5-16 #EmbraceMondays : Apple has allegedly teamed up with E Ink; Micron has announced the industry’s first 3D NAND memory device featuring 232 layers; SpaceX has announced its satellite internet service Starlink is now available in 32 countries around the world; etc.

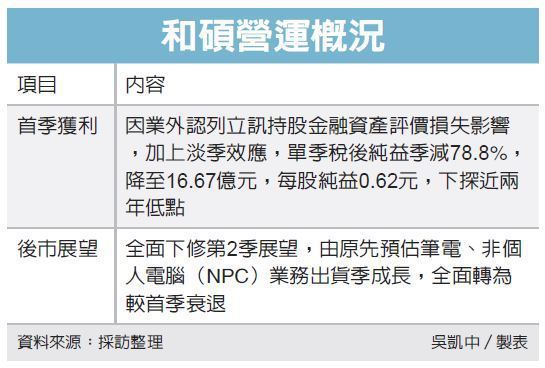

Apple assembly partner Pegatron has advised production at a factory in Shanghai has been impacted by the COVID-19 lockdown, a warning that could harm the manufacturing of iPhones and other products. Pegatron assembles between 20% to 30% of all iPhone models, but it is unclear if the latest statement means Apple-related production will be hit or if it will impact Pegatron’s other clients more.(CN Beta, CW, China Times, UDN, SCMP, Apple Insider)

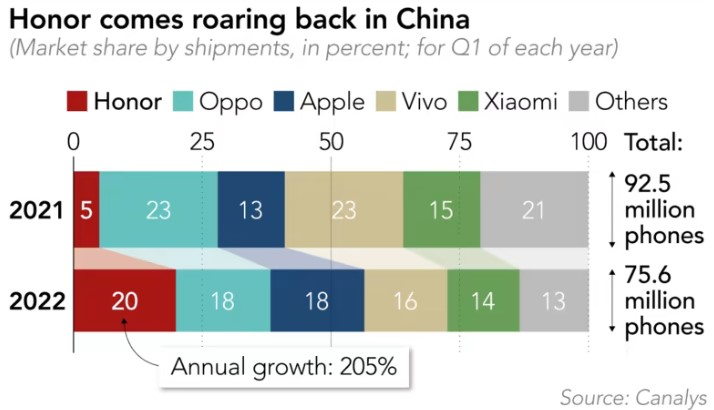

Honor is venturing into 20 overseas markets in Europe, the Middle East, Latin America and Southeast Asia, marking an ambitious comeback attempt for the former Huawei unit after it spent more than a year focusing solely on the domestic market. Honor CEO George Zhao has indicated the U.K., France, Italy, Germany, Spain and the Czech Republic will be the company’s main focus in Europe. He has also said they are determined to embrace a global supply chain with partners from the U.S., Europe, Japan, South Korea and Taiwan to collaboratively face market competition. He expects the shipments for the foldable smartphones segment will be 5-10 times that number by around 2023. Currently, 100% of Honor’s products are made in China, but he has said in the longer term will shift some capacity outside of China in accordance with the needs of overseas markets. To better control its supply chain and facilitate quicker integration with its research and development team, 10%-15% of the company’s smartphones, especially its premium offerings including the Magic V, are made in house at its factory in the Chinese city of Shenzhen. (Asia Nikkei, Laoyaoba)

