5-27 #Home : Broadcom has agreed to buy VMware; Google has allegedly postponed the launch of its first foldable smartphone again; Samsung is planning to exit the high volume but low value feature phone business in India gradually; etc.

Samsung is planning to exit the high volume but low value feature phone business in India gradually, with the last batch of the devices for the country set to be manufactured by contract manufacturing partner Dixon in Dec 2022. Samsung is believed to be focusing its energies on higher price tiers, which it will be launching smartphones mostly above INR15,000 going forward. The move comes with Samsung, among the two major multinational contributors to the government’s production-linked incentive (PLI) scheme, mandated to get sops only on producing handsets worth over INR15,000 factory price and, as average selling prices in India rise with the INR10,000-20,000 price segment seeing the most traction by volume.(Gizmo China, India Times)

Apple is reportedly planning to keep iPhone production roughly flat in 2022, a conservative stance as the year turns increasingly challenging for the smartphone industry. The company is asking suppliers to assemble roughly 220M iPhones, about the same as 2021. Apple already warned that supply problems will impact sales by USD4B-8B in 2Q22, largely because Covid-19 lockdowns are roiling production lines in China. And the whole tech industry is bracing for a slowdown in consumer spending as rising fuel and materials prices push up the cost of everyday essentials. (Bloomberg, Financial Post)

Apple CEO Tim Cook said Apple will consider increasing suppliers in Vietnam after meeting Vietnamese prime minister Pham Minh Chinh. Apple has 31 partner factories in Vietnam with around 160,000 workers that manufacture panels, cameras, and displays for Apple. The partners in Vietnam include Taiwan-based Foxconn, Pegatron, and China-based Luxshare, all of which have invested large amounts in manufacturing in Vietnam.(CN Beta, Digitimes, Digitimes)

OPPO A57 4G is launched in Thailand – 6.56” 720×1612 HD+ v-notch, MediaTek Helio G35, rear dual 13MP-2MP depth + front 8MP, 3+64GB, Android 12.0, side fingerprint, 5000mAh 33W, THB5,499 (USD160). (GSM Arena, Facebook)

Samsung Galaxy M13 is announced – 6.6” FHD+ v-notch, Samsung Exynos 850, rear tri 50MP-5MP ultrawide-2MP depth + front 8MP, 4+64 / 4+128GB, Android 12.0, 5000mAh 15W, price yet to be announced. (GSM Arena, Phone Arena, Gizmo China, Samsung)

Niantic officially announces Lightship Visual Positioning System (VPS), which enables developers to determine the position and orientation of their users and anchor AR content with centimeter-level precision for real world immersive AR on a global scale. Developers can now add locations to Niantic’s AR map of the world to build their own location-based AR reality channel apps and experiences. More than 30,000 VPS-activated public locations available, with density in San Francisco, London, Tokyo, Los Angeles, New York City and Seattle. Lightship VPS demo partners include JR Reality by Superblue, AREALM by FoundrySix, PIXELYNX, Shueisha XR, Rhizomatiks, Liquid City and TRIPP. Niantic also announces Campfire, a social application for the real-world metaverse that weaves together our games and helps players discover new people, places and experiences.(CN Beta, Road to VR, Niantic, Silicon Angle)

Ikea has announced a new HomeKit-compatible smart home hub with Matter support and a redesigned home app that will make it easier for users to control the company’s smart products. Ikea has unveiled the hub, the Dirigera, which is able to handle more product categories and onboard more smart home devices than the company’s current Tradri hub. It also supports Matter, the new standard made by a group of companies that includes Apple, Amazon, Google, Samsung, and others. Matter support will make it easier for smart home users to use devices made by various companies with virtual assistant services.(Engadget, Apple Insider, Ikea)

