2-15 #LanternFestival : Intel is to buy Tower Semiconductor; Harman has announced that it has acquired Apostera; Luxshare Precision has signed a strategic cooperation framework agreement with Chery Group; etc.

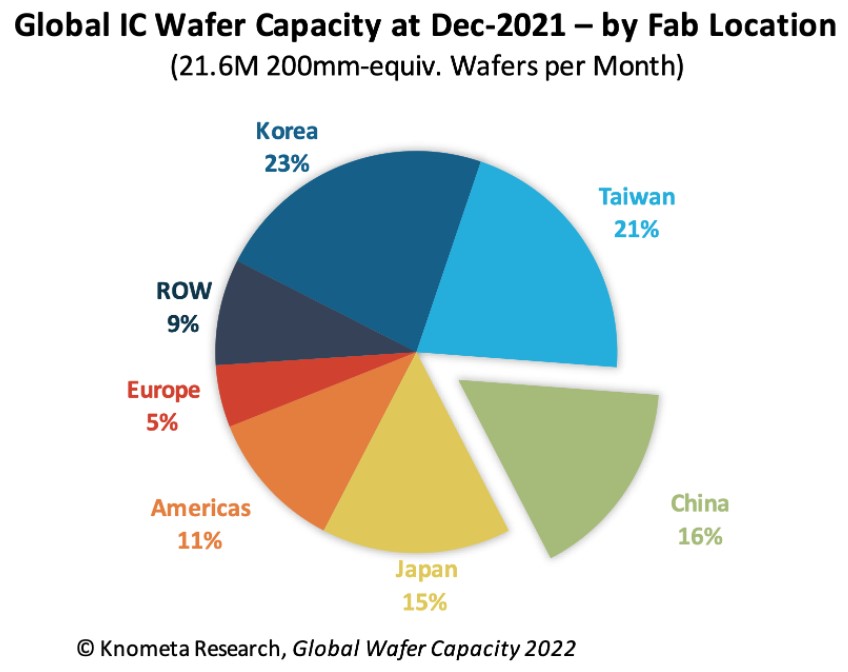

According to Knometa Research, China’s share of the world’s capacity for fabricating IC wafers continued to grow in 2021. The country ended the year having 16% of global capacity, based on normalized installed monthly capacity amounts. Worldwide IC wafer capacity at the end of 2021 was 21.6M 200mm-equivalent wafers per month, with fabs in China having the capacity to process 3.5M. China’s share of capacity has increased one percentage point in each of the last two years and a total of seven points since 2011, when the country accounted for just 9% of all IC wafer capacity. (CN Beta, Knometa Research, EE News)

There is still no sign of the global chipsets shortage alarm being lifted, and the delivery time of semiconductors is still being stretched. According to data provided by U.S. electronic components distributor Sourceengine, lead times for chip orders in Feb 2022 increased by 5 – 15 weeks compared to Oct 2021. Based on these calculations, the average lead time for general-purpose products for 16-bit processors is 44 weeks, an increase of 15 weeks from Oct 2021, and the average lead time for power management chips is 37 weeks, an increase of 9 weeks. Maximum lead time of 99 weeks for some processors. (199IT, Asia Nikkei, CN Beta)

