5-1 #LaborDay : Intel CEO expects the semiconductor industry to suffer supply shortages until 2024; Samsung Display CEO has allegedly met with Apple CEO; The Indian Enforcement Directorate has annoucned that it has seized bank accounts of Xiaomi India; etc.

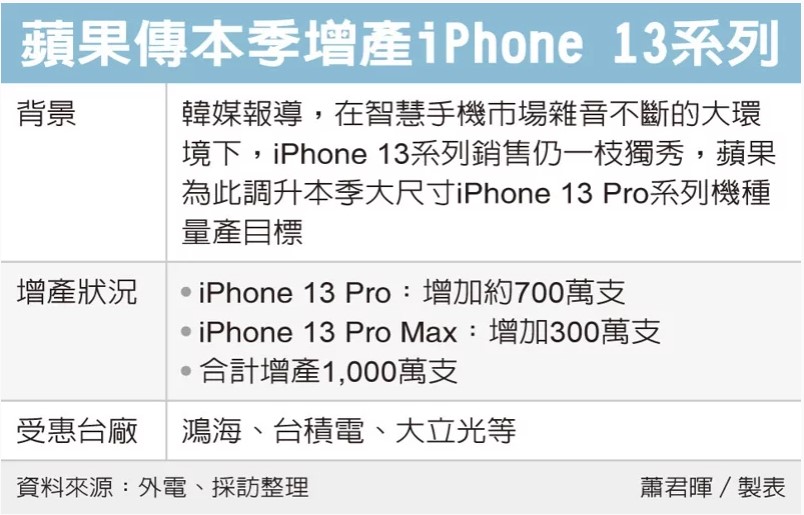

Apple plans to increase the production of the iPhone 13 Pro and iPhone 13 Pro Max by 10M units for 2Q22, according to Digitimes. The report suggests an improving situation with Apple’s supply chain, which has been struggling to meet demand amid COVID-19 lockdowns and restrictions in China. Several of Apple’s suppliers have been forced to partially or entirely suspend production, threatening the supply and availability of the iPhone, iPad, Macs, and other consumer electronics. (Digitimes, MacRumors, UDN)

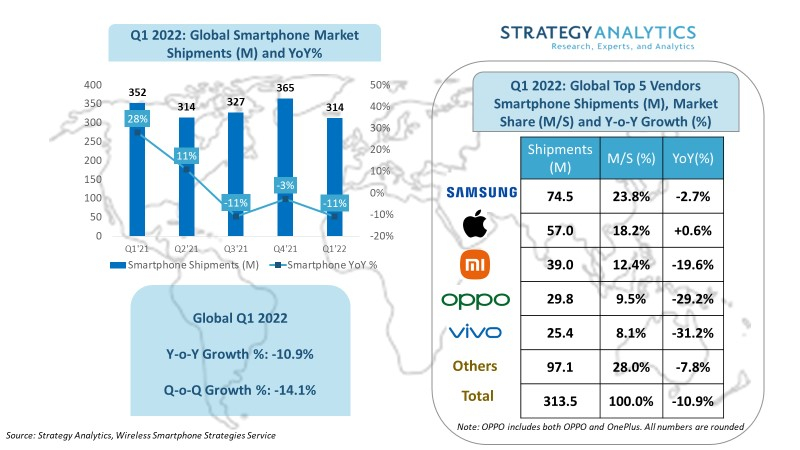

According to Strategy Analytics, global smartphone shipments fell -11% YoY to 314M units in 1Q22. Samsung topped the global smartphone market with a healthy 24% share in Q1 2022, the highest first quarter performance over the past 5 years. Apple ranked the second place with 18% share. Xiaomi, OPPO (including OnePlus) and vivo stayed in the top 5 list. Factory constraints and component shortages continued to restrict smartphone supply in the first quarter of this year. Meanwhile, unfavorable economic conditions, geopolitical issues, as well as COVID-19 disruption (China rolling lockdown etc.) continued to weaken consumers’ demand on smartphones and other non-essential products. (Laoyaoba, Strategy Analytics)

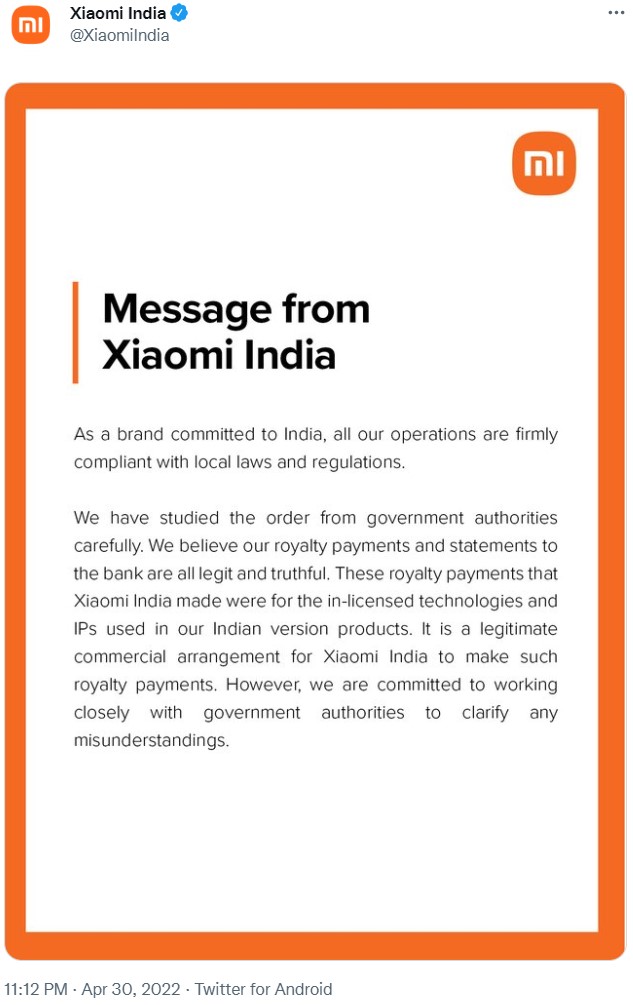

The Indian Enforcement Directorate has annoucned that it has seized bank accounts of Xiaomi India after finding that the company has remitted USD725M to 3 foreign-based entities “in the guise of royalty” payments. The agency has indicatet that such huge amounts in the name of royalties were remitted on the instructions of their Chinese parent group entities. It has accused Xiaomi of providing “misleading information to the banks while remitting the money abroad”. Xiaomi has responded that it believes its payments were legitimate. (Engadget, TechCrunch, Reuters, Twitter, CN Beta)

