4-22 #LaborDays : vivo has announced a new imaging chip V1+; Apple has allegedly struck a deal with BOE in 2022; Huawei has renamed the Huawei Consumer Business name to Huawei Smart Device Business; etc.

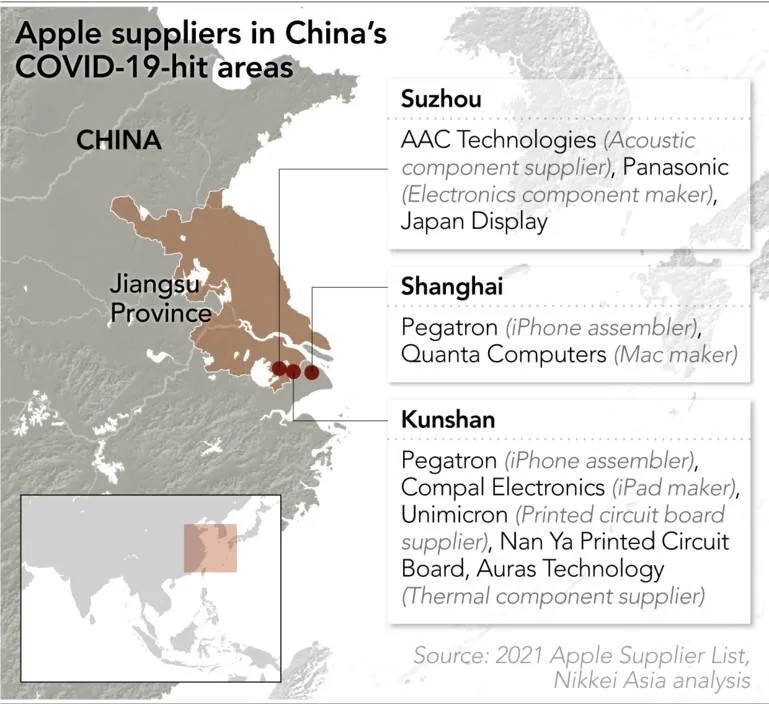

Almost half of Apple’s 200 top suppliers are based in Shanghai and other COVID-19 lockdown-hit areas of China, according to a Nikkei Asia analysis of Apple’s available supplier list. Over 70 of the firms directly supply Apple from their manufacturing plants in the affected Jiangsu Province. The majority are in Kunshan and Suzhou, two cities near Shanghai. Then another 30 or so Apple suppliers have production facilities that are based in Shanghai itself. Many also supply other firms, so the potential impact is to the whole technology industry. Apple may be able to compensate for lockdown disruptions to iPhone and MacBook production by switching orders to manufacturers outside the region. However, a prolonged lockdown would be harder for any firms to cope with. (Asia Nikkei, CN Beta, 9to5Mac, Benzinga, Apple Insider)

Richard Yu, CEO of Huawei CBG has officially announced that Huawei has entered the commercial field and renamed the Huawei Consumer Business name to Huawei Smart Device Business. Huawei’s smart device business has entered the commercial field in an all-around way. It will bring the innovation capabilities and smart experience of the consumer field to the commercial field. In this segment, Huawei continues to build consumer products for consumers, it will also strategically invest in the commercial field for a long time to create a better and smarter commercial product experience for government and enterprise customers. In this segment, Huawei continues to build consumer products for consumers, it will also strategically invest in the commercial field for a long time to create a better and smarter commercial product experience for government and enterprise customers.(CN Beta, Sina, CE, Huawei Central)

Tesla CEO Elon Musk has secured USD46.5B in funding to buy Twitter and is considering a tender offer for its shares. Musk himself has committed to put up USD33.5B, which will include USD21B of equity and USD12.5B of margin loans, to finance the transaction. Banks, including Morgan Stanley, have agreed to provide another USD13B in debt secured against Twitter itself.(CN Beta, SCMP, NPR, Reuters, SEC)

