4-24 #Thankful : TSMC will begin construction for a new chip plant in Japan’s Kumamoto Prefectur; Samsung is likely to use batteries from LGES on its new foldable smartphones; Semiconductor manufacturers worldwide are on track to boost 200mm fab capacity by 1.2M wafers; etc.

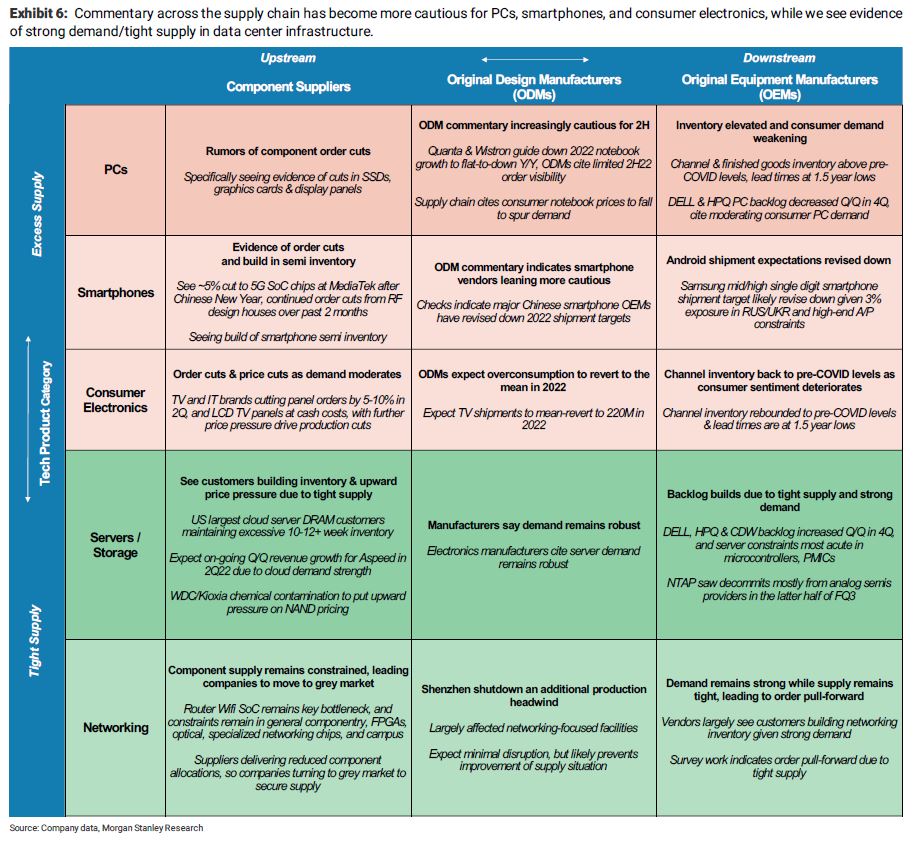

Morgan Stanley is cautious on consumer hardware, but are less cautious on data center infrastructure, autos, and industrials. Overall, commentary across the supply chain has been relatively consistent by end-market. In the smartphone and consumer electronics markets, supplier / ODM commentary points to order cuts, and vendor commentary suggests demand is moderating. Conversely, supply remains tight across data center infrastructure (server, storage & networking), with suppliers / ODMs citing continued tight supply/upward price pressure, and vendors seeing rising backlog and strong demand as refreshes pushed from 2020 / 2021 are restarted in 2022. From the semis side, auto and industrials demand remains robust. (Morgan Stanley report)

