3-23 #MU5375 : ASML has said shortage of critical equipment over the next 2 years; Foxconn is reportedly planning to build a new USD9B facility in Saudi Arabia; Xiaomi will maintain its initial schedule of entering mass production in 1H24; etc.

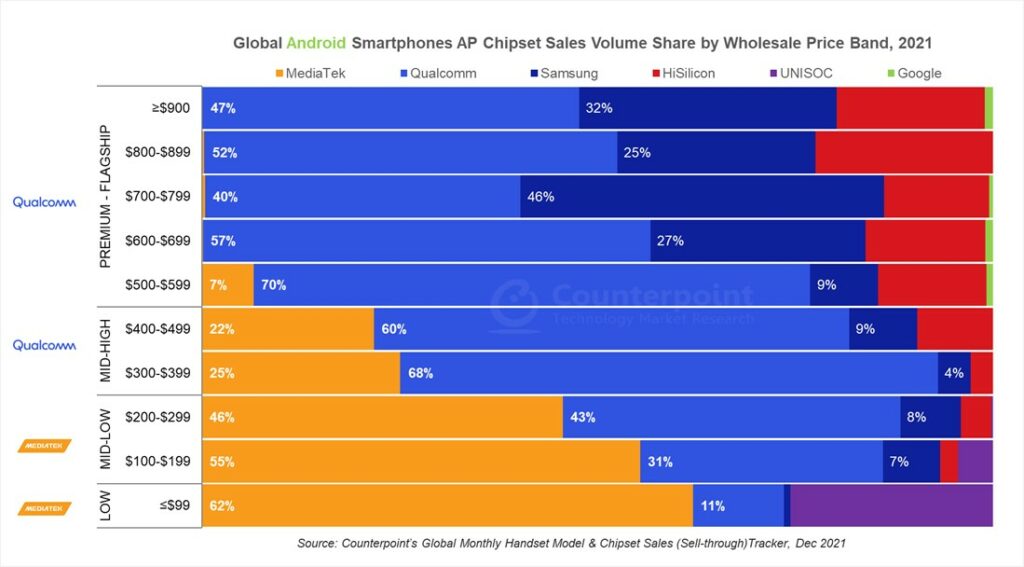

The global Android smartphone AP (Application Processor) / SoC (System on Chip) sales grew 3.6% YoY in 2021, according to Counterpoint Research. MediaTek led the Android smartphone SoC market in 2021 with a 46% share, followed by Qualcomm with 35%. Most of the market share growth for MediaTek in 2021 came from the low-mid tier wholesale price segment (sub-USD299), driven by strong demand for the Dimensity 700 / 800 series chipsets. Qualcomm struggled with a tight supply throughout the year for its mid-tier solutions. The shift in focus away from 4G SoCs also didn’t help. However, in the high value USD300+ segment, Qualcomm continued to dominate with its Snapdragon 7 and 8 series. The number of design wins for Qualcomm in the USD399+ Android smartphones continued to climb not only for chipsets (AP/SoC) but also for RFFE (RF Front End) components, allowing it to capture a higher BoM (Bill of Materials) share and boost both its top and bottom lines. (Gizmo China, Counterpoint Research)

Qualcomm has revealed that it is collaborating with Square Enix on a new project. The two companies will create extended and mixed-reality gaming experiences on the Snapdragon Spaces developer platform. Based on the way the company described the collaboration, it seems Qualcomm will be making an extended reality (XR) experience for Square Enix’s intellectual property. Square Enix’s Advanced Technology Division will work on the Snapdragon Spaces XR developer platform. Qualcomm has continued its foray into the metaverse by establishing a USD100M fund that will be used to back developers and companies building extended reality (XR) experiences, as well as associated AR and AI technologies.(VentureBeat, RoadToVR, ZDNet, Qualcomm)