Apple has cautioned that the resurgence of Covid-19 in China threatens to hinder sales by as much as USD8B in 2Q22—a setback after seeing supply-chain improvements during the first 3 months of 2022. The company CEO Tim Cook has acknowledged the challenges they are seeing from supply-chain disruptions driven by both Covid and silicon shortages to the devastation from the war in Ukraine. The new pain points for Apple come as areas around Shanghai, where Apple has many suppliers, face government lockdowns aimed at curbing Covid-19 infections. Luca Maestri, Apple’s chief financial officer, has revealed that the constraints will hurt revenue by USD4B-8B in the 3 months through Jun 2022. The lockdowns are also expected to damp demand in China.(Laoyaoba, 9to5Mac, WSJ, Taipei Times)

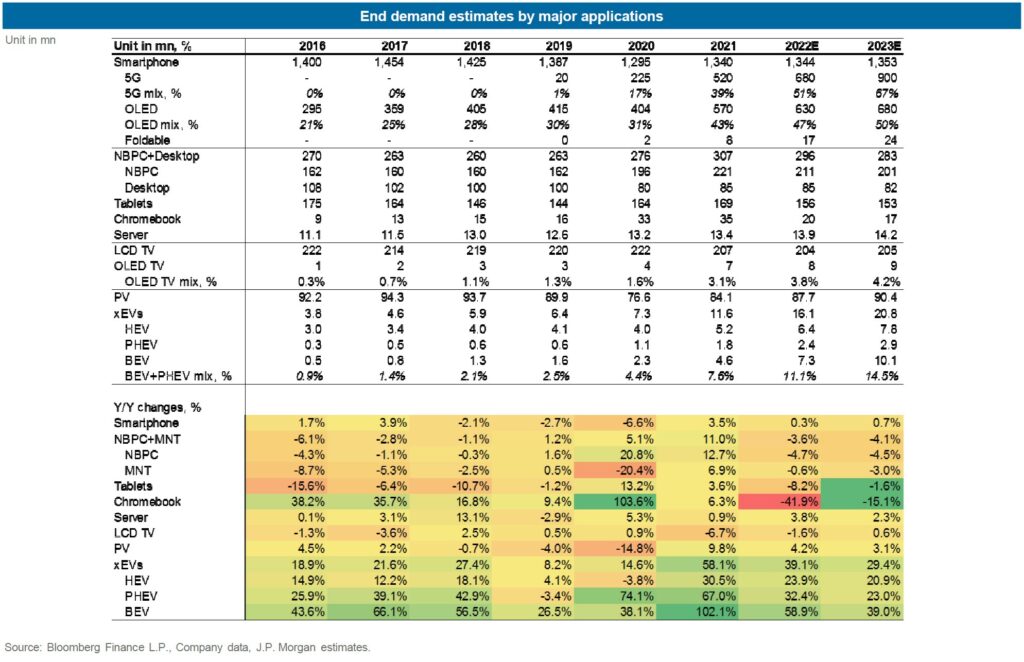

According to JP Morgan, demand of industry is normalizing in 2022, while mobile growth remains key and electric venichle long term trend intact. (JP Morgan report)

POCO M4 5G is official in India – 6.58” 1080×2400 FHD+ v-notch 90Hz, MediaTek Dimensity 700, rear dual 50MP-2MP depth + front 8MP, 4+64 / 6+128GB, Android 12.0, side fingerprint, 5000mAh 18W, INR12,999 (USD170) / INR14,999 (USD195).(Gizmo China, GSM Arena, POCO)

POCO F4 GT is launched in Europe – 6.67” 1080×2400 FHD+ HiD AMOLED 120Hz, Qualcomm Snapdragon 8 Gen 1, rear tri 64MP-8MP ultrawide-2MP macro + front 20MP, 8+128 / 12+256GB, Android 12.0, stereo speakers, side fingerprint, 4700mAh 120W, EUR599 / EUR699. (GSM Arena, Unwire.hk, Gadgets360)