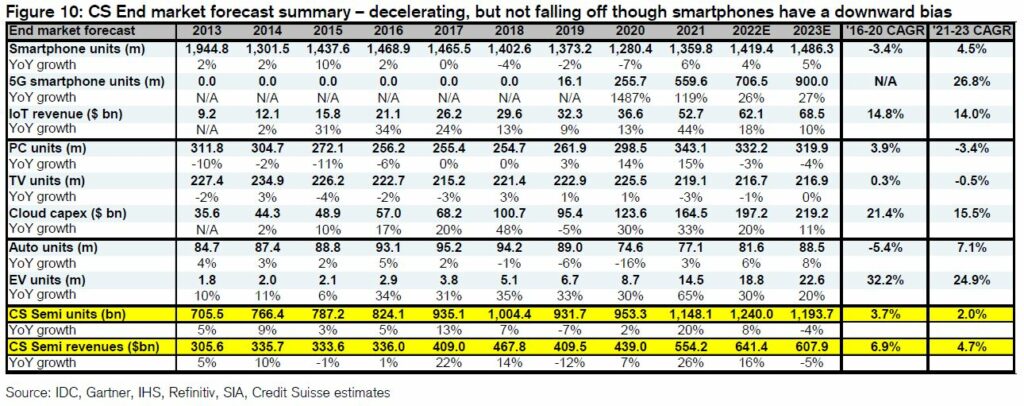

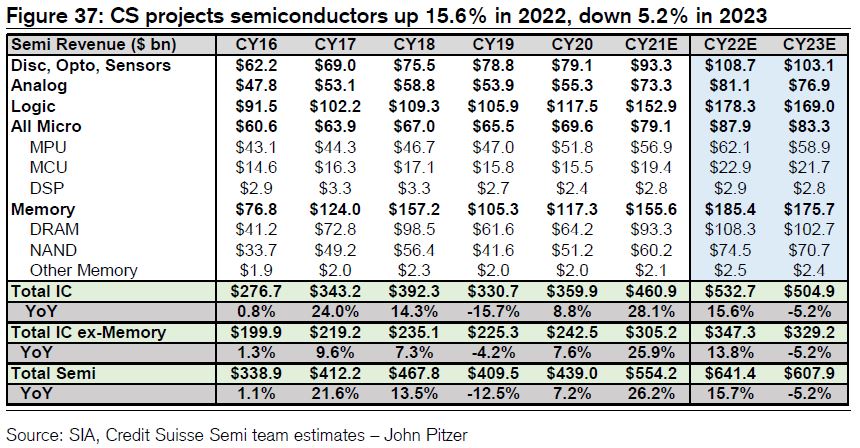

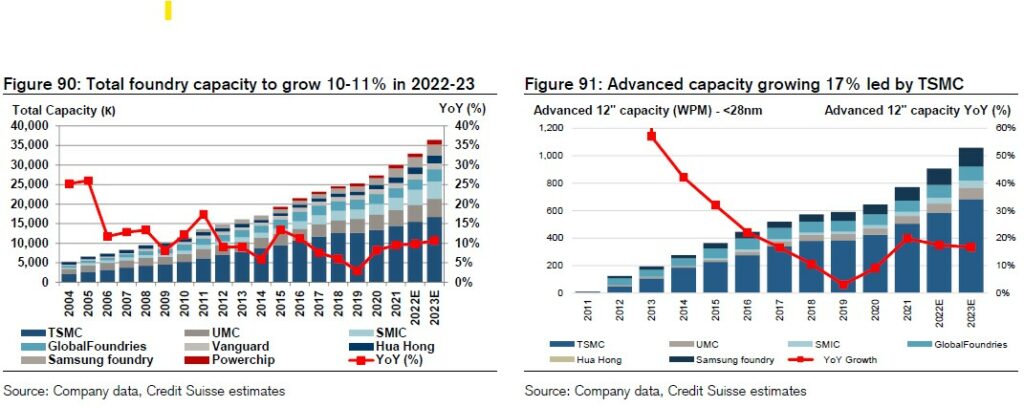

Credit Suisse views the combination of building inventory, inflationary pressures from rising oil and commodity prices, and rolling Covid-19 lockdowns in China impacting demand, coupled with more supply ramps by 2023, triggering a slowdown and potentially some reversal of the inventory build. They model a soft landing and under-utilization in 1H23, and return to mild price erosion as supply becomes less tight. Their global semiconductor forecast since the start of 2022 has factored in a 5% YoY sales decline in 2023 after growing +15% YoY in 2022, and with the rising rates, war and inflationary pressure, now looks more possible than stronger for longer. (Credit Suisse report)