Japanese manufacturer Nidec has said that it will build a flagship electric vehicle motor plant in China, with production set to launch in the fall of 2023. Construction of the facility, in Zhejiang Province, will start in Oct 2022 and it will go online the same month a year later. It will be Nidec’s fifth EV motor factory in China and its seventh overall. The plant will have the capacity to churn out 1M E-Axle motor systems in a year, making it Nidec’s largest production center for the component. Apart from the E-Axle, the flagship plant will also make inverters, gears and other EV motor parts. Nidec sees the fiscal year ending Mar 2026 as a “watershed” period in which demand for EV motors will surge. The company is investing roughly JPY300B (USD2.3B) through fiscal 2025 to raise its overall E-Axle production capacity to 7M units. That segment is expected to become profitable starting in fiscal 2023. (Laoyaoba, AA Stock, Nikkei, Nikkei)

Toyota Motor will cut its global production plan by about 100,000 to roughly 850,000 vehicles in Jun 2022 due to the semiconductor shortage. The company did not change its estimate of producing about 9.7M vehicles worldwide by Mar 2023. The automaker has also announced an additional domestic factory line suspension due to supply shortage triggered by COVID-19 lockdown in Shanghai. The additional suspension will be up to 5 days on 25 May – 3 Jun 2022, affecting 16 lines at 10 factories for May-Jun 2022 in total. It is planning to produce about 850,000 vehicles globally a month on average from Jun through Aug 2022, adding chips shortage and COVID-19 outbreaks and other factors “are making it difficult to look ahead”. (Laoyaoba, Asia Nikkei, Reuters)

Plus, a Silicon Valley-based provider of autonomous trucking technology, is taking an innovative driver-in approach to commercialization that aligns with the critical challenges facing the trucking industry today. With a nationwide truck driver shortage estimated at 80,000 in 2021 and growing, PlusDrive, Plus’s market-ready supervised autonomous driving solution, helps long-haul operators reduce stress while improving safety for all road users. In 2021 Plus achieved a critical industry milestone, becoming the first self-driving trucking technology company to deliver a commercial product to the hands of customers. Over 2021 Plus has delivered units of PlusDrive to some of the world’s largest fleets and truck manufacturers.(VentureBeat, Plus.ai)

Stellantis, the parent company of Jeep, Chrysler, and Dodge, has agreed to plead guilty to criminal conduct and pay USD300M to settle a probe into its effort to illegally conceal the amount of pollution created by its diesel engine vehicles. The guilty plea will settle a years-long probe by the US Department of Justice into the automaker’s efforts to evade emissions requirements for more than 100,000 older Ram pickup trucks and Jeep SUVs available in the US. (CN Beta, The Verge, Reuters)

Volkswagen has said it would pay GBP193M to British claimants over its 2015 diesel emissions tests cheating scandal. The German company has faced claims around the world since revelations that it cheated pollution tests by installing devices to reduce nitrogen oxide readings. A class action was brought on behalf of some 91,000 claimants in England and Wales but Volkswagen settled out of court, avoiding a lengthy, potentially costly trial and any appeal.(CN Beta, RTHK, Reuters)

Kurt Sievers, president and CEO of NXP Semiconductors, has announced that NXP is set to finish development of its next-generation automotive chip that will be produced using Taiwan Semiconductor Manufacturing Company’s (TSMC) 5nm process technology. NXP is already teaming up with TSMC to volume produce radar and vehicle network processors, fabricated using TSMC’s 16nm FinFET process technology. NXP will soon kick off volume production of its 5nm automotive SoCs. NXP’s S32G series of automotive processors will power the Model C series of electric RVs rolled out by Foxtron Vehicle Technologies, a joint venture between Foxconn and Yulon Motor, according to Sievers.(CN Beta, Taiwan News, Digitimes, Forbes)

