7-7 #Old : OPPO is reportedly working on two new foldable smartphones; Apple has reportedly approved supplier BOE to provide OLED panels; Samsung is considering dropping its prices for memory chips in 2H22; etc.

Japanese chemicals supplier Showa Denko K.K. expects to further raise prices and cut back unprofitable product lines as it grapples with a barrage of economic challenges confronting the USD550B semiconductor industry. That is on top of at least a dozen hikes already in 2022, reflecting Covid-19 supply snarls, surging energy costs from the Ukraine war and the yen’s dramatic weakening, according to the CFO Hideki Somemiya. He has further added that the situation is unlikely to significantly improve until at least 2023. Tokyo-based Showa Denko, which supplies essential chip fabrication materials to the likes of Taiwan Semiconductor Manufacturing Co (TSMC) and Infineon Technologies, has been forced to drastically increase the cost it passes on to customers. Because it is a key supplier of the chemicals used early in the production chain by chipmakers and other manufacturers like Toyota Motor, its price hikes could potentially squeeze margins or pressure customers to follow suit. (Financial Post, CN Beta, Bloomberg)

SK Materials, an industrial gas manufacturing affiliate of South Korea’s SK Inc, and Japanese chemicals company Showa Denko K.K. have agreed to jointly seek business opportunities in the US semiconductor materials market. Under the initial agreement, the two companies plan to build a factory in the US to produce high-purity gases to meet growing demand from chipmakers in North America. Showa Denko is the global top producer of etching gases used to carve fine grooves and holes on the surface of wafers to design electronic circuits. SK Materials mainly produces nitrogen trifluoride (NF3), which is used to remove residue on the internal walls of chemical vapor deposition chambers; and silane (SiH4), used to deposit silicon on semiconductor wafers and flat-panel glass substrates. (KED Global, Business Korea)

Xiaomi has officially announced its self-developed Surge G1 battery management chip. The combination of the Surge P1 fast-charging chip and the Surge G1 battery management chip has realized the independent development of battery management full chain technology. Xiaomi launched two self-developed chips in 2021, the Surge C1 and the Surge P1. The Surge C1 is Xiaomi‘s first professional imaging chip, while the Surge P1 is Xiaomi‘s first independently developed charging chip.(CN Beta, My Drivers, EET China, Xiaomi Communitiy, Pandaily)