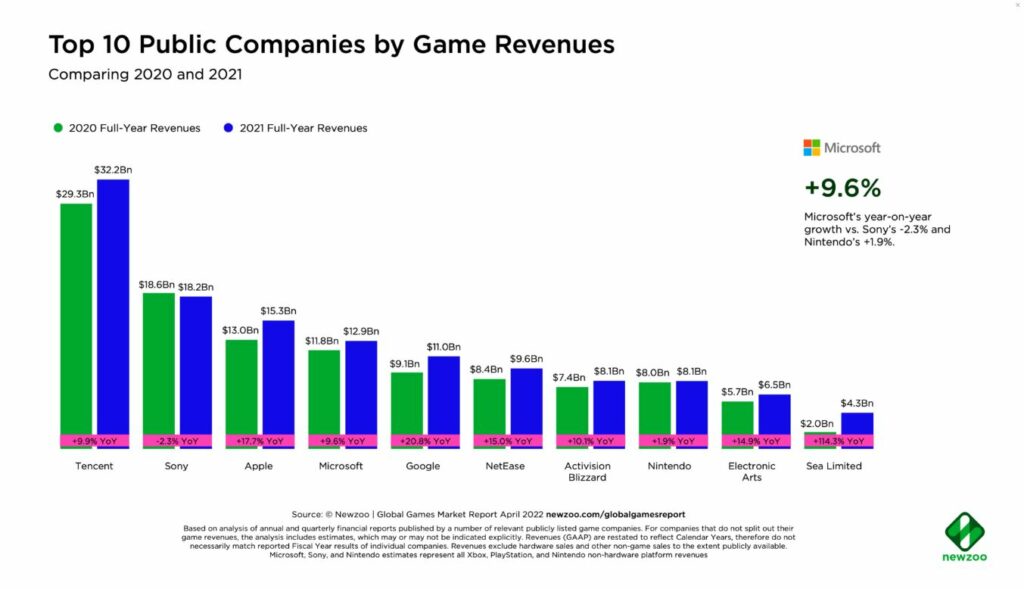

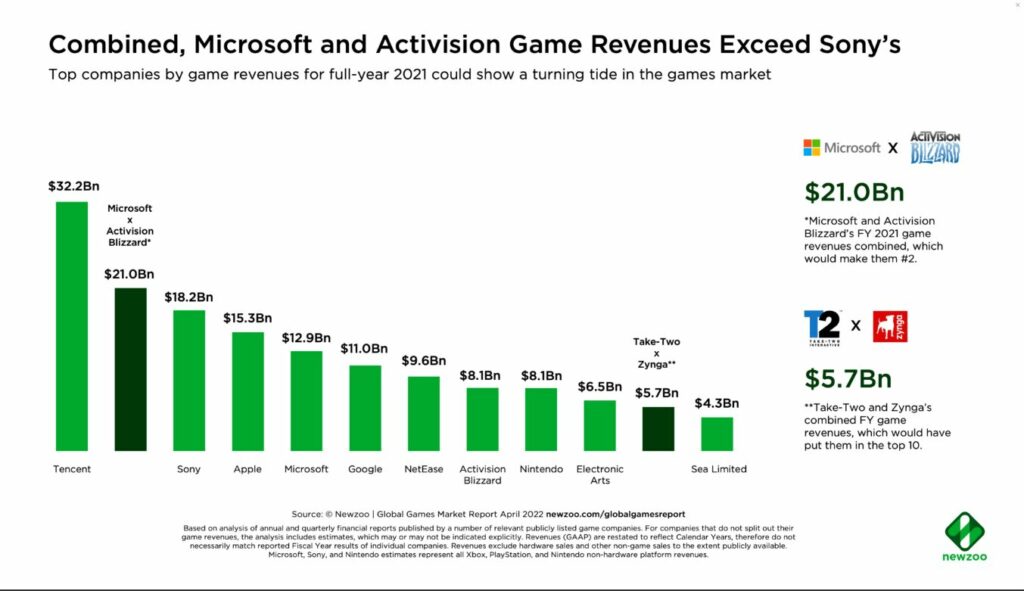

According to Newzoo, the top 10 public companies by game revenues generated a combined USD126B in 2021, a YoY growth of +10.2%. While these companies contributed most to the games market’s 2021 revenues of USD192.7B, top 10 also grew the slowest of all the public companies they cover . The top 11-25 companies are beginning to capture a bigger share of the global games market pie, while those ranked 26 and below saw even faster growth than the top 25. Therefore, it is unsurprising that the biggest game companies are eyeing M&A for growth. (VentureBeat, Newzoo)

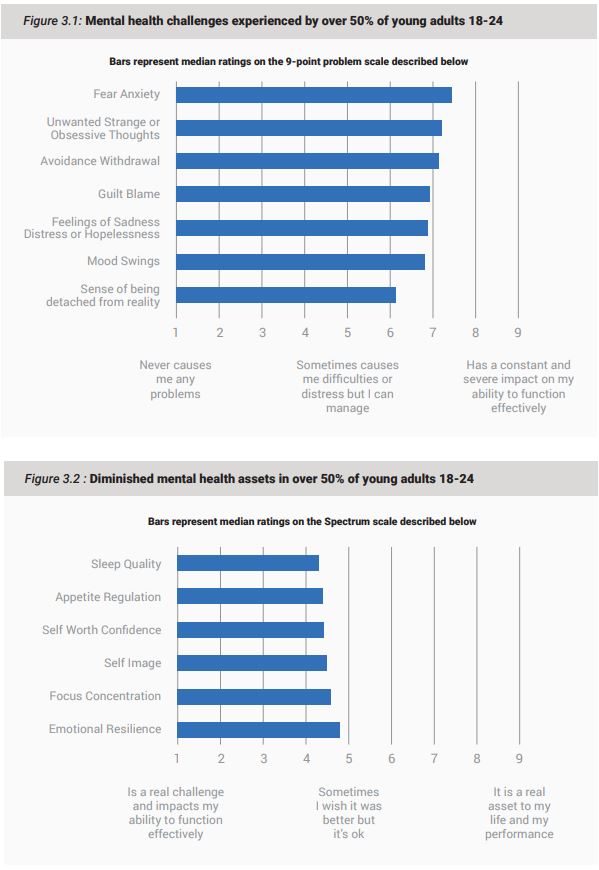

Sapien Labs indicates that smartphone use could be responsible for an ongoing decline in the mental health of young adults in the 18-24 age range. The report notes that before the internet, by the time someone turned 18, they would have spent 15,000 to 25,000 hours interacting with peers and family in person.With the internet, that number has dropped down to a range of 1,500 to 5,000 hours. Tara Thiagarajan, Chief Scientist at Sapien Labs, says that this reduction in social interaction prevents people from learning important skills such as how to read facial expressions, body language, physical touch, appropriate emotional responses, and conflict resolution. Thiagarajan noted that people who lack these skills can end up detached from society and feel suicidal. (Phone Arena, Sapien Labs)

