5-22 #IdealWeekend : YMTC has delivered samples of its in-house developed 192-layer 3D NAND flash memory; Apple has reportedly told some of its contract manufacturers that it wants to increase production outside China; Google’s Russian subsidiary plans to file for bankruptcy after authorities seized its bank account; etc.

Apple has reportedly told some of its contract manufacturers that it wants to increase production outside China.India and Vietnam, which are already sites of Apple production, are among the countries short-listed by the company as alternatives. Apple is citing China’s strict anti-Covid policy and other reasons for its decision. (Apple Insider, WSJ, CNA)

Google’s Russian subsidiary plans to file for bankruptcy after authorities seized its bank account, making it impossible to pay staff and vendors, but free services including search and YouTube will keep operating. The Alphabet unit has been under pressure in Russia for months for failing to delete content Moscow deems illegal and for restricting access to some Russian media on YouTube, but the Kremlin has so far stopped short of blocking access to the compan’’s services.(GizChina, Reuters)

Google has showcased a new “Now in Android” app for developers. The app aims to help developers stay up to date with all areas of Android development and showcase best practices, opinionated designs, and solutions to complex real-world problems that other sample apps don’t handle. The first alpha release of the “Now in Android” app is available for download on GitHub, and all Android app developers should definitely check it out. Google plans to add a few more features to the ‘Now in Android’ app with future updates, including user authentication and loading data from a real backend. (Android Headlines, XDA-Developers, Android)

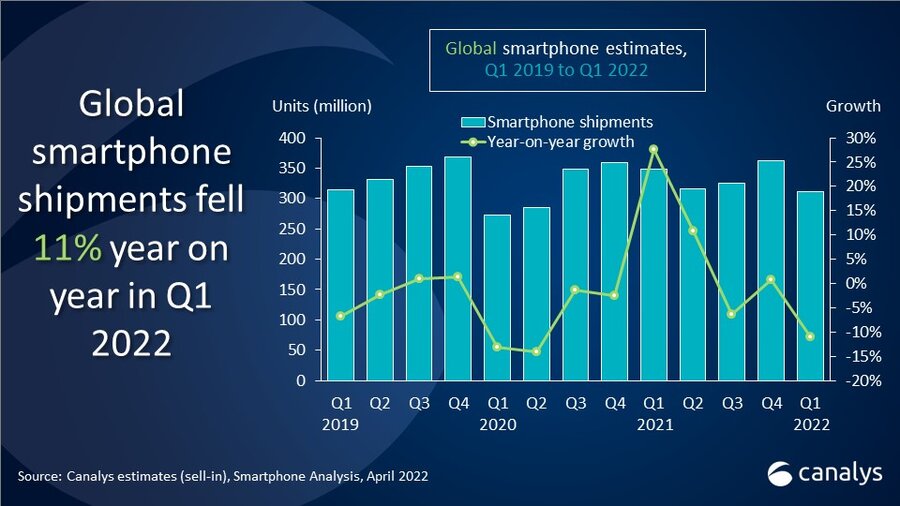

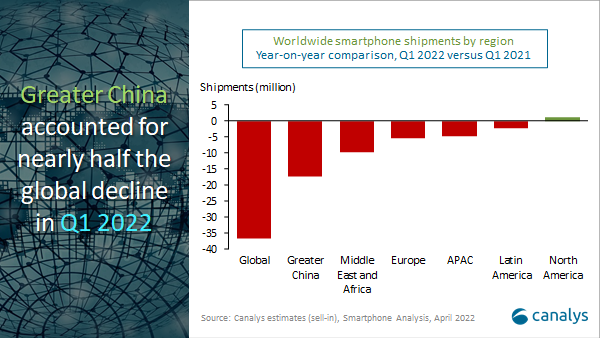

According to Canalys, global smartphone shipments reached 311.2M units in 1Q22, down 11% YoY. Samsung retook the lead after refreshing its portfolio for 2022, shipping 73.7M units, down 4% on a year ago. Apple combined high demand for the iPhone 13 series with a new iPhone SE, leading to solid growth of 8% and 56.5M units shipped. Xiaomi, OPPO and vivo completed the top five. (Laoyaoba, Canalys)

