4-29 #BFF : Samsung has said that it is on track to start high-volume production using its 3GAE in 2Q22; Samsung is reportedly reviewing using batteries from ATL for its upcoming foldable smartphones; Foxconn has reportedly started assembling Apple iPhone 13 in Brazil; etc.

Snap is launching a new feature called Director Mode, aimed at providing easier access to Snapchat’s native creative tools for publishing video on its platform, including to its short-form video feature known as Spotlight. At launch, Director Mode will include a new Dual Camera future that will allow users to record front both the front-facing and back-facing cameras at the same time.(TechCrunch, Snap)

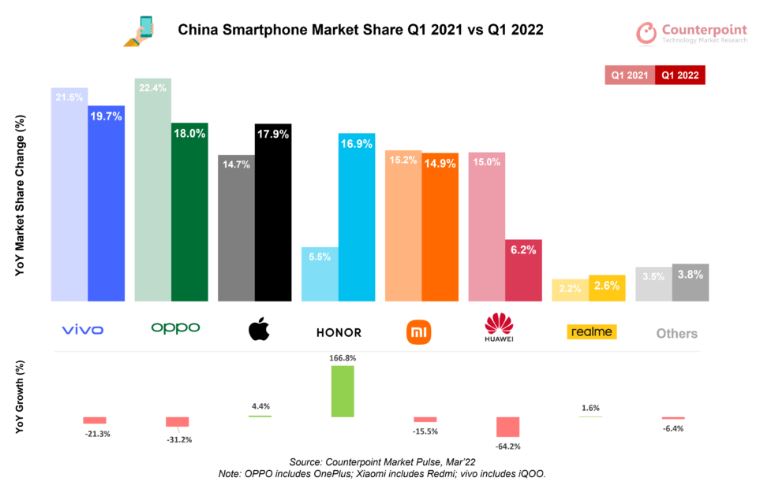

Smartphone sales in China decreased 14% YoY in Q1 2022, reaching 74.2M units, according to Counterpoint Research. During the quarter, vivo regained its market-leading position from Apple (in Q4 2021) with a share of 20%. The newly launched mid-end S12 series, which focuses on self-portraits and sports a lightweight and fashionable design, has received positive market feedback, especially among younger customers. vivo’s affordable Y series phones, such as the Y76s and Y31s, were also strong performers during the quarter. Honor has had a strong rebound, with its market share jumping to 17% in 1Q22 from 5% in 1Q21. Thanks to the popularity of its Honor 60, the brand was also the only major OEM that achieved both positive YoY and QoQ growth during the quarter, at 167% and 15%, respectively. (GSM Arena, Counterpoint Research)

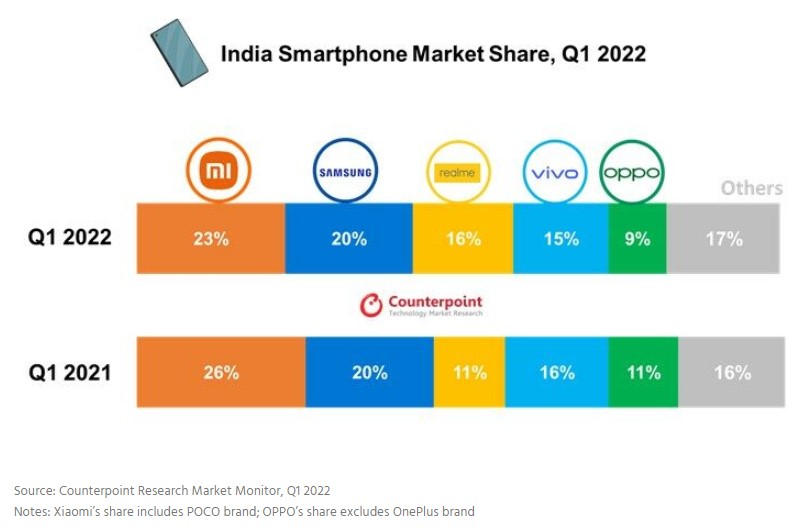

India’s smartphone shipments declined 1% YoY to reach over 38M units in Q1 2022, according to Counterpoint Research. Supply constraints due to the ongoing component shortages and demand decline during the third COVID-19 wave led to this decline. The Chinese brands held a 74% share in 1Q22. Xiaomi led the market with a 23% share, followed by Samsung, realme, vivo and OPPO. Xiaomi registered its highest ever share in the upper-tier (INR20,000-INR30,000) segment driven by the Xiaomi 11i series. This also resulted in Xiaomi recording its highest ever retail ASP (average selling price). Samsung revamped its Galaxy A series to drive consumer demand in offline channels. (GSM Arena, Counterpoint Research)

