2-19 #Home : Intel’s series of announcements; UMC has reported suspension of production at its Hejian 8-inch fab; Micron may raises its NAND prices; OPPO works with Hasselblad; etc.

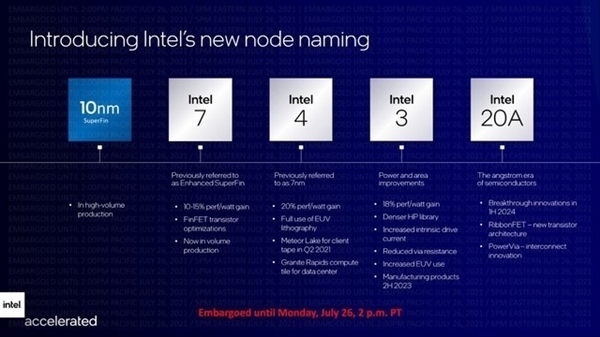

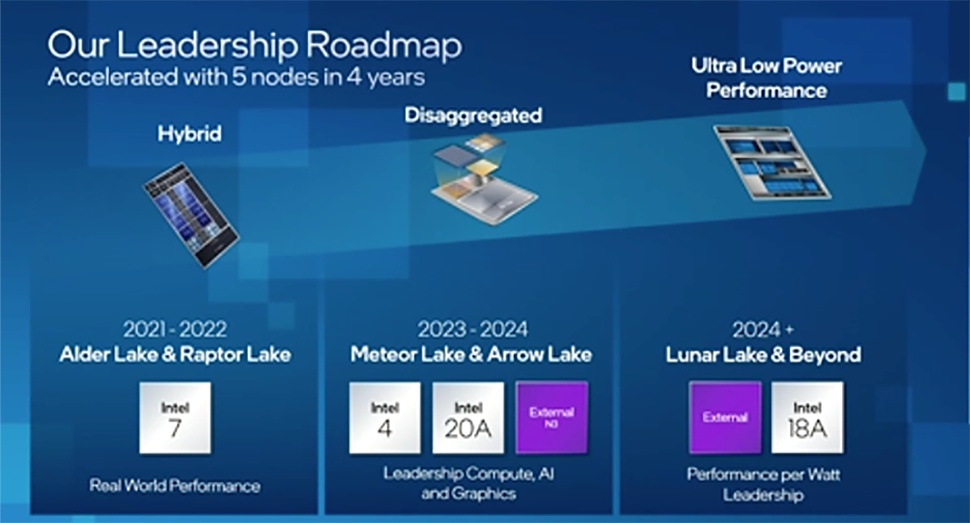

At the end of Jan 2022, Intel announced that a batch of EUV equipment will enter the factory, but at that time, the Fab 34 fab in Ireland, Europe, was installed, which is a lithography resist track working with the UV scanner partner. It first coats the silicon wafer with a precise coating, then enters the EUV scanner for exposure, and then the wafer returns to the lithography equipment, and then performs a series of high-precision photodevelopment and cleaning operations. Ireland’s Fab 34 will mass-produce the Intel 4 process in the future, which is the previous 7nm process. This is Intel’s first process using EUV lithography, and the 14th-generation Core Metor Lake processor will debut this process in 2023. However, Intel has great ambitions in EUV lithography machines, and the focus will be on the next-generation EUV lithography machines. It has already ordered NA 0.55 high numerical aperture EUV lithography machines. It is said that the cost is as high as USD300M. Compared with the current EUV lithography machine with NA 0.33, the new generation of lithography machine purchased by Intel can mass-produce more advanced CPU processes. The future 20A and 18A processes will be used, and mass production will be in 2025 at the earliest. (CN Beta, AnandTech)

Honda Motor has said that two of its domestic manufacturing sites will operate at 90% of capacity until early March due to a shortage of semiconductors. Honda’s Saitama factory and two production lines at its Suzuka plant will see their production capacity cut by about 10% at least until early Mar 2022, hit by the chip shortage and disruptions caused by COVID-19 lockdowns.(Laoyaoba, Euro News, Reuters)

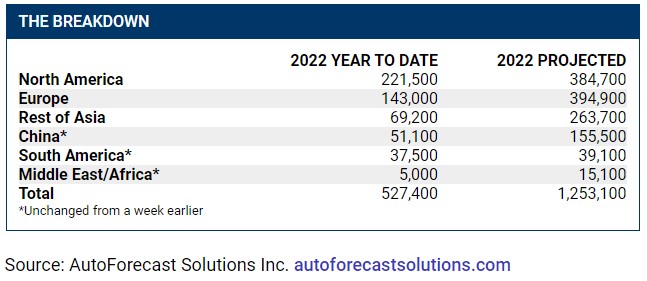

The number of vehicles cut from production schedules at North American factories more than doubled from a week earlier in AutoForecast Solutions’ latest estimate of manufacturing disruption caused by the global shortage of microchips. About 221,500 vehicles have been cut from North American production schedules so far this year, compared with about 95,700 vehicles a week earlier, according to AFS. AFS now estimates that 527,400 vehicles have been axed from automakers’ assembly plans worldwide, up 42 percent from a week earlier. Cuts at European plants rose to about 143,000 vehicles, compared with last week’s estimate of 124,600 vehicles. Plants in Asia, outside of China, have seen about 69,200 vehicles removed from plans, a 22% increase. (Laoyaoba, Auto News, UDN)

