4-28 #Moved : TSMC may raise its foundry quotes in Jun 2022; OnePlus allegedly has more than 15 devices planned for release in 2022; Samsung plans to increase its OEM smartphone production in China by 20M units; etc.

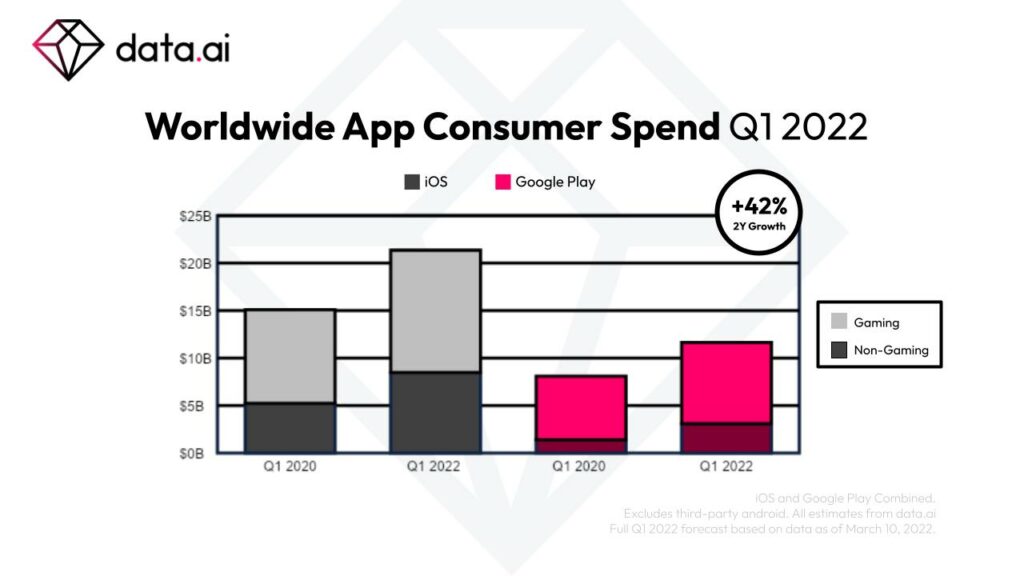

According to Data.ai (formerly App Annie), mobile game spending topped a whopping USD22B in 1Q22. This includes both the Google Play Store and the iOS App Store. As expected, gaming made up the majority of mobile spending in 2022, and years prior. On average, $0.65 of every $1 was spent on a game. Total 73% of the money spent on the Play Store was on games. Also, of all the app downloads on the Play Store, 44% of them were apps. As for the iOS App Store, 60% of the money spent was on gaming. When it comes to app downloads, 28% were games. Altogether, the source predicts that there were about 14B app downloads in total. (Android Headlines, VentureBeat, Data.ai)

OnePlus allegedly has more than 15 devices planned for release in 2022. It will release at least one new product each month till the next quarter. These likely include smartwatches and true wireless earbuds (TWS) and a few smartphones. The majority of the upcoming OnePlus devices will reportedly be part of the affordable Nord lineup. This suggests the company is looking to expand its low-cost product portfolio in 2022. (Android Headlines, Twitter)

Twitter has announced that it has entered into a definitive agreement to be acquired by an entity wholly owned by Elon Musk, for approximately USD44B. Upon completion of the transaction, Twitter will become a privately held company. (Apple Insider, PR Newswire, Reuters, Twitter)