Foxconn has reportedly started assembling Apple iPhone 13 in Brazil. It seems that only the 6.1” iPhone 13 is being assembled at Foxconn Brazil, located in Jundiai, São Paulo. Apple has updated the iPhone 13 documentation at ANATEL (the Brazilian telecom regulator) on 24 Jan2022 to include Foxconn Brazil as a manufacturing facility for the product. The documents also confirm that neither the iPhone 13 mini nor the 13 Pro models will be assembled in Brazil. (Laoyaoba, IT Home, UDN, CNYES, 9to5Mac, Apple Insider, MacMagazine)

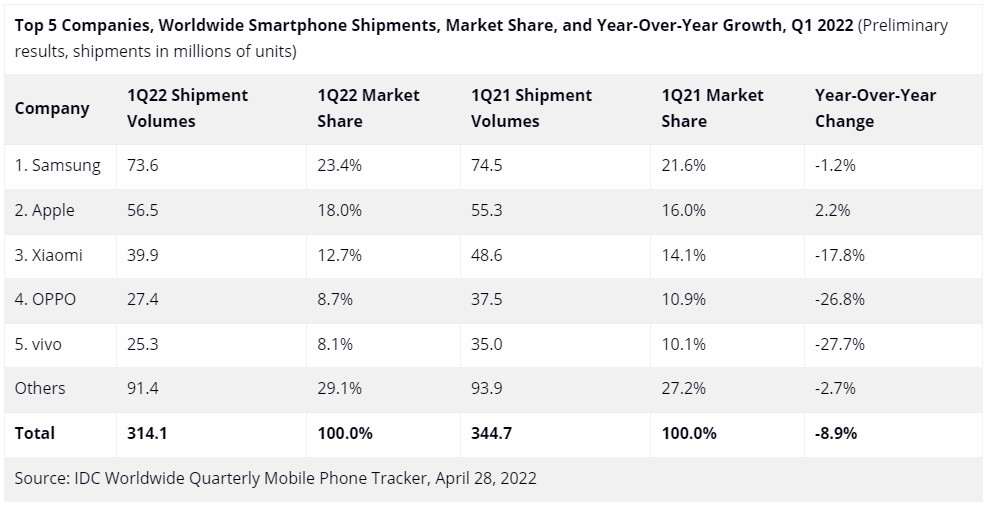

Worldwide smartphone shipments declined 8.9% YoY in 1Q22, according to IDC. This marks the third consecutive quarter of decline for the smartphone market as shipments fell to 314.1M units in the quarter, about 3.5% lower than IDC forecast in Feb 2022. Despite the challenging environment, vendor positioning was not altered much during 1Q22. Samsung led the vendor race with the top spot and 23.4% share, its largest share in any given quarter since 1Q18. Apple came in second with 18.0% share, while Chinese vendors Xiaomi, OPPO, and vivo followed in the next three positions with 12.7%, 8.7%, and 8.1% share, respectively. (IDC, CN Beta)

According to China Securities, in Apr 2022, Samsung placed an additional ODM (original design manufacturing) order for more than 10M phones from Wingtech. This additional order of more than 10M phones is one of Samsung’s phone ODM projects in 2023. Samsung repotedly plans to increase its OEM smartphone production in China by 20M units, with a total of 70M units in 2022. It is understood that Samsung’s mobile phone orders in 2022 will be divided up by a number of ODM manufacturers, namely Huaqin, Wingtech and Longche. (Laoyaoba, Sohu, CS)

OnePlus 10R and Nord CE 2 Lite 5G are announced:

- 10R – 6.7” 1080×2412 FHD+ HiD Fluid AMOLED 120Hz, MediaTek Dimensity 8100 Max, rear tri 50MP 1.0um OIS-8MP ultrawide-2MP macro + front 16MP, 8+128 / 12+256GB, Android 12.0, stereo speakers, fingerprint on display, 5000mAh 80W / 4500mAh 150W, INR38,999 (USD509) / INR42,999 (USD561).