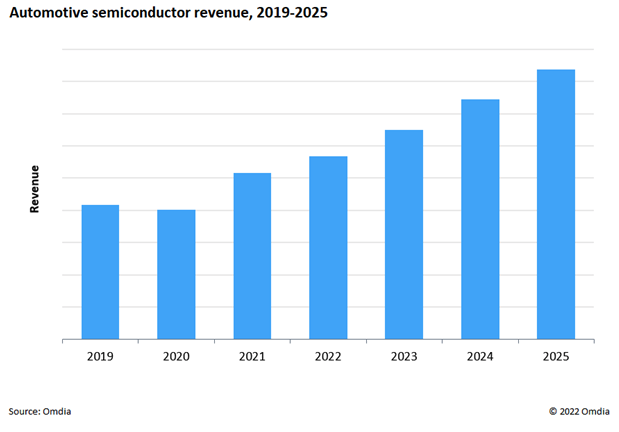

The automotive semiconductor industry is set to surge at a compound annual growth rate (CAGR) of 12.3% through 2025 on the heels of a strong comeback from the pandemic, according to Omdia. Those trends include rising sales of battery electric vehicles (BEVs) and growing demand for advanced driver assist systems (ADAS) and infotainment & telematics (I&T) systems. The average BEV creates 2.9 times more semiconductor revenue than a vehicle with a traditional internal combustion engine. (Laoyaoba, Semiconductor Digest, Omdia, EET China)

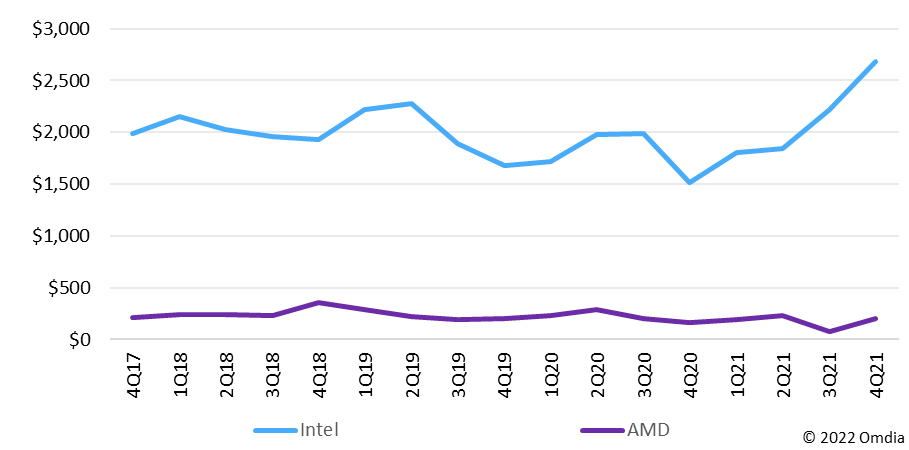

According to Omdia, Intel’s finished goods inventory increase for 5 consecutive quarters. The value of processors Intel is storing is now at an all-time high. The trend would suggest Intel was caught off-guard by the level of market share loss over the past year, particularly in 4Q21. Intel is currently sitting on nearly USD2.7B of finished goods inventory, compared to AMD’s USD197M. Over the last 5 years, the finished goods inventory Intel holds has been between 10% and 15% of Intel’s revenue. (Laoyaoba, Data Center Knowledge)

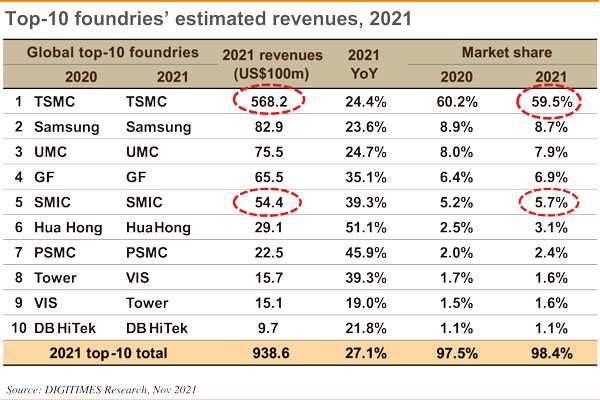

The wafer foundry business is a highly concentrated industry in terms of revenue, with the top-10 players accounting for 98.4% and the top-5 for nearly 90% of global contribution ratio. It is apparent that in this capital-intensive, technology-intensive sector where tight relationships with clients are important, one could not dominate the market without multiple competitive edges. According to DIGITIMES Research, TSMC’s revenue reached USD56.82B, with a global market share of 59.5%, and an almost complete dominance in the 7nm and 5nm matket segments. Samsung in second place has reported a total revenue of about USD18B in its System LSI division, with external orders contributing about USD8.2B. Samsung’s aggregated revenues of non-memory businesses amount to about 1/3 of TSMC’s revenues, while Samsung’s wafer foundry businesses are only 14.5% of TSMC’s revenues. (Digitimes Research, report, Laoyaoba)

MediaTek reportedly plans to release the new chip based on the highly advanced 6nm manufacturing process to replace the Helio G96. The chip is currently only referred to as Next-G, which is built through the 6nm process. It would feature two Cortex-A76 cores running above 2.0 GHz and six Cortex-A55 cores powering at 2.0 GHz. It is capable of handling cameras with resolutions up to 108MP, 2K video recording at 30fps. (GSM Arena, Gizmo China)

