6-3 #DragonBoatFestival : Qualcomm would be interested in forming a consortium of some kind to acquire Arm; Panasonic plans to quadruple its production of electric vehicle batteries by fiscal 2028; Apple is moving some iPad production out of China and shifting it to Vietnam; etc.

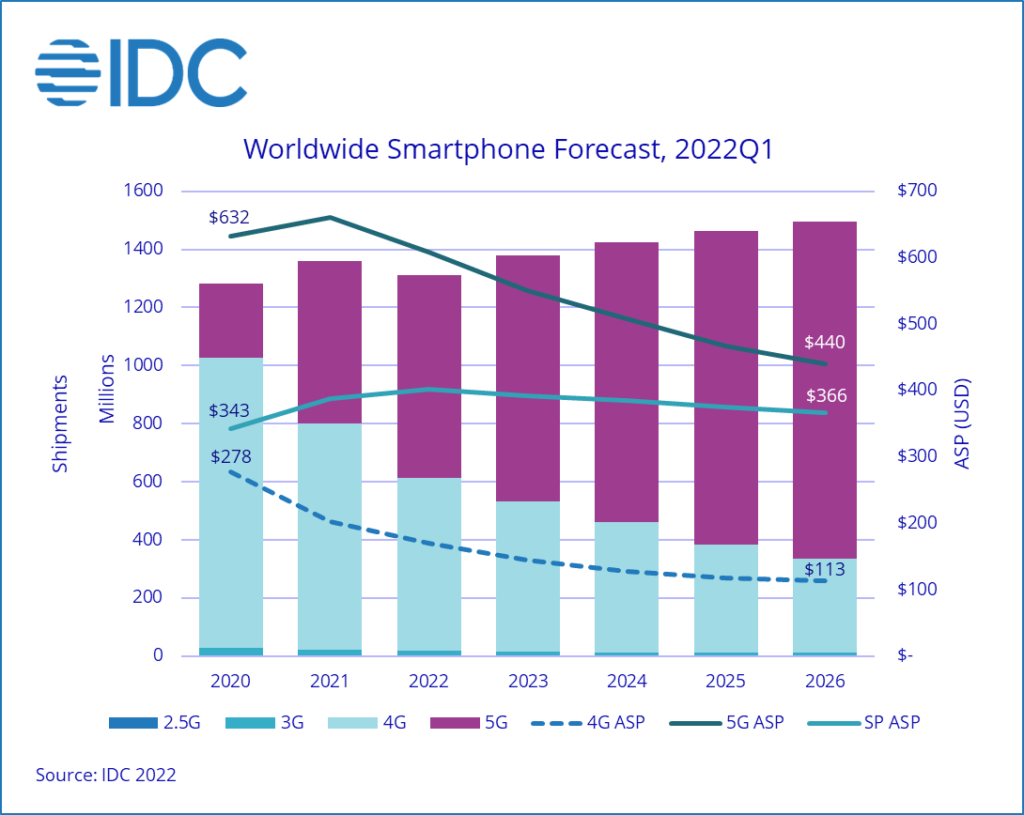

According to IDC’s forecast, shipments of smartphones will decline 3.5% to 1.31B units in 2022. After three consecutive quarters of decline and increasing challenges in both supply and demand, IDC has significantly reduced its forecast for 2022 from the previous projection of 1.6% growth. However, IDC expects this to be a short term set back as the market rebounds to achieve a 5-year compound annual growth rate (CAGR) of 1.9% through 2026. From a regional view, the largest decline in 2022 is expected in Central and Eastern Europe (CEE) with shipments down 22%. China is forecast to decline 11.5% or roughly 38M units, which is about 80% of the global reduction in shipment volume in 2022. Western Europe is expected to decline 1% while most other regions will see positive growth in 2022, including Asia/Pacific (excluding Japan and China) (APeJC) with 3% growth, the second largest region after China. (CN Beta, IDC)

Apple App Store prevented 1.6M risky and untrustworthy apps from defrauding users in 2021, according to new fraud analysis data shared by Apple. Apple says that the App Store stopped “nearly USD1.5B in fraudulent transactions” during the year. Apple rejected more than 34,000 apps for hidden features, and more than 157,000 that were spam or copycat apps. 343,000 apps were rejected for various privacy violations. Over 800,000 fraudulent developer accounts were terminated. (MacRumors, Apple)