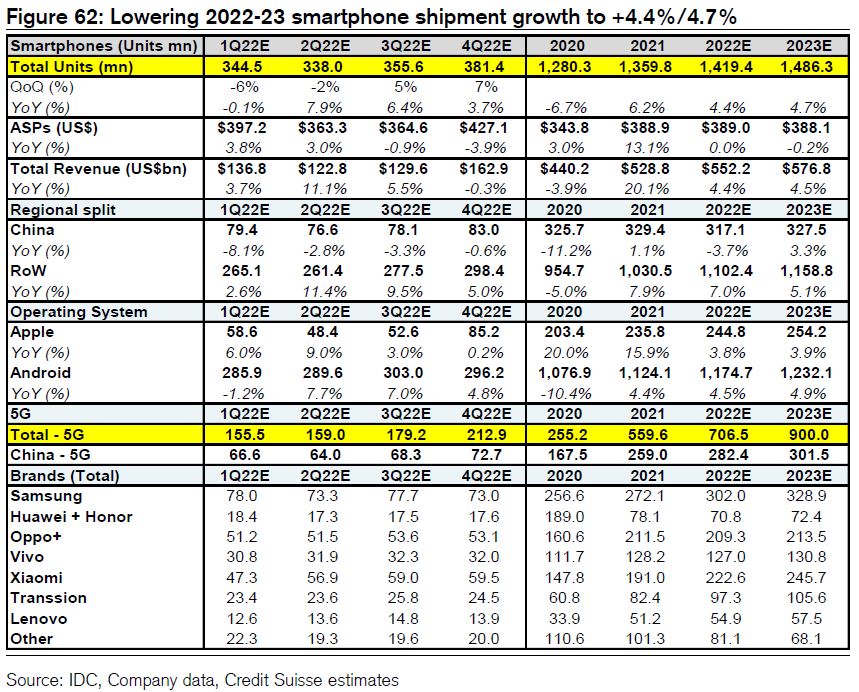

Credit Suisse is seeing downside in smartphones and trimmed their 2022 global smartphone estimates to 1.41B / +4.4% YoY in Mar 2022 (from 1.453B / +6.6% YoY) and 2023 units to 1.486B / +4.7% YoY, as smartphone sales remain sluggish and held back by inflationary BOM cost pressure and evolutionary feature upgrades. Most of the China smartphone brands have been lowering their annual shipment targets to reflect this demand uncertainty, with Credit Suisse’s Xiaomi estimates down from 223M in the beginning of the year to 207M, OPPO down to 199M, vivo down to 121M and Honor down to 62M. Factoring in these adjustments and the potential impact at Samsung in emerging market demand, the smartphone industry may be cut to 0-2% growth though still pending on the outcome of Covid-19 in China, the Russia-Ukraine conflict and reopening progress. (Credit Suisse report)

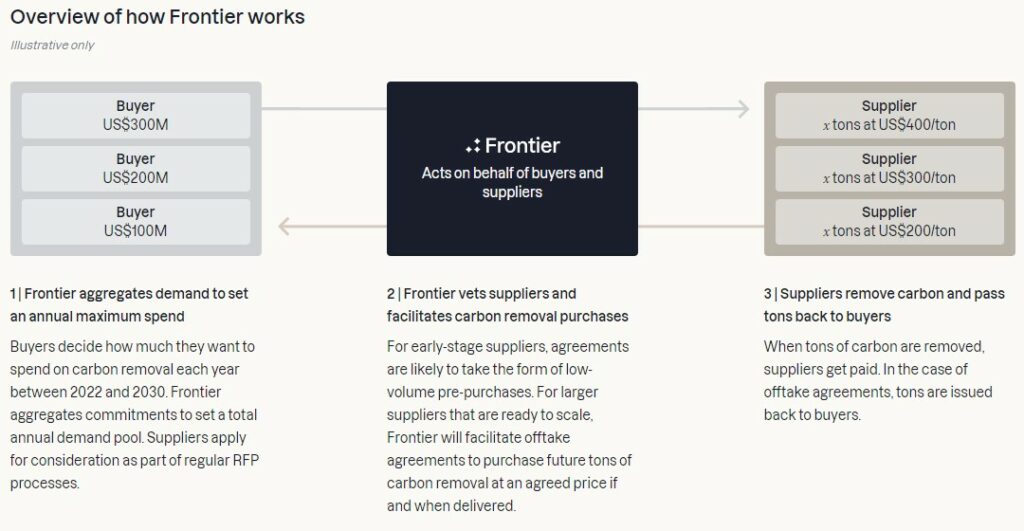

Shopify, Alphabet, Meta, and McKinsey & Co have all pledged to join Stripe’s Frontier fund, a public-benefit corporation, in a USD925M carbon offset buying effort and the largest combined financial commitment in the world aimed solely at carbon removal. The Frontier fund is modeled after efforts launched a decade ago to speed the development of pneumococcal vaccines for developing countries. The fund says its the first to adopt this same technique to carbon removal. Carbon capture efforts have great potential but have been underutilized, according to the Fund. As of 2021, fewer than 10,000 tons of CO2 have been removed from the atmosphere and it says that’s one million times short of the necessary annual removal.(CN Beta, Cheddar News, UDN, Frontier)

Foxconn has set itself new targets to cut down on its emissions, with an aim of a 21% reduction by the company by 2025. A second target has been set to meet a 63% reduction by 2035, which will take it beyond the halfway point to its 2050 net zero-emissions goal. In terms of energy usage, it intends to generate at least half of its requirements from green sources by 2030. Foxconn also claims it has already started adopting solar power, as well as improving the efficiency of its equipment over the last few years. Under the same announcement, Foxconn said it wants to recycle at least 60% of the plastic used at its sites around the world. It also plans to set up monitoring systems for wastewater discharge and for air quality.(Apple Insider, Asia Nikkei)

