7-23 #SoulSucking : Samsung is considering investing around USD200B in new semiconductor plants in the Austin area; Apple is allegedly testing a 9” foldable OLED display; SK Hynix has indefinitely postponed plans for a KRW4.3T expansion of a memory chip plant; etc.

Samsung is considering investing around USD200B in new semiconductor plants in the Austin area. Samsung has filed 11 applications in Texas, where it is seeking tax breaks potentially amounting to USD4.8B for the construction of the chip factories, if all applications are approved. Two factories will apparently be built in the Austin area, where Samsung may invest USD24.5B in the project that could potentially create 1,800 jobs. The rest of the plants could rise in Taylor with a potential investment of about USD167.6B. Those projects could employ around 8,200 individuals.(Android Central, Austin Business Journal)

Samsung Electronics has announced that it has started initial production of its 3nm process node applying Gate-All-Around (GAA) transistor architecture. Samsung plans to conduct its first 3nm GAA chipset shipment ceremony. The company would debut the new chip architecture tech at its production facility located in Hwangseong, Gyeonggi Province. As for smartphone chipsets, Samsung may use its 3nm GAA technology to mass produce the upcoming Exynos 2300. The SoC may be used in the upcoming Galaxy S23 series, and possibly a variant of that could be used by Google for its third-generation Tensor chip for the Pixel 8 family.(CN Beta, Samsung, Tech Times, Android Headlines, WCCFTech, Business Korea)

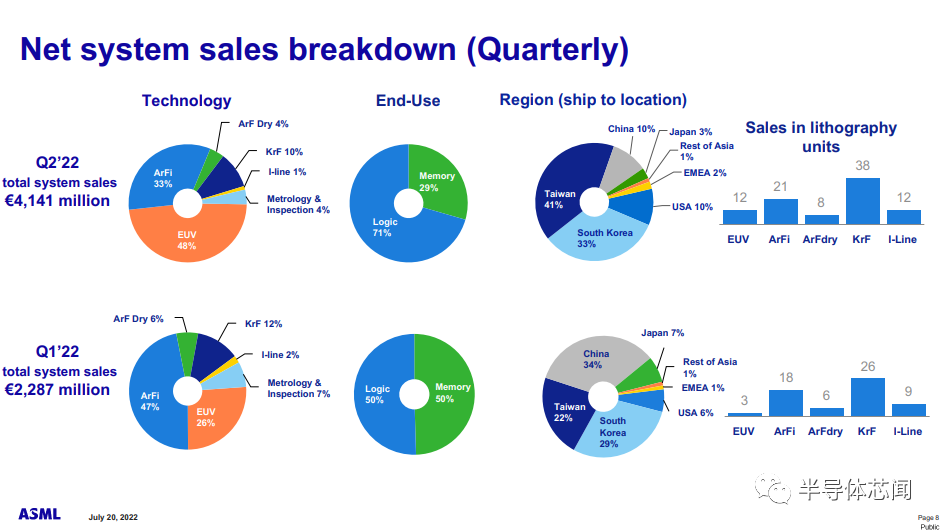

Top European chip equipment supplier ASML has warned that the world’s semiconductor supply chain will face disruptions if the U.S. forces the company to stop selling its mainstream equipment to China. The US proposes restrictions in which ASML will not be able to sell their mainstream Deep Ultraviolet (DUV) lithography tools to China as well. ASML’s shipments to Taiwan made up 41% of its total sales in the second quarter, while South Korea accounted for 33%, leaving mainland China in third place. China was the largest buyer of semiconductor equipment in 2021 for the second consecutive year, with spending surging as much as 58% to USD29.62B. China’s two top chipmakers, SMIC and Hua Hong Semiconductor, together control about 10% of the global market in the contract chipmaking sector. (Laoyaoba, Asia Nikkei, SCMP, TechTimes)

ByteDance has confirmed that it is considering to design and develop chips for its own development needs, but not for sale to third party. ByteDance will develop customized chips to handle video platforms, information and entertainment applications. (Laoyaoba, Sina, OfWeek, 163)

Qorvo, a leading provider of innovative RF solutions that connect the world, has announced it has completed MFi certification of interoperability for its Ultra-Wideband (UWB) solutions with the Apple U1 chip used in supported iPhone and Apple Watch models. Qorvo UWB solutions comply with the Nearby Interaction accessory protocol and allow developers to easily design new commercial UWB-enabled accessories that leverage the advanced location, direction and distance capabilities of U1-equipped iPhone or Apple Watch models.(The Verge, MacRumors, Qorvo)

In an effort to avoid supply chain shortages, Apple has continued diversifying the suppliers for its next iPhone. TF Securities analyst Ming-Chi Kuo stated that SG Micro’s components passed quality certification for the higher end iPhone 14 models. He notes that SG Micro will likely ship power management integrated circuitry (PMIC) for the iPhone 14 in 2H22. This would be the first time SG Micro would supply components for Apple’s higher-end iPhones. Kuo anticipates that Apple will continue to partner with SG Micro to avoid future supply chain risks. (Phone Arena, Apple Insider, Twitter)