Google has announced that it is merging Meet with Duo. So far the former was aimed at business users primarily, while the latter was intended as everyone’s video messaging app to rival Apple’s FaceTime. New features include customizable virtual backgrounds in calls and meetings, scheduling of meetings, in-meeting chat, live sharing of content, real-time closed captions, video calls with up to 100 participants, “enhanced video and audio experiences with noise cancellation”, and integration with other Google tools like Gmail, Calendar, Assistant, and Messages.(Liliputing, GSM Arena, Google, Engadget)

Huawei has sued Shenzhen Jinyun Video Equipment that the latter has infringe Huawei’s trademark. It also used the “FREEBUDS” trademark for counterfeit products. They also used taglines like “official genuine Huawei only” and “official original equipment” on their online products page to trick customers. After multiple complaints from those who suffered from this scam, Huawei decided to investigate the matter. Huawei has demanded CNY3M (USD450K). The company has alleged economic losses. Furthermore, the behemoth asked China’s legal authorities to force the accused to bear the litigation cost. The Yuhang District People’s Court of Hangzhou City, Zheijiang Province, China has ruled in Huawei’s favor and ordered Shenzhen Jinyun Equipment Company to pay Huawei an amount of CNY1M. (GizChina, IT Home)

The India Cellular and Electronics Association (ICEA) has urged the Indian federal government to intervene and accused the country’s enforcement agencies of a “lack of understanding” of royalty payments in the technology industry. India’s anti-money-laundering agency is accusing Xiaomi of moving money out of the country by falsely claiming it was for patent-fee payments. The agency seized more than USD700M from a local unit of the Chinese smartphone maker in Apr 2022, a move that has since been put on hold pending a final court decision. The risk for the other companies is that Indian authorities apply similar interpretation of royalty payments to other tech firms, too. Xiaomi is a member of the ICEA, as are rivals including China’s OPPO and homegrown firm Lava as well as Apple and its suppliers Foxconn Technology and Wistron. (CN Beta, Communications Today, India Times, Bloomberg)

For the first time ever Apple is moving some iPad production out of China and shifting it to Vietnam after strict COVID lockdowns in and around Shanghai led to months of supply chain disruptions. Apple has also asked multiple component suppliers to build up their inventories to guard against future shortages and supply snags. China’s BYD, one of the leading iPad assemblers, has helped Apple build production lines in Vietnam and could soon start to produce a small number of the iconic tablets there. The iPad will become the second major line of Apple products made in the Southeast Asian country, following the AirPods earbud series. To further guard against supply chain disruptions, Apple has also asked suppliers to build up additional supplies of components such as printed circuit boards and mechanical and electronics parts, especially those made in and around Shanghai, where COVID-related restrictions led to shortages and logistic delays. (Apple Insider, Asia Nikkei, CNBC)

Pimax is announcing the Pimax Crystal. Pimax uses glass aspheric lenses instead of plastic lenses that other headsets use. Glass lenses allow more light to pass through than plastic lenses and Pimax claims a 99% transmittance rate. Using glass also lowers the amount of stray light coming into the lens and precludes the need for software to adjust for light aberration. Pimax Crystal boasts a resolution of 2880×2880 per eye with 42 pixels per degree (PPD). With a 160Hz refresh rate, it should reduce the “screen door” effect. It is sports a Qualcomm XR2, Wi-Fi 6E, auto-IPD (inter-pupillary distance), and Tobii eye tracking. (Digital Trends, Pimax)