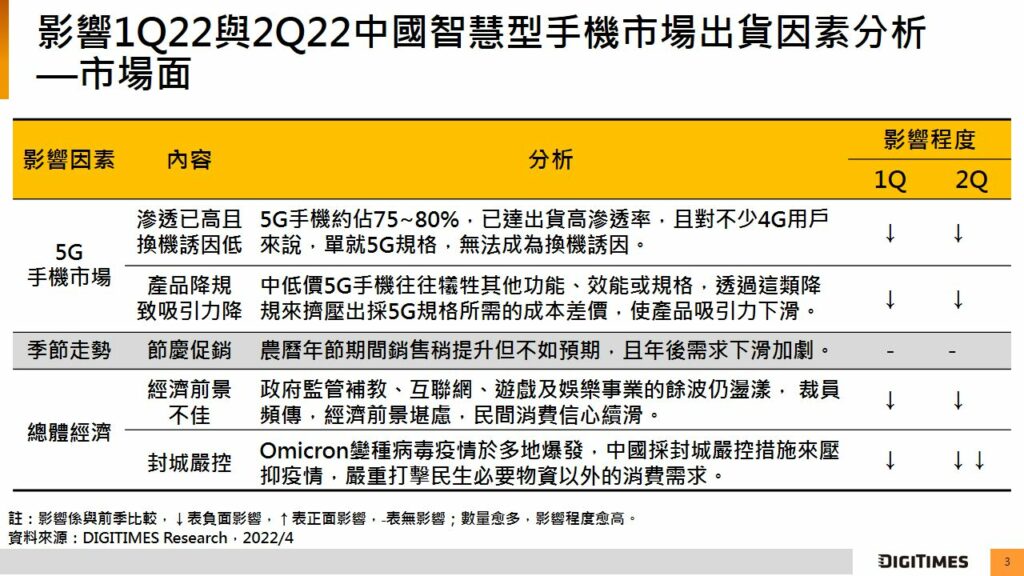

According to DIGITIMES Research, 1Q22 smartphone shipments to the China market fell 26.5% from the prior year level, coming short of the 70M-unit mark amid weak market demand. Apple ranked first, followed by vivo, Honor, Apple and Xiaomi. The top five brands accounted for about 92.3% of the Chinese mainland market, slightly lower than 92.4% in the previous quarter. Looking forward to 2Q22, DIGITIMES Research has pointed out that in order to combat the epidemic, the Chinese mainland government has implemented city closure measures since mid-Mar 2022 and continued throughout Apr, and continued to expand the number of areas and cities under lockdown, which has led consumers to shift their consumption focus to reserve Consumer goods are necessary, which in turn crowds out the purchase demand for smartphones. It is estimated that shipments will continue to decline, with an annual decrease of nearly 20%, hitting a new low since 2Q22. (Digitimes, Digitimes, Laoyaoba)

vivo Y75 is launched in India – 6.44” 1080×2400 FHD+ u-notch, MediaTek Helio G96, rear tri 50MP-8MP ultrawide-2MP macro + front 44MP, 8+128GB, fingerprint on display, 4050mAh 44W, INR20,999 (USD269). (GSM Arena, Fonearena, GizChina, vivo)

Moto G52j is launched in Japan – 6.8” 1080×2460 FHD+ HiD 120Hz, Qualcomm Snapdragon 695, rear tri 50MP-8MP ultrawide-2MP depth + front 13MP, 6+128GB, Android 11.0, side fingerprint, 5000mAh 15W, JPY39,800 (USD310).(91Mobiles, Gizmo China)