Intel says it expects to ship more than 4M discrete GPUs in 2022. The company is also laying out a roadmap that promises at least two more big launches coming later on. One is a previously undisclosed GPU in the cloud service code-named “Project Endgame”, which Intel says “will enable user to access Intel Arc GPUs through a service for always-accessible, low-latency computing experience”. The company says Project Endgame will launch later in 2022. The company also says its begun designing a new GPU architecture code-named “Celestial”, which is designed for the “ultra-enthusiast segment”.(Liliputing, Intel, Twitter)

Intel has announced one of its next major steps in supercomputing platforms: the codenamed Falcon Shores design that will bring general-purpose x86 processor cores and highly parallel compute Xe-HPC GPU cores together into one socket, along shared high-bandwidth memory developed by Intel. The product is expected to arrive in 2024. Bringing together x86 CPU and Xe-HPC GPU resources and into the same socket as well as switching to a unified memory architecture will enable Intel to increase per socket compute density by over five times compared to current platforms (due to new architectures, finer process technologies and the addition of GPU cores), boost memory capacity and bandwidth by more than five times compared to existing designs and upsurge performance per watt by over five times relative to platforms available in Feb 2022.(CN Beta, AnandTech, Tom’s Hardware)

Intel has demonstrated a working desktop PC based on its 13th Generation Core Raptor Lake processor made using its Intel 7 process technology. In addition, the company confirmed that multi-chiplet / multi-tile Arrow Lake and Lunar Lake processors would follow Raptor Lake in the coming years. Intel’s 13th Generation Core Raptor Lake processors will pack up to 8 high-performance and 16 energy-efficient cores that can process up to 32 threads simultaneously. Intel’s Meteor Lake uses a disaggregated multi-tile / multi-chiplet design interconnected using Intel’s EMIB technology with its ingredient — the CPU tile — produced using Intel 4 fabrication process (previously known as 7nm). Also, Meteor Lakes will use an all-new integrated GPU (called tGPU for now) featuring the next iteration of Intel’s Xe architecture. Also, these processors will get built-in AI acceleration. Lunar Lake CPU that will feature a tile fabbed using Intel 18A technology and which will come in 2024.(VideoCardZ, Notebook Check, Tom’s Hardware)

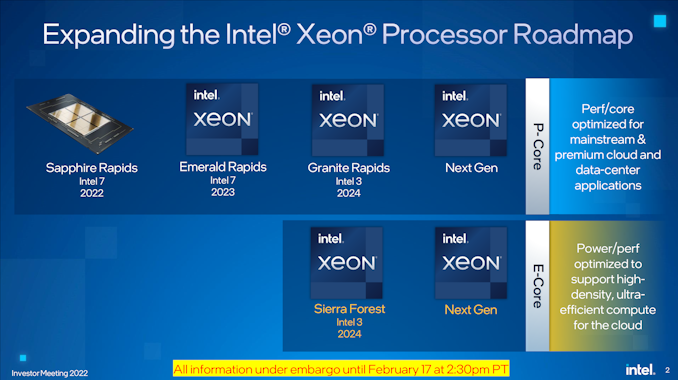

Intel is quoting more shipments of its latest Xeon products in Dec 2021 than AMD shipped in all of 2021, and the company is launching the next generation Sapphire Rapids Xeon Scalable platform later in 2022. Intel has put a large amount of effort into discussing its 4th Generation Xeon Scalable platform, Sapphire Rapids. The launch of Sapphire Rapids is significantly later than originally envisioned several years ago, but we expect to see the hardware widely available during 2022, built on Intel 7 process node technology. After Sapphire Rapids, we will have a platform compatible Emerald Rapids Xeon Scalable product, also built on Intel 7, in 2023. After Emerald Rapids is where Intel’s roadmap takes on a new highway. Starting at the top is Granite Rapids (GNR), built entirely of Intel’s performance cores, on an Intel 3 process node for launch in 2024. (CN Beta, AnandTech)

NEC has announced it has begun trials that involve using quantum computing technology to improve the way maintenance parts are delivered by IT equipment maintenance servicer NEC Fielding. According to NEC, the test involves utilising its vector annealing service and applying it to selected on-site maintenance services to help formulate delivery plans for maintenance parts so that it’s in line with customer engineer (CE) dispatch plans. NEC claims based on trial calculations compared with past parts delivery data, using quantum technology can reduce delivery costs by 30% as it results in a lower number of delivery vehicles and shortens travel distances. (CN Beta, NEC, Bloomberg, ZDNet)

