7-29 #LockedCrazy : Qualcomm strengthen partnership with Samsung; Samsung has dismissed suggestions that it would discontinue its Exynos chipset; TCL allegedly talks to Apple; etc.

According to TF Securities analyst Ming-chi Kuo, the world’s largest GaAs foundry WIN Semiconductors has offered a conservative 2H22 outlook, mainly due to weak demand for Android phones. His latest survey indicates that other component suppliers (e.g., MOSFET, adapters, camera supply chain) have a similar view to WIN Semiconductors and expect inventory corrections to continue until 4Q22. So even if Android brands’ order-cut slowed down in June-July and smartphone shipments in the Chinese market grew by 9% YoY in Jun 2022, it is still not enough to prove that the worst is over for Android phones. (Twitter, CN Beta)

Qualcomm has announced that the company has strengthened its strategic partnership with Samsung Electronics to deliver leading premium consumer experiences for Samsung Galaxy devices. Qualcomm Incorporated and Samsung have agreed to extend their patent license agreement for 3G, 4G, 5G and upcoming 6G mobile technology through the end of 2030. These collaborations reinforce the Companies’ track record of success and reaffirms their commitment to expanding technology leadership and delivering the world’s best device experiences.(CN Beta, PR Newswire, Seeking Alpha)

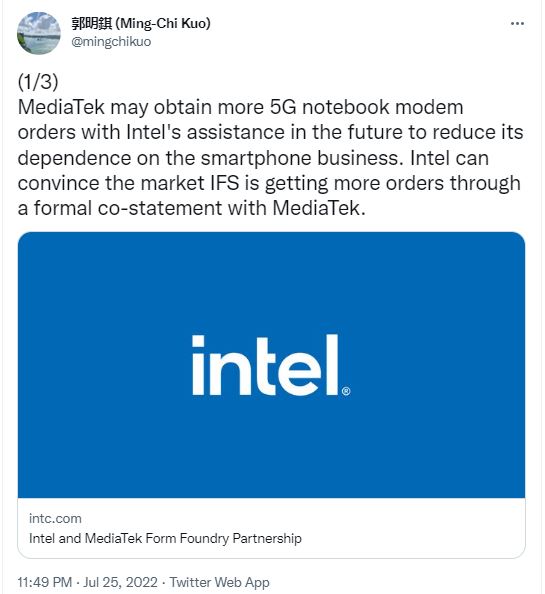

TF Securities analyst Ming-Chi Kuo estimates that MediaTek may obtain more modem orders for 5G notebooks with the assistance of Intel in the future” This will “ultimately reduce the Taiwanese firm’s dependence on the smartphone business. Furthermore, Intel can convince the market IFS through a formal joint statement with MediaTek. (Twitter, GizChina, IT Home)

Logitech is seeing the impact of the global semiconductor chip shortage moderating, according to Chief Executive Bracken Darrell, saying he expects problems to be overcome by the end of 2022. He has further indicated that they are not over it, but the symptoms are getting milder.(Laoyaoba, Seeking Alpha, Reuters, CNBC, US News)

SK Group has said it will commit USD22B to new investments in the U.S. to expand the supply chain in semiconductors, green energy and bioscience projects. SK Group is the second-largest conglomerate in South Korea and the chairman of the organization originally said it planned to invest more than USD50B in the U.S. through 2030. SK Group announced in May 2022 that by 2026, it will invest KRW247T in new energy industries, mainly batteries, biology and chips, of which KRW179T will be invested in South Korea and the remaining KRW68T will be invested overseas. (Laoyaoba, CNN)

Samsung has dismissed suggestions that it would discontinue its Exynos chipset business, as rumors persist that the company will skip Exynos power for its flagship phones in 2023 and possibly 2024. Samsung has explained they are reorganizing our system-on-chip (SoC) business model, and are pursuing a plan to strengthen our competitiveness in the mid- to long-term. In particular, they are focusing on strengthening the competitiveness of the next-generation mobile Exynos, and we are trying to maximize the market share of major customers by strengthening cooperation with leading IP companies and starting early development.(Android Authority, CN Beta, MK)

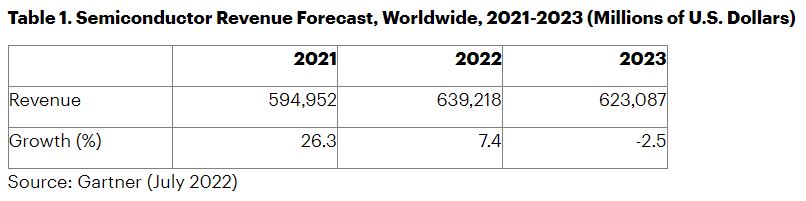

Global semiconductor revenue is projected to grow 7.4% in 2022, down from 2021 growth of 26.3%, according to the latest forecast from Gartner. Although chip shortages are abating, the global semiconductor market is entering a period of weakness, which will persist through 2023 when semiconductor revenue is projected to decline 2.5%. Overall, 2022 global semiconductor revenue has been reduced from the previous quarter’s forecast by USD36.7B, to USD639.2B, as economic conditions are expected to worsen through the year. Memory demand and pricing have softened, especially in consumer-related areas like PCs and smartphones, which will help lead the slowdown in growth. (Gartner, Neowin)

Apple is opening a new development site in Jerusalem, Israel, to develop new Apple silicon chips for future Macs. The Apple development facility will participate in several Israel-led flagship projects, with “future processors for the Mac” being at the forefront. Apple already operates two research and development sites in Herzliya and Haifa.(MacRumors, Times of Israel, Linkedin, Globes)