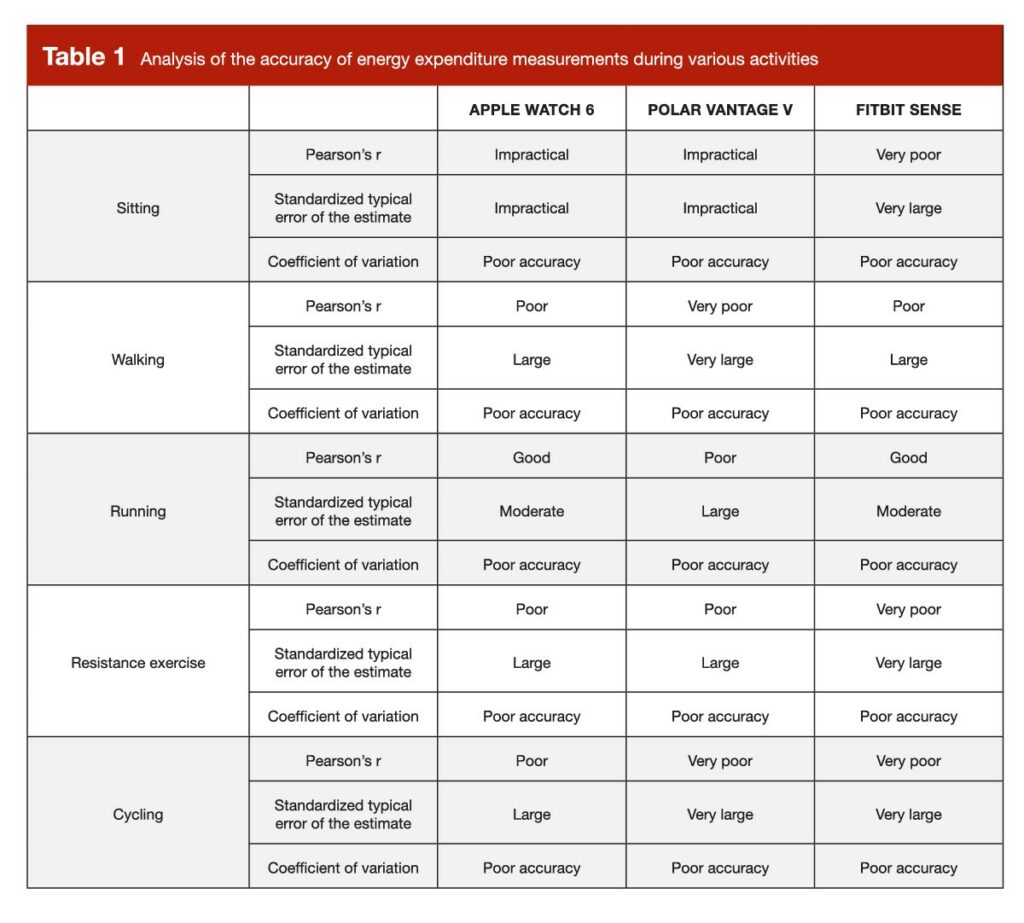

Stronger by Science has tried to evaluate the usefulness of wrist-worn smart devices for tracking energy expenditure and heart rate. The Apple Watch Series 6, Polar Vantage V and the Fitbit Sense were used by 30 healthy male and female participants engaging in weight training, cycling, running walking and even sitting. As reference devices, the team used the Polar H10 chest strap and the MetaMax 3B. As it turns out, all of the devices were bad at tracking calories in almost all of the activities. Not only that, but the average deviation from the actual daily expenditure was unpredictable and wildly varying rendering the watches useless at tracking calories. (CN Beta, National Library of Medicine, Stronger by Science)

Petaverse Network, a non-fungible token (NFT) game company started by the founders of Tiny Rebel Games, will use the Polygon blockchain to mint its cute digital cats. It is taking the gameplay of digital pets and modernizing them based mostly on blockchain and metaverse concepts. Petaverse has stated the deal marks the primary of many platforms Petaverse Community will companion with, powering its mission to grow to be the primary cross-chain platform for digital pets.(VentureBeat, TechyInsight)