Moto G82 is launched in Europe – 6.6” 1080×2400 FHD+ HiD AMOLED 120Hz, Qualcomm Snapdragon 695 5G, rear tri 50MP OIS-8MP ultrawide-2MP macro + front 16MP, 6+128GB, Android 12.0, side fintgerprint, stereo speakers, 5000mAh 30W, EUR239. (GSM Arena, Motorola)

OnePlus Nord 2T is launched in Europe – 6.43” 1080×2400 FHD+ HiD AMOLED 90Hz, MediaTek Dimensity 1300, rear tri 50MP 1.0µm OIS-8MP ultrawide-2MP depth + front 32MP, 8+128 / 12+256GB, Android 12.0, stereo speakers, fingerprint on display, 4500mAh 80W, EUR399 / EUR499. (GSM Arena, OnePlus)

vivo S15 series is launched in China:

- S15 – 6.62” 1080×2400 FHD+ HiD AMOLED 120Hz, Qualcomm Snapdragon 870, rear tri 64MP OIS-8MP ultrawide-2MP macro + front 32MP, 8+128 / 8+256 / 12+256GB, Android 12.0, fingerprint on display, 4500mAh 66W, CNY2,699 (USD403) / CNY2,999 (USD448) / CNY3,299 (USD493).

- S15 Pro – 6.56” 1080×2376 FHD+ HiD AMOLED 120Hz, MediaTek Dimensity 8100, rear tri 50MP 1.0µm OIS-12MP ultrawide-2MP depth + front 32MP, 8+256 / 12+256GB, Android 12.0, stereo speakers, fingerprint on display, 4500mAh 80W, CNY3,399 (USD505) / CNY3,699 (USD805).

realme Narzo 50 series is launched in India:

- Narzo 50 – 6.6” 1080×2408 FHD+ v-notch 90Hz, MediaTek Dimensity 810, rear dual 48MP-2MP depth + front 8MP, 4+64 / 6+128GB, Android 12.0, side fingerprint, 5000mAh 33W, INR15,999 / INR17,999.

- Narzo 50 Pro – 6.4” 1080×2400 FHD+ HiD Super AMOLED 90Hz, MediaTek Dimensity 920, rear tri 48MP-8MP ultrawide-2MP macro + front 16MP, 6+128 / 8+128GB, Android 12.0, fingerprint on display, 5000mAh 33W, INR21,999 / INR23,999.

(GSM Arena, Live Mint, Gadgets360)

Hyundai Motor has confirmed plans to spend KRW6.3T (USD5.54B) to build its first dedicated electric vehicle and battery manufacturing facilities in the U.S. The operations are expected to open during 1H25, with an annual production capacity of 300,000 vehicles. The investment is the latest example of a global automaker seeking to establish new supply chains and production facilities in the U.S. to produce electric vehicles, which are expected to grow exponentially during the decade.(CN Beta, CNBC, TechCrunch, Reuters)

Intel has announced two new investments in its continuing efforts to create more sustainable data center technology solutions. First, Intel unveiled plans to invest more than USD700M for a 200,000-square-foot, state-of-the art research and development mega lab focused on innovative data center technologies and addressing areas such as heating, cooling and water usage. Additionally, Intel has introduced the technology industry’s first open intellectual property (open IP) immersion liquid cooling solution and reference design. The new mega lab will be focused on areas such as immersion cooling, water usage effectiveness and heat recapture and reuse. Construction on the lab will begin in 2022 at the Jones Farm campus in Hillsboro, Oregon, with opening expected in late 2023. (CN Beta, Intel)