TCL chairman Li Dongsheng is expected to visit Apple’s headquarters in Cupertino soon. His visit is likely aimed at winning supply orders for liquid crystal display (LCD) panels made by TCL subsidiary CSOT from Apple for use on its tablets and MacBooks. CSOT is a fierce competitor to compatriot BOE in the global LCD market. BOE is already supplying LCD panels to Apple for MacBooks and iPads. CSOT has also formed a team during 1H22 to review building an OLED production line aimed at iPhones. (CN Beta, My Drivers, IT Home, The Elec)

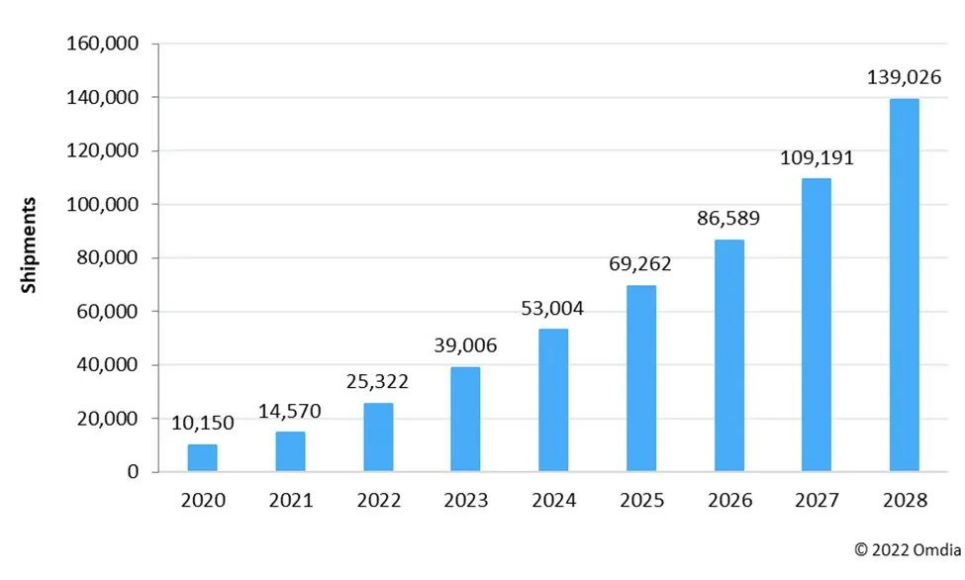

According to Omdia, Ddsplay shipments for applications featuring near-eye displays are expected to reach 25.3M units in 2022, up 73.8% YoY, before reaching 139M units in 2028. Omdia expects revenue growth to peak in 2023 primarily because more brands are expected to adopt OLED on silicon (OLEDoS) for near-eye devices in 2023 with higher unit prices. VR displays can be either single- or dual-display. The requirements for VR displays include higher resolution to achieve higher pixels per degree (PPD) and a lower screen-door effect. (Laoyaoba, Omdia)

Samsung has applied to secure the “Hexa2pixel” trademark with KIPRIS in Korea, and the same trademark also popped up in Europe via TMView. It may imply that this sensor will do 36-in-1 pixel binning (a group of 6×6 pixels merged into one), which is well above the current arrangements of Tetracell (2×2) and Nonapixel (3×3). If the target is 12MP output, the resolution may be 432MP, though it could be rounded to 450MP. It will more than double the resolution of the 200MP sensors from Samsung, the ISOCELL HP1 (1/1.22”, 0.64µm pixels) and the HP3 (1/1.4”, 0.56µm). Both HP sensors have “Tetra2pixel” color filters, which allows them to do both 4×4 and 2×2 pixel binning for 12MP and 50MP output, respectively.(GSM Arena, Twitter, Phone Arena, SamMobile, Twitter)

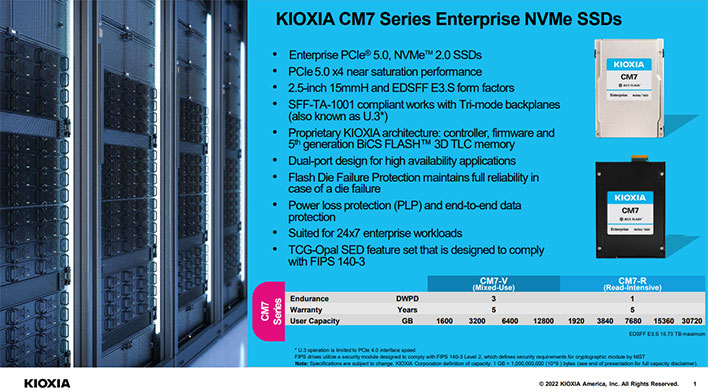

KIOXIA has announced that its CM7 Series enterprise NVMe SSDs are now shipping to select customers. Optimized for the needs of high-performance, highly efficient servers and storage, the CM7 family is designed with PCIe 5.0 technology in Enterprise and Datacenter Standard Form Factor (EDSFF) E3.S and 2.5-inch form factors. PCIe 5.0 will deliver new levels of performance and will usher in a wave of EDSFF form factor SSDs, helping to replace the 2.5-inch form factor for servers and storage. KIOXIA expects the EDSFF form factor to grow to over 50% of enterprise SSD unit shipments by 2026. With the new CM7 Series family of SSDs, KIOXIA is well positioned to capitalize on the transition to EDSFF.(CN Beta, Kioxia, Hot Hardware, Techpowerup)