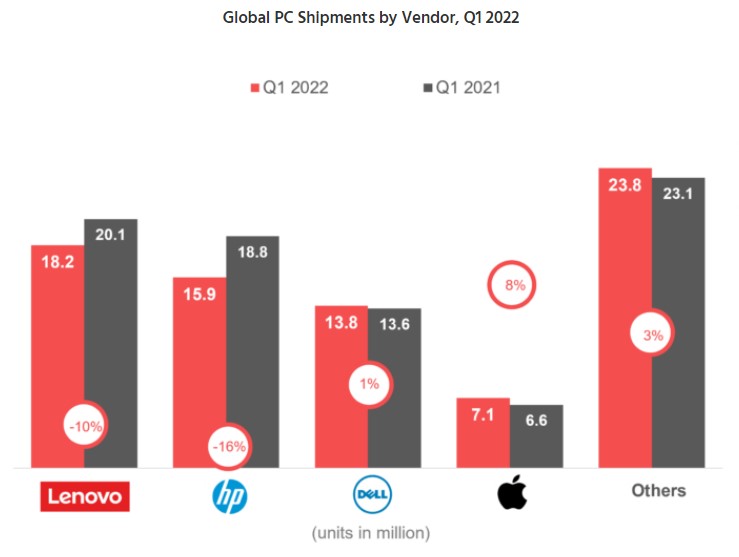

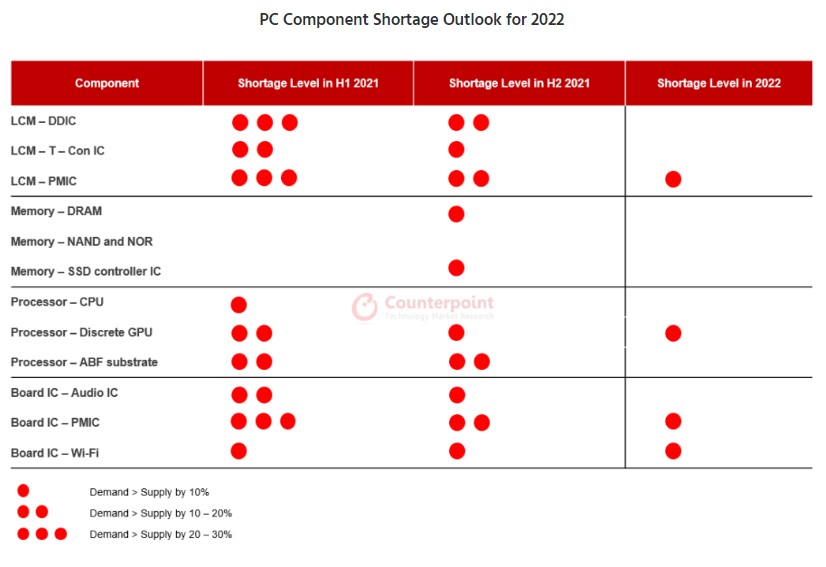

Global PC shipments fell 4.3% YoY in 1Q22 to reach 78.7M units, according to Counterpoint Research. Entering 2022, the PC supply chain experienced easing component shortages and logistics issues compared to 2H21. Order backlog from 2021 continued to contribute substantially to PC shipments in the beginning of 2022. Lenovo maintained its lead in the global PC market in Q1 2022 with a 23.1% share, which was down a little compared to 2021. The brand’s total shipments of 18.2M units were down 9.5% YoY. Lenovo performed well during the pandemic largely due to its in-house manufacturing and operation control. This advantage will continue to help the company in times of demand uncertainty or component supply issues. (GizChina, IT Home, Counterpoint Research)

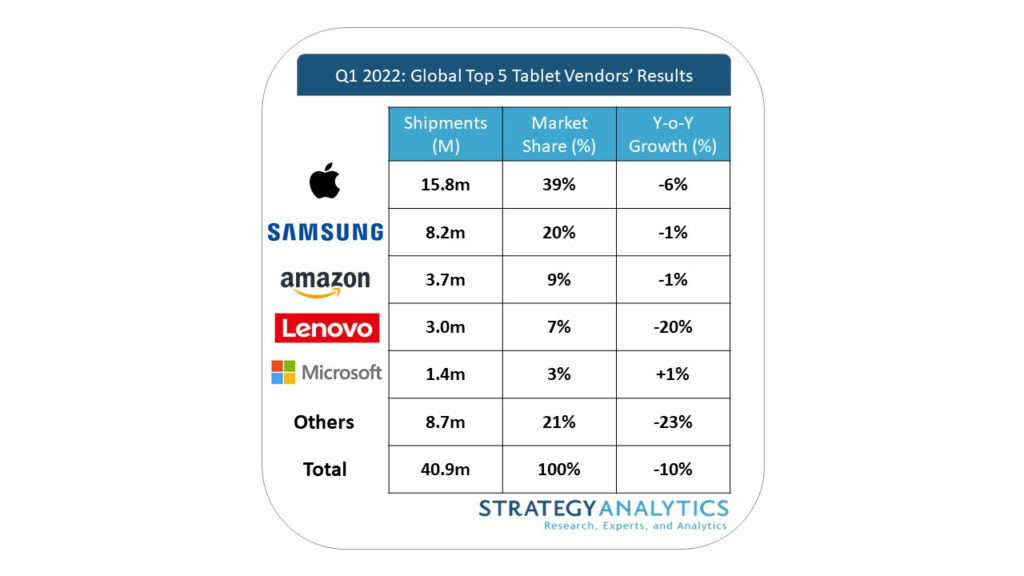

The ripple effects of the COVID pandemic continues to impact the tablet market and produced some surprising results in 1Q22, according to Strategy Analytics. High demand persists while vendors wrestle with supply constraints and logistical issues also stemming from the pandemic, now in Year Three. Considering this context, Samsung, Amazon, Microsoft, and Apple met this twin challenge with impressive growth rates. A better than expected start to 2022 may be short-lived however, as COVID restrictions in China, additional logistic and inflationary pressures, and the Russian invasion of Ukraine all threaten to hold back supply going forward. Apple iPadOS shipments (sell-in) fell -6% YoY to 15.8M units in 1Q22, with worldwide market share climbing 1.7 percentage points to 39% as the vendor outpaced the market; compared to the holiday quarter when Apple was severely supply-constrained, shipments were actually 1% higher QoQ. (Strategy Analytics)

