3-25 #Turned45 : Samsung will allegedly launch scrollable smartphone this year; Samsung Display is reportedly developing a new UPC for Apple; Apple is reportedly working on a hardware subscription service; etc.

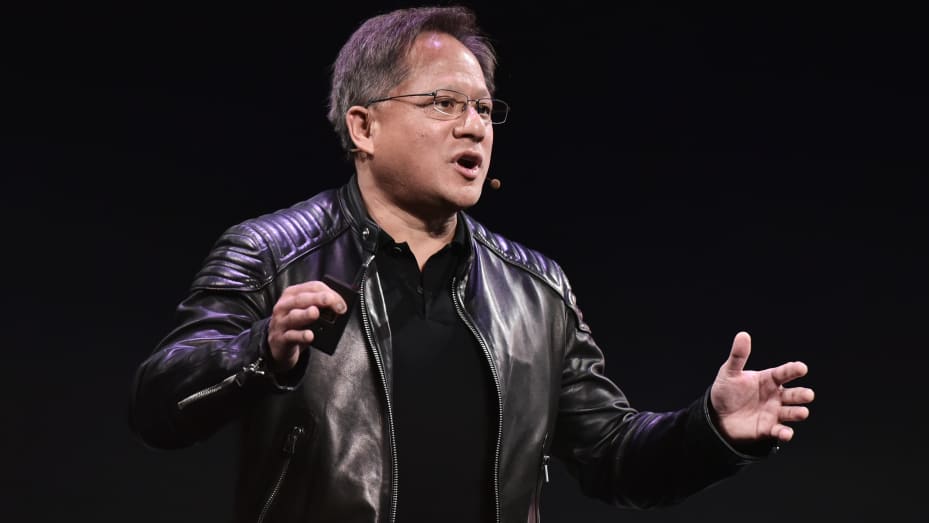

Nvidia CEO Jensen Huang has confirmed that his company is considering using Intel’s foundry to possibly make some of its chips. Intel is now a direct competitor with Nvidia on both the CPU and GPU fronts, but he has also explained that Intel and AMD have known Nvidia’s secret roadmaps for years, so he is not paranoid about sharing more information. He has explained the company’s strategy is to expand supply base with diversity and redundancy at every single layer. At the chip layer, at the substrate layer, the system layer, at every single layer.(CN Beta, Tom’s Hardware, Reuters)

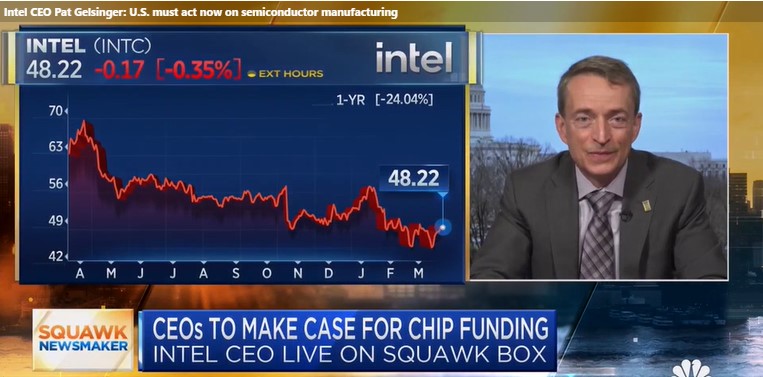

Intel CEO Pat Gelsinger has compared to semiconductors to oil, suggesting that computer chips will play a central role in international relations in the decades ahead. He has indicated that oil reserves have defined geopolitics for the last 5 decades. Where the fabs are for a digital future is more important. Geslinger has expressed concern for the humanitarian consequences of Russia’s attack on Ukraine, while also pointing to economic implications.(CN Beta, CNBC, MSN)