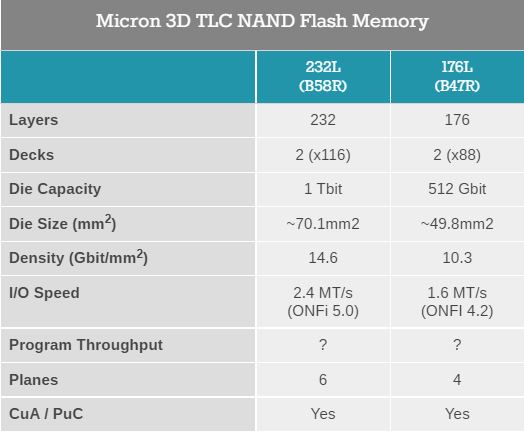

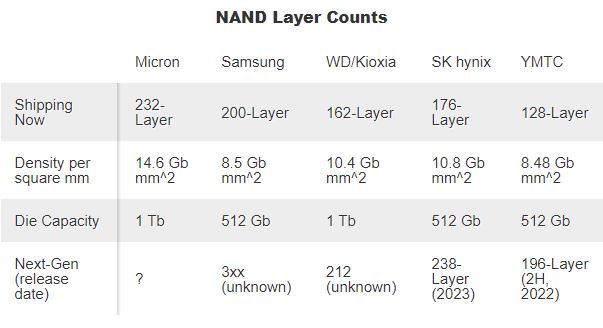

Micron has announced that their next-generation 232 layer NAND has begun shipping. The sixth generation of Micron’s 3D NAND technology, 232L is slated to offer both improved bandwidth and larger die sizes – most notably, introducing Micron’s first 1Tbit TLC NAND dies, which at this point are the densest in the industry. Micron’s 232-layer NAND technology provides the high-performance storage necessary to support advanced solutions and real-time services required in data center and automotive applications, as well as responsive, immersive experiences on mobile devices, consumer electronics and PCs. This technology node enables the introduction of the industry’s fastest NAND I/O speed, 2.4 gigabytes per second (GB/s).(My Drivers, AnandTech, Micron, Tom’s Hardware)

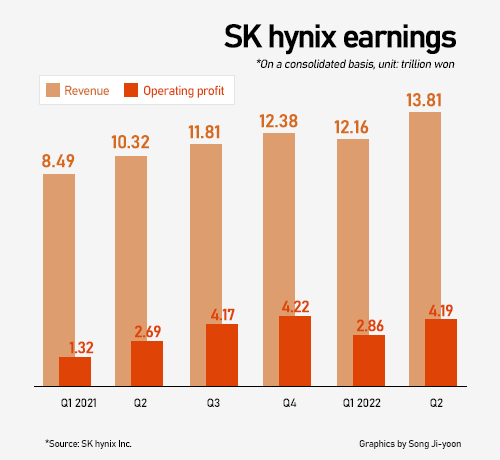

SK Hynix has revealed that it plans to complete 238-layer NAND pilot production during 2022 and achieve mass production in 1H23. The company also said that it plans to achieve 70% of its main product, 176-layer 4D NAND, in wafer form by the end of 2022 to further improve gross margins. In response to the DRAM market, although the current average selling price (ASP) of DRAM is low, the decrease in cost is sufficient to compensate for the change in ASP, and the company expects DRAM shipments to increase by about 10% and NAND flash shipments to increase by 20% in 2022.(CN Beta, Techgoing,Pulse News)

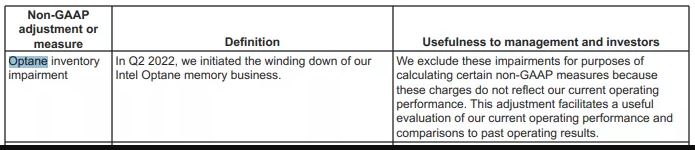

Intel CEO Pat Gelsinger has implied that Intel will wind down its Optane business. The move incurs a USD559M inventory impairment / write-off. Intel has used Optane memory to create both storage and memory products. Intel had already stopped producing its Optane storage products for client PCs, which makes sense as it is at the beginning of a multi-year journey to sell its NAND business to SK hynix. However, Intel originally retained its memory business for the data center, including its persistent memory DIMMs that can function as an adjunct to main memory – a capability only Intel offered. Those products will also come to an end.(CN Beta, Tom’s Hardware, AnandTech, My Drivers)

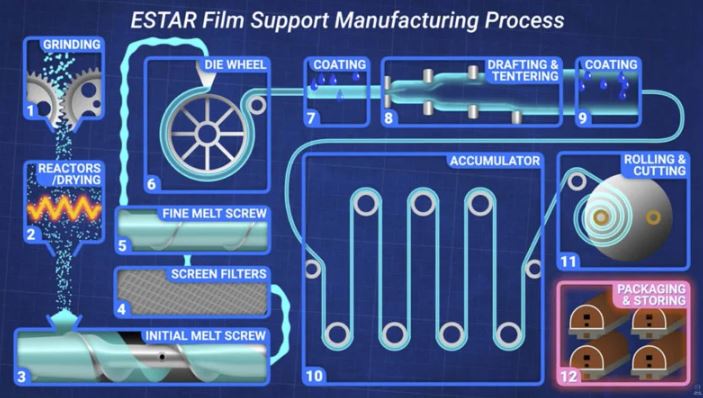

Kodak has announced that it is repurposing some of the expensive, high-tech machines used to manufacture its photography film for use on batteries for electric vehicles (EV). The company has invested in Wildcat Discovery Technologies, which makes EV batteries. Kodak has discovered that the “supercell” batteries Wildcat manufactures, require a similar coating and engineering services, like their 35mm film. So, with minimal retooling, these USD70M machines have a new life, producing materials needed to create batteries. Kodak’s current process of film manufacturing , known as ESTAR, requires using polymers to create the film itself. These polymers have replaced the old school acetate base in 35mm film (except for motion picture film) and requires special chemical coatings, which Kodak says is very similar to what is required in Wildcat’s Supercell EV batteries.(Gizmo China, Peta Pixel, Daily Sentinel)