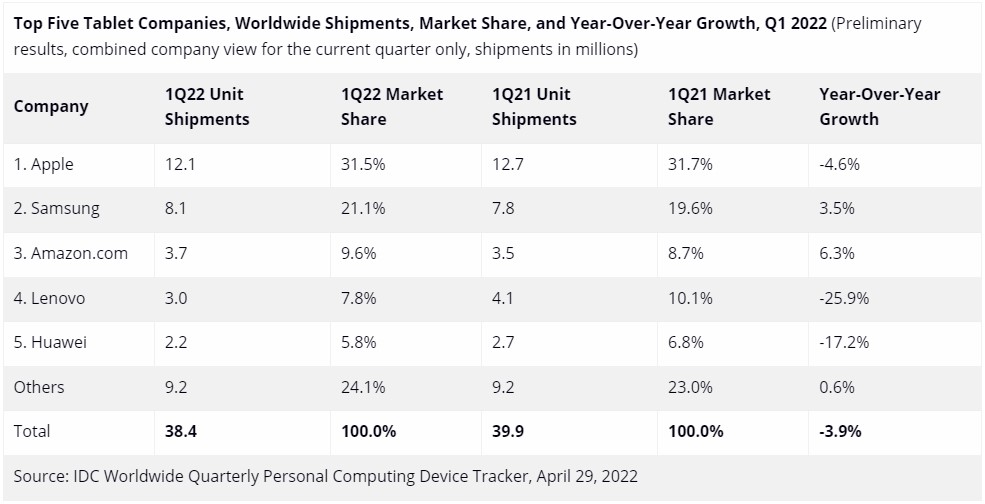

Worldwide tablet shipments reached 38.4M units during 1Q22, posting a decline of 3.9% YoY as demand slowed, according to IDC. Shipments are still above pre-pandemic levels; however, growth has softened, which is an indication of the market reverting to normal seasonality. Also, aggressive purchasing of devices in 2020 and 2021 led many users to hold onto their recently purchased tablets. Chromebooks also continued to decline with shipments down 61.9% YoY in 1Q22. (IDC)

Huawei MatePad SE is launched in China – 10.1” 1200×1600 IPS LCD, HiSilicon Kirin 710A, rear 5MP + front 2MP, 4+128GB, HarmonyOS 2.0, stereo speakers, 5100mAh, Wi-Fi only CNY1,499 (USD226) / Wi-Fi + LTE CNY1,699 (USD256). (Gizmo China, Huawei, Huawei Central)

realme Pad Mini is launched in India – 8.7” 800×1340 IPS LCD, Unisoc Tiger T616, rear 8MP + front 5MP, Wi-Fi 3+32 / LTE 3+32 / Wi-Fi 4+64 or LTE 4+64GB, Android 11.0, 6400mAh 18W, stereo speakers, INR10,999 (USD144) / INR12,999 (USD170) / INR14,999 (USD196).(GizChina, 91Mobiles, India Today)

Voicee is a microphone-equipped set of glasses which display the text of what other people are saying. Along with the noise-cancelling mic in front, they also incorporate a Google Glass-like projected display on the inside of one lens, an Android-based microprocessor, a touchpad for controlling their functions, and of course a lithium-polymer battery. They come with clear lenses by default, although they can be fitted with prescription lenses. The Voicee technology is capable of picking up the speech of another person who is conversing with the wearer, and displaying their words as near-real-time text captions within the glasses.(CN Beta, Indiegogo, New Atlas)

Samsung has committed USD25M of investments on DoubleMe, an up and coming South Korean metaverse startup. DoubeMe’s early vision in 2015 came with the introduction of a solution that could convert two-dimensional videos to three-dimensional models rendered through its tech. The firm later shifted to the metaverse in 2020, with the launch of TwinWorld, a metaverse platform enabling users to build augmented reality (AR) experiences on any physical environment.DoubleMe now specializes in real-time personal volumetric capture technology.(CN Beta, Coin Marketcap, Crypto Daily, Tech in Asia)

Sonos has joined the Connectivity Standards Alliance, who are the coalition responsible for developing the smart home standard, Matter. Matter is a wireless interoperability protocol that has been in the works since 2019 and it already includes companies like Apple, Google, Amazon, Samsung and Zigbee. The goal of Matter is to become an interoperability protocol with standard data models that ensure smart home devices can work across different ecosystems.(Pocket-Lint, The Verge, Twitter)

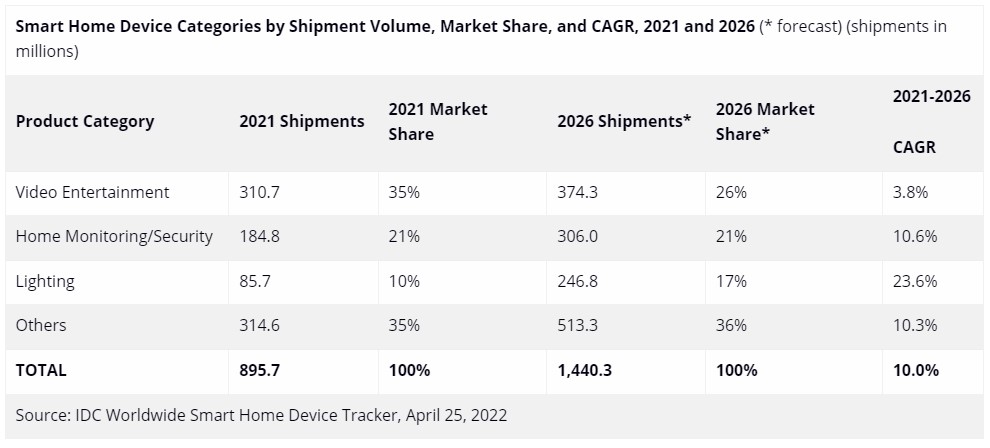

The worldwide market for smart home devices grew 11.7% in 2021 compared to 2020 with more than 895M devices shipped, according to IDC. Notwithstanding the market volatility due to the coronavirus pandemic and its impact on supply chains as well as demand-side shocks, IDC anticipates that the worldwide smart home device market will see steady growth over the next five years as smart home users expand their smart home ecosystems and seek more sophisticated connected experiences. Networked video entertainment devices – such as smart TVs, streaming sticks, and internet-connected set-top boxes – held the largest volume of shipments with 34.7% share and grew 4.8% YoY in 2021. (CN Beta, IDC)