- Nord CE 2 Lite 5G – 6.43” 1080×2400 FHD+ HiD AMOLED 90Hz, MediaTek Dimensity 900, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 6+128 / 8+128GB, Android 12.0, fingerprint on display, 4500mAh 65W, INR19,999 (USD261) / INR21,999 (USD287).

Tecno Phantom X is launched in India – 6.7” 1080×2340 FHD+ 2xHiD Super AMOLED 90Hz, MediaTek Helio G95, rear tri 50MP 1.2um-13MP telephoto 2x optical zoom-8MP ultrawide + front dual 48MP-8MP ultrawide, 8+256GB, Android 11.0, fingerprint on display, 4700mAh 33W, INR25,999 (USD340). (GSM Arena, Gizmo China)

Huawei Mate Xs 2 is announced – 7.8” 2200×2480 Foldable OLED 120Hz + 6.5” 1176×2480 folded cover display, Qualcomm Snapdragon 888 4G, rear tri 50MP-8MP telephoto 3x optical zoom OIS-13MP ultrawide + front 10.7MP, 8+256 – 12+512GB, HarmonyOS 2.0, side fingerprint, 4600mAh / 4800mAh 66W, supports M-Pen 2s stylus pen, CNY9,999 (USD1,512) – CNY12,999 (USD1,966). (GSM Arena, Huawei, TechNode)

Snap is partnering with Live Nation to enhance the experience of going to concerts and festivals via its AR technology. The company says the multiyear partnership with Live Nation will “elevate performances beyond stages and screens”. The goal of the partnership is to create a deeper connection between artists and fans via immersive AR created with the help of Snap’s creative studio, Arcadia, which launched in Oct 2021.(TechCrunch, Variety, Pocket-Lint)

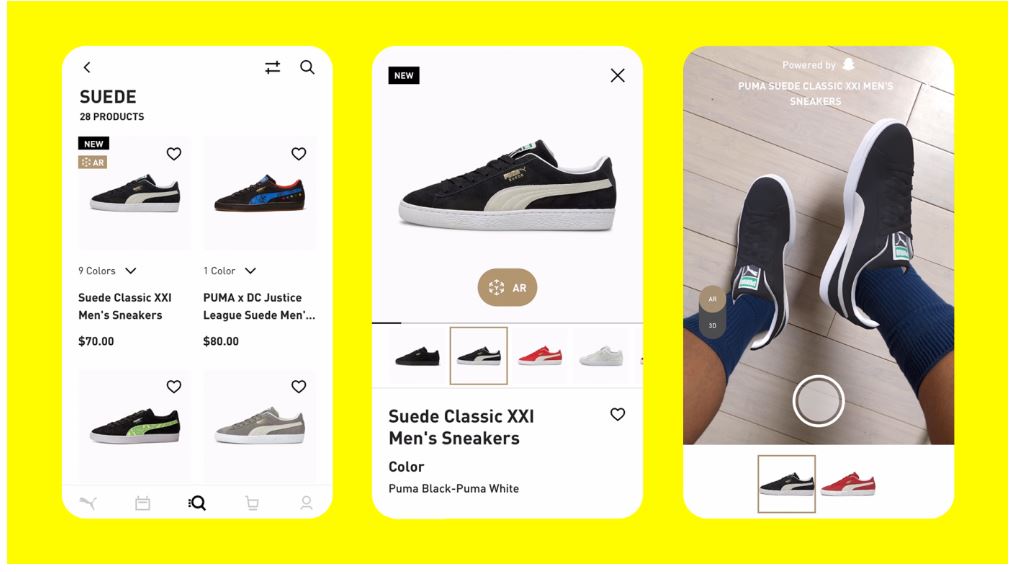

Snap has announced a number of new initiatives focused on using its AR technology to aid with online shopping. Most notably, the company is introducing a new in-app destination within Snapchat called “Dress Up” that will feature AR fashion and virtual try-on experiences, and it is launching tools that will allow retailers to integrate with Snapchat’s AR shopping technology within their own websites and apps, among other updates designed to ease the process of AR asset creation.(TechCrunch, The Verge, Reuters)

