6-1 #Dance : Samsung will reportedly collaborate with Google on the next Tensor chip; Samsung Display has decided to close its LCD business in Jun 2022; Sony has said it will increase production capacity at an image sensor plant in Nagasaki Prefecture; etc.

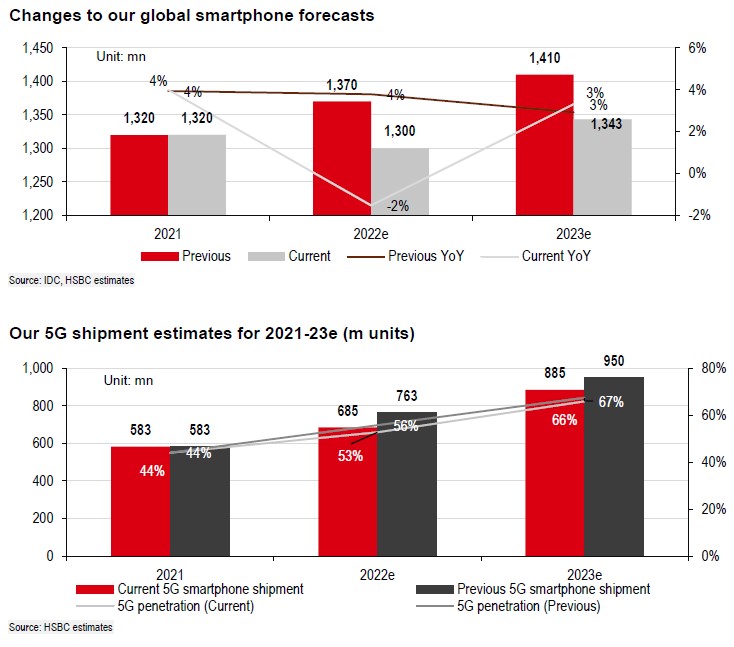

HSBC has lowered their global and 5G smartphone shipment forecasts by 5%-10% for 2022, to 1,30M-1,343M units, and by 5%-7% for 2023, to 685M-885Munits, to reflect weaker demand given the macro uncertainties. While overall smartphone demand has been weak for the last 2 years, they expect to see further declines in overall market expectations. They expect overall Android smartphone momentum to continue to disappoint in the near term, especially with the ongoing uncertainty over demand and the COVID-19 lockdowns across various regions in mainland China. Hence, they have recently lowered their 2022 and 2023 smartphone forecasts by various mainland Chinese smartphone vendors such as Xiaomi, OPPO, and vivo by 6%-16%. However, their bear-case scenarios imply there is potential for additional units to fall a further 4%-12% vs their base case assuming further downside to Android shipments. (HSBC report)

According to Counterpoint Research, global smartphone sales declined 8% YoY in Apr 2022, but Samsung’s sales grew 9% YoY capturing 24% of the global smartphone market. This was driven by the strong performance of the Galaxy S22 series in the premium segment and the A series in the mid-segment. Samsung also had low exposure to the declining China market, which negatively affected sales of all Chinese OEMs. Promotions in some of Samsung’s core markets like Latin America and growth in India, where it became the No.1 brand in Apr 2022, also helped in expanding its market share during the month. Samsung’s supply chain management through 2022 has also been robust, successfully catering to the demand. (CN Beta, Counterpoint Research)

Foxconn has confirmed it is expecting stability to improve in the supply chains in 2H22. Foxconn chairman Young Liu stated the company is “confident in the stability of their supply chain for 2H22”. The recent wave of COVID across China has disrupted demand and supply for all major electronic products including smartphones, tablets and PCs. (GSM Arena, Reuters, Mingpao, HKET, UDN)

In regards to the company planning to launch its sub-brand “Xingyao”, Honor CEO George Zhao has responded that in the past year, Honor has had several rounds of internal thinking and discussions, but at present, Honor’s various series of products have met the needs of consumers, and it still needs better growth and development to control the multi-brand Honor, and it will take some time to observe. In terms of channels, George Zhao has said that in 2022, Honor offline experience stores will increase from 2,000 to about 3,000. Regarding the foldable phone, he has pointed out that the foldable phone represents the future direction, and Honor will continue to develop in this segment, optimizing in terms of weight, thickness, dual-screen experience, etc. (Laoyaoba, Sohu, IT Home, Sina, Pandaily)