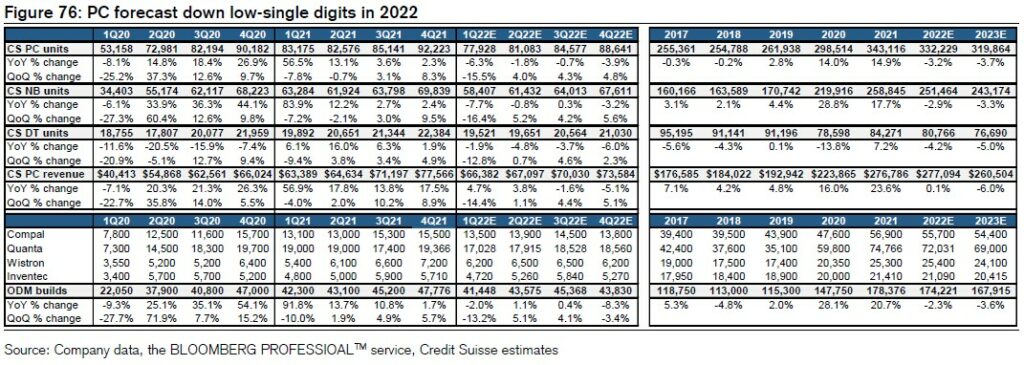

Global PC shipments are tracking in-line to Credit Suisse estimates of a modest decline in 2022-2023, after nearly 2 years of PC shipment growth of +14% YoY in 2020 / 2021 amid the pandemic. Though global demand held relatively stable through Jan-Feb 2022, consumer sentiments especially in Europe has softened since the Ukraine / Russia war with rising inflation and commodity prices to potentially impact Mar and Apr 2022 sell through. As a result, some brands and ODMs have revised down their forecast from the flat to slight up YoY to flat to slightly down in units in line. Credit Suisse believes that PC ASPs could continue to grow in 2022E on a more favorable mix and inflationary cost pressures. With component supply pressures easing by 2023, they expect the PC blended ASP (-2.4% YoY) and industry revenue (-6% YoY) to contract in 2023. (Credit Suisse report)

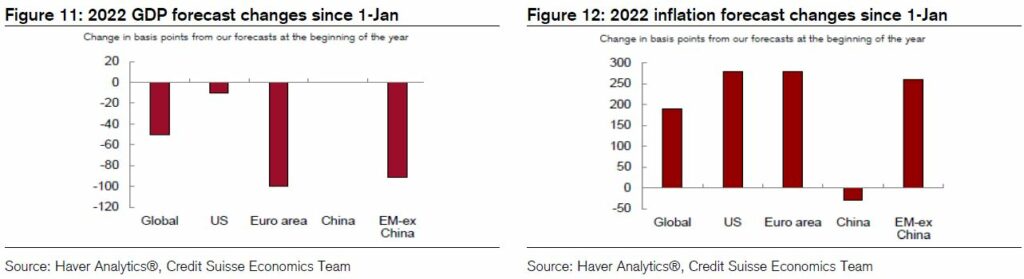

Credit Suisse has revised down its global GDP growth forecast on 5 Apr 2022 from +4.0% to +3.5% in 2022 and revised up global inflation estimates from +4.4% to +6.4% following the Russia-Ukraine conflict, triggering a more hawkish pace for the US Fed to hike rates. The downward revision was led by the EU (down from +3.8% to +2.8%) and countries with higher exposure to Russia, Ukraine and those which are highly dependent on oil and gas imports, with limited cuts for the US (from +3.3% to +3.2%) and China (unchanged at +5.9% YoY though a risk from the lockdown). They expect a slowdown but not a recession due to stronger corporate balance sheets, a recovering service sector, robust labour markets and fiscal support. (Credit Suisse report)

Credit Suisse in its Jan 2022 outlook report forecast semiconductor growth forecasts in 2022 of +15.7% and at the high end of street expectations, but a 5% YoY decline in 2023 as the industry adjusts inventory after the Covid-19 safety stock build-up and as supply worries subside. They would view 2022 as being well on track factoring in the ASP expansion and 1H22 still on track, with capacity still tight, but now view the 2023 correction scenario more possible factoring in the rising pressures from inflation, rates + quantitative tightening, rising inventory and some deceleration in consumer tech demand coming out of the pandemic. (Credit Suisse report)