Snap has announced a mini drone Pixy, which is a yellow plastic copter is designed to pair with the Snapchat app, lift off from the palm of its owner’s hand, quickly capture a photo or video, and zoom back down to the person’s palm. The captured media is then wirelessly shared to Memories in the Snapchat app, where Snap’s signature AR filters and video effects can be applied. It is priced at USD230.(TechCrunch, Pixy, Wired, Drone DJ, CNET)

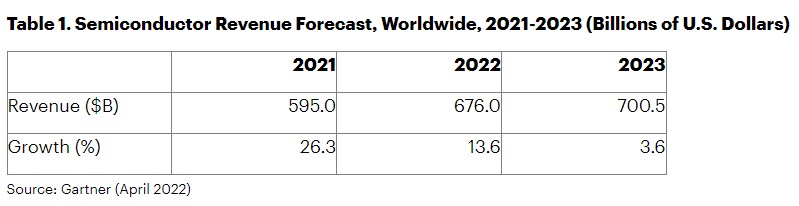

Global semiconductor revenue is projected to total USD676B in 2022, an increase of 13.6% from 2021, according to Gartner. Automotive applications will continue to experience component supply constraints – particularly in microcontrollers (MCUs), power management integrated circuits (PMICs) and voltage regulators — extending into 2023. Slowing growth in PCs, smartphones and server end markets is expected to gradually slow down the growth of semiconductor revenue as semiconductor supply and demand gradually comes into balance during 2022. (CN Beta, Gartner)

After establishing a joint venture with Foxconn to set up a 28nm fab in India, Vedanta Group reportedly is seeking generous subsidies from local governments, including free land, cheap water, and electricity. Vedanta is in advanced talks with at least three states for fab investment, including Telangana and Karnataka in the south and Maharashtra in the west. Vedanta reportedly told state governments that the fab would generate USD2.2B in tax revenues in the next 20 years. (Laoyaoba, Digitimes, Reuters, Money Control)