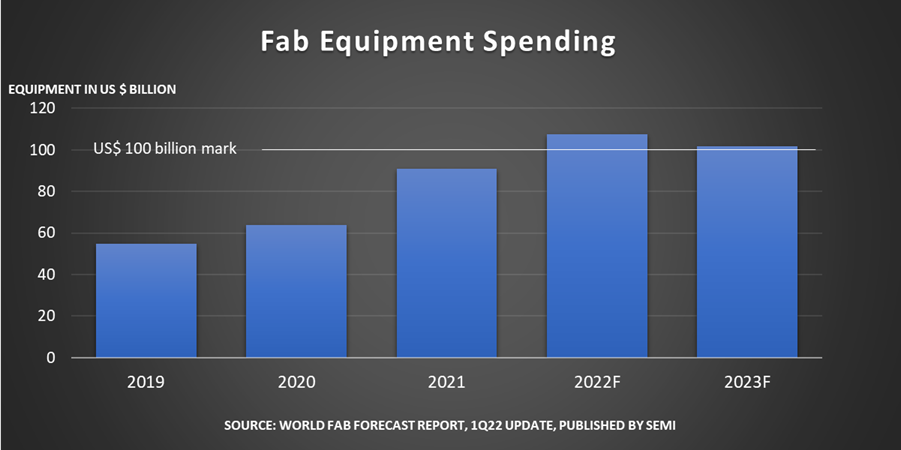

Global fab equipment spending for front-end facilities is expected to jump 18% YoY to an all-time high of USD107B in 2022, marking a third consecutive year of growth following a 42% surge in 2021, according to SEMI. Taiwan is expected to lead fab equipment spending in 2022, increasing investments 56% YoY to USD35B, followed by Korea at USD26B, a 9% rise, and Mainland China at USD17.5B, a 30% drop from its peak in 2021. Europe / Mideast is forecast to log record high spending of USD9.6B in 2022, and while comparatively smaller, this would represent a staggering growth of 248% YoY. (SEMI, Laoyaoba, Evertiq)

Samsung Electronics reportedly will launch midrange- to high-end Galaxy smartphones powered by MediaTek’s Dimensity 9000 chipset. It could either be the Galaxy S22 FE or a supposed “Galaxy A53 Pro”. (Laoyaoba, Notebook Check, Weibo, Android Police, Digitimes)

Samsung foldable phones in 2022, dubbed Galaxy Z Fold 4 and Galaxy Z Flip 4, will allegedly use Qualcomm’s unannounced Snapdragon 8 Gen 1+ processor. Qualcomm Snapdragon 8 Gen 1+ will be fabricated on TSMC’s 4nm process.(Android Headlines, Twitter)

Samsung will allegedly add a third foldable device to its smartphone lineup in 2022 that will likely feature a unique rollable form factor. The codenames that Samsung is using internally for the models expected this year are said to include B4, Q4, and N4, with B4 and Q4 believed to relate to the Z Flip 4 and Z Fold 4, respectively, and the N4 referring to a completely new device. Samsung’s third foldable device is set for release in 2H22. It is also believed the codename of the new device is in fact “Diamond” and it may have a rollable form factor. (GSM Arena, Twitter, Twitter, MacRumors, Digital Trends, Pocket-Lint, CN Beta)

OPPO allegedly plans to commercialize scrollable display mobile phones, and 2023 will be a new era, Xiaomi will also launch, and OPPO will be faster. OPPO has previously demonstrated the OPPO scrollable display phone in 2020, and this scrollable display is named OPPO X 2021. OPPO X 2021 fundamentally solves the inherent defect of folding screen mobile phones – the crease problem. (My Drivers, Sina, IT Home)

Xiaomi has filed a patent relating to a heat dissipation system for sliding screens. The patent shows a smartphone with a sliding structure, with various air vents capable of simulating active cooling. The mechanism in question would certainly increase the ease of use with reference to a smartphone with a rollable display. This is because it would improve heat dissipation when using the open screen.(CN Beta, My Drivers, ZOL, Xiaomi Today)