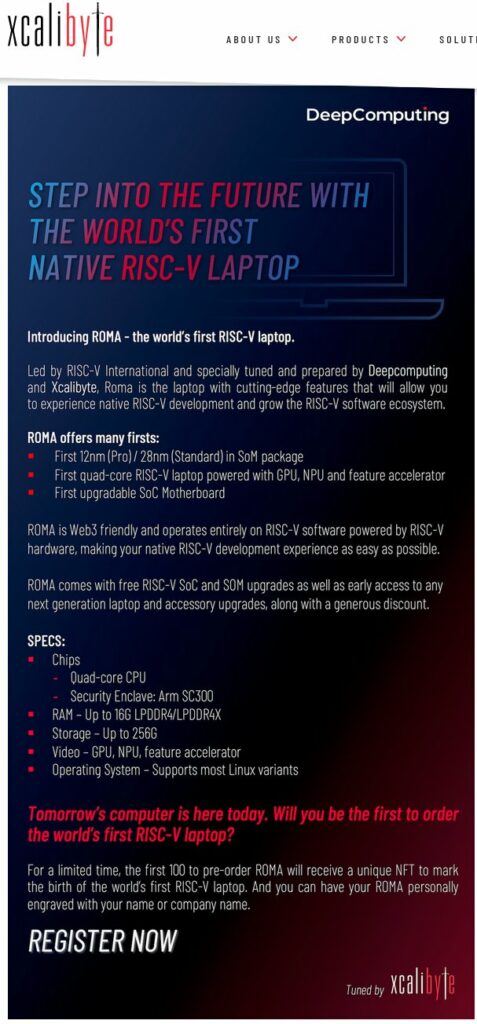

The world’s first laptop operating on the RISC-V instruction set, called ROMA, has gone up for preorder. DeepComputing and Xcalibyte will produce ROMA in China. The laptop features a quad-core RISC-V processor, up to 16GB of LPDDR4/LPDDR4X memory, and up to 256GB of storage, with support for RISC-V and most Linux operating systems. The laptop will use a “world’s first” 12nm / 28nm SoM package. The chip will include four cores and a GPU and NPU for 3D/2D and AI acceleration. Only 100 ROMA laptops will be available, and all are available for preorder now.(opens in new tab). (Laoyaoba, Sohu, Phoronix, Tom’s Hardware)

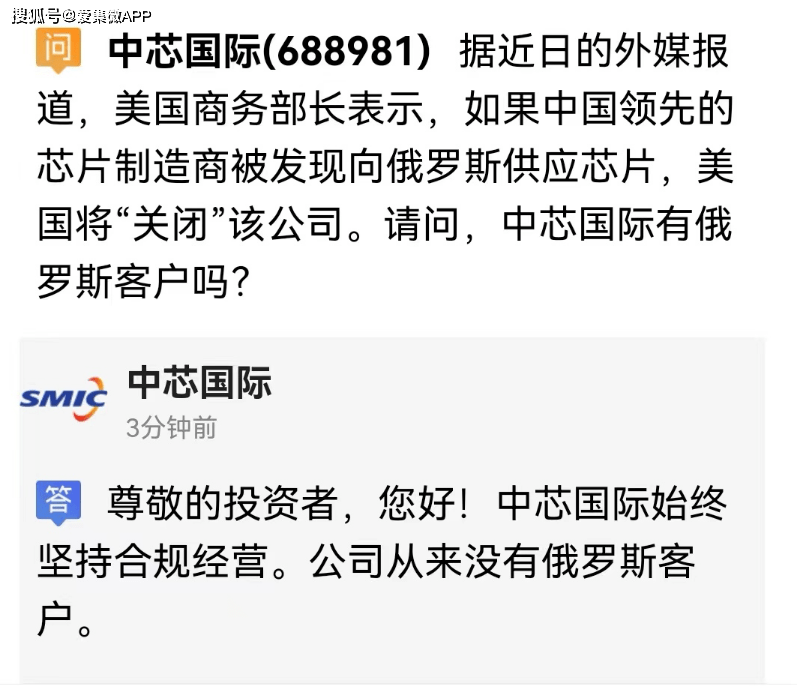

In response to the question of “whether the company has Russian customers”, SMIC has that SMIC has always adhered to compliance operations. The company has never had Russian customers. SMIC’s claim of never having Russian customers appear to be because of fear of the U.S. SMIC is a Chinese company and there are no restrictions from the Chinese government. (GizChina, IT Home, ETToday, RFI, UDN)

South Korean AI chip developer Rebellions has raised a KRW30B (USD22.8M ) extension to its Series A financing from strategic investor KT, one of the largest telecom companies in South Korea. Incoming funds will be used to commence mass production of its ATOM AI chip and develop new neural processing AI chips for deployment in data centers, self-driving vehicles, and fintech platforms. KT says it wants to develop AI chips such as NPU (neural processing unit) that will be used for data centers, autonomous vehicles and fintech. (TechCrunch, KED Global, Inside.com)

Samsung Display president Choi Joo-sun has indicated that the company has raised its production yield of quantum dot (QD)-based organic light emitting diode (OLED) displays to 85%. He has also revealed that in 1H22, sales of small and medium-sized panels increased by 10% compared to the same period of the previous year, reaching an all-time high. The improved yield of 85% is expected to have a positive impact on securing customers. The company’s yield of QD-OLED panels in the initial stage of mass production in Nov 2021 stood at 50%.(CN Beta, Pulse News, Business Korea, UDN)

