2-6 #HappyCNY : Toshiba will invest about JPY125B to more than double production of power management semiconductors; Volvo Cars and Northvolt will build their joint battery plant in Gothenburg; Sony has announced a deal to acquire Bungie for USD3.6B; etc.

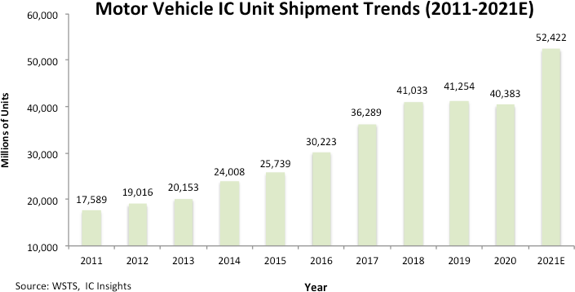

The vast majority of the current headlines regarding the auto industry revolve around the semiconductor device shortage that began in earnest in 2021 and has carried over into 2022. The commonly accepted reason for this shortage is as follows: In Mar 2020, in the very early stages of the Covid-19 pandemic, auto demand plunged worldwide and automakers subsequently began to shut down plants and halt semiconductor orders from their suppliers. While this was happening, there was a surge in demand for cellphones, TVs, computers, games, and home appliances from a global population that was sheltering in place and increasingly working from home. As a result, semiconductor suppliers switched their production capacity away from automotive devices to devices that were being used in the other electronic systems that were in higher demand. When the auto industry came back online in 2H20, it found that semiconductor suppliers, after having shifted production capacity away from automotive applications, couldn’t meet their renewed demand and a serious shortage ensued. IC Insights believes that the above scenario is not the primary reason for the IC shortage now impacting the automotive industry. The real reason behind the automotive IC shortage lies in the surge in demand for automotive ICs in 2021 and not from the semiconductor suppliers’ inability to ramp up production. In fact, device suppliers shipped 30% more IC units to the automotive industry in 2021 as compared to 2020, which was much greater than the 22% increase in total worldwide IC unit shipments last year. Moreover, 27% more IC units were shipped to the auto sector in 2021 as compared to the pre-pandemic year of 2019. (Laoyaoba, IC Insights)

Toshiba has said it will invest about JPY125B (USD1.09B) to more than double production of power management semiconductors, aiming to catch up with power chip giants such as Infineon Technologies AG. It will build a cutting-edge 300mm fabrication plant in central Japan for power management chips, which efficiently control electric power in cars, electronic devices and industry equipment. The new plant is set to start operating by Mar 2025. When the first phase is complete, Toshiba’s power chip output capacity would be 2.5 times its current level. (CN Beta, Reuters, Business Today)

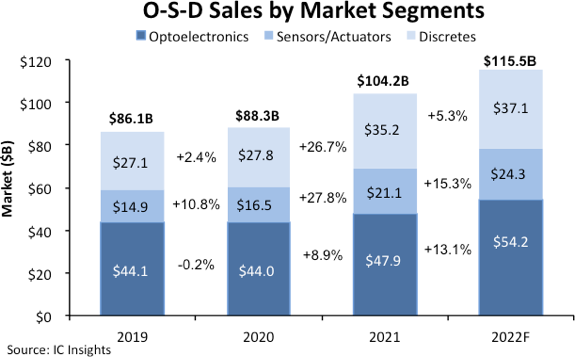

Worldwide sales of optoelectronics, sensors and actuators, and discrete semiconductors (O-S-D) each climbed to record-high levels during the 2021 global economic rebound from the Covid-19 virus crisis and lockdowns aimed at slowing the spread of the deadly pandemic. According to IC Insights, total O-S-D revenues crossed USD100B for the first time ever in 2021, growing 18% to USD104.2B compared to USD88.3B in 2020, when combined sales in the 3 markets increased by less than 3% as the virus first took hold. O-S-D sales—which accounted for 17% of the world’s USD613.9B total semiconductor market in 2021 (the rest being ICs)—were primarily driven in 2021 by sharp increases in unit demand for widely used discrete devices, tight supplies of sensors and actuators, higher average selling prices (ASPs), long lead times for deliveries, and delays in restocking factory inventories by system makers. (Laoyaoba, IC Insights)

