8-20 #CrappyIT : TSMC’s 3nm chip will be mass-produced in 2H22; Samsung aims to invest to increase 4nm production; Samsung has dropped its smartphone shipment to 260M units in 2022; etc.

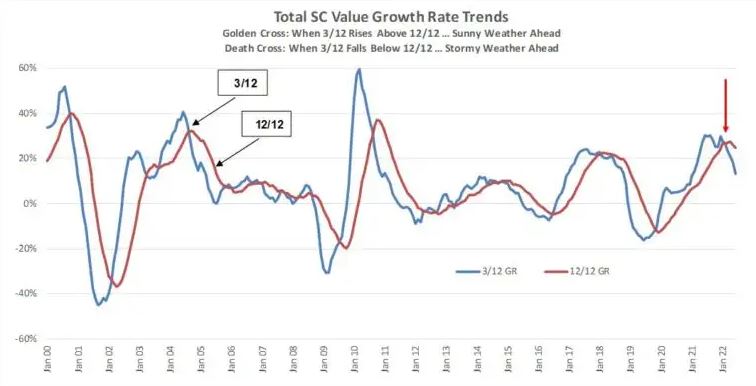

According to SemiWiki’s Malcolm Penn, the current semiconductor Super Cycle is finally drawing to a close and the 17th market downturn has now well and truly started. At the macro level, the worldwide semiconductor momentum indicator, pictured above, passed through the ‘Death Cross’ in Mar 2022 signifying storm clouds on the horizon; Jun’s market data saw the start of the storm. PC and smartphone shipments, two key semiconductor market drivers, are both showing declines in the first half of 2022, with PC shipment now reportedly at their lowest level since 2019, and Smartphone shipments expected to show negative growth in 2022. Products that require specific manufacturing capacities, such as automotive, are still showing signs of tightness, but the end market demand for cars is likely to soften as prospective customers, now squeezed by and struggling with inflation and a massive spike in energy costs, put off buying that new car. (SemiWiