3-12 #NoFreedom : BOE is allegedly in talks with Honor to make a two-stack tandem OLED panel; Samsung is pondering how to reorganize its TV lineup; LG Electronics is reportedly planning to license out its patents; etc.

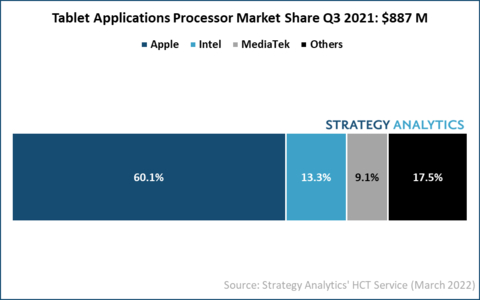

According to Strategy Analytics, Apple, Intel, MediaTek, Qualcomm and Samsung LSI captured the top-five tablet AP revenue share rankings in 3Q21. Apple maintained its tablet AP market share leadership with a 60% revenue share, followed by Intel with 13% and MediaTek with 10%. The X86-based tablets accounted for 12% of total tablet APs shipped in 3Q21. Cellular-integrated APs (3G/4G/5G) accounted for one-third of tablet AP shipments. Tablet AP ASPs grew 25% YoY, driven by an increased mix of premium APs and supply constraints. (Strategy Analytics, CN Beta)

Ouster, provider of high-resolution digital lidar sensors, has announced the introduction of the Chronos chip, an automotive-grade, fully custom digital lidar silicon receiver that will power its DF solid-state sensor suite. The state-of-the-art Chronos chip is the foundation of the DF architecture and enables Ouster to deliver more performant, power efficient, and compact digital lidar sensors that enable L2 to L5 automation in high-volume automotive series production vehicles.(Laoyaoba, Barron’s, Bloomberg, Business Wire)

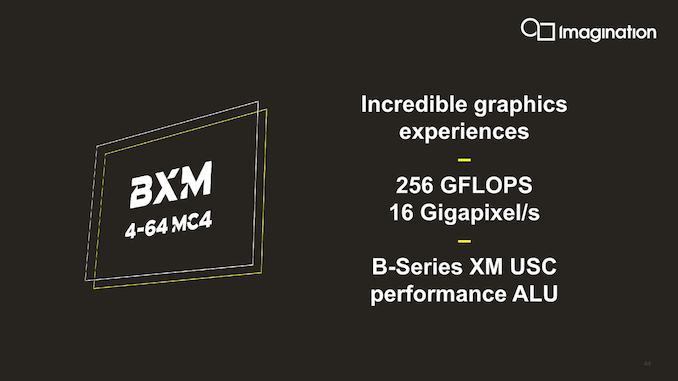

Imagination Technologies announces that its IMG B-Series BXE-4-32 GPU, with IMGIC image compression technology, has been integrated into Realtek’s latest System-on-Chip (SoC), RTD2885N, and is currently shipping into significant digital television (DTV) worldwide brands. The IP has been previously licensed by Realtek in 2021, continuing a long-established, innovation-driven collaboration between the two companies. (Laoyaoba, 12Chip, Imagination, New Electronics, Sina, AnandTech)