According to Display Supply Chain Consultants analyst Ross Young, Samsung Galaxy Z Fold 4 and Flip 4 could see a price cut, which would be key to making these foldables appeal to the masses. Samsung will produce double the Z Fold 4/Z Flip 4 units in Jul 2022. (CN Beta, Tom’s Guide, Twitter, TechRadar)

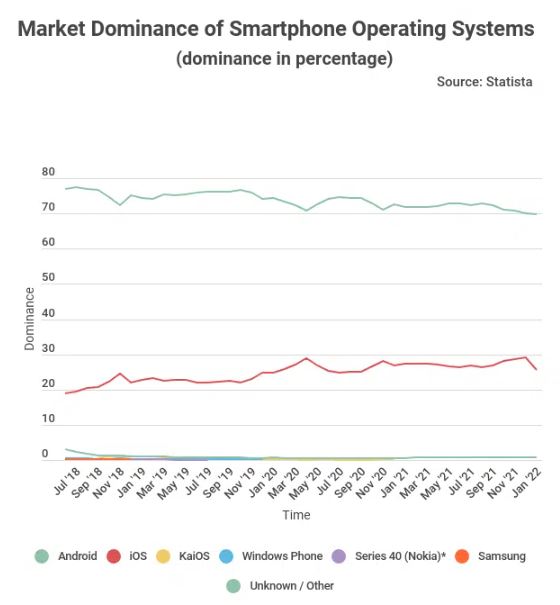

StockApps has noted that Google’s Android mobile operating system’s market share has fallen from 77.32% in 2018 to 69.74% in Jan 2022. While the most popular OS has lost 7.58% of the market over the past 5 years, Apple’s iOS has increased from 19.4% to 25.49%. Although Android is the first choice in most regions, the North American market is dominated by iOS and the competition between the two mobile operating systems is fierce. The Asian and South American continents accounted for 81% and 90% of Android shares respectively. The share of iOS in Asia and South America is 18% and 10%. (GizChina, StockApps)