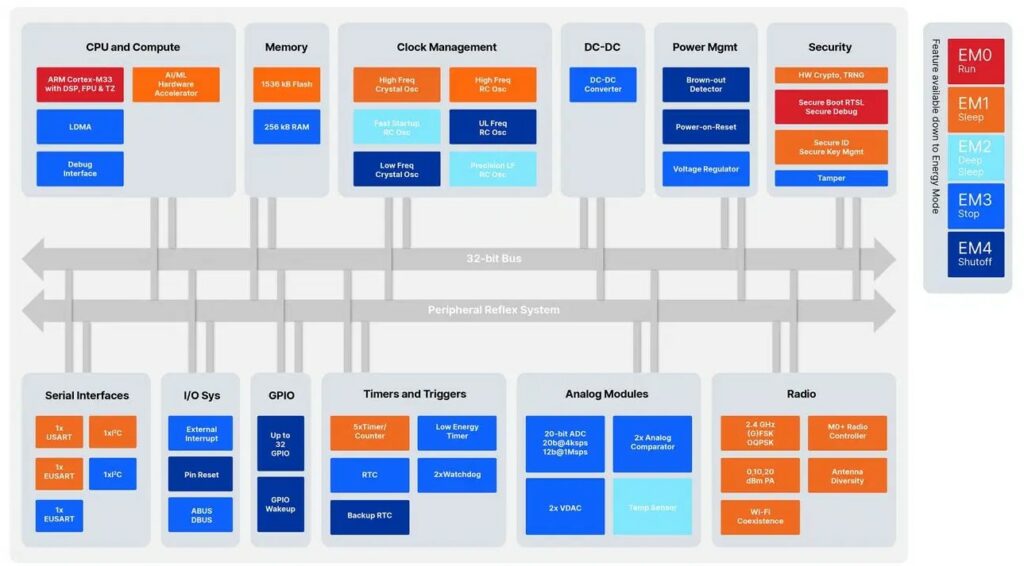

Silicon Labs has announced new families of SoCs with a focus on Matter, AI and machine learning, multiprotocol wireless and Bluetooth: the BG24 and MG24. The MG24 and BG24 includes a purpose built matrix vector execution unit optimised for convolutional neural networks. The accelerator is designed with native support for the TensorFlow Lite for Microcontrollers (TFLM) framework from Google, offloading the matrix calculations from the ARM Corex M33 microcontroller core in the chip. The single-die BG24 and MG24 SoCs combine a 78 MHz ARM Cortex-M33 processor, high-performance 2.4 GHz radio, industry-leading 20-bit ADC, an optimized combination of Flash (up to 1536 kB) and RAM (up to 256 kB), and an AI/ML hardware accelerator for processing machine learning algorithms while offloading the ARM Cortex-M33, so applications have more cycles to do other work. Supporting a broad range of 2.4 GHz wireless IoT protocols, these SoCs incorporate the highest security with the best RF performance / energy-efficiency ratio in the market. (Laoyaoba, Silicon Labs, Silicon Labs, EE News Europe)

Merck Group, the German giant, has announced that it would invest in a high-end semiconductor material integration project in Zhangjiagang, eastern China’s Jiangsu Province to further optimize production capacity and supply chain layout. This project will mainly serve China’s chip manufacturing industry and empower China’s semiconductor and electronics industries as a core part of Merck’s Level Up program in electronics. In Jan 2022, Merck said to double its investment in China by spending over CNY1B (USD156M) by 2025 in expanding its electronics business.(Laoyaoba, PRNAsia, Laoyaoba)