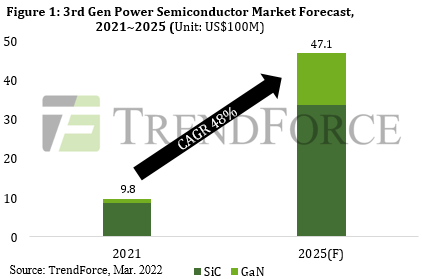

At present, the materials with the most development potential are Wide Band Gap (WBG) semiconductors with high power and high frequency characteristics, including silicon carbide (SiC) and gallium nitride (GaN), which are mainly used in electric vehicles (EV) and the fast charging battery market. TrendForce estimates, the output value of third generation power semiconductors will grow from USD980M in 2021 to USD4.71B in 2025, with a CAGR of 48%. SiC is suitable for high-power applications, such as energy storage, wind power, solar energy, EVs, new energy vehicles (NEV) and other industries that utilize highly demanding battery systems. Among these industries, EVs have attracted a great deal of attention from the market. However, most of the power semiconductors used in EVs currently on the market are Si base materials, such as Si IGBT and Si MOSFET. However, as EV battery power systems gradually develop to voltage levels greater than 800V, compared with Si, SiC will produce better performance in high-voltage systems. SiC is expected to gradually replace part of the Si base design, greatly improve vehicle performance, and optimize vehicle architecture. The SiC power semiconductor market is estimated to reach USD3.39B by 2025. (TrendForce, TrendForce, CN Beta)

About 56% of semiconductor industry leaders expect the chip shortage that has plagued us during the pandemic to last into 2023, according to KPMG. Because of this expectation, the confidence about growing global semiconductor revenues is at an all-time high. 95% of respondents have said they believe revenue at their companies will grow over 2023 with 34% expecting growth of 20% or more. (KPMG, report, VentureBeat)

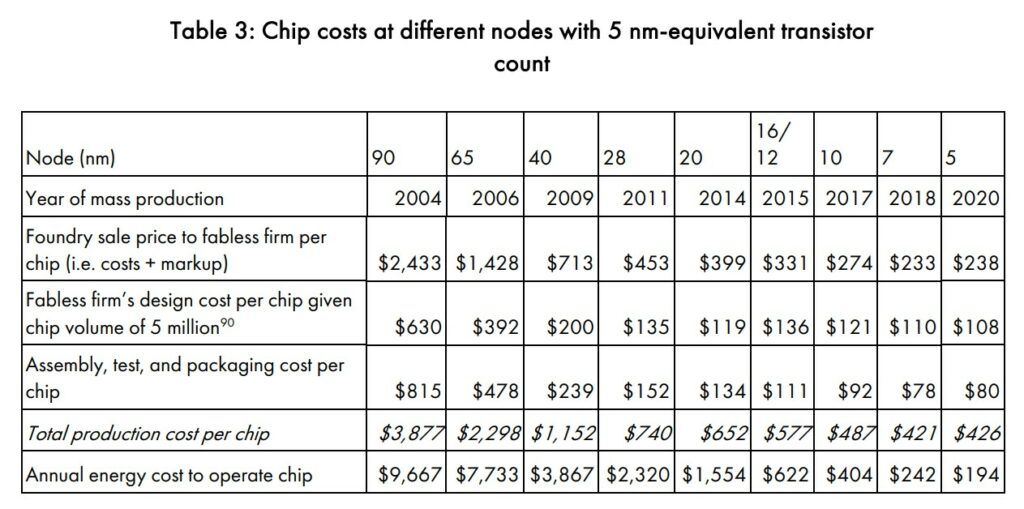

According to The Center for Security and Emerging Technologies (CSET) model, a single 300 mm wafer built on the 5nm node costs approximately USD16,988. A similar wafer built on the 7nm node reportedly costs USD9,346. Using a theoretical ~600 mm2 die, approximately equal in size to the Nvidia GA102 GPU used inside the RTX 3080 and RTX 3090, the per-chip costs of each die were calculated to be USD233 and USD238, for the 7nm and 5nm nodes, respectively. The foundry sale price per wafer is calculated as the sum of the “other costs and mark-up per wafer” and the “capital consumed per wafer processed in 2020”, or in other words, the sum of the profit margins, assembly cost, and estimated development cost. (TechSpot, CSET, CSET, CN Beta)

BOE is allegedly in talks with smartphone brand Honor to manufacture a two-stack tandem OLED panel to apply to a smartphone planned for later in 2022. The pair believe that the use of the technology, where the OLED panel has two emission layers, can reduce the power consumption of the smartphone by approximately 30%. This means the smartphone can use a smaller battery that will allow the phone to be designed thinner. Honor also wanted the two-stack tandem OLED panel to have low-temperature polycrystalline oxide (LTPO) thin-film transistor (TFT) technology. But BOE had rejected the application of LTPO TFT, opting to have the panel use low-temperature polycrystalline silicon (LTPS) TFT that it already mass produces. The decision not to apply LTPO TFT is likely due to technology only contributing to around 5% to 10% reduction in power consumption, when two-stack tandem will be already be reducing 30% by BOE’s estimation.(CN Beta, The Elec)