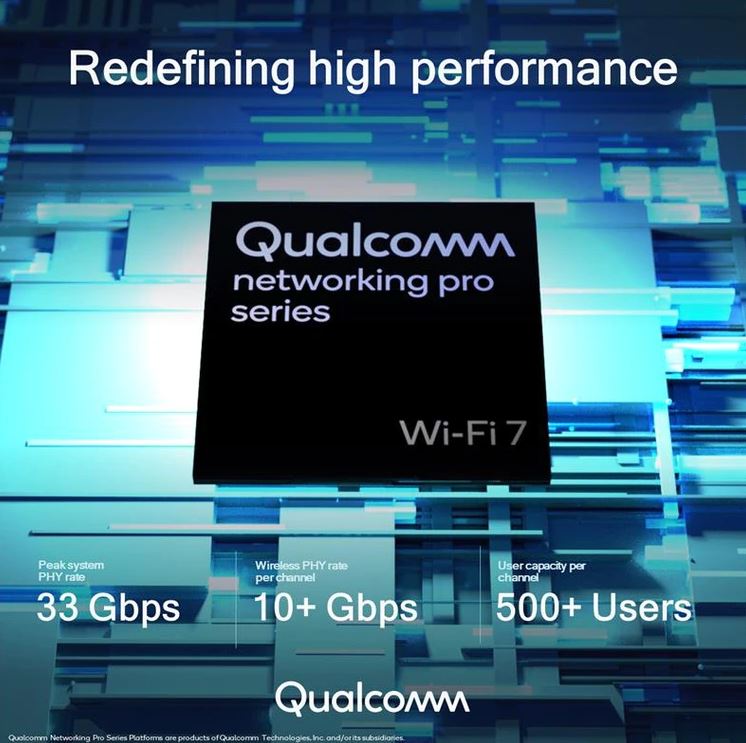

Rahul Patel, Qualcomm’s senior vice president and general manager of the connection, cloud and network department, said that it is expected that most of the top Android phones, gateways and access points will be The Wi-Fi 7 chip will be adopted in 2023, and the Wi-Fi 7 chip has already begun to be shipped at this stage, and due to the higher-than-expected networking demand, the penetration rate is expected to reach 10% from 2023 to 2024.(Laoyaoba, Money DJ, Apple Daily)

Qualcomm chief executive Cristiano Amon believes sales of high-end smartphones will be unaffected by any economic slowdown, he sees room for growth even in the current climate. He explains that people are looking to have better phones, with more capabilities, and those are things that may keep the mobile market stable even in the face of inflation and with the risk of a slowdown.(Android Headlines, TechRadar, Reuters)

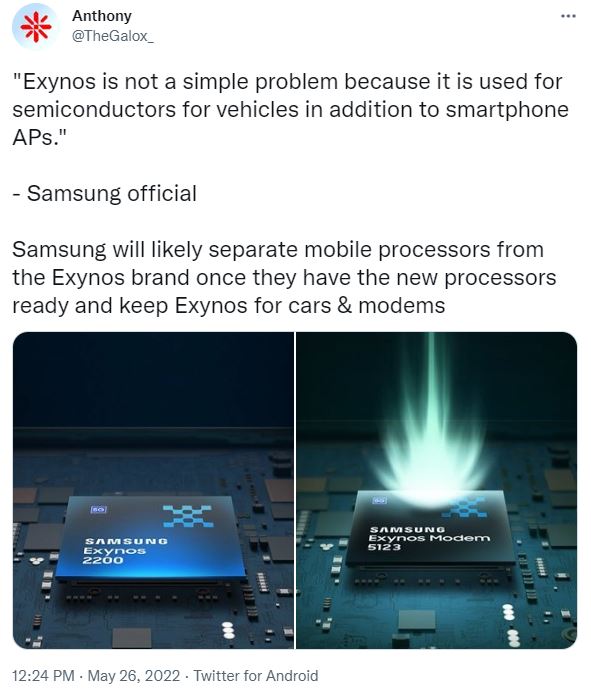

Samsung’s custom processor for its smartphones may not carry the Exynos brand. Rumored to debut in 2025, the Galaxy-exclusive chipset could get a new name. Samsung may be planning to entirely drop the Exynos brand from its mobile processors. Samsung has already begun preliminary work on custom processors for its smartphones. (Android Headlines, Twitter)

Samsung is reportedly working on 2 new Exynos chips, one for flagship devices and one for mid-range ones. The new high-end chip has the codename S5E9935 while the Exynos 2200 is S5E9925, so it certainly seems like there will be an Exynos 2300 in 2023, and the Galaxy S23 is a likely candidate for it. The other chip that Samsung is developing has the model number S5E8535, which could be lower-end chip meant for Samsung’s budget smartphones. GizChina, IT Home, Naver, SamMobile, SamMobile)