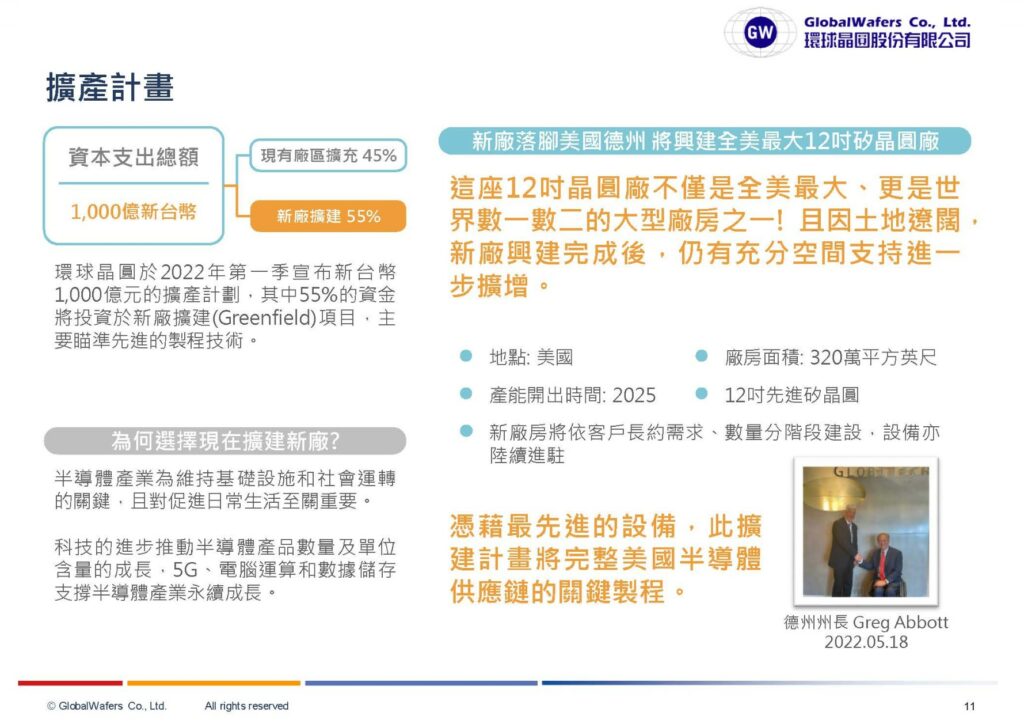

Silicon wafer supplier GlobalWafers continues to see strong demand from its chipmaking customers who have yet to revise their LTA contracts, according to company chairperson Doris Hsu. Currently, the inventory adjustment of 6” silicon wafer customers is indeed under great pressure, but the demand for 8” and 12” silicon wafers is still healthy, and the inventory is still healthy according to long-term production and delivery. She has emphasized that the semiconductor industry has spent 60 years and its output value has exceeded CNY500B, but it is estimated that by 2030, the output value will exceed USD1T, which will be achieved in only 10 years, and the growth rate is quite amazing. She cited the advanced process as an example. The mass production of 2H22 3nm will be advanced to 1.4nm by 2030, and the production capacity of other processes will also expand rapidly. The density of transistors per square millimeter of silicon wafer area will exceed 1B, and The production capacity of other processes will continue to expand, and the demand for 12” will continue to expand. This is also the key for factories to actively sign long-term contracts in order to ensure output. (Laoyaoba, UDN, UDN, CNYES, Vocus, Digitimes)