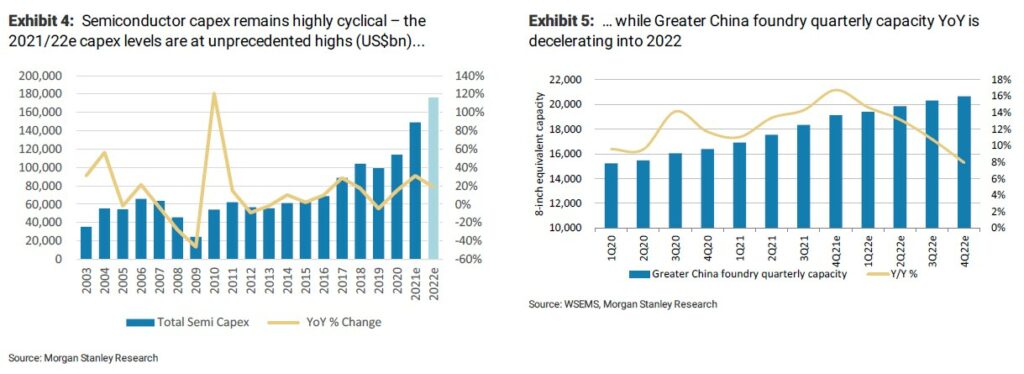

For the customers that use semiconductor chips, it is a constant exercise in securing the right amount of them to satisfy demand but not tying up too much money in inventory. However, uncertainty on supply availability creates customer anxiety driving stock piling. Manufacturers must project output at least 9-12 months in advance because supply tends to lag demand, causing major fluctuations in investment and returns. Given the large capital expenditures and long lead times to add new facilities, the bulk of supply comes in steps, eventually causing an imbalance. The revenue growth trend line has been very consistent for the past 10 years, at around 2.1x nominal GDP growth per year. (Morgan Stanley report)

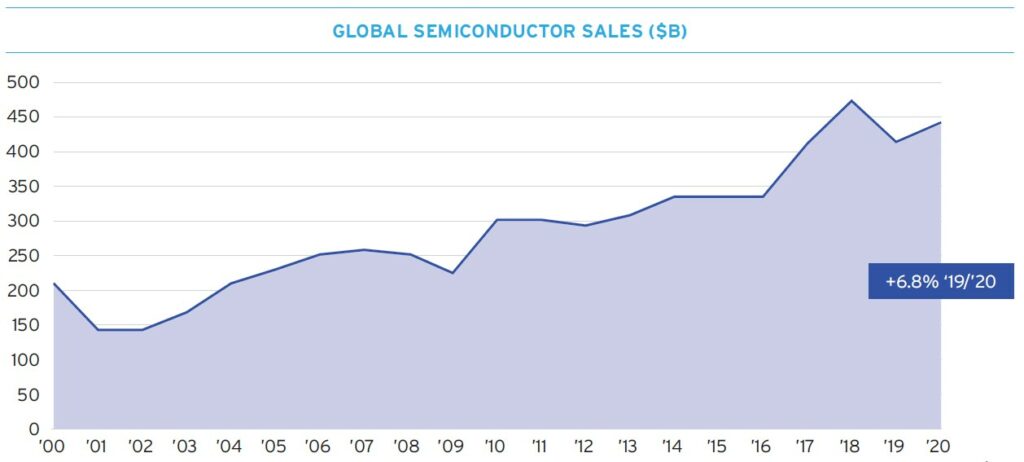

Following weak sales of USD412.3B in 2019, global sales in 2020 increased by 6.8% to USD440.4B, due largely to demand growth spurred by the COVID-19 pandemic. The World Semiconductor Trade Statistics (WSTS) Semiconductor Market Forecast released in Jun 2021 projected worldwide semiconductor industry sales will increase significantly to USD527B in 2021, an upward revision from its Fall 2020 forecast for 2021, due mainly to the continued strong demand growth in the overall market from 2020. In 2022, WSTS forecasts global sales will continue growing to USD573B. (SIA report)

Nvidia has failed attempt at acquiring Arm. Japanese conglomerate SoftBank has quickly announced it would go the IPO route for Arm after international regulators burned the record-setting, USD66B Nvidia acquisition. However, Allen Wu, the head of the company’s Arm-China joint venture, has launched a third legal case against the company with the aim of getting himself officially reappointed to the Arm China board. (Apple Insider, Financial Times, Tom’s Hardware, AA Stock)

Intel has launched a new chip for blockchain applications such as Bitcoin mining and minting NFTs to cash in on the rising usage of cryptocurrencies. The chip will ship later in 2022 and the first customers include Block, the Jack Dorsey-led firm that recently changed its name from Square to highlight its growing focus on the blockchain. Intel has said its chip is an energy-efficient “accelerator” designed to speed up blockchain tasks that require huge amounts of computing power and thereby consume a lot of energy.(Reuters, The Verge, Intel, NASDAQ)