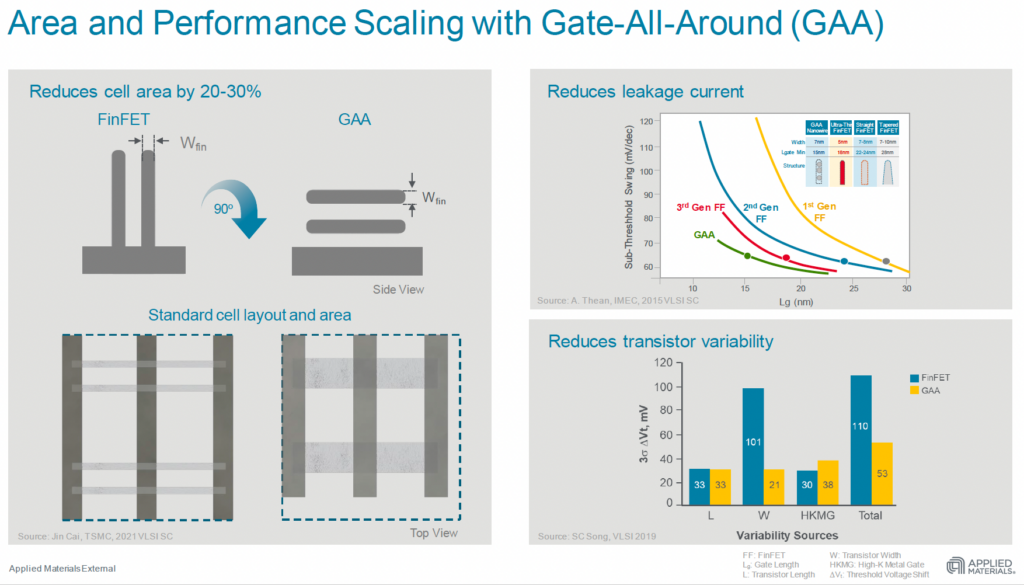

Samsung has said that it is on track to start high-volume production using its 3GAE (3 nm-class gate all-around early) fabrication process in 2Q22. Samsung Foundry’s 3GAE process technology is the company’s first process to use GAA transistors, which Samsung officially calls multi-bridge channel field-effect transistors (MBCFETs). Samsung formally introduced its 3GAE and 3GAP nodes about 3 years ago. Samsung has said that the process would enable a 30% performance increase, a 50% power consumption reduction, and up to 80% higher transistor density (including a mix of logic and SRAM transistors).(CN Beta, Tom’s Hardware, Samsung)

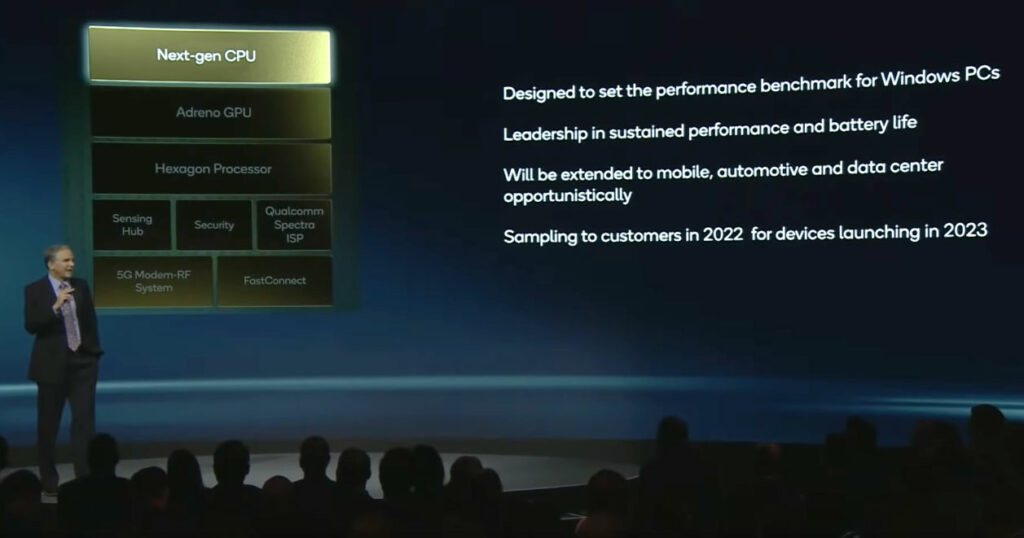

Qualcomm’s President and CEO, Christian Amon, has provided an update on the integration of the Nuvia team, and progress in their goal of developing a big-leap-forward for Arm processors. He has revealed that we may expect to see Nuvia powered Windows laptops on retail shelves, indicating things are currently on track for late 2023. Processors are still going to be sampled with device design partners in 2H22. This gives us some hope for performance leaks surfacing between late 2022 and late 2023.(CN Beta, Tom’s Hardware, Ars Technica, PC World)

Kim Sung-koo, Samsung mobile business vice-president has indicated that the company is working on new foldable devices that will be launching later in 2022. He has further added that the company is looking to make foldable phones another “main column next to the Galaxy S series within our business”. The company will also be making sure that the new foldable devices are not affected by the supply chain issues once the new foldable devices are finally available in the market.(CN Beta, WCCFTech, Samsung, Yonhap News)

