3-26 #School : Sony is reportedly working and testing a new sensor, the largest in the industry; Kioxia will will start constructing a new fabrication facility (Fab2) at its Kitakami Plant; Samsung is reportedly planning to locally manufacture its 4G and 5G gear in India; etc.

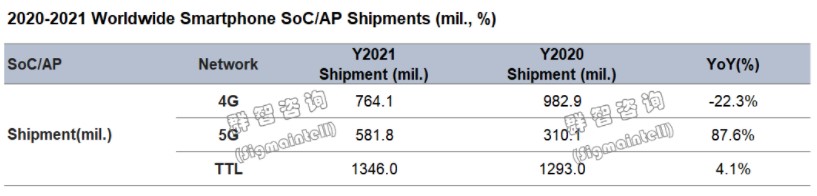

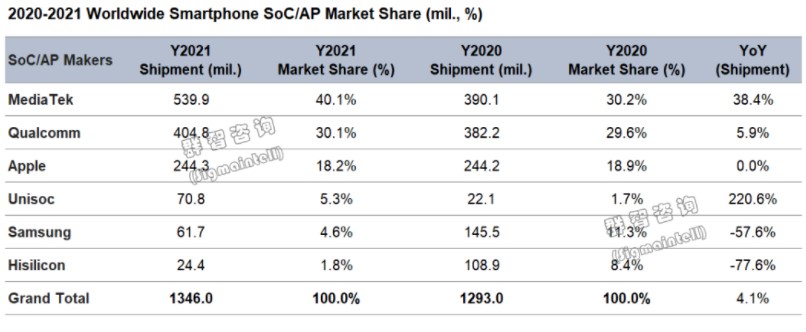

After the production of HiSilicon Kirin chips is discontinued, the supply pattern of smartphone SoCs changes in 2021, forming a competition pattern between MediaTek and Qualcomm duopoly. On the demand side, vendors overstocked in the 1H21. Under the circumstance of tight upstream foundry capacity, the smartphone SoC market was out of stock and prices rose throughout the year. According to Sigmaintell, the global smartphone SoC shipments (including APs) in 2021 is about 1.35B units, a YoY increase of approximately 4.1%. From the perspective of production capacity and supply, it is estimated that the global smartphone SoC (including AP) shipments will be about 1.4B in 2022, a YoY increase of about 4%. At present, the outbreak of the Russian-Ukrainian war and the repeated domestic epidemics, the global economic growth in 2022 may be lower than expected, and the terminal demand will continue to weaken due to various factors. The supply and demand situation of smartphone SoCs has eased. Structural shortage risks remain. In 2021, Qualcomm and MediaTek will account for about 70% of the smartphone SoC market, gradually forming a duopoly competition pattern. (Laoyaoba, Sigmaintell)

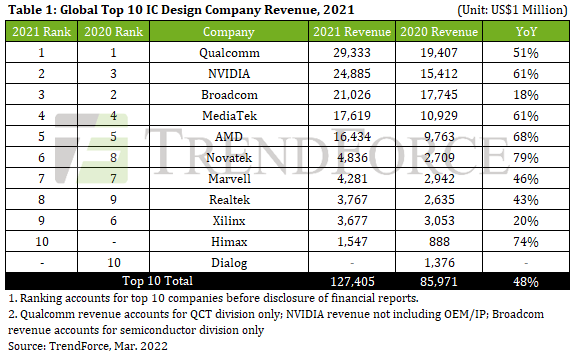

According to TrendForce research, due to vigorous stocking of various terminal applications causing a shortage of wafers in 2021, the global IC industry was severely undersupplied. This, coupled with spiking chip prices, boosted 2021 revenue of the global top ten IC design companies to USD127.4B, or 48% YoY. TrendForce further indicates three major disparities from the 2020 ranking. First, Nvidia surpassed Broadcom to take the second position. Second, Taiwanese companies Novatek and Realtek rose to sixth and eighth place, respectively. Originally ranked tenth, Dialog was replaced at this position by Himax after Dialog was acquired by IDM giant Renesas. Qualcomm continues its reign as number one in the world, primarily due to 51% and 63% growth YoY in sales of mobile phone SoC (System on Chip) and IoT chips, respectively. (Laoyaoba, TrendForce, TrendForce)