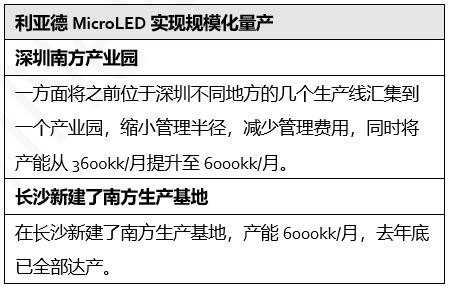

Leyard has indicated that in 2020 it will take the lead in mass production of MicroLED. In the past, Leyard’s MicroLED products were planned to be extended from 0.9mm to a smaller size, and the minimum has been 0.4mm. The goal is to enter the application of smaller-pitch products. It requires the industry chain to make smaller-sized chips from the chip side. Then through the mass transfer, the display product is finally formed. The company has also made a larger layout in terms of production capacity to cope with market changes. In addition to Shenzhen Nanfang Industrial Park and the newly built Nanfang production base in Changsha, there are also Beijing production base, Wuxi MicroLED production base and European production base.(Laoyaoba, Sohu)

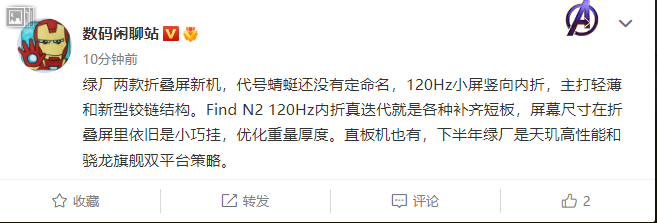

OPPO is reportedly working on two new foldable smartphones, one with a clamshell fold design and another with a book-like folding design. The upcoming smartphone with a clamshell folding design has been codenamed Dragonfly but the actual name of the smartphone has not been decided yet. The phone will reportedly come with a display offering a 120Hz refresh rate and the company is focusing on reducing the thickness of the foldable smartphone as well as adopting a new hinge structure. (GizChina, IT Home, Gizmo China)

Samsung will reportedly try to focus more on the foldable phone market to catch up with iPhone, as it has lagged behind Apple. Kim Ji-san, head of research at Kiwoom Securities, has indicated that Samsung will lower its sales target of the Galaxy A and the Galaxy S series and focus on selling new foldable phones to be released in Aug 2022. Inflation has a more negative impact on the sales of low-priced phones than on high-priced ones. In May 2022, the proportion of phones costing more than USD600 was the same as the previous month at 19%, but low-priced phones worth less than USD100 accounted for 26%, similar to the lowest level of those products in 2021. (Android Headlines, Korea Times)

Apple has reportedly approved supplier BOE to provide OLED panels for the iPhone 14 even after earlier manufacturing changes were performed without Apple’s knowledge. BOE may have finally landed a small production order from Apple for “iPhone 14”. Supply chain data sourced from Runto Luotu Technology Research indicates that Apple had certified BOE’s OLED display. It is expected that Apple’s new BOE order for 5M units will be used to supply panels for the standard 6.1” “iPhone 14”. Industry estimates suggest Apple will purchase 60M display units from Samsung Display and LG Display will supply 25M. (GSM Arena, IT Home, Apple Insider, CN Beta)

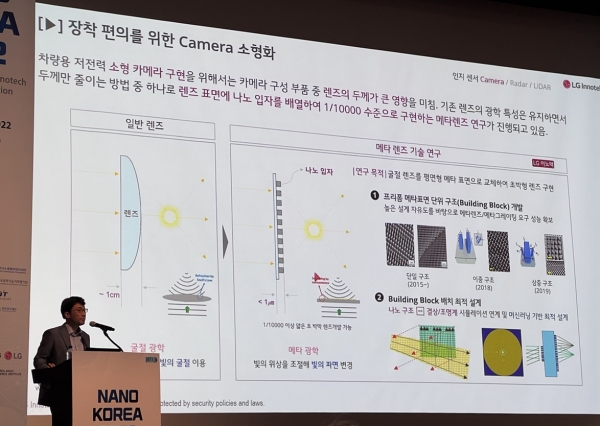

LG Innotek is developing a novel ultrathin lens technology that it says can be applied to phone cameras, dubbed metalenses. They eschew the bulky glass or plastic ones on current phones that present the bulk of the camera islands sticking out from out handsets. The metalens is basically an ultrathin planar structure with nanoparticles scattered on it, which have the ability to shape-shift and focus light like regular lenses, but with the important caveat that the whole set can be made up to one micron thin. The company is developing a microlens that is 1/10,000th of the regular lens thickness and can find application anywhere where micro-cameras are needed.(Phone Arena, The Elec)