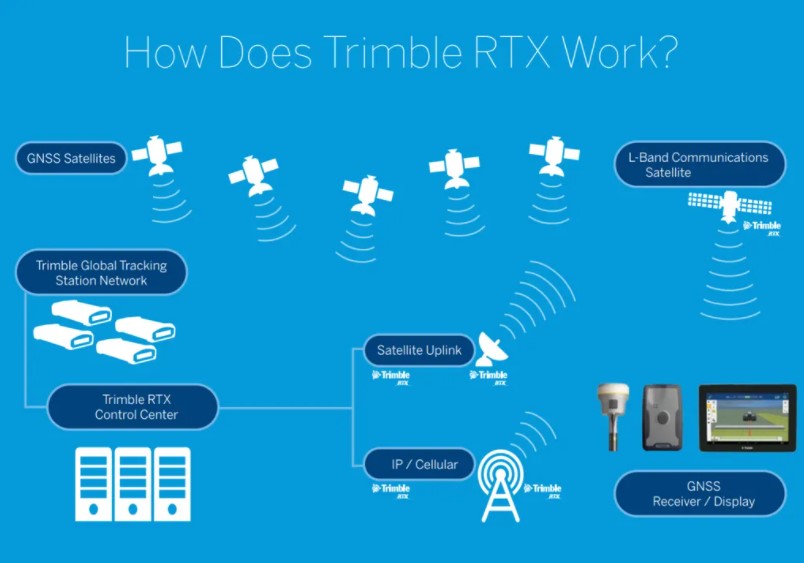

Trimble and Qualcomm have announced today the availability of Trimble RTX GNSS technology for Snapdragon 8 Gen 1 and Snapdragon 888 Mobile Platforms. This technology enables superior location capabilities in premium Android smartphones worldwide. The integration of Trimble RTX GNSS technology, a correction services platform, with Snapdragon contributes to a higher quality, more accurate location-based user experiences—such as car navigation with lane-level guidance.(CN Beta, GizChina, GSM Arena, PR Newswire)

Peter Wennink, chief executive of ASML, has indicated that chipmakers’ multibillion-dollar expansion plans will be constrained by a shortage of critical equipment over the next 2 years as the supply chain struggles to step up production. He has said that in 2023 and 2024 there will be shortages. ASML is going to ship more machines in 2022 than in 2021. However, it will not be enough if they look at the demand curve. They really need to step up their capacity significantly more than 50%. That will take time. ASML has 700 product related suppliers, of which 200 are critical. (CN Beta, Financial Times, DutchNews, MoneyDJ, 9to5Mac)

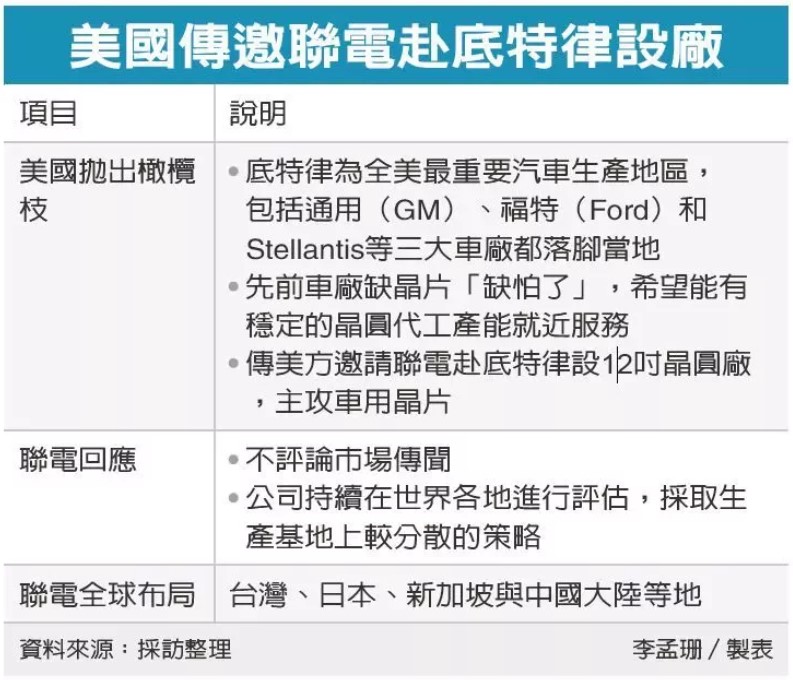

The U.S. government has allegedly invited UMC to build a 12” wafer fab in Detroit, a major city in the U.S. auto industry, and provide chips for local automakers nearby. UMC has said it does not comment on market rumors. It is understood that UMC is expanding the capacity of its Phase VI plant at Fab 12A due to the strong market demand for the 22 / 28nm process. In addition, UMC announced at the end of Feb 2022 that it will expand a new advanced fab in the Fab12i factory in Singapore. The monthly production capacity of the first phase of the new factory is planned to be 30,000 wafers, and mass production is expected to start by the end of 2024. (Laoyaoba, CTEE, Yahoo, UDN, Taipei Times)