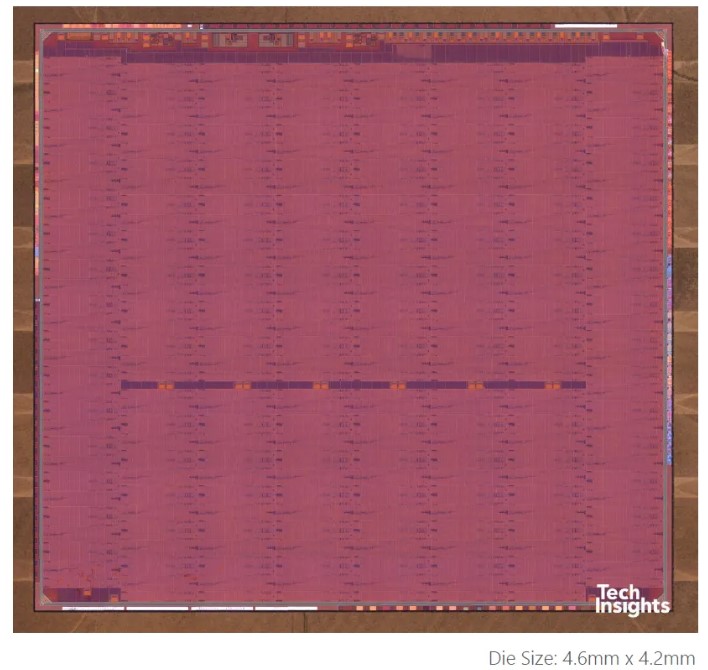

According to TechInsights, Chinese foundry SMIC has been producing chips based on its 7nm process node for a Bitcoin Miner SoC, and they have been shipping since Jul of 2021. TechInsights has reverse-engineered the chip, saying the “initial images suggest it is a close copy of TSMC 7nm process technology”, a telling discovery after TSMC has sued SMIC twice in the past for copying its tech. The discovery comes as China continues to build out its own homegrown semiconductor production, with the heavily-sanctioned SMIC leading the way. Meanwhile, the US government is on the cusp of approving large subsidies for US-based chipmakers. The TechInsights report says that TSMC, Intel, and Samsung have all developed much more sophisticated technology than SMIC’s 7nm and are at least two nodes ahead. (Phone Arena, TechInsights, Tom’s Hardware, SemiAnalysis)

TF Securities Ming-Chi Kuo has revealed that Apple is testing a 9” foldable OLED display with the PPI (unit pixel density) between iPhone and iPad, but the rumored foldable iPhone will not be available until 2025 or later. The device is only used to evaluate and verify Apple’s key technology in foldable, and does not represent the specifications of any final retail product. He believes that Apple’s foldable product development will initially focus on medium-sized devices, then launch larger-screen devices, and finally expand to small devices like the iPhone. (UDN, Mashdigi, iPhone Wired, RM)

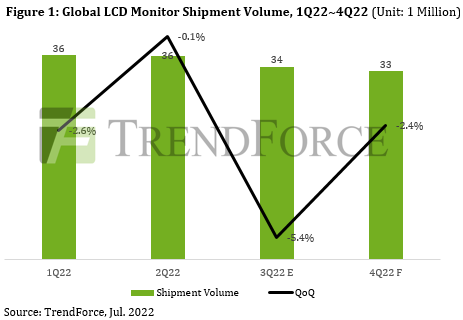

According to TrendForce, global LCD monitor shipments reached 72.3M units in 1H22, a level on par with to the same period in 2021. Certain whole devices orders in 4Q21 were deferred to 1Q22 due to logistics and transportation issues. In addition, some brands felt optimistic regarding the outlook for 2022, so they initiated aggressive promotions to stimulate sales in 1Q22. Although the Russian-Ukrainian war and rising inflation have seriously impacted demand in the European consumer market since Q2, demand for business models is still positive, which in turn bridges the gap left by the consumer market. Looking forward to LCD monitor market trends in 2H22, TrendForce indicates, since most orders for business models had been digested by the end of 2Q22, coupled with the sluggishness of new orders, overall business demand momentum has not been as good as in 1H22. Consumer models are affected by rising inflation and interest rate hikes in the United States and market consumption continues in lethargy. LCD monitor shipments are expected to decrease by 5.4% and 2.4% QoQ in 3Q22 and 4Q22, respectively. The proportion of shipments in 1H / 2H22 will fall at approximately 51.7: 48.3. (Laoyaoba, TrendForce, TrendForce)

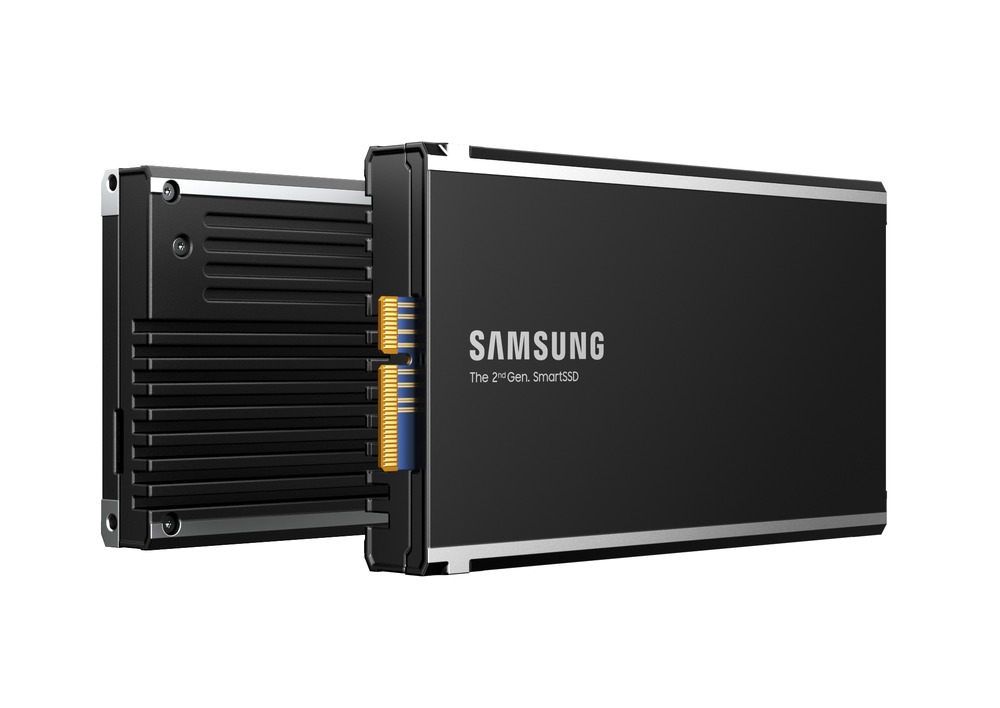

Samsung Electronics has developed a second generation of its computational solid-state drive (SSD), which features improved system performance and much higher energy efficiency. The new SmartSSD jointly developed with AMD has more than doubled the computational performance compared to its predecessor released in 2020. Compared to conventional data center SSD, the new version can slash processing time for scan-heavy database queries by over 50%, energy consumption by up to 70% and CPU utilization by up to 97%.(CN Beta, Samsung, Samsung, Pulse News, Tom’s Hardware)