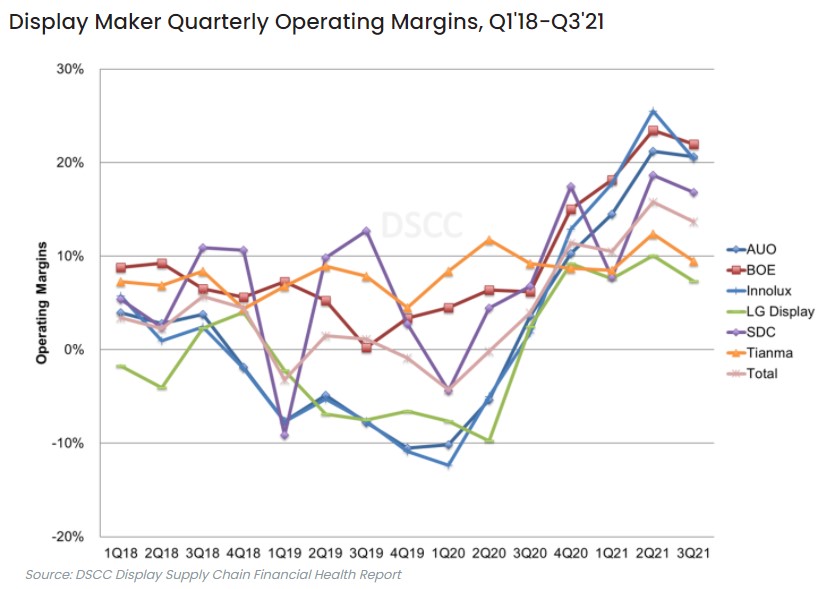

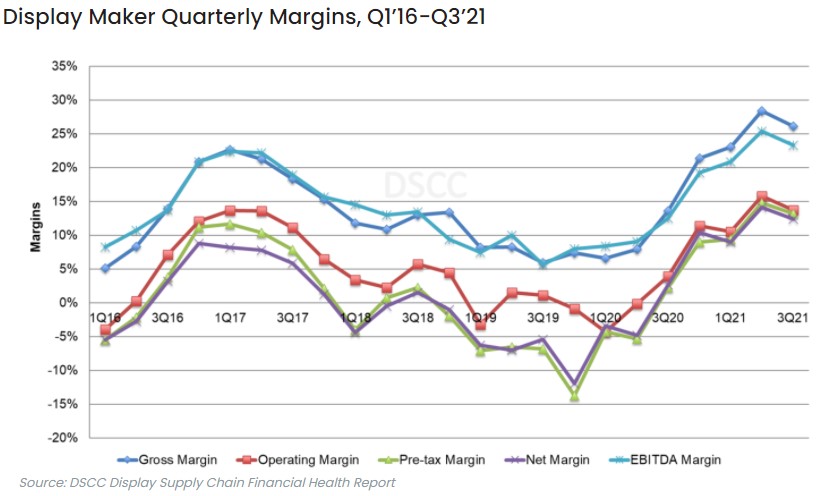

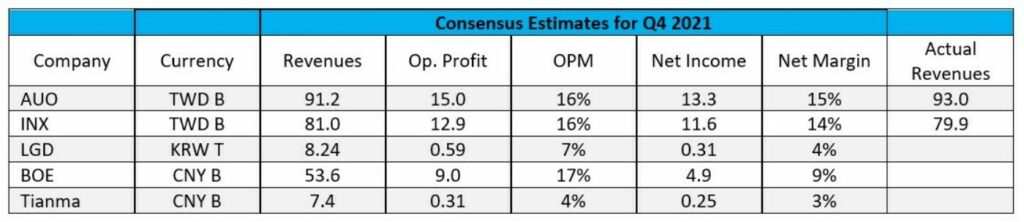

According to DSCC, margins of display makers peaked in 2Q21, capping a 5-quarter run from the bottom of the Crystal Cycle to the top. In 4Q21, DSCC expects that these margins will be reduced, especially for the companies focused on LCD, as LCD TV panel prices declined by an average of 32% QoQ, the largest QoQ price decline ever, in 4Q21. LG Display (LGD) revenues for OLED shipments increased by 44% QoQ in 4Q21, driven mostly by an 86% increase in mobile OLED displays for smartphones and smart watches. Even so, LGD would need to have kept LCD revenues close to flat to beat the consensus revenue estimates. (DSCC)