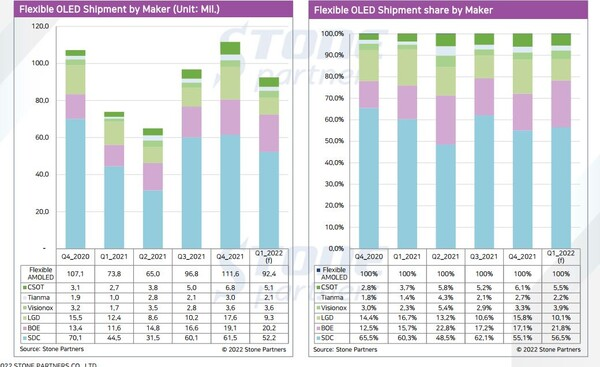

According to Stone Partners, BOE’s flexible OLED shipments are expected to hit 20.2M units in 1Q22, a 74% increase from 11.6M units in the same period of 2021. BOE’s shipments have steadily increased every quarter since 1Q21. BOE’s flexible OLED market share is expected to record 21.8% in 1Q22, an increase of 6.1 percentage points from 15.7% in the same period of 2021. Samsung Display, which ranks first in this field, is also expected to ramp up its shipments. The company’s shipments in 1Q22 are 52.20M units, a 17% increase compared to 44.50M units in the same period of 2021. (Laoyaoba, Business Korea, TechNews)

Samsung Display is reportedly developing a new under panel camera (UPC) technology for its customer Apple to hide the Face ID under the display in the next iPhone. Apple is planning to apply hole-display and under panel Face ID on the iPhone 15 Pro models. Samsung Display is collaborating with Canada’s OTI Lumionics for its new under panel camera technology, which will include a metal patterning layer that uses cathode mask materials. In OLED panels, the light emitted from the emission layer at the bottom goes through the cathode at the top, which is called top emission. The cathode needs to be transparent for under panel camera technology to work. The cathode is patterned so that it can be transparent while being able to absorb light from the outside at the same time. OTI Lumionics has its own technology that can use fine metal masks to deposit cathode patterning materials. An open metal mask is then used to deposit the cathode that avoids being deposited on the patterning material. LG Display is also developing its own under panel camera technology with the aim to increase the light transmittance rate of the hole to over 40% after 2024. (Laoyaoba, The Elec)

Stellantis and LG Energy Solution (LGES) have announced they have executed binding, definitive agreements to establish the first large-scale, domestic, electric-vehicle battery manufacturing facility in Canada. The joint venture company will invest more than CAD5B (USD4.1B) to establish operations, which will include an all-new battery manufacturing plant located in Windsor, Ontario, Canada. Plant construction activities are scheduled to begin later this year, with production operations planned to launch in 1Q24. The plant aims to have an annual production capacity in excess of 45 gigawatt hours (GWh). (CN Beta, The Verge, Stellanis)

LG Energy Solution (LGES), a supplier for electric car makers Tesla and Lucid, said on Thursday in Korea it plans to invest KRW1.7T (USD1.4B) to build a battery factory in Arizona by 2024 to meet demand from “prominent startups” and other North American customers. Construction will start in 2Q22 with production starting in 2024 with a production capacity of 11 gigawatt-hours per year. This will be their first US plant to produce the cylindrical elements used in Tesla and Lucid vehicles. (CN Beta, Tesmanian, Reuters, Detroit News)

Sichuan Contemporary Amperex Technology Limited (CATL-SC), a wholly-owned subsidiary of CATL, received the PAS 2060 certification on carbon neutrality from the world’s leading testing, inspection and certification company SGS in Mar 2022, making the plant the world’s first zero-carbon factory in the new energy industry. CATL-SC has taken multiple measures to reduce carbon emissions. It has developed a trailblazing smart plant management system, which enables the interconnection of data through automatic capture of the plant system data and equipment operation data. (CN Beta, PR Newswire)

Apple plans to make the iPhone SE using low-carbon and carbon-free aluminum produced from an innovate new smelting process its USD4.7B Green Bonds investment helped create. Apple’s Green Bond projects have so far seen the company invest USD4.7B in research projects since its launch in 2019. Now that work has resulted in new smelting technology which will Apple says will produce aluminum without creating any direct carbon emissions.(Apple Insider, Apple)