South Korean chipmaker SK Hynix has indefinitely postponed plans for a KRW4.3T (USD3.3B) expansion of a memory chip plant, amid rising costs and concerns about a protracted slump in demand. It was slated to break ground on the new 430,000-sq.-meter M17 fabrication facility at its Cheongju campus in 2023, with production to begin in 2025. SK Hynix makes NAND flash memory at the Cheongju site, and the planned factory had been expected to mass-produce advanced memory chips. The move also comes amid increasing costs for equipment and materials. Prices are rising for chipmaking equipment, exacerbated by the dollar strengthening to a 13-year high against the won, which inflates SK Hynix’s expenses further as purchases are typically negotiated in dollars. The company joins other major chipmakers that are adjusting their spending plans in light of worsening conditions. (CN Beta, KED Global, YNA, Asia Nikkei)

NOR flash memory prices are poised to drop 10-15% in 3Q22, as China-based suppliers scale up their output and offer more competitive prices, according to Digitimes. The price of NOR Flash, which has been rising continuously since 2H20, stopped rising in 2Q22, and started to decline in 3Q22. The price of 512Mb, 1Gb, 2Gb high-density NOR Flash with relatively stable prices in 1H22 will also decrease. (Digitimes, Laoyaoba, Digitimes)

Samsung SDI has broken ground on a new KRW1.7T (USD1.3B) battery factory in Malaysia to make cylindrical batteries. Samsung invests the KRW1.7T in stages in the factory in the region of Seremban until its completion in 2025. The factory is expected to begin producing cylindrical batteries starting 2024. The batteries are expected to be used for various applications ranging from power tools and micro-mobility to electric vehicles (EVs). The factory will be Samsung SDI’s second in Malaysia, with the first making cylindrical batteries for EV customers.(CN Beta, Reuters, Bloomberg, Malay Mail, The Star)

BYD’s new power battery project with an annual output of 12GWh. The total investment of the project is CNY7B, and the annual investment is CNY2.1B. It covers an area of 1,000 mu and has a total construction area of about 600,000 square meters. It mainly builds new power battery CELL, PACK production lines and their supporting parts. After completion, a new power battery will be formed. With a production capacity of about 12GWh, it will provide high-quality power batteries for BYD’s new energy passenger vehicles and external vehicle manufacturers. In 1H22, the project completed an investment of CNY1.45B, 69% of the annual planned investment. At present, the first phase has been completed, and equipment installation and commissioning has begun.(Laoyaoba, 163, IT Home)

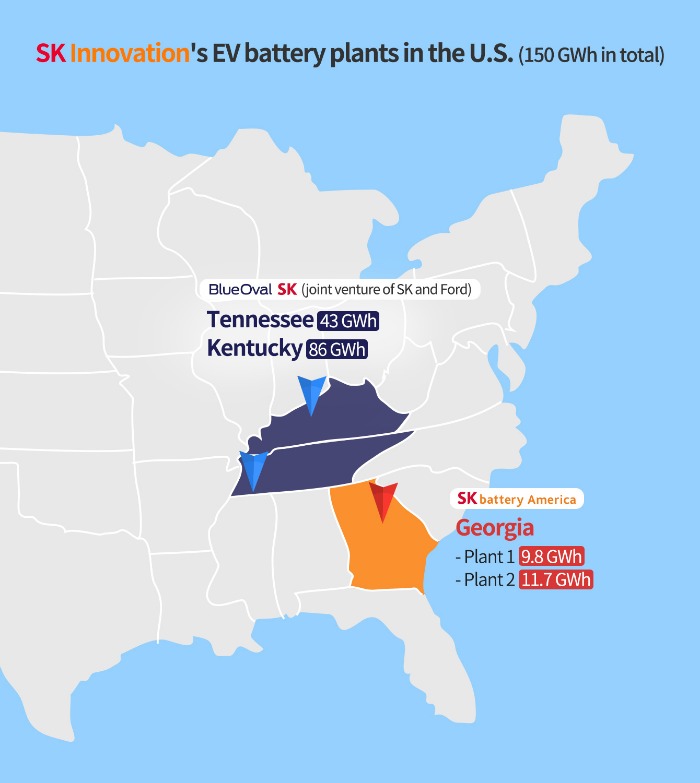

LG Energy Solution, SK Innovation, and other South Korean companies are poised to strengthen their business ties with Michigan-based Ford Motor in an effort to cement their footholds in North America. LG Energy Solution has announced it will increase its supply of battery packs to Ford, on the back of increased sales of the company’s popular electric vehicle Mustang Mach-E and commercial electric car E-Transit. The mineral procurement arm of LG Corp will double its capacity at the Poland-based battery pack production facility for Ford by 2023. The company is planning to gradually increase the output further. While the company refrained from announcing the size of the expansion, industry insiders estimate it to be by around 30 GWh per year. The plant’s mass production capacity currently stands at 70 GWh. LG Energy Solution has been supplying battery packs for Ford’s Mustang Mach-E and E-Transit since 2H20.(CN Beta, Korea Herald, KED Global, Korea Times)