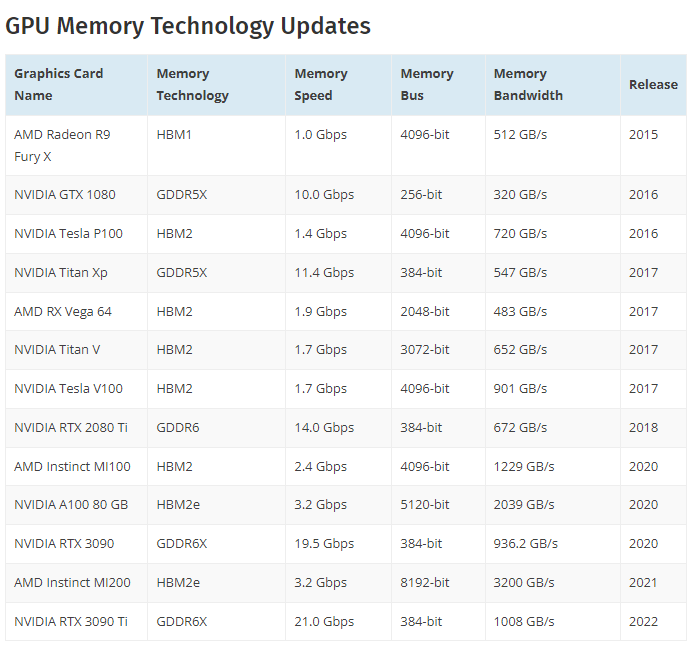

JEDEC has published the HBM3 High-Bandwidth Memory standard which offers an insane uplift over existing HBM2 and HBM2e standards. Key attributes of the new HBM3 include: Extending the proven architecture of HBM2 towards even higher bandwidth, doubling the per-pin data rate of HBM2 generation and defining data rates of up to 6.4Gb/s, equivalent to 819GB/s per device. Doubling the number of independent channels from 8 (HBM2) to 16; with two pseudo channels per channel, HBM3 virtually supports 32 channels.(CN Beta, WCCFTech, JEDEC)

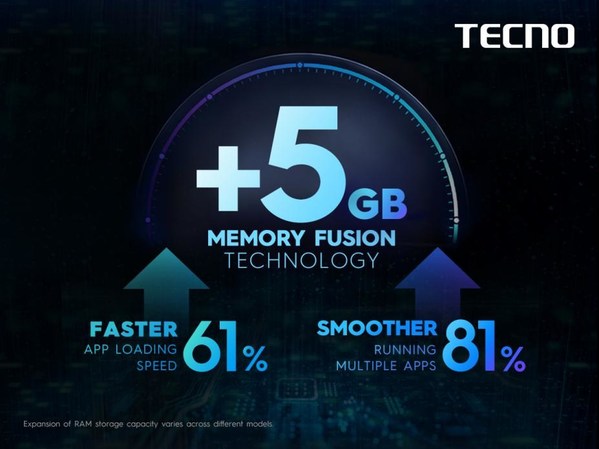

Tecno has announced that its proprietary ‘memory fusion’ feature will be available through OTA updates, across its range of smartphones. The company has stated that the technology has proved to significantly improve smartphone performance an 80% increase in the average application start-up time has been observed, as well as up to two-fold rise in the number of backend cache applications.(Gizmo China, Live Mint, PRNasia)

Continental is developing an intelligent charging robot that will make filling up with electricity much easier and more convenient in the future. Under development by Continental Engineering Services and its partner Volterio, the two-part system includes a floor-mounted charging plate and a receiver that mounts to the vehicle underbody. When the car rolls over top the charging plate, the two components detect each other via ultra-broadband short-distance radio communications and automatically create a physical connection. (CN Beta, New Atlas, Continental, Electrive)

India will introduce a new policy for battery swapping to boost sales of electric vehicles (EVs), its finance minister Nirmala Sitharaman has said, amid a broader push by the government to meet its decarbonization goals. Prime Minister Narendra Modi’s government plans to reduce carbon emissions by up to 35% by 2030 as part of a commitment under the Paris Climate Agreement and it wants automakers to build more EVs. (Engadget, Reuters)

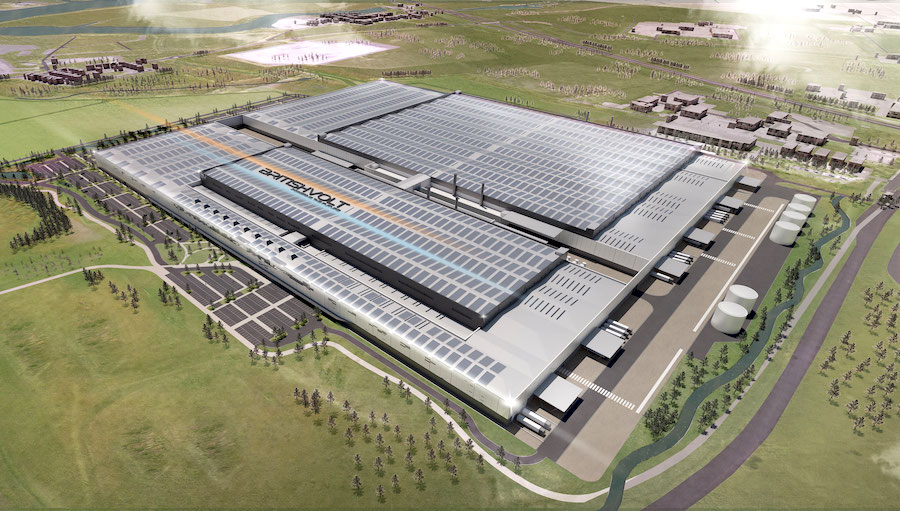

Volvo Cars and battery manufacturer Northvolt will build their joint battery plant in Gothenburg, western Sweden. The new 50-gigawatt-hour (GWh) plant will create up to 3,000 jobs and make battery cells specifically developed for use in pure electric Volvo and Polestar cars, the Sweden-based companies said. Operations will begin in 2025. The two companies said in 2021 they would form a joint venture to develop batteries, including setting up a gigafactory for production and a research and development centre, a total investment of about SEK30B (USD3.3B). (Laoyaoba, CNBC, Northvolt, Reuters)