Nothing’s Founder Carl Pei has revealed that the company will be announcing its first smartphone dubbed Nothing Phone (1) in summer 2022. The phone will boot on Android and have the Nothing OS on top of it. As per the company, Nothing OS will have 40% fewer pre-installed apps. The UI is expected to have a Black and White theme. Furthermore, the company will also launch its own launcher called Nothing OS launcher which will be launched in April for select Android smartphones. Nothing has also officially announced its partnership with Qualcomm. The company is expected to bring its upcoming phones powered by Qualcomm Snapdragon SoCs. The company has confirmed that Phone (1) will get 3 years of OS updates and 4 years of security updates.(GSM Arena, GizChina, CN Beta, Gizmo China, Android Authority)

Starting today, Apple has said Arizona residents can add their driver’s license or state ID to the Wallet app, and tap their iPhone or Apple Watch to seamlessly and securely present it at select TSA security checkpoints in Phoenix Sky Harbor International Airport. Apple has said the feature is also available for use at select TSA checkpoints in select other states, with travelers advised to check TSA checkpoint signage to confirm availability. Additional states will offer driver’s licenses and state IDs in the Wallet app soon, according to Apple, including Colorado, Hawaii, Mississippi, and Ohio, as well as the territory of Puerto Rico. (MacRumors, Apple, CNBC)

Apple is reportedly working on a hardware subscription service that would let users use its products in exchange for a monthly fee. The service would include regular upgrades and launch in either late 2022 or early 2023. Pricing is also unknown. Apple’s current upgrade program currently requires USD35 or more per month to get both yearly iPhone upgrades and continuous AppleCare+ coverage. (Engadget, Bloomberg, Phone Arena)

Netflix has acquired Boss Fight Entertainment, a mobile game studio based in Texas. This is the company’s third acquisition. Netflix has a total of 16 game titles, all for iOS and Android smartphones. The company has reasoned that offering games as part of a subscription will enhance its value proposition and help attract as well as retain subscribers.(Android Headlines, Netflix, Neowin, Business Insider)

OPPO K10 is announced in India – 6.59” 1080×2412 FHD+ HiD 90Hz, Qualcomm Snapdragon 680 4G, rear tri 50MP-2MP macro-2MP depth + front 16MP, 6+128 / 8+128GB, Android 11.0, side fingerprint, 5000mAh 33W, reverse charging, INR14,990 (USD197) / INR16,990 (USD223). (GSM Arena, Gizmo China, GizChina)

realme C31 is launched in Indonesia – 6.5” 720×1600 HD+ v-notch, Unisoc Tiger T612, rear tri 13MP-2MP macro-0.3MP depth + front 5MP, 3+32 / 4+64GB, Android 11.0, side fingerprint, 5000mAh, IDR1.599M (USD110) / IDR1.749M (USD120). (GSM Arena, Gizmo China, GizChina)