The Indian government is modernising the existing Semi-Conductor Laboratory (SCL) in Mohali as part of the effort to set up a latest manufacturing facility for making semi-conductors which are used in display panels of smart phones, laptops, TV screens, weapon systems and automobiles. The Parliamentary Standing Committee on Communications and Information Technology gave a report in the House on the Ministry of Electronics and Information Technology which detailed a plan on modernising the SCL unit in Mohali, saying that the government had informed the committee of the upgrade plan. (Laoyaoba, ElectronicsB2B, The Tribune, iFeng)

MediaTek has announced that it will now offer the first commercial SoC support for Dolby Vision IQ with Precision Detail. Televisions with Dolby Vision IQ now come with Precision Detail feature, and it will be compatible with MediaTek’s Pentonic series for 8k and 4k smart televisions as well. The Pentonic series will further allow TV manufacturers to offer support for features that have been developed for gaming in Dolby Vision among other enhanced capabilities. MediaTek had joined hands with Dolby for the adoption of these technologies, available beginning in 2H 2022 for TV OEMs to start implementing. (Neowin, MediaTek)

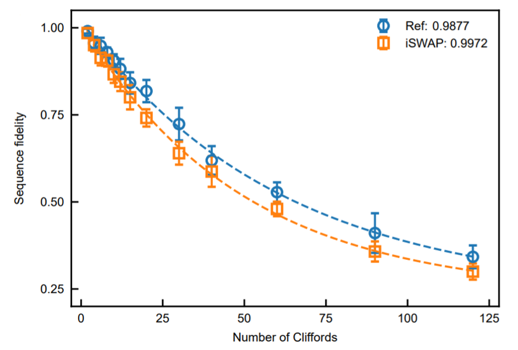

The quantum laboratory of Alibaba Damo Academy from China announced its newly developed new type of superconducting quantum chip, which achieved 99.72% control accuracy of two-bit gates on the chip, reaching this level. The world’s best level of bit-like. The latest breakthrough of DAMO Academy’s quantum laboratory is based on a new type of quantum bit, fluxonium. As a new type of superconducting quantum, fluxonium belongs to the epigenetic force. Compared with the charge-type transmon, the magnetic-flux-type fluxonium is more resistant to the interference caused by charge noise and dielectric loss, and the fluxonium is also closer to an ideal 2-level system.(CN Beta, Sohu, Airvers)

Rockchip and Xvisio Technology have jointly announced a strategic cooperation. Based on their respective advantages and resources, the two parties will jointly create a high-performance XR platform solution based on the Rockchip RK3588 platform to accelerate high-end products in the field of perception and interaction landing. Intervision’s mainstream AR glasses products will be fully compatible with Rockchip’s RK3588 chip, including all-in-one and thetered devices, covering product series including SeerLens One, K40RE series, B50R series, etc.(CN Beta, The Paper, EE China)

E Ink has announced the launch of the latest generation of their Advanced Color ePaper (ACeP) platform, E Ink Gallery Plus. This next generation, full color ePaper module, has a color gamut ideally reaching 60,000, an improvement over the earlier generations. E Ink Gallery Plus targets indoor commercial signage for retail, restaurants, transportation and public information displays. E Ink Gallery Plus is using E Ink ACeP, a full color electronic ink system with four color pigments: cyan, magenta, yellow, and white, used to achieve a full color gamut at each pixel. The contrast ratio is improved by 40%, from 10 to 14, providing a more impactful visual experience. (CN Beta, E Ink)

The largest China-based LED epitaxial wafer and chip maker Sanan Optoelectronics will invest up to CNY7.9B (USD1.24B) to set up production capacity for miniLED and microLED chips at its production base in central China, according to Digitimes. The annual production capacity to be set up consists of 1.61M GaN-based mini / microLED epitaxial wafers, 750,000 GaAs-based epitaxial wafers and 84,000 miniLED backlight units (BLU) for 4K display, the sources said. Sanan has become a supplier of miniLED backlighting applications for Apple, Samsung Electronics and TCL. For microLED R&D, Sanan has established a joint venture with China-based OLED panel maker Visionox Technology and another with China-based LCD panel maker China Star Optoelectronics Technology (CSOT). (Digitimes, Laoyaoba, OfWeek)

TCL CSOT has pointed out that India CSOT has completed the production capacity construction of 3 lines of equipment, with a monthly production capacity of 1.2M units. At the same time, the 4th and 5th lines will be moved in in Apr 2022, and by May 2022, the realization of bonding, fitting, and the entire assembly process will be put into production, and the monthly production capacity will reach 2M units. It is reported that India CSOT has integrated the production of large-size TV screens and small-size mobile terminal display screens. The project covers a total area of 280,000 square meters. The construction of the plant is divided into two phases. The first phase plans to invest 1.53 billion yuan and configure 11 production lines, including 5 large-size panels and 6 small-size mobile phone panels. 10,000 pieces of 3.5~8 inch small size mobile phone panels. India Huaxing will become India’s first Bonding-Assembly full-process LCD panel module factory. This project will provide a key component – LCD module to local mobile phone and TV manufacturers in India.(Laoyaoba, Sina, EET China)

