7-26 #Durian : Samsung has celebrated the first shipment of 3nm GAA chips; Intel and MediaTek have announced a strategic partnership; U.S. Energy Department intends to loan a joint venture of General Motors and LG Energy Solution USD2.5B; etc.

Amid India’s efforts to build a local semiconductor supply chain, a Taiwanese delegation, with members including semiconductor manufacturers, is reportedly planning to visit India for semiconductor cooperation. After the Indian side visited Taiwan twice in 2021 to discuss semiconductor cooperation, a Taiwanese delegation, including TSMC and UMC, will visit India, perhaps in the coming weeks. The Indian side has identified locations for manufacturing units with adequate land, semiconductor-grade water, and high-quality power supply. India will also provide financial support of up to 50% of project costs. India announced an INR760B (USD10B) semiconductor and display fab investment incentive plan in December 2021. It has won support from multinationals such as ISMC, IGSS Ventures, and Foxconn, with ISMC and IGSS Ventures choosing to set up their fabs in southern India. Still, India decided to extend the application period indefinitely for the USD10B plan for potential investments from TSMC, Intel, and Samsung Electronics in the future. (Laoyaoba, Digitimes, Daily Clipper, Hindustan Times, Digitimes)

Volvo CEO Jim Rowan has indicated that after a rough couple of years, automotive semiconductor chip supplies are finally catching up with demand. Volvo Cars has that it has seen a “marked improvement in the stabilization of its supply chain with production making a strong comeback in Jun 2022”. While improvement at a single, relatively small automaker does not indicate an industry-wide recovery, there is evidence that the supply of automotive-grade chips may rebound. Volvo Cars has seen enhanced demand for its Recharge line of plug-in hybrids and electric vehicles, Rowan added. The firm is pushing to go full-electric by the end of the decade.(Laoyaoba, CNBC, The Drive)

Honda Motor has said that it would slash production by up to 30% in Japan next month against original plans due to persistent supply chain and logistical issues. Two lines at its Suzuka plant in western Japan will reduce production by about 10% in Jul 2022 and by about 30% in early Aug 2022 versus previous plans. Its assembly plant in Saitama prefecture, north of Tokyo, will also cut back production by about 10% early Sept 2022. (Laoyaoba, Sina, Business Recorder, Auto Blog, Reuters)

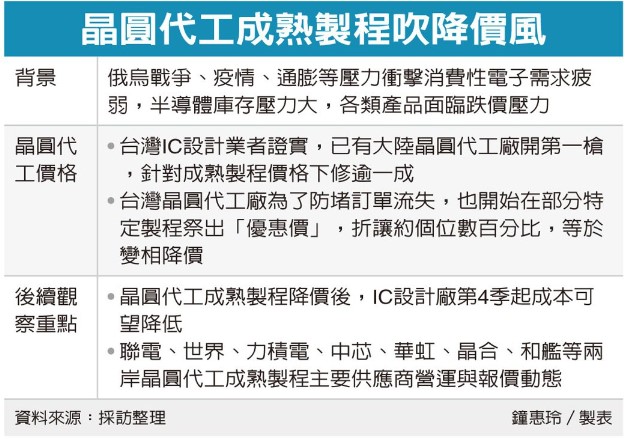

The production capacity of the mature wafer foundry process is loose, and the tide of price cuts is coming. It is rumored that the mainland wafer foundry has fired the first shot, and the price has dropped by more than 10% recently. In order to prevent the loss of orders, the Taiwan wafer foundry has begun to offer “preferential prices” on some specific processes, with a discount of about a single-digit percentage. It is like a price cut in disguise. The mainland wafer foundry mature process index factories include SMIC, Hua Hong Semiconductor, Jinghe, Hejian Technology, etc.; Taiwan is dominated by UMC, VIS, and Powerchip. As the price begins to fall, it affects the follow-up operations of the relevant industry. (UDN)

It is rumored that Intel’s products will generally increase prices, up to 20%. A letter to customers from Intel’s PSG (Programmable Solutions Group) has flowed out, confirming that a number of FPGA products are about to increase in price. The letter stated that due to the increase in supply chain costs and the continued high demand in the industry, the prices of some Intel PSG products will increase from 9 Oct 2022, and new prices will be implemented for products shipped after that, of which the new prices will increase by 10%, 20% price increase for old models. (CN Beta, My Drivers)

Samsung Electronics has celebrated the first shipment of 3nm GAA chips, a milestone for the world’s top memory chipmaker trying to keep its lead in chip supremacy amid intensifying competition. Its 3nm chip built on gate-all-around (GAA) transistor technology enables up to 45% increased power efficiency and 23% higher performance compared with its 5nm process on FinFET technology, according to Samsung Electronics. Samsung Electronics is producing the 3nm chip on next-generation technology at V1 line, built exclusively for employing the extreme ultraviolet (EUV) lithography, at its Pyeongtaek complex, the world`s largest semiconductor facility located about 70km south of Seoul.(Laoyaoba, CN Beta, Samsung, Pulse News)