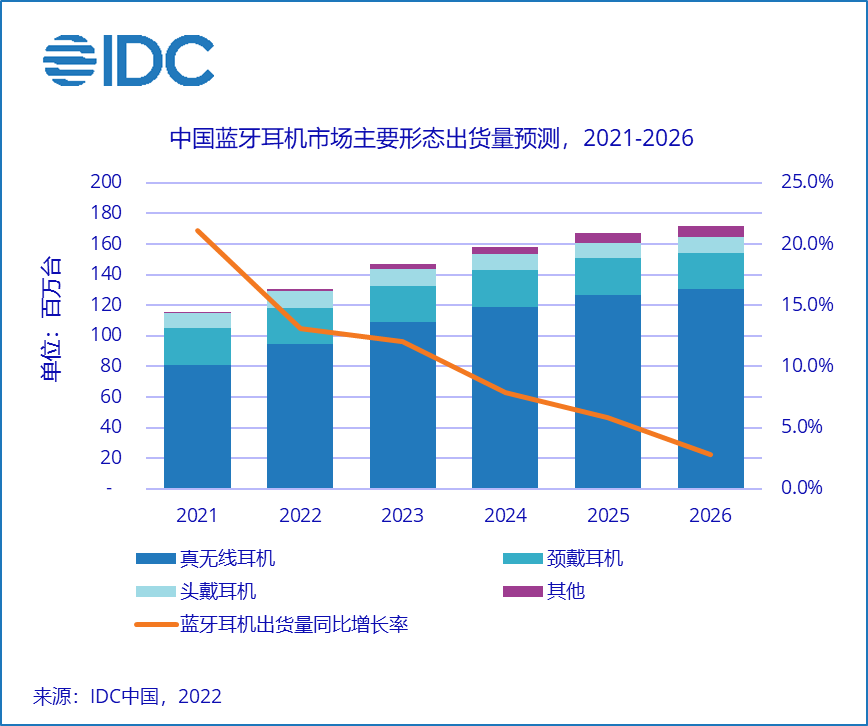

According to IDC, China’s Bluetooth headset market will ship about 120M units in 2021, a year-on-year increase of 21.1%. Among them, the growth of true wireless earphones (TWS) has an obvious driving effect on the overall Bluetooth earphone market, with shipments of approximately 80.92M units in 2021, a YoY increase of 28.0%. It is estimated that in 2022, China’s Bluetooth headset market shipments will be about 130M units, a YoY increase of 13.1%. Among them, the TWS is expected to ship 94.56M units, a YoY increase of 16.9%. (IDC, Laoyaoba)

Snap has acquired NextMind, the Paris-based neurotech startup behind a headband that lets the wearer control aspects of a computer — like aiming a gun in a video game or unlocking the lock screen of an iPad — with their thoughts. The idea is that NextMind’s technology will eventually be incorporated into future versions of Snap’s Spectacles AR glasses. The startup raised about USD4.5M in funding to date and was last valued at roughly USD13M. (CN Beta, TechCrunch, The Verge, Snap)

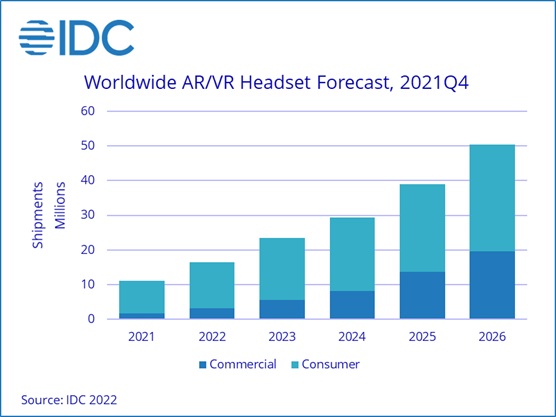

The worldwide market for augmented reality and virtual reality (AR/VR) headsets grew 92.1% YoY in 2021 with shipments reaching 11.2M units, according to IDC. Meta’s Quest 2 was by far the most popular product with 78% share of the combined AR/VR market during 2021. In second place was DPVR, which has had plenty of success in Asian markets and captured 5.1% share globally. ByteDance’s Pico VR products ranked third (4.5% share) and, like DPVR, is well position in Asian markets but has also done well in North America and Western Europe where it has helped fill the void left when Meta discontinued its Oculus Go. VR pioneer HTC and China-based online video platform iQIYI rounded out the top 5. (IDC)

Autonomous vehicle technology company Aurora Innovation is launching a small test fleet of custom-designed self-driving Toyota Siennas for future ride-hail operations. The company will test its vehicles on highways and suburban streets in the Dallas-Forth Worth, Texas area, with a focus on high-speed routes. The hybrid electric Toyotas will be equipped with the same software and hardware as Aurora’s Class 8 trucks that the company is testing for hauling goods. Similar to Waymo, Aurora wants to prove that it has a “key competitive advantage”, namely the “transferability” of its common core technology across two significant markets — trucking and passenger mobility. (TechCrunch, Engadget, Aurora)