Sony is reportedly working and testing a new sensor, the largest in the industry. Its resolution will be 50-megapixels with an optical format of 1/1.1 inches. The new sensor may be used in the future flagships of Xiaomi, Huawei and vivo. (GizChina, Sparrow News, Weibo, 163, Sina)

Dongguan YuTong Optical Technology (YTOT) has indicated that the company has business cooperation with Huawei to supply optical lenses. The company currently has two vehicle lens production lines, one automated line is mainly used to produce standardized products, with a production capacity of 400,000 pieces/month, and a semi-automated line is mainly used to produce small batches of multiple varieties of personalized products, with a production capacity of 100,000 pieces/month, In the follow-up, additional production capacity will be added in a timely manner according to customer needs and market changes.(Sohu, Sina)

Kioxia says it will will start constructing a new fabrication facility (Fab2) at its Kitakami Plant in Iwate Prefecture, Japan in order to expand the of production of its 3D Flash memory BiCS FLASH. Construction of the facility is currently scheduled to start in Apr 2022 and is expected to be completed in 2023. The company says in a press release that the new Fab2 facility will utilise AI-based manufacturing to increase production capacity of the entire Kitakami Plant – which, according to Kioxia, will allow the company to expand its business organically and take advantage of the medium to long term growth of the flash memory market.(CN Beta, Kioxia, Financial Post, Evertiq)

Kioxia has said that it plans to jointly build with Western Digital (WD) a new flash memory fabrication facility in its plant in northern Japan, which, may entail an investment of some JPY1 T (USD8.3B). The construction of the new earthquake-resistant facility at its Kitakami plant in Iwate prefecture is scheduled to commence in Apr 2022 and is expected to be completed in 2023.(CN Beta, Gadgets Now, Reuters, Economic Times)

Apple is facing yet another EUR5M (USD5.5M) fine in the Netherlands for failing to sufficiently meet recently mandated alternative payment system requirements for dating apps. Apple has been fined EUR45M (USD49.5M) by the Dutch Authority for Consumers and Markets (ACM) to date. The ACM has initially said that it planned to fine Apple EUR5M per week until it hit a maximum fine of EUR50M, but now it looks like the total fines could exceed that.(CN Beta, Reuters, MacRumors)

Samsung is reportedly planning to locally manufacture its 4G and 5G gear in India. The company has conveyed its stance to the telecom department and is looking to apply for the next edition of the production-linked incentive (PLI) 2.0 scheme for network equipment. It is currently in talks with Reliance Jio and Bharti Airtel for 4G expansion and 5G supply contracts. The company has informed the Department of Telecommunications (DoT) that it is looking to be a part of phase 2 of the country’s PLI scheme. It has written a letter about the same to the Indian government. In mid-2021, Samsung had decided not to take part in the initial PLI scheme for network equipment, reasoning that setting up a plant for network equipment was not viable at that time in India with just one client, Reliance Jio Infocomm.(CN Beta, India Times, Digitimes, Fonearena)

The European Union has announced plans to enact new legislation that would demand major messaging services — including iMessage, WhatsApp, and Facebook Messenger, to send and receive messages, calls, videos, and files from smaller competitors. The rule, part of the larger proposed Digital Markets Act (DMA) would require major messaging platforms to allow their services to work with smaller messaging platforms. Services that would need to work between platforms include sending messages, making video calls, and even sending files. The rule would apply to any company that has at least 45M monthly active end users and 10,000 annually active corporate users in Europe. Failure to comply with the new legislation could see violators incurring fines of up to 10% global annual turnover or up to 20% for repeat violations. (Apple Insider, TechCrunch)