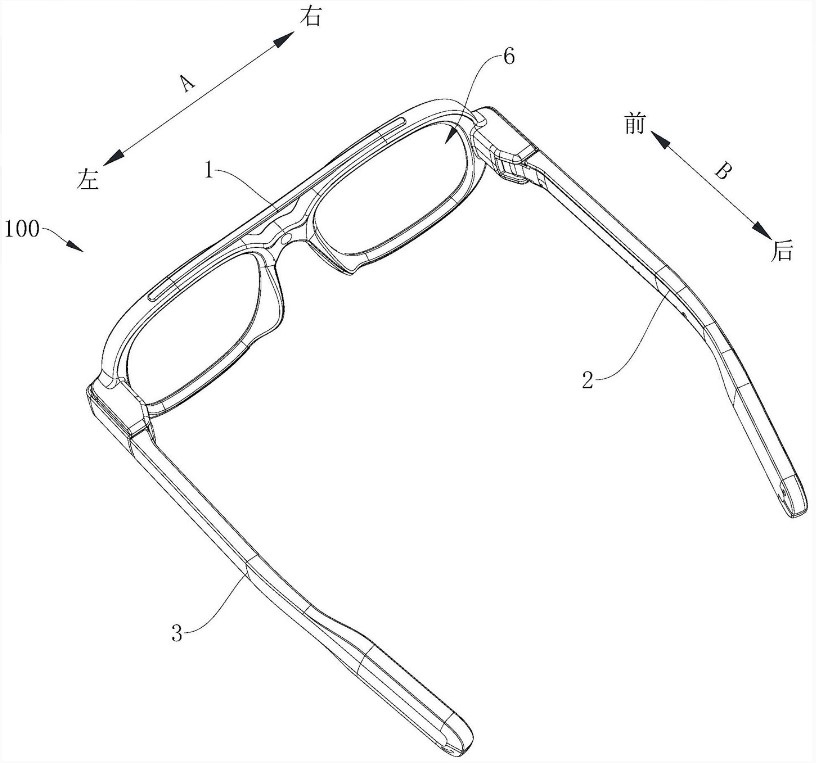

Xiaomi has applied for AR glasses, which is officially approved. The patent summary suggests the AR glasses include a frame, temple, power supply, motherboard assembly, waveguide assembly and circuit assembly. Specifically, the first power supply is installed on the first temple, and the main board assembly is installed on the second temple.(CN Beta, Pandaily, IT Home)

Cruise, the autonomous vehicle unit of General Motors, has finally been given the green light to start charging fares for its driverless robotaxi service in San Francisco. The California Public Utilities Commission (CPUC) has voted to award Cruise with a driverless deployment permit, the final hurdle the company needed to jump to begin operating its autonomous ride-hail service commercially. Cruise will be operating its passenger service at a maximum speed of 30 miles per hour between the hours of 10 p.m. to 6 a.m. on select streets in San Francisco, adding another one and a half hours to its current service.(CN Beta, TechCrunch, Cruise)

Ford Motor will invest USD3.7B and add 6,200 jobs across plants in Michigan, Ohio and Missouri to expand production of both electric and internal combustion engine vehicles. The investment also will fund the establishment of a new packaging facility in Monroe that will support the company’s customer service division. Under CEO Jim Farley, Ford is implementing a growth strategy, dubbed Ford+, centered on electrification, commercial vehicles and digital connectivity. The automaker in 2021 launched a dedicated commercial vehicle business unit, Ford Pro, and earlier 2022 announced a major restructuring to separate its legacy internal combustion engine and EV businesses into distinct units: Ford Blue and Ford Model e, respectively.(CN Beta, Detroit News, Detroit Free Press, ABC News)

Stellantis and Toyota Motor Europe have announced a new agreement on large-size commercial vans (conventional and electric) for the European market, which essentially is an expansion of the existing partnership on compact and mid-size vans. Under the agreement, Stellantis will supply Toyota with the new large-size commercial van for sale in Europe under the Toyota brand, just like in the case of compact- and mid-size models (respectively: Toyota Proace since 2012 and Toyota Proace City since 2019).(CN Beta, Reuters, InsideEVs, Stellanis)

Marco Lomio, local head of UILM metalworkers union, has indicated that Stellantis will again stop operations at its key Melfi plant in southern Italy between 6-11 Jun 2022 due to a chip shortage. The Melfi plant currently produces the Fiat 500X small crossover, the Jeep Renegade small SUV and the Jeep Compass compact SUV. The FIM-CISL and UILM unions said in May that Stellantis also plans to produce four all-electric mid-size vehicles for its different brands at the Melfi plant starting in 2024. The new models will use its all-electric STLA mid-size platform. (CN Beta, Reuters, CNA, US News)