Mining group Glencore has formed a joint venture with British battery cell start-up Britishvolt to recycle batteries. The partners plan a recycling plant at Britannia Refined Metals operation, a Glencore company located in Northfleet, England. The plant will be operational by mid-2023 and will recycle at least 10,000 tonnes of lithium-ion batteries per year. According to Glencore, the plant will recycle the entire step from Britishvolt’s battery production and batteries from other sources – such as batteries from electronic devices or complete battery packs from e-cars. (Laoyaoba, Minig.com, Glencore, Electrive)

Xpeng Motors has indicated that Xpeng would gradually transit from Contemporary Amperex Technology (CATL) batteries to products made from China Lithium Battery Technology (CALB) to address pressure of cost increase due to CATL’s raising prices significant. Owing to price increase in the upstream product battery, the vehicle price of China’s overall new energy vehicles (NEVs) market, including battery electric vehicles (BEVs), hybrid electric vehicles (HEVs) and other non-fossil fuel-powered vehicles, also experienced price hikes in 2020 and Xpeng started to raise prices by CNY4,800 per unit from 11 Jan 2022. It delivered 16,000 vehicles with a YoY increase of 181% in December, refreshing the record a month ago when the manufacture for the first posted more than 15,000 units in a month, and the annual delivery increased to 98,155 units, 3.6 times more than the year of 2020.(Laoyaoba, Sohu, Sohu, The Paper, CNEVpost)

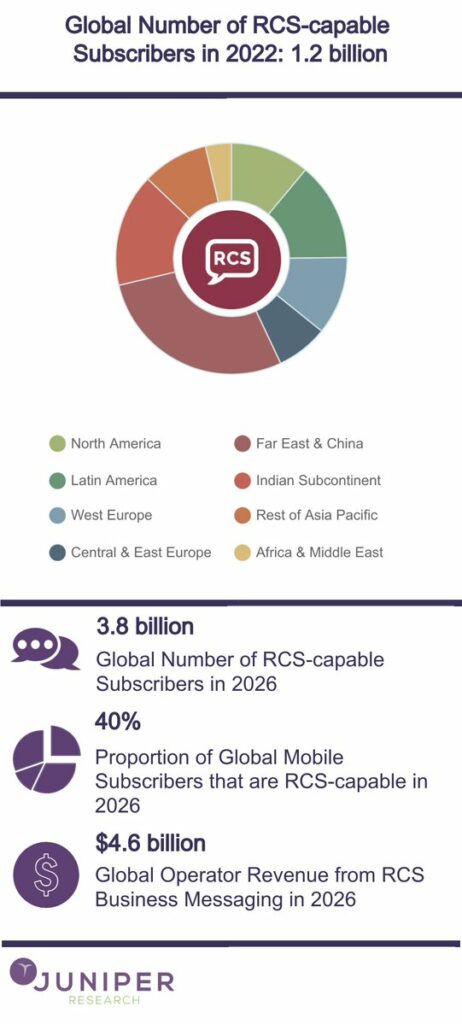

A new study from Juniper Research has found the total number of RCS (Rich Communication Services) subscribers will grow from 1.2B in 2022 to 3.8B by 2026; accounting for 40% of global mobile subscribers. This represents growth of over 200%. RCS is protocol for rich media messaging over operator networks that provides advanced business messaging services, such as chatbots and payments. (Android Headlines, Juniper Research)