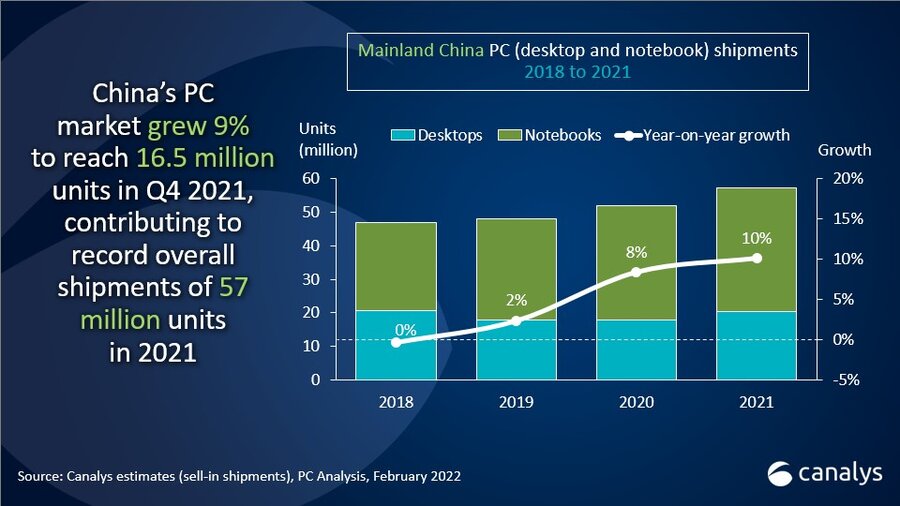

PC shipments (excluding tablets) in China grew 9% to reach 16.5M units in Q4 2021. This finished another year of strong growth for the Chinese market, which saw shipments rise 10% in 2021 to a record 57M units. Notebook shipments grew 12% YoY to 10.8M in 4Q21, and 8% to 36.5M for full-year 2021. Desktops also grew in the final quarter, with shipments up 2.5% at 5.6 M units, leading to a full-year total of 20.4M units, 15% higher than in 2020. (Canalys, CN Beta)

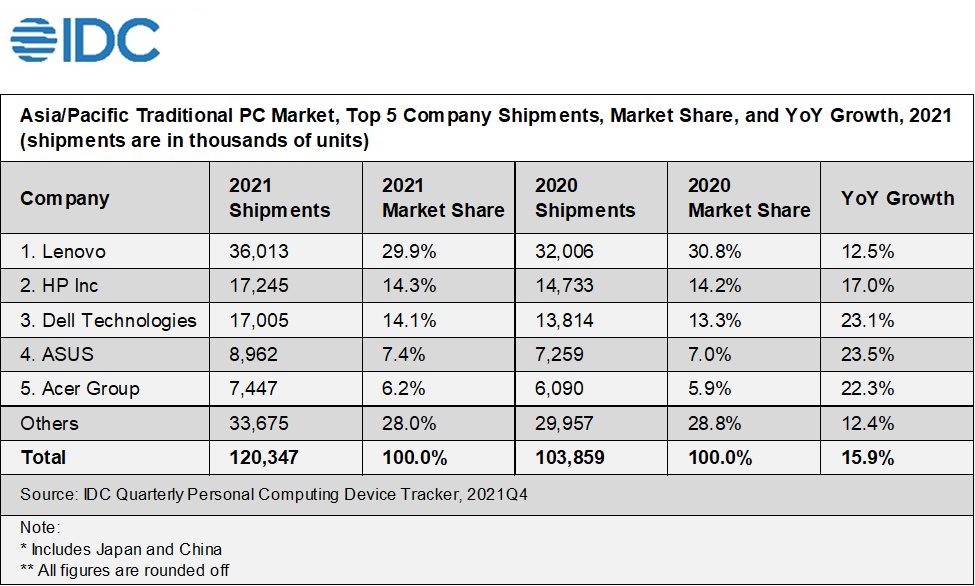

The traditional PC market (Desktops, Notebooks, and Workstations) in the Asia / Pacific (including Japan and China) region posted a 15.9% YoY increase in 2021, reaching 120.3M units, according to IDC. PC shipments are expected to remain robust in 2022, following a strong 2021 that experienced better supply and solid demand for PCs. The Asia / Pacific region benefited from significantly improved supply in 2H21. With slowing demand in mature economies like the United States, PC vendors began to prioritize countries in Asia/Pacific, which led to much-needed backlog order fulfillments and inventory replenishments. (IDC)

TF Securities analyst Ming-Chi Kuo predicts that Apple’s shipments of both the devices could be in the range of 500K-600K units in 2022. (Laoyaoba, IT Xinwei, IT Home, Twitter, Benzinga, Market Insider)

Google has already released 3 Assistant Smart Displays. Google is allegedly working on a new Nest Hub for 2022 with a dockable tablet form factor where the screen detaches from a base / speaker.(Android Headlines, Pocket-Lint, 9to5Google)