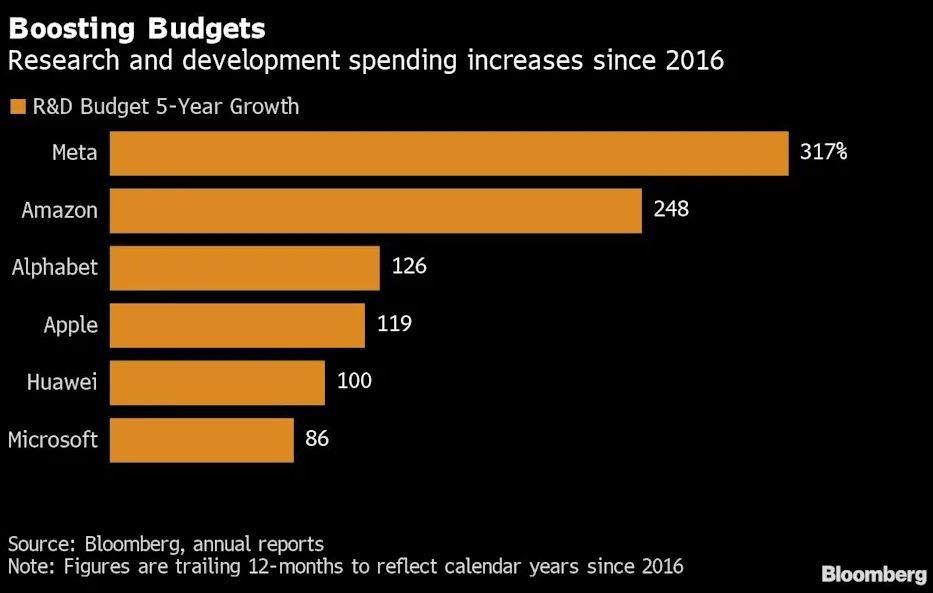

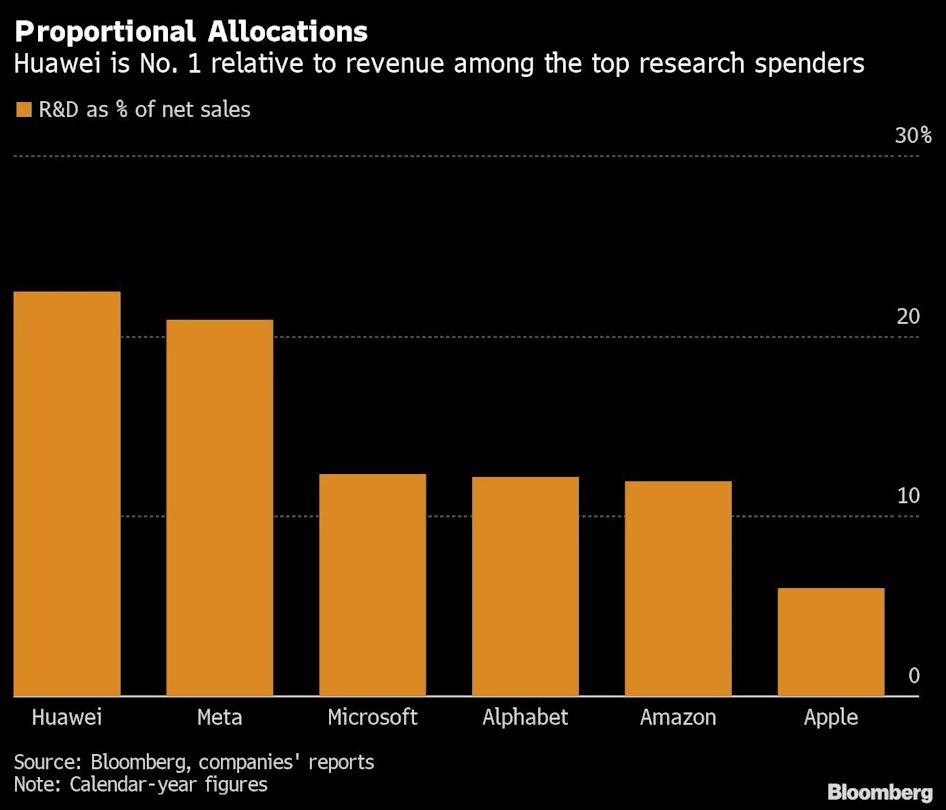

Huawei has almost doubled its R&D budget over the past half-decade to USD22.1B in 2021, more than any company in the world outside America. That is 22.4% of its sales that year: nearly double Amazon.com’s and Google-owner Alphabet’s proportions and more than triple Apple’s. Only Meta Platforms came close among the so-called Faang contingent with 20.9%, data compiled by Bloomberg shows. Huawei, which is not publicly traded, was one of just six companies worldwide that spent more than USD20B on R&D in 2021. (GizChina, Bloomberg, Yahoo)

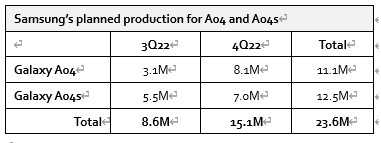

Samsung plans to increase its OEM smartphone production in China by 20M units, with a total of 70M units in 2022. Samsung initially planned to manufacture the 20M phones itself. This includes the mid-range Galaxy A04 and A04s series. Recent devices like the Galaxy A03, A03s, A03 Core and the Galaxy A22 5G are all JDM phones. These are produced jointly by Chinese companies Wingtech and Huaqin. Samsung has decided to shift an upcoming low-end device from self-production to JDM.(GizChina, SamMobile, The Elec, IT Home)