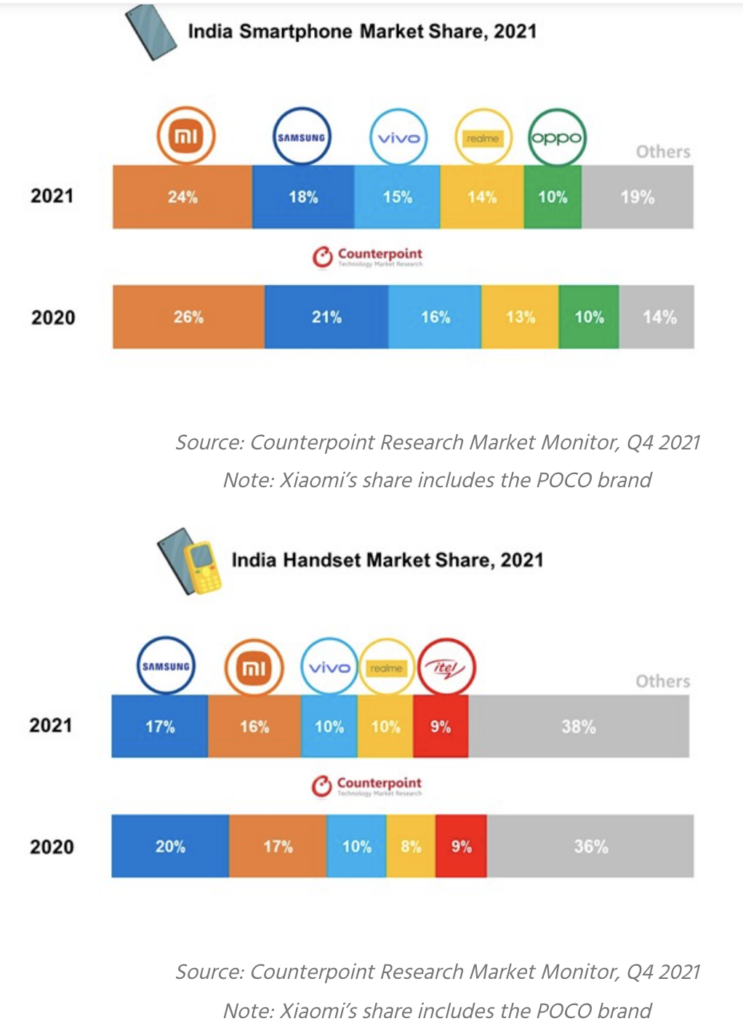

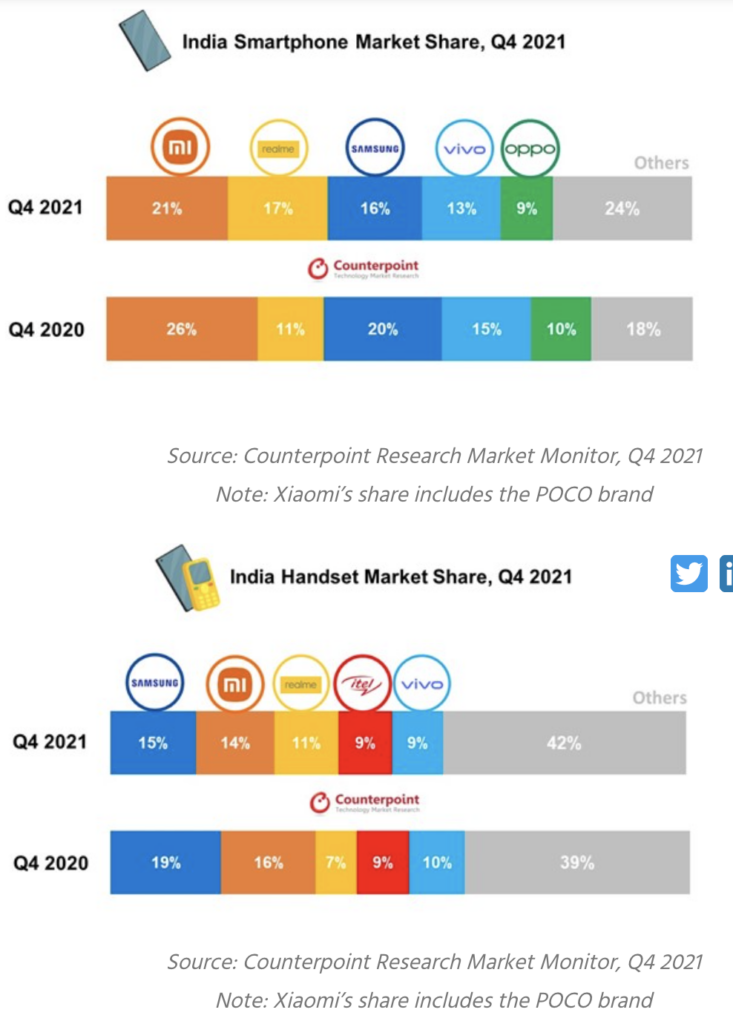

India’s smartphone shipments grew 11% YoY to reach 169M units in 2021, according to Counterpoint Research. However, the shipments declined 8% YoY in 4Q21 due to supply issues plaguing the smartphone manufacturing ecosystem. Xiaomi led the market with a 24% shipment share.The brand also reached its highest ever share in the premium segment (>INR30,000, ~USD400) with 258% YoY growth. Samsung registered its highest ever retail ASP in 2021. The brand led the INR20,000-45,000 (~USD267-600) price segment with a 28% share. (Android Central, Counterpoint Research)

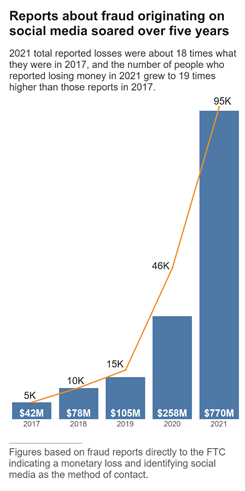

According to the FTC, social media accounted for 25% of reported losses due to scammers. Throughout 2021, people report when they get scammed to the FTC and they report how much money they lose. As per the report, of the people who reported scams in 2021, more than 95,000 of them were scammed on social media. More than USD770M were stolen last year just from social media. This figure is much larger than in previous years. Back in 2020, the figure was USD258M. Since 2017, the number of people scammed through social media increased 18-fold. (Android Headlines, FTC)