Benteler EV Systems, Beep, and Mobileye, an Intel Company, have announced a strategic collaboration to develop and deploy automotive-grade, fully electric, autonomous movers in public and private communities across North America. Aimed at first- and last-mile use cases in urban areas, the shuttles are due to begin production deployments in the United States in 2024. The collaboration will facilitate the development and deployment of a fully autonomous (SAE Level 4) electric mover for the U.S. designed to meet automotive industry and safety standards for public road use.(CN Beta, Reuters, Intel, Fierce Electronics)

Intel is close to a USD6B deal to buy Tower Semiconductor. The company, which makes a wide variety of chips ranging from those catering to the consumer, industrial, automotive and mobile markets, has manufacturing facilities —- called “fabs” in industry parlance — in Migdal Haemek, Israel; Agrate, Italy, Newport Beach, Calif.; and San Antonio, Texas. In the summer of 2021, Intel had wanted to acquire GlobalFoundries (GF), but GF’s owners ultimately opted for an IPO. (CN Beta, Reuters, Market Watch, WSJ)

Hyundai Motor is allegedly considering procuring home appliance IC controllers as the prolonged global chip shortage continues to affect automobile production. The company is conducting tests to see whether these controllers can replace the ones it currently uses and procures from automotive chipmakers. Toyota has also begun stocking up on general-use chips in case it faces difficulty in procuring automotive chips. (CN Beta, The Elec)

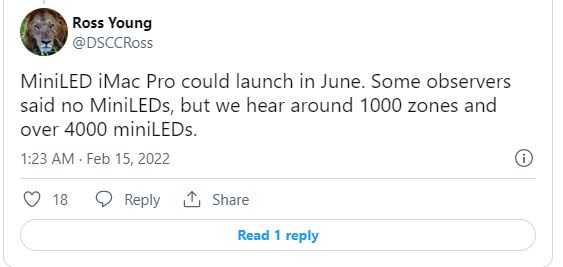

Display Supply Chain Consultants analyst Ross Young has indicated that Apple’s mini LED iMac Pro “could launch in Jun 2022”. In addition to the timeline, Young has reiterated rumors that the iMac Pro would feature mini LED backlighting, contrary to what some observers are claiming. Young has said his firm is hearing reports that the device could sport 1,000 zones and more than 4,000 mini LEDs. (Apple Insider, CN Beta, Twitter)

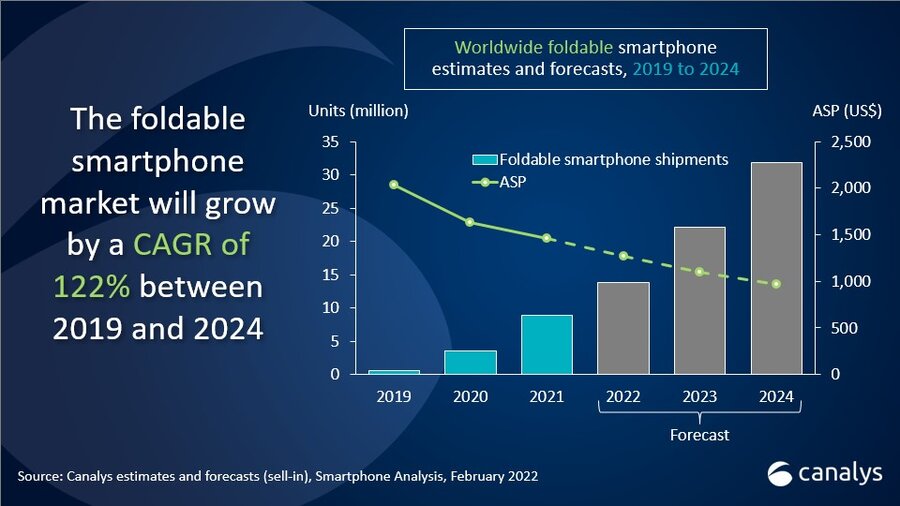

Foldable smartphone shipments are forecast to increase by a CAGR of 53% between 2021 and 2024 to exceed 30M in 2024, according to Canalys. The segment is forecast to grow by a CAGR of 122% between 2019, the year the first foldable products launched, and 2024. Driven by Samsung, foldable smartphone shipments reached 8.9M in 2021. The foldable segment grew 148% YoY despite high price tags, while the overall smartphone market only grew 7%. (CN Beta, Canalys)