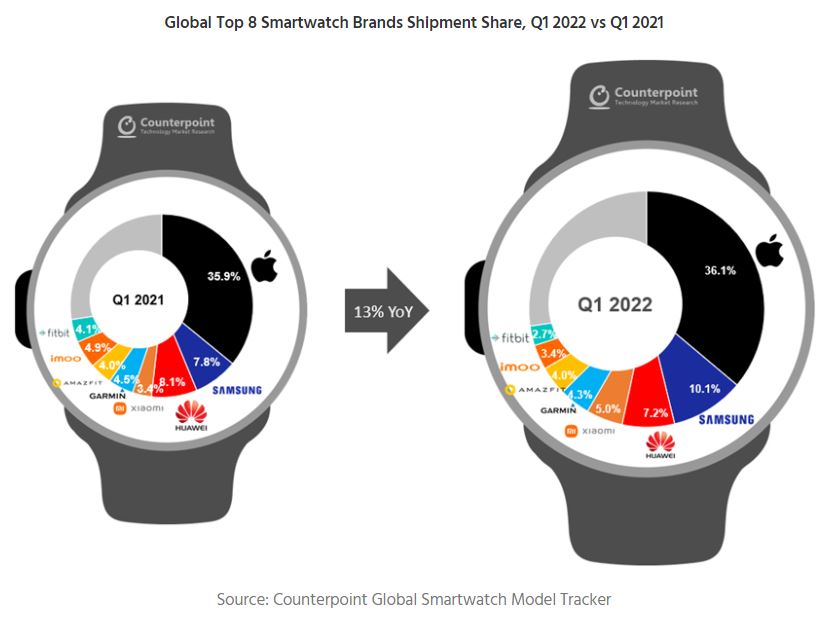

The global smartwatch market recorded 13% more shipments in 1Q22 compared to the same period in 2021, despite concerns over economic slowdown and inflation, according to Counterpoint Research. Despite -24% QoQ due to weak seasonal demand, Xiaomi performed well with it record-highest quarterly shipments. Although the global smartwatch market saw little growth in 2020 due to the impact of Covid-19, it has continued to perform well since its rebound in 2021. In particular, Apple accounted for more than a third of the total shipments in 2021, and it is further increasing its influence with a market share of 36% in 1Q22. (GSM Arena, Counterpoint Research)

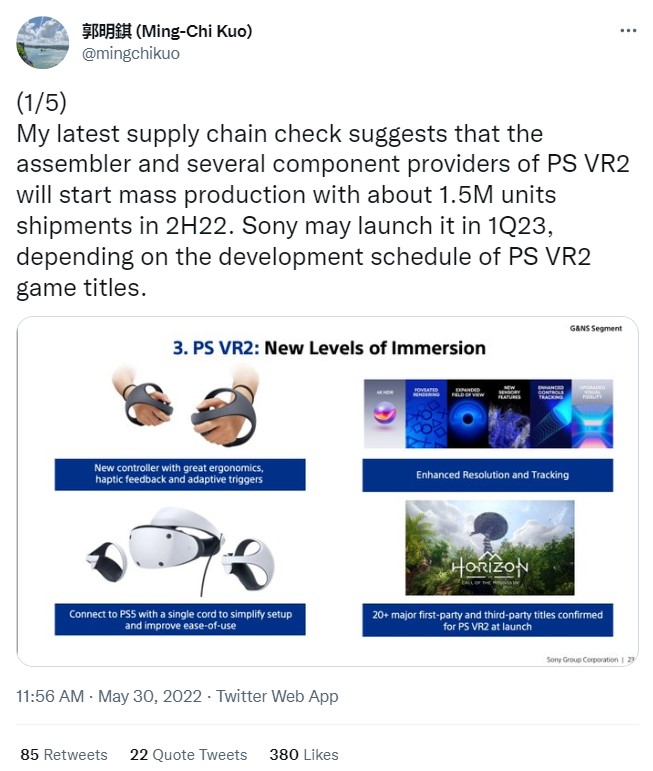

TF Securities analyst Ming-Chi Kuo believes that Sony’s Playstation VR2 (PSVR2) may start mass production later 2022 with a potential launch in 1Q23. He suggests that the assembler and several component providers of PS VR2 will start mass production with about 1.5M units shipments in 2H22. He has added that one of the main changes in PlayStation VR’s production is the inclusion of cameras built into the headset, something the first PlayStation VR did not have. (CN Beta, Twitter, Game Rant, VGC)

Home appliances remain in short supply across Japan due to the global semiconductor crunch and supply chain disruptions tied to Beijing’s zero-COVID policy, as companies that have resumed production at factories in China say it will take time to reach normal operations. Microwaves and rice cookers on store shelves carry signs saying that new orders are suspended due to a halt in shipments. Some appliances already owned may be difficult to repair because parts no longer are readily obtained. Panasonic has suspended production of some washing machines at its plant in eastern Japan’s Shizuoka Prefecture since mid-Apr 2022 due to the shutdown of a client factory in China that makes parts. The company’s Shanghai plant also has been shut down, causing delays in the delivery of some microwave models to electronics retailers. The impact has spread to a wide range of products, including rice cookers and massage chairs, for which new orders on some models have been halted. Shanghai’s lockdown would be lifted beginning 1 Jun 2022. However, with China sticking to its zero-COVID policy, supply disruptions are likely to continue. In a survey by research firm Teikoku Databank, 48% of Japanese firms have said the Chinese lockdown would have a “negative impact”. (Asia Nikkei, CN Beta)