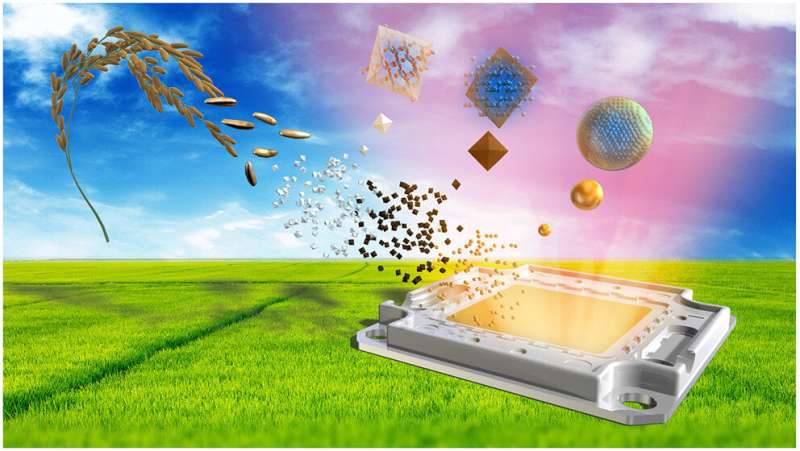

Hiroshima University in Japan has managed to develop a process which could minimize toxic materials used in producing Quantum Dot (QD) LEDs. The team has found a way to recycle these rice husks (a by-product of milling rice to separate the grain from the shell) to create the first silicon quantum dot (QD) LED light. The University claims this finding could soon transform the husks – and potentially other agricultural waste – into state-of-the-art light-emitting diodes in a low-cost, environmentally friendly way. (CN Beta, ACS, What HiFi, TechXplore)

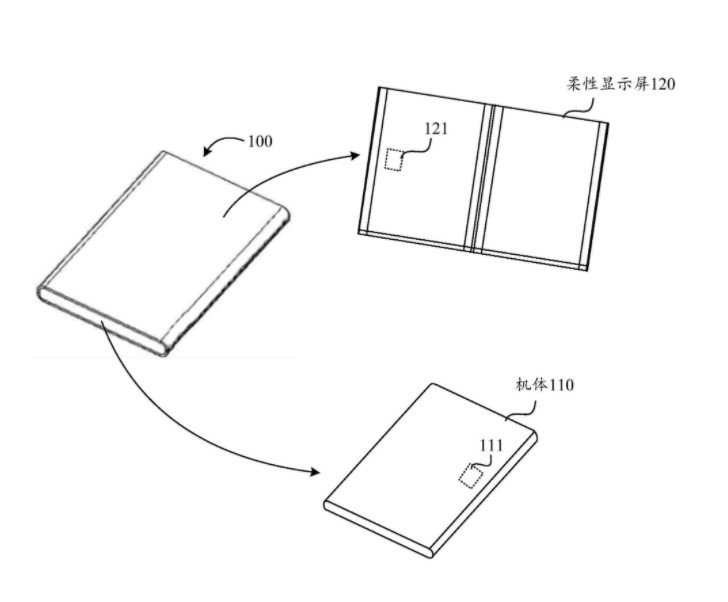

Xiaomi’s patent highlights a unique and innovate handset that has a flexible display that can be detached from the body. The body of the smartphone and the foldable display panel can be separated from one another. Furthermore, the flexible display wraps around and covers the body when it is attached to the main body. Notably, the display is still usable after being removed from the body through wireless data transmission between the flexible screen and the main body. This also implies that the screen itself will be capable of basic computing and houses a battery separate from the main housing as well.(Gizmo China, IT Home)