BMW has announced two new vehicles with support for its Digital Key Plus feature, including the 2023 X1 and an all-new electric SUV called the iX1. Digital Key Plus allows for compatible BMW vehicles to be locked, unlocked, or started with an Apple’s iPhone or Apple Watch, eliminating the need for a physical key. The standard NFC version of the feature requires the iPhone or Apple Watch to be held near the driver-side door to unlock the vehicle, but Digital Key Plus utilizes Ultra Wideband technology to detect when driver is near the vehicle, allowing to keep iPhone in pocket.(MacRumors, BMW)

Square has announced that it is signing on to support Apple’s new Tap to Pay on iPhone feature. The feature, which was announced by Apple in Feb 2022, allows businesses to use an iPhone to accept contactless payments without the need for any additional hardware. Square says that it will roll out support for Tap to Pay on iPhone through its existing Square Point of Sale app. Square says it plans to roll out the feature later in 2022.(CN Beta, Protocol, Reuters, 9to5Mac, Square)

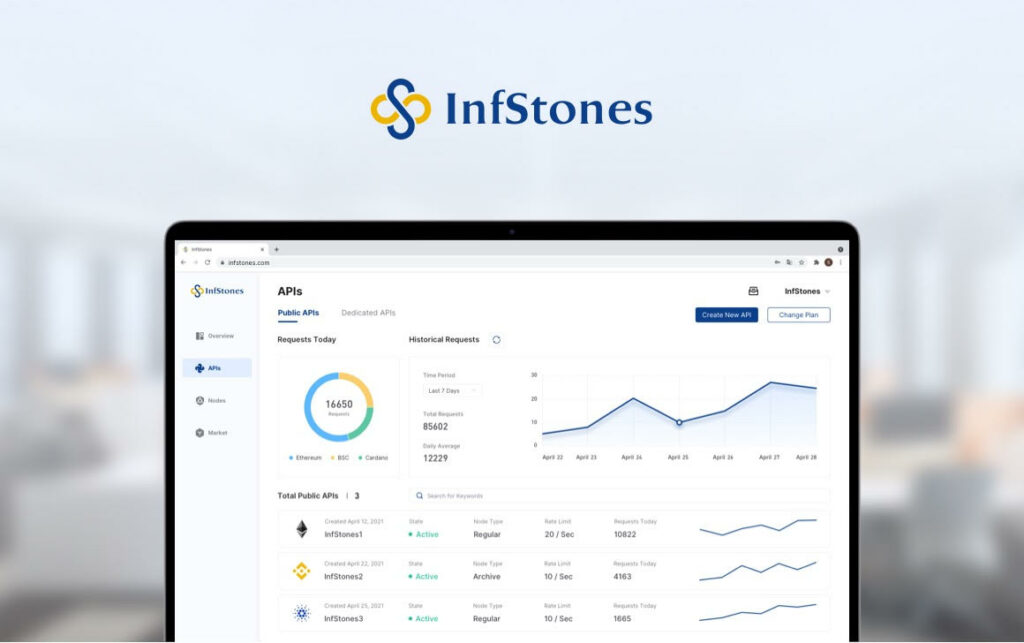

InfStones, which aims to help clients build applications across a number of blockchain platforms, has closed a USD66M round led by SoftBank Vision Fund 2 and GGV Capital. The company was founded in 2018 and has customers ranging from centralized crypto entities like Binance and Circle to decentralized scaling platforms like Polygon. It provides services for institutional clients globally and supports infrastructure for over 50 blockchains, including Ethereum, Polygon, Solana and Chainlink, among others. (TechCrunch, CoinDesk, PR Newswire)

Walmart will open 4 new fulfillment centers over the next three years that the company says will let it pack and ship online orders more quickly. The first one will open summer 2022 in Joliet, Illinois, about 40 miles southwest of Chicago. The company says the system at the new facility will simplify work for employees. Three more will follow in McCordsville, Indiana; Lancaster, Texas; and Greencastle, Pennsylvania in the next 3 years. With more of Walmart’s sales coming from its website in recent years, it already has 31 facilities that prepare online orders. More than 3,500 of its stores, or about 75% of its locations, also fulfill online orders.(CN Beta, CNBC)

