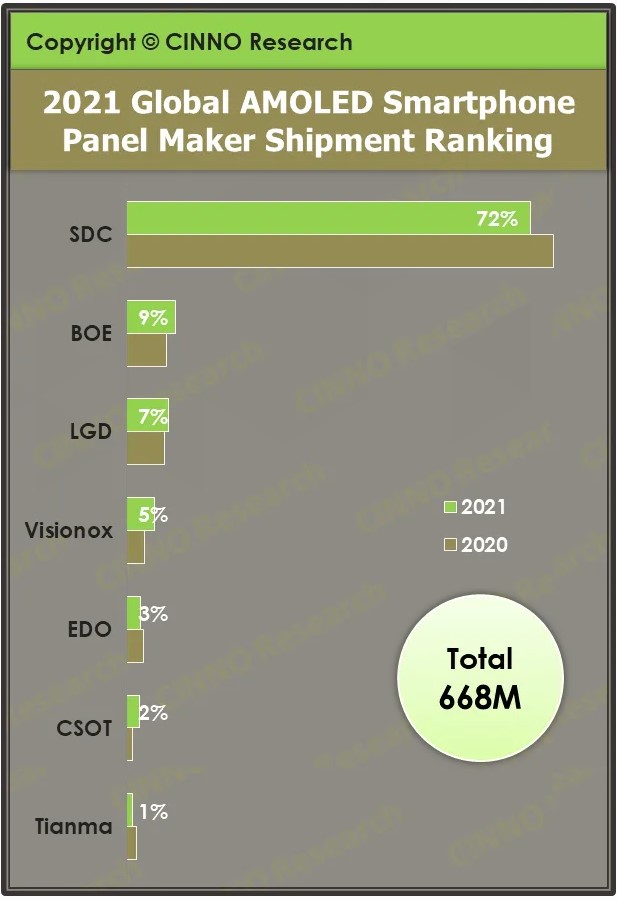

According to CINNO Research, the global shipments of AMOLED smartphone panels in 2021 will be about 668M units, a YoY increase of 36.3%. In terms of different regions, the shipment share of AMOLED smartphone panels in South Korea is nearly 80%, and the shipment share of domestic manufacturers has steadily climbed to 20.2%, an increase of 3.7 percentage points year-on-year. Samsung Display is still the dominant player. The report shows that in 2021, Samsung Display AMOLED smartphone panel shipments will be about 480M units, a year-on-year increase of 28.8%; the corresponding global market share will be 72.3%, a YoY decrease of 4.2 percentage points. (CINNO Research, CN Beta)

Samsung Electronics has indicated that its semiconductor manufacturing facilities in Xian, China, have returned to normal operation. Samsung’s Xi’an factory is mainly for manufacturing NAND Flash. The monthly production capacity of the first phase is about 120,000 pieces, and the monthly production capacity of the second phase is about 130,000 pieces, accounting for 42.3% of the company’s NAND Flash production capacity and 15.3% of the global production capacity. In addition, the company is continuing to expand in Xi’an. Its goal is to establish a 96-layer V-NAND production base in China, but the progress has been delayed due to the impact of the pandemic.(CN Beta, Reuters, Korea Herald, Samsung)

SK Hynix has signed a contract to supply non-volatile memory express (NVMe) solid state drives (SSDs) to Meta (formerly known as Facebook). The exact contract value is unknown, but it is estimated at hundreds of billions of won. Behind SK Hynix’s signing of this contact is FADU, a Korean fabless startup specializing in semiconductor design. FADU is a company that develops controllers, one of the key semiconductors for SSDs. SK Hynix used FADU’s controllers for its NVMe SSDs to be supplied to Meta. In Korea, a handful of companies, including Samsung Electronics, have the ability to independently design SSD controllers. Technology fees that SK Hynix pays to FADU reportedly stands at about KRW80B. This controller makes up about 5% of the SSD product cost. (My Drivers, Business Korea, LTN)