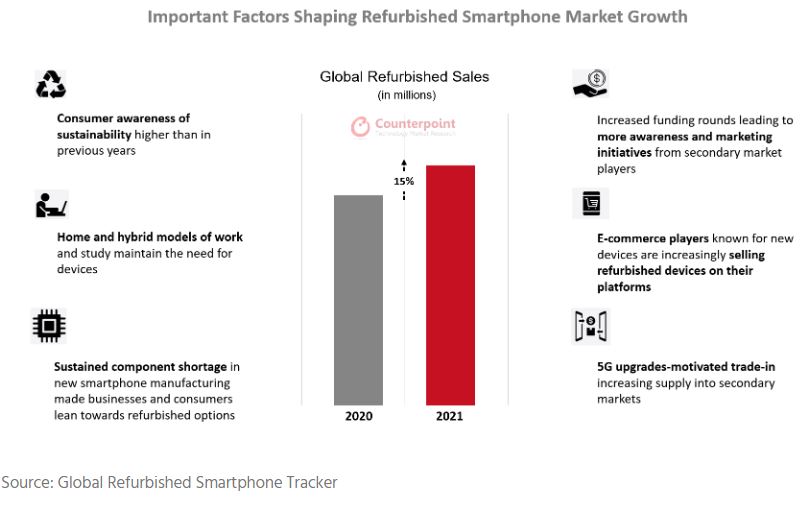

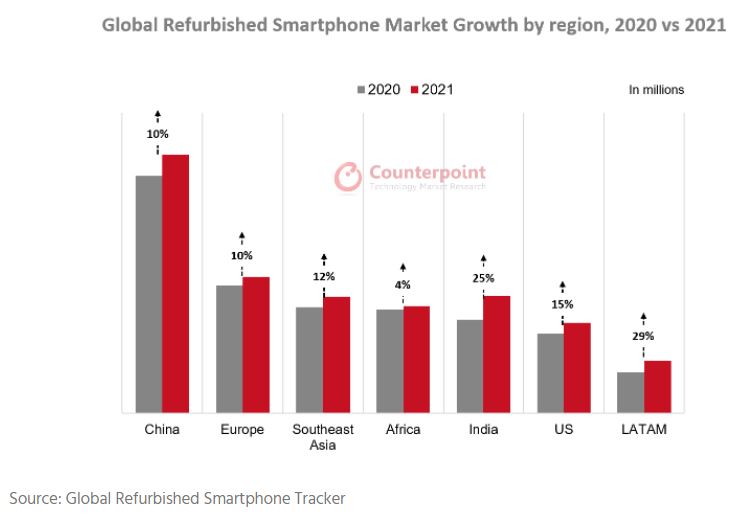

The global secondary smartphone market saw a surge in demand as well as supply in 2021. Even as new smartphone shipments grew 4.5% YoY in 2021, refurbished smartphone volumes witnessed a 15% YoY growth, according to Counterpoint Research. With new flagship smartphone prices remaining at the higher end, a larger share of consumers considered buying refurbished models of popular brands like Apple and Samsung. (GSM Arena, Counterpoint Research)

OnePlus Nord N20 5G is announced – 6.43” 1080×2400 FHD+ HiD AMOLED, Qualcomm Snapdragon 695 5G, rear tri 64MP-8MP ultrawide-2MP depth + front 16MP, 6+128GB, Android 11.0, fingerprint on display, 4500mAh 33W, USD282. (GSM Arena, GizChina, MySmartPrice)

Xiaomi Civi 1S is launched – 6.55” 1080×2400 FHD+ HiD OLED 120Hz, Qualcomm Snapdragon 778G+ 5G, rear tri 64MP-8MP ultrawide-2MP macro + front 32MP, 8+128 / 8+256 / 12+256GB, Andrroid 12.0, fingerprint on display, 4500mAh 55W, CNY2,299 (USD355) / CNY2,599 (USD405) / CNY2,899 (USD450). (GSM Arena, GSM Arena,Gizmo China, Mi.com)

realme Q5 and Q5 Pro are announced in China:

- Q5 – 6.6” 1080×2412 FHD+ HiD 120Hz, Qualcomm Snapdragon 695 5G, rear tri 50MP-2MP macro-2MP depth + front 16MP, 6+128 / 8+128 / 8+256GB, Android 12.0, side fingerprint, stereo speakers, 5000mAh 65W, CNY1,399 (USD220) / CNY1,599 (USD250) / CNY1,799 (USD280).

- Q5 Pro – 6.62” 1080×2400 FHD+ HiD AMOLED 120Hz, Qualcomm Snapdragon 870 5G, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 8+128GB, Android 12.0, fingerprint on display, stereo speakers, 5000mAh 80W, CNY2,299 (USD360).

Redmi 10A and 10 Power are launched in India:

- 10A – 6.53” 720×1600 HD+ v-notch, MediaTek Helio G25, rear 13MP + front 5MP, 3+32 / 4+64GB, Android 11.0, rear fingerprint, 5000mAh, INR8,499 (USD111) / INR9,499 (USD125).

- 10 Power – 6.7” 720×1650 HD+ v-notch, Qualcomm Snapdragon 680 4G, rear dual 50MP-2MP depth + front 5MP, 8+128GB, Android 11.0, rear fingerprint, 6000mAh 18W, INR14,999 (USD197).