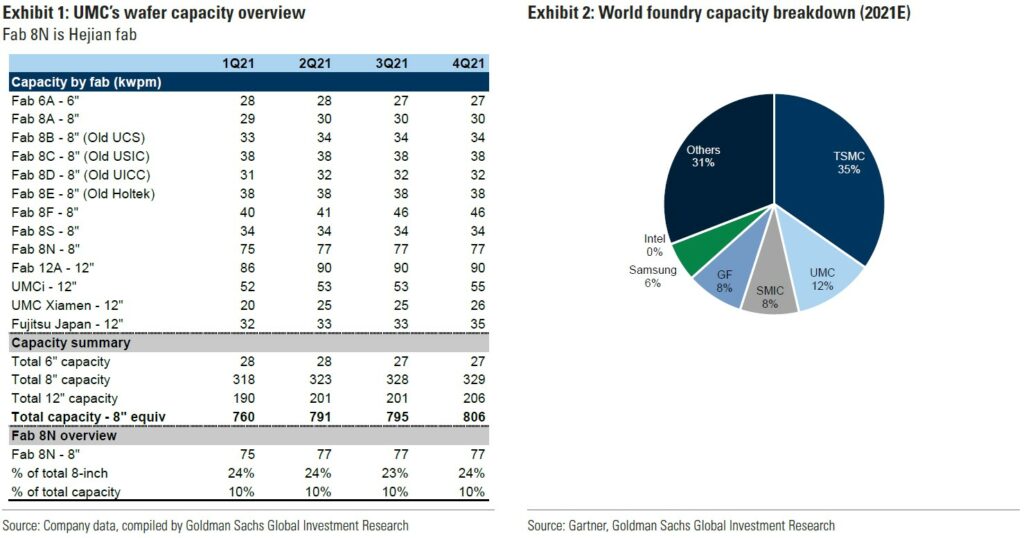

United Microelectronics Corporation (UMC) reported suspension of production at its Hejian 8-inch fab (8N fab) in Suzhou, mainland China, due to a suspected Covid-19 case in mid Feb 2022. The fab is now cooperating with local government to conduct Covid-19 testing. The company sees the production impact as manageable given that the revenue contribution from the Hejian fab is only c.5% of total revenue and maintains its 1Q22 guidance for a 5% QoQ increase in blended ASP with flat wafer shipments and a gross margin of around 40%. The resumption of production depends on the local government’s approval.(Goldman Sachs report, CN Beta, Focus Taiwan, Yicai Global )

BOE is allegedly facing production problems in OLED panels for Apple’s iPhones due to the ongoing global chip shortage. BOE procures display driver ICs for the panels from South Korean chip firm LX Semicon. However, LX Semicon’s production volume is falling short of the planned amount. LX Semicon, due to the lack of production capacity from foundries, is supplying its display driver ICs first to LG Display, its other customer besides BOE. BOE is expected to lower the OLED panel unit production volume up to Mar 2022 by around 2-3M units from the issue. Apple is expected to have ordered up to 10M units of OLED panels for iPhones to BOE for 1H22. BOE has internally aimed to ship over 40M units of OLED panels for iPhones in 2022. It is unlikely that they will meet this target now and its ultimate shipment numbers will more close to 30M units by the end of the year. (The Elec, Apple Insider)

According to IDC, worldwide shipments of foldable phones, inclusive of both flip and fold form factors, reach a total of 7.1M units in 2021. This represents an increase of 264.3% over the 1.9M units shipped in 2020. A new forecast from IDC projects foldable phone shipments will reach 27.6M units in 2025 with a compound annual growth rate (CAGR) of 69.9% from 2020 to 2025. The growth in 2021 can largely be attributed to Samsung’s recent success, as the Korean giant made waves in the market thanks to its newest foldable flagships. (Digital Trends, IDC)

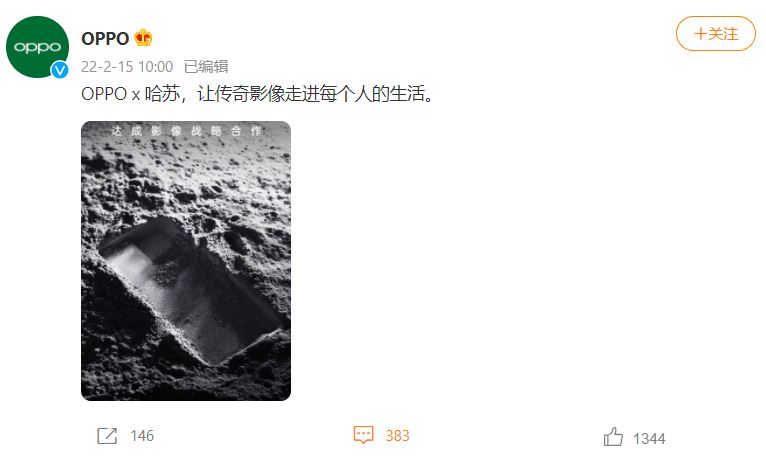

OPPO has officially announced it will collaborate with iconic Swedish photography brand Hasselblad on the imaging system of the upcoming Find X5 series. OPPO’s self-developed MariSilicon X NPU chip will handle image processing and the omni-directional autofocus system.(Gizmo China, GSM Arena, Weibo, Weibo, IT Home)

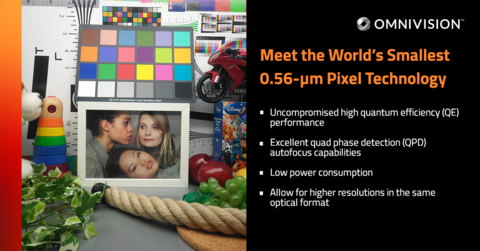

OmniVision has announced a major pixel technology breakthrough―the world’s smallest 0.56-µm pixel with uncompromising high quantum efficiency (QE) performance, excellent quad phase detection (QPD) autofocus capabilities and low power consumption. The 0.56 µm pixel design is enabled by a CMOS image sensor (CIS)-dedicated 28nm process node and 22nm logic process node at TSMC, with a new pixel transistor layout and 2×4 shared pixel architecture. The pixel is based on OmniVision’s PureCel Plus-S stacking technology.(Laoyaoba, OmniVision, Yahoo)