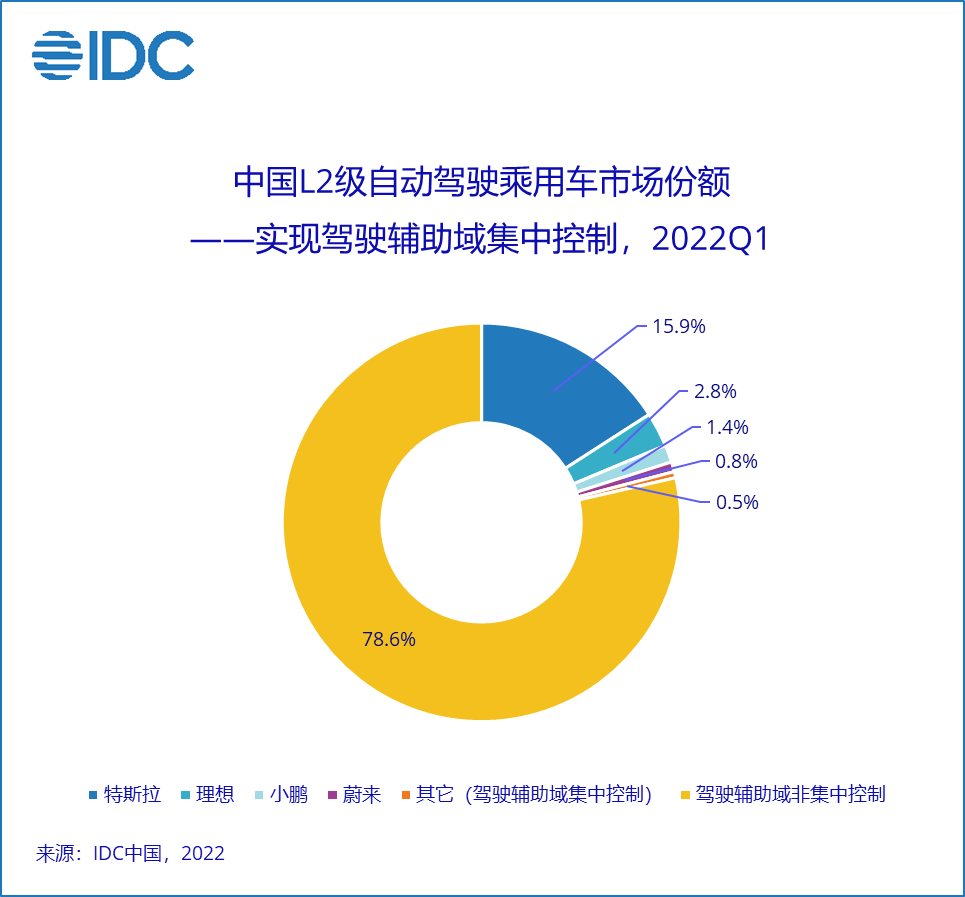

According to IDC, in 1Q22, the penetration rate of new vehicles for L2 autonomous driving in the passenger car market reached 23.2%, and the entire market is in the stage of L2 to L3 development. IDC predicts that with the continuous increase in the market share of new electric models and the deployment of domain control electronic and electrical architectures in traditional car companies, the proportion of models that achieve centralized control in the driver assistance domain will increase rapidly in the next 3 years to support higher levels. of autonomous driving. (Laoyaoba, IDC)

Google’s Pixel Watch is allegedly using Samsung Exynos 9110, which is first released in Aug 2018. Many have assumed that Google would be leveraging the just-announced Exynos W920 found on the Galaxy Watch 4. This would have given the Pixel Watch the benefit of the latest performance and efficiency associated with a 5nm chip and Corex-A55 cores. Instead, the Exynos 9110 is built on a 10nm process with two Cortex-A53 cores. This is similar to the Snapdragon Wear 4100+, though that Qualcomm chip is 12nm, which is, in turn, less efficient. (Laoyaoba, GSM Arena, 9to5Google, SamMobile)

Japanese electronics manufacturer TDK will spend roughly JPY50B (USD383M) to construct a domestic factory that makes parts for electric vehicles, in a move that follows a growing trend of locating capacity at home due to supply chain pressures and the weak yen. The new facility will make multilayered ceramic capacitors and be located next to an existing plant in Kitakami, a city in Iwate Prefecture. The prospective factory will be up and running by the end of 2024. TDK plans to double the companywide capacity for making the capacitors, although the exact volume has not been disclosed. (Laoyaoba, Asia Nikkei)