BlackBerry sold 90 patents to Huawei in 2021, now the company has announced a USD600M deal to sell yet more patents related to mobile devices, messaging and wireless networking to Catapult IP Innovations. Based in Delaware, Catapult was formed specifically to hold the BlackBerry patents. The money is split as USD450M in cash and a USD150M promissory note.(GSM Arena, The Globe and Mail)

Nokia has announced the launch of new protection plans and extended warranty for Nokia phones. With the new extended warranty, Nokia customers will receive an additional 12 months following the device’s original warranty period, covering the device for a full additional year from unexpected mechanical or electrical failure. The cost of the extended warranty is USD10 in the United States.(Phone Arena, Nokia)

Apple reportedly imports budget iPhone to India for testing, along with 2 iPad models. Among the 7 SKUs, 3 of them correspond with an unreleased iPhone, assumed to be Apple’s rumored third-generation iPhone SE. The iPhone model is imported under the model numbers A2595, A2783, and A2784 and to cost ~INR23,000 (~USD306) before import taxes. (GSM Arena, 91Mobiles)

Moto G Stylus 2022 is announced in United States – 6.8” 1080×2460 FHD+ HiD IPS LCD 90Hz, MediaTek Helio G88, rear tri 50MP (0.64µm)-8MP ultrawide-2MP depth + front 16MP, 6+128GB, Android 11.0, side fingerprint, 5000mAh, passive stylus pen, USD299.(GizChina, GSM Arena)

Gionee G13 Pro is launched in China – 6.26” 720×1600 HD+ notch, Unisoc Tiger T310, rear dual 13MP-2MP + front 5MP, 4+32 / 4+128GB, HarmonyOS, no fingerprint scanner, 3500mAh, CNY529 (USD83) / CNY699 (USD110). (GSM Arena, GizChina, Gadgets360)

TCL 305 is launched in Europe – 6.52” 720×1600 HD+ v-notch, MediaTek Helio A22, rear tri 13MP-2MP depth-2MP macro + front 5MP, 2+64GB, Android 11.0 Go, rear fingerprint, 5000mAh, EUR205. (GSM Arena, Gizmo China)

Sony Interactive Entertainment (SIE) has announced a deal to acquire Bungie for USD3.6B. After the deal closes, Bungie will be “an independent subsidiary” of SIE. The deal caps off a massive Jan 20222for games industry acquisitions. Take-Two announced an agreement to acquire Zynga for roughly USD12.7B on 11 Jan 2022, and Microsoft followed up with a USD68.7B deal for Activision Blizzard a week later. (CN Beta, Android Central, Gamesindustry.biz)

Worldwide tablet shipments reached 46M units during 4Q21, posting a decline for the second time since the pandemic began in 2020. Shipments declined 11.9% YoY in 4Q21 as demand slowed, according to IDC. For the full year 2021, total tablet shipments were up 3.2% YoY and reached 168.8M units, the market’s highest level since 2016. Meanwhile, Chromebook shipments declined 63.6% YoY in 4Q21, but managed to grow 13.5% for the full year. (IDC, Apple Insider)

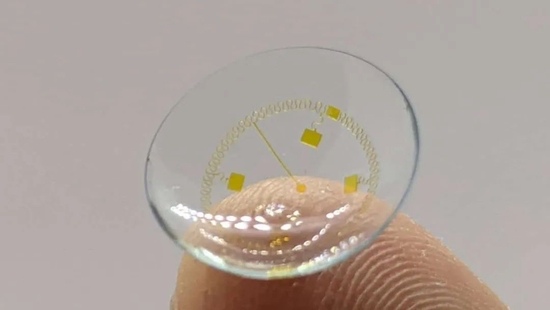

InWith has announced that it has successfully developed the world’s first soft AR contact lens. InWith is a company specializing in ophthalmology and MEMS (Micro Electro Mechanical Systems) technology. They say their research team has pioneered the key technology to integrate solid components and circuits into hydrogel materials, enabling the integration of related augmented reality (AR) display modules into mainstream contact lens materials in the market. InWith plans to obtain Breakthrough Device clearance from the FDA in 2022, bringing the related contact lens product to market shortly thereafter. (CN Beta, Gaming Deputy)