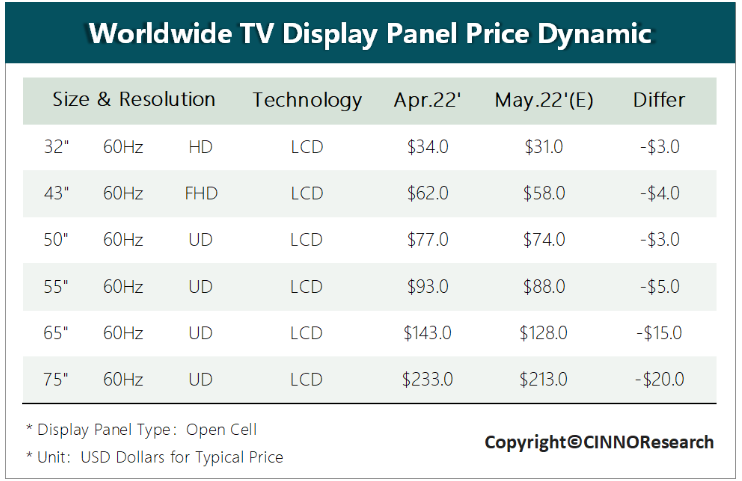

CINNO Research has pointed out that due to factors such as the Russian-Ukrainian war, global inflation and logistics, the reduction of orders by major TV brand manufacturers has led to a drop in the overall LCD TV panel price far exceeding the expectation in Apr 2022, which has fallen below the cash cost of the panel factory. CINNO Research predicts that the price decline of LCD TV panels will not converge in May. If the price continues to fall to July, it may fall below the material cost of panel manufacturers, and it is estimated that the global LCD TV sales volume will increase by 3-4% in 2022. decline. The agency also predicts that global OLED TV shipments will also decline by about 1M units planned for the whole year. However, since the current OLED TV panel belongs to the oligopolistic market, the panel quotation in 2Q22 is still flat. (Laoyaoba, CINNO Research)

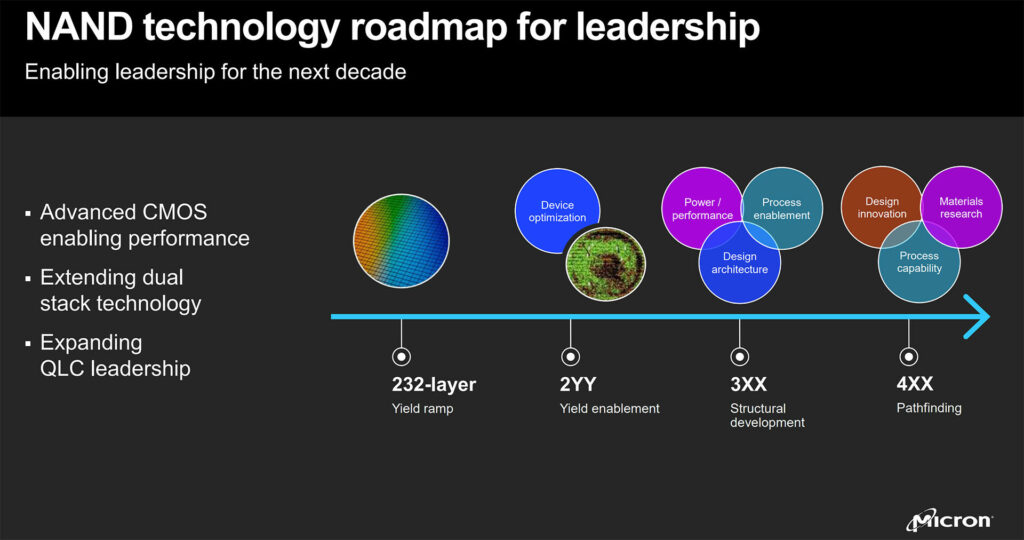

Chipmakers’ entry into the race for 200-plus-layer 3D NAND flash chips will be accelerating the adoption of QLC SSDs particularly in the consumer sector in 2023, according to Digitimes. Among consumer SSDs, the adoption rate of QLC NAND flash is expected to reach 20% in 2023. As the price of QLC NAND flash memory will be further dragged down by the technological iteration of chip manufacturers, it is expected that QLC NAND SSD will also be widely used in enterprise SSDs from 2024 to 2025. Samsung Electronics may start producing 3D NAND flash memory chips with more than 200 layers as early as the end of 2022. The vendor expects to launch its eighth-generation V-NAND with more than 200 layers in early 2023. Micron Technology has launched what it claims is the industry’s first 232-layer 3D NAND flash memory, which will be used in new SSDs launching in 2023. Micron also announced plans for 2YY-layer, 3XX-layer and 4XX-layer NAND technology. Both Samsung and Micron are already mass producing their respective 176-layer 3D NAND flash memory chips. (Digitimes, Laoyaoba)