Austin, Texas is already home to one of Samsung’s most advanced chip manufacturing facilities in the world. The company has recently announced that it would build a brand new USD17B chipmaking factory in nearby Taylor. It appears that Samsung may be looking into the feasibility of further expanding its facilities in the state of Austin. The company has filed paperwork to seek tax incentives from Taylor and Manor school districts. Samsung is now seeking more tax breaks from Taylor and Manor school districts. It has filed paperwork to request Chapter 313 incentives. This incentive is offered by the state to attract economic development. (CN Beta, SamMobile, Bizjournal)

Broadcom has announced that it has agreed to buy VMware via a cash-and-stock transaction where it will buy outstanding stock. In all, it will cost Broadcom about USD61B to acquire the company but it is also taking on USD8B of VMware’s net debt which it’ll have to repay to creditors. With Broadcom paying USD61B for VMware, it makes it the second-largest acquisition in 2022 after Microsoft agreed to buy Activision. Broadcom previously acquired CA Technologies, makers of security and database software, for USD18.9B in 2018, and it even acquired Symantec’s enterprise security unit for USD10.7B in 2019. Less than 12 months later, it sold the Symantec business to Accenture for an undisclosed sum.(The Verge, Engadget, Apple Insider, Neowin, Broadcom)

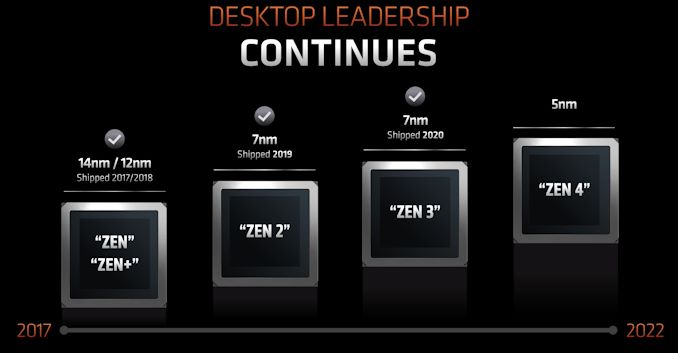

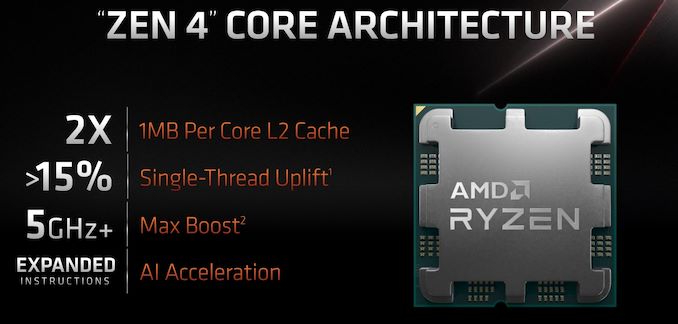

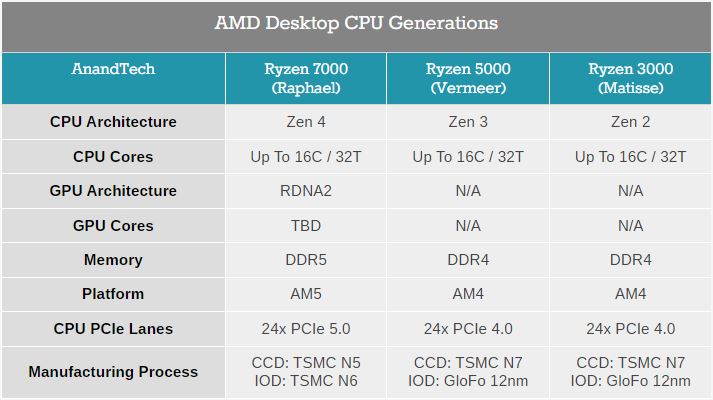

Advanced Micro Devices (AMD) has introduced a new line of personal computer processors, the Ryzen 7000 series, that features significant performance improvements and built-in machine learning capabilities. The executive has also previewed a new processing core architecture, the Zen 4, that will power the central processing unit series. The cores in the Ryzen 7000 series are based on AMD’s new Zen 4 chip architecture. The AMD Ryzen 7000 and Zen 4 are similar to Zen 3, including a chiplet-based design, with two Core Complex Dies (CCDs) based on TSMC’s 5nm manufacturing process.(Laoyaoba, TechNews, Tom’s Hardware, Angstronomics, Silicon Angle, AMD, AnandTech)