Although it is always best to reuse and recycle, many small, simple, low-power electronic devices tend to be single-use. A new paper battery could make them more eco-friendly, as it is activated by water, and it biodegrades once discarded. Developed by scientists at Switzerland’s Empa institute, the battery is intended for use in applications such as “smart” shipping labels, environmental sensors, and disposable medical diagnostic devices. In its current proof-of-concept form, the battery consists of one more linked cells. Each cell measures 1cm (0.4in) squared, and its paper substrate is impregnated with sodium chloride (aka table salt). One end of it has a wax coating, to which two wires are attached. Printed onto one side of the paper is an ink containing graphite flakes, which serves as the cathode. An ink containing zinc powder, which serves as the anode, is printed onto the other side. Covering both inks, on both sides of the paper, is a third ink containing graphite flakes and carbon black – it connects the cathode and anode to the two wires at the one end. (CN Beta, New Atlas, New Scientist, Nature)

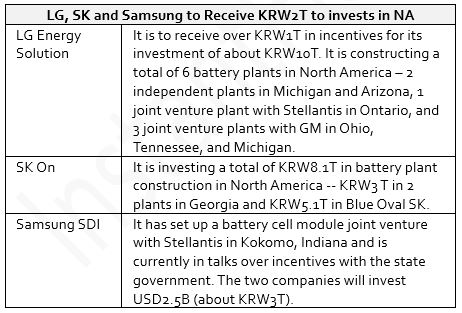

LG Energy Solution, SK On, and Samsung SDI will receive at least KRW2.1T in incentives, including tax benefits, for investing a total of about KRW21T to build battery plants in North America.(Laoyaoba, Business Korea)

LG Energy Solution (LGES) has signed a memorandum of understanding with Huayou Cobalt to set up a joint venture for battery recycling in China. This is the first such venture by Korean and Chinese companies for battery recycling in China. Both companies plan to finish establishing the body by 2022. The new company will extract nickel, cobalt and lithium from scraps and waste batteries. The extracted materials will be used for the production of cathode materials which will be supplied to the Korean firm’s electric vehicle battery plant in Nanjing. A pre-treatment factory processing scraps and waste batteries will be located near LGES’ manufacturing plant in Nanjing. A post-treatment factory producing cathode materials using the extracted materials will be located in Quzhou, where Huayou Cobalt has its operations.(Laoyaoba, Pandaily, Korea Times, Korea Herald)

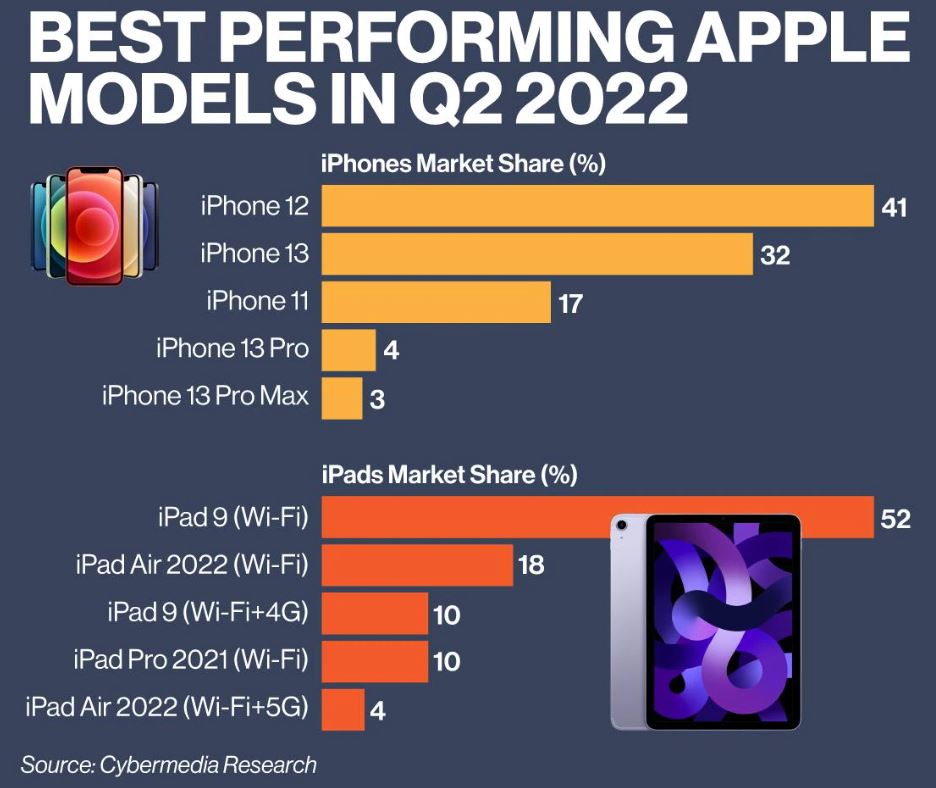

CyberMedia Research has revealed Apple has registered another record second quarter in India. For Apple iPhones alone, Apple shipped 1.2M units in 2Q22, registering a 94% growth YoY. Apple has been able to maintain its India growth momentum with a healthy YoY growth, driven by increased local iPhone manufacturing and retail initiatives. The iPhone 12 series, along with the iPhone 13 series, accounted for the most iPhones shipped into the market. Of the iPhone lineup available in India, iPhone 12 emerged as the best performing model accounting for 41% share followed by iPhone 13 at 32%, and iPhone 11 at 17%. The iPhone 13 Pro variant was the fourth most popular model with a 4% share and the iPhone 13 Pro Max with 3%. (Laoyaoba, India Times, Business Standard, Business Today)