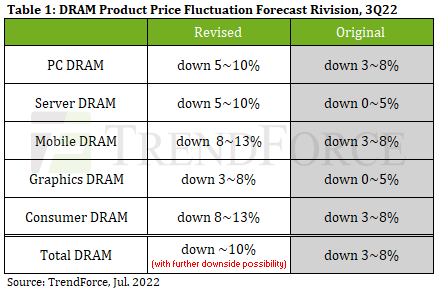

Samsung Electronics is considering dropping its prices for memory chips in 2H22, aiming to further expand its market share, according to Digitimes. If Samsung decides to cut prices, other memory chip companies will follow suit, triggering a price war in 2H22. Almost all types of memory prices will drop more than 10% QoQ in 3Q22. In the spot market, prices have been falling rapidly since 2Q22. Micron has said that some enterprise OEM customers intend to reduce their memory and storage inventories due to weak end demand in the consumer market and in the data center segment. (Digitimes, Digitimes, CN Beta)

According to the latest TrendForce research, despite the rapid weakening of overall consumer demand in 1H22, DRAM manufacturers previously presented a tough stance on price negotiations and gave little ground, steadily conveying inventory pressure from buyers to sellers. Facing uncertain peak-season demand in 2H22, some DRAM suppliers have begun effectively expressing clear intentions to cut prices, especially in the server field, where demand is relatively stable, in order to reduce inventory pressure. This situation will cause 3Q22 DRAM pricing to drop from the previous 3~8% to nearly 10% QoQ. If a price war is incited due to companies competing for sales, the drop in prices may exceed 10%. (TrendForce, TrendForce, CN Beta)

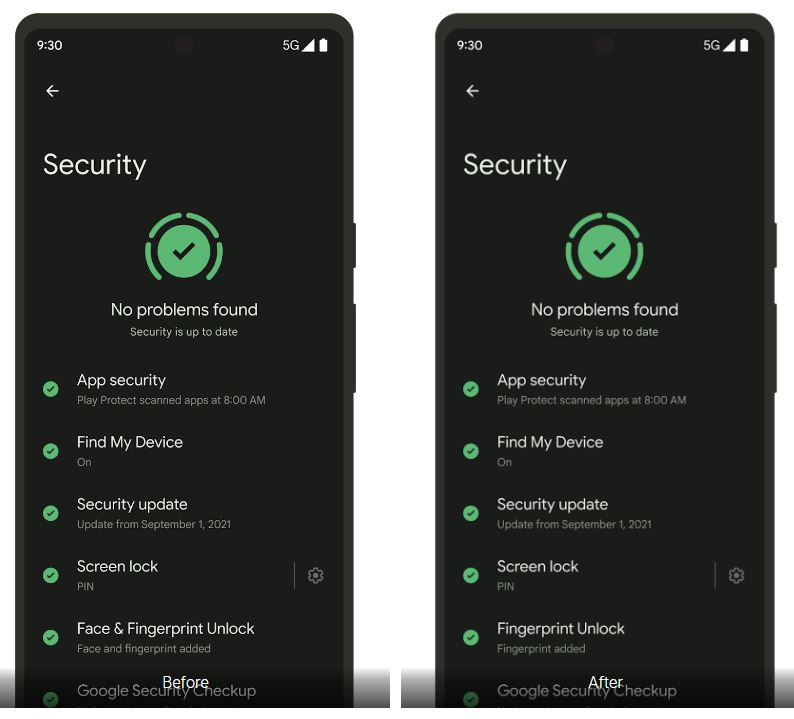

Google is reportedly still developing Pixel face unlock. Google is still working on face unlock for future Pixel phones. Accuracy and battery concerns are reasons why it has not launched on the Pixel 6 Pro. (Android Headlines, 9to5Google)