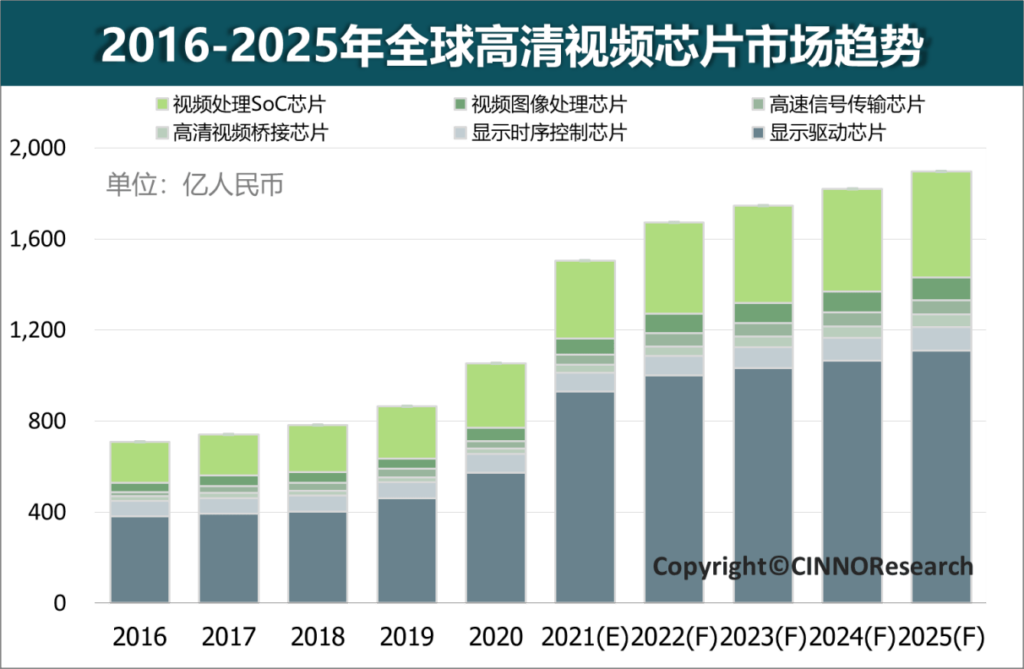

According to CINNO Research, the global high-definition video chip market size in 2020 will be CNY105.237B. In 2021, affected by the tight global wafer supply, the sharp rise in foundry prices will drive up chip prices, which will boost the global high-definition video chip market size in 2021. increased to CNY150.417B. In the future, with the continuous and rapid development of the high-definition video industry, it is expected that the global high-definition video chip market will reach CNY189.716B in 2025, with a compound annual growth rate of about 6.0% from 2021 to 2025. (Sina, Sohu, 163)

A Toshiba subsidiary will ramp up capital expenditures in the new fiscal year that starts in Apr 2022 to expand capacity of power semiconductor devices at its main production base amid booming demand. Toshiba Electronic Devices & Storage has earmarked an investment of JPY100B (USD839M) for fiscal 2022, about 45% higher than its estimate of JPY69B for fiscal 2021. The money will fund construction of a new fabrication facility on the premises of production subsidiary Kaga Toshiba Electronics in Ishikawa Prefecture, which is slated to begin in the spring of 2023. It will also cover installation of a new manufacturing line inside an existing structure.(Laoyaoba, Asia Nikkei, TechNews)

