7-17 #VIP : Intel may raise prices on a majority of its microprocessors and peripheral chips; BYD has a plan to develop proprietary autonomous driving-dedicated chips; Rivian is allegedly planning to lay off about 700 employees; etc.

The Indian Finance Ministry has said that the Directorate of Revenue Intelligence (DRI) has detected Customs duty evasion of around INR4,389 crore (USD551M) by OPPO Mobiles India. The company has been issued a showcause notice, following the recovery of documents that indicated “wilful misdeclaration” of some imports, and remittance of royalty and licence fees to various multinational companies, including those based in China. In a statement, OPPO India said it has a “different view” on the charges mentioned in the showcause notice and will take appropriate steps, including legal remedies. (Gizmo China, Money Control, The Indian Express, Wallstreet CN, 163)

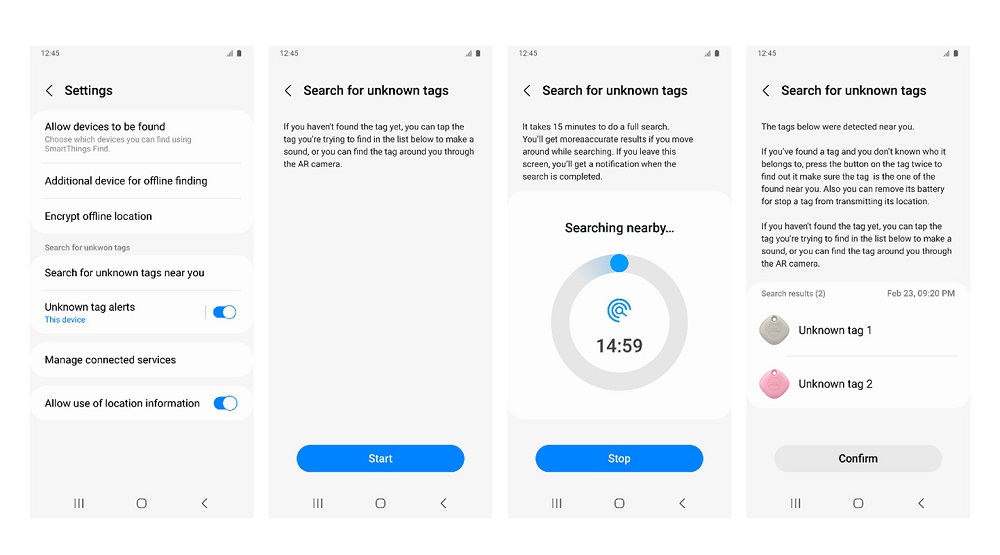

Samsung Electronics has announced that the SmartThings Find service has grown rapidly and is now comprised of more than 200M find nodes working to help users locate their misplaced devices. Find nodes are devices that have been registered on the SmartThings Find service to help other Samsung Galaxy users to locate their lost devices. TM Roh, President and Head of Samsung Electronics’ MX (Mobile eXperience) Business hs indicated that in less than 2 years, 200M devices have opted in to help fellow Samsung Galaxy users find their misplaced devices — making it one of the fastest growing services at Samsung. (GSM Arena, Samsung, CN Beta)