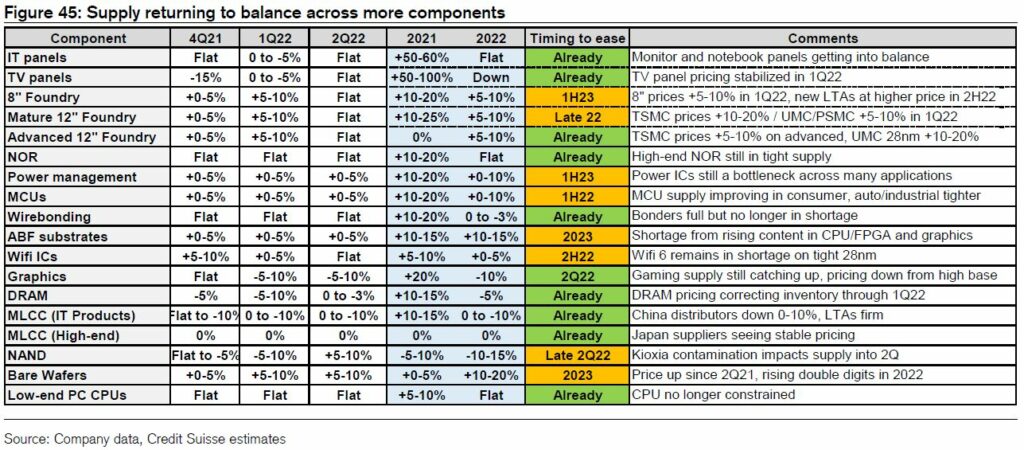

Credit Suisse has indicated hardware companies are now seeing 90%+ of their component supply back in balance and broadly available. Lingering component bottlenecks remain on the high-end substrates and on ICs produced on mature nodes including PMIC, MCU, Wifi and switch. NAND flash also has a temporary bottleneck after Kioxia’s contaminant impact in 1Q22. Supply is now sufficient across panels, DRAM, MLCCs and CPUs, and catching up in mobile SoCs. The semiconductor logic foundry chain continues to operate under full capacity in 1H22 as the channel and downstream inventory try to build up inventory to avoid more bottlenecks and manage somewhat mild supply growth until 2023. (Credit Suisse report)

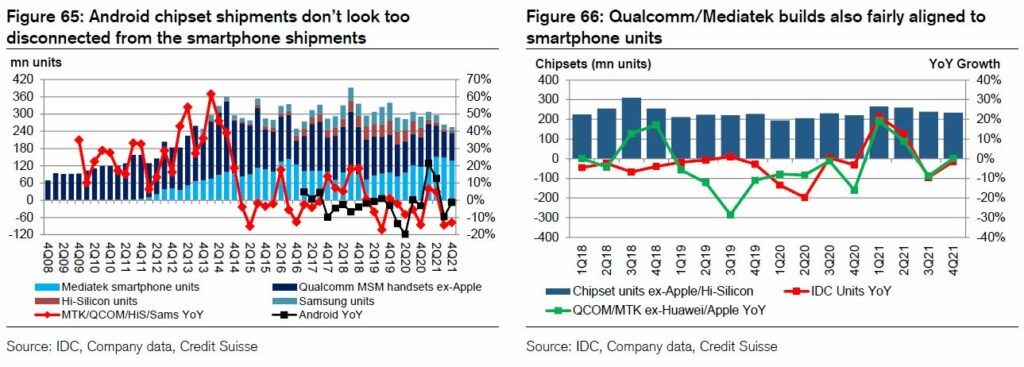

According to Credit Suisse, the market is fearing inventory pile-up due to long foundry lead times although on several key factors, chipset shipments at least through 2021 were tracking not far off the handset shipment actuals, meaning most of the build-up YTD was due to the step down in smartphone sales: 1) Qualcomm mix over volume. Qualcomm’s entire 4Q21 YoY mobile growth was from ASPs adding the iPhone modem and recovering premium mix, with its unit volume flat YoY; 2) Huawei ban. HiSilicon dropping almost completely from annualized 200M in late-2019, 3) Exynos share loss. Samsung Exynos volumes, according to IDC, declined from over 60M / quarter in 2H19 to 15M / quarter in 2H21, with Mediatek ramping in; and, 4) MediaTek’s adjustments. MediaTek’s handset unit slowdown in 2H21 kept sales flat HoH. (Credit Suisse report)