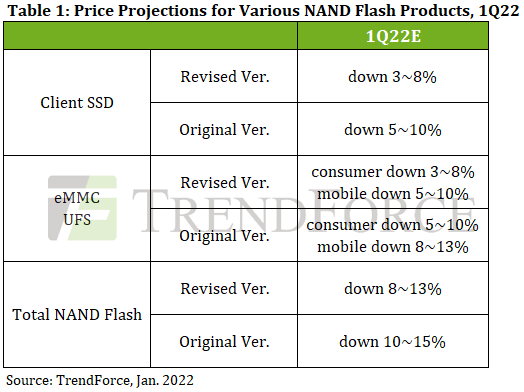

NAND Flash prices for 1Q22 are expected to decline by 8-13% QoQ, compared to TrendForce’s previous forecast of 10-15% QoQ, primarily due to PC OEMs’ increased orders for PCIe 3.0 products and the impact of the lockdown in Xi’an on PC OEMs’ price negotiation approaches. To mitigate potential risks in logistics, NAND Flash buyers are now more willing to accept a narrower decline in contract prices in order to obtain their products sooner. However, as the Xi’an lockdown has not noticeably affected the local fabs’ manufacturing operations, the movement of NAND Flash contract prices going forward will likely remain relatively unaffected by the lockdown. (TrendForce, TrendForce, Laoyaoba)

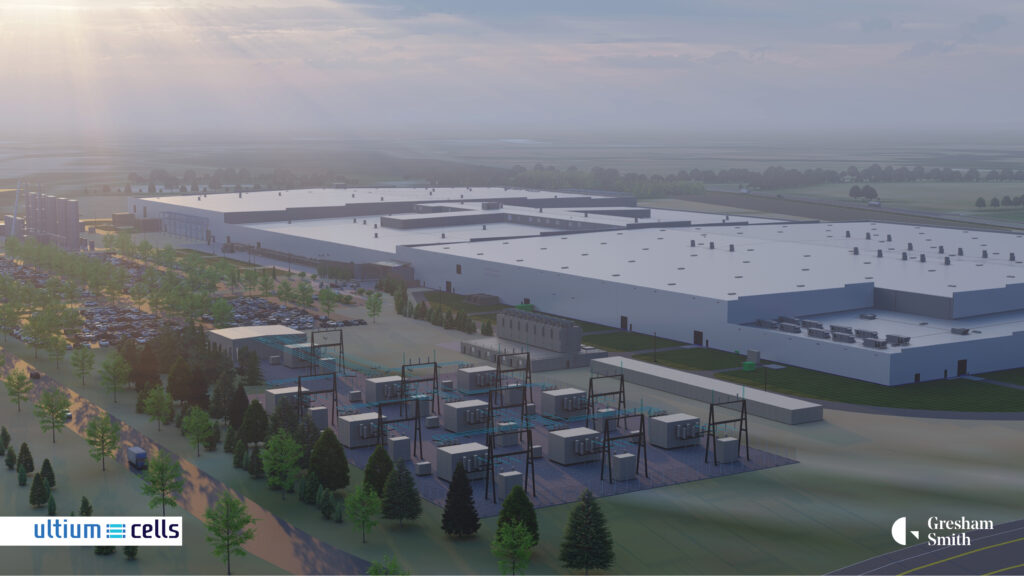

General Motors (GM) and LG are building a third Ultium factory in the US. The USD2.6B plant in Lansing, Michigan will make batteries for GM’s electric vehicles. Ultium Cells, a joint venture between the companies is projected to open in late 2024. At full production, Ultium expects the factory to have a battery cell capacity of 50 gigawatt hours, and it will be able to adapt to advancements in materials and tech. Construction is underway on Ultium’s other battery manufacturing sites in Tennessee and Ohio. The Ultium factory forms part of a new USD7B investment by GM (the company’s largest single outlay to date) in 4 Michigan sites.(Engadget, General Motors, CN Beta)