VisionNav Robotics, a global manufacturer of driverless industrial vehicles, announced a C+ round of more than US$80m led by Meituan (China’s leading e-commerce platform for services) and 5Y Capital. VisionNav is committed to applying artificial intelligence (AI), environmental perception, deep learning, servo control, and other core technologies to industrial vehicles, providing autonomous vehicles and flexible unmanned solutions for intralogistics in factories and warehouses. At present, VisionNav Robotics has developed nine series of driverless industrial vehicles and robot control systems. (Pocket-Lint, The Verge, Twitter)

Apple will be accused of “unfairly blocking groups such as PayPal and leading banks from accessing its mobile wallet system” by the European Union and could face heavy penalties if the accusation moves forward. In specific, the EU is taking issue with Apple’s restriction of NFC technology on the iPhone, which Apple does not allow third-party app developers to access. By limiting access to the NFC chip, services such as PayPal, Venmo, banks, and other financial providers, are unable to provide a similar experience to that of Apple Pay for iPhone users. Apple claims that its restrictions on NFC are in place as a safeguard for user privacy and security.(GizChina, MacRumors, Financial Times)

The Open Network (TON) Foundation has added crypto payments to Telegram, allowing its 550M users to send and receive toncoin within the messaging app. The aim is to make sending toncoin “feel like sending a text message”. The TON crypto project was abandoned by Telegram in Aug 2020 following a lawsuit from the U.S. Securities and Exchange Commission (SEC). The foundation recently raised USD1B worth of TON from its users to advance its ecosystem.(CN Beta, The Verge, Coin Desk, Yahoo, Twitter)