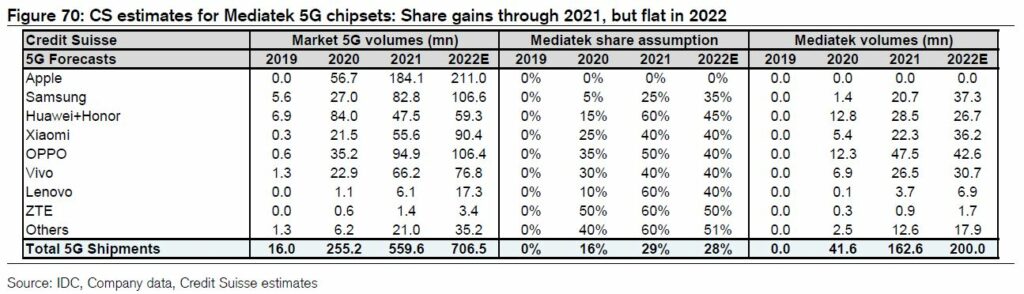

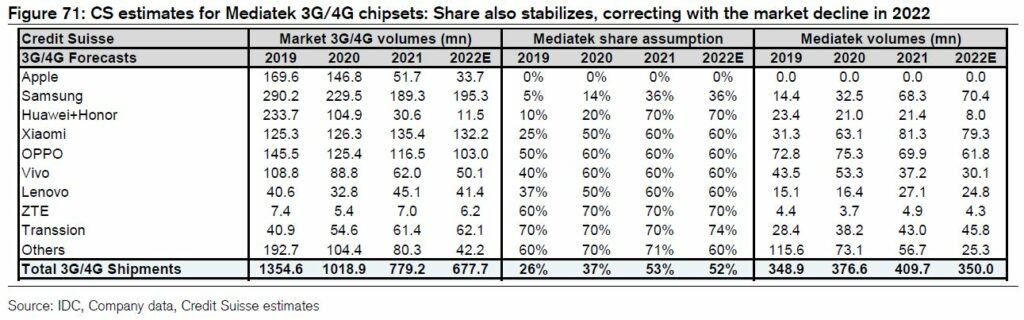

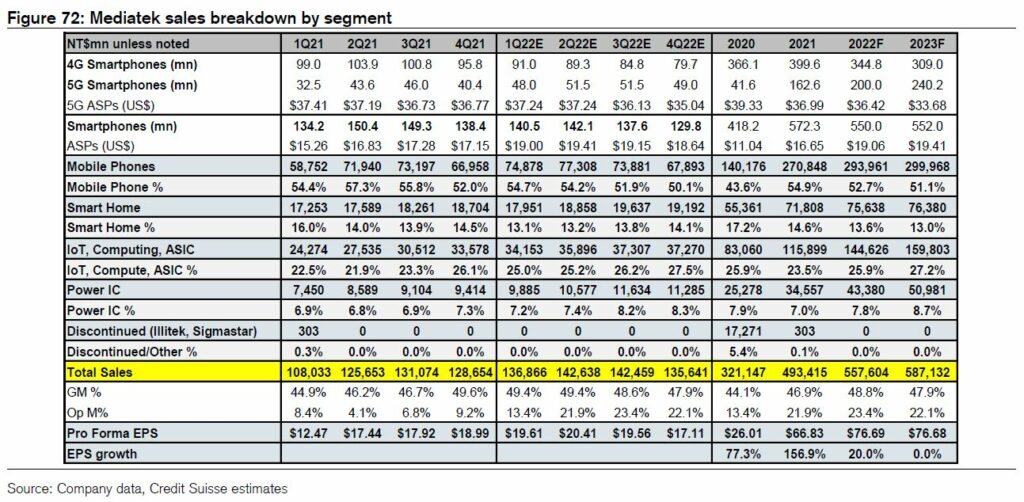

Credit Suisse has trimmed their MediaTek 5G forecast from 220M to 200M units, reflecting lower assumptions for the China brands although lift their Samsung projection as they continue to believe the company gained mid-tier 5G share into Samsung mobile in 2022. They have factored a lower % of the OPPO, vivo and Xiaomi volumes which were left unchanged as their industry smartphone model will refresh each quarter after all the results. For 3G/4G, they had only lowered slightly for MediaTek as they already factored in a decline in volumes in 2022 and reflect UniSOC growing from a low base. Combining together, they estimate MediaTek smartphone shipments to decline from 572M to 550M as 2022 should see some unit recovery for Qualcomm after its constraints in 2021 and the UniSOC 4G growth. (Credit Suisse report)

The 12” advanced supply is more consolidated, with the Top 5 players holding a 92% market share (TSMC 54%, UMC 11%, Samsung foundry 10% and SMIC 9%) and more of the foundry sourcing decisions planned a couple years out so less subject to customers switching fabs in a correction period for pricing. On the advanced nodes, TSMC has captured 64% of the market, along with Samsung capturing 80% of market share. The landscape is more fragmented in the mature 12” nodes (130-40nm), with TSMC leading the market at 46% share and UMC at 16% share. Credit Suisse estimates global 12” foundry capacity has been growing at 14% CAGR in the past decade, but advanced capacity at a faster 26% rate as these nodes attract the industry growth in high performance compute, 5G and some initial demand from ADAS, infotainment and some of the advanced edge computing nodes. (Credit Suisse report)