Foxconn has said it has partnered with Indonesia’s Investment Ministry and several companies to support the development of electric cars in the Southeast Asian country. Foxconn has expanded its activities in electric vehicles (EVs) in recent years, announcing deals with U.S. startup Fisker and Thailand’s energy group PTT PCL. Foxconn said it has signed a memorandum of understanding for a wide scope of investment on EVs including battery manufacturing with the Indonesian Ministry of Investment as well as Indonesia Battery Corporation, energy firm PT Indika Energy and Taiwanese electric scooter vendor Gogoro. The cooperation, which aims to build a “new energy ecosystem” in Indonesia. Under the partnership, an open “MIH platform” that provides both hardware and software services will be available to companies in Indonesia.(Laoyaoba, Reuters, Green Car Congress, US News, Foxconn)

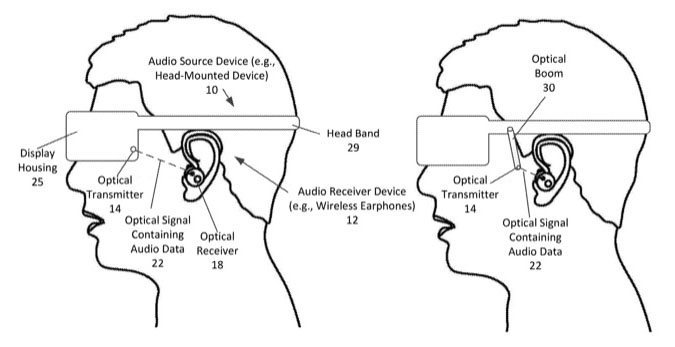

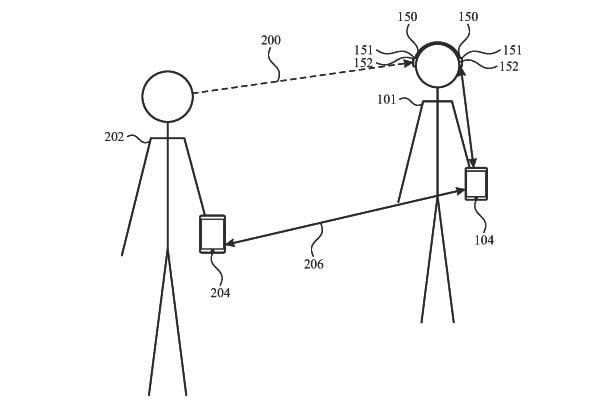

Apple has filed a patent that relates to an audio source device that transitions between transmitting audio data as an over-the-air optical signal to an earphone, to transmitting the audio data as an over-the-air radio frequency (RF) signal. The patent also illustrates that the technology could be used with Apple’s future Mixed Reality Headset and/or smart-glasses. Apple states in their granted patent that wireless communication capabilities are available in a broad array of accessory devices that can be configured to communicate with audio source devices.(Phone Arena, What HiFi, 9to5Mac, Patently Apple)