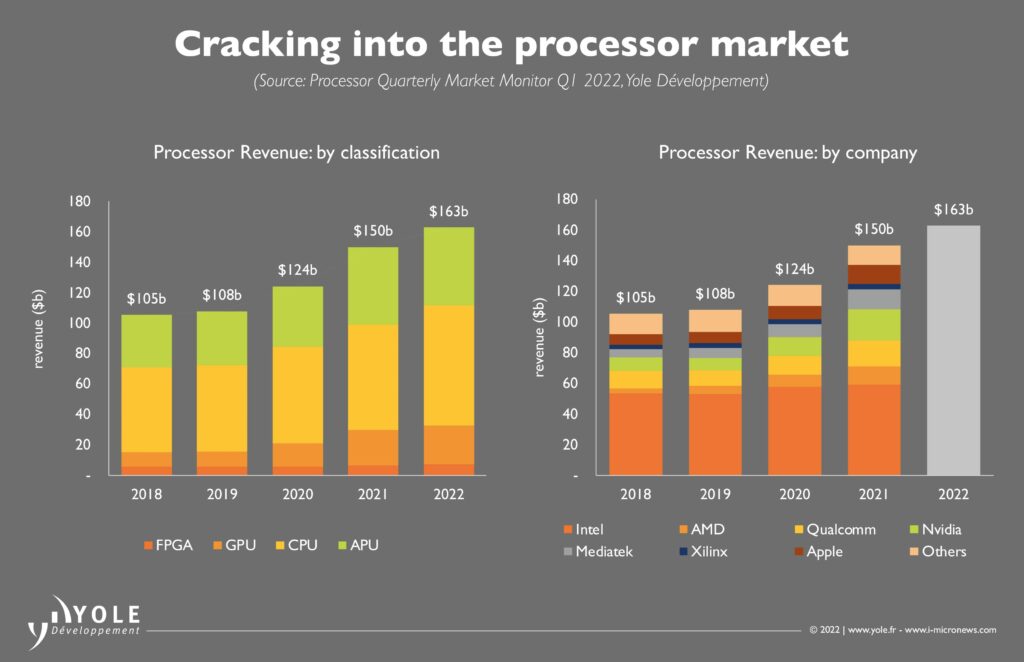

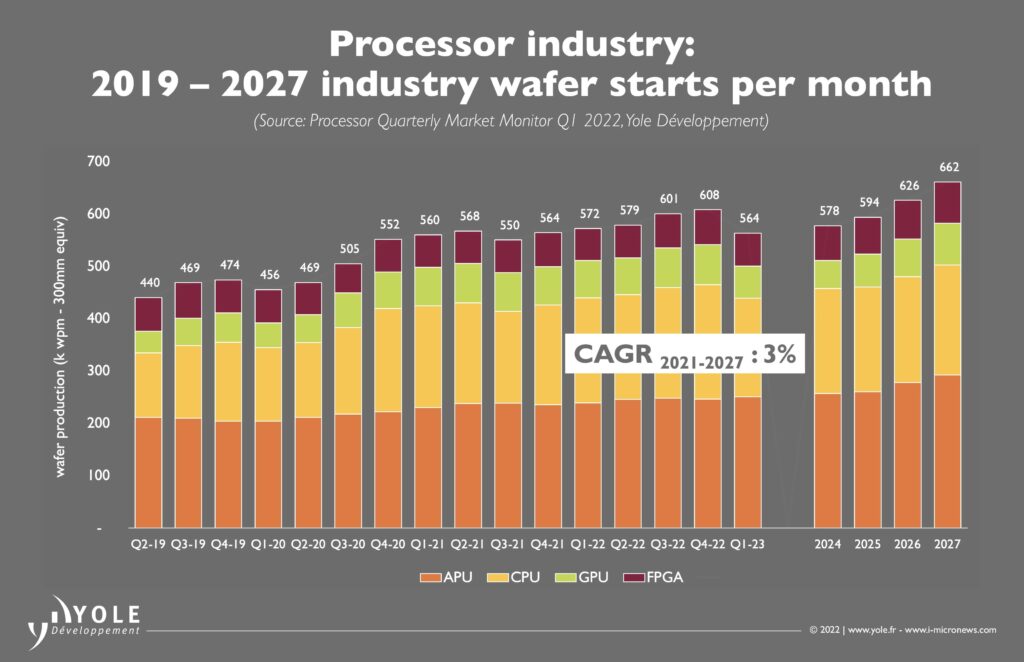

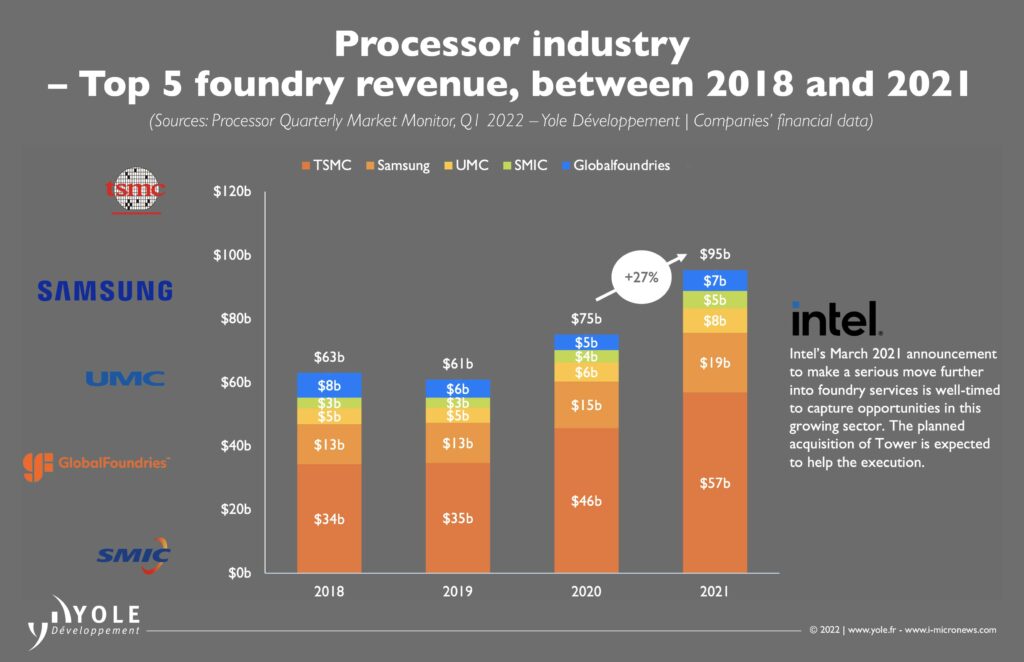

The market for processors was worth USD150B in 2021 split between FPGA, GPU, CPU and application processing units (APUs), according to Yole Developpement. The market is expected to increase by 8.7% in 2022, although Intel’s processor business is unlikely to keep pace. The rise of GPU and APU solutions addressing artificial intelligence applications in the data center and smartphones, respectively, has driven Intel’s processor market share down from 51% in 2018 to 39% in 2021. Meanwhile the foundry market showed 27% annual growth in 2021, Yole states, and is set to achieve 20% plus growth in 2022. (Yole Development, Laoyaoba, EE News Analog)

Intel forecasts 2Q22 revenue and profit below Wall Street expectationson worries of weak demand in its largest market, PCs, and increased supply-chain uncertainty due to COVID-19 lockdowns in China.Rising inflation, resurgence of COVID-19 in China and uncertainties around the war in Ukraine have shifted consumer spending away from gadgets, hurting Intel. More than half of its revenue last year came from the segment selling processors for PCs. Intel Chief Executive Pat Gelsinger has indicated that they are expecting that Shanghai does open up fairly soon, but that does moderate their outlook a little bit on 2Q22. It does not change any perspective on the year, which they think as they go into 2H22, it has more PC demand. (Laoyaoba, Reuters, Business Journal, US News)

Intel CEO Pat Gelsinger has indicated that he expects the semiconductor industry to suffer supply shortages until 2024. He has said that the global chip crunch may drag on due to constrained availability of key manufacturing tools, serving as an obstacle to expanding capacity levels required to meet elevated demand.(CNBC, The Verge)