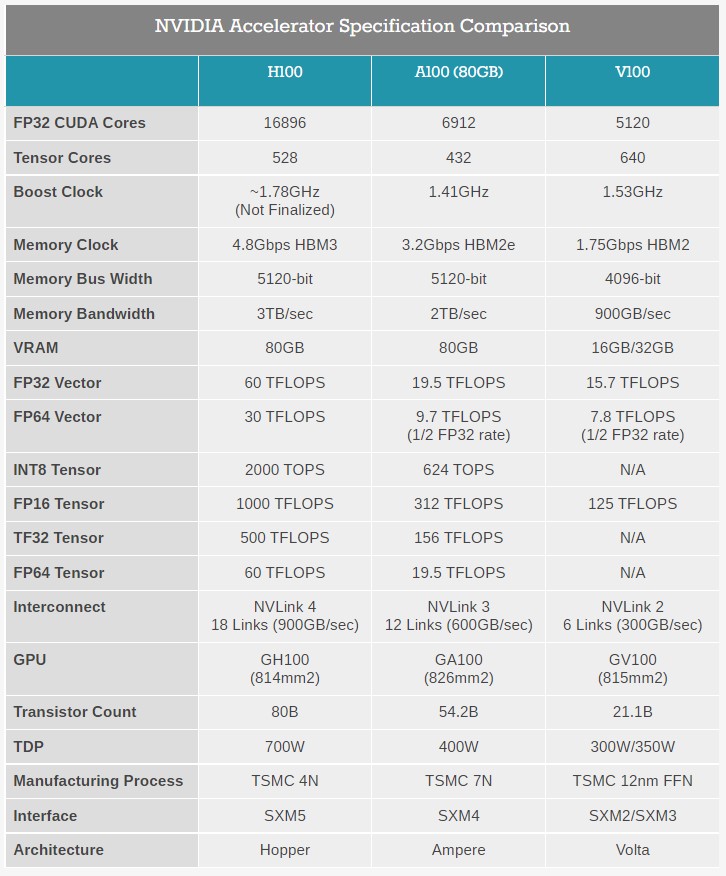

Nvidia has announced its next-gen Hopper GPU architecture and the Hopper H100 GPU, as well as a new data center chip that combines the GPU with a high-performance CPU, which Nvidia calls the “Grace CPU Superchip”. With Hopper, Nvidia is launching a number of new and updated technologies. The new Transformer Engine in the H100 chip promises to speed up model training by up to six times and because this new architecture also features Nvidia’s new NVLink Switch system for connecting multiple nodes, large server clusters powered by these chips will be able to scale up to support massive networks with less overhead.(TechCrunch, AnandTech, Nvidia, CN Beta)

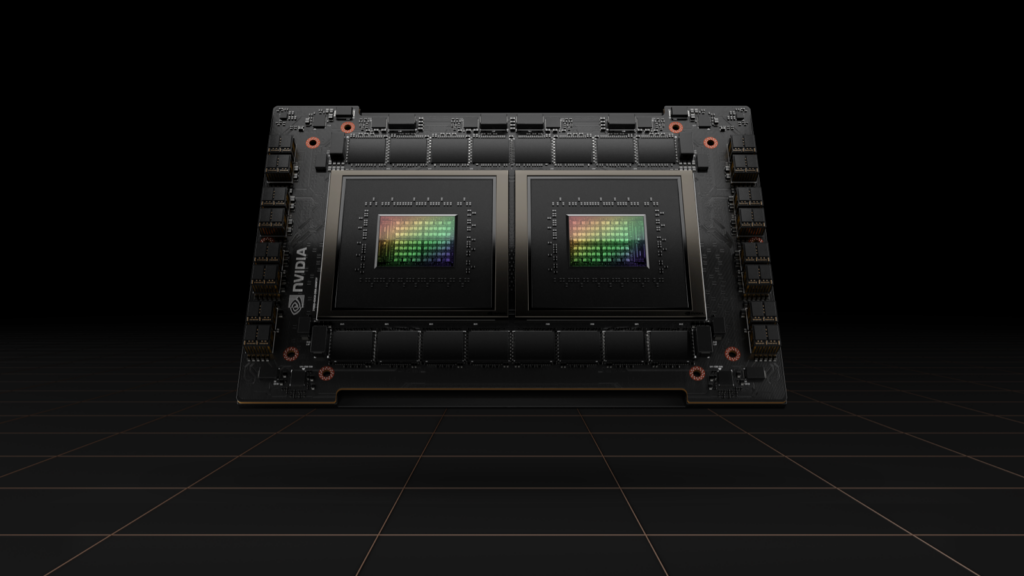

Nvidia has unveiled a new Grace CPU Superchip for servers that packs 144 ARM CPU cores into a single socket using the same trick Apple used for its M1 Ultra processor: smush two chips together using a high-speed interface. For the M1 Ultra, Apple developed what it calls “UltraFusion” architecture. Nvidia calls its interconnect architecture NVLink-C2C and says it supports bandwidths “of 900 gigabytes per second or higher” while delivering far better efficiency than a PCIe Gen 5 interface. While the first chip to make use of the new NVLink-C2C technology is designed for data centers rather than consumer devices, NVIDIA plans to use it to connect CPUs, GPUs, and other components for “a new class of integrated products built via chiplets” that deliver high bandwidth and density, but low latency and power consumption.(TechCrunch, CN Beta, Liliputing, Nvidia)