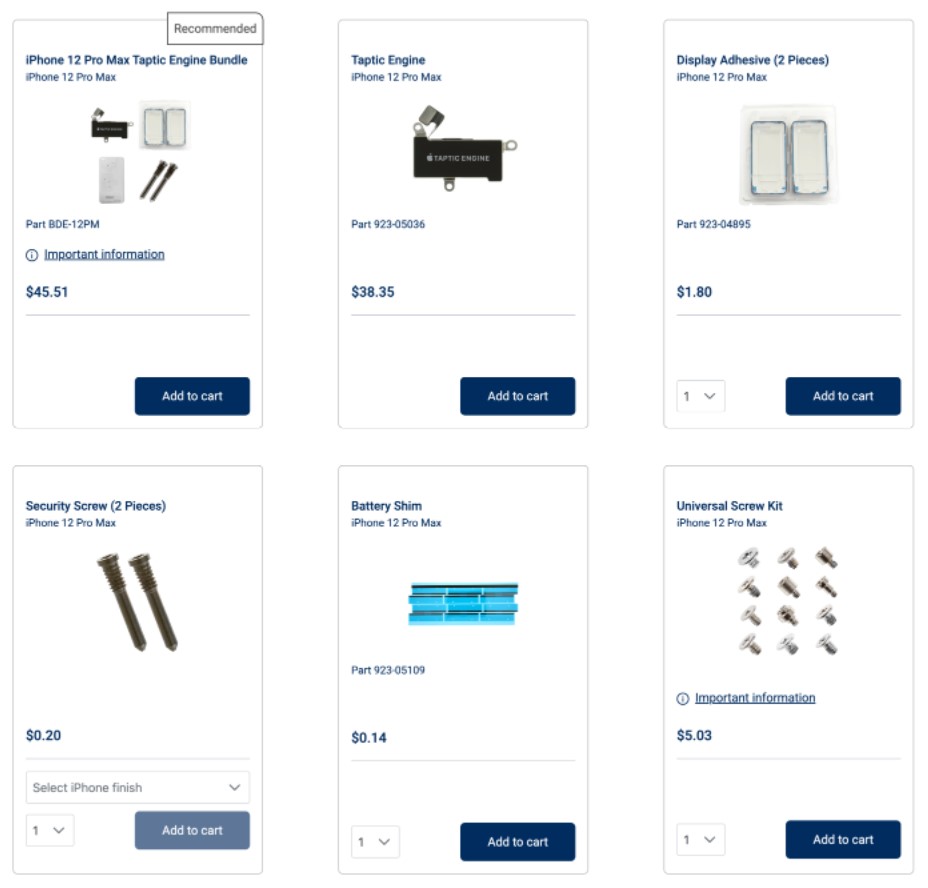

Apple has unveiled its self-repair program, rolling it out first to its US customers. As part of the service, Apple has set up a Self Service Repair Store website, giving users the ability to read Apple’s repair manual for their specific product, learn more about self-service repair, and order from the 200 parts and tools available. The company emphasizes the service is for “customers who are experienced with the complexities of repairing electronic devices”. The Self Service Repair shop has displays, batteries, speakers, camera modules, SIM trays and Taptic engines as well as a bunch of miscellaneous spare parts like bolts and screws.(Android Authority, GSM Arena, Apple, TechCrunch, CN Beta)

According to Digitimes, Apple is rumored to expand its production plan for the iPhone 13 in 2Q22. Among them, the production of high-end models of the iPhone 13 Pro and iPhone 13 Pro Max is planned to increase by about 10M units, and relevant Apple supply chain players are expected to benefit. The report suggests an improving situation with Apple’s supply chain, which has been struggling to meet demand amid COVID-19 lockdowns and restrictions in China. (MacRumors, Digitimes)

vivo T1 5G and T1x 4G are announced in Malaysia:

- T1 5G – 6.58” 1080×2408 FHD+ v-notch 120Hz, Qualcomm Snapdragon 695 5G, rear tri 50MP-2MP macro-2MP depth + front 16MP, 8+128GB, Android 11.0, side fingerprint, 5000mAh 18W, MYR1,299 (USD300).

