4-10 #Ahhhh : BOE may develop panels for Samsung’s entry-level models; BOE plans to increase OLED panel deliveries by nearly 70% in 2022; LGD has come up with two new projects recently; etc.

MediaTek has announced the Dimensity 1300. It is built on TSMC’s 6nm process, features an octa-core processor with four Cortex-A78 cores (one Ultra, running up to 3GHz, and three Super, up to 2.6GHz) and four Cortex-A55 efficiency cores, scaling up to 2GHz. The graphics processor is a 9-core Arm Mali-G77 MC9. The Dimensity 1300 supports up to 168Hz displays at up to FullHD+ resolution, or 2520×1080. The chip can be paired with as much as 16GB of 4266Mbps LPDDR4x RAM. The Dimensity 1300 supports UFS 3.1 type storage.(GSM Arena, MediaTek)

British chip design giant Arm has transferred its shares in its wayward China joint venture to a special purpose vehicle that it jointly owns with its parent SoftBank Group, in a move that could speed up its plans to go public if it decides to list in the U.S. As a result, Arm China will continue to distribute Arm’s IP in China, and Arm Ltd. will continue to collect licensing fees from Chinese companies. However, it will not have to disclose Arm China’s financial results to regulators or Arm’s future investors. (CN Beta, Asia Nikkei, Tom’s Hardware)

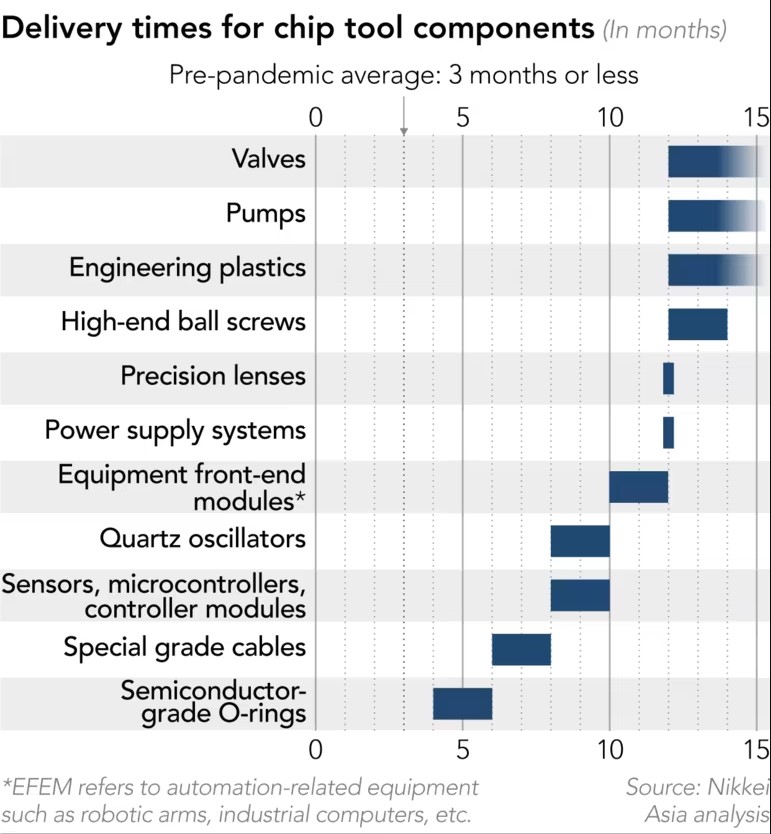

Companies like Intel, Samsung, and TSMC have planned their ways to accelerate semiconductor manufacturing. However, since companies are now looking for equipment to produce chips, it has resulted in a shortage of chip-making equipment. Specialized chip tool manufacturers like ASML, Lam Research, Applied Materials, and KLA have warned their clients that they might have to wait for up to 18 months to receive critical equipment needed for semiconductor manufacturing. The higher demand for chip-making tools has led to a shortage of everything – from engineering plastics to precision lenses, valves, pumps, special cables, sensors, and a lot more. A single EUV lithography machine which is made by ASML requires over 100,000 components from more than 800 global suppliers and costs up to USD200M. Wait times for some of its products are now more than 20 months. The world’s largest supplier of chip substrates, Unimicron, says that the equipment deliveries it desperately needs now have lead times of up to 30 months instead of 12-18 months estimated in 2021. (Neowin, Asia Nikkei)