Samsung Electronics’ negotiations on OLED panels with LG Display are stuttering as the two companies are failing to narrow their differences on prices. The two companies are having a tug-of-war on prices. Samsung Electronics wants to purchase OLED panels from LG Display at prices which are lower than those for LG Electronics, but understandably, this is a demand that LG Display cannot accept. Samsung Electronics is pondering how to reorganize its TV lineup. The company is expected to place micro LED TVs at the top of its lineup, with mini LED TVs (Neo QLED TVs) coming next and then OLED TVs. If the company adopts this lineup, it should bring down the OLED panel prices as much as possible. Samsung’s launch of QD-OLED TVs, which is originally slated for 1H22, may also be delayed. Samsung Display started volume production of QD displays in Nov 2021, but the yield is not stabilized yet. Samsung Display’s QD-OLED panel production capacity is 1M panels per year. But in light of its low yield, industry insiders say it will be able to produce 500K-600K units annually. (CN Beta, Business Korea)

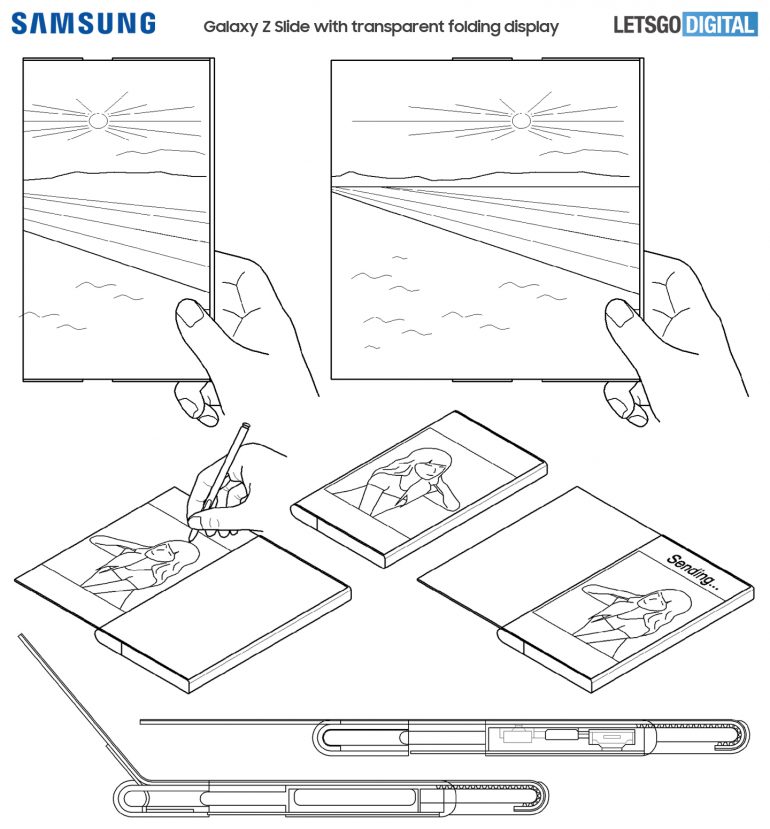

Samsung Electronics has filed a patent with the WIPO (World Intellectual Property Office) for a “slidable electronic apparatus and method for using transparent display in said electronic apparatus”. It describes a smartphone-like device with a large the display area that can be extended all the way to the back. The patent describes the technology that is needed to make a transparent smartphone and can even be used in other electronic gadgets as well, including TVs, monitors, laptops and gaming consoles. The device seen in the patent has narrow bezels and a large transparent screen and an OLED panel is apparently used.(CN Beta, LetsGoDigital, News18, Techeblog)