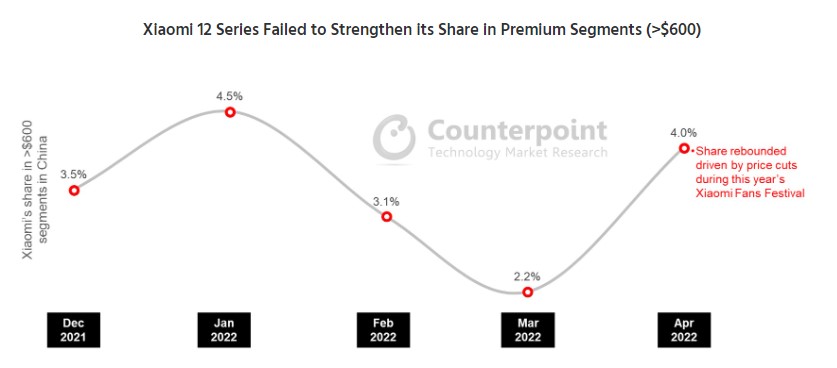

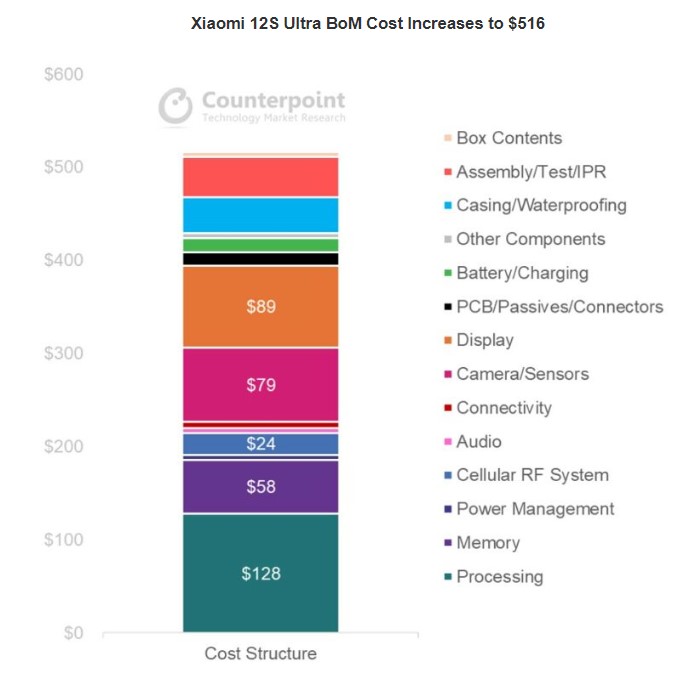

According to Counterpoint Research, producing a Xiaomi 12S Ultra equipped with 8GB RAM and 256GB storage costs around USD516. The market price of the model is CNY5,999 or around USD899. The processing, display and image sub-systems, along with memory, contribute nearly 67% of the total manufacturing cost. Below is the functional cost structure of the ultra-premium model. In terms of suppliers, Qualcomm, Samsung and Sony are among the beneficiaries. Qualcomm has a wide range of design wins, from the SoC and paired power management and RF transceiver to RF front-end components, connectivity IC and audio codec. The latter two vendors provide the display panel and LPDDR5 RAM, and image sensors respectively. (Counterpoint Research, CN Beta)

The US Justice Department is likely to reject concessions offered by Alphabet, clearing the way for an antitrust lawsuit over Google’s dominance of the online advertising market. While Google has made at least one settlement offer to the Justice Department’s antitrust division to address its concerns, the agency is poised to file a lawsuit soon. The division has been investigating Google’s practices in the ad-tech market since 2019 and in 2020 sued the company over its search operations. (Android Central, Bloomberg)

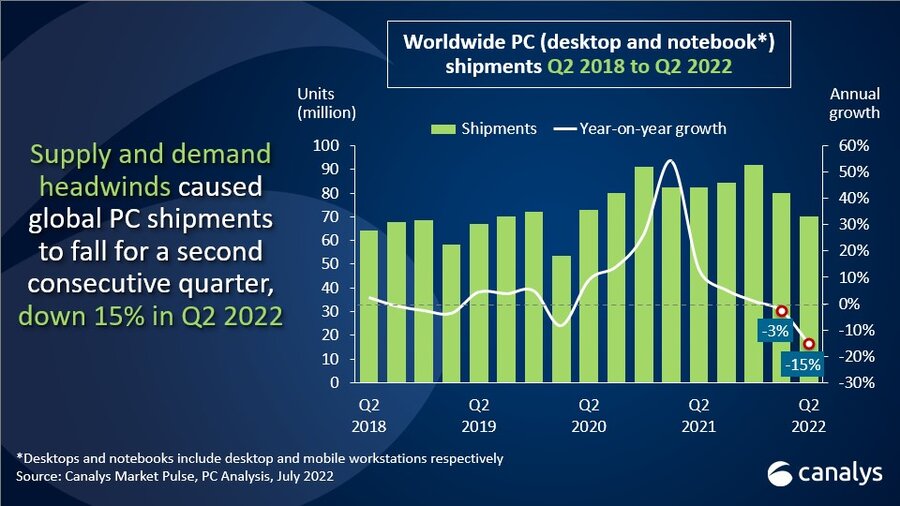

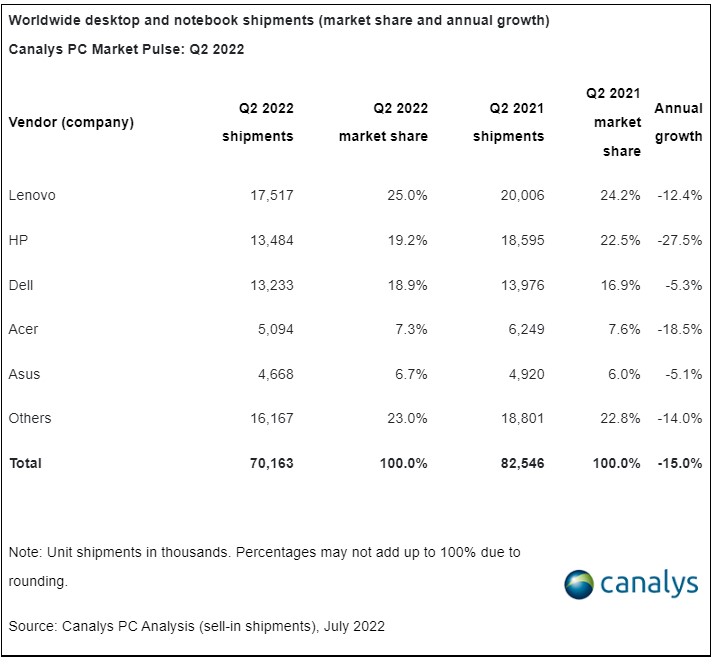

The latest Canalys data shows total shipments of desktops and notebooks fell 15.0% annually to 70.2M units in 2Q22, the lowest level since a similar disruption occurred in 1Q20. Demand headwinds, especially from consumers, have also ramped up as inflation remains unchecked in many of the world’s largest PC markets. Notebook shipments fell 18.6% in 2Q22 at 54.5M units, down for a third consecutive quarter as education procurement remained muted compared with the same quarter a year ago. Desktops fared much better, posting modest growth of 0.6% to 15.6M units as the strength of commercial demand amid the further opening of economies helped spur investment in desktop refreshes and upgrades. The premium commercial segment will remain a bright spot for the overall PC market this year, despite mounting challenges in the global macroeconomic outlook. (CN Beta, Canalys)