(GSM Arena, GSM Arena, India Times, Live Mint, Mi.com, 91Mobiles)

Meta executive producer Ruth Bram has indicated that both the hardware and software need more work, and it may take 5-10 years to fully bring metaverse to life. Meta has hinted at its plans for the metaverse, and how it sees future hardware playing a role in its ongoing development. They think the metaverse will build on this foundation to become the next generation of the internet and the next evolution in social technology.(Digital Trends)

2C2P, a global payments platform and Ant Group has announced a strategic partnership to accelerate digital payment adoption and innovation. The partnership, upon completion, will see Ant Group becoming the majority shareholder of 2C2P. Through the strategic partnership, 2C2P’s extensive pool of merchants inclusive of global and regional brands will be connected with Alipay+, extending its current 250 payment options offering to include even more e-wallets and local payment methods. (TechCrunch, Business Wire)

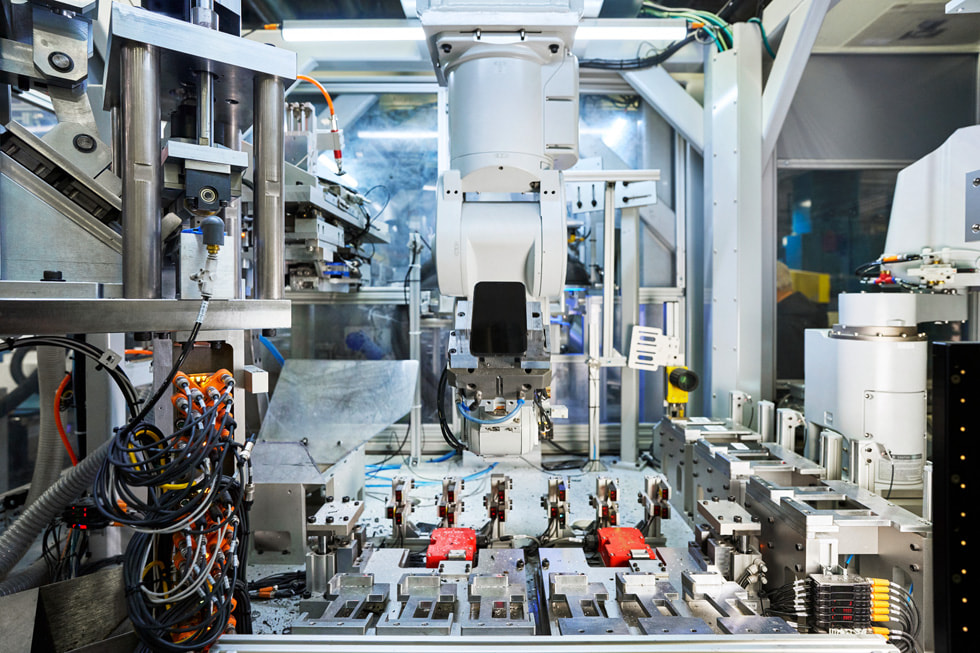

According to ASML CEO Peter Wennick, there is no sign of any slackening in demand from semiconductor manufacturers amid the global computer chip shortage. He has further added that they see no signs of any weakening in our customer base. He has further added that in light of the demand and our plans to increase capacity, we expect to revisit our scenarios for 2025 and growth opportunities beyond. ASML’s CFO, Roger Dassen, has said that the company was looking at the feasibility of raising annual shipments of current EUV tools from 55 now, to 90 by 2025. Annual shipments of deep-UV tools, which are not nearly as complex as EUV machines, could rise to 600 over the same period.(CN Beta, Seeking Alpha, Reuters, Asia Nikkei, Bloomberg, Yahoo, Optics)

According to ASML CEO Peter Wennink, the chip shortage has become so dire that large industrial companies are buying washing machines in order to rip out the chips and repurpose them. Wennink has said that internet of things is likely driving the demand for these older chips found inside home appliances. ASML itself is struggling to build all of the tools its customers want, and is trying to figure out how to produce just over 700 lithography tools in total every year.(CN Beta, Protocol, Bloomberg)