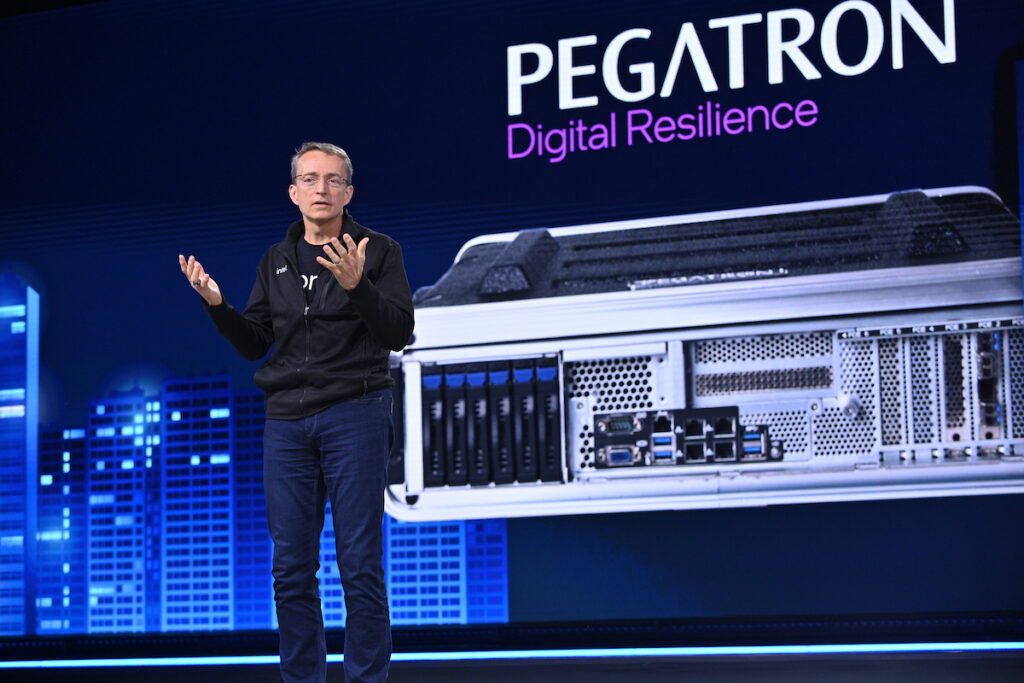

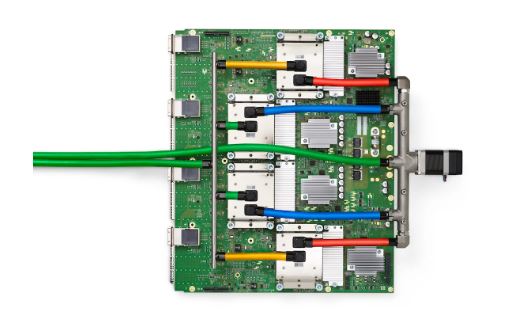

Intel CEO Pat Gelsinger has demonstrated a portable 5G solution developed by Pegatron. Using Intel’s platform, software and tools, Pegatron has developed a portable 5G wireless signal base station designed for field rescuers to deploy at disaster sites. It runs on the Intel Xeon Scalable Platform and is about the size of a briefcase. It can be easily brought into the scene of earthquakes, typhoons or other natural disasters when the normal communication infrastructure has been destroyed.(CN Beta, Intel, 4Gamers)

Google has announced the public preview of a full cluster of Google Cloud’s new Cloud TPU v4 Pods. Google’s fourth iteration of its Tensor Processing Units launched in 2021 and a single TPU pod consists of 4,096 of these chips. Each chip has a peak performance of 275 teraflops and each pod promises a combined compute power of up to 1.1 exaflops of compute power. Google now operates a full cluster of eight of these pods in its Oklahoma data center with up to 9 exaflops of peak aggregate performance. Google believes this makes this “the world’s largest publicly available ML hub in terms of cumulative computing power, while operating at 90% carbon-free energy”.(CN Beta, TechCrunch, Google)

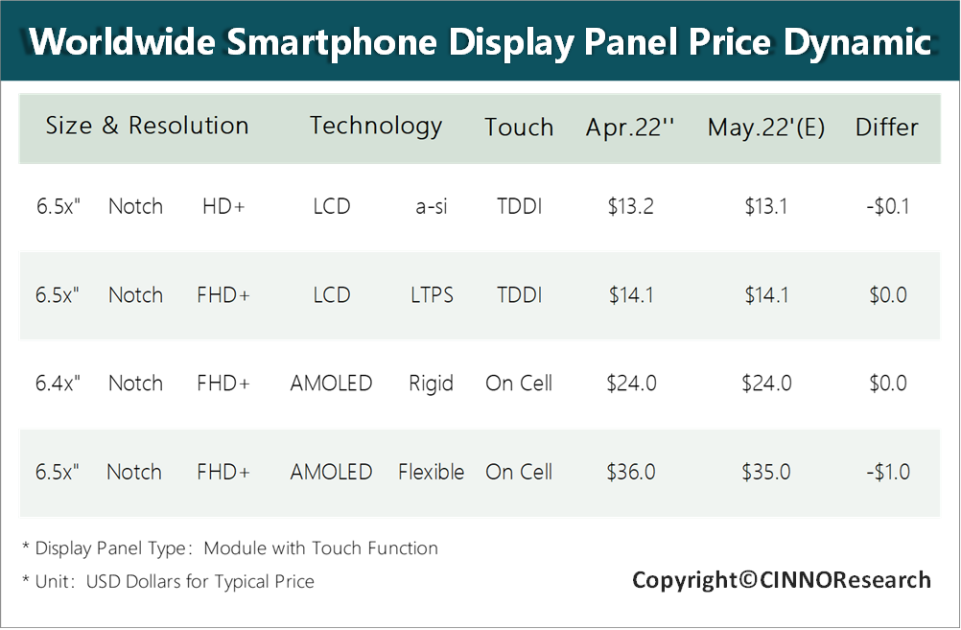

CINNO Research has pointed out that due to sluggish terminal demand, the price of a-Si/LTPS smartphone panels in Apr 2022 is still in a downward trend, continuing to drop by USD0.1; although the overall price of AMOLED panels remained basically flat in Apr 2022, flexible AMOLED mobile phone panel prices fell in May after 17 months of flat. The agency believes that entering 2Q22, under the combined influence of multiple factors such as the Russian-Ukrainian conflict, domestic epidemic control, inflation and other factors, terminal demand will continue to be sluggish, and major mobile phone brands will continue to revise their shipments in 2022 after lowering their annual targets at the beginning of the year. The current annual shipment target has been lowered by more than 10% compared to the beginning of the year. CINNO Research estimates that the price of flexible OLED panels will drop by USD1 in May and Jun 2022, and the price of rigid OLED panels will also be adjusted when the price of flexible OLED panels is reduced; the price of a-Si products will continue to decline in May USD0.1, the prices of some LTPS products remain unchanged, and some products will continue to drop by USD0.1. (Laoyaoba, CINNO Research)