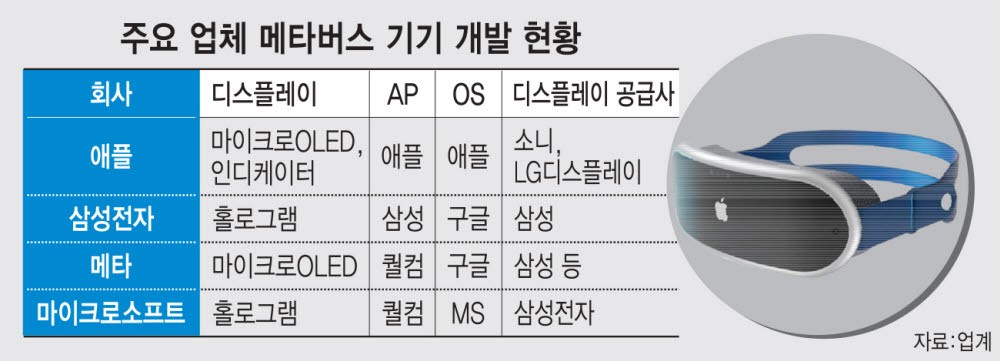

Apple will allegedly debut an extended reality (XR) headset in early 2023, with an improved version shipping in 2024. The first generation of the product will focus on gaming and “testing the metaverse” so Apple can produce a second generation shortly thereafter. Apple’s headset is said to feature a micro-OLED display (OLEDoS) supplied by Sony and LG Display (LGD) that boasts a thin design and power-efficiency, three 3D-sensing modules from LG Innotek, and a mid- to low-specification camera from a supplier in China. (MacRumors, ET News, Apple Insider)

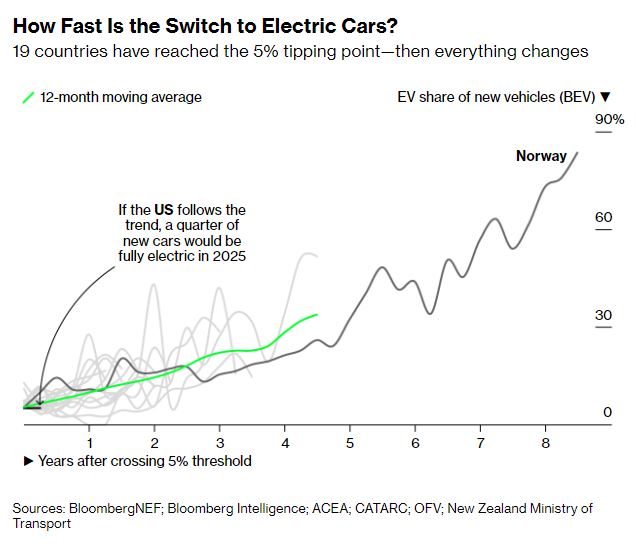

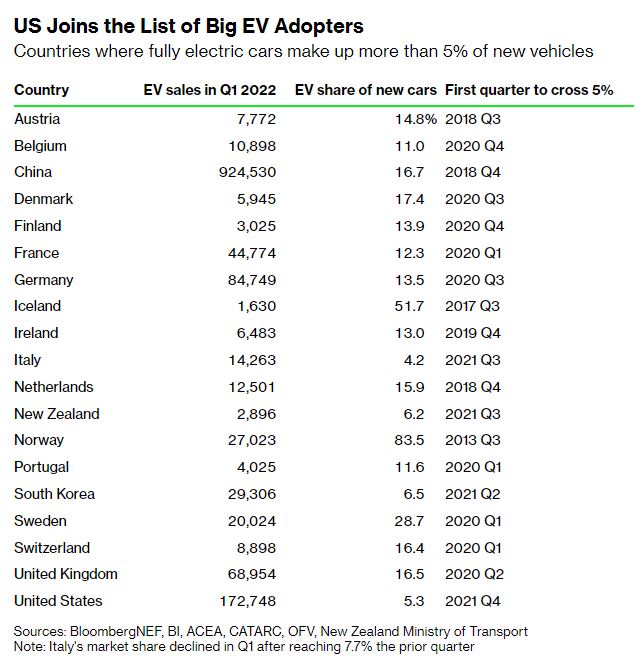

That same society-altering shift is happening now with electric vehicles, according to a Bloomberg analysis of adoption rates around the world. The US is the latest country to pass what’s become a critical EV tipping point: 5% of new car sales powered only by electricity. This threshold signals the start of mass EV adoption, the period when technological preferences rapidly flip, according to the analysis. For the past 6 months, the US joined Europe and China — collectively the 3 largest car markets — in moving beyond the 5% tipping point. If the US follows the trend established by 18 countries that came before it, a quarter of new car sales could be electric by the end of 2025. That would be a year or two ahead of most major forecasts. (Driving.ca, Bloomberg, press)

Swedish electric vehicle maker Polestar has said that it still expects to deliver 50,000 vehicles in 2022, in line with its earlier guidance, despite Covid-related production challenges at its factory in China. Polestar has delivered about 21,200 vehicles in 1H22, up 123% from the same period in 2021. Polestar is a joint venture between Sweden’s Volvo Cars and Volvo Cars’ corporate parent, the Chinese automaker Geely. The company went public via a merger with a special-purpose acquisition company in Jun 2022. It plans to begin production of its third model, an electric SUV called the Polestar 3, at a U.S. factory owned by Volvo in fall 2022. (CN Beta, Electrek, Barron’s, CNBC, Yahoo)

Rivian is allegedly planning to lay off about 700 employees, or 5% of its 14,000-strong workforce. The move aims to cut down staffing in areas where it has grown too fast. The company is just starting to ramp up production of its pickups, SUVs, and delivery vans for Amazon. The company has said it had produced around 2,553 vehicles, delivered 1,227, and was still planning on having made 25,000 by the end of 2022. (Laoyaoba, The Verge, Business Insider)