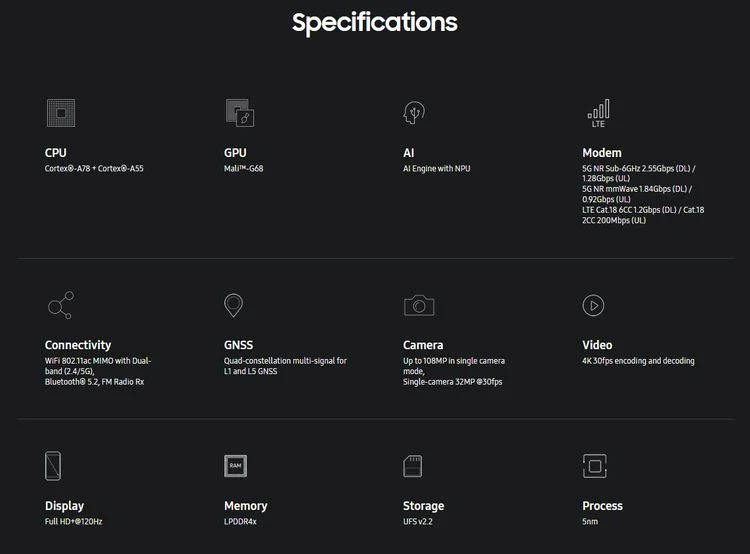

Samsung has announced the Exynos 1280 chipset. The 1280 moves to a 5nm process with two high-speed Cortex A78 CPUs and six efficient A55 cores. The new SoC is optimized with Fused Multiply-Add (FMA) which should bring better power consumption and battery life. The onboard neural processing unit (NPU) brings AI functions like scene segmentation, real-time motion analysis and multi-object surveillance.(GSM Arena, Samsung)

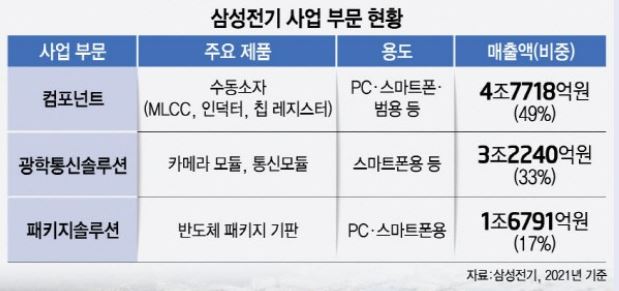

Samsung Electro-Mechanics (SEMCO) is expected to develop a flip chip ball grid array (FC-BGA) for Apple’s next-generation PC processors. FC-BGA is a semiconductor substrate that connects the semiconductor chip to the main substrate. Samsung Electro-Mechanics will develop the product by 2022, and expected to supply to Apple. Samsung Electro-Mechanics is participating in Apple’s PC processor M2 development project developed by Apple. LG Innotek has recently entered the FC-BGA business, and it seems like LG Innotek will not participating in the Apple M2 project.(Apple Insider, ET News)