- T1x 4G –6.58” 1080×2408 FHD+ v-notch 90Hz, Qualcomm Snapdragon 680 4G, rear tri 50MP-2MP macro-2MP depth + front 8MP, 4+64 / 8+128GB, Android 11.0, side fingerprint, 5000mAh 18W, MYR699 (USD160) / MYR899 (USD205).

(GSM Arena, GizChina, vivo, vivo)

vivo X80 series is launched:

- X80 – 6.78” 1080×2400 FHD+ HiD AMOLED 120Hz, MediaTek Dimensity 9000, rear tri 50MP 1.0um OIS-12MP telephoto 2x optical zoom-12MP ultrawide + front 32MP, 8+128 / 8+256 / 12+256 / 12+512GB, Android 12.0, fingerprint on display, 4500mAh 80W, CNY3,699 (USD565) / CNY3,999 (USD610) / CNY4,399 (USD670) / CNY4,899 (USD745).

- X80 Pro –6.78” 1440×3200 QHD+ HiD LTPO 120Hz, Qualcomm Snapdragon 8 Gen 1 / MediaTek Dimensity 9000, rear quad 50MP gimal OIS-8MP periscope telephoto OIS 5x optical zoom-12MP telephoto 2x optical zoom-48MP ultrawide + front 32MP, 8+256 / 12+256 / 12+512GB, Android 12.0, fingerprint on display, 4700mAh 80W, 50W fast wireless charging, IP68 rated, CNY5,499 (USD840) / CNY5,999 (USD915) / CN6,699 (USD1,020).

(GSM Arena, Gizmo China, XDA-Developers)

vivo S15e is launched in China – 6.44” 1080×2404 FHD+ u-notch AMOLED 90Hz, Samsung Exynos 1080, rear tri 50MP-8MP ultrawide-2MP macro + front 16MP, 8+128 / 8+256 / 12+256GB, Androd 11.0, fingerprint on display, 4700mAh 66W, CNY1,999 (USD305) / CNY2,299 (USD350) / CNY2,499 (USD380). (GSM Arena, Money Control)

OPPO K10 5G and K10 Pro 5G are announced:

- K10 5G – 6.59” 1080×2412 FHD+ HiD 120Hz, MediaTek Dimensity 8000 Max, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 8+128 / 8+256 / 12+256GB, Android 12.0, side fingerprint, stereo speakers, 5000mAh 67W, CNY1,999 (USD305) / CNY2,199 (USD336) / CNY2,499 (USD382).

- K10 Pro 5G – 6.62” 1080×24o0 FHD+ HiD AMOLED 120Hz, Qualcomm Snapdragon 888 5G, rear tri 50MP 1.0um OIS-8MP ultrawide-2MP macro + front 16MP, 8+128 / 8+256 / 12+256GB, Android 12.0, fingerprint on display, stereo speakers, 5000mAh 65W, CNY2,499 (USD382) / CNY2,799 (USD427) / CNY3,199 (USD488).

(GSM Arena, My Drivers, Gadgets360)

Micromax IN 2c is announced in India – 6.52” 720×1600 HD+ v-notch, Unisoc T610, rear dual 8MP-VGA depth + front 5MP, 3+32GB, Android 11.0, 5000mAh, no fingerprint scanner, INR8,499 (USD110). (Gizmo China, GSM Arena)

Moto Edge 30 is official – 6.5” 1080×82400 FHD+ HiD AMOLED 144Hz, Qualcomm Snapdragon 778G+ 5G, rear tri 50MP 1.0um OIS-50MP ultrawide-2MP depth + front 32MP, 8+128 / 256GB, Android 12.0, side fingerprint, 4020mAh 33W, starting price EUR450.(GSM Arena, Android Central)

Fitbit was granted clearance by the US FDA to passively send notifications when signs of Atrial Fibrillation (AFib) were detected by its smartwatches and trackers in Mar 2022. Now, Fitbit is officially rolling out Irregular Heart Rhythm Notifications to 9 of its products, including the Sense and Charge 5. Irregular Heart Rhythm Notifications are what Fitbit has decided to call notifications that alert users of a potential heart problem. AFib is the most common form of irregular heart rhythm, affecting more than 5M people in the United States alone according to John Hopkins Medicine, and Fitbit says over 33M are affected globally. AFib is a serious condition that leaves those affected at 5 times higher risk of a stroke. (Android Headlines, 9to5Google)