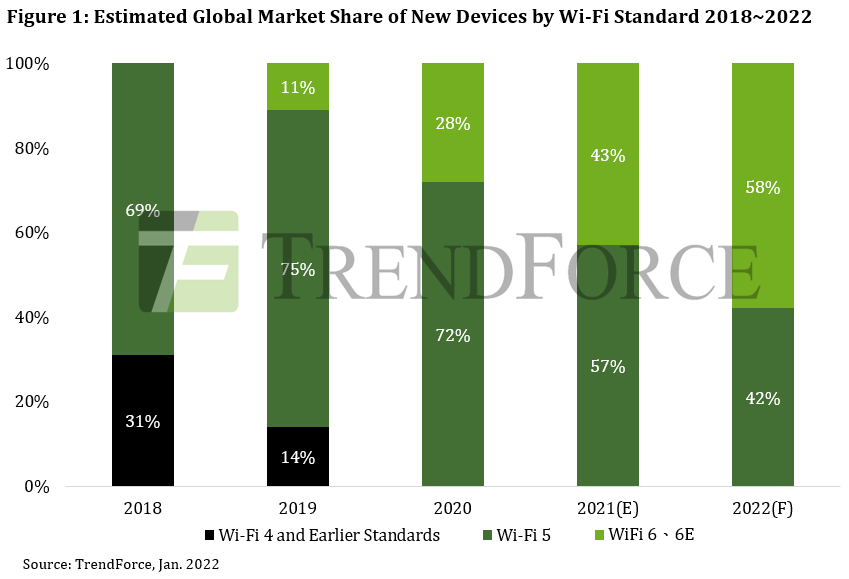

Exponential demand growth for remote and unmanned terminals in smart home, logistics, manufacturing and other end-user applications has driven iterative updates in Wi-Fi technology. Among the current generations of technologies, Wi-Fi 5 (802.11ac) is mainstream while Wi-Fi 6 and 6E (802.11ax) are at promotional stages, according to TrendForce. In order to meet the connection requirements of industry concepts such as the Metaverse, many major manufacturers have trained their focus on the faster and more stable next generation 802.11be Wi-Fi standard amendment, commonly known as Wi-Fi 7. Considering technical characteristics, maturity, and product certification status, Wi-Fi 6 and 6E are expected to surpass Wi-Fi 5 to become mainstream technology in 2022, with global market share expected to reach 58%. (Laoyaoba, TrendForce, TrendForce)