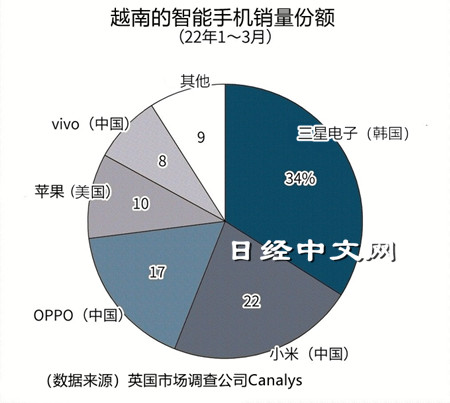

Google is reportedly considering moving orders for future phones to Vietnam in an effort to avoid risks posed by current US-China trade tensions and China’s COVID-19 lockdown. Google has originally planned to have the smartphone made in Vietnam, but changed its mind due to the pandemic and the strong support from China’s supply chain; however, the strict lockdown imposed by China this year in response to the resurgence of COVID-19 caused the company to reconsider. The production line for Google’s new smartphones in Vietnam will be established after 2023 and will be responsible for new-generation models. Foxconn’s wholly owned subsidiary FIH, together with Compal Electronics, are the primary manufacturers of Google’s Pixel line of smartphones. Both FIH and Compal already have factories set up in Vietnam and will be able to meet Google’s demand at any time. (CN Beta, Digitimes, PingWest, WCCFtech)

Xiaomi has allegedly begun to produce smartphones in Vietnam, which are produced by the DBG Technology OEM factory. The factory covers an area of about 200,000 square meters, and the investment is about USD80M. In addition to Vietnam, Xiaomi will also export to Southeast Asian regions such as Malaysia and Thailand, the report said. The products produced are not only smartphones but also components such as data transmission equipment and circuit boards. (EETop, Sina, Nikkei, RPRNA)

OnePlus may push “Nord” to become an independent brand. OnePlus sees this as a way for “Nord” to grow in the mid-range segment. So, OnePlus may do with Nord what OPPO already did with realme, vivo with iQOO, and Xiaomi with POCO. “Nord” will be treated as a standalone company. Not only will it include its own branding, but it will also have its stores, and even a separate team from OnePlus. OnePlus may either use “Nord by OnePlus” branding, or ditch the “OnePlus” brand completely. Nord will be looking to strengthen its offline presence. It will focus on “offline channels” to do that, as it already has strong partnerships with third-party stores and authorized sellers.(CN Beta, Android Authority, Android Headlines, The Mobile Indian)

Xingji Technology, a smartphone company launched by Geely’s founder and chairman Eric Li in Sept 2022, acquired a controlling stake of 79.09% of Meizu. Meizu will continue to operae as an “independent brand” following the strategic investment. Its founder Huang Zhang, also known as Jack Wong, will be involved as the brand’s “product strategy advisor”. The tie-up joins a raft of phone and auto makers working closer together and betting on a future where in-car control and handset operating systems are more integrated. In the highly homogenous consumer device market, Meizu and Xingji aim to build “a multi-device, scenario-agnostic, and immersive” digital experience.(Sina, CN Beta, Takungpao, Bloomberg, TechCrunch)

The Enforcement Directorate of India is conducting searches at 44 places across the country in a money-laundering investigation against vivo and related firms. The searches are being carried out under sections of the Prevention of Money Laundering Act (PMLA). Meanwhile, on 30 Apr 2022 ED officials had seized INR5,551.27 crore from Xiaomi India in connection with illegal outward remittances made by the company.The seizure was made from the company’s bank accounts under provisions of the Foreign Exchange Management Act (FEMA). (Gizmo China, Live Mint, India Times, 163, Yahoo)