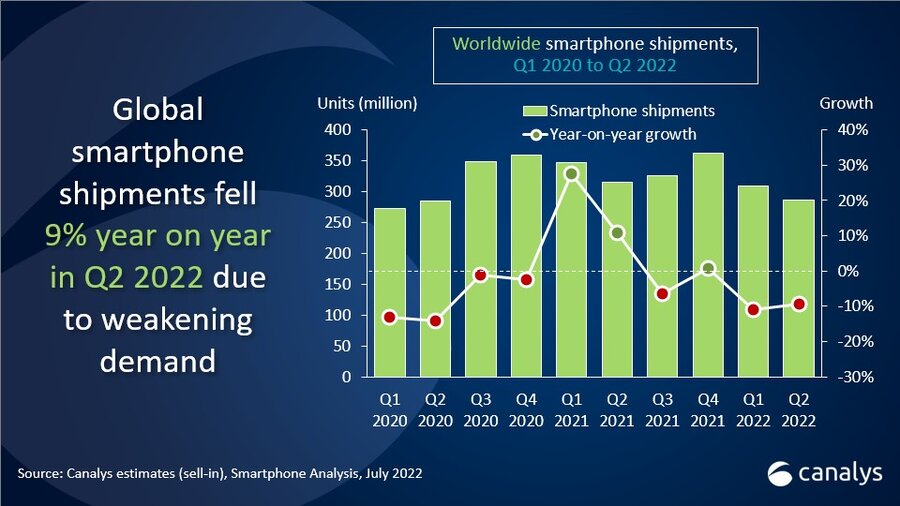

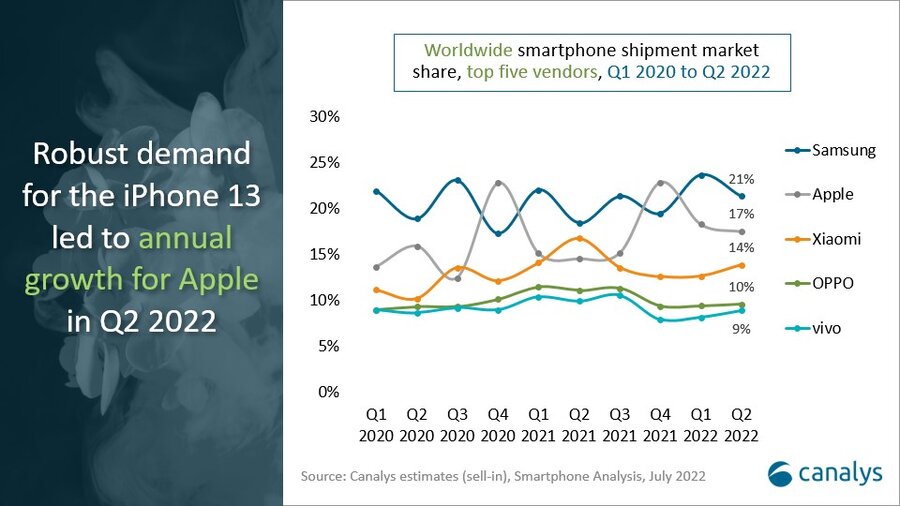

According to Canalys, worldwide smartphone shipments fell 9% YoY in 2Q22. Demand has started to wane following economic headwinds and regional uncertainty. Samsung took first place with a 21% market share as it strengthened its low-end A series supply. Apple came second with a 17% share as the iPhone 13 remained in high demand. Xiaomi, OPPO and vivo continued to struggle in China, suffering double-digit declines to take 14%, 10% and 9% market shares respectively. (GizChina, Android Central, Canalys)

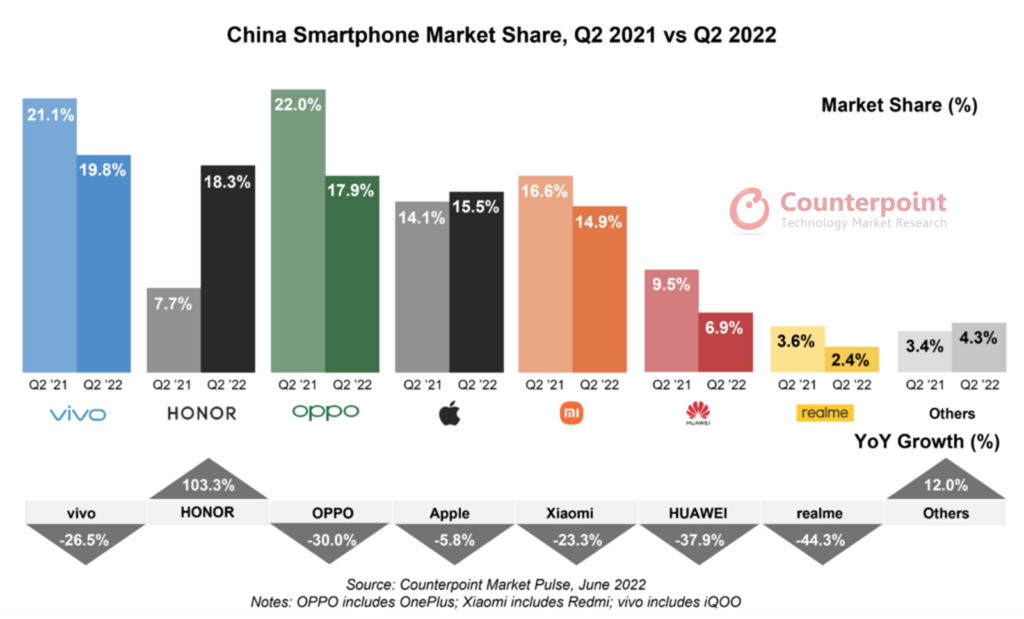

According to Counterpoint Research, China’s smartphone sales hit a fresh low in 2Q22 to reach less than half of the sales of the historical peak in 4Q16. The last time the sales were lower than this point was nearly a decade ago in 4Q12, when the iPhone 5 was introduced. Capturing a 19.8% share, vivo retained its first place in2Q22, followed by Honor (18.3%) and OPPO (17.9%). Apple took the fourth position with a 15.5% share. Honor doubled its sales YoY and was the only major brand to show a YoY increase. realme’s sales dropped 44.3% YoY. (Gizmo China, Counterpoint Research)