Stellantis and Dongfeng Motor (Hong Kong) International, a subsidiary of Dongfeng Motor Group Company have executed a heads of agreement (“HOA”) related to the 99.2M common shares in Stellantis held by Dongfeng, representing 3.16% of Stellantis’ share capital. Under the HoA, Dongfeng may from time to time submit an offer to sell to Stellantis, all or a portion of the Stellantis common shares held by Dongfeng. Stellantis will have the right but not the obligation to accept such an offer and purchase the offered shares at the average of the closing prices per Stellantis share on Euronext Milan for the five trading day period immediately prior to the date on which Dongfeng submits the offer.(Laoyaoba, Yahoo)

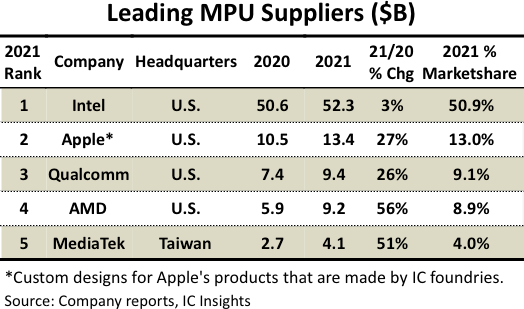

Despite economic troubles brewing in 2022, total microprocessor sales are expected to maintain double-digit percentage growth in 2022, rising nearly 12% to a record-high USD114.8B, thanks to higher average selling prices (ASPs), according to IC Insights’ updated 2Q22 semiconductor forecast. Total MPU sales grew 13% in 2021 and climbed 16% in 2020, when the Covid-19 virus health crisis wrecked the global economy but also drove up microprocessor demand because of the need for more personal computers, smartphones, and Internet connections in the deadly pandemic. The total MPU shipments rising just 3% this year, which will lift unit volume to an all-time high of nearly 2.5M processors following increases of 6% in 2021 and 5% in 2020. (IC Insights, CN Beta)

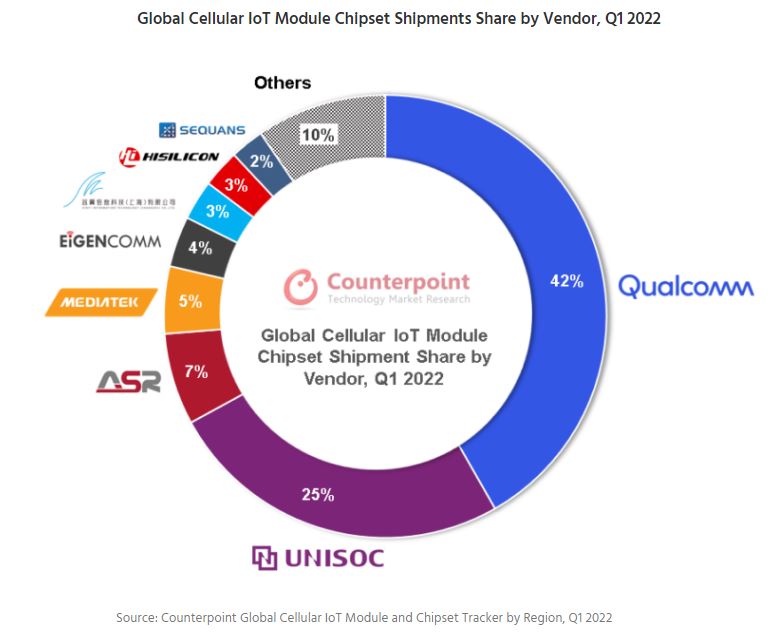

Global cellular IoT module chipset shipments grew 35% YoY in 1Q22, according to Counterpoint Research. China was the key region for cellular IoT module chipset consumption during the quarter, with China, North America and Western Europe accounting for over 75% of the volume. Qualcomm, UNISOC and ASR held the top three positions in the global cellular IoT module chipset market in 1Q22, accounting for nearly 75% of the total shipments. UNISOC, Qualcomm and ASR were top chipset players in China in terms of shipments. For the rest of the world, Qualcomm led, followed by UNISOC and Sequans. 4G (Cat 1 and Cat 1 bis) grew 79% YoY in 1Q22. (Laoyaoba, Counterpoint Research)

Recent news about chip price hikes, chip supply shortfalls, and chip overcapacity are interspersed, triggering a drop in global chip stocks and confusing investors. On the whole, the overall increase in global chip production is sufficient to explain the active expansion plans of TSMC and Samsung Electronics. But despite this, the supply of automotive chips remains tight, with a new report from auto industry data forecasting firm AutoForecast Solutions (AFS) predicting that global automakers will cut production by 3.31M vehicles by the end of 2022 due to a shortage of chips. Meanwhile, memory chips used in smartphones and laptops are showing signs of excess. Analysts at Jefferies Group, a financial services firm, expect the semiconductor industry to face inventory adjustments in 2H22 or early 2023 due to a sharp rise in inflation, slowing end-user demand in areas such as PCs, and companies’ previous stockpiling of components. Earlier in 2022, Richard Gordon, vice president of semiconductors and electronics at Gartner, warned that the semiconductor market has reached its peak and may pull back at any time. (Laoyaoba, UDN, CNYES)

Intel has allegedly informed customers it will raise prices on a majority of its microprocessors and peripheral chip products later 2022, citing rising costs. Intel says the price hikes are required because of the surging costs for production and materials. The percentage increases have not been finalized, and could be different for different types of chips, but are likely to range from a minimal single-digit increase to more than 10-20% in some cases. Suppliers of chip materials such as Shin-Etsu Chemical, Sumco and Showa Denko have all told clients they will increase prices by at least 20%. Doris Hsu, CEO of GlobalWafers, the world’s No. 3 wafer material maker, also recently confirmed it was raising prices for chipmaking customers. (GizChina, Asia Nikkei, NASDAQ)