Foxconn chair Young Liu has indicated that a chronic global shortage of chips has forced automakers to halt production and hurt big smartphone customers, including Apple. In terms of automotive chips, Foxconn’s goal in the next 3 years is to become the first electric vehicle manufacturer that has “no shortage of materials”. This goal includes the mass production of key ICs for self-owned vehicles, the coverage of 90% of the specifications of small ICs for free vehicles, and the supply of sufficient materials for small ICs for vehicles. He has said that Foxconn aims to capture about 5% of the global electric vehicle market by the end of 2025. The company hopes to increase its production capacity for electric vehicle chips and has announced further enhancements to chip supply. (Laoyaoba, Mingpao, 163)

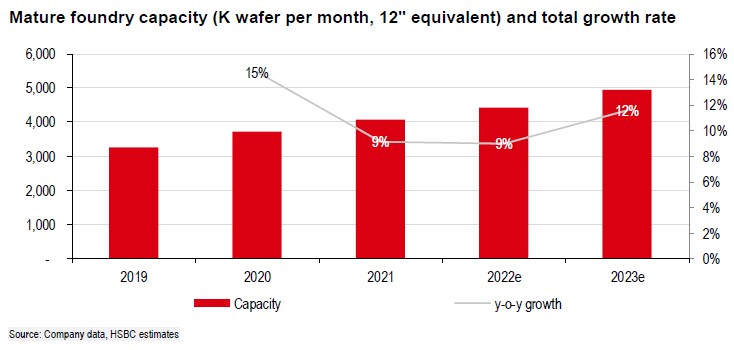

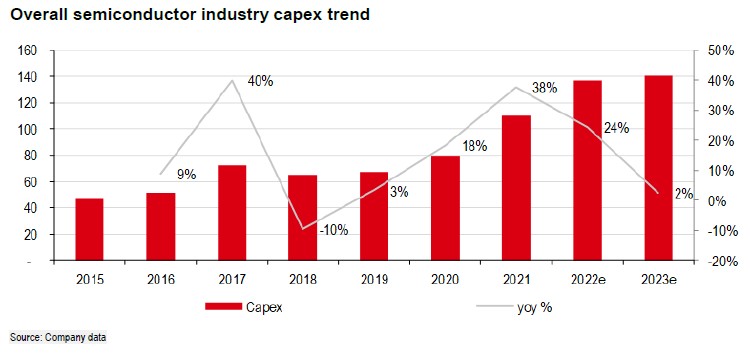

Overall, HSBC expects to see limited mature foundry capacity (they have excluded TSMC given its focus on advanced foundry) growth of 9% in 2022 as the majority of new fab expansion announced in 2021 is not expected to ramp up until 2H23 when they expect overall foundry capacity unit growth to come in at 12%. Hence, they believe previous market concerns over a potential semiconductor correction was not expected to occur until 2023 given the impact of new supply growth, especially with regards to mature foundry expansion. Overall semiconductor capex – including both foundry and integrated device manufacturer (IDMs) – rose by +38% and +24% YoY in 2021 and 2022 as spending resumed given ongoing semiconductor shortages as well geopolitical drivers to re-shore semiconductor manufacturing in the US, Europe, and Japan. (HSBC report)

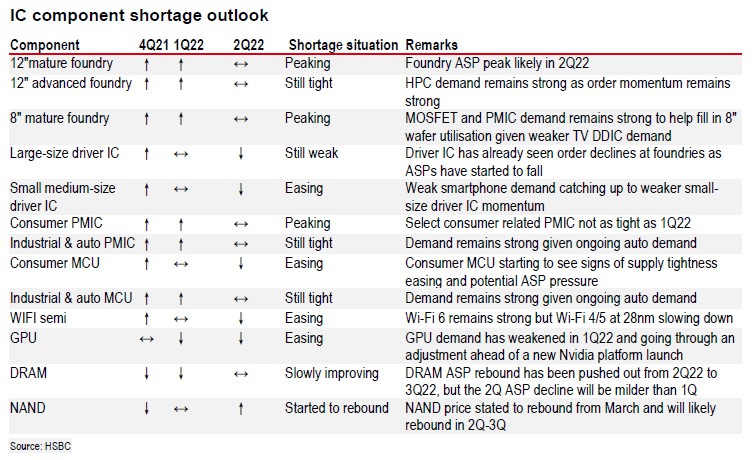

Based on exhibit on IC component shortage, HSBC believes shortage situation for consumer-related ICs such as MCUs and audio codec have started to decline in 1Q22 implying that the overall tightness across most semiconductor subsectors has already peaked or is starting to loosen. They have also seen monthly sales YoY momentum from second-tier Taiwanese MCU makers, power ICs, and driver IC fabless peak in 2H21. (HSBC report)