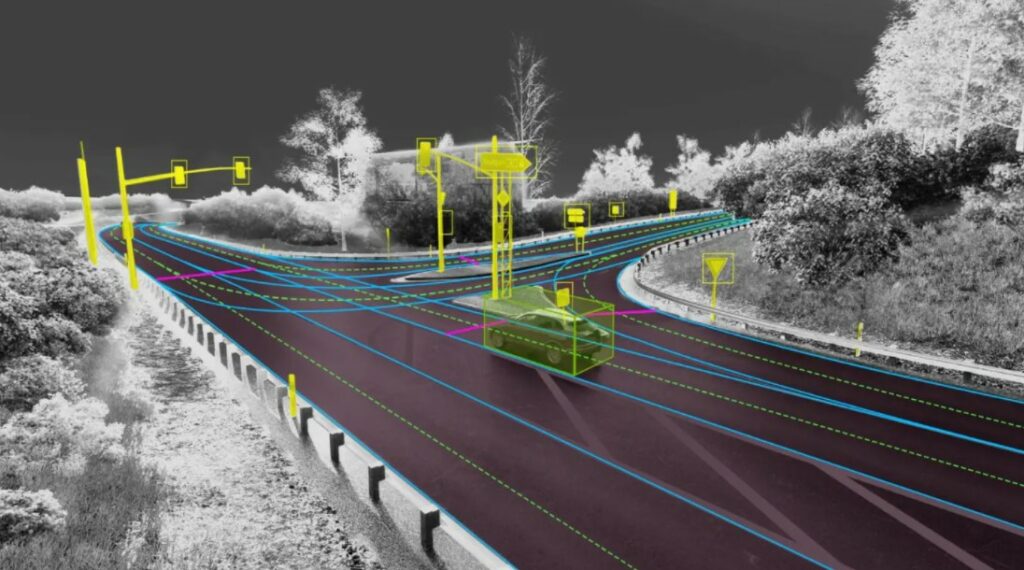

Nvidia’s founder and CEO Jensen Huang has announced that the company has launched a new mapping platform that will provide the autonomous vehicle industry with ground truth mapping coverage of over 300,000 miles of roadway in North America, Europe and Asia by 2024.The platform, dubbed Drive Map, is geared toward enabling high levels of autonomous driving. Drive Map is not only open to existing Nvidia customers, but it does augment the company’s existing solutions for the AV industry.(CN Beta, Nvidia, TechCrunch)

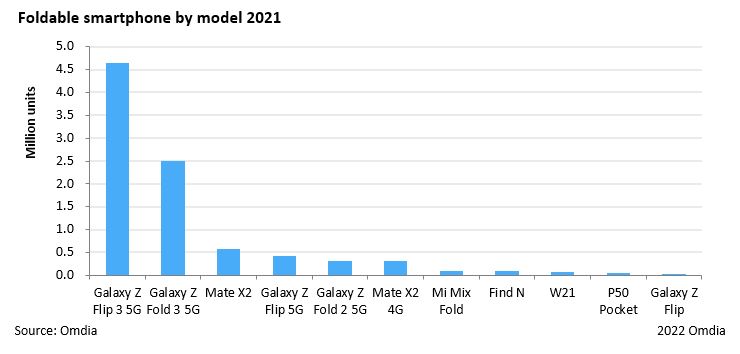

Cumulative shipments of foldable smartphones distributed worldwide by the end of 2021 recorded 11.5M units for the first time since the first foldable smartphone was launched in 2019 according to Omdia. Due to the high price barrier, sales of early foldable smartphones were limited. However, from 2H21, sales volume increased rapidly with annual foldable smartphone shipments reaching 9M units in 2021, up 309% year-on-year. Of these, 8M units were sold in the second half of 2021, accounting for 89% of the total shipment in 2021. Samsung is the largest original equipment manufacturer (OEM) in the foldable smartphone market. To date, Samsung has shipped over 10M units, accounting for more than 88% of the foldable smartphone market, which is also the only brand in the market with over 10M foldable smartphones. Samsung has released a total of 9 foldable smartphone models, and the foldable smartphones currently on sale are Samsung’s 3rd generation models. (DisplayDaily, Omdia)

Despite the start of the 2Q22 promotional peak season (hot sales season on June 18), the overall equipment manufacturers are slightly cautious in stocking, and the supply of upstream parts is still relatively abundant. For 2MP products, under the background of limited demand and fierce competition, Sigmaintell expects that the module price in 2Q22 will show a decrease of about 5.2% MoM. For 8MP products, after the chip price cut in 1Q22, Sigmaintell expects the overall chip price to be relatively stable in 2Q22, but the module price still shows a drop of about 1.6%. (Sigmaintell)