In mid-Feb 2022, Kioxia and Western Digital announced that since late Jan 2022, part of the business of Yokkaichi and Kitakami factories in Japan has been affected by production line pollution, and the contaminated products are concentrated in 3D NAND (BICS) 6.5Exabyte (approximately 6,500M GB) was affected, of which the damaged part accounted for 13% of the group’s production capacity in the first quarter of this year and 3% of the total annual production capacity. The supply chain revealed that after receiving a notification from Micron, the NAND chip contract and spot prices both rose. The contract price rose by 17%-18%, and the spot price was more than 25%. It is currently the manufacturer with the highest price increase. It is estimated that Taiwanese vendors such as Phison, ADATA, Winbond, Macronix will benefit from the surge in quotations. (CN Beta, CSIA, Yahoo, PC Home)

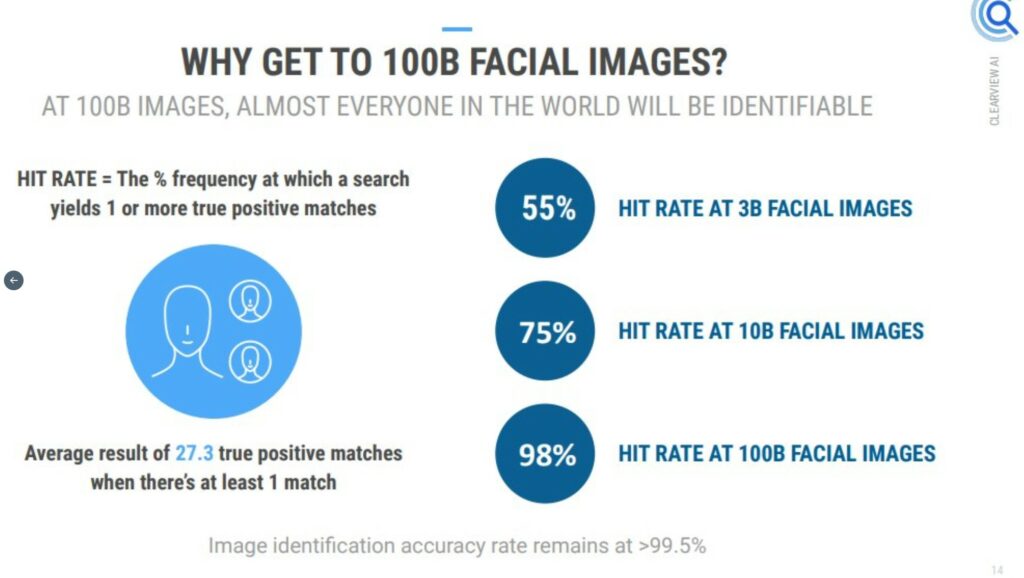

The facial recognition company Clearview AI has indicated that it is on track to have 100B facial photos in its database within a year, enough to ensure “almost everyone in the world will be identifiable”. Those images — equivalent to 14 photos for each of the 7B people on Earth — would help power a surveillance system that has been used for arrests and criminal investigations by thousands of law enforcement and government agencies around the world. With USD50M from investors, the company said, it could bulk up its data collection powers to 100 billion photos, build new products, expand its international sales team and pay more toward lobbying government policymakers to “develop favorable regulation”.(My Drivers, Ars Technica, Washington Post, Twitter)

Xiaomi is reportedly almost ready with the development of a 150W charging solution. With 120W fast charging, the Redmi K50 Gaming Edition can charge in just 17 minutes, so 150W would likely offer even shorter charge times. (Gizmo China, GSM Arena, My Drivers)

Tesla has said that non-Tesla owners can charge their electric vehicles at all Supercharger stations in the Netherlands. The announcement marks an expansion of a pilot program that kicked off in Nov 2021 with 10 stations. CEO Elon Musk had initially expressed interest in opening up the Supercharger network to other EVs in the summer of the same year. Unlike other automakers, Tesla operates an expansive proprietary network that has previously prevented EVs from other automakers from using the chargers. The network, which Tesla began building in 2012, now numbers 30,000 Supercharging stations globally.(TechCrunch, Tesla)

LG Energy Solution (LGES), the battery-making wing of LG Group, secured a firm foothold to expand energy storage system capabilities by fully acquiring NEC Energy Solutions, a Massachusetts-based battery integrator. The acquisition underlines efforts to provide integrated energy storage systems instead of simply supplying batteries.With the acquisition, the Korean battery company said it will establish LG Energy Solution Vertech, which will oversee the company’s ESS system integration business. (CN Beta, UPI, Korea JoongAng Daily)