BYD has a plan to develop proprietary autonomous driving-dedicated chips, according to a local media outlet. The report said this project is led by BYD Semiconductor, which has already delivered its demands to design companies. According to the corporate data provider Qichacha, Yuxi EVE Energy Co., Ltd. was incorporated on 15 Jul 2022 in Yuxi city, Yunan Province, with a business scope that covers battery manufacturing, and sales of NEV battery swapping facilities and NEV production testing equipment. (Laoyaoba, 36Kr, Pandaily, Autonews)

Cadence Design Systems and Tower Semiconductor have announced a collaboration to advance automotive and mobile IC development. Through the collaboration, the companies are developing a new, comprehensive automotive reference design flow using the Cadence Virtuoso Design Platform and Spectre Simulation Platform to provide customers with a faster design cycle, maintaining comprehensive design verification for advanced automotive IC product development.(Laoyaoba, Tower Semiconductor, Cadence, Bloomberg, Seeking Alpha)

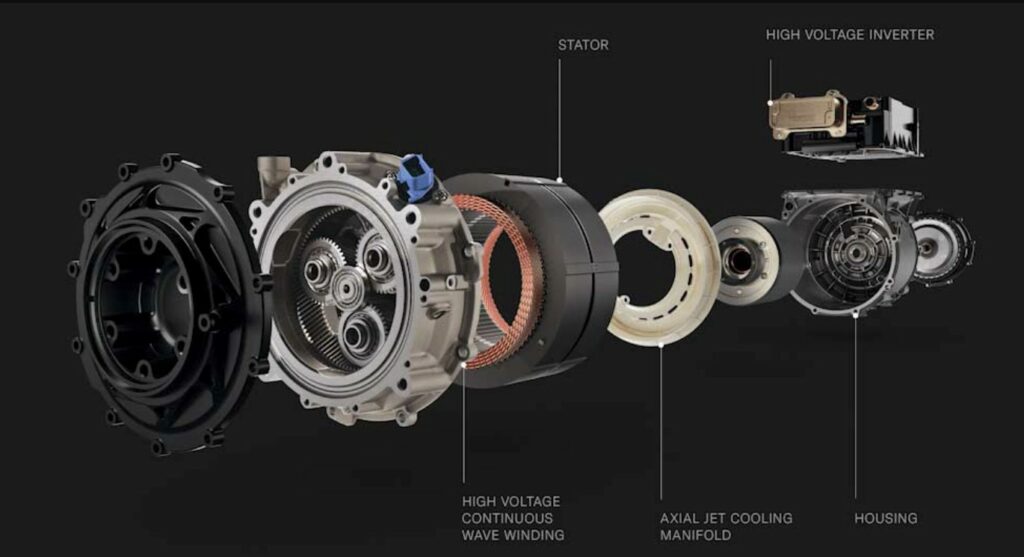

Wolfspeed, the global leader in Silicon Carbide technology, today announced that Lucid Motors deploys its Silicon Carbide power device solutions in the automaker’s high-performance, pure-electric car – the Lucid Air. Wolfspeed and Lucid have a multiyear agreement for Wolfspeed to produce and supply Silicon Carbide devices. Wolfspeed’s Mohawk Valley Fab will be the world’s largest 200mm Silicon Carbide fabrication facility and dramatically expand production capacity for Wolfspeed’s power devices. Wolfspeed’s EAB450M12XM3, the newest edition to its four-member XM3 family, is an automotive-qualified, 1200 V, 450 A SiC half-bridge module. Taking advantage of the low switching losses enjoyed by SiC power devices, the module will provide the driving power for the Lucid Air’s absurdly light 163-lb, 670-hp (500 kW) electric motor.(Laoyaoba, Wolfspeed, EE Power, Yahoo)

Advanced Semiconductor Engineering (ASE), a global leader in packaging and testing, officially started construction of the new second park in Zhongli Industrial Zone, and spent CNY30B to expand new factories and expand advanced packaging and testing capacity. It is expected to be completed and put into production in September 2024. In total, the total investment of ASE Group in the first and second parks of Zhongli Industrial Zone will reach CNY100B, and the production capacity will reach CNY100B. ASE said that the second park will invest CNY10B for plant construction and CNY20B to expand advanced packaging capacity, which is expected to be completed in 3Q24. (Laoyaoba, Yahoo, UDN, TechNews)

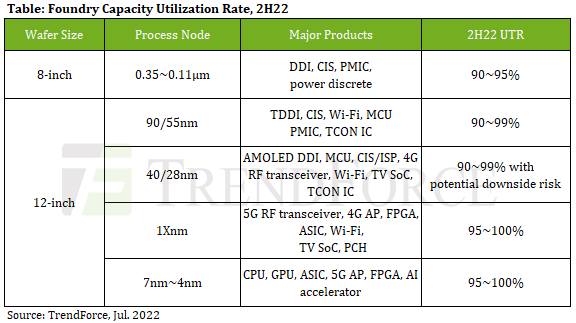

According to TrendForce investigations, foundries have seen a wave of order cancellations with the first of these revisions originating from large-size Driver IC and TDDI, which rely on mainstream 0.1Xμm and 55nm processes, respectively. Although products such as MCU and PMIC were previously in short supply, foundries’ capacity utilization rate remained roughly at full capacity through their adjustment of product mix. However, a recent wave cancellations have emerged for PMIC, CIS, and certain MCU and SoC orders. Although still dominated by consumer applications, foundries are beginning to feel the strain of the copious order cancellations from customers and capacity utilization rate has officially declined. Looking at trends in 2H22, TrendForce indicates, in addition to no relief from the sustained downgrade of driver IC demand, inventory adjustment has begun for smartphones, PCs, and TV-related peripheral components such as SoCs, CIS, and PMICs, and companies are beginning to curtail their wafer input plans with foundries. This phenomenon of order cancellations is occurring simultaneously in 8” and 12” fabs at nodes including 0.1Xμm, 90 / 55nm, and 40 / 28nm. Not even the advanced 7 / 6nm processes are immune. (TrendForce, TrendForce)