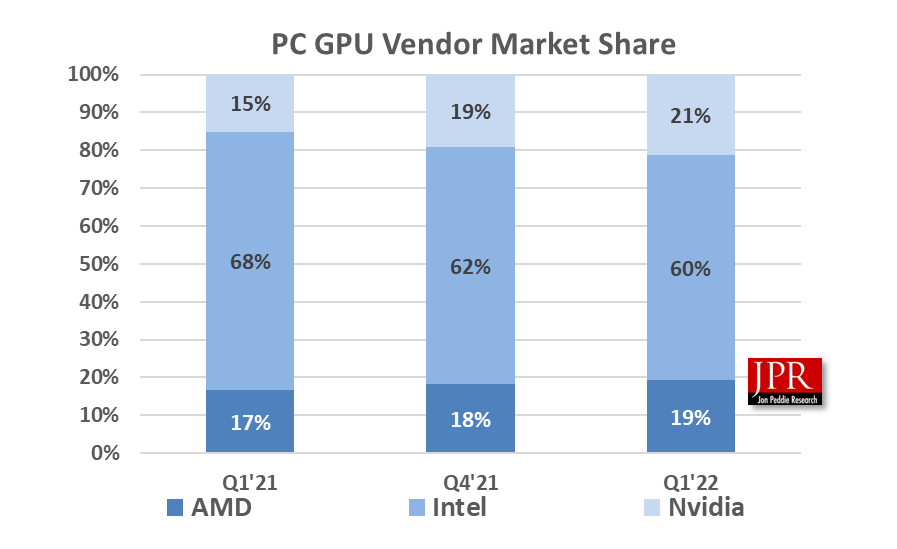

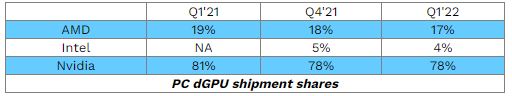

Jon Peddie Research reports that the global PC-based graphics processor units (GPU) market reached 96M units in 1Q22 and PC GPUs shipments decreased 6.2% due to disturbances in China, Ukraine, and the pullback from the lockdown elsewhere. However, the fundamentals of the GPU and PC market are solid over the long term, JPR predicts GPUs will have a compound annual growth rate of 6.3% during 2022–2026 and reach an installed base of 3.3M units at the end of the forecast period. Over the next 5 years, the penetration of discrete GPUs (dGPU) in the PC market will grow to reach a level of 46%. AMD’s overall market share percentage from last quarter increased 0.7%, Intel’s market share decreased by -2.4%, and Nvidia’s market share increased 1.69%. (CN Beta, Jon Peddie Research)

Qualcomm CEO Cristiano Amon has revealed that Qualcomm would be interested in forming a consortium of some kind to acquire Arm. The purchase price would be high, but Amon has said Qualcomm and others could create a deal that was “big enough”. Qualcomm has previously opposed Nvidia’s purchase of Arm, citing the work it took from many partners to build. (Ars Technica, TechRadar, Android Headlines, Financial Times, Sina)

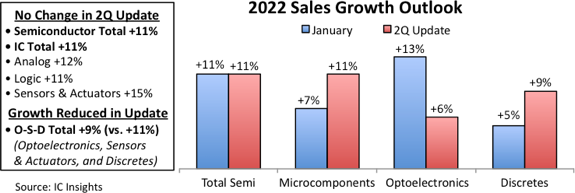

IC Insights raises and lowers sales growth forecasts in a number of major semiconductor product categories in 2022. These changes offset each other and keep the overall increase of the semiconductor market at 11% in 2022, despite stiffening economic headwinds that are challenging global growth in 2022. The 2Q22 Update raises the sales forecast for microcomponent ICs to 11% in 2022 from 7% early 2022. This increase is being driven by stronger microprocessor sales in the embedded MPU category (now up 12% versus 9%, previously) and in cellular application processors (rising 22%, which is significantly higher than 10% in the Jan 2022 forecast). The overall projection of total IC sales growth in 2022 is unchanged and expected to rise 11% in 2022 to a record-high USD567.1B. (CN Beta, IC Insights)

Check Point Research has revealed that the Unisoc smartphone chips have a critical security vulnerability. The issue exists in the modem firmware and affects 4G and 5G Unisoc chipsets. The issue, tracked as CVE-2022-20210, was discovered while scanning Non-Access Stratum (NAS) message handlers. This vulnerability could be exploited to neutralize or block the cellular communication capabilities of the device. Unisoc has acknowledged the vulnerability upon the receipt of disclosure and issued a patch. (Check Point, Gizmo China)