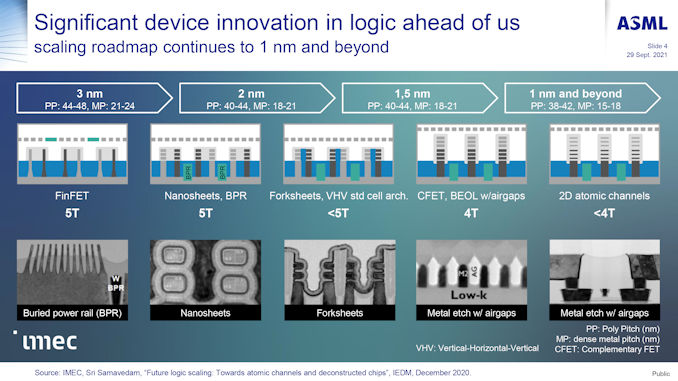

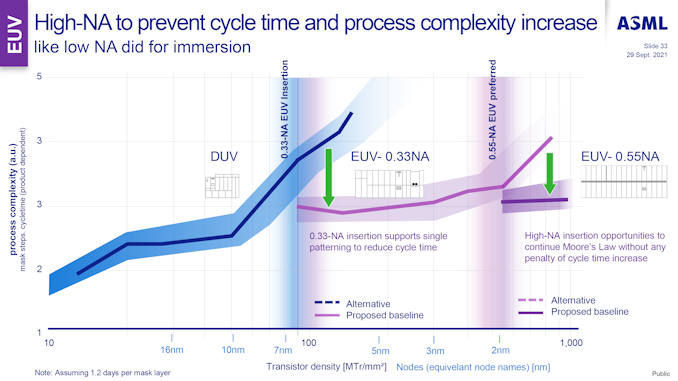

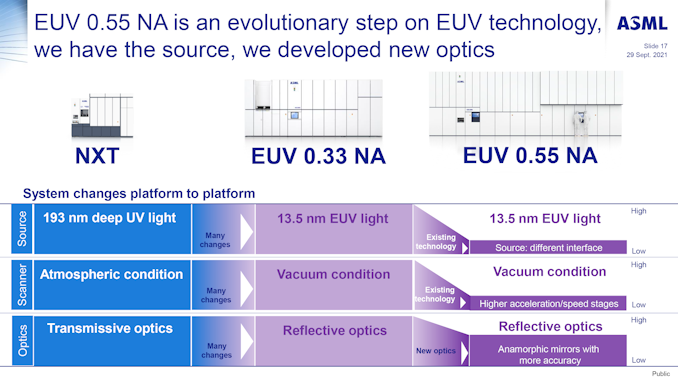

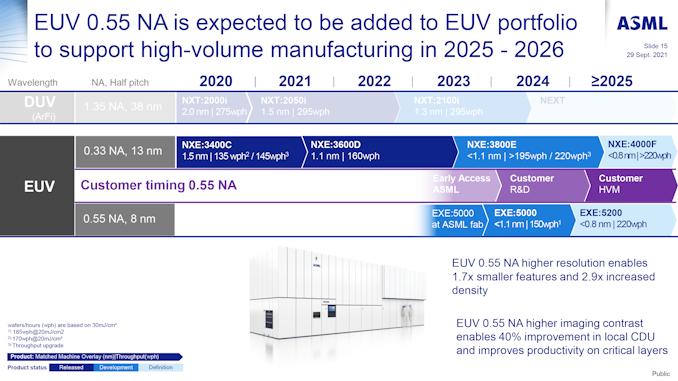

Nowadays the most advanced chips are made on 5/4nm-class process using EUV lithography ASML’s Twinscan NXE:3400C (and similar) systems that feature a 0.33 numerical aperture (NA) optics, which provides a 13nm resolution. This resolution is good enough for a single-pattern approach at 7 nm/6 nm nodes with 36nm ~ 38nm pitches and at 5nm with 30nm ~ 32nm pitches. However as pitches get below 30nm (at beyond 5nm nodes) the 13nm resolution might call for dual lithographic exposure that is going to be used for years to come. For post-3nm nodes, ASML and its partners are working on a brand-new EUV tool — the Twinscan EXE:5000-series — featuring a 0.55 NA (High-NA) lens capable of an 8nm resolution, which is projected to avoid multipatterning at 3nm and beyond. The new High-NA scanners are still in development, they are expected to be extremely complex, very large, and expensive — each of them will cost over USD400M. (CN Beta, AnandTech)

LG Display has collaborated with Turkish-American new media artist Refik Anadol to showcase on its transparent OLED panels his latest AI-driven NFT collection, ‘An Important Memory for Humanity’. This limited-edition NFT collection utilized video, audio and health data taken from Inspiration, the first-ever all-civilian spaceflight, to create a unique and expressive series of data visualizations. The NFT art collection was also auctioned off for USD6.2M, and the buyer was given the NFT collection on a transparent OLED panel. (Android Authority, Korea Herald, TechRadar)

Samsung Galaxy Z Fold4, which is believed to be launched in 3Q22, is believed to have a smoother display than its predecessor. It will be interesting to see what improvements Samsung made to the hinge design to reduce the hinge gap when the main screen is folded.(GSM Arena, Twitter)

Google has allegedly postponed the launch of its first foldable smartphone again. The panel, which would have been provided by Samsung Display, is expected to have a 7.57” main screen and 5.78” secondary screen as well as an ultra-thin glass cover. Nexplus, a South Korean supplier of hinges for the panels to Samsung Display, had previously all but confirmed that it plans to manufacture hinges for a 7.57” foldable display, meaning Google’s, at its factory at Yesan. (GSM Arena, The Elec)