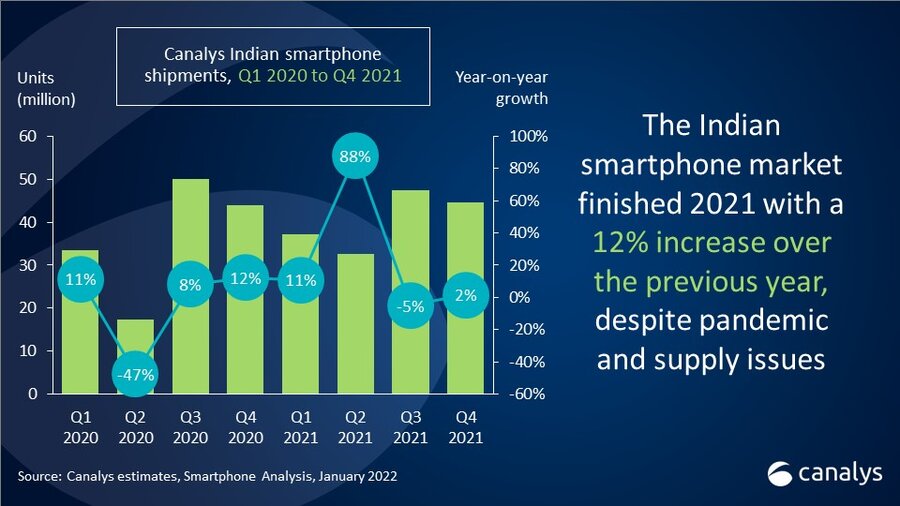

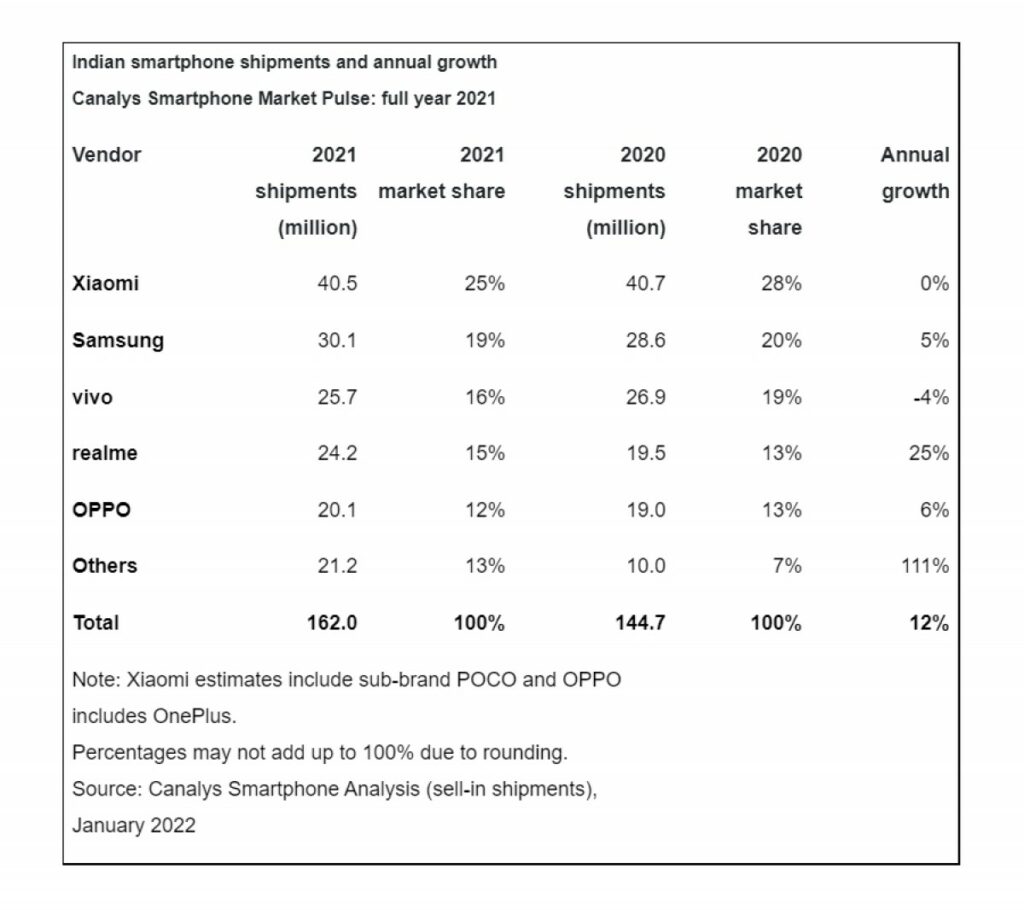

According to Canalys, the smartphone market in India achieved a record 162M shipments in 2021, growing 12% on 2020. After a tough start to the year, due to the second wave of COVID-19, India recovered strongly in 2H21. Following a strong comeback in 3Q21, smartphone vendors shipped 44.5M devices in 4Q21 for 2% growth, despite a challenging supply chain. Xiaomi was the leader, shipping 9.3M units and maintained its 21% market share. Samsung came second with 8.5M units for 19% share. For the first time realme climbed to third place in India, with a 49% YoY increase in volume that reached 7.6M shipments. (GSM Arena, Canalys)