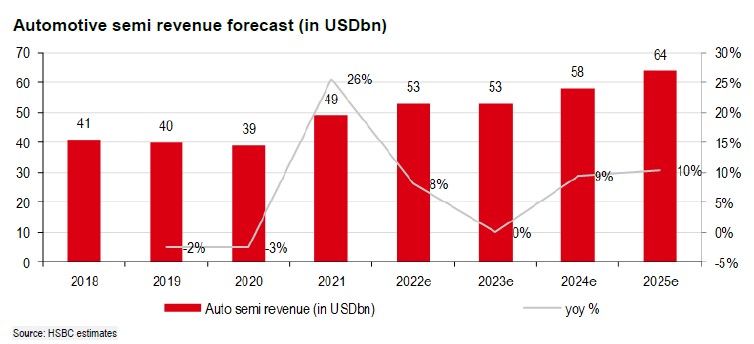

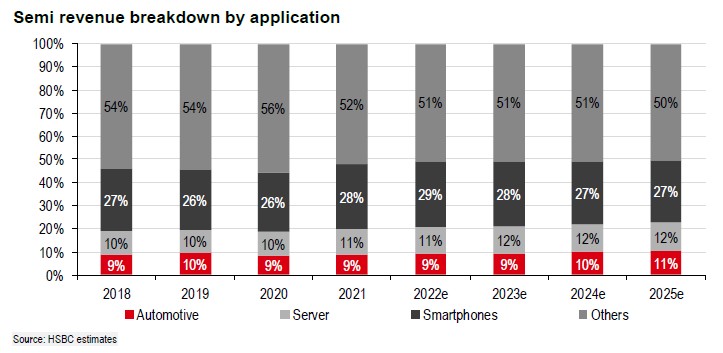

Semi auto demand is also expected to remain strong in 2022e as the overall shortage in auto semis remains given ongoing semi content growth. According to IDC, their overall semi auto CAGR of +10% over 2020-2025 remains much higher vs the -2% CAGR in 2018-2022. Nevertheless, HSBC expects overall auto semis will also begin to decelerate in 2022, as positive growth of 26% in 2021 is not likely sustainable. Despite the ongoing strength they expect in server and auto semiconductor demand in 2022, server and auto semi revenue of USD62B and USD53B, respectively, account for only 11% and 9% of overall 2022 semiconductor industry revenue of USD565B. Hence, they do not believe the positive momentum in server and automotive demand alone would be enough to offset a slowdown in other semiconductor applications in the event of a semiconductor correction. (HSBC report)

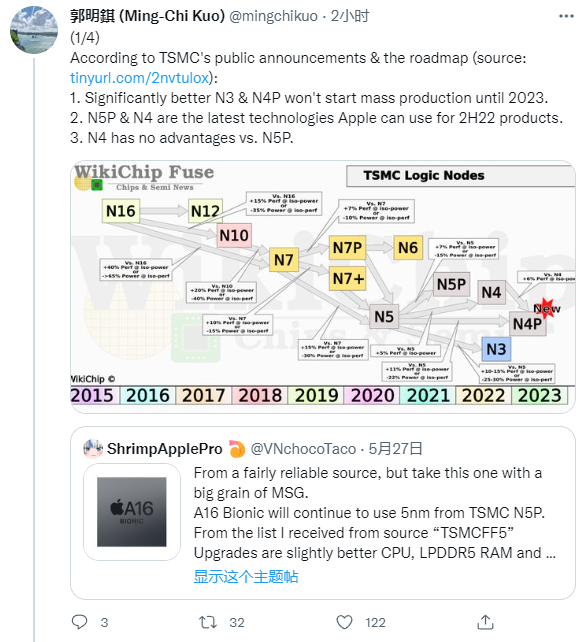

TF Securities analyst Ming-chi Kuo has pointed out that the public roadmap for TSMC’s silicon processes indicates that its 3nm and 4nm fabs will not be available for mass production until 2023. This is another indication that Apple’s A16 chip coming with the iPhone 14 will continue to use a 5nm fabrication process. The new A16 Bionic chip will also arrive with support for LPDDR5 RAM along with a new and improved CPU and GPU as well. On the other hand, there have also been rumored that the iPhone 14 and iPhone 14 Max will feature the 5nm process based A16 Bionic, while the Pro models are equipped with a more advanced A16 Pro chipsets. (My Drivers, 9to5Mac, Gizmo China, Twitter)