Xiaomi has recently filed a patent with the CNIPA (China National Intellectual Property Administration) that details a foldable smartphone with clamshell folding design, and shown in both its folded state and unfolded state. All the physical buttons sit on the right-hand side of the device. That includes the power/lock button, along with the volume up and down keys.(Android Headlines, Gizmo China)

Samsung Electronics has announced far-ranging collaboration in next-gen memory software technology with U.S. open source solutions provider Red Hat as it goes all-out to strengthen its chip leadership through USD356B investment pledge for the next 5 years. The two companies under the partnership will cooperate on software development related to next-gen memory solutions like for non-volatile memory express (NVMe) SSDs and CXL memory and jointly conduct verification work and promotional activity. Samsung plans to launch a testbed for memory rolutions, dubbed Samsung Memory Research Cloud (SMRC), in 2H22 to provide environment to evaluate new software products in configuring optimal combinations with memory hardware for clients. (CN Beta, Samsung, Pulse News, Korea Herald)

SK companies will invest KRW247T (USD195B) over the course of the next 5 years with a focus on chips, batteries and bio. Of the KRW247T fund, KRW179T will be spent in Korea. Chip business will take utmost priority. SK Group allocated KRW142.2T, more than half of the total investment, into semiconductor manufacturing and related businesses. The biggest focus is on expanding chip production capacity. SK has cited the construction of SK hynix’s massive chip cluster in Yongin, Gyeonggi, as one of the major projects over the next 5 years. The chipmaker plans to break ground on the KRW120T Yongin complex in May 2022 and begin operations in 2026. SK will also build additional fab facilities and manufacturing plants for chip-making materials such as specialty gases and wafers by 2026. About KRW67.4T will go to battery and renewable energy businesses.(Laoyaoba, Korea JoongAng Daily, Reuters, Korea Herald)