Meituan has announced it will put 100,000 smart safety helmets into use in Beijing, Suzhou, Haikou and other cities in 2022. Meituan has started R&D of smart safety helmets since June of 2020, then put them into trial operations in Hunan, Guangdong, Liaoning and Ningxia provinces in June 2021. The smart safety helmets are distinguished from traditional helmets by virtue of their numerous smart safety functions, such as detection in wearing and collision, self-sensing taillights, Bluetooth headsets, microphones, shortcut keys and other innovative features. From receiving orders to delivery, riders need to use smartphones or answer calls many times, often leading to distraction and accidents. Smart safety helmets have functions such as voice calling and order receiving, thus greatly enhancing the driver’s security during delivery.(CN Beta, Sohu, IT Home, Pandaily)

Amazon has sold hundreds of millions of Echo devices since it is launched 8 years ago, making it the market leader in smart home assistants, ahead of such formidable rivals as Google and Apple. Dave Limp, Amazon’s head of devices and services sees this as just a first step towards a new platform known as “ambient computing”: technology that, unlike a smartphone, can operate almost invisibly without physical input. His vision differs greatly from that of tech peers who believe the virtual reality “metaverse” will become the next big computing realm. Ambient computing is another paradigm to interface with technology, but it is different in a number of ways. It is embodied by the fact that when you are around it, you should not have to learn it. There should not have to be a manual, there should not have to be teaching. And that is true for young and old. Amazon sees ambient computing as the direction of technology that will forever change the shape of the world. Dave Limp revealed that Amazon performs hundreds of millions of smart home operations every month, but more than 1/4 of the operations are automatically triggered by the device before the user has issued a command. Dave Limp has responded to Alexa’s commercialization progress. He also talks about Amazon’s transition from the flop Fire Phone to the Alexa business, and shares his thoughts on the “killer app” of Amazon’s Astro home robot. (CN Beta, Financial Times, IT Home, Twitter)

Qualcomm is preparing to launch an upgraded version of its Snapdragon 8 Gen 1 flagship smartphone processor soon, as early as May 2022, or latest by Jun. Internally coded SM8475, the new chipset will arrive as Snapdragon 8 Gen 1+. The Snapdragon 8 Gen 1+ will bring a 10% boost in overall performance over the vanilla Snapdragon 8 Gen 1. The new chipset is also reportedly more stable with better thermal management and improved battery life.(Twitter, Android Headlines)

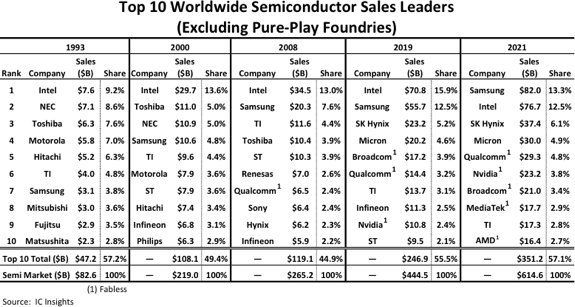

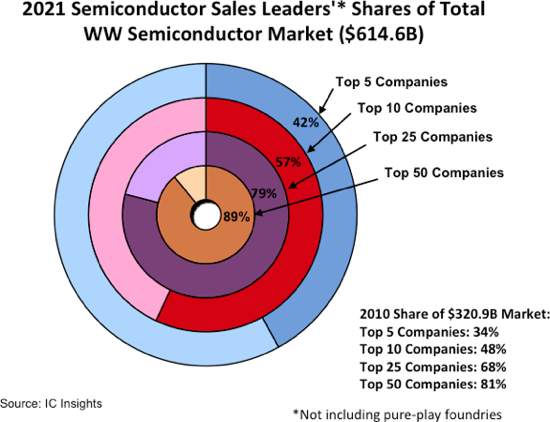

According to IC Insights, in 2021, the top 50 semiconductor suppliers, not including the pure-play foundries, represented 89% of the total USD614.6B worldwide semiconductor market, up eight points from the 81% share the top 50 companies held in 2010. The top 5, top 10, and top 25 companies’ share of the 2021 worldwide semiconductor market increased 8, 9, and 11 percentage points, respectively, as compared to 2010. With additional mergers and acquisitions expected over the next few years, IC Insights believes that the consolidation could raise the shares of the top suppliers to even loftier levels. In 2021, five of the top 10 semiconductor suppliers were fabless companies, two more than in 2019. In 2008 there was only one fabless company in the ranking (i.e., Qualcomm) and in 2000, there were none. All of the top 10 companies had sales of at least USD16.4B in 2021. (CN Beta, IC Insights)

India is in talks with global chipmakers Intel, GlobalFoundries and Taiwan Semiconductor Manufacturing Co (TSMC) about setting up local operations, part of efforts to center more high-tech manufacturing in the country.Prime Minister Narendra Modi’s government late 2021 unveiled a INR76,000 crore (USD10B) incentives plan, offering to cover as much as half of a project’s cost, to lure display and semiconductor fabricators to set up base in India. The country has set itself the ambitious goal of emulating neighboring China and becoming the electronics factory of the world. To attract smartphone assemblers, the Indian government has imposed import taxes on devices produced elsewhere and offered financial incentives for local manufacturing. The effort has been successful, aided by India’s large and growing smartphone user base, and has turned India into the world’s second-biggest smartphone maker. Companies including Samsung, Xiaomi and Apple’s Taiwanese suppliers Hon Hai Precision, Wistron and Pegatron are all making devices locally. (Gizmo China, India Times, Economic Times, Live Mint, Bloomberg)

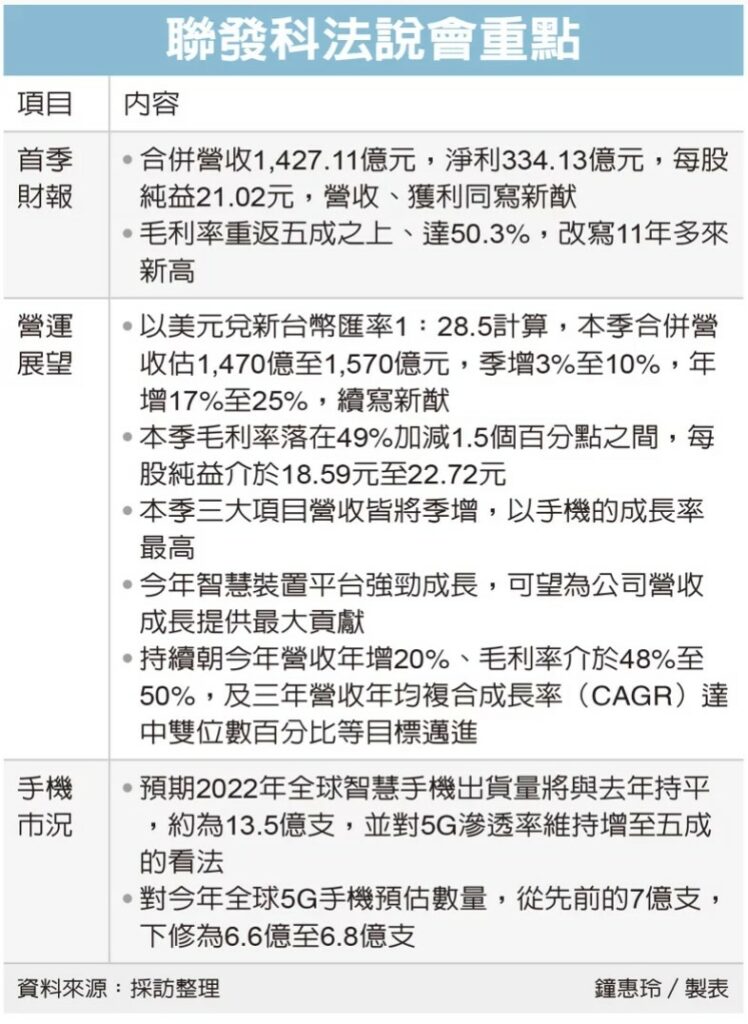

MediaTek CEO Rick Tsai has indicated that global smartphone demand is slowing down, and it is expected that global smartphone shipments in 2022 will be the same as in 2021, at about 1.35B units. At the same time, he has emphasized that his view on the global 5G mobile phone penetration rate growing to 50% in 2022 remains unchanged, about 660-680M units, although slightly lower than the 700M units estimated in 4Q21, but still an increase of 30% from 2021. (Laoyaoba, UDN, UDN, IT Home, ET Today)