Huawei has released an upgraded version of its own operating system. With more than 300M Huawei devices already equipped with HarmonyOS 2, making Harmony the fastest-developing OS in history. HarmonyOS 3, Huawei’s third-generation operating system, is designed to provide a more seamless experience across devices, including smartphones, tablets, printers, cars and smart home devices such as televisions. The latest OS offers an improved experience in aspects including HyperTerminal function, smoother performance, and privacy and security. The HarmonyOS 3 HyperTerminal function supports 12 kinds of smart devices including printers, smart glasses and car devices.(CN Beta, My Drivers, Global Times, SCMP, Huawei)

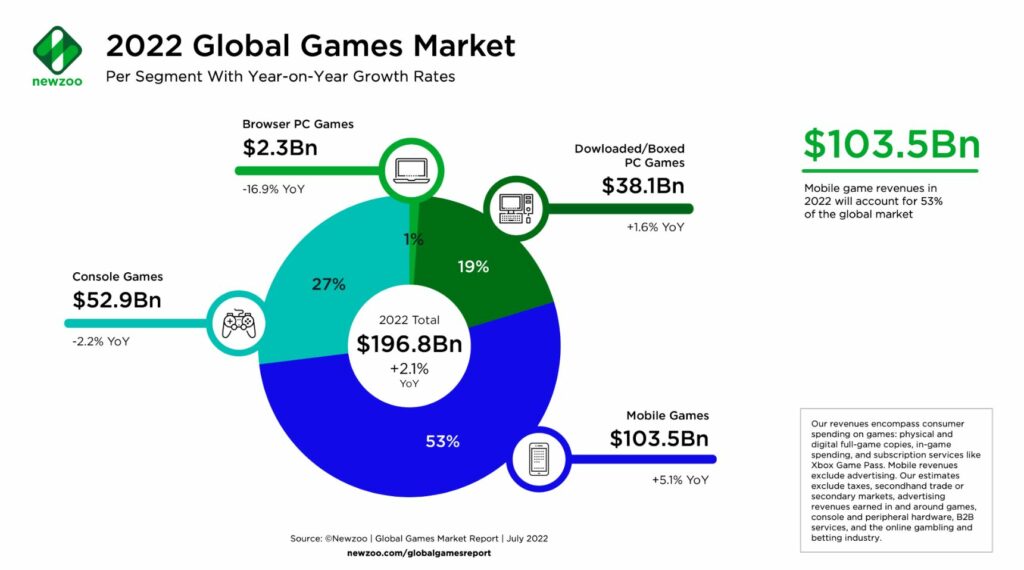

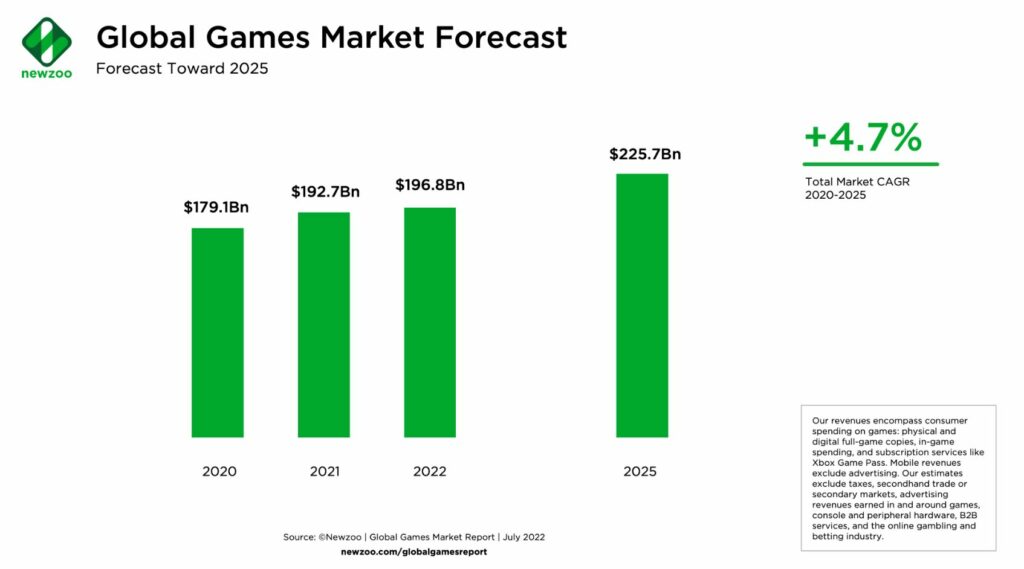

Newzoo’s latest market forecasts show that there will be 3.2B gamers worldwide in 2022. These gamers will help the global games market generate USD196.8B in 2022, up by +2.1% YoY. Newzoo believes that the market is on track for even further growth in the years to come—even in the face of challenging economic conditions. To that end, they also believe the games market is—to some extent— ‘’recession proof’’. The games market will continue to grow in the following years, reaching USD225.7B in 2025, a +4.7% CAGR between 2020 and 2025, underlining our belief that the games market will continue growing healthily in a post-pandemic world. (VentureBeat, Newzoo)