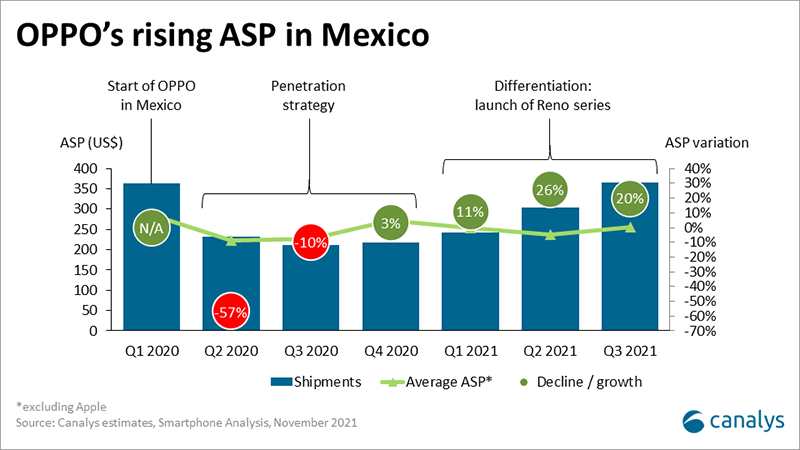

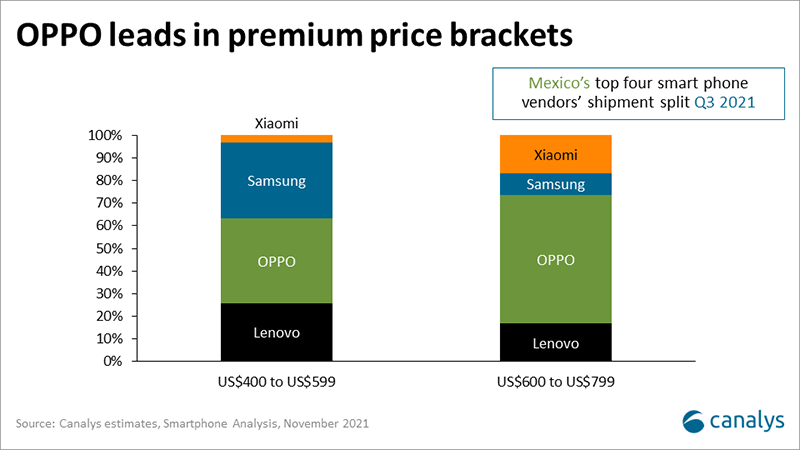

OPPO only entered the Latin America market in 2020. It has set itself high targets in the region, such as to become the best-selling smartphone vendor in Mexico in 2022. OPPO was importing mostly entry-level and mid-range smartphones, such as the A12, A31, A53 and A72, which when combined represented 86% of its shipments in 2020. This means that, like most smartphone vendors, OPPO was using a penetration market strategy to kickstart growth and build share faster than the competition. It built a solid foundation for future success with two important agreements sealed in 2H20 with the two largest carriers in México, Telcel (América Móvil) and AT&T. This helped it increase shipments significantly by 1,035% and 107% in 3Q20 and 4Q20, respectively. OPPO’s Latin American expansion continued in 2021.(My Drivers, Canalys)

According to CINNO Research, in 2021, due to the continuous shortage of upstream core components supply, repeated epidemics in many places in China, and the decline in purchasing power of the consumer market, the performance of the entire smartphone market is not optimistic. In 2021, smartphone sales in the Chinese market will be approximately 314 million units, a YoY increase of 3%. Among them, 1H21 benefited from the rapid recovery of market demand after the epidemic, superimposed on Xiaomi, OPPO, vivo and other brands to release new phones to stimulate the market, 1H21 is not weak in the off-season, and the cumulative sales contribution reached 51.5%. (CINNO Research, Laoyaoba)