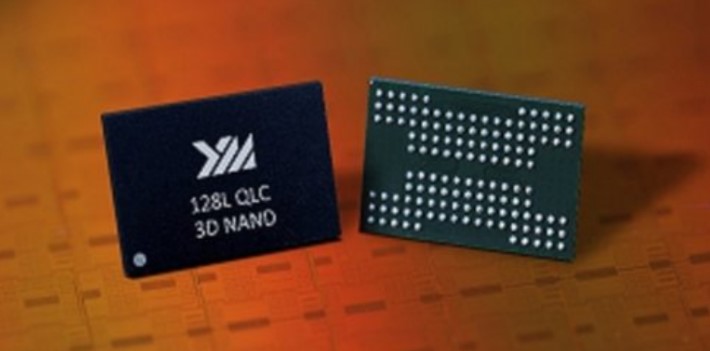

China’s Yangtze Memory Technologies (YMTC) has delivered samples of its in-house developed 192-layer 3D NAND flash memory to a few customers recently, and it expects to commercialize the product by end of 2022, according to Digitimes. As the yield of the 128-layer 3D NAND flash memory process has improved to a satisfactory level, YMTC has also expanded its monthly output to 100,000 wafers. The company will soon complete construction of the second phase of its Wuhan-based facility, with equipment roll-in expected to start later this year. By the end of 2023, the monthly output of YMTC may exceed 200,000 pieces, and the global market share is expected to reach 7-8%. (Digitimes, Laoyaoba)

Wallace Kou , general manager of Silicon Motion, a major manufacturer of NAND flash memory controllers in Taiwan, has said that the 2Q22 NAND market is affected by the lockdown in mainland China, and the performance may be weak. The market rebounded in Jun 2022. He has further said that the current weak demand for mobile phones and computers on the consumer side has led to poor performance in the NAND market, but demand in areas such as automobiles and servers is still hot. In other market segments, slowing Chromebook demand has led to a decline in the overall PC market, but business notebook demand is still strong. (Laoyaoba, UDN)

SOLiTHOR, the newly created spin-off company from imec – partner in the top European energy R&D innovation hub EnergyVille – is spearheading the development, manufacturing and commercialization of innovative solid-state lithium (Li) battery cell technology to reliably and economically offer high energy storage solutions. SOLiTHOR raised €10M in a seed investment round led by imec.xpand supported by a strong investment syndicate including LRM, Nuhma and FPIM. The proceeds will be used to develop the technology required to enable further electrification of our transport industry with solutions that address current issues in autonomy, performance, longevity and safety. (Laoyaoba, imec, PR Newsasia)

The rapid growth of electric vehicles (EVs) and energy storage systems has intensified the short supply of lithium batteries, while battery materials prices are being further pushed up by manufacturers’ overbooking of materials, according to Digitimes. The EV market has braced for battery shortages in 2022, estimating the shortages could be as impactful as automotive chip shortages in 2021. Battery makers are actively expanding production capacities, and they have placed one to three times more than usual orders to materials suppliers. Materials suppliers are coming under the most pressure in the supply chain, followed by suppliers of minerals and equipment. Nonetheless, lithium battery and mineral prices are unlikely to rise as fast as materials prices but will go up steadily amid market fluctuations, the industry sources said, citing the effects of policy incentives and penalties as curbs. The readiness of EV chargers is another issue. The ratio of EVs and charging piles in China remains at 3:1, and the growth of EVs still outpaces that of chargers. Even if the latter’s number picks up, whether there will be sufficient and stable electricity supply to power the chargers is questionable. (Digitimes, press, Digitimes)