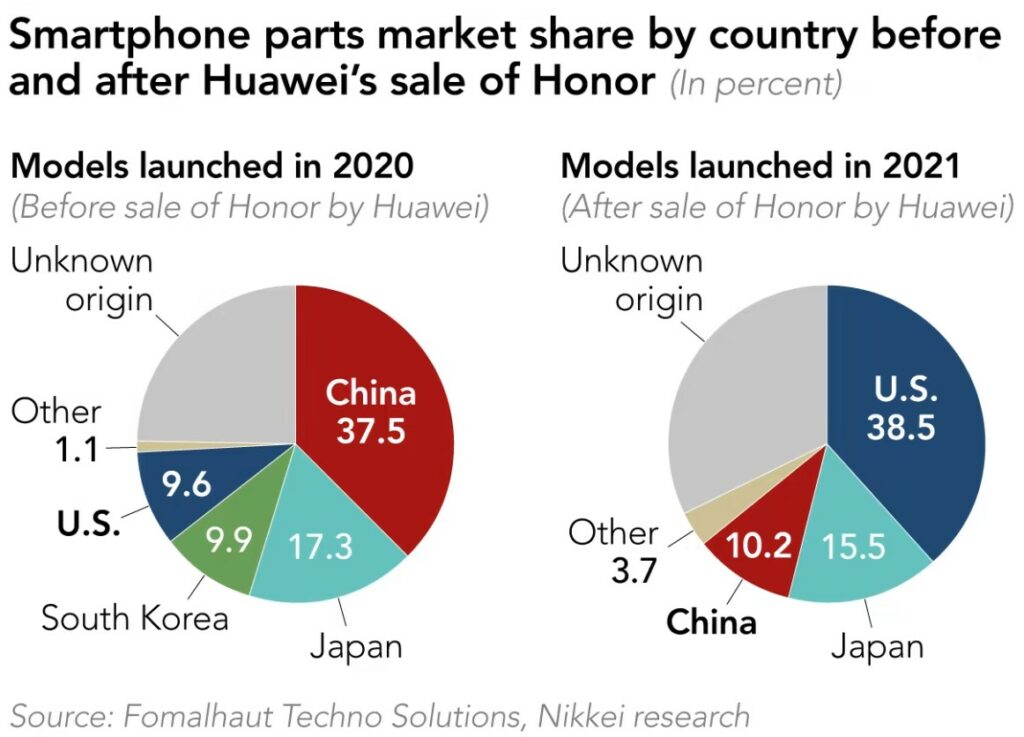

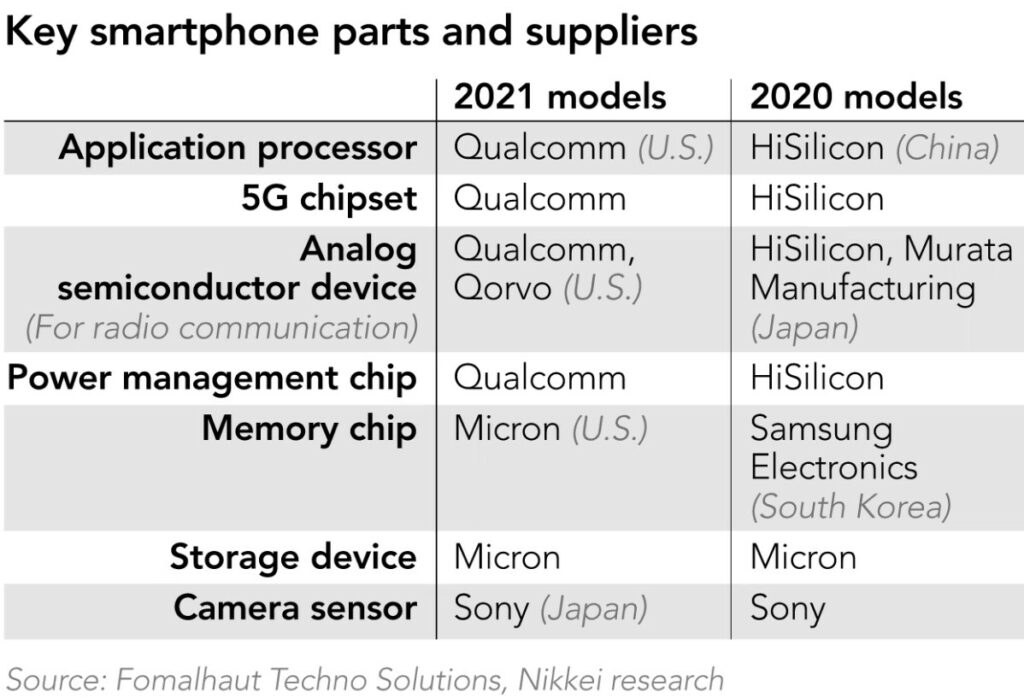

A teardown of Honor’s latest smartphone model has revealed that parts made by U.S. companies account for 40% of the product’s manufacturing cost, as the former budget brand of embattled Chinese tech group Huawei Technologies has turned to American suppliers since the former parent was targeted by Washington’s sanctions. The share of U.S. components in Honor’s X30, a 5G smartphone launched in December 2021, has soared to 39%, from just 10% for the 30S model released in 2020 which was manufactured by Huawei. The estimated production cost of Honor’s mass-market smartphone, the X30, is USD217. U.S. components took the lion’s share of the cost, accounting for 39% of the total. That is a robust 29-point increase from the figure for the 30S, which Huawei rolled out in the spring of 2020 under the Honor brand. U.S. components have replaced Chinese ones in most core areas including the main processor and the 5G chipset. (CN Beta, Asia Nikkei)

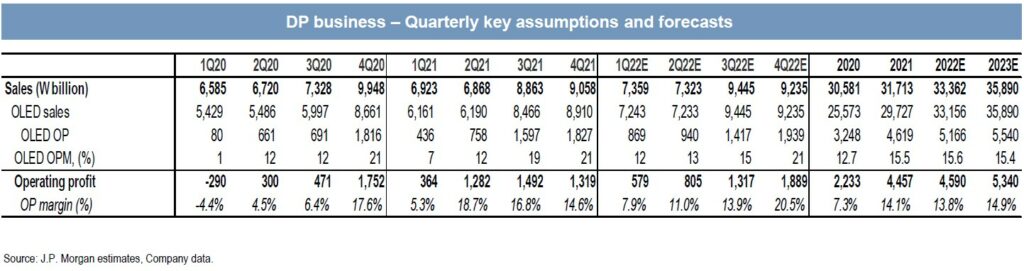

Samsung Display CEO Joo-Sun Choi has allegedly met with Apple CEO Tim Cook and asked Apple to guarantee the purchase of OLED panels. He was on a business trip when learning of Apple’s decision to cut annual iPhone output by 15% in 2022. He made a request “not to reduce the initial commitment to purchase OLED panels”. Apple set a 220M iPhone 2022 production schedule late in 2021 and notified its component suppliers accordingly. Of those, Samsung Display received orders from Apple for an expected supply of 160M iPhone OLEDs.(Phone Arena, Patently Apple, ATP, IT Home)

Samsung Display (SEC) expects revenues to improve sequentially driven by new product launches at major customers and sales to increase in premium products such as foldable smartphones. Expansion into large-size monitors and IT devices such as NBPC and tablets should also support robust sales growth. In 2022, OLED adoption will continue to increase from higher 5G penetration amid growing foldable market and recovery of smartphone demand. Non-smartphone applications such as IT / gaming / automotive are also expected to bolster OLED demand. SEC has started manufacturing QD displays in 4Q21 and is preparing for mass production of QD for both TV and IT upon request from customers. Of note, the conversion ratio of QD-Display from LCD line is expected to be 30%.(JP Morgan report)