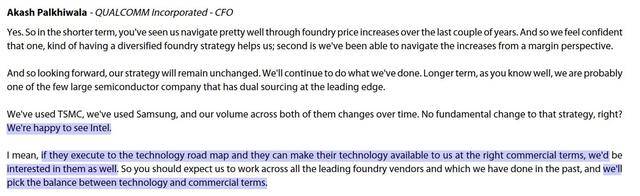

Qualcomm CFO Akash Palkhiwala has said that Qualcomm has long adhered to a diversified foundry strategy, which has effectively responded to the rise in foundry prices in the past few years, and will continue to maintain this strategy in the future. In response to Intel’s entry into the foundry market, Palkhiwala has expressed a positive attitude, saying that Qualcomm will also be open to cooperation if Intel’s technology roadmap is implemented smoothly and appropriate conditions for foundry business cooperation can be provided.(Laoyaoba, Seeking Alpha, Sohu)

SK Hynix appears to be close to wrapping up the acquisition of Key Foundry, a Korean semiconductor foundry specializing in analog IC. SK Hynix aims to expand its 8” wafer foundry business, which has recently been in explosive demand, by acquiring Key Foundry. Recently, a severe supply shortage is taking place in the 8” wafer foundry industry.SK Hynix has a foundry subsidiary named SK Hynix System IC in Wuxi, China. The affiliate runs a foundry that can process about 100K 8” wafers per month. Key Foundry has a factory with a capacity of 90K 8” wafers right next to SK Hynix’s campus in Cheongju, North Chungcheong Province. The acquisition of Key Foundry will boost SK Hynix’s production capacity to close to 200K sheets of 8” wafers. Combined foundry sales of the two companies amounted to KRW1.32T in 2021. Their combined production capacity and sales exceed those of DB HiTek, the 10th largest foundry player in the world.(CN Beta, Business Korea, Sina)

Infineon new Chief Production Officer, Rutger Wijburg, has stated that the company would in future commission a new fab every 2-3 years. Previously, the rhythm for opening new plants was more like 4-5 years. The market situation now calls for an increase in the pace of investment, and it is also possible that Infineon will push ahead with several large construction projects in parallel in the future. The background to the decision is, among other things, the high capacity utilization of contract manufacturers, who now only accept orders with long delivery times. Another reason is the delivery times for machines for semiconductor production. Twelve-month delivery times are now normal, Wijburg told Handelsblatt, “but 18 months and longer are not uncommon either”. (CN Beta, EE News Europe, Handelsblatt)

Samsung will reportedly collaborate with Google on the next Tensor chip that will underpin the Pixel 7 range that will apparently be unveiled in Oct 2022. Mass production will begin in Jun 2022 and the chip will be based on the Samsung’s 4nm process. Samsung will reportedly use the panel-level packaging (PLP) tech for the chip because of its cost benefits and higher manufacturing efficiency. The second-gen Tensor model number GS201 and will feature the unreleased Exynos Modem 5123. The first-gen Tensor, featured on Pixel 7 series, was co-developed by Samsung and Google and appears to borrow heavily from Exynos foundational blocks and IPs. The chip features a different CPU setup than other SoCs, opting for a 2+2+4 configuration instead of a 1+3+4 big+mid+little configuration. The chip has two Cortex-X1 cores, two Cortex-A76 middle cores, and four A55 cores. (Phone Arena, Naver News, Twitter)

J.P.Morgan analyst Harlan Sur predicts Broadcom’s revenue from Meta as a cloud-computing chip customer will reach USD1B-plus annually over the next 3-4 years. Sur has said the chip maker is the largest provider of high-end custom chips followed by Marvell Technology. The custom chip (or ASIC) business for Broadcom is a strong franchise and augments its leadership in networking, broadband, storage, and wireless. ASIC (application-specific integrated circuit) chips will drive USD2B-2.5B in revenue for Broadcom in 2022, helped by its deals with Meta and partnerships with Alphabet and Microsoft. Harlan Sur believes these wins are primarily at 5nm and 3nm and will be used to power Meta’s metaverse hardware architecture that it will deploy over the next few years. (CN Beta, Barron’s, Reuters, Yahoo)