Contemporary Amperex Technology Co Ltd (CATL) chief scientist Wu Kai has revealed that CATL has already put the M3P batteries into volume production and plans to put them into the market in 2023. The M3P battery is developed based on CATL’s new type of materials system. It features a higher energy density than that of the LFP battery, but lower cost compared to the ternary-lithium battery. CATL previously revealed in an investigation report that the M3P was not exactly the lithium manganese iron phosphate (“LMFP”) battery, but it also contains other metallic elements. The company would like to call it a ternary lithium battery of the phosphate chemistry system. LMFP batteries have a theoretical energy density that is 15-20% percent higher than LFP batteries, but at a similar price point. For 1H22, CATL still ranked highest among battery makers in China with a power battery installed capacity of 52.5GWh, accounting for 47.67% of China’s total volume, according to the data by the China Automotive Power Battery Industry Innovation Alliance (CAPBIIA).(Laoyaoba, My Drivers, Sina, Electrek, Auto News)

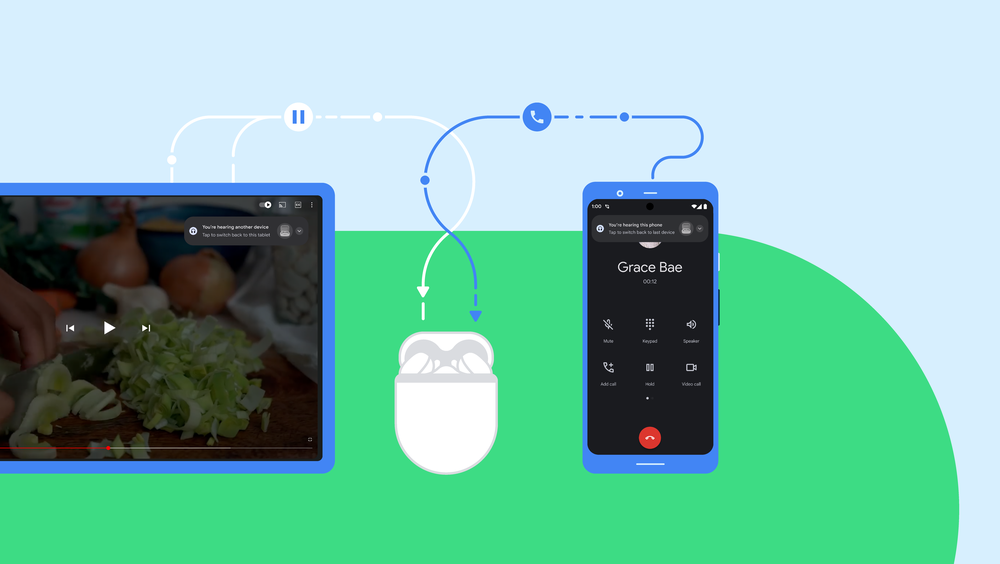

Google has announced new audio switching technology built on its Fast Pair feature. This will automatically switch your Bluetooth headphones to a different device in some scenarios. The feature is available on the Pixel Buds Pro, with some Sony and JBL headphones getting it soon. The company adds that a notification will appear on the second device after switching to it, allowing you to switch back to the original device with one tap. Google further states that headphones with audio switching and multi-point support can connect to two Bluetooth devices at a time.(IT Home, GizChina, Android Authority, Google)