Samsung’s mobile experience division VP, Sung Koo Kim, has reaffirmed that the company wants to carry the momentum of the Galaxy S and foldable phone lineups throughout 2H22. Samsung aims for its foldable phones to “deliver sales volumes that are above the sales volumes we used to report using the Note series”. Samsung believes that its foldable devices are ready to go mainstream. Samsung is looking to push sales of its folding handsets to boost the profitability of its mobile division which has been hit by rising materials costs and waning consumer demand. For reference, Samsung shipped 190M Note devices over the phone’s lifetime, according to IDC. So far, Samsung has shipped over 10M foldable phones.(CN Beta, CNBC, SamMobile)

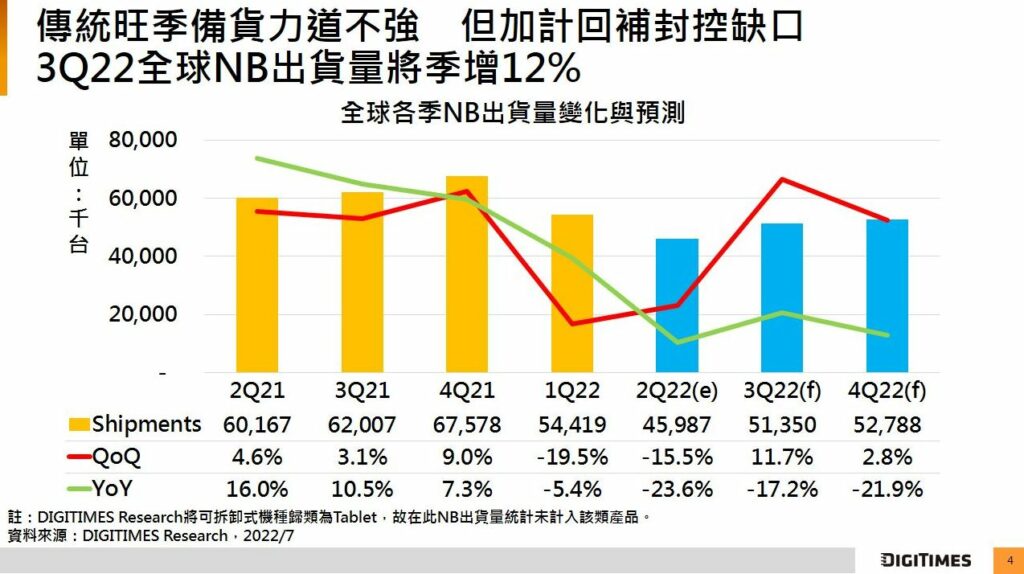

Despite shortages for some ICs in 2Q22, the notebook industry is expected to see oversupply of panels and audio chips, according to Jim Hsiao, a senior analyst at DIGITIMES Research. First-tier notebook brands especially Dell, Asustek Computer and Acer are seeing high notebook panel inventory as they failed to adjust their procurement strategies in time to tackle slipping end-market demand, and panel makers were not active in cutting their output. The first-tier brands have already been decelerating their panel order pull-ins since May 2022 and the momentum is unlikely to pick up until Aug 2022. Meanwhile, the increasing supply of audio codec ICs, Wi-Fi ICs, and non-IDM power ICs since 1Q22 has also eased their shortages in 3Q22. (Digitimes, press, Digitimes, Laoyaoba)

According to TrendForce research, global TV shipments in 2H22 reached 45.17M units, falling 5% QoQ and 6.8% YoY. This was the first time shipments fell below a record low of 46M units in the second quarter. The economies of Europe and the United States have been hit by rising inflation and interest rate hikes. In addition, China has been affected by the spread of the COVID-19 pandemic and has repeatedly implemented measures such as lockdowns and a dynamic zero-COVID policy. These three major TV sales regions are facing different facet of economic issues, seriously affecting overall shipments and sales. TV shipments from Samsung and LG, mainly sold in Europe and the United States, were revised downward by nearly 30% in 2Q22 and, with a combined market share of nearly 32%, this development sent shockwaves through on the market. TrendForce further indicates, as the world was enveloped by inflation this year, global TV shipments reached 92.72M units in 1H22, a decrease of 5.8% YoY. (Laoyaoba, TrendForce, TrendForce)

In a new regulatory filing Tesla will increase spending by USD1B in 2022. The money will basically be for the expansion of factories and the development of new batteries. Furthermore, it will also spend a part of the money on other projects. In the filing, Tesla expects capital expenditures of USD6B-8B in 2022. This is actually higher than the initial forecast of USD5B-7B in Apr 2022. The increase in spending is just one of several new disclosures by Tesla in its quarterly report to the U.S. Securities and Exchange Commission (SEC). The company also claims that there is more scrutiny from SEC and lost USD170M on its bitcoin investments.(GizChina, NY Times, WSJ, WION News)