Samsung Electronics has said that Vice Chairman Lee Jae-yong has met with Intel CEO Patrick Gelsinger to discuss how to work together in a wide range of semiconductor businesses, as competition heats up among industry leaders including Taiwan Semiconductor Manufacturing Company (TSMC) amid global supply chain woes. Intel has expertise in designing central processing unit (CPU) chips, while Samsung is a leader in manufacturing memory chips. Both companies are trying to expand their presence in the foundry business — the manufacturing of customized semiconductors for companies — dominated by TSMC.(Laoyaoba, Asia Nikkei)

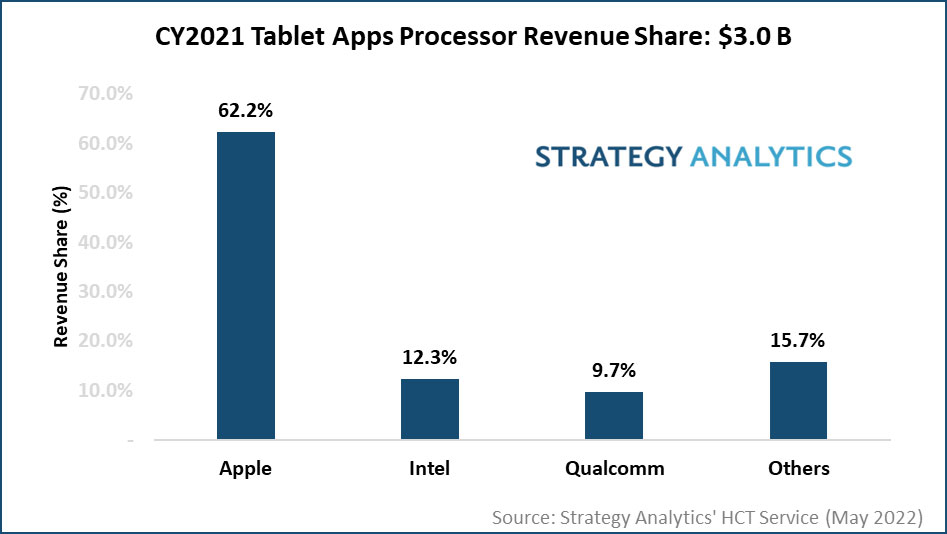

The global tablet applications processor (AP) market grew 12% to USD3B in the calendar year 2021, according to Strategy Analytics. Apple, Intel, Qualcomm, MediaTek and Samsung LSI captured the top-five tablet AP revenue share rankings in 2021. Apple led the tablet AP market with a 62% revenue share, followed by Intel with 12% and Qualcomm with 10%. Arm-based tablets accounted for 89% of total tablet APs shipped in 2021. Tablet AP ASPs grew 21% YoY, driven by a better mix and wafer supply constraints. (Laoyaoba, Strategy Analytics)

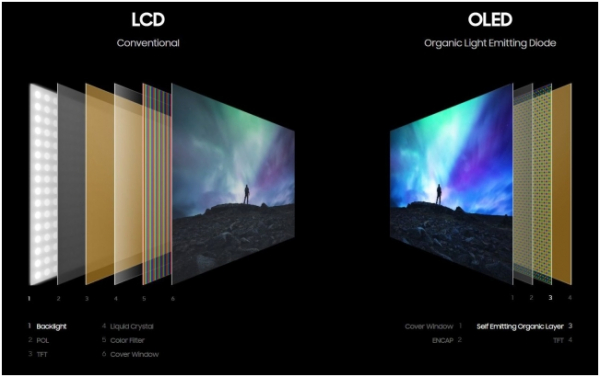

Samsung Display has decided to close its liquid-crystal display (LCD) business in Jun 2022, hobbled by a declining global competitive edge due to cheaper products made by its Chinese and Taiwanese counterparts. The decision by the display affiliate of Samsung Group came 6 months sooner than expected, due in large part to rapid losses from falling LCD prices. Samsung Electronics, the largest buyer of Samsung Display products, is partnering with overseas LCD suppliers, including BOE Technology and AU Optronics (AUO). Samsung Display will no longer produce LCDs used for large TV screens and focus instead on manufacturing organic light-emitting diode (OLED) and quantum dot (QD) displays.(Gizmo China, GSM Arena, Korea Times, CN Beta)

Bloomberg’s Mark Gurman has indicated that Apple iPhone 14 Pro series, which is to be launched in 2H22, will feature Always-on Display (AoD) functionality. The AOD functionality will likely be exclusive to the iPhone 14 Pro and Pro Max and their LTPO AMOLED displays. These panels can dial back the refresh rate on the lock screen in a bid to save up battery power while displaying AOD information like time, date and notifications. (GSM Arena, Bloomberg, Yahoo)