SkyWater Technology, the trusted technology realization partner, has announced the Department of Defense (DOD) is funding a USD27M Other Transactional (OT) Agreement Option to further develop intellectual property (IP) for its 90nm Strategic Rad-Hard by Process (RH90) FDSOI technology platform. SkyWater’s RH90 platform is based on MIT Lincoln Laboratory’s 90nm fully depleted silicon-on-insulator (FDSOI) complementary metal-oxide-semiconductor (CMOS) process, which was engineered to produce radiation-hardened (rad-hard) electronics which can withstand harsh radiation environments. (My Drivers, CN Beta, Skywater)

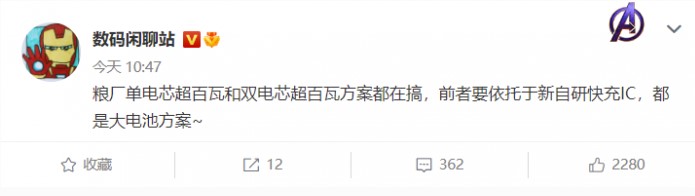

Xiaomi is currently developing solutions for single-cell super-100W and dual-cell super-100W. Super-100W refers to fast charging with higher power than the current 120W, such as 200W and so on. The new single-cell super-100W fast charging mentioned here is mainly based on a new generation of self-developed fast charging ICs, which should be named Surging P2 without any accident. This chip can not only charge faster single-cell fast charge, but also allow super 100W fast charge and larger battery to take into account at the same time.(CN Beta, IT Home)

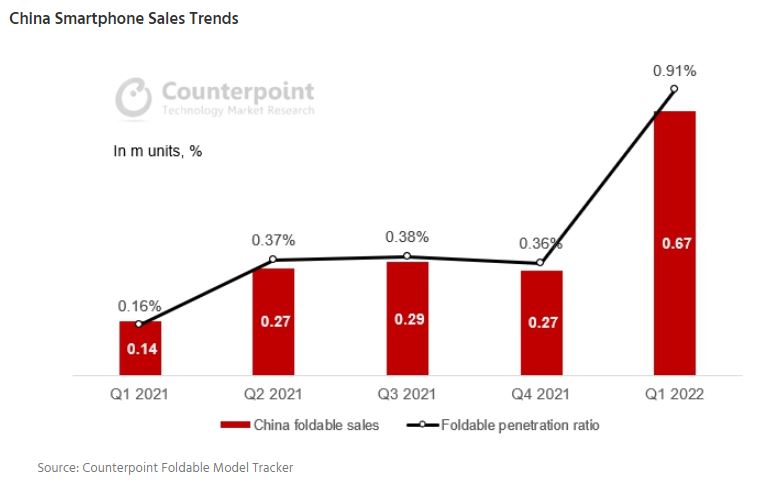

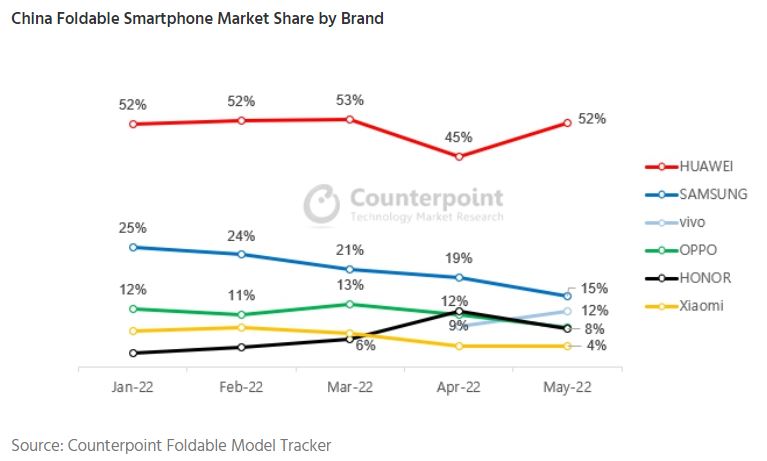

According to Counterpoint Research, the Chinese foldable smartphone market saw a sales volume of 0.67M units in 1Q22 to register 391% YoY and 152% QoQ growth. As foldable sales have maintained their momentum in Apr / May 2022, China’s foldable market is expected to grow 225% YoY to reach 2.7M units in terms of shipments. The Chinese foldable smartphone market’s growth in 2022 will make clear the market’s characteristics, like the preference for domestic brands. The sales volume for the Chinese foldable market for Jan-May 2022 shows Huawei occupying 50% of the foldable sales in China, followed by Samsung with 20%, and OPPO and Xiaomi in third and fourth places, respectively. (Gizmo China, Counterpoint Research)