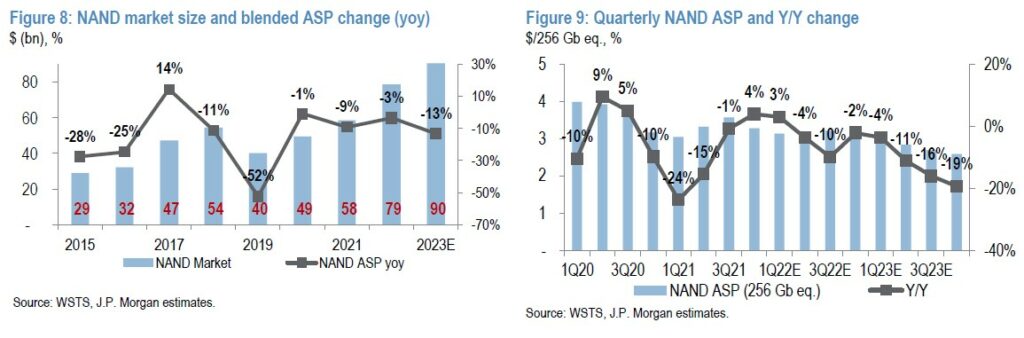

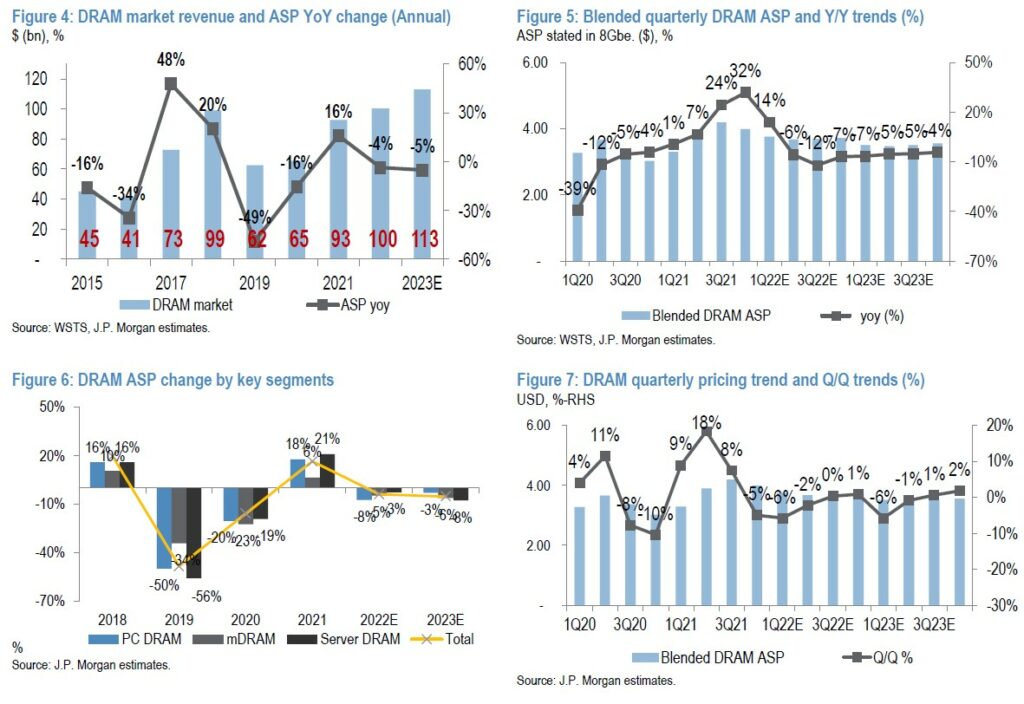

JP Morgan forecasts the global DRAM market to deliver 8% YoY growth, driven primarily by 20% YoY demand growth amidst 4% YoY ASP decline, and the NAND market to significantly grow by 35% YoY in 2022 on the back of price-elastic demand growth of 32% YoY, which would help to offset a mild 3% YoY ASP decline. They have revised up 2022 memory revenue estimate by 8%, including 7% / 11% upward revisions to DRAM / NAND revenue, respectively. The majority of revenue upside in DRAM is triggered by stronger-than-expected price outlook as evidenced by lower-than-expected supply growth. NAND price adjustments now reflect a mild QoQ growth from 2Q22 onwards vis-à-vis previously MSD% QoQ decline due to limited supply addition from supply disruption at Western Digital / Kioxia fab. (JP Morgan report)

JP Morgan keeps their previous assumption of 3-quarter price downcycle from 4Q21-2Q22 but revise the ASP upward by 9% / 4% in 2022 / 2023 led by robust demand for server DRAM amidst healthy cloud capex and lean inventory at memory makers. On annualized basis, they expect DRAM ASP to correct by 4% YoY in 2022 (after a mid-teen% hike in 2021) and continue its downward trend but at a moderate pace in 2023. In 2022, despite their downward revision in smartphone demand, they cautiously expect mobile DRAM pricing to stage a milder decline of 5% YoY in 2022 (previously 10%) driven by flagship model launches and ongoing 5G adoption at mid-end smartphones. (JP Morgan report)

JP Morgan meaningfully revises up NAND ASP by 15% in both 2022-2023, predominantly driven by limited supply side addition from contamination issue at Western Digital / Kioxia fab. They estimate that the total impact to industry bit supply is around ~5% in 1H22, which is fairly significant. To reflect their view, following a 5% QoQ decline in 1Q22, they expect NAND pricing to pick up QoQ strength during 2Q22 / 3Q22, and gradually stage a flattish growth in 4Q22 as the supply situation normalizes. On a YoY basis, contrary to their previous assumption of 12% YoY decline, they now expect a much milder price decline of 3% in 2022. (JP Morgan report)