TF Securities analyst Ming-Chi Kuo now expects Apple will not release a revised Mac mini until 2023, instead of the 2022 that he previously predicted. He has updated predictions for Apple’s major hardware releases in 2022 and 2023. (Laoyaoba, CN Beta, Apple Insider, Twitter, MacTrast)

BOE is listed as a major panel supplier in Samsung Electronics’ business report. BOE has filled the vacancy created by Samsung Display’s phased reduction of large LCD panels for TVs. The business report, which was registered with the Financial Supervisory Service’s electronic disclosure system, listed 3 major display panel suppliers for the company’s consumer electronics (CE) sector in 2021 — BOE and CSOT and AUO. BOE is newly added as a major supplier. BOE surpassed LG Display in 2018 to become the world’s No. 1 LCD manufacturer. Samsung Display decided in early 2021 to stop producing large LCD panels beginning from 2022. The decision was made to speed up its transition to next-generation QD-OLED panels as the profitability of the LCD business fell significantly due to a price war with Chinese companies. (CN Beta, Business Korea)

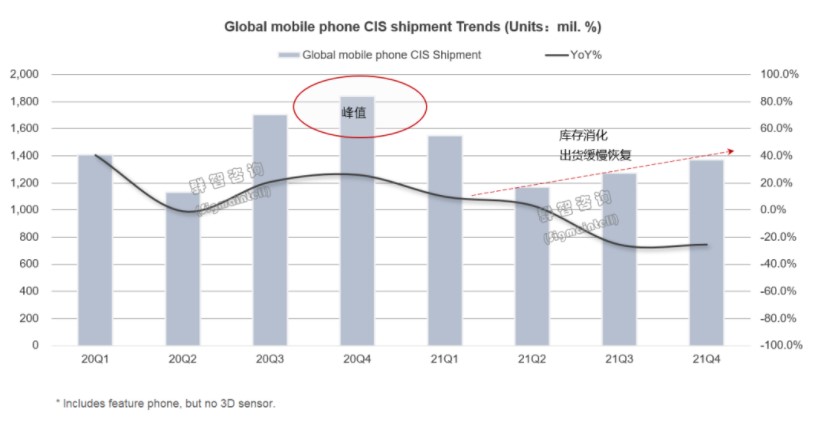

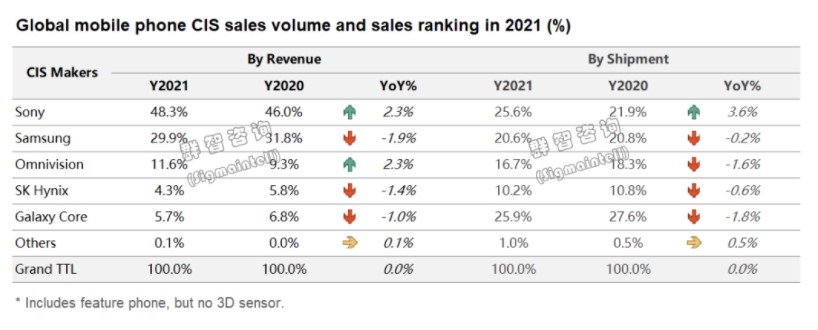

According to Sigmaintell, the global mobile phone image sensor shipments in 2021 will be approximately 5.37B units, a YoY decrease of about 11.8%; among which, the global mobile phone image sensor shipments in 4Q21 will be about 1.37B units, a YoY decrease. About 25.3%. At the same time, it is estimated that the global mobile phone image sensor shipments will be about 5.50B in 2022, a year-on-year increase of about 2.5%. In 1H21, due to the long ramp-up cycle of ultra-high pixel production capacity and the squeeze of low-end pixel production capacity by other applications, there was a short-term structural imbalance and market price fluctuations rose. In 2H21, the production capacity of Samsung and Sony’s external foundries was released steadily and significantly, but the sales in the terminal market were lower than expected and the stocking plan was lowered again, resulting in an oversupply in the overall image sensor market. (Sigmaintel)