Intel and MediaTek have announced a strategic partnership to manufacture chips using Intel Foundry Services’ (IFS) advanced process technologies. The agreement is designed to help MediaTek build a more balanced, resilient supply chain through the addition of a new foundry partner with significant capacity in the United States and Europe. MediaTek plans to use Intel process technologies to manufacture multiple chips for a range of smart edge devices. Intel is likely to produce chips for medical devices, industrial computing, and much more for MediaTek.(Neowin, Intel, Engadget, CN Beta, My Drivers)

Display making is a volatile industry, affected by even slight changes in demand for consumer electronics. Tired of this constant buffeting, panel makers are making forays into the chip industry in search of more stable growth. Innolux, AUO, and BOE Technology Group and China Star Optoelectronics Technology (CSOT) have all formed teams tasked with applying their panel production technologies to chip packaging and assembly. Chip packaging is the final step in making chips before they are mounted onto printed circuit boards and assembled into electronic devices. The technological threshold for chip packaging is lower than for manufacturing the chips themselves. Display makers are not alone in their efforts. Some of their most important suppliers, including Corning of the U.S. and Japan’s Asahi Glass, are investing resources to develop glass carriers, or substrates, for use in advanced chip packaging techniques. (Asia Nikkei, Laoyaoba)

The recent high global inflation has slowed down the device demand, and the panel industry has also been affected. It is reported that Innolux and AUO continue to control production capacity, and Innolux even encourages employees to take more vacations when adjusting production capacity. The continued weakening of panel prices is a key factor for panel manufacturers to adjust their production capacity. Except that most TV panel prices have reached the cash cost price, monitor and notebook panel prices have also continued to weaken. The overall monthly price decline has begun to converge, and the strategic benefits of each factory have gradually emerged. (CNYES, Laoyaoba)

According to Industry Minister Ryad Mezzour, Morocco is negotiating with electric vehicle battery manufacturers to set up a plant in the country to mesh with its existing automotive sector and cobalt output. The planned factory for EV batteries will “offer a huge momentum for the local automotive sector” and will benefit from the availability of renewable energy and raw materials such as cobalt and phosphates in the country. Demand for such batteries is growing outside and within Morocco, where Citroen plans to double its production capacity within 2 years from 50,000 supermini electric cars. Morocco is home to production plants of Renault and Stellantis with a combined production capacity of 700,000. He has revealed that they are targeting 1M within next 3-4 years. (CN Beta, Reuters)

The U.S. Energy Department has announced it intends to loan a joint venture of General Motors and LG Energy Solution USD2.5B to help finance construction of new lithium-ion battery cell manufacturing facilities. The conditional commitment for the loan to Ultium Cells for facilities in Ohio, Tennessee, and Michigan is expected to close in the coming months and comes from the government’s Advanced Technology Vehicles Manufacturing (ATVM) loan program, which has not funded a new loan since 2010. GM and LG have plans to invest more than USD7B to jointly build 3 battery plants. Production at the Ohio factory is expected to begin in Aug 2022. In Tennessee, production is scheduled for late 2023, and in Michigan for 2024. (TechCrunch, Reuters, CN Beta)

Samsung is reportedly sourcing the battery packs for the Galaxy Z Fold 4 and Galaxy Z Flip 4 from three different suppliers. The company’s in-house firm Samsung SDI is understandably one of them. Additionally, it is also shipping the new foldables with batteries from its compatriot LG Energy Solution and Chinese firm Amperex Technology Limited (ATL). This would also be the first time a Samsung smartphone would be using batteries made by 3 different companies. Samsung is diversifying the supply chain to lower manufacturing costs. (Android Headlines, The Elec)

Sono Motors, the Munich-based startup debuts the world’s first affordable solar electric vehicle (SEV), the Sion, in its production design, and the unveiling of its novel ‘Solar Bus Kit’, a scalable B2B retrofit solution that reduces fuel consumption and inner-city greenhouse gas emissions, thereby contributing to climate protection. Through an integration of proprietary solar panels into the exterior of its flagship Sion SEV, it can gather an additional 70 to 150 miles of range per week from the sun alone. Sono Motors is currently building out its fleet of series-validation solar EVs at Bertradt near its Munich HQ. Solar Bus Kit is a complete retrofit solar solution that can fit most twelve meter public transport buses in Europe to help reduce diesel consumption and CO2 emissions. (CN Beta, Sono Motors, Electrive, Globe Newswire)

Redwood Materials is building a USD3.5B factory in Nevada to produce battery components to power electric vehicles. Redwood is building the factory outside Reno to make material for anodes and cathodes, key components for electric-vehicle batteries. Redwood Materials is ramping up production of anode and cathode components to 100 gigawatt-hours by 2025, enough to supply batteries for 1M EVs a year, then to 500 GWh by 2030, enough to supply 5M EVs a year or more. Redwood Materials, whose partners include automaker Ford Motor Co and EV battery maker Panasonic Holdings Corp, is building a closed-loop battery ecosystem aimed at lowering EV costs by cutting dependence on imported materials, while also reducing the environmental impact. (CN Beta, Reuters, Teslarati, Bloomberg, CNA)