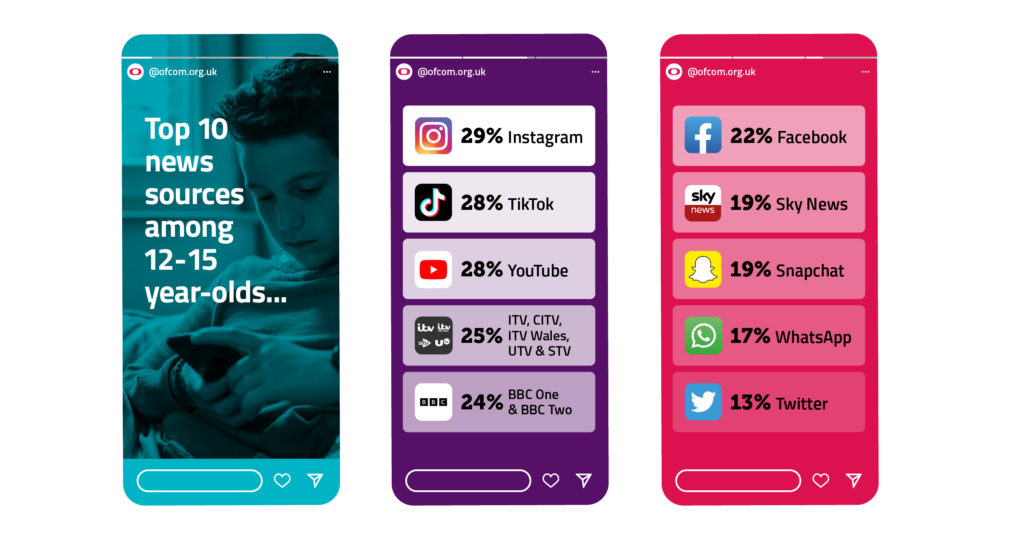

Teenagers in the UK are turning away from traditional news channels and are instead looking to Instagram, TikTok and YouTube to keep up to date, Ofcom has found. Ofcom’s News consumption in the UK 2021/22 report shows that, for the first time, Instagram is the most popular news source among teenagers used by nearly 3 in 10 in 2022 (29%). TikTok and YouTube follow closely behind, used by 28% of youngsters to follow news. Conversely, TikTok has seen the largest increase in use of any news source between 2020 and 2022 – from 0.8M UK adults in 2020 (1%), increasing to 3.9M UK adults in 2022 (7%).3 This brings it onto a par with Sky News’ website and app. TikTok’s growth is primarily driven by younger age groups, with half of its news users aged 16 to 24. Users of TikTok for news claim to get more of their news on the platform from ‘other people they follow’ (44%) than ‘news organisations’ (24%). (OfCom, report, CN Beta)

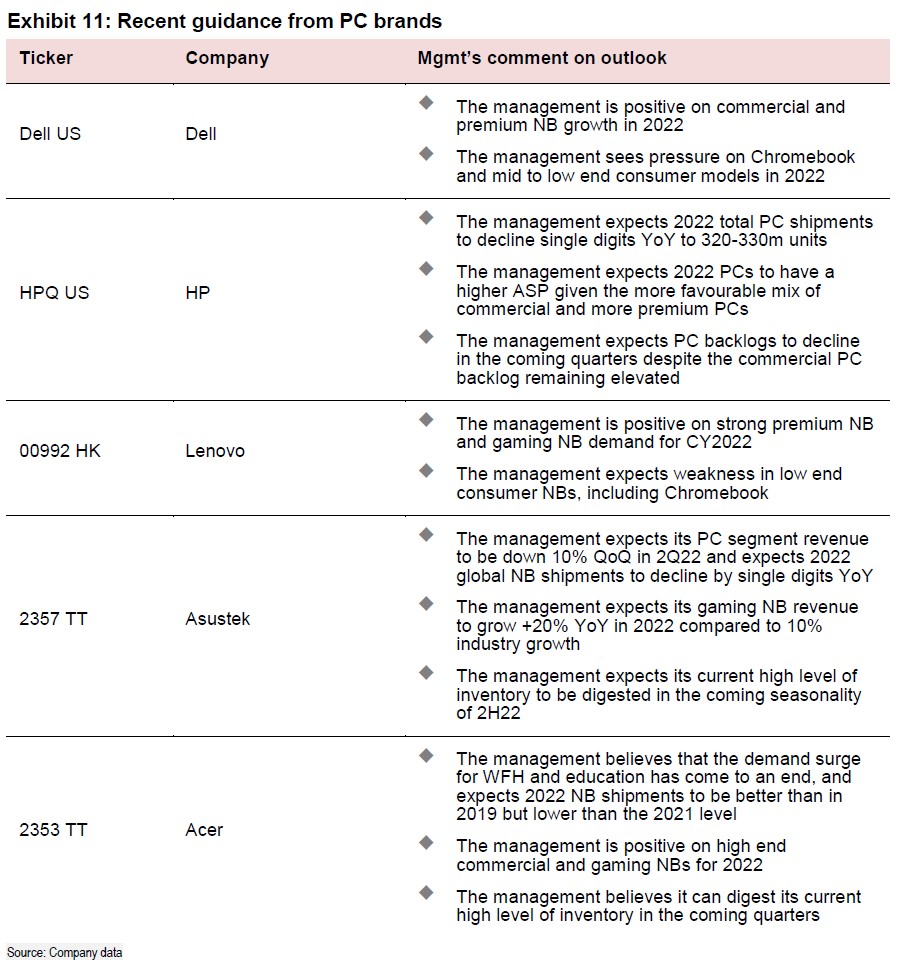

PC vendors have mostly been seeing weaker consumer and Chromebook demand since early-2Q22, with unclear visibility into 2H22. Some of the PC brands remain positive on gaming and commercial demand. Overall, the PC brands expect a single digit decline in overall notebook (NB) shipments in 2022e, with a better product mix, while HSBC Research forecast for shipments is more bearish. Specifically, they expect Acer to see the biggest decline in shipments among the major PC brands, as they note that it has been seeing weaker demand from Europe and America since early-2Q22, coupled with expected continued inventory digestion into 3Q22. HP is another company that might see a greater decline in shipments, based on their estimate, due to Chromebook (18% of HP’s total shipments in 2021, according to IDC) and consumer demand weakness. On the other hand, they are expecting a smaller decline in shipments for Apple supported by new M2 Macbook release and ramp-up in 2H22. (HSBC report)