BOE plans to increase OLED panel deliveries by nearly 70% in 2022. Its two production lines in Chengdu and Mianyang will run at full capacity in fiscal year 2022. The third production line in Chongqing is in full production. This will increase BOE’s OLED production from 60M units in 2021 to 100M units in 2022. The Sichuan factory is already supplying Apple, and BOE apparently hopes that the Chongqing factory will also supply Apple with panels. Furthermore, the company is also considering building a new OLED factory in Chengdu, saying it is based on “assessing the strategy, market, technology and financial situation”. The new plant is scheduled to start production by the end of 2024, but production capacity has not been announced.(GizChina, My Drivers, Asia Nikkei)

LG Display (LGD) is considering a variety of OLED technologies for when it launches OLED panels dedicated to monitors. The company’s VP Lee Hyun-hoo has indicated that the company is reviewing both white-OLED (W-OLED) and red, green and blue-OLED (RGB-OLED) for OLED panels aimed at monitors in the 30” range. LGD is currently developing Gen 8.5 (2200×2500mm) OLED technology where OLED panels are cut out from 2200x2500mm glass substrates to manufacture panels aimed at IT products such as tablets and notebooks. These panels are expected to be from 10” to 20” in size. LGD is planning to use fine metal masks (FMM) for these panels as it is currently doing for Gen 6 (1500 x 1850mm) OLED panels. (CN Beta, The Elec, Sina)

LG Display (LGD) has come up with two new projects recently, namely “Small Panel Advanced Technology Development Task Force” and “Next Generation Display”. Not only is BOE developing dual-stack OLED display tech that makes long-life panels that are 30% more energy efficient and much brighter, but it is also working on the Gen-8.5 OLED production method for larger screens, hoping to enter Apple’s supply chain for devices with screens larger than the iPhone’s. Moreover, BOE and CSOT are the first companies that supply OLED displays for Galaxy phones, and Samsung has increased its order to 3.5M panels in 2022, even for upper midrange phones like the Galaxy A73, demonstrating that BOE can procure OLED screens as good as Samsung Display’s at a lower cost.(Phone Arena, The Elec, The Bell)

BOE may develop panels for Samsung’s entry-level models. These models will include the Samsung Galaxy A13, Galaxy A23, and other models. Both companies are currently discussing technical verification and contract signing. Samsung originally planned to stop the production of LCD panels by the end of 2020. However, the LCD panel market started to increase prices in the past year or so. This made Samsung’s LCD factory continue to operate for another 2 years. (GizChina, My Drivers, Laoyaoba)

E Ink has announced the launch of E Ink Kaleido 3. This new generation of E Ink Kaleido offers richer colors, along with 16 levels of grayscale and 4096 colors. Kaleido 3 is using E Ink’s Print Color ePaper technology, where a color filter array (CFA) is used in conjunction with E Ink’s Carta black and white ink film, creating a full color device for a more fully realized eBook shopping and reading experience. In addition to improved color performance, Kaleido 3 uses E Ink ComfortGaze, a new front light technology designed by E Ink’s Front Light Team. ComfortGaze has been engineered to reduce the amount of blue light reflected off the surface of the display, providing further comfort while reading. (CN Beta, Medium, Business Wire, GoodReader)

DS Techopia is planning to expand its production capacity for hexachlorodisilane (HCDS), a precursor used in the production of NAND flash memory chips, by up to 50% during 3Q22. The company said it was doing so as its customers such as Samsung are expanding their overall NAND flash production volume while at the same time applying more advanced processes such as 3D layers. HCDS is used to form the silicon oxide (SiO2) and silicon nitride (SiN) layers on the silicon wafers.(Laoyaoba, China Flash Market, The Elec)

Kioxia has held a groundbreaking ceremony for its state-of-the-art semiconductor fabrication facility (Fab2) at its Kitakami Plant in Iwate Prefecture, Japan. Utilizing AI-based cutting-edge manufacturing, the new facility will contribute towards possible expansion of production of its proprietary 3D flash memory BiCS FLASH at the Kitakami Plant. Construction of the Fab2 facility is scheduled to be completed in 2023. (Laoyaoba, Business Wire, Kioxia, Evertiq)