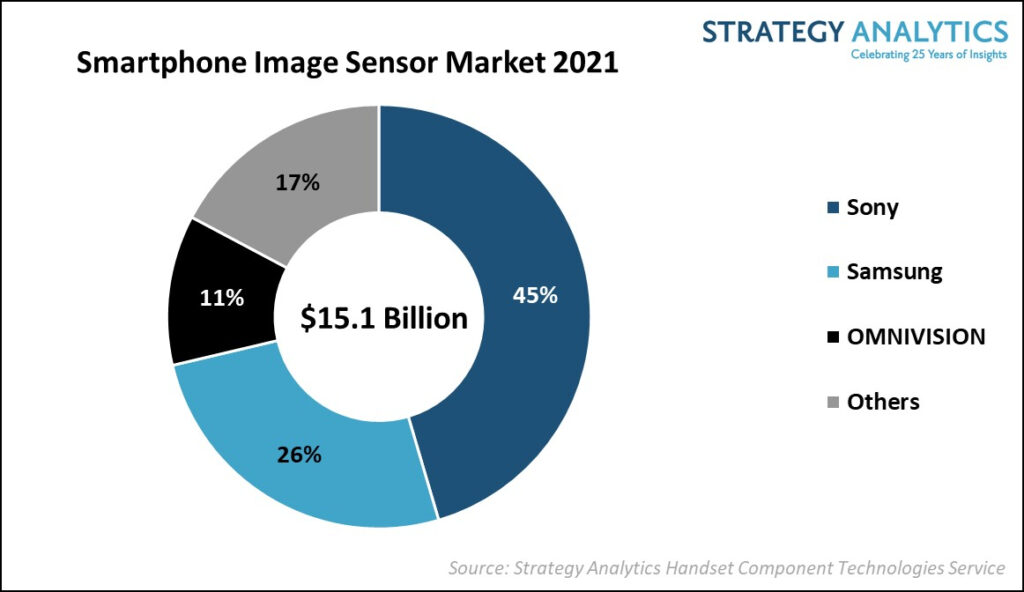

According to Strategy Analytics, the global smartphone Image sensor market in 2021 secured a total revenue of USD15.1B. Strategy Analytics finds that the smartphone image sensor market witnessed a revenue growth of more than 3% YoY in 2021. Sony Semiconductor Solutions topped with 45% revenue share followed by Samsung System LSI and OmniVision in 2021. The top 3 vendors captured nearly 83% revenue share in the global smartphone image sensor market in 2021. In terms of smartphone multi-camera application, Image sensors for Depth and Macro application reached 30 percent share while those for Ultrawide application exceeded 15% share. (Laoyaoba, Strategy Analytics)

Luminar, a company that builds vision-based lidar and machine perception technologies for autonomous vehicles, is acquiring high-performance laser manufacturer Freedom Photonics for about USD42.3M. The buy is Luminar’s latest to vertically integrate core lidar components to bring more accurate, lower-cost products to market.(TechCrunch, Business Wire)

The cost of batteries has reportedly risen sharply. Since 2H21, the price of CTAL’s batteries has increased twice. According to the battery cost of a new energy vehicle, it has risen by CNY10,000 last time, and it has risen by CNY10,000 again not long ago. Since 2021, the prices of upstream raw materials for lithium batteries such as cobalt and lithium have risen sharply, and the lithium battery sector has been under obvious pressure. According to data from Shanghai Nonferrous Metals Network and Wind, as of 21 Mar 2022, the average price of battery-grade lithium carbonate was CNY503,000 / ton, an increase of 867.3% from the price of CNY52,000 / ton on 31 Dec 2020. Rising raw materials and tight supplies continue to weigh on auto production as the conflict between Russia and Ukraine continues. In response to rising costs, vehicle prices are facing a surge. Among the lithium salt demand, lithium batteries account for the largest proportion, accounting for about 70%, of which lithium carbonate and lithium hydroxide as cathode materials are the core demand. (Laoyaoba, Yicai)

Quarterhill subsidiary WiLAN and WiLAN’s subsidiary Polaris Innovations Limited (“Polaris”) today announced a new patent license agreement with Apple. The Agreement also includes the settlement and dismissal of all litigation pending between WiLAN and Polaris and Apple in the United States, Canada and Germany. The specific consideration payable under the Agreement and all other terms and conditions are confidential.(Engadget, PR Newswire, CN Beta)

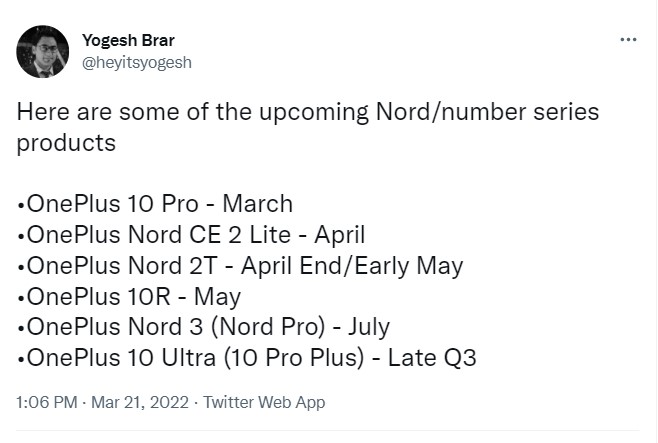

OnePlus is allegedly set to unveil 6 new devices until the end of Sept 2022. (GSM Arena, Twitter)