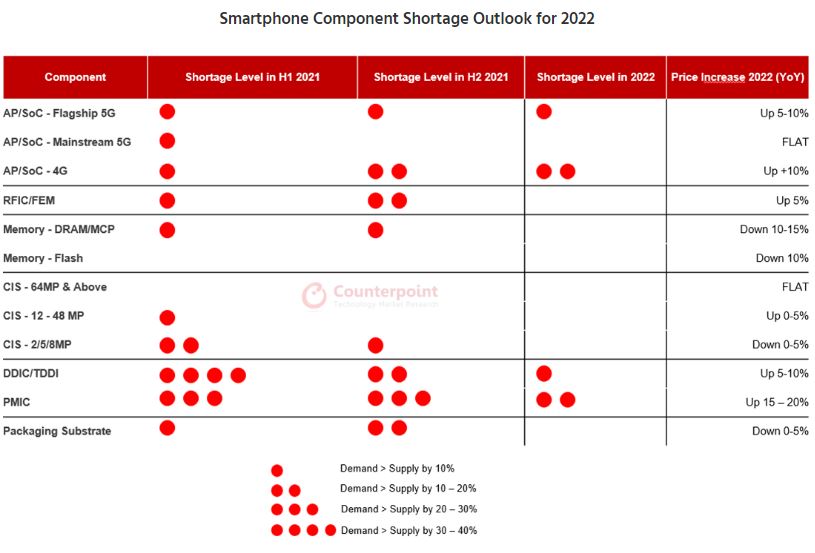

Global semiconductor chip shortages are likely to continue easing during 2H22 as demand-supply gaps decrease across most components, according to Counterpoint Research. These shortages have plagued many industries for the past two years and vendors across the supply chain have spent much effort dealing with uncertainties. Since late 2021, demand-supply gaps have been shrinking, signaling an approaching end to supply tightness across the broader ecosystem. Inventory levels of 5G-related chipsets including mainstream application processors, power amplifiers and RF transceivers have increased significantly, though some exceptions exist, like older-generation 4G processors as well as power management ICs. (CN Beta, Counterpoint Research)

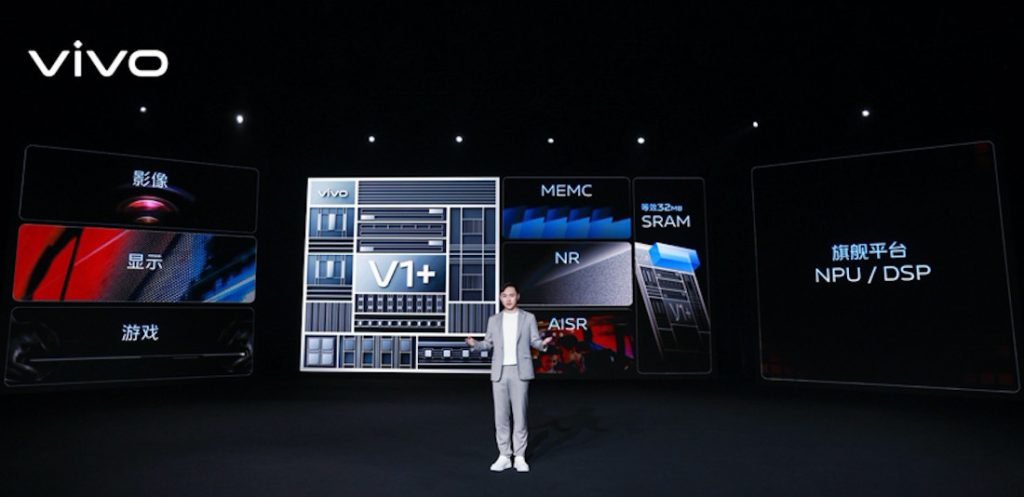

vivo has announced a new imaging chip that is bound to enhance the display and imaging capabilities of its next flagships. The Vivo X80 series will have the V1+ chip developed in-house by the company and MediaTek. The V1+ is the successor to the V1 which was released in 2021. vivo and MediaTek have been working on the V1+ to fully adapt it to the Dimensity 9000 platform. With fine tuning of its noise reduction algorithm, the V1+ can take night shots in situations where there is less than 1 lux of ambient lighting. This is also made possible by the chip’s 32MB SRAM and 8GB/s data throughput speed. Additionally, vivo has announced improvements in image brightness by 16% and white balance accuracy by 12%. A photo’s most prominent portions can in fact see further boosts in brightness of up to 350%.(Gizmo China, Fonearena, GSM Arena, Sina, Sohu)