Wafer foundry UMC has announced that it will spend CNY4.858B (about NTD21.4B) to buy back all of its joint venture shareholders from Leadcore in 3 years. Lianxin’s equity, making it a wholly-owned subsidiary of UMC. UMC has said that when it signed the contract with the investor, it was agreed that Leadcore would be included as a wholly-owned subsidiary seven years after its establishment. Leadcore’s current monthly production capacity is 27,500 pieces and will be expanded to 32,000 pieces.(Laoyaoba, LTN, Apple Daily, UDN)

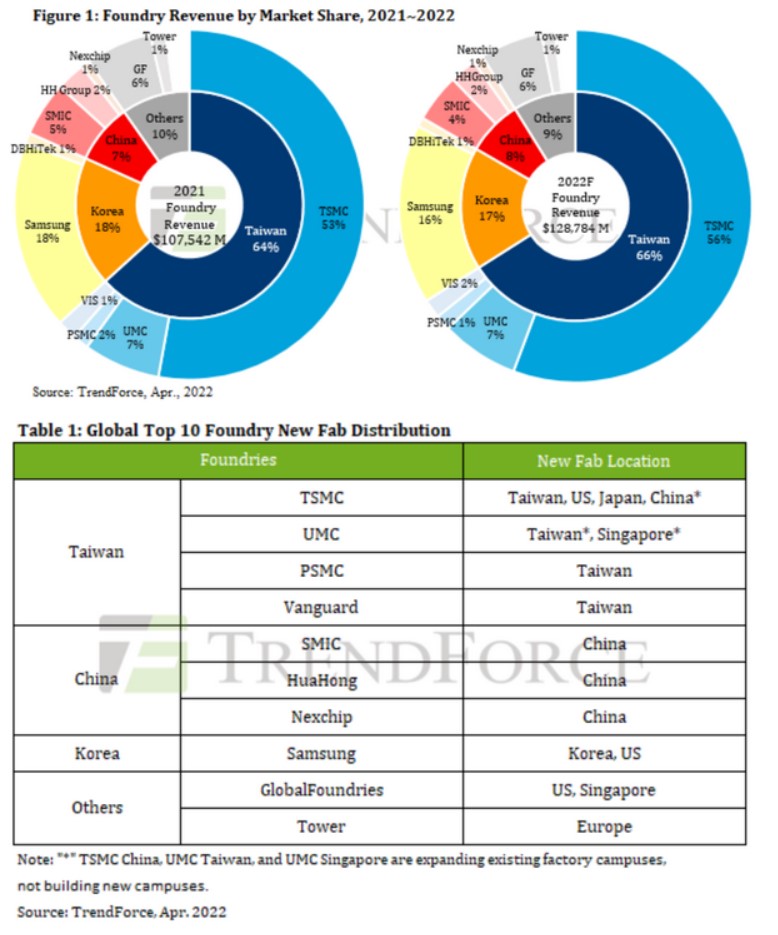

According to TrendForce, Taiwan is crucial to the global semiconductor supply chain, accounting for a 26% market share of semiconductor revenue in 2021, ranking second in the world. Its IC design and packaging & testing industries also account for a 27% and 20% global market share, ranking second and first in the world, respectively. Firmly in the pole position, Taiwan accounts for 64% of the foundry market. In 2022, Taiwan will account for approximately 48% of global 12” equivalent wafer foundry production capacity. Only looking at 12” wafer production capacity with more than 50% market share, the market share of advanced processes below 16nm (inclusive) will be as high as 61%. However, as Taiwanese manufacturers expand their production globally, TrendForce estimates that the market share held by Taiwan’s local foundry capacity will drop slightly to 44% in 2025, of which the market share of 12” wafer capacity will fall to 47% and advanced manufacturing processes to approximately 58%. (Laoyaoba, TrendForce)

Semiconductor Manufacturing International Corp (SMIC) has said that more than 60% of its workers in Shanghai are living on campus, showing the pressure that factories operating in and around the city are under to sustain the country’s semiconductor supply chain amid an extended Covid-19 lockdown. The company has been operating under a “closed-loop” arrangement since mid-Mar 2022. The compnay has further added that the production is normal, with the capacity utilisation rate running at a higher level.(Yahoo, My Drivers, TechWeb, Sina)