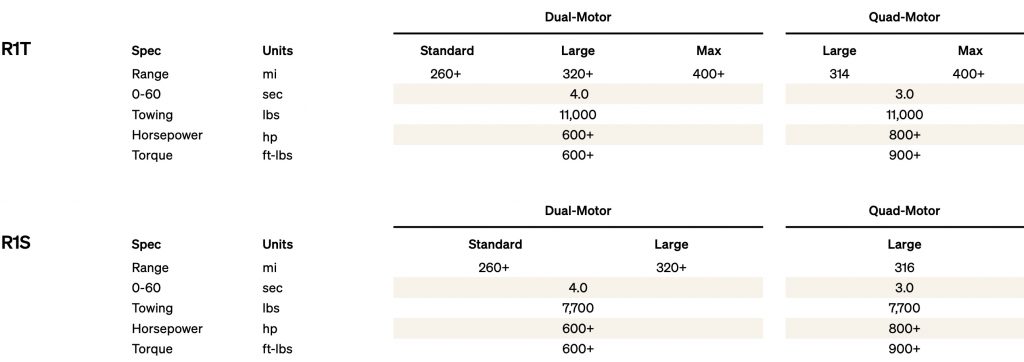

Rivian has announced that it developed a new pack architecture using Lithium-Iron-Phosphate (LFP) cells. Rivian is expanding its cell and pack technology by including high-nickel and LFP cells. The company believes that including more battery chemistries would expand its available supply while reducing costs. The Illinois-based EV manufacturer plans to use the LFP cells in its Standard battery packs and the Rivian Commercial Van (RCV) — otherwise known as the all-electric Amazon delivery van. Rivian believes commercial customers will see similar daily range capabilities with LFP chemistry while providing significant cost savings for the company. (CN Beta, CNBC, Teslarati)

Tesla CEO Elon Musk wants to make cheaper batteries fast. The stakes are high. Prices of battery ingredients like nickel hit records this week on supply fears stemming from the Russia-Ukraine conflict, and Musk in Jan 2022 forecast battery supply constraints in 2022, making in-house production a key to growth. He says making the batteries at scale will be very difficult, but they are critical to his goal of building less expensive, longer-range electric cars that will keep Tesla ahead of a growing pack of competitors. Tesla sources battery cells from suppliers like Panasonic, CATL and LG Energy Solution. In late 2020, Musk announced that Tesla aims to halve the costs of the most expensive part of an EV by producing its own batteries. Tesla faces a lengthy process in ramping up a battery factory, complicated by plans to use a new manufacturing technology called dry electrode coating. Gene Munster, managing partner at venture capital firm Loup Ventures, believes that Tesla will probably fall short of the ramp-up of 4680 over 2023. Munster sees Tesla beating its targets longer-term, but starting off slowly, given its history of new-model production. (CN Beta, Teslarati, Reuters)

Northvolt and Stora Enso have recently signed a letter of intent on a purchase of the Kvarnsveden Mill and the surrounding industrial area in Borlänge, Sweden. Northvolt will develop the site into a manufacturing plant for active material and battery cells, reusing and refurbishing much of the existing facilities and site infrastructure.The factory is expected to start the first part of its operations in late 2024, utilizing 100% clean energy from the region. Fully built out, the site will have a potential annual production capacity of more than 100 GWh of cathode material, which will enable cell assembly at multiple Northvolt facilities. The site will also feature cell production. (CN Beta, InsideEVs, Green Car Congress, Northvolt)

British luxury carmaker Aston Martin has signed a memorandum of understanding with lithium-ion battery cell technologies company Britishvolt. The companies will work together toward developing battery cell technology designed for high-performance cars. Aston Martin plans to launch its first battery-electric vehicle in 2025, which is expected to be a direct replacement of one of the automaker’s current sports cars. The automaker also aims to provide an electrified powertrain option to all new product lines by 2026, with a target of displaying a fully electrified core portfolio by 2030. (CN Beta, TechCrunch, Green Car Reports, CNBC)