Samsung is allegedly drastically cutting shipping targets for the Z Fold 5 and Z Flip 5. Samsung seems to have set an overall target of 10M units for the Galaxy Z Fold 5 and Z Flip 5. Of this, only 2M units of the former are expected to be circulated by the company. It is believed that Samsung would be betting bigger on its Galaxy Z Flip 5, and is targeting shipments of 8M units for the phone. In comparison, Samsung has reportedly set a target of 15M units for the upcoming Z Fold 4 and Z Flip 4. (Android Authority, The Elec)

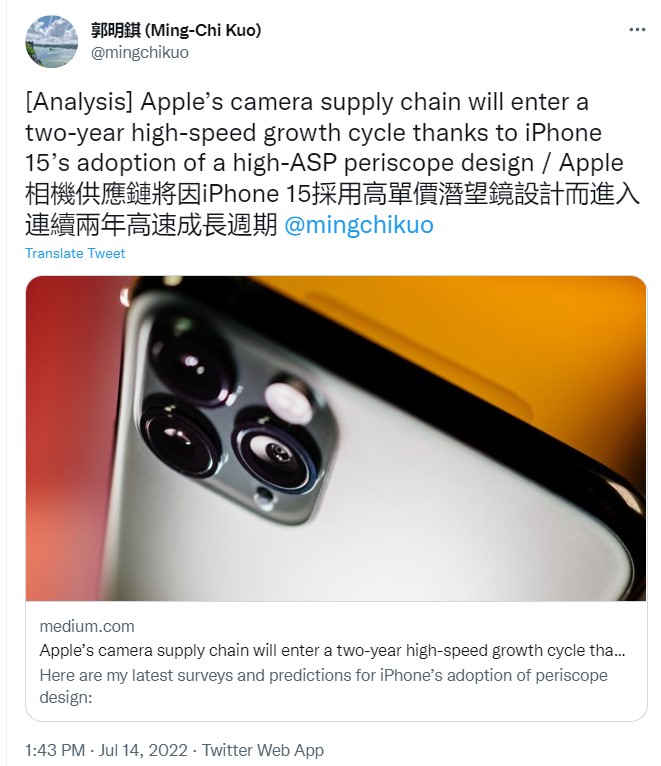

According to TF Securities analyst Ming-chi Kuo, Apple’s new iPhone in 2H23 (iPhone 15 Pro Max) and 2H24 (iPhone 16 Pro / Pro Max) will adopt periscope design, which helps Apple’s camera supply entering 2-year high-speed growth cycle. The main beneficiaries of iPhone’s adoption of periscope are: LG Innotek (VCM and CCM), Cowell (CCM), Jahwa (VCM), Largen (lens), and Lante Optics (prism). Among all components, lens specifications, and business models have changed the most, and output value has grown the most. The complete periscope lens module includes a high-ASP 1G2P lens, two high-ASP prisms, and a lens barrel. The ASP of CCM is very high. If the initial yield is not good, the ASP may even be as high as USD60–70 or more. Periscope lens module ASP may reach USD10–15 (vs. ASP of existing high-end 7P lens is about USD1.5–2). (GSM Arena, GizChina, CN Beta, 9to5Mac, Medium, Twitter)

Samsung Electronics announced the start of trial shipments of the industry’s first Graphics Double Data Rate 6 (GDDR6) DRAM memory chips, providing speeds of 24 Gb/s. In addition, Samsung has also updated slower solutions, providing them with reduced power consumption. The products are manufactured using HKMG (High-K Metal Gate) technology, which was first used in Samsung GDDR6 memory in 2018. Samsung’s new GDDR6 chips deliver approximately 33% faster performance than the previous generation of 18Gb/s solutions. The announced chips production uses a 10 nanometer (1z) class deep ultraviolet (EUV) photolithography process. Samsung’s new GDDR6 chip family will also feature low-power options to help extend laptop battery life.(Sammy Hub, GizChina, CN Beta)

Micron’s Japanese plant at Hiroshima suffered a power outage on 8 Jul 2022. According to TrendForce investigations, this plant’s monthly wafer starts accounts for approximately 30% of Micron’s total monthly wafer starts in 3Q22. In terms of global wafers starts, this plant’s proportion of wafer starts is approximately 7%. The plant’s primary production process is 1Z nm, accounting for more than 50% of capacity, followed by 1Y nm, accounting for nearly 35%. Although machinery initiated the uninterruptible power supply system when the outage occurred, due to the voltage drop, plant machinery required initialization and inspection. The power outage persisted for approximately 5~10 minutes and the effect on production capacity was limited.(TrendForce, TrendForce, The Register, Micron, EE Times)

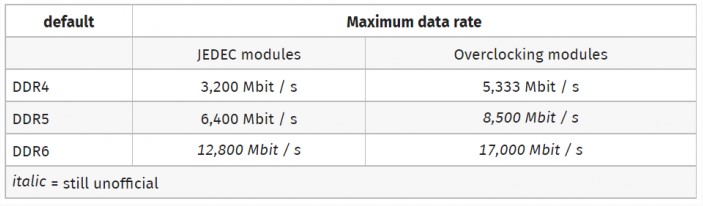

Samsung will begin applying modified Semi-Additive Process (MSAP) package technology in DRAM production starting with double data rate 6 (DDR6) and onward. The previous tenting method only coated areas of the circular copper plate where the circuit patterns will be formed while the other areas were etched out. But in MSAP, the areas besides the circuits are coated and the empty spaces plated, allowing for finer circuits. As the capacity and data processing speed of memory chips increase, packages must be designed to fit that. As the number of layers increases and processes become more sophisticated, the memory package market is also expected to grow exponentially.(GizChina, SamMobile. The Elec, CN Beta)