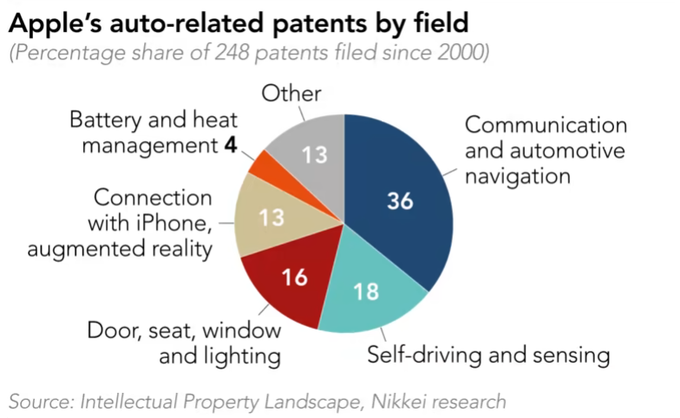

A joint investigation by Nikkei and a Tokyo analytics company Intellectual Property Landscape has found that Apple has jumped into automobile-related technologies, as shown by the company’s recent patent applications. Apple has filed for and published a total 248 automobile-related patents since 2000. Patents cover self-driving technology, riding comfort, seats, suspensions, navigation, battery management, vehicle-to-everything (V2X) connectivity for car-to-car communication, and more. Apple has filed the most patents related to communication and navigation, followed by autonomous driving. (GizChina, MacRumors, IT Home, Asia Nikkei)

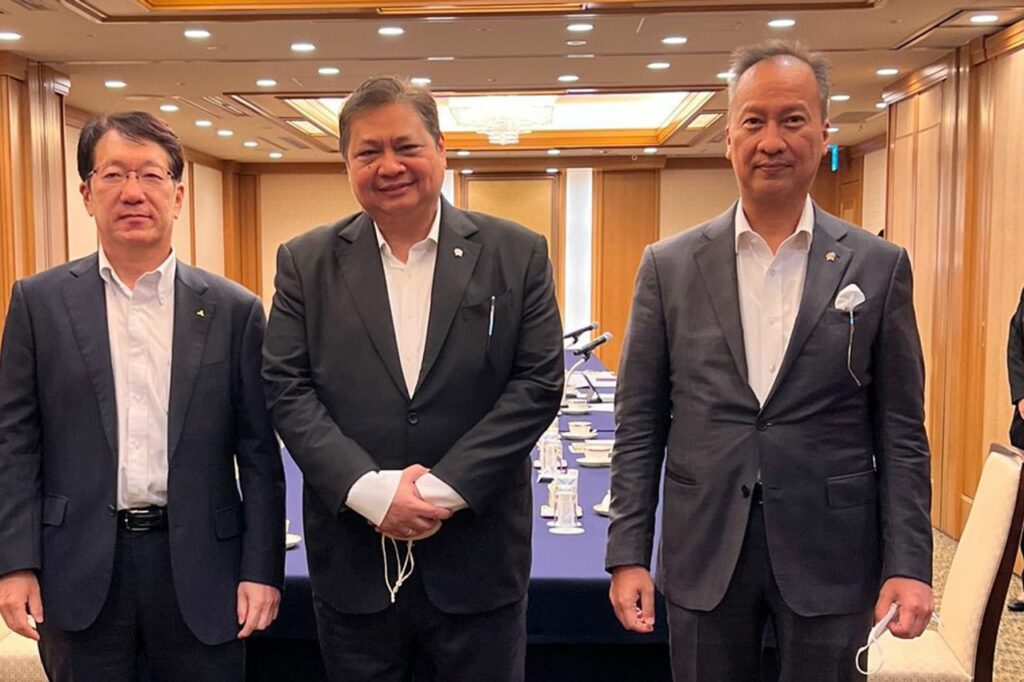

Indonesia’s Chief Economics Minister Airlangga Hartarto has revealed that Toyota Motor plans to invest IDR27.1T (USD1.80B) in Indonesia in the next 5 years to produce electric vehicles (EVs).Indonesia aims to become a global hub for producing and exporting EVs through processing its rich supplies of nickel laterite ore for use in lithium batteries. Toyota had invested IDR14T in the country since 2019. Indonesia, which has a population of 270M, aims to sell only electric cars and motorcycles by 2050 to replace vehicles powered by combustion engines, as the country seeks to reduce its carbon emissions. The nation has also set a target of having 13 million electric motorcycles — including converted ones — and 2.2M electric cars on its roads by 2030. Toyota plans to produce various types of hybrid EVs in its pipeline over the next 4 years. (CN Beta, CNBC-Indonesia, Asia Nikkei)

Ford Motor has announced a series of agreements to fast-track its shift to electric vehicles, involving sourcing battery capacity and raw materials from such companies as Chinese battery maker Contemporary Amperex Technology Limited (CATL) and Australian leading global mining Group, Rio Tinto. Ford plans to invest over USD50B in EVs through 2026. Ford in Europe on track to go all-electric by 2035. The agreements are part of Ford’s thrust to have its annual EV production rate internationally achieve a mark of 600,000 vehicles by the end of 2023 and over 2M by late 2026. Ford has stated that it foresees a compound annual growth rate (CAGR) for EVs to cover 90% through 2026, which will more than augment the projected industry growth ratio.(Laoyaoba, TechCrunch, Global Economics, Motor Trader)

Mitsubishi Motors (MMC) has promised new investments up to 2025 worth IDR10T (USD666M). The investment is to continue the development of electrically based products. It is noted that MMC has invested IDR11.3T until 2021 for the MMC factory in Indonesia. In addition, MMC plans to invest IDR10T for the period from 2022 to 2025. MMC will also diversify their products. After 2023, MMC will focus on producing the xEV type car model, which consists of the Xpander and Pajero Sport models. In addition, MMC will also produce two new electric vehicle (EV) models starting in 2024. MMC also plans to increase its export destination countries, so that by 2022 there will be 40 export destinations for Mitsubishi products made in Indonesia. Meanwhile, the number of exports is estimated to be able to reach 72,000 units in 2022, an increase from 42,000 units in 2021, and a target of 98,000 units in 2024. MMC is conducting a pilot project to use BEV commercially with four companies. (CN Beta, Reuters, Voi.id)