Yangtze Memory Technology Corp (YMTC) has launched a new consumer-grade solid-state drive product, the TiPlus 5000, priced from 399 yuan. This product adopts the third-generation 3D flash memory chip of YMTC based on Xtacking 2.0 architecture, supports PCIe Gen3x4 interface, NVMe 1.3 protocol, and has a sequential read speed of 3500 MB/s.(CN Beta, EET China, IT Home)

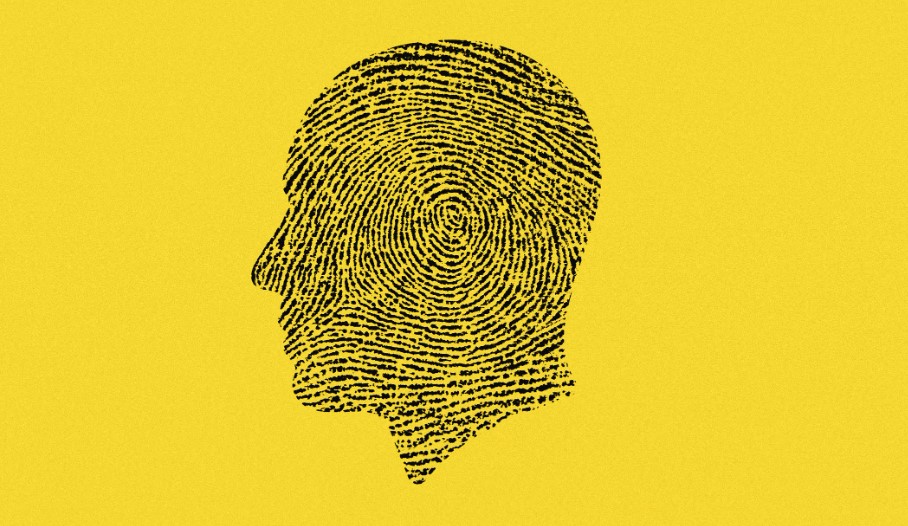

Samsung is expected to be launching the Galaxy Z Fold 4 and Galaxy Z Flip 4 in 2H22. Samsung will reportedly not be using the fingerprint under display technology on its upcoming foldable phones. However, these foldable phones will continue to have a fingerprint sensor embedded inside the power button on the side of the device. Samsung has decided to maintain the existing unlocking method, judging that it is more advantageous in terms of user experience (UX) to unlock foldable devices by having them recognize fingerprints naturally while opening their screens due to their structural characteristics not the limitations of technology.(Pocket-Lint, Android Headlines, Business Korea, SamMobile)

The European Union is planning to expand a database used to share DNA, fingerprints and other data related to criminals by adding facial recognition data to the mix. The plans are part of a wider push to “modernize” policing in the 27-member bloc and are covered by the Prüm II data-sharing proposals. The EU initially announced the move back in Dec 2021. The first iteration of Prüm was signed by seven European countries—Belgium, Germany, Spain, France, Luxembourg, the Netherlands, and Austria—back in 2005 and allows nations to share data to tackle international crime. Since Prüm was introduced, take-up by Europe’s 27 countries has been mixed. (CN Beta, European Commission, Wired, TechRadar)

Electric-vehicle maker Tesla, payments firm Block and blockchain company Blockstream will collaborate to mine bitcoin using solar power in Texas, according to the Blockstream CEO Adam Back. Tesla is building the solar power infrastructure and providing its Megapack batteries. Tesla’s 3.8-megawatt Solar PV array and its 12 megawatt-hour Megapack will power the facility, and construction has started on the project. Blockstream and Block, which wasp reviously known as Square, have said that they were collaborating to build an open-source and solar-powered bitcoin mining facility in the United States. (CN Beta, CNBC, Reuters, PR Web)

iFixit has signed a deal with Google to make Pixel repairs much easier. iFixit.com will sell genuine Google parts individually and in kits later in 2022. Google says that parts will be offered for the “Pixel 2 through Pixel 6 Pro, as well as future Pixel models, in the US, UK, Canada, Australia, and EU countries where Pixel is available.” iFixit is the leading site for consumers wanting to find parts and instructions on how to fix devices, and soon, it will sell Pixel screens, batteries, cameras, and more. (CN Beta, iFixit, ArsTechnica, Google, MacRumors)