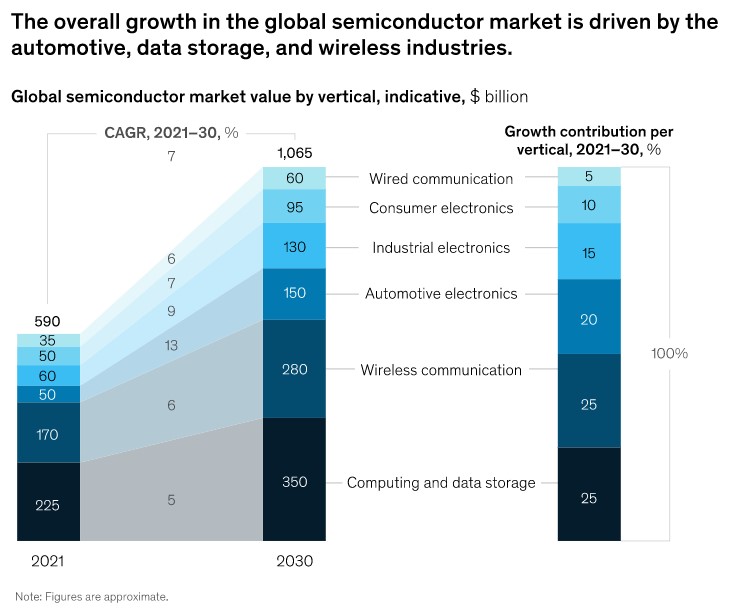

Research conducted by McKinsey & Co into the global semiconductor chip market found that industry revenue is set to grow 6-8% annually over the next decade to top USD1T by 2030. The research found that 70% of industry growth up to 2030 will be driven by just 3 sectors: automotive, computing and data storage, and wireless communications. Growth in demand is a given and the big issue is how the semiconductor industry satisfies that demand. Over the coming years there will be ongoing shortages, and there is a real need for additional capacity to be built. Fabs are currently experiencing a rate of utilisation that’s over 90 per cent. It is a non-linear manufacturing process with many individual steps so at that level of utilisation we’ll see lead times explode and that’s not a healthy situation. McKinsey is predicting a 13-15% annual increase in chips for the automotive industry as the market shifts to ramp up production of electric vehicles and fully autonomous driving becomes mainstream. (McKinsey, EMS Now, Laoyaoba)

A subsidiary of Taiwan Semiconductor Manufacturing Co (TSMC) has announced that it will begin construction for a new chip plant in Japan’s Kumamoto Prefecture. The chip fab is being built through a joint-venture between TSMC, Sony Semiconductor Solutions Corporation (SSS), and Denso called Japan Advanced Semiconductor Manufacturing (JASM). JASM and the Japanese government will invest a total of USD8.6B into the project. The facility will have two production lines, one that produces 12nm and 16nm semiconductors, and one that will manufacture 22nm and 28nm ones. The plant will have a monthly capacity of 55,000 12” wafers. The Kumamoto plant is expected to produce chips used in image sensors and microcontrollers.(Laoyaoba, CNYES, Taiwan News, TechNews, MoneyDJ, Kyodo News)

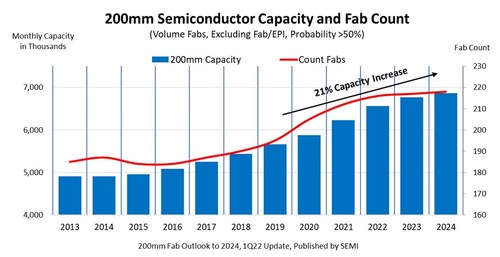

According to SEMI, semiconductor manufacturers worldwide are on track to boost 200mm fab capacity by 1.2M wafers, or 21%, from the start of 2020 to the end of 2024 to hit a record high of 6.9M wafers per month. After climbing to USD5.3B in 2021, 200mm fab equipment spending is expected to be USD4.9B in 2022 as 200mm fab utilization remains at high levels and the global semiconductor industry works to overcome the chip shortage. Foundries will account for more than 50% of fab capacity worldwide in 2022, followed by analog at 19% and discrete/power at 12%. Regionally, China will lead the world in 200mm capacity with 21% share in 2022, followed by Japan with 16% and Taiwan and Europe / Mideast at 15% each. (SEMI, PR Newswire, Laoyaoba)