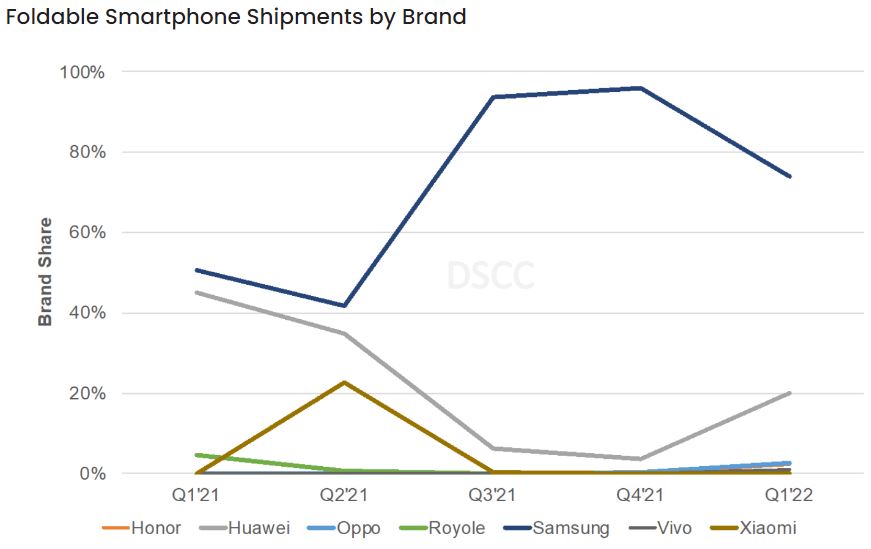

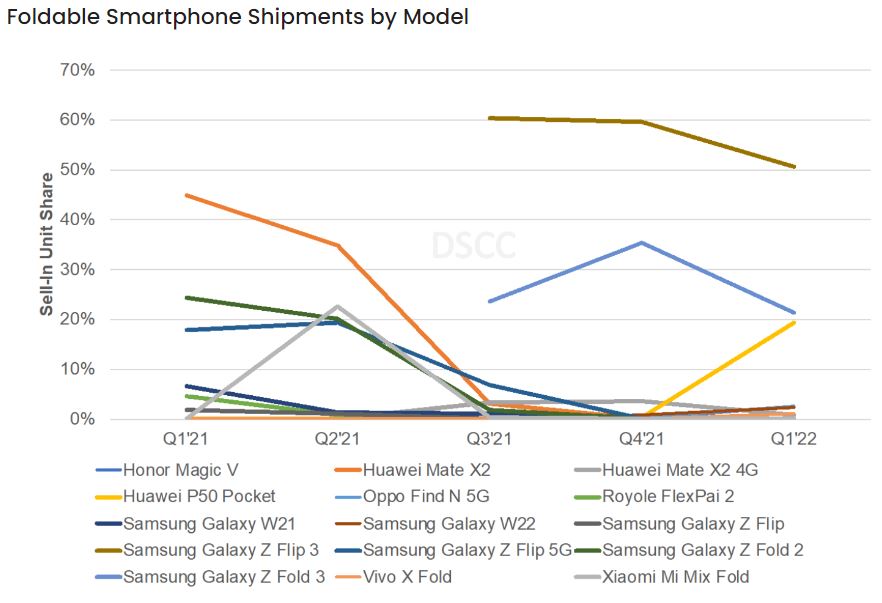

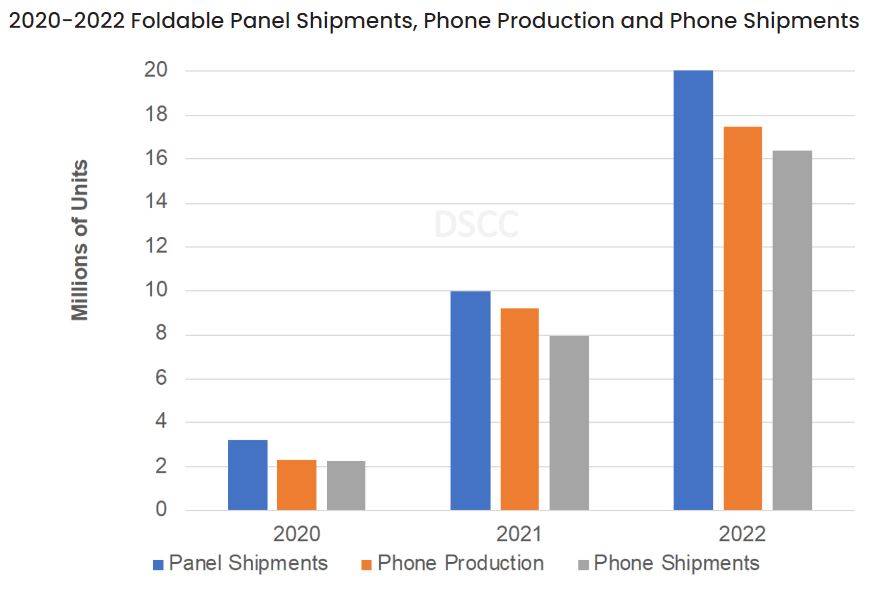

According to DSCC, foldable smartphone shipments rose 571% YoY in 1Q22 to 2.22M. It was the 3rd best quarter to date for the rapidly growing category, but was down 47% QoQ from the record high of 4.2M units in 4Q21. Samsung continued to dominate the category, but its share fell to 74% with Huawei’s share rising to 20%. No other brand had more than a 2% share. By model, the Samsung Galaxy Z Flip3 led the market for a 3rd straight quarter, earning a 51% share. The Galaxy Z Fold3 remained #2 for the 3rd straight quarter, but was nearly overtaken by the Huawei P50 Pocket. Those three models accounted for a 91% share with no other model having more than a 2.5% share. Clamshell models like the Z Flip 3 and P50 Pocket accounted for a 70% share, its highest share since 3Q20. While 2022 will be a challenging year for most display applications, foldable smartphones will see strong growth. DSCC expects a 107% increase in foldable smartphone shipments to over 16M units with 102% increase in foldable smartphone panel shipments to over 20M. (CN Beta, GSM Arena, DSCC, OLED-Info)

Huawei and Nationstar Optoelectronics have signed a “Comprehensive Cooperation Agreement” for mini-LED development. The partnership is based on complementary advantages and mutual benefits on a principle of common development. It will center on the core technologies and industrial resources of both parties. The two companies plan to carry out in-depth innovation, and research to expand their future business coverage. Nationstar Optoelectronics will collaborate with its prowess in LED display, backlight, and other fields. The companies will focus the partnership on the development of mini and micro-LED display technology.(GizChina, IT Home, Sina)

The JEDEC organization released the HBM3 standard in early 2022, and continued to expand and upgrade at various levels such as storage density, bandwidth, channel, reliability, and energy efficiency. The transmission data rate doubled on the basis of HBM2, and the transmission rate of each pin (pin) It is 6.4Gbps, with a 1024-bit bit width, the maximum bandwidth of a single device can reach 819GB/s. The new generation of HBM3 memory developed by Samsung has a higher pin rate, reaching 8Gbps/pin, and the bandwidth easily reaches 1024GB/s when stacking 4, which is more than ten times that of DDR5 memory. (CN Beta, Samsung, My Drivers)