Airtel, Jio, and Vi (Idea Vodafone) have suggested there might be a sharp decline in the availability of the latest 5G smartphones since the Indian government called for mandatory local testing and certification of devices from 1 Jan 2023 before they are sold in the country. Operators have also warned the Department of Telecommunications (DoT) that this move would also hit data consumption and restrict market access. This would also deprive consumers of buying the latest 5G phones. This comes amidst when mobile carriers are preparing to invest crores of rupees in the upcoming 5G spectrum actions, which are likely to be conducted around May-Jun 2022, and roll out the 5G network in 2023. Furthermore, the telecom operators have cautioned that a move to test and certify all 5G smartphones at local labs would hinder India’s ambitions of becoming a global manufacturing base.(Gizmo China, Economic Times, 91Mobiles)

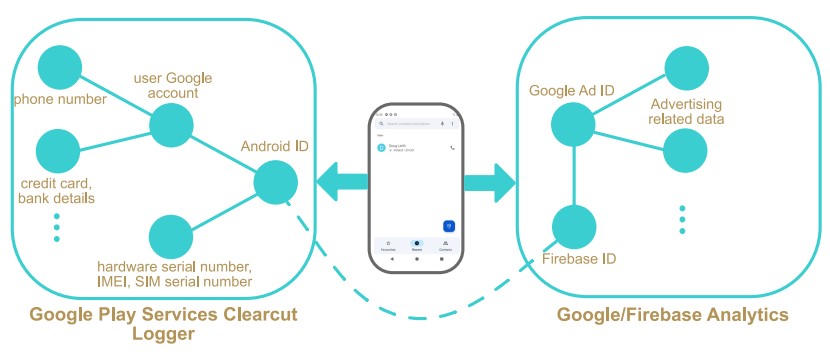

Google’s Messages and Dialer apps for Android devices have been collecting and sending data to Google without specific notice and consent, and without offering the opportunity to opt-out, potentially in violation of Europe’s data protection law. According to a research conducted by Trinity College Dublin, the data sent by Google Messages includes a hash of the message text, allowing linking of sender and receiver in a message exchange. The data sent by Google Dialer includes the call time and duration, again allowing linking of the two handsets engaged in a phone call. Phone numbers are also sent to Google. The timing and duration of other user interactions with these apps has also been transmitted to Google. And Google offers no way to opt-out of this data collection. (Android Central, The Register, SCSS)

The Dutch Senate has passed a motion calling on the government to “use its powers” to temporarily block the construction of Facebook owner Meta’s planned giant data center in the Netherlands. The party opposes the decision to locate the Meta data center on farmland and leader Tom Zonneveld says he will do all he can to have it reversed. The most important step, changing the zoning plan, has already been taken and that will be difficult to reverse. (CN Beta, Bloomberg, Dutch News, Telecompaper)

According to Xiaomi, in 2021, the total revenue of Xiaomi Group reached CNY328.3B (USD52B), a YoY increase of 33.5%; the adjusted net profit reached CNY22B (USD3.46B), a YoY increase of 69.5%. In terms of both global shipments and market share, Xiaomi smartphones reached a record high. Particularly, global shipments of smartphones reached 190M units, a YoY increase of 30.0%. (GizChina, CN Beta, Weibo)

Foxconn is reportedly planning to build a new USD9B facility in Saudi Arabia, a factory that could be used to expand its business into auto production, possibly even the Apple Car. Hon Hai Precision Industry has made an offer to the Saudi government for a dual-line foundry, used for “surface-mount technology and water fabrication”. The offer is apparently under review, with both sides seeking assurances about the project’s end result. (Apple Insider, WSJ, ForbesGA, EET China)

OPPO A16e is announced – 6.52” 720×2600 HD+ v-notch, MediaTek Helio P22, rear 13MP + front 5MP, 3+32 / 4+64GB, Android 11.0, no fingerprint, 4230mAh, price yet to be announced.(GSM Arena,Gizmo China, GizChina, OPPO, Gadgets360)

realme Narzo 50A is launched in Indonesia – 6.5” 720×1600 HD+ v-notch, MediaTek Helio G80, rear tri 50MP-2MP macro-2MP depth + front 8MP, 4+64 / 4+128GB, Android 11.0, rear fingerprint, 6000mAh 18W, IDR1.999M (USD140) / IDR2.199M (USD155). (Gizmo China, GSM Arena, realme)

realme GT Neo3 is launched – 6.7” 1080×2412 FHD+ HiD AMOLED 120Hz, MediaTek Dimensity 8100, rear tri 50MP 1.0um OIS-8MP ultrawide-2MP macro + front 16MP, 8+256 / 12+256GB, Android 12.0, stereo speakers, fingerprint on display, 5000mAh 80W / 4500mAh 150W, CNY2,599 (USD408) / CNY2,799 (USD440). (GSM Arena, Pocket-Lint)