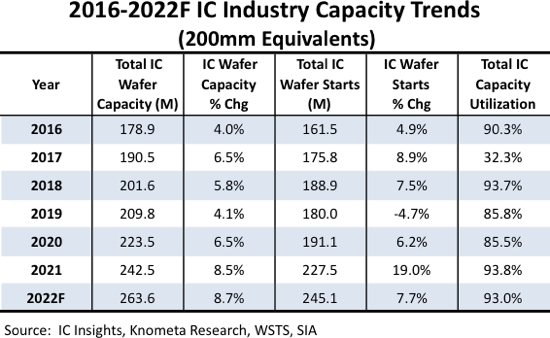

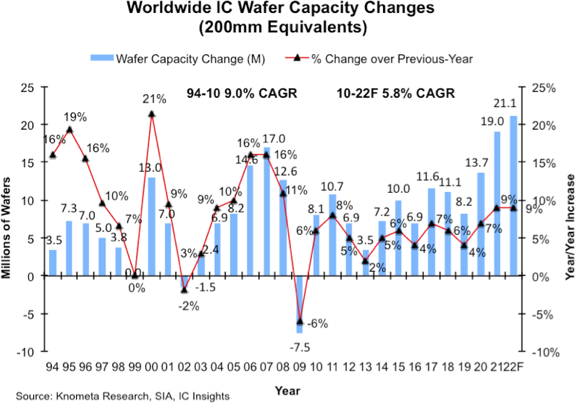

The volatile nature of the IC industry is reflected by large swings in annual wafer starts. Over the past 5 years, for example, annual wafer start growth rates have ranged from -4.7% in 2019 to 19.0% growth in 2021. The industry’s installed wafer capacity also fluctuates according to market conditions, but the changes are not usually as dramatic as they are for wafer starts. The annual wafer capacity growth rates over the past five years have ranged from 4.0% in 2016 to 8.5% in 2021. The 8.7% jump in IC industry capacity forecast for 2022 will come primarily from the addition of 10 new 300mm wafer fabs that are scheduled to open this year (3 less than were added in 2021). The biggest increases in capacity are expected to come from the large new memory fabs of SK Hynix and Winbond as well as the three new fabs (two in Taiwan; one in China) from TSMC, the world’s largest pure-play foundry. Other new 300mm fabs include CR Micro’s fab for power semiconductors; Silan’s fab for power discretes and sensors; TI’s RFAB2 facility for analog devices; ST/Tower’s fab for mixed-signal, power, RF, and foundry; and SMIC’s new fab for foundry operations. (IC Insights, CN Beta)

Samsung Display has started to bring display process equipment into Asan Gen-6 Organic Light-Emitting Diode (OLED) factory “A4-2”. It is estimated that the investment is around KRW1T. Samsung Display’s A4-2 lines of LCD factory (L7-2), which were closed early in 2021, is being converted into Gen-6 OLED production lines. Samsung Display will secure additional 180,000 units of its annual production capacity of Gen-6 OLED panels through new OLED line. It is known that investment on the line is around KRW1T.(GizChina, ET News, IT Home)

TF Securities analyst Ming-Chi Kuo believes that Apple could launch its first full-display smartphone in 2024, with the “iPhone 16 Pro” potentially the first Apple device to feature under-display Face ID and an camera under display (CuD) front camera. (CN Beta, 9to5Mac, MacRumors)

Apple has allegedly struck a deal with BOE in 2022, which is worth CNY50B (USD7.75M) and is for 25% of OLED displays (about 50M units), designated for the vanilla iPhone 14 smartphone. BOE will supply only 6.1” panels, meaning the bigger iPhone 14 Max and the iPhone Pro duo will still exclusively use screens, manufactured by LG and Samsung. In order to meet Apple’s needs for future contracts, BOE will expand its B16 plant in Sichuan and will equip it with the appropriate power, needed to yield the required number of OLEDs panels. (My Drivers, GSM Arena, Gizmo China, The Elec)