LG Display (LGD) will halt its production line for automotive liquid crystal display (LCD) panels after 20 years of operation. The line at Gumi, called P5, began operation back in 2003 and manufactures Gen 5 (1100x1250mm) a-Si LCD panels. LG Display has been reducing its a-Si thin-film transistor (TFT) LCD production for years now, due to the intense competition with BOE and AUO. The company is opting to focus on the more sophisticated low-temperature polycrystalline silicon (LTPS) TFT LCDs. The production volume at P5 will be shifted to the line adjacent to it, the Gen 6 (1500×1850) P6 line. LG Display is currently using its Gumi plant mostly to manufacture plastic OLED. Its plans in China and Vietnam are focused on LTPS TFT LCD and automotive display modules, respectively.(Laoyaoba, The Elec)

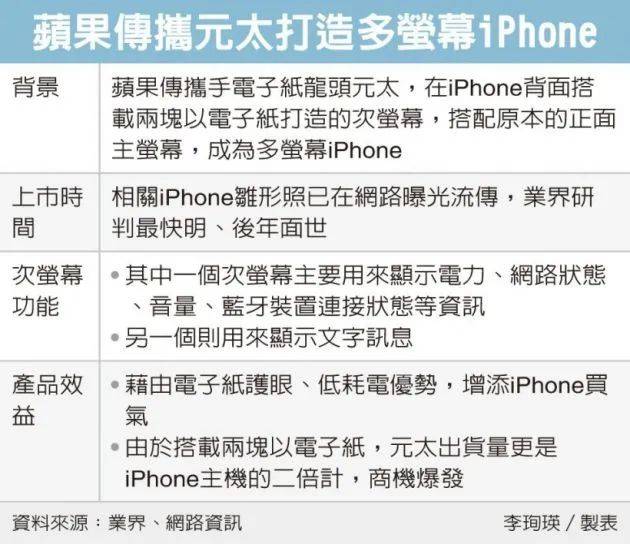

Apple has allegedly teamed up with E Ink, a leading electronic paper (ePaper) company, to develop a new “iPhone”. It seems that two secondary screens made of electronic paper have been added to the back of the iPhone, and the original front main screen has become a multi-screen iPhone. The new “electronic paper / ink display” version of the iPhone will also have the advantages of electronic paper eye protection and low power consumption due to the new design. (Laoyaoba, LEDInside, UDN)

E-ink tablet maker reMarkable has now sold more than 1M devices since 2017 and raised money at a valuation of USD1B indicating that its unusual minimalist reading- and writing-focused tablet is growing its market share despite competition with fully-fledged tablets like the iPad. (MacRumors, TechCrunch)

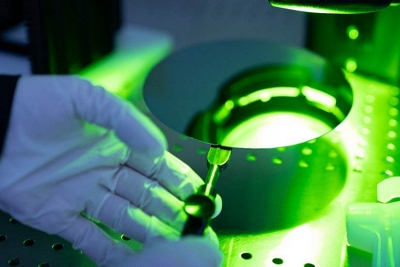

Epiwafer and substrate maker IQE of Cardiff, UK has announced what is said to be the world’s first commercially available 200mm (8”) vertical-cavity surface-emitting laser (VCSEL) epiwafer. IQE reckons that the increase in wafer diameter to 200mm will enable a step-change in unit economics for compound semiconductors, allowing expansion to new foundry partnerships (including silicon-based foundries). IQE notes that 3D sensing was made economical within premium smartphones in 2017 when it developed and scaled VCSEL epiwafers from 100mm to 150mm. The introduction of 200mm creates opportunities beyond the smartphone, into a broad range of intelligent connected devices and also enables applications in the metaverse. IQE has formed a partnership with Poro Technologies (Porotech) to commercialize gallium-nitride based microLED displays. The partnership will develop, scale and commercialize Porotech’s technology, which can achieve red, green and blue light emitters on a single 200mm- or 300mm-diameter GaN-based wafer. (Laoyaoba, IQE, IQE, IQE, Optics, Business Insider, Semiconductor Today)