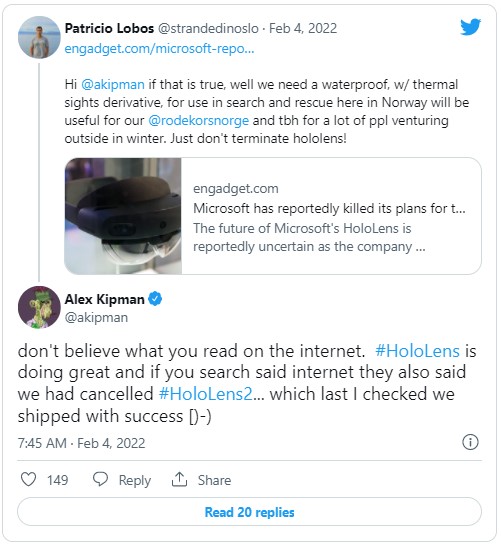

Microsoft’s Alex Kipman has indicated that Microsoft has not abandoned development on HoloLens 3. He has added that the device is a “critical part of the company’s plans for emerging categories like mixed reality and the metaverse”. Microsoft has been working on a custom HoloLens headset for the US Army in a contract that could be worth up to USD21.88B over 10 years.(Engadget, The Verge, Business Insider)

Mozilla has announced that it is shutting down its Firefox Reality browser, which is a four-year-old browser built for use in virtual reality environments. The technology had allowed users to access the web from within their VR headset, doing things like visiting URLs, performing searches and browsing both the 2D and 3D internet using VR hand controllers, instead of a mouse. Firefox Reality first launched in fall 2018 and has been available on Viveport, Oculus, Pico and HoloLens platforms through their various app stores.(TechCrunch, PC Mag, Mozilla, The Verge)

Tesla CEO Elon Musk has said that Tesla does not plan to launch any new models in 2022, and that the company’s goal will be to increase annual vehicle deliveries by 50% as a priority. However, Bernstein analyst Toni Sacconaghi has said the delay in launching the new model could make it difficult for Tesla to maintain the company’s current rapid growth momentum, and questioned whether Tesla’s demand for the Model 3 and Model Y alone would be sufficient to meet the company’s growth target by 2024. (CN Beta, CNBC, Investopedia, Live Mint)

Xpeng Motors, the China-based electric vehicles manufacturers, has become the first Chinese EV company to enter Sweden. This marks the second European market for the company after entering Norway. The smart car-making company is currently setting up its first store in Sweden. (Gizmo China, Reddit)

Tesla is recalling more than 817,000 vehicles in the U.S. because the seat belt reminder chimes may not sound when the vehicles are started and the driver has not buckled up. The recall covers the 2021 and 2022 Model S sedan and Model X SUV, as well as the 2017 through 2022 Model 3 sedan and 2020 through 2022 Model Y SUV.(TechCrunch, Tesla, AP News, Engadget)

Tesla is recalling nearly 54,000 cars and SUVs because their “Full Self-Driving” software lets them roll through stop signs without coming to a complete halt. Recall documents posted by U.S. safety regulators say that Tesla will disable the feature with an over-the-internet software update. The “rolling stop” feature allows vehicles to go through intersections with all-way stop signs at up to 5.6 miles (9km) per hour.(TechCrunch, ABC News)

Shipping firm SF Express has announced that SF UAS, a logistics drone operator and R&D institution, had obtained a trial operation license and business license for regional logistics unmanned aerial vehicles (UAV) issued by the Civil Aviation Administration of China (CAAC). After the approval, SF UAS will take the lead in developing regional logistics and transportation services in Yulin, Shaanxi province, and other places in northwest China. This will help SF Express build a three-phase air transportation network consisting of “large manned transport aircrafts + large regional unmanned aerial vehicles + delivery unmanned aerial vehicles.”(CN Beta, The Paper, 163, IT Home, Pandaily)