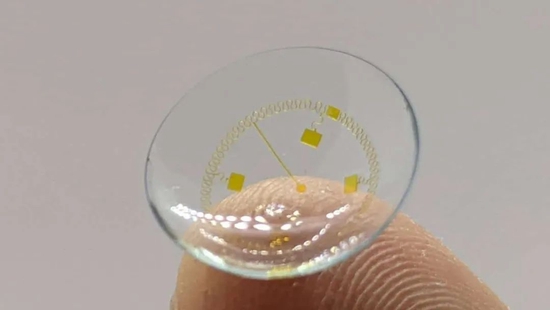

Google and Samsung will reportedly be at the forefront of the new industry of smart contact lenses, perhaps serving as the catalyst for an entirely new type of wearable. Both companies have been laying the groundwork for smart contact lenses for a few years at this point. Likewise, Sony has a large stake in imaging, which is why Global Market Vision names it as one of the leading companies for that upcoming smart contact lens market, along with Sensimed AG and PEGL. Newcomer Mojo Vision has joined the rat race for wearable innovation in technology. According to Global Market Vision, a new smart contact lens market will rise in the next 5 or so years and will experience an explosion in growth with the companies marching in full force. (CN Beta, SlashGear, Business Insider)

Samsung Galaxy Z Fold4 is expected to bring some major camera improvements with the main camera will be upgraded to a 108MP sensor. The sensor may be the 1/1.33” ISOCELL HM3 sensor.(CN Beta, GSM Arena, Twitter)

Xiaomi and Motorola will allegedly launch smartphone featuring 200MP main camera. The 200MP sensor used by Xiaomi is allegedly Samsung ISOCELL HP1, the unit pixel area is 0.64μm, and it supports ChameleonCell pixel synthesis. In a dark light environment, Samsung’s 200MP can synthesize 1.28μm large pixels to generate 50MP pixel proofs, or synthesize 2.56μm large pixels to generate 12.5MP proofs. (My Drivers, ZOL, Sohu)

Winbond Electronics has announced key enhancements to its DDR3 product on the ultra-high-speed performance. Winbond has been delivering competitive DDR3 products for 10 years and will keep delivering DDR3 in coming 10+ years with superior customer support and product quality. Winbond has disclosed plans to boost its DDR3 chip output, which will climb as a proportion of the company’s total DRAM revenue to 50% by 2024 from the current 30%. Winbond says in an update that its DDR3 shipments makes up 30% of its total DRAM revenue and that it is projected to increase to 50% in 2024. The company continues to say that it will add new wafer capacity to its new fab in Kaohsiung, Taiwan from 4Q22, which Winbond says will offer more advanced manufacturing technologies.(My Drivers, PR Newswire, Digitimes, Digitimes, Evertiq, China Times)

Rivian CEO RJ Scaringe has warned that a shortage of electric-car batteries could soon eclipse the issues that the automotive industry has faced from the computer chip shortage. He has indicated that semiconductors are a small appetizer to what we are about to feel on battery cells over the next 20 years. Over the past 2 years, the chip shortage has led companies to slash production and cut electronic features like touch screens and seat heaters. Now, automakers looking to branch out into electric cars could face a critical shortage of EV batteries, as well as the metals required to produce the roughly 1,000 pound lithium-ion batteries. He has further added that all the world’s cell production combined represents well under 10% of what we will need in 10 years, meaning 90% to 95% of the supply chain does not exist. (CN Beta, NY Post, Business Insider, CNBC)

Apple has announced that in 2021, almost 20% of all the materials it used in its devices were recycled. The company confirmed that this is the highest amount of recycled material it has ever used in a given year and it is the first time it has used certified recycled gold. Notably, it also doubled its use of recycled tungsten, rare earth elements, and cobalt.(GizChina, Neowin, Apple)

Huawei has allegedly shipped telecommunications equipment to Russia’s VimpelCom (AKA VEON) worth around USD15M. The supply contract is lengthy and was initially signed back on 24 Feb 2022. However, sanctions that were imposed caused issues in deliveries. Back in Feb 2022, the US Department of Commerce’s Bureau of Industry and Security had also issued a clarification that the export or transfer of goods to maintain civilian telecommunications infrastructure will be excluded from this rule. (Gizmo China, IT Home, Digit News)