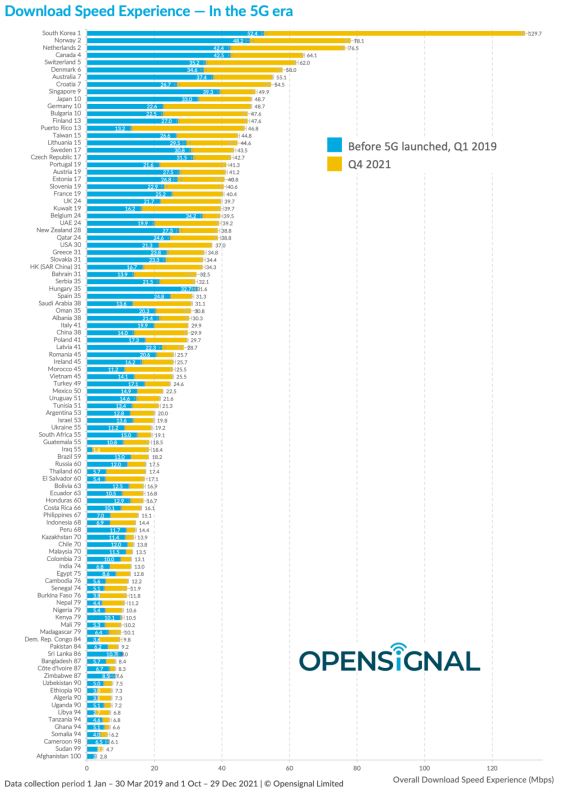

OpenSignal shows that data speeds are up globally thanks to the widespread rollout of 5G, which began in late 2019. Download speeds have increased notably in South Korea. Prior to 5G launching, South Korean users averaged 52.4 Mbps but now average 129.7 Mbps. These speed increases have resulted in South Korea being listed as the best place to play online games based on internet speed. Users in Canada have also seen a notable speed boost, rising from 42.5 Mbps to 64.1 Mbps on average. Users in the U.K. saw an increase from 21.7 Mbps to 39.7 Mbps, while those in the U.S. also saw a modest increase from 21.3 Mbps to 37 Mbps. (Apple Insider, OpenSignal, report)

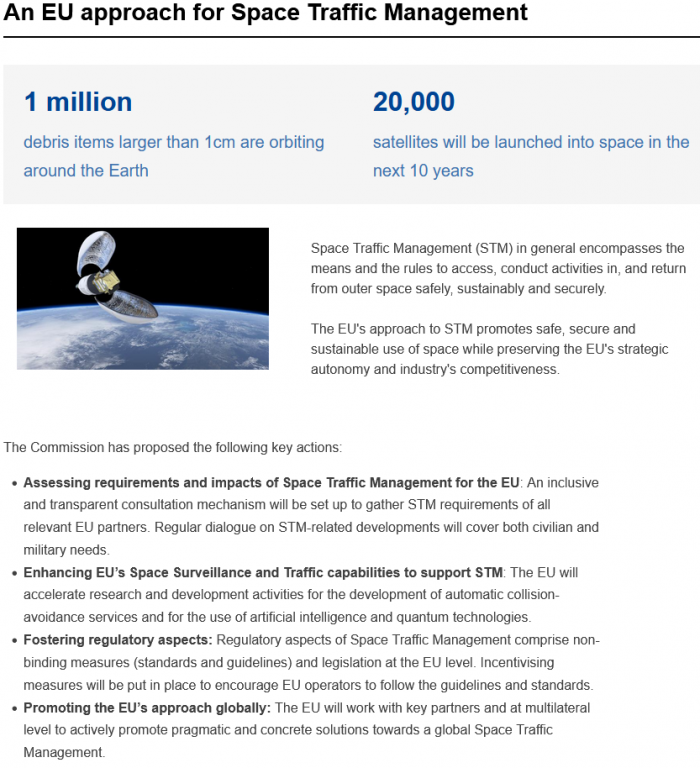

The European Commission has set out a EUR6B (USD6.8B) satellite communications plan, part of a push to cut the European Union’s dependence on foreign companies and protect key communications services and surveillance data against any outside interference. The EU proposal aims to build and operate a space-based state-of-the-art connectivity system, help to counter cyber and electromagnetic threats and improve the resilience of EU telecommunication infrastructures. The EUR6B cost will be funded by a EUR2.4B contribution from the EU from 2022 until 2027, the EU budget, EU countries, the European Space Agency and private investments. (CN Beta, Europa, Reuters, Xinhuanet, Nasdaq)

Anthony Chavez, vice president of product management for Android security and privacy, has announced that a “privacy sandbox” will be built on the Android system to introduce newer, more private advertising solutions. These solutions limit the sharing of user information with third parties and can operate without cross-app identification, including advertising IDs. The goal of building a privacy sandbox on Android is to develop effective and privacy-enhancing advertising solutions.(GizChina, Google, The Verge, IT Home, CN Beta)