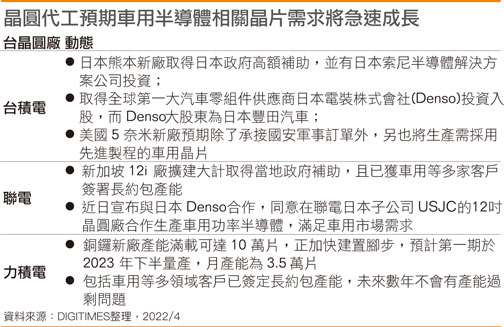

TSMC’s still-tight fab capacity may encourage the foundry to raise its foundry quotes in Jun 2022, with fellow Taiwan-based foundries likely to follow suit making another upward adjustment in their prices during 3Q22, according to Digitimes. TSMC and other Taiwanese pure-play foundries may have experienced a decline in chip orders for consumer electronics and other mass-market applications, but orders for automotive, high-performance computing and IoT device applications are rapidly filling the released capacity. TSMC, UMC, World Advanced and NSMC continued to exceed 100% fab capacity utilization while securing more long-term contracts. The overall demand outlook remains positive at present, pushing foundries to build additional fab capacity. (Digitimes, Digitimes, press, Laoyaoba)

According to Digitimes, Taiwanese factories are under pressure to expand production capacity and supply, the number of new orders from automotive customers has also increased significantly, and they have signed long-term contracts for production capacity. USJC, a Japanese subsidiary of UMC, cooperates in the production of power semiconductors for vehicles, and both projects are supported by the Japanese government. Wafer foundries are aspiring to be optimistic about the development prospects of electric vehicles. It is expected that the demand for automotive semiconductor-related chips will grow rapidly, which is expected to greatly reduce the risk of production expansion. (Digitimes, press)

AUO chairman Paul Peng has indicated that order visibility is not clear and time is needed for customers to reduce channel inventory to a healthy level given macroeconomic uncertainties, COVID-19 lockdowns in China and the war in Ukraine. AUO’s factory utilization rate fell to below 90% in 1Q22. Large lockdowns in China have reduced AUO’s production by between 30% and 40% at its plant in Kunshan, one of its major manufacturing sites for high-end notebook computer panels.(CN Beta, Yahoo, TechNews, UDN, LTN, Nikkei Asia, Taipei Times)

E Ink has announced the launch of E Ink Gallery 3, a next generation of color ePaper for the eReader and eNote markets. E Ink Gallery 3 is based on the E Ink ACeP Advanced Color ePaper platform. In this platform, a full-color gamut is achieved through a four particle ink system: cyan, magenta, yellow and white, which allows a full color gamut at each pixel. In Gallery 3, the black and white update time has been improved to 350ms, the fast color mode is 500ms, standard color mode is 750-1000ms and best color is achieved at 1500ms.(Engadget, CN Beta, Business Wire)

Nissan has announced a new driver-assistance technology, which is currently in-development, that utilizes highly accurate, real-time information about the vehicle’s surrounding environment to dramatically enhance collision avoidance. Nissan’s “ground truth perception” technology fuses information from next-generation high-performance LIDAR, radar and cameras. The technology can detect the shape and distance of objects, as well as the structure of the area surrounding the vehicle, in real time with a high degree of accuracy. Utilizing this information, it is possible for the vehicle to instantly analyze the current situation, judge and automatically perform required collision-avoidance operations.(CN Beta, Motor Authority, Yahoo, Kyodo News, Nissan)

General Motors (GM) has announced a standard feature for its EVs that ride on the company’s proprietary Ultium-based architecture, called “Ultium Energy Recovery”. It will capture energy from the battery that may otherwise be wasted. The system then uses it to increase range, charging speed, and acceleration. GM explains that batteries and related parts produce heat. The system can store the excess heat to use when needed. For example, if the stored heat is used to keep the cabin warm, the vehicle will use less energy for its HVAC system, which means more energy for the vehicle itself. The company goes so far as to say that the new Ultium system can even capture outside humidity, as well as the body heat produced by passengers.(Engadget, Inside EVs, Forbes)

The Presidential Transition Committee said that the new South Korean government is planning to come up with a 6G communications prototype in 2026 with the technology expected to be commercialized in 2028-2030. The new government is planning to add 6G communications, secondary battery, display, defense and aerospace, advanced nuclear power plant and digital content. (GizChina, My Drivers, Business Korea)