Samsung is ramping up its gender-friendly credentials with the announcement that it has opened its first mobile store in India that is fully staffed by females. The new Samsung mobile store is located in Ahmedabad and is aimed at shoring up Samsung’s market share in the sub-continent by promoting the strength of Indian women. Support for the staff comes in the form of the Employee Resource Group (ERG) and Women in Samsung Electronics (WISE) to help the women grow both professionally and in their personal lives. (Gizmo China, Samsung, The Mobile Indian)

LG Electronics is reportedly planning to license out its patents related to smartphone and mobile technologies. LG Electronics holds some 20,000 patents related 4G, 5G, Wi-Fi and other mobile technologies, which is costing it KRW20B per year to maintain. The company has announced that it plans to start patent licensing operations. Prior to exiting the smartphone business, many companies have shown interest in purchasing related patents from LG Electronics, including Germany’s Volkswagen and other conglomerates. (Andriod Central, Digital Trends, The Elec)

The social media TikTok has announced the launch of SoundOn, its all-in-one platform for music marketing and distribution. According to TikTok, SoundOn is its own promotion and music distribution platform, which will enable artists to “grow their fanbases, harness their creative voices, and get their music heard worldwide”. (Phone Arena, TikTok, TechCrunch)

realme 9 5G and 9 5G SE are launched in India:

- realme 9 5G – 6.5” 1080×2400 FHD+ HiD 90Hz, MediaTek Dimensity 810 5G, rear tri 48MP-2MP macro-2MP depth + front 16MP, 4+64 / 6+128GB, Android 11.0, side fingerprint, 5000mAh 18W, INR14,999 (USD195) / INR17,499 (USD228).

- realme 9 5G SE – 6.6” 1080×2412 FHD+ HiD 144Hz, Qualcomm Snapdragon 778G 5G, rear tri 48MP-2MP macro-2MP depth + front 16MP, 6+128 / 8+128GB, Android 11.0, side fingerprint, 5000mAh 30W, INR19,999 (USD261) / INR22,999 (USD300).

(GSM Arena, GizChina, 91Mobiles)

Honor X8 is official – 6.7” 1080×2388 FHD+ HiD 90Hz, Qualcomm Snapdragon 680 4G, rear quad 64MP-5MP ultrawide-2MP macro-2MP depth + front 16MP, 6+128GB, Android 11.0, side fingerprint, 4000mAh 22.5W, price not yet announced. (GizChina, GSM Arena, Honor)

Google’s CTO of tablets Rich Miner has claimed that tablets could be set for a major comeback, with the handheld devices better suited for work and productivity tasks. He believes that tablets started to be much better for things beyond consumption and were being used for creativity and productivity. He believes there is going to be a “crossover point” at some point in the near future where tablets would surpass laptop sales. To prepare for the future, Google will encourage developers to develop new tablet-first apps. In addition, citing 2020 sales data, he has said that tablet purchases have begun to approach shipments of laptops.(CN Beta, Android Central, The Verge, TechRadar, 9to5Google)

Magic Leap is showcasing its next-generation AR glasses, dubbed Magic Leap 2 (ML2). The new AR glasses aim to deliver a number of improvements over the previous iteration. Specifically, the new glasses offer a smaller profile, a wider field of view, and an interesting new mechanism to make the AR elements appear more crisp even when the glasses are used outdoors. The glasses is powered by Nvidia-based silicon, and feature Liquid crystal on silicon (LCoS) displays that help project holographic images into the viewer’s surroundings.(VentureBeat, Protocol, Magic Leap, Tom’s Guide)