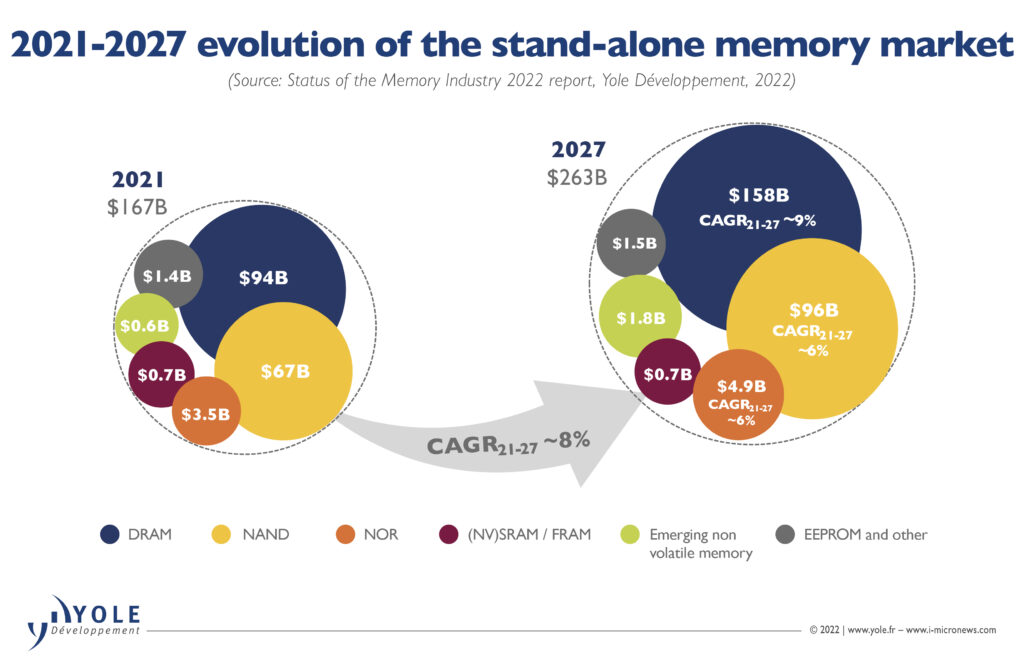

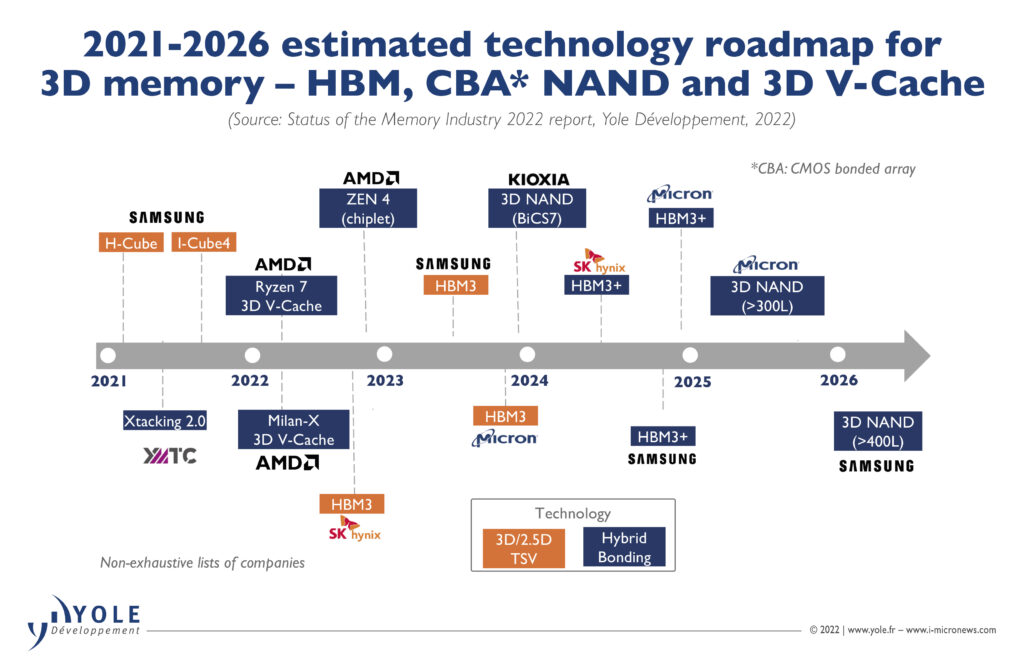

According to Yole Development, the DRAM and NAND market revenues are expected to reach USD158.5B and USD96B in 2027, respectively. New technical solutions, such as EUV lithography, hybrid bonding, and 3D DRAM, will enable continuous density scaling and performance growth in the long term. The production ramp-up of China-made memory is opening up new business opportunities for OSATs. Amid trade-war tensions and the COVID-19 pandemic, the stand-alone memory market has been expanding throughout the last 2 years. Revenue was up 15% and 32% in 2020 and 2021, respectively. DRAM is expected to grow to USD118B, up 25%. NAND flash memory will reach USD83B, up 24%, in 2022. (Yole Development, Laoyaoba)