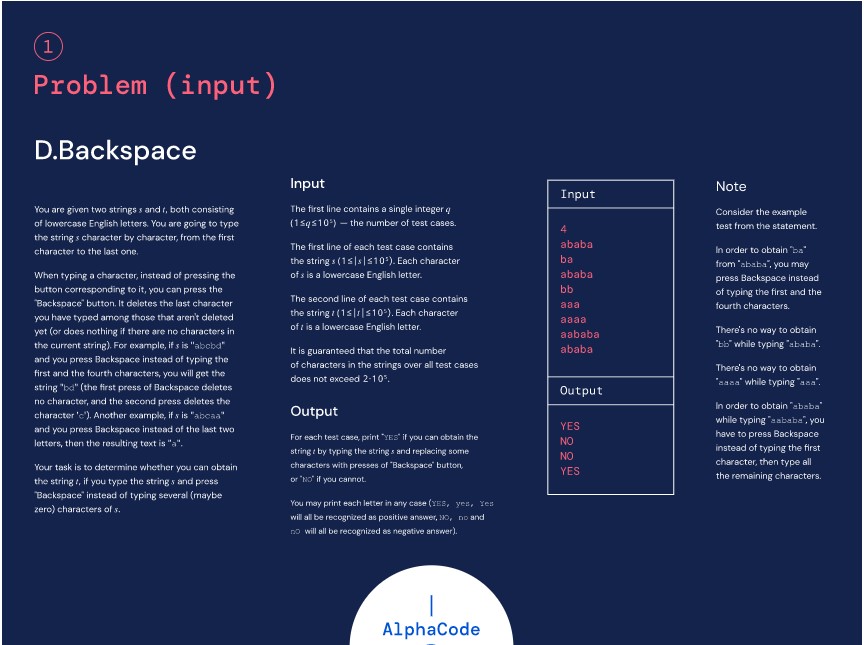

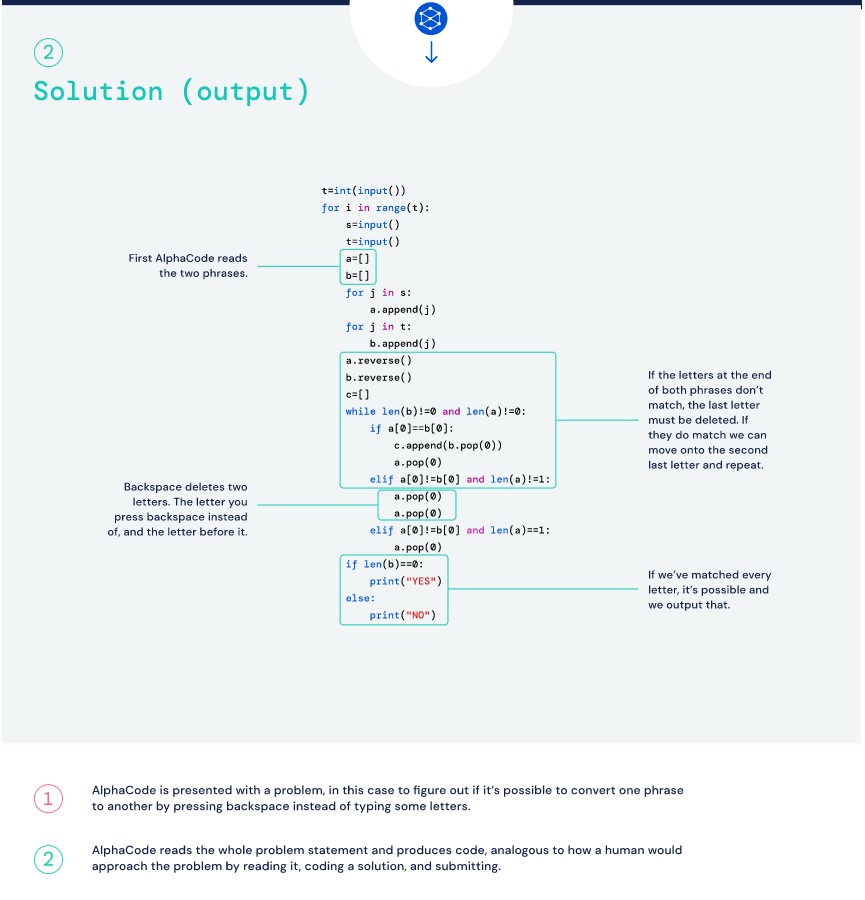

DeepMind has created an AI system named AlphaCode that it says “writes computer programs at a competitive level”. The Alphabet subsidiary tested its system against coding challenges used in human competitions and found that its program achieved an “estimated rank” placing it within the top 54% of human coders. The result is a significant step forward for autonomous coding, says DeepMind, though AlphaCode’s skills are not necessarily representative of the sort of programming tasks faced by the average coder.(The Verge, DeepMind)

India’s Finance Minister Nirmala Sitharaman has announced that virtual digital assets will be taxed and any income from transfer of such asset shall be taxed at 30%. A 30% tax may be on the higher and can disincentivize some people to trade in virtual digital assets including NFTs. Along with 30% tax, there will be 1% TDS (tax deducted at source) on payments made on transfer of digital assets. (CN Beta, Business Standard, Money Control)

MicroStrategy has reported a net loss of USD90M (USD8.43 a share) in 4Q21, missing consensus estimates for a profit of 89 cents a share. The loss appears largely due to MicroStrategy’s inclusion of impairment losses on its Bitcoin, amounting to USD147M. That more than wiped out the company’s USD110.5M gross profit from its software business. The company has taken to accumulating bitcoin, said it bought approximately 660 bitcoins for around USD25M in 30 Dec 2021 and 31 Jan 2022. The company has paid an average price of USD37,865 per bitcoin. (CN Beta, Coin Desk, Barron’s)

Blockchain.com has announced it is partnering with Cloud9, the esports organization. The cryptocurrency platform will offer financial literacy opportunities to Cloud9’s audience. Cloud9, which has 16 teams playing across 12 games, will feature the Blockchain.com logo on its jersey and will also receive a portion of the deal in crypto. Blockchain.com plans to educate Cloud9’s users about cryptocurrency through its upcoming programs. (VentureBeat, eSports Insider, Cloud9)