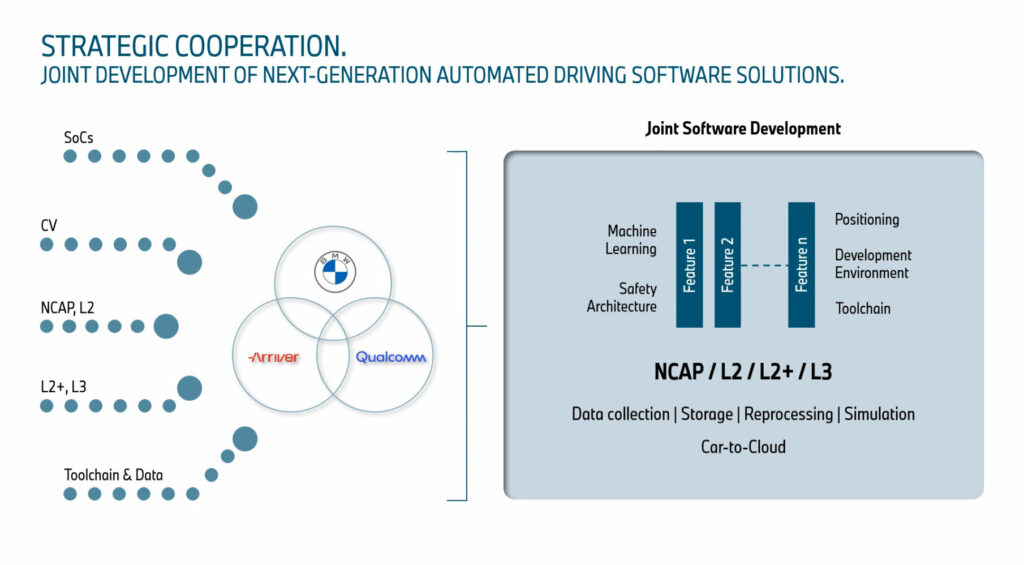

BMW Group, Qualcomm and Arriver Software AB have announced a long-term development cooperation for the development of Automated Driving (AD) technologies. The companies signed an agreement for a strategic cooperation, which will focus on joint development of next-generation AD technologies ranging from New Car Assessment Program (NCAP), Level 2 Advanced Driving Assistance Systems to Level 3 High Automated Driving functionalities. The co-development of software functions is based on the current BMW Automated Driving software stack first launched with the BMW iX in 2021, which will be further extended in the next generation through this cooperation.(GizChina, Auto Futures, PR Newswire)

BMW has acquired tuning outfit Alpina, 60 years after the Buchloe-based brand produced its first uprated component for a production BMW model. ALPINA will also build four major brands together with BMW Group’s existing BMW, MINI and Rolls-Royce Rolls-Royce. ALPINA is an automobile production company located in Bavaria, Germany. It is usually regarded as a tuner for BMW models, but Alpina is actually certified by TÜV as a car manufacturer, so ALPINA is also regarded as one of the smallest car manufacturers in Germany.(Laoyaoba, CN Beta, Auto Car, Alpina, Motor1)

Zeva Aero, a Washington-based startup whose prototype vehicle has recently had a successful full-scale vertical takeoff. The unique aircraft is designed to hit speeds of 160 mph and has a range of 50 miles. As it can take off and land vertically, no airstrip is required, making it ideal for trips to and from urban centers. The battery-powered Zeva Zero will next be tested for forward flight. Zeva Aero aims to ultimately put a sustainable air vehicle in every garage. The likely price tag of around USD250K excludes most commuters for now. (Digital Trends, Reuters)

Kia has announced an electrification roadmap, promising to have 14 fully electric models by 2027 and sales of 1.2M EVs by 2030. It also revealed that its EV9 SUV, unveiled in concept form in Nov 2021, will be the first to use autonomous driving tech it calls “Automode”. Kia’s road map builds on its “Plan S” development strategy announced early in 2021 that included new branding and a plan to introduce seven EVs by 2027. Now, the company plans to double that with 14 BEV (battery electric vehicle) models available by 2027 and total EV sales of 1.2M by 2030. It also projects to sell 4M vehicles annually by 2030, so EVs would make up just over a quarter of that — while automakers like Mercedes-Benz plan to only sell BEVs by 2030. Automode is “a range of autonomous driving technologies” that will include a “Highway Driving Pilot” feature that works by itself without driver intervention on highway sections.(CN Beta, Yahoo, Pocket-Lint, InsideEVs, TechCrunch)