SK hynix reportedly plans to build a new NAND M17 production line to increase the output of NAND products. SK hynix is one of the top 10 semiconductor companies in the world, dedicated to the production of semiconductor products based on DRAM and NAND Flash. In Oct 2020, SK hynix acquired Intel’s NAND memory and storage business for USD9B, acquiring the latter’s NAND SSD business, NAND components, wafer business and a NAND memory manufacturing plant in China. (CN Beta, Digitimes)

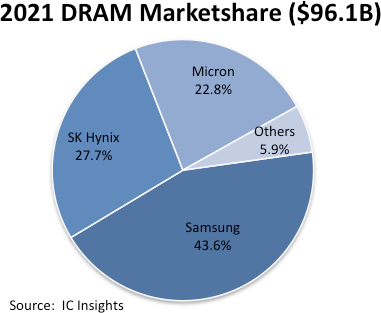

According to IC Insights, the 3 largest suppliers—Samsung, SK Hynix, and Micron—collectively held 94% DRAM marketshare in 2021. Samsung and SK Hynix accounted for 71.3% of the world’s DRAM sales in 2021. With 44% marketshare, Samsung remained the world’s largest DRAM supplier in 2021 with sales that reached nearly USD41.9B. Ranked second and accounting for 28% DRAM marketshare in 2021 was SK Hynix, whose DRAM sales increased 39% to USD26.6B. DRAM accounted for about 71% of the company’s total 2021 semiconductor sales. Its total DRAM sales were split: server DRAM, 40%; mobile DRAM, 35%; 15% from PC DRAM; and consumer and graphics DRAM each accounted for 5%. Micron was the third-largest DRAM supplier in 2021, with sales of USD21.9B. Micron’s DRAM sales increased 41% and accounted for 23% of global marketshare. On the whole, DRAM accounted for about 73% of Micron’s total calendar year IC sales of USD30.0B. (Digitimes, IC Insights)

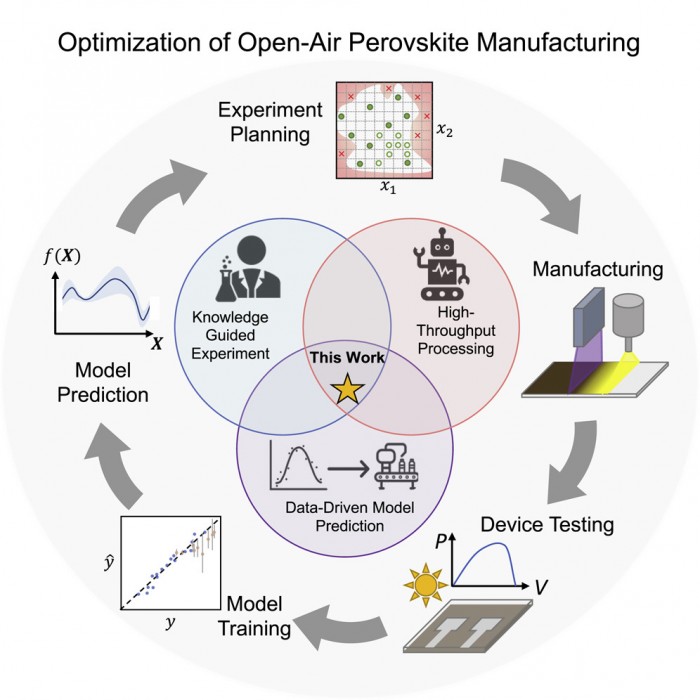

Perovskite materials would be superior to silicon in PV cells, but manufacturing such cells at scale is a huge hurdle. Perovskites are a family of materials that are currently the leading contender to replace the silicon-based solar photovoltaics that are in broad use today. They carry the promise of panels that are far lighter and thinner, that could be made in large volumes with ultra-high throughput at room temperature instead of at hundreds of degrees, and that are easier and cheaper to transport and install. The system, developed by researchers at MIT and Stanford University over the last few years, makes it possible to integrate data from prior experiments, and information based on personal observations by experienced workers, into the machine learning process. This makes the outcomes more accurate and has already led to the manufacturing of perovskite cells with an energy conversion efficiency of 18.5%, which is a competitive level for today’s market. (CN Beta, Joule, SciTechDaily, PV Magazine)