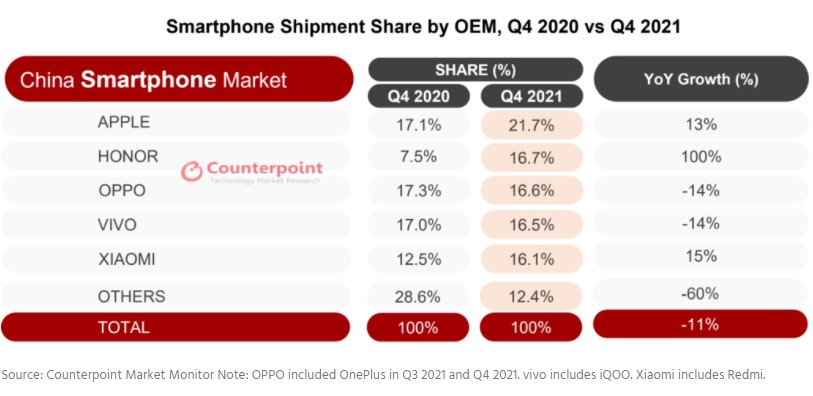

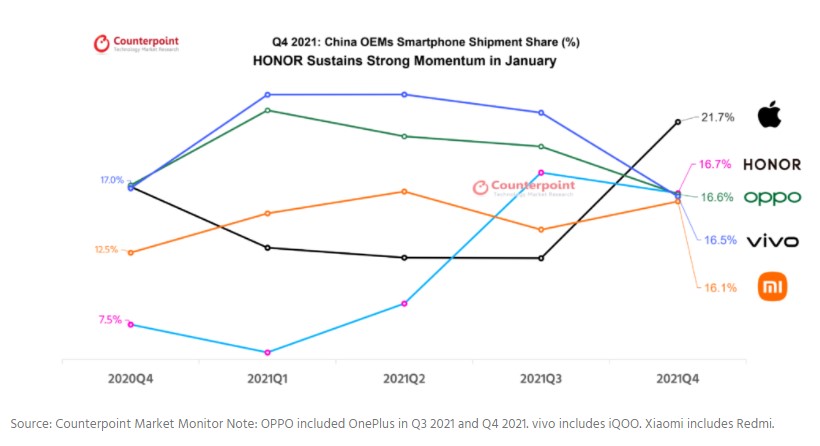

China’s smartphone shipments dropped 11% YoY in 4Q21, according to Counterpoint Research. Honor increased its market share by more than 2 times from a year ago to become China’s second-biggest OEM for the first time after becoming an independent company. Both Apple and Honor have delivered surprises to the upside and continued the trend of a constantly changing competitive landscape. (GSM Arena, Counterpoint Research)

Jio Platforms is investing USD200M in Glance, which serves media content, news and casual games on Android handsets’ lockscreen, the latest in a series of bets from Mukesh Ambani’s empire as it looks to expand its offering to more than 420M telecom subscribers it reaches in the South Asian market. The new investment values Google-backed Glance at about USD1.7B. Founded in 2019, Glance ships pre-installed on several popular smartphone models and has amassed “presence” on 400M users.(TechCrunch, India Times, Business Standards)

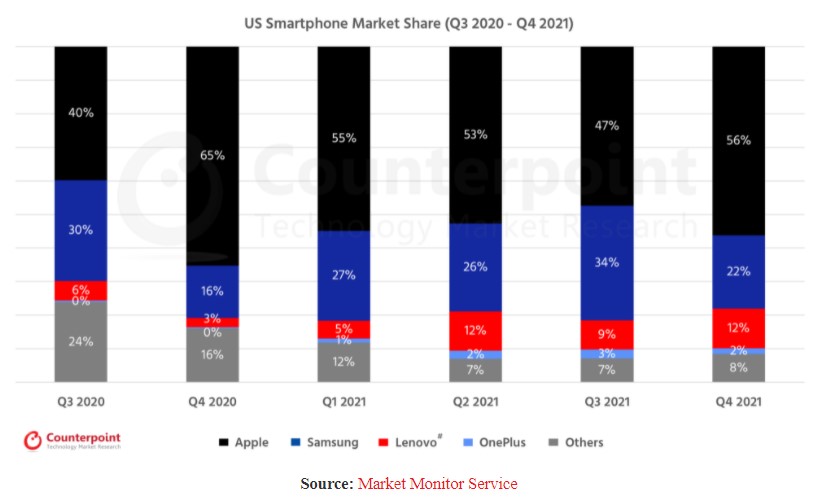

According to Counterpoint Research, smartphone shipments grew 10% YoY and 30% QoQ in 4Q21 as the new Apple iPhone 13 launched, filling channels with its latest premium devices for the holiday season. In the premium segment, although Apple grew 67% QoQ due to the new launch, Samsung declined -11% QoQ as it could not replenish its Galaxy S21 series fast enough which also resulted in a decline in market share, down to 22%. Lenovo (Motorola) once again grew to 12% market share with the help of devices such as the Moto G Pure, which is the first major MediaTek device for the OEM in the US market. (Laoyaoba, Counterpoint Research)

OnePlus Nord CE 2 5G is launched – 6.43” 1080×2400 FHD+ HiD AMOLED 90Hz, MediaTek Dimensity 900 5G, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 6+128 / 8+128GB, Android 11.0, fingerprint on display, 4500mAh 65W, starts from EUR349 / GBP299 / INR23,999. (Android Headlines, GSM Arena, The Verge)

OPPO A76 is launched in Malaysia – 6.56” 720×1612 HD+ v-notch 90Hz, Qualcomm Snapdragon 680, rear dual 13MP-2MP depth + front 8MP, 6+128GB, Android 11.0, side fingerprint, 5000mAh 33W, MYR899 (USD215). (GSM Arena, OPPO)

According to IDC, in 4Q21, China’s tablet market shipped approximately 7.42M units, a YoY increase of 20.9%. In 2021, China’s tablet market shipments are approximately 28.46M units, a YoY increase of 21.8%, the highest growth rate in the past seven years. Global tablet shipments in 4Q21 fell 11.9% YoY to 45.54M units due to slowing demand. For the full year of 2021, total global tablet shipments increased by 2.9% YoY to 168M units, the highest level since 2016. (IDC, CN Beta)