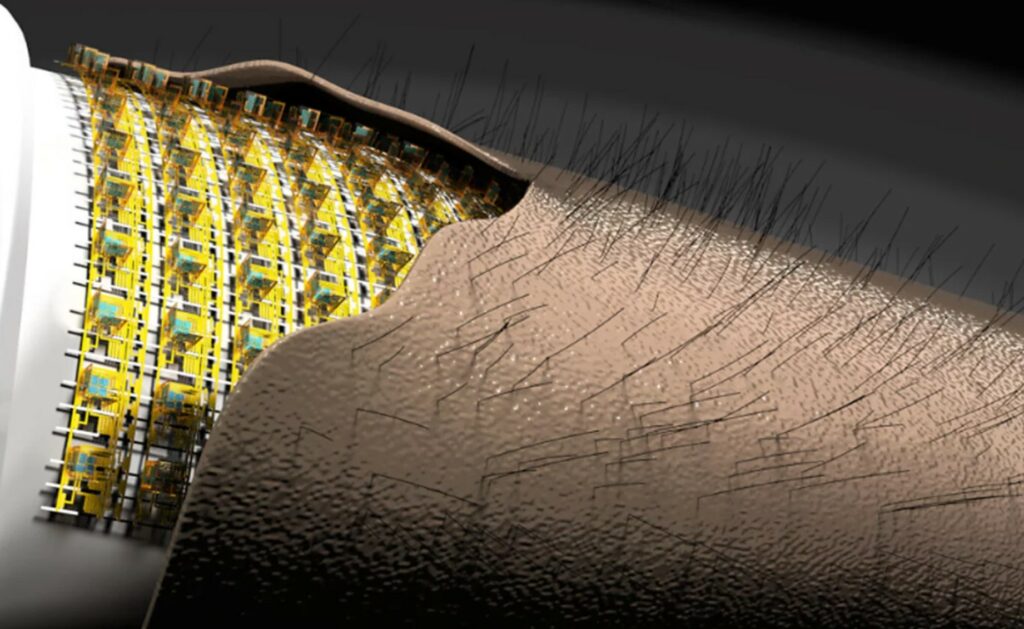

Research Center for Materials, Architectures and Integration of Nanomembranes (MAIN) at Chemnitz University of Technology, Germany, has adopted a new approach to the development of extremely sensitive and direction-dependent 3D magnetic field sensors that can be integrated into an e-skin system (active matrix). The core of the system is an anisotropic magnetoresistance (AMR) sensor, which can be used to precisely determine changes in magnetic fields. Current applications for AMR sensors include speed sensors in cars or determining the position and angle of moving components in machinery. To develop the highly compact sensor system, the researchers took advantage of the so-called “micro-origami process”. This process is used to fold AMR sensor components into three-dimensional architectures that can resolve the magnetic vector field in three dimensions. (CN Beta, Nature, New Atlas, The Engineer)

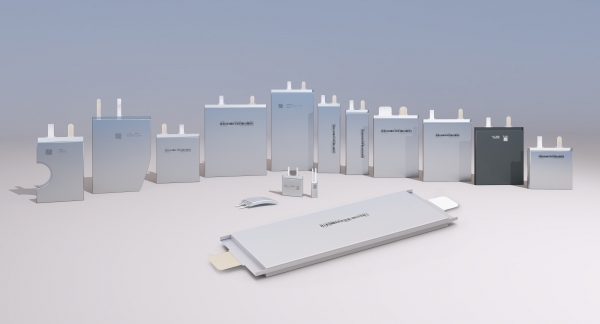

Samsung is reportedly reviewing using batteries from Chinese battery maker Amperex Technology Limited (ATL) for its upcoming foldable smartphones. ATL once lost Samsung as a customer in 2017 following the controversy around the Galaxy Note 7 phones catching fire. However, since then, ATL has resumed supplying batteries to Samsung for the Galaxy A and M series of smartphones. It has also started supplying to premium smartphones again with the Galaxy S21 in 2021. Samsung has so far mostly used affiliate Samsung SDI for the batteries used in the Galaxy Z Flip and Galaxy Z Fold series. Batteries account for around 5% of the cost of manufacturing smartphones. Samsung can use ATL to cut unit prices down of its exiting supplier Samsung SDI. Samsung is also planning to use batteries from LG Energy Solution on its latest foldable phones. (Phone Arena, The Elec)

Wi-Charge, long-range wireless power solutions provider, is partnering with Belkin to apply Wi-Charge’s patented long-range wireless power technology to Belkin’s future products. Wi-Charge revealed its plans to introduce a truly wireless charger, which would not require the device to lie on a Qi base. Wi-Charge’s CEO Ori Mor has mentioned that this product could be released as soon as 2022 thanks to a partnership with Belkin, but now the accessory maker says it’s “too early” to talk about it. Belkin spokesman Jen Wei has confirmed that the company has been working closely with Wi-Charge on product concepts. Wi-Charge leverages its field-proven infrared technology to provide wireless power across distances of up to 40 feet. The company has clarified that its technology transmits up to 1W of power from a transmitter. (CN Beta, TechCrunch, 9to5Mac, ArsTechnica, Stuff.TV, PR Newswire)