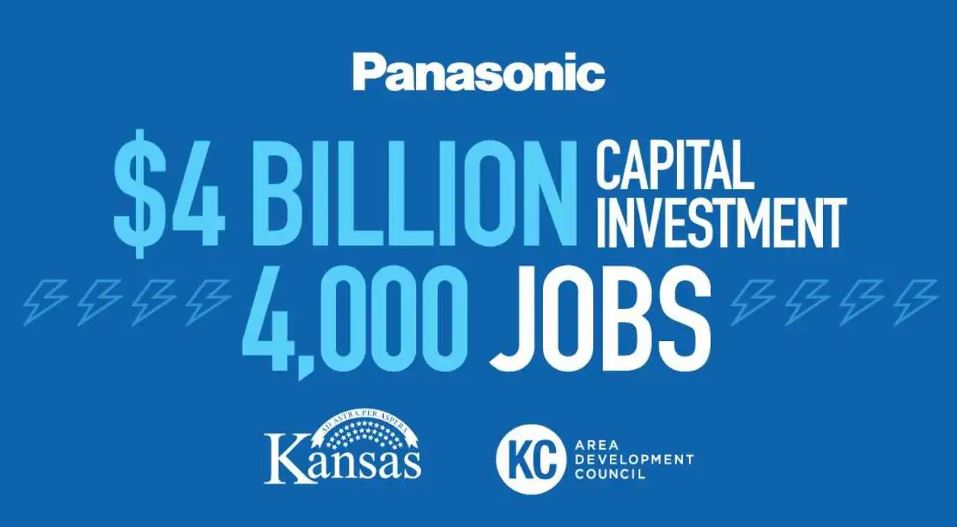

Panasonic will spend USD4B to build a new battery factory in the United States for electric vehicles. Panasonic previously invested in and jointly operates a battery factory with Tesla in Sparks, Nevada, outside of Reno, known as the Gigafactory (or Gigafactory 1). That sprawling facility was slow to achieve profitability due to high defect rates and slower-than-anticipated mass production, Nikkei reported, but it became profitable in 2021. Panasonic aims to begin producing a high-capacity battery for Tesla in early 2024. Those batteries are expected to increase energy capacity fivefold, which could boost range by more than 15% and cut production costs. Panasonic said its advanced battery technology will improve EV range and that scaling its operations will lower the cost to produce EVs.(CN Beta, TechCrunch, CNBC, InsideEVs, Asia Nikkei)

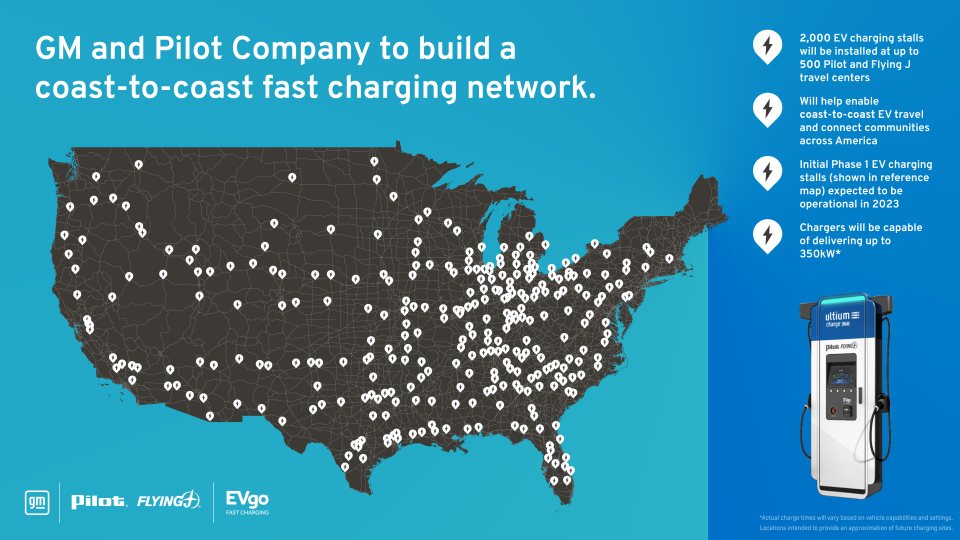

General Motors (GM) is collaborating with the Pilot Company (the petroleum company that runs the Pilot Flying J chain of truck stops and gas stations in the US) to set up a network of EV rapid chargers spread around America’s highways. The goal is to promote the purchase of EVs by making it easier to drive one from coast to coast, thus making EVs seem like a more viable alternative to gas-burning vehicles. They plan to install some 2,000 charging stalls powered by EVgo eXtend, but they will also be co-branded with Pilot Flying J and Ultium Charge 360, spread among 500 Pilot Flying J locations. The plan is to put these chargers at 50-mile intervals, and all these locations will have additional amenities like free in Wi-Fi, lounge areas, on-site restaurants and shops that provide travel essentials and souvenirs.(Engadget, PR Newswire, InsideEVs, Yahoo)

Ola Electric CEO Bhavish Aggarwal has disclosed that the company is developing its own battery cell, and there will be more in the future. Ola cells might be comparable to those used in its current Ola S1 Pro e-scooter. Notably, the Ola S1 Pro now has a 3.97 kWh battery, which, according to the company, enables the scooter to travel 180 km on a single charge. Currently, LG Chem Korea is the supplier of the 3.97kWh battery pack used by Ola Electric. The 224 cell components in this battery pack are NMC cells (Lithium-Nickel-Manganese-Cobalt-oxide). This is done in two cell sets totaling 112 units. Additional parts, including connecting buses and a variety of sensors to measure, analyze, and carry out various operations, are also included in the full battery pack.(Gizmo China, India Times, 91Mobiles, Twitter)