Ford is reportedly planning to cut up to 8,000 jobs over the coming weeks in an effort to fund its plans to build EVs. The layoffs would occur at its Ford Blue unit, recently created to develop vehicles with internal combustion engines (ICE), and would affect other salaried positions in the company. The bulk of cuts are expected to occur in the US. In Mar 2022, Ford CEO Jim Farley restructured the company, dividing it into the Ford Blue and Model E divisions, with the latter dedicated to electric cars and pickups like the Mach E and F150 Lightning. As part of that, he announced plans to cut USD3B in costs by 2026, with the aim of transforming Ford Blue into “the profit and cash engine” for the entire company. (Engadget, Bloomberg, Yahoo)

Arcfox has announced that its alphaS (or αS) electric car is the first model to run on the Huawei Inside full smart car solution platform. The Huawei Inside will run the alphaS’ array of sensors while the cabin runs on Huawei’s HarmonyOS. The alphaS will be available in China with a starting price of about CNY397,000 (USD59,000). Arcfox is owned by BAIC and will hope to drive its sales using the home-grown Huawei Inside and HarmonyOS technologies.(Gizmo China, Sina, My Drivers)

iFLYTEK has revealed that the company’s automotive intelligent product cooperation has covered more than 90% of China’s mainstream independent brands and joint venture brand car manufacturers, including BYD, NIO, Ideal, Gaohe, Weimar, Leapmotor and other new energy vehicle manufacturers. In addition to empowering OEMs, iFLYTEK’s products also continue to play a role in the field of intelligent transportation. Among them, vehicle exhaust emissions are one of the typical scenarios of carbon emissions.(Laoyaoba, Sohu)

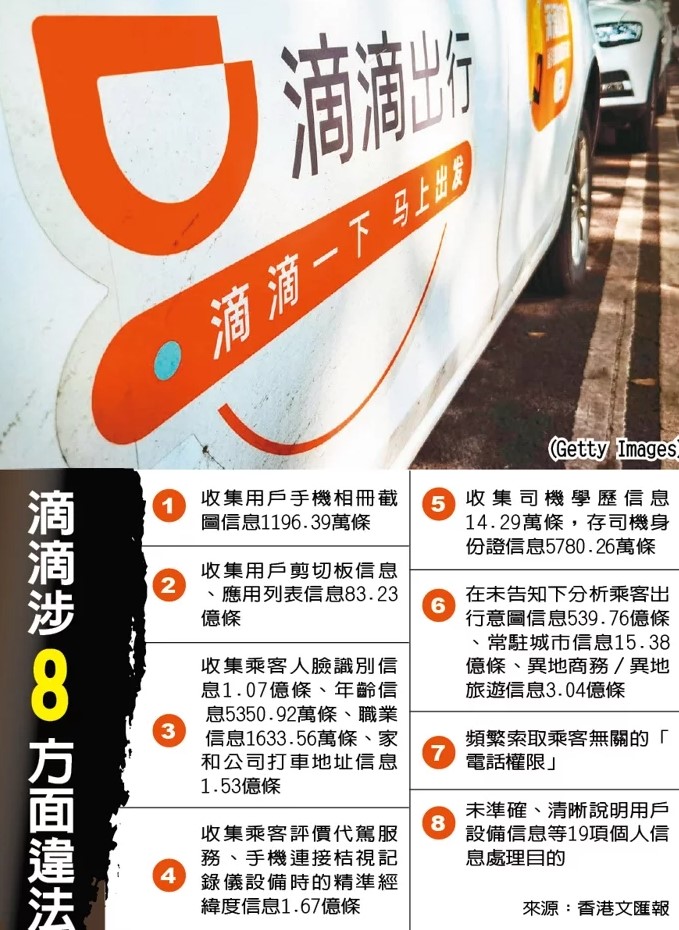

The Cyberspace Administration of China has said it would fine Didi CNYY8.026B (USD1.19B) after deciding the company violated China’s network security law, data security law and personal information protection law. Didi has said it has accepted the cybersecurity regulators decision. The cybersecurity authority’s announcement did not say whether the fine meant that Didi would soon be able to add new users or restore its presence on app stores in China. (Sina, TechCrunch, WSJ, Reuters, Live Mint, Washington Post, CNBC, CAC, RFA, Sohu)