Huawei has filed a patent describing a 3D camera technology that should make it possible to analyze one’s face and skin structure. The triple camera system capable of taking 3D facial images with the goal of performing accurate facial analysis. The cameras have been positioned accordingly, with the first and second cameras being perpendicular to each other. The third camera is placed in between the two and at the center of the camera module lies a large display. (GizChina, Gizmo China, LetsGoDigital, CN Beta)

OPPO has announced that the company conducted a 5G standalone and non-standalone network trial in partnership with Indian telecom network operator Reliance Jio. OPPO has further said that the 5G trial is successfully concluded on the Reno7 smartphone in a demo setup. The results has showcased lag-free 4K video streams, super-fast uploads and downloads. (Gizmo China, Business Standard, Business Insider)

SpaceX may have lost a bunch of its Starlink internet satellites in early Feb 2022. However, according to the company CEO Elon Musk, the company has found 150,000 new Starlink customers in recent months. Starlink uses a constellation of low-Earth orbit satellites to beam broadband to customers on the ground. (Digital Trends, Twitter)

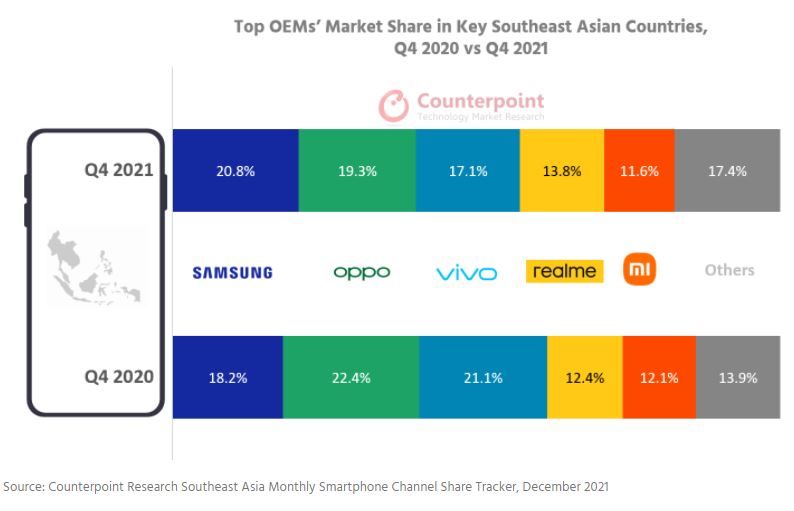

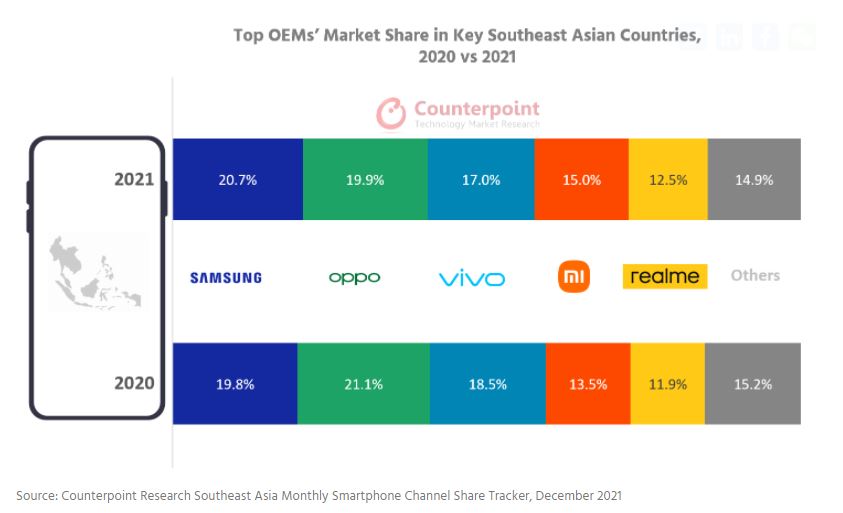

According to Counterpoint Research, key Southeast Asian countries’ (Indonesia, Thailand, Philippines and Vietnam) smartphone shipments were highest ever in a calendar year in 2021, reaching 96M units and growing 5% YoY. Xiaomi, realme and Apple shipped their highest ever volumes in these countries. Xiaomi had a strong 1H21 and even though it had a sluggish 2H21, the brand grew 17% YoY in 2021. Apple saw its highest ever growth of 68% YoY in 2021 due to the sales of iPhone 11 and iPhone 12 series and the launch of iPhone 13 series. 5G smartphone share was 18% in 2021, compared to 3% in 2020. (Counterpoint Research, Laoyaoba)

Samsung Electronics has shifted some smartphone production back to South Korea from Vietnam. The company has moved some of its overseas smartphone production lines to its plant in Gumi, North Gyeongsang Province. At the end of 2021, Samsung Electronics shifted 2 smartphone partner company production lines in Vietnam to the Gumi plant. And the expansion of the production line at the Gumi plant is the first of its kind after shifting its manufacturing base overseas.(CN Beta, Korea Herald, ET News, Asian Tech Press)