SpaceX has launched a batch of Starlink satellites, the 6th launch for the programme in Jul 2022 alone, and the company’s 33rd launch of 2022. Starlink, the satellite Internet service from SpaceX, includes roughly 2,900 Starlink satellites(opens in new tab) launched to date. Starlink Group 4-25 adds on to previous launches this month from both the west and east coasts of the United States. The company is working to amp up service quickly. It has regulatory approval to put at least 12,000 Starlink in orbit and is asking for an international regulator to loft another 30,000 satellites after that.(CN Beta, Space.com, Business Standard)

Honor CEO Zhao Ming has said that 2022 is the first year for Honor’s overseas development. Zhao Ming said that Honor had a team and operated in India for a long time a few years ago. Later, the Honor India team withdrew. At present, Honor still has partners in India and started related businesses. At the same time, the Indian market has maintained profitability. In the future, Honor will take a very prudent way to conduct business in the Indian market. Zhao Ming has pointed out that, in fact, it is not only the large-scale enterprises like Honor that finally chose to withdraw from the Indian market. Many small and medium-sized factories in my country located in important industrial chains such as mobile phones in India have collapsed, and the remaining ones have not closed down. Few opt out of the Indian market. And companies such as OPPO, vivo, Xiaomi and other companies that still insist on operating in India are also very difficult in India for the same reason.(My Drivers, Laoyaoba)

Investment Bank Morgan Stanley says that Apple’s path to a USD3T market valuation will stem from the company’s user base and an increasing shift to a subscription model. Morgan Stanley analyst Erik Woodring makes the case that Apple’s market cap could rise by another USD1T as the company shifts from a focus on maximizing unit growth to making as much money as it can from the installed base, the vast number of Apple devices already in use. In other words, he thinks that investors should be viewing Apple more as a subscription-driven business, rather than simply a hardware vendor. (CN Beta, Barron’s, Apple Insider, Bloomberg)

Samsung has revealed that the company has sold more than 30M soundbars in its lifetime. Samsung has been in this business since 2008 and achieved that milestone mid-way through 2022. The first-ever soundbar that Samsung released in 2008 was called the HT-X810. It was the industry’s first product to wirelessly connect with the sub-woofer. The soundbar also came with a built-in DVD player and was a huge hit back then.(Android Headlines, Samsung)

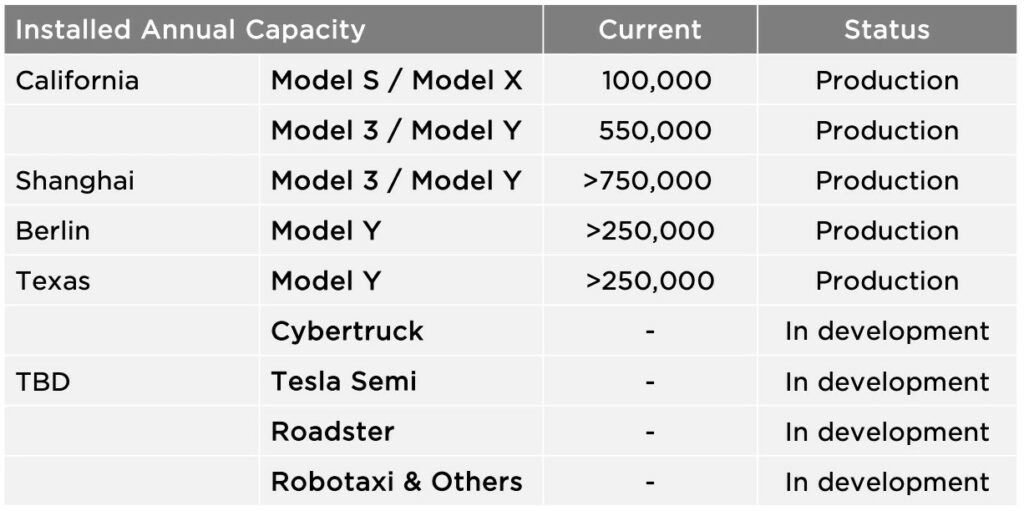

Tesla’s Gigafactory in Shanghai has become the world’s largest factory by annual production volume, exceeding that of its California plant. According to the 2Q22 financial summary of Tesla, recent equipment upgrades in its Shanghai base enabled the auto manufacturer to continue to increase production rate further, with the installed annual capacity exceeding 750,000 units. In comparison, the production capacity of Tesla’s factory in California reached 650,000 units, followed by Gigafactories Texas and Berlin, with the figures both surpassing 250,000 units.(Laoyaoba, Electrek, China Daily)

The state of Georgia and local governments are giving USD1.8B (KRW2.4T) in tax breaks and other incentives to Hyundai Motor Group in exchange for the automaker building its first U.S. plant dedicated to electric vehicles near Savannah. The deal calls for Hyundai to invest USD5.5B in its Georgia plant. Hyundai plans to start construction on the plant next year and begin producing up to 300,000 vehicles per year in 2025. The new factory also will produce vehicle batteries.(CN Beta, Independent, Detroit News)