Google has announced Chrome OS Flex, an early preview of a new initiative that aims to bring Chrome OS to virtually any PC (and older Intel-based Macs). Built on top of CloudReady, which Google acquired in 2020, Chrome OS Flex is aimed at enterprises and educational users who want to prolong the lifetime of their existing devices, but anyone with access to a USB drive can use it to give an older PC — or maybe even a low-powered new one — a new lease on life. The idea here is to bring the full Chrome OS experience to virtually any computer.(TechCrunch, Google)

Horizon is Meta’s brand for its suite of “metaverse” social VR apps: Horizon Worlds, Horizon Workrooms, Horizon Venues, and the soon-to-launch Horizon Home. Each uses user’s Meta Avatar and each requires an active Facebook account for access. Horizon Worlds & Horizon Venues combined reportedly have 300,000 monthly active users (MAU).(The Verge, UploadVR)

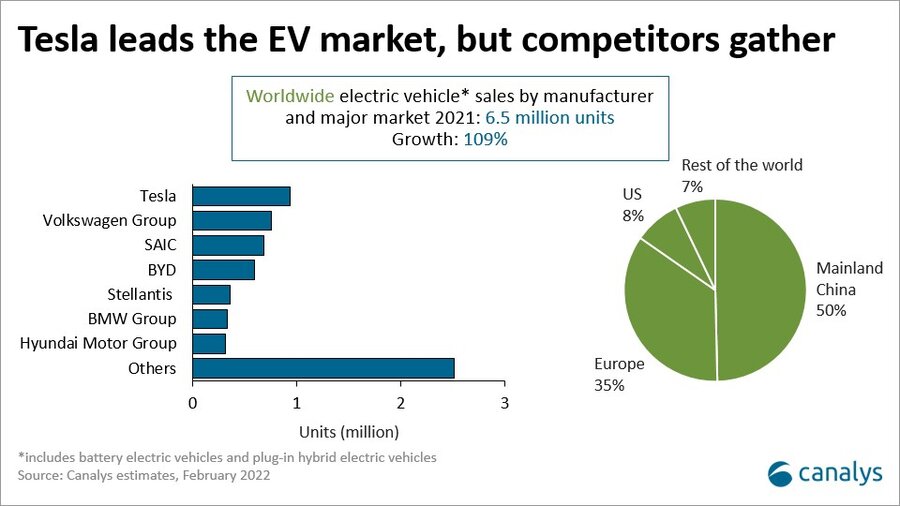

Canalys estimates that 6.5M electric vehicles (EVs) were sold worldwide in 2021, up 109% on 2020. EVs include fully electric and plug-in hybrid passenger cars. The total global car market grew just 4% in 2021 as it continued to struggle with COVID-19 restrictions and chip shortages. EV sales represented 9% of all passenger car sales in 2021. 85% of EVs sold globally were delivered to customers in Mainland China and Europe. 3.2M EVs were sold in 2021 in Mainland China, accounting for 15% of all new cars sold. 2.3M EVs were sold in Europe, accounting for 19% of new cars. In comparison, while demand is growing, just 4% of new cars sold in the US in 2021 were EVs, some 535,000 units. (Canalys, Laoyaoba)

The autonomous vehicle subsidy of General Motors (GM), Cruise senior government affairs manager Carter Stern has revealed that Cruise plans to expand the self-driving delivery pilot it has with Walmart in Arizona. Cruise is mostly focused on testing — and eventually launching — a commercial robotaxi service in California. But Cruise also has a small fleet of electric autonomous Chevy Bolts in Arizona as part of a limited pilot program with Walmart. That pilot involves just one Walmart store located on Salt River Pima-Maricopa Indian Community lands near Scottsdale. The autonomous vehicles all have human safety operators behind the wheel. The company plans to expand to as many as eight Walmart stores in 2022.(CN Beta, Yahoo, TechCrunch)

German carmaker Volkswagen is allegedly in talks with Huawei for a possible acquisition of the tech company’s autonomous vehicle unit. Huawei’s autonomous unit sits under the telecom equipment and smartphone behemoth’s “smart vehicle solution” business unit, which started only in 2019. (Gizmo China, Reuters, TechCrunch, Auto News, Manager-Magazin, Sina)

Amazon has reached a global agreement with Visa to settle a dispute over the credit card giant’s fees. The deal means Amazon customers in the U.K. can continue using Visa credit cards, as previously announced by the two companies. Amazon will also drop a 0.5% surcharge on Visa credit card transactions in Singapore and Australia, which it introduced last year. In Jan 2022, Amazon said it had dropped plans to stop accepting Visa credit cards in Britain, two days before the change was expected to take place. The companies said at the time that they would continue talks on a broader resolution to their spat. (CN Beta, Reuters, CNBC, BBC)

T. Rabi Sankar, deputy governor of Reserve Bank of India (RBI), has indicated that cryptocurrencies have been “specifically developed to bypass the regulated financial system”, and are not backed by any underlying cash flow. He has compared cryptocurrency to a “Ponzi scheme” and suggested an outright ban in its sharpest criticism after the government proposed taxation of the virtual digital asset and paved way to recognize it as legal tender in the world’s second-largest internet market. The nation’s Finance Minister Nirmala Sitharaman proposed taxing income accrued from transfer of cryptocurrencies and NFTs in the federal budget early Feb 2022. (TechCrunch, India Today, Bloomberg Quint)