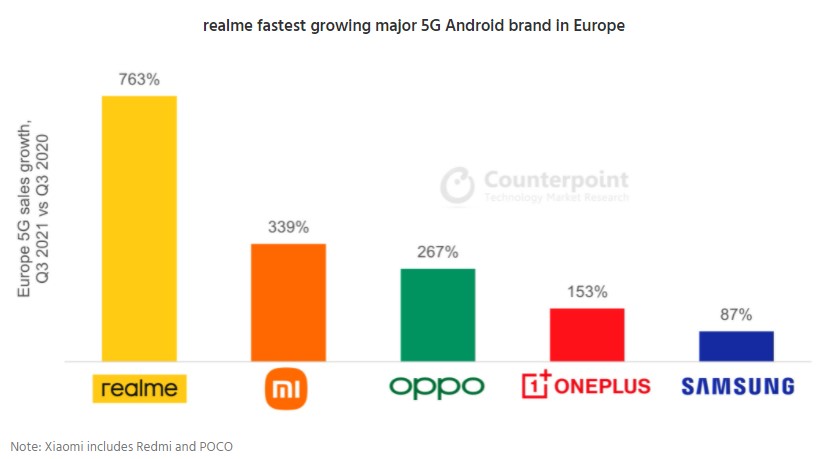

Sky Li, the founder and CEO of realme, has revealed that the company plans to enter the European high-end smartphone market with its most expensive models in Feb 2022. This move aims at expanding its product line and increasing its global smartphone sales by 50% in 2022. Li has pointed out that realme plans to start selling high-end GT 2 Pro phones all over Europe in Feb 2022, at a price of USD700-800.(Laoyaoba, Reuters, Reuters, Pandaily)

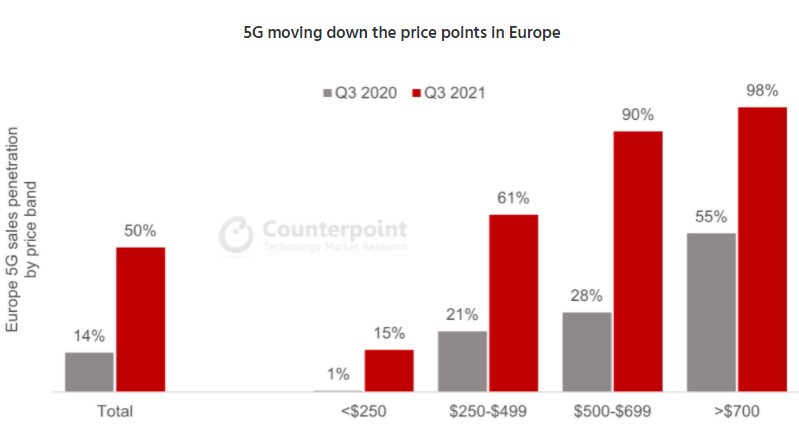

5G is growing rapidly in Europe. 5G sales in the region more than doubled over 2020 and accounted for half of all smartphone sales in 3Q21 (up from just 14% in 3Q20). The key to this growth is the push of 5G down into the lower price tiers. 5G smartphones accounted for the majority of sales in the mid-price (USD250-499 wholesale) segment in 3Q21, up from 21% in the previous year. Even in the budget segment (<USD250), 5G smartphones accounted for 15% of sales in 3Q21, up from practically nothing in 3Q20. realme is one of the main drivers of cheaper 5G smartphones in Europe in 2021 (globally too), showcasing impressive growth compared to 2020. realme’s 5G volumes grew 763% in 3Q20-3Q21, resulting in realme becoming a top-5 major Android 5G brand behind Samsung, Xiaomi (including Redmi and POCO), OPPO and OnePlus. (GSM Arena, Counterpoint Research)

Micromax IN Note 2 is launched in India – 6.43” 1080×2400 FHD+ HiD AMOLED, MediaTek Helio G95, rear quad 48MP-5MP ultrawide-2MP macro-2MP depth + front 16MP, 4+64GB, Android 11.0, side fingerprint, 5000mAh 30W, reverse charging, INR13,490 (USD180). (Gizmo China, GSM Arena)

Tecno Pop 5X印度和墨西哥问世 – 6.52寸720×1600 HD+ V槽,展锐SC9863CE,后置三摄800万-QVGA-QVGA+前置500万,2+32GB,Android 10.0 Go,后置指纹,4000毫安,8499卢比 (113美元) / 2000墨西哥披索 (115美元)。(GSM Arena, Gizmo China, Tecno)

Apple has filed a new patent application for a new feature on the AirPods Pro, titled “Interrupt for noise-canceling audio devices” which is basically an automatic transparency mode. With this feature, users will be able to determine in advance when the Active Noise Cancellation feature should get paused. For this, the user can set the feature to be interrupted by one or more pre-defined contacts that are identified by electronic devices or through verbal commands, either via sound recognition or trigger words.(GizChina, Gizmo China, Digital Trends, Apple Insider)