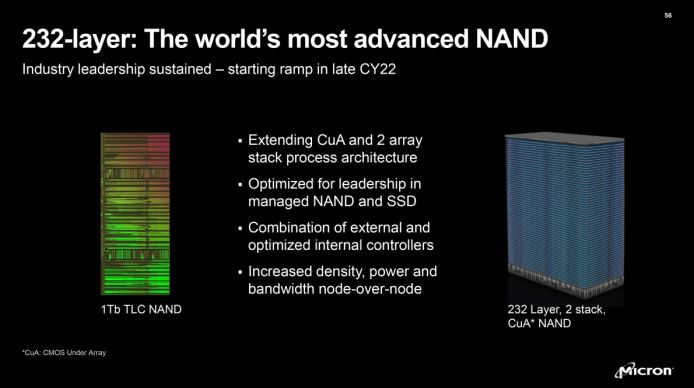

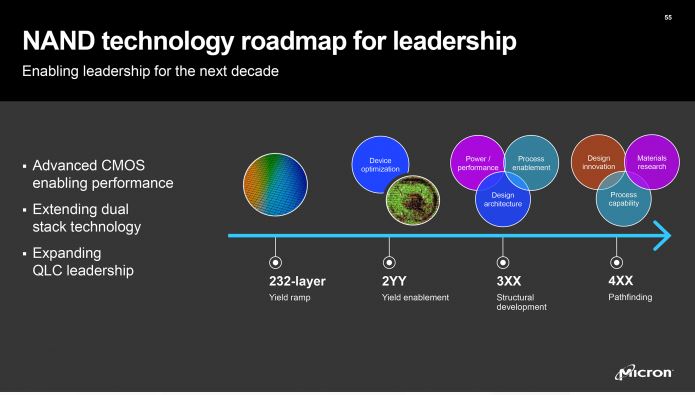

Micron has announced the industry’s first 3D NAND memory device featuring 232 layers. The company plans to use its new 232-layer 3D NAND products for a variety of products, including solid-state drives and plans to start ramping up production of such chips sometimes in late 2022. Micron’s 232-layer 3D NAND device features a 3D TLC architecture and has a raw capacity of 1Tb (128GB). The chip is based around Micron’s CMOS under array (CuA) architecture and uses NAND string stacking technique to build two arrays of 3D NAND on top of each other. The CuA design coupled with 232-layers of NAND will greatly reduce die size of Micron’s 1Tb 3D TLC NAND memory, which promises to decrease production costs and enable Micron to price devices featuring these chips more aggressively or just increase its margins.(CN Beta, Micron, Tom’s Hardware)

Egis Technology (Egistec) CFO George Chang has pointed out that since the competition in the fingerprint recognition market is still quite fierce, it is expected that new products will be released in 2H22. He has further added that there are still many challenges in the fingerprint market today, including pressures such as price and cost. (Laoyaoba, CNYES, TechNews)

Contemporary Amperex Technology Co Ltd (CATL) has licensed CTP (cell to pack) technology to yet another company, after licensing it to Hyundai Motor’s components division in 2021. CATL has recently signed a strategic cooperation memorandum with Thailand’s Arun Plus to collaborate on battery-related businesses in the ASEAN region. Under the agreement, CATL will license CTP technology to Arun Plus, and the two companies will promote the application of CTP technology on the ground in Thailand and globally. Arun Plus, the electric vehicle (EV) subsidiary of Thai state energy group PTT, and CATL will supply battery products to Horizon Plus and other electric vehicle brands. (CNEVPost, Pandaily, Laoyaoba)

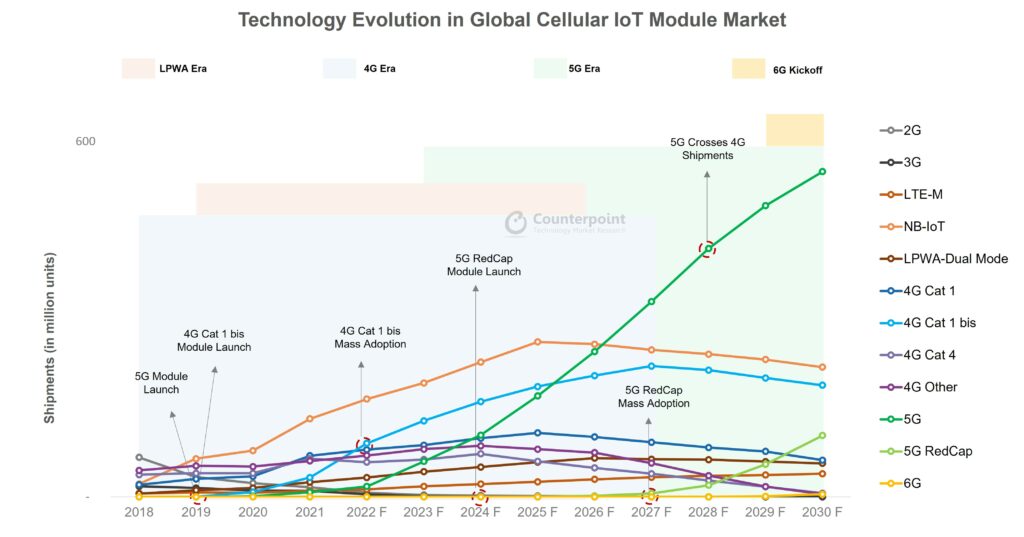

Global cellular IoT module shipments are expected to cross 1.2B units by 2030 with a CAGR of 12%, according to Counterpoint Research. The shipments will be mainly driven by 5G, NB-IoT and 4G Cat 1 bis technologies. 5G will be the fastest growing (60%) technology, followed by 4G Cat 1 bis, during 2022-2030. With 5G becoming mature, we will see large module vendors such as Quectel, Fibocom, MeiG, Foxconn, Thales, Telit and Sierra Wireless consolidating their positions in the global cellular IoT module market. Longtail module vendors will struggle with scale and partnerships. (Laoyaoba, Counterpoint Research)

SpaceX has announced its satellite internet service Starlink is now available in 32 countries around the world. SpaceX shows the service as “available” across most of Europe and North America, as well as parts of South America, Australia, and New Zealand. Much of the rest of the world, including the entire continent of Africa, is shown as “Coming Soon” with availability expected at various points in 2023.(CN Beta, The Verge, Twitter, Mashable)