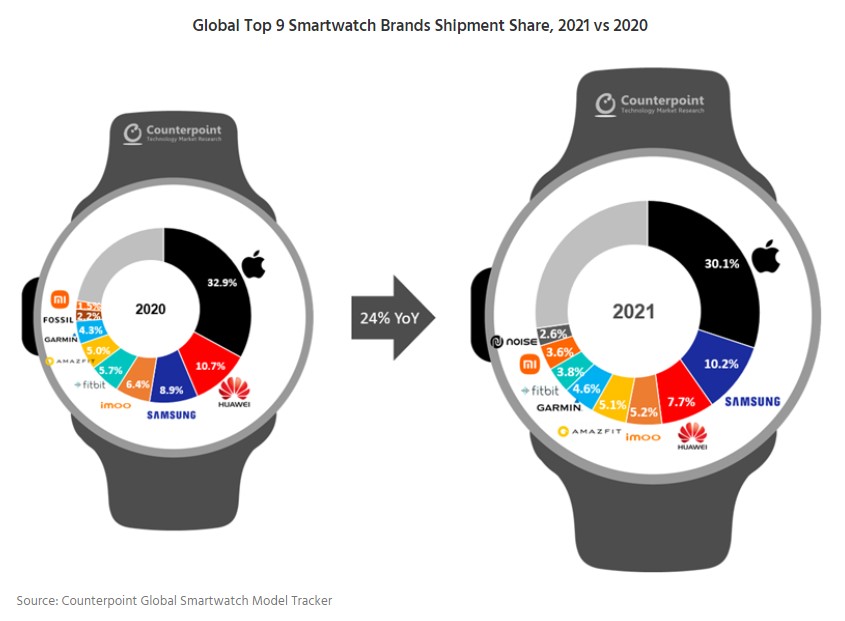

The global smartwatch market shipments hardly grew in 2020 due to COVID-19, but they recorded a healthy 24% YoY growth in 2021, according to Counterpoint Research. The 4Q21 alone saw shipments of more than 40M units, the highest quarterly shipments ever. Apple maintained its solid No. 1 position with a 30% market share but fell 3% points YoY due to intensified competition. However, its ASP rose 3% without the release of the SE model in 2021. As a result, Apple accounted for half of the total market revenue. (CN Beta, Counterpoint Research)

Samsung has announced that it has renovated its metaverse hangout 837X so that it now includes a new “customization quest” for visitors to create their own unique NFT. When 837 debuted in Jan 2022, it was as a “brand land takeover” within the blockchain-powered Decentraland metaverse. Previously, Decentraland users could get virtually dropped off just outside the virtual 837X building, which is based on the flagship Samsung 837 store on Washington Street in New York City. Upon going inside, 837X visitors would be taken on “a digital adventure through the Connectivity Theater and Sustainability Forest to complete quests along the way for 837X Non-Fungible Token (NFT) badges and by a celebration at the Customization Stage”. Over the course of 837X’s original run, Samsung says it attracted nearly 120,000 visitors.(Digital Trends, Samsung)

Morris Garages (MG Motors) is developing low-cost city-use EVs for India and neighboring countries. MG Motors plans on introducing a new EV based on the SAIC-GM-Wuling Global Small Electric Vehicle (GSEV) platform. This GSEV platform is currently deployed in multiple Chinese market cars and underpins cars such as the Baojun E100, E200, E300, and E300 Plus, as well as the Wuling Hongguang Mini EV. These vehicles are compact two-door vehicles with short overall lengths and tight turning circles. These EVs are hence a perfect urban runabout solution.(GizChina, 91Mobiles, Cartoq)

Volkswagen (VW) will invest an additional USD7.1B into its North American production over the next 5 years. The automaker is aiming to add 25 new electric vehicles in the region by 2030, including an updated version of VW’s classic Microbus. The company plans to allocate the funds to boosting its product portfolio, regional R&D and manufacturing capabilities. The new aforementioned Microbus model, dubbed the ID.Buzz, will first be imported from VW’s Hanover base in Germany, before American assembly plants will be able to produce the vehicle in 2024, according to VW’s president and CEO Scott Keogh. In addition to the ID.Buzz, Volkswagen plans to produce the ID.4 in 2022, and a yet-to-be-announced SUV in 2026.(Engadget, Reuters, Hypebeast, CN Beta)

Xiaomi Group has said that as of now, the Xiaomi Car project R&D team exceeds 1,000 people. In the future, it will continue to expand R&D in core areas such as autonomous driving and smart cockpits. The company reiterates that it will maintain its initial schedule of entering mass production in 1H24. According to Xiaomi, the initial investment for the Xiaomi Car project is USD10B in the next 10 years.(GizChina, My Drivers)