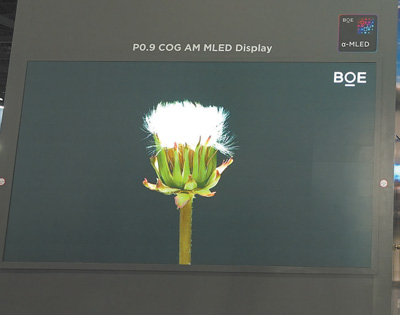

BOE has revealed their revolutionary next-generation P0.9 mini-LED display, which is a sub-millimetre light-emitting diode display, meaning it measures less than 1mm in thickness. The mini LED display is made of a glass-based material. BOE has also been developing a series of mini LED display products, which have greatly improved the display effect by incorporating glass-based mini LED backlights and related technologies.(Gizmo China, People.cn)

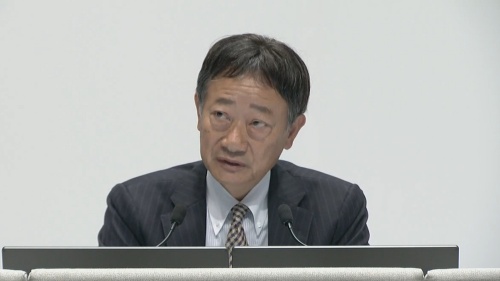

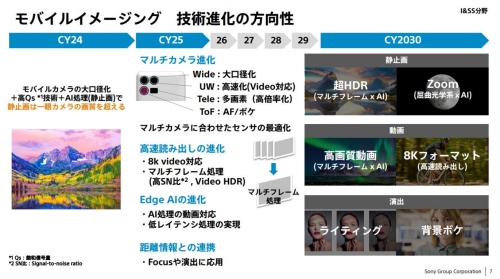

The President and CEO of Sony Semiconductor Solutions (SSS) Terushi Shimizu has indicated that he expects that still images will exceed the image quality of single-lens reflex cameras within the next few years. The image quality of smartphones will exceed that of single-lens reflex cameras in 2024. He also believes that judging from the current development progress, by 2030, smartphones will be expected to realize the exclusive functions of current professional cameras such as 8K shooting and ultra-high-speed continuous shooting. In recent generations of Xperia, the camera module has always been the focus of the upgrade. The Xperia 1 IV, launched in 2022, is the first to put continuous optical zoom technology into the mobile phone, which can provide 85~125mm equivalent focal length, 3.5~ 8 times the optical variable range. On the other hand, Sony also plans to expand the area of related production areas by 60% by 2023 and increase the production of image sensors for smartphones.(CN Beta, Photo Rumors, Sony Addict, Nikkei)

Sony has said it will increase production capacity at an image sensor plant in Nagasaki Prefecture. The clean room in the newest building that opened last year will expand 60% to about 37,000 sq. meters, according to Terushi Shimizu, president of subsidiary Sony Semiconductor Solutions. The market for image sensors used in high-end smartphones is expected to grow by an average of roughly 10% a year through fiscal 2030, according to Sony. Self-driving vehicles will accelerate demand for these components. Sony plans JPY900B (USD7.07B) in capital spending on image sensors for 3 years through fiscal 2023, lifting the previous projection by JPY200B. (Laoyaoba, Asia Nikkei)