According to Ministry of Electronics and Information Technology (MeitY), the Centre has banned 54 Chinese apps that “pose a threat to India’s security”. Since Jun 2020, the government has banned around 224 Chinese smartphone apps, including popular applications like TikTok, Shareit, WeChat, Helo, Likee, UC News, Bigo Live, UC Browser, ES File Explorer, and Mi Community. According to ministry sources, the list of 54 apps includes some of those that been had been banned by the Indian government earlier too but had rebranded themselves and relaunched under new names. Upon official confirmation and after establishing the country of origin, orders have once again been issued to ban the apps. (Gizmo China, TechCrunch, Bloomberg, India Today, Live Mint, DW, Sina)

vivo has acquired multiple trademarks for their NEX lineup including — NEX Flex, NEX Flip, NEX Pocket, NEX Ultimate, NEX Ultra, NEX Max, and NEX Pro+. The NEX Flex might be the name for the upcoming NEX Fold which is rumored to be in development and is said to debut later in 2022. While the NEX Flip and the NEX Pocket can be the name of a flip smartphone that the brand might be working on behind closed doors.Gizmo China, Twitter, My Drivers)

Nokia G21 is announced in Europe – 6.5” 720×1600 v-notch 90Hz, Unisoc T606, rear tri 50MP-2MP macro-2MP depth + front 8MP, 4+64 / 4+128GB, Android 11.0, side fingerprint, 5050mAh 18W, starts from EUR170. (GizChina, GSM Arena, NDTV)

Infinix Zero 5G is launche din India – 6.78” 1080×2460 FHD+ HiD 120Hz, MediaTek Dimensity 900 5G, rear tri 48MP-13MP telephoto 2x optical zoom-2MP depth + front 16MP, 8+128GB, Android 11.0, side fingerprint, 5000mAh 33W, INR19,990 (USD265). (Gizmo China, Infinix)

The trend of crashing into furniture while in the metaverse has provoked a 31% jump in home contents claims involving VR headsets in 2021, according to the insurer Aviva, marking a 68% overall increase since 2016. Aviva has said the average VR-related claim for accidental damage in 2021 was about GBP650, often from broken TVs smashed by overenthusiastic gamers. (Engadget, The Guardian, Daily Mail)

Plagiarism, fakes, scams, and fraud can be found all throughout the NFT space right now. NFT marketplace Cent is temporarily halting most transactions to address “rampant” sales of fake and plagiarized tokens. Cent stopped allowing users to buy and sell most NFTs on 6 Feb 2022. It continues to operate its Valuables marketplace, the place where people can purchase non-fungible tokens of tweets. (Engadget, Reuters, Mashable, UDN)