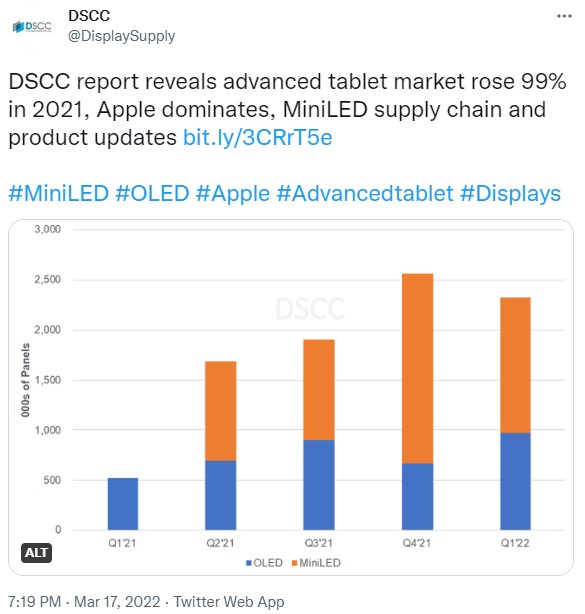

Flat panel shipments with MiniLED technology will increase to more than 40M units by 2026, according to Display Supply Chain (DSSC). Apple launched its iPad Pro with MiniLED technology and the average quarterly shipments reached 1M sets in 2021. Apple also launched a new MacBook Pro (14” and 16”) with MiniLED BLU in 4Q21. By leveraging its M1 CPU, Apple’s MiniLED IT products had outstanding sales results in 4Q21, and the forecast for 2022 also looks very promising. The DSSC further states that with the lower production costs and further vertical integration, the price of mini LED will no longer be “out of reach”. Therefore, Apple may increase this technology on more products rather than saving it for premium devices. (DSCC, Twitter, IT Home, GizChina)

Samsung is likely to use batteries from LG Energy Solution on its new foldable smartphones launching later 2022. Samsung’s MX Business, the name of its mobile business, was reviewing using LG Energy Solution’s small-sized pouch batteries on the Galaxy Z Fold 4. Samsung has been using LG Energy Solution’s batteries since 2019. They were used in the Galaxy S and Note smartphone series. If Samsung approves the use of LG Energy Solution’s batteries for Fold 4, which is likely, it will be the first time that it is using their batteries on a foldable smartphone.(Laoyaoba, The Elec)

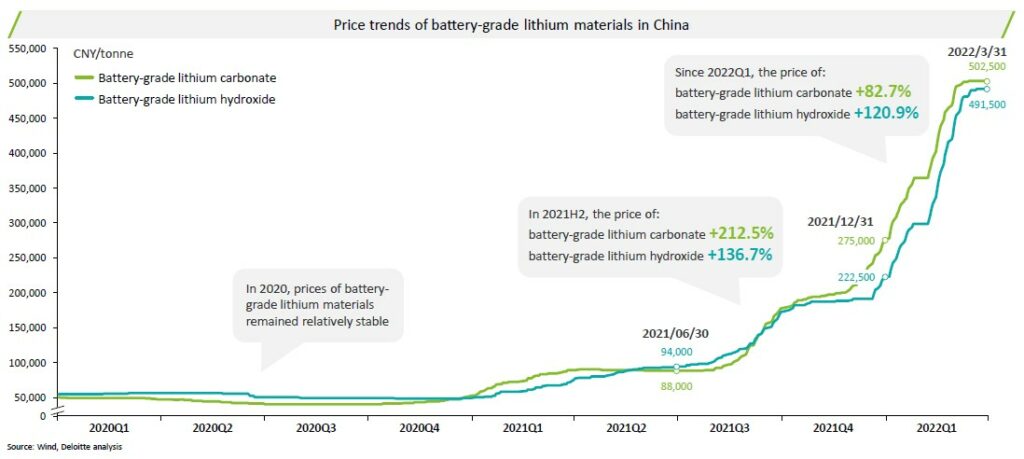

According to Deloitte, Since 2H21, the lithium batteries market has experienced tremendous growth, with more than five-fold price increases for battery-grade lithium specialty materials, far surpassing previous market expectations. (Deloitte report, Deloitte report)

Japan is aiming for a 20% share of the global rechargeable battery market in 2030 by boosting global output capacity at Japanese companies nearly 10-fold to 600 gigawatt hours (GWh), according to the industry ministry. Japan’s market share in global lithium-ion batteries used in electric vehicles (EVs) dropped to 21% in 2020 from 40% in 2015, and its share in batteries used in energy storage systems fell to 5% in 2020 from 27% in 2016. For the 2030 target, presented by the ministry at a specialist panel to discuss Japan’s battery strategy, the country aims to boost domestic production capacity of batteries used in EVs and energy storage systems to 150 GWh by 2030 from around 20 GWh now. (Laoyaoba, Reuters, Car & Bike, Nippon)