Apple has been said to be cutting orders of its 5G iPhone SE and AirPods in the second quarter, but Taiwan-based Apple supply chain companies have pointed out that they have yet to receive instructions from customers about revising orders, according to Digitimes. (Digitimes, CN Beta)

vivo Y21G is launched in India – 6.51” 720×1600 HD+ v-notch, MediaTek Helio G70, rear dual 13MP-2MP macro + front 8MP, 4+64GB, Android 11.0, side fingerprint, 5000mAh 18W, INR13,990 (USD185). (GizChina, Gizmo China, GSM Arena, vivo)

Samsung Galaxy M53 is launched in India – 6.7” 1080×2408 FHD+ HiD Super AMOLED Plus 120Hz, MediaTek Dimensity 900 5G, rear quad 108MP-8MP ultrawide-2MP depth-2MP macro + front 32MP, 6+128GB, Android 12.0, side fingerprint, 5000mAh 25W, price yet to be announced. (Gizmo China, GSM Arena, Samsung)

Samsung Galaxy M33 5G is launched in India – 6.6” 1080×2408 FHD+ v-notch 120Hz, rear quad 50MP-5MP ultrawide-2MP depth-2MP macro + front 8MP, 6+128 / 8+128GB, Android 12.0, side fingerprint, 6000mAh 25W, reverse charging, INR18,999 (USD250) / INR20,499 (USD270). (Gizmo China, Samsung, Live Mint, Gadgets360)

Honor Play 6T and 6T Pro are announced:

- 6T – 6.74” 720×1600 HD+ u-notch 90Hz, MediaTek Dimensity 700 5G, rear tri 13MP-2MP macro-2MP depth+ front 5MP, 8+128 / 8+256GB, Android 11.0 (no GMS), side fingerprint, 5000mAh 22.5W, CNY1,199 (USD190) / CNY1,399 (USD220).

- 6T Pro – 6.7” 1080×2388 FHD+ HiD 90Hz, MediaTek Dimensity 810 5G, rear dual 48MP-2MP depth + front 8MP, 8+256GB, Android 11.0 (no GMS), side fingerprint, 4000mAh 44W, CNY1,599 (USD250).

(Gadgets360, GSM Arena, Honor)

Honor Magic4 Lite is announced in France – 6.81” 1080×2388 FHD+ HiD 120Hz, Qualcomm Snapdragon 695 5G, rear tri 48MP-2MP macro-2MP depth + front 16MP, 6+128GB, Android 11.0, side fingerprint, 4800mAh 66W, price not yet announced.(GSM Arena, Honor)

realme 9 4G is launched in India – 6.4” 1080×2400 FHD+ HiD Super AMOLED 90Hz, Qualcomm Snapdragon 680 4G, rear tri 108MP-8MP ultrawide-2MP macro + front 16MP, 6+128 / 8+128GB, Android 12.0, fingerprint on display, 5000mAh 33W, INR15,999 (USD210) / INR16,999 (USD225). (GSM Arena, Gizmo China)

Tesla CEO Elon Musk has indicated that Tesla may start production of a humanoid robot known as Optimus as early as 2023. Musk has claimed that Optimus will eventually be able do anything that humans do not want to do, claiming that it will bring about an “age of abundance”. When Musk first announced Tesla’s robot, he said it will be based on the same chips and sensors that the company’s cars use for self-driving features. It is five foot eight inches tall, according to Musk, and has a screen at head-height for useful information.(CN Beta, CNBC, Electrive)

Adyen, the global financial technology platform, is working with Apple to offer Tap to Pay on iPhone for its U.S. customers later in 2022. The solution allows Adyen’s U.S. customers to use their iPhones to accept contactless payments, without the need to purchase or manage additional hardware or payment terminals. Adyen is working with enterprise customers and commerce platforms, such as Lightspeed Commerce and NewStore, to bring the feature to even more businesses. With Adyen’s support, NewStore will pilot the new capability with its customer Vince. (Engadget, Adyen)