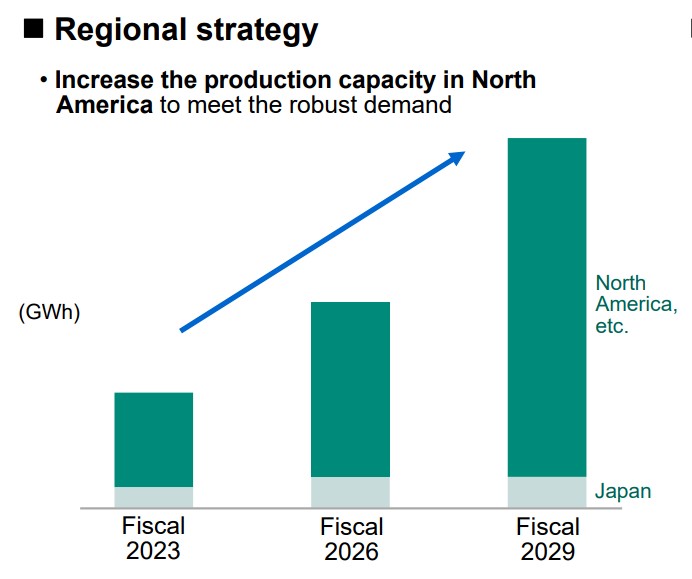

Panasonic has said that it has shipped samples of Tesla’s 4680 cell to the automaker ahead of mass production. Pansonic believes mass production of the 4680 cell is set to begin in Mar 2023 when the company’s fiscal year starts. Panasonic’s Wakayama plant will initially handle the production of the cell. It will then be shifted to North America. Tadanobu has not committed in the past to produce the 4680 cells in the United States, but now that he is stating the company will transition production to North America, it could bring another plant to the U.S. (CN Beta, Electrek, Teslarati, Reuters)

Panasonic Holdings plans to quadruple its production of electric vehicle batteries by fiscal 2028 (end by Mar 2029) as it expects increasing demand from American EV manufacturing giant Tesla. Panasonic Holdings considers its battery production business as an area of growth. Panasonic Energy plans to revamp its plant in Wakayama Prefecture to begin mass producing its next-generation 4680 battery cell in fiscal 2023 to be supplied to Tesla. Kazuo Tadanobu, president of Panasonic Energy, said at an investor relations event that he hopes to contribute to the public becoming familiar with EVs by increasing production of the next generation batteries. Panasonic is also eyeing increasing the production of batteries and the construction of new factories in North America. The company is looking at potential factory sites in Kansas and Oklahoma to supply the batteries to the U.S. electric automaker’s plant in Texas.(CN Beta, Reuters, Japan Times)

BYD is rumored to be in the process of acquiring lithium mines in Africa to meet its needs for years to come. BYD has its eye on 6 lithium mines in Africa, all of which it has now agreed to acquire. According to BYD’s internal calculations, the 6 lithium mines have more than 25M tons of ore with a 2.5% lithium oxide grade, meaning up to 1M tons of lithium carbonate. On the cost side, the price of lithium carbonate per ton must be under CNY200K. The price of battery-grade lithium carbonate is still as high as CNY470K per ton, despite a drop since this month. By comparison, they were less than CNY50K per ton in early 2021. If all 25M tons of ore from these African mines were mined, it could meet the demand for 27.78M vehicles with 60kWh batteries. (CN Beta, Sina, Toutiao, Financial Express, Financial Post, Benzinga, The Paper)

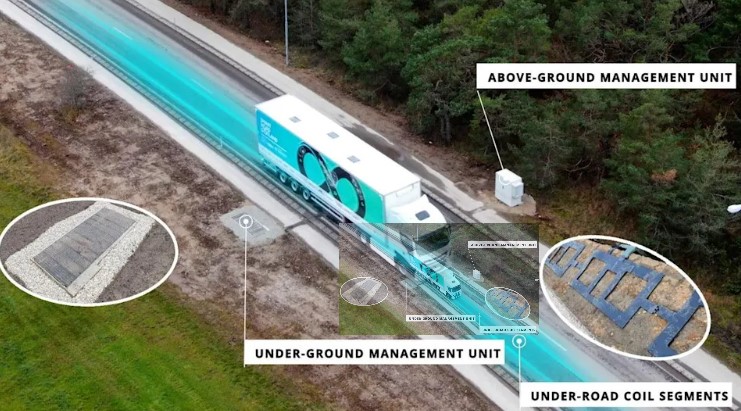

Israeli company Electreon has announced that it is planning to build the first US road with wireless-charging capabilities for electric vehicles. The pilot project is set to be finished in 2023 in Detroit, Michigan, and it will initially only be one mile long. The road will work by having an underground network of charging coils that connect to the energy grid, with EVs needing to have a receiver to charge while driving over them. The system does not emit electricity without an active receiver. It is also modular, as each coil is connected individually to the grid. (CN Beta, Electreon, Yahoo, Techspot)

Samsung Electronics and NAVER Cloud have announced that the companies have joined together to switch on South Korea’s first private 5G network. Deployed at NAVER’s new second headquarters, “1784”, Samsung’s network solution will support NAVER’s private 5G commercial service to power cloud-based autonomous mobile robots in Jun 2022— the world’s first use case of its kind — created to provide convenient services to employees throughout the building.(Sammy Hub, Sina, Samsung)