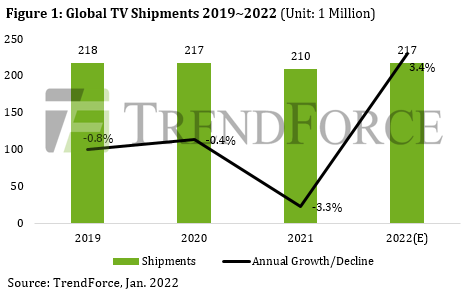

The shipment performance of TV brands in 1H21 benefited from COVID-19 economic relief funds in the U.S., driving a continuing boom in North American shipments, according to TrendForce. At the same time, TV brands continued to replenish panel inventories, pushing up panel prices. As the pandemic slowed down in Europe and the United States in 2H21, life returned to normal and pandemic stimulus no longer applied, challenging demand levels. In addition, rising raw material and freight prices pushed up whole device cost, forcing TV brands to pass costs onto retail pricing. Even though TV brands staked their hopes on the two major annual yearend sales promotion events of Singles Day in China (the biggest shopping day of the year globally, online and IRL) and Black Friday, sales performance was poor due to high costs leading to a slump in end-user demand and eventually causing TV shipments to decline by 3.2% annually to 210M units in 2021. (TrendForce, TrendForce)

Jidu Automotive, the smart electric vehicle (EV) arm of Baidu, has received nearly USD400M in the latest round of financing to support the development and production of a car with level 4 (L4) autonomous driving technology. The company has said that the capital was raised from its two shareholders –Baidu and carmaker Zhejiang Geely Holding. Jidu will continue to speed up the process of R&D and mass production. The first concept car of a car robot will be released at the Beijing Auto Show in Apr 2022, and the mass-produced model will be launched in 2023.(CN Beta, CNBC, TechNode, SCMP)

Renault SA, Nissan Motor and Mitsubishi Motors reportedly plan to triple their investment to jointly develop electric vehicles (EVs). The 3 are expected to announce a plan to invest more than EUR20B (USD23B) over the next 5 years on EV development. By 2030, the alliance is expected to come up with more than 30 new battery EVs underpinned by 5 common platforms. That is in addition to EUR10B the group has already spent on electrification. (Laoyaoba, Japan Times, Economic Times, Reuters, Financial Post)

Metaphysic, an artificial intelligence company founded in 2021, has raised USD7.5M in funding. Metaphysic launched in Jun 2021 after a viral social media campaign featuring deepfake videos of Tom Cruise produced with artificial intelligence and synthetic media technologies, and the company said these “hyperreal experiences” can be used to connect content creators with their audiences.(VentureBeat, Business Insider)

Bokksu, a Japanese digital marketplace for snacks and groceries, has raised USD22M in a Series A funding round. The investment raised its valuation to USD100M. Bokksu, which recently expanded into grocery, is looking to build momentum amid increasing access online in the U.S. to Asian groceries and snacks. (TechCrunch, Food Business News, Grocery Drive)

Food and grocery delivery platform Swiggy has raised USD700M at a valuation of USD10.7B, doubling its valuation in 6 months. The new round of funding gives Swiggy the ammunition to strengthen its food-delivery business and double down on its express grocery delivery business Instamart, where it competes against Zomato-backed Blinkit, Reliance-backed Dunzo, new upstart Zepto. Flipkart, Amazon, and Tata-owned BigBasket are the other players in the segment. (TechCrunch, Money Control, Economic Times)

Apple is reportedly developing a new feature that would allow iPhone users to accept credit card payments via contactless technology without any extra hardware. Apple’s system is likely to use NFC technology like Apple Pay. Apple would be able to leapfrog Square’s hardware by integrating tap-to-pay terminal technology directly into the iPhone using its built-in NFC chip. This means small businesses would be able to accept tap-to-pay payments without any external hardware. (Engadget, Bloomberg, Apple, 9to5Mac, The Verge)