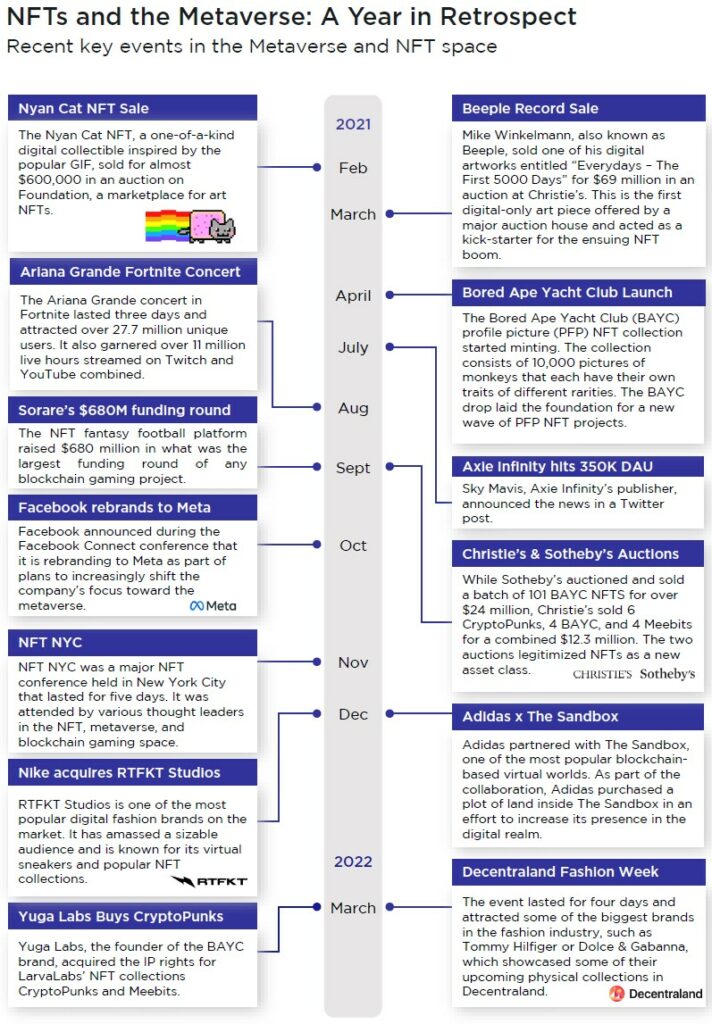

Consumers spend increasingly more time in virtual worlds, and successful brands follow them. As a result, consumer-facing companies will be forced to develop a metaverse strategy to stay connected with their (future) customers and remain relevant. Since there is no single “right” approach to tackling the metaverse, different brands have approached it in distinct ways. Now, these can range from IP activations inside virtual worlds and acquiring virtual land NFTs to outright M&As. (Newzoo report)

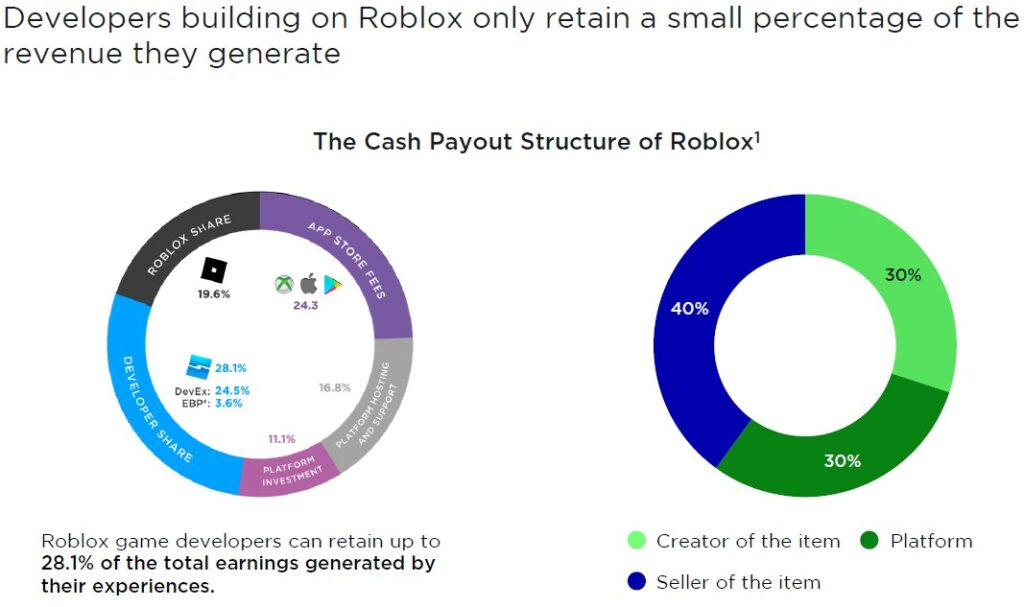

As opposed to traditional distribution platforms like Steam and Google Play, which feature a standard 30% cut on all game or in-app purchases for most developers, Roblox takes a much higher fee—close to 75%—from game developers building on its platform. This is substantial, even when compared to Meta announcing a 47.5% take rate for Horizon Worlds, a move that generated ample community backlash. However, part of the difference between Roblox and traditional digital storefronts can be explained by the various advantages associated with building games on Roblox, such as the large user base (53.1M DAU) and the already existing game engine—Roblox Studio—that game developers can tap into. Compared to traditional games, creating Roblox experiences is much more accessible in terms of both manpower and development time. (Newzoo report)