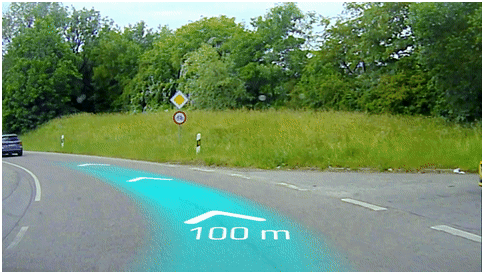

Samsung Electronics’ U.S. subsidiary Harman has announced that it has acquired Apostera, a German augmented reality (AR) head-up display (HUD) software company. Founded in 2017, Apostera is a company that provides augmented reality and mixed reality software solutions. Apostera supplied HUDs for Audi’s Q4 e-tron 2021. Harman is expected to apply Apostera’s technology to its digital cockpit (infotainment) products.(CN Beta, The Elec, Business Korea)

Motorola and Verizon are announcing a “5G Neckband” that they believe can allow headset makers to leave things like connectivity, processing and battery to the collar and focus on making their heads up displays lightweight and comfortable. The neckband and ultra-lightweight AR smart glasses leverage Verizon’s 5G Ultra Wideband network and mobile edge compute platform, enabling us to deliver immersive technology in many fields, such as sports training and fan experiences, as well as making VR theaters scalable.(Neowin, Engadget, Motorola)

By 2026, 25% of people will spend at least 1 hour a day in the metaverse for work, shopping, education, social and/or entertainment, according to Gartner. Gartner defines a metaverse as a collective virtual shared space, created by the convergence of virtually enhanced physical and digital reality. (Gartner, CN Beta)

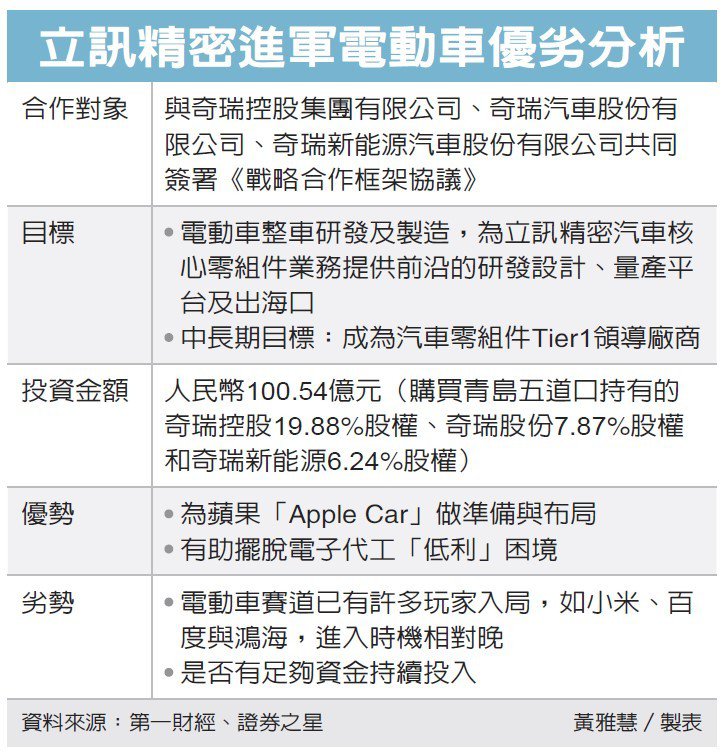

Vehicle component maker Luxshare Precision has announced that it has signed a strategic cooperation framework agreement with Chery Group, including plans to form a joint venture with Chery New Energy for the development and manufacturing of new energy vehicles (NEVs). The joint venture will also provide Luxshare’s core automotive components business with cutting-edge R&D design and mass production platforms. Luxshare Precision has said it has always sought to become a leading vehicle component manufacturer in the automotive field, and has been looking for a platform that can test its products’ performances.(CN Beta, UDN, ETToday, CTEE, Pandaily, Asia Nikkei)

The Securities and Exchange Commission has announced that it fined crypto lending firm BlockFi USD100M, and now the firm plans to register with the agency to offer clients its popular high-yield crypto savings product. As a condition of a USD100M settlement with the SEC as well as state securities regulators, the firm has announced plans to file an S1 to offer BlockFi Yield to US investors as a security. (The Verge, The Block, CN Beta)