Rivian CEO RJ Scaringe has revealed that the company’s supply chain and production are ramping. They have just announced production of 4,401 vehicles for 2Q22 bringing their cumulative total since start of production to 7,969 — keeping them on track to reach their year-end goals of producing 25,000 vehicles. In addition to an approximately 71,000 vehicle preorder backlog, the company has a 100,000 van order it needs to fulfill for minority owner Amazon. Late 2021, Rivian announced it would build a second factory in Georgia, but that facility will not be operational until sometime 2024. Until then, the startup is dependent on its single factory in Normal, which it says will eventually produce 200,000 vehicles annually.(Engadget, CN Beta, Twitter)

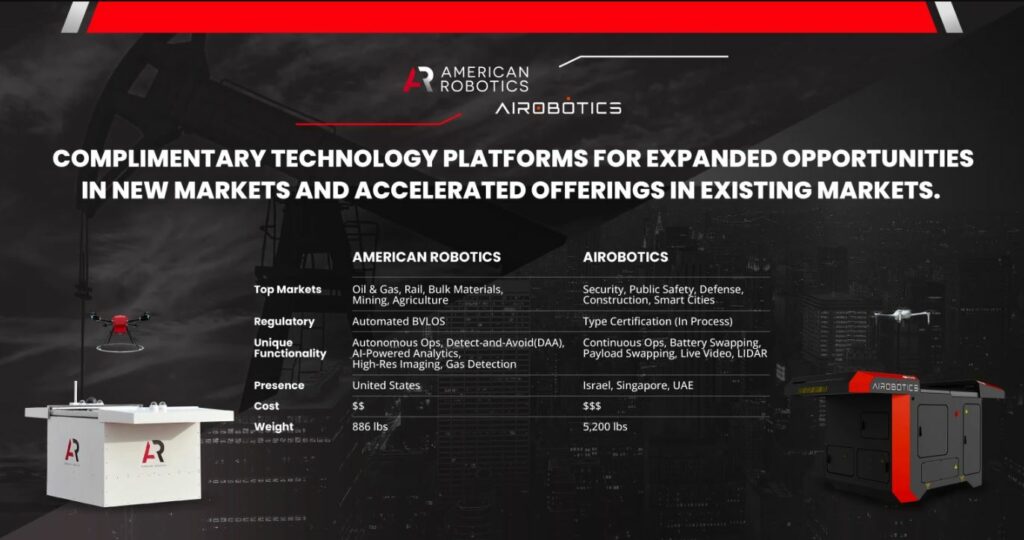

American Robotics, a subsidiary of Ondas Holdings, has announced it signed a term sheet to acquire Airobotics, an Israeli developer of autonomous unmanned aircraft systems (UAS). To date, the company has raised USD130M since its 2014 founding. American Robotics, meanwhile, was acquired by Ondas in Aug 2021. American Robotics’ primary play is Scout, a fully autonomous drone system that can operate on remote sites without direct human oversight. Similarly, Airobotics offers an all-in-one autonomous drone solution. The company’s Optimus drone launches out of an automated docking space that serves as a base and transmits data to the quadcopter. Applications include emergency response, mapping and surveying. (CN Beta, TechCrunch, The Robot Report)

Xiaomi has showcased its CyberDog open-source robot. The Xiaomi CyberDog is designed as an open-source robot and could provide a rich resource for developers globally. The CyberDog is powered by the Jetson Xavier NX AI Supercomputer for Embedded Edge Systems. It has an SSD storage capacity of 128GB and is equipped with 11 high-precision sensors. The sensor provides instant feedback that helps the robot to navigate the terrain seamlessly. CyberDog comes with Xiaomi’s smartphone imaging technology enabling it to smartly perceive its environment. Its complement of cameras includes AI interactive sensors, binocular ultra-wide-angle fisheye cameras, and an Intel Depth module. CyberDog can be trained using its computer vision algorithm.Xiaomi CyberDog robot. The robot also features autonomous object tracking, human posture, face recognition, obstacle avoidance, and SLAM.(Gizmo China, India Times, Mi.com, IT Home)