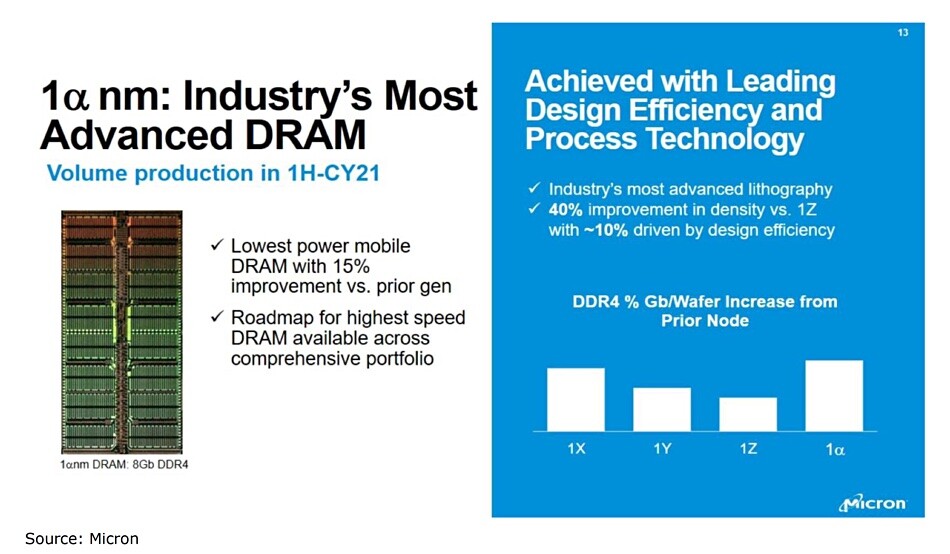

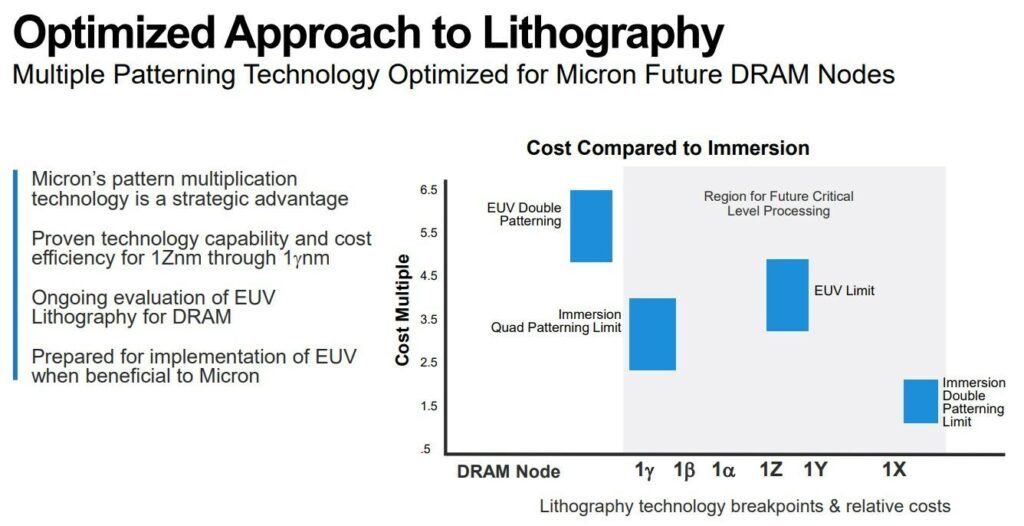

Micron Technology is set to install the industry’s most cutting-edge technology — extreme ultraviolet (EUV) lithography equipment — in its facility in Taichung in 2022. In early preparation for the volume production of 1-gamma nanometer node DRAM, the company plans to introduce EUV tools to our Taichung fab later in 2022. Gamma refers to the dimension of half the distance between cells in a DRAM chip. Micron is also looking forward to beginning mass production of its next-generation DRAM products manufactured using the 1-beta nanometer node process in Taiwan in 2023. Micron unveiled its 1-alpha nanometer node DRAM in 2021, which the company said has 40% more memory density than its 1z nanometer node DRAM. Micron’s Taiwan fabs have begun volume production of 1-alpha nanomerter node DRAM, starting with DDR4 memory for computer customers and consumer PC DRAM products for its Crucial brand.(CN Beta, Taipei Times, Focus Taiwan)

GigaDevice has officially announced that the cumulative shipment of its flash memory products has exceeded 19B units, of which the market share of NOR flash memory ranks among the top 3 in the world. GigaDevice has also revealed that it is continuing to polish products in ultra-low power consumption, ultra-small packaging and other technical processes. For example, NOR flash memory products using WLCSP ultra-small packaging have been launched, which can greatly reduce the system PCB area; for example, the main ultra-low power consumption is 1.2V NOR products are coming soon, which can significantly extend battery life. (CN Beta, ChinaZ, FengNew)

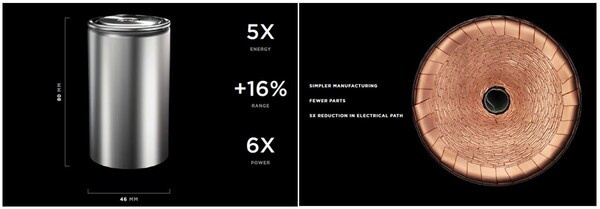

Samsung SDI potentially might become another supplier of the 4680-type cylindrical battery cells for Tesla, like Panasonic and LG Energy Solution. Samsung SDI is allegedly developing various versions of the 4680-type batteries, or rather cylindrical cells with a diameter of 46mm and different heights. Besides the base form factor of 4680 (46mm in diameter and 80mm tall), reportedly the company works also on a shorter version with a length 40-60mm. Currently, Tesla produces 4680-type battery cells in-house in the US, while Panasonic officially admits that it was asked to speed up development. Samsung SDI also is a battery supplier for BMW (prismatic cells). (Laoyaoba, Inside EVs, iFeng)

vivo has collaborated with Reliance Jio for its flagship X80 series smartphones, conducting 5G test trials with Reliance Jio in a test environment. These trials showcased lag-free 4K-video streaming on the X80 devices along with super-fast data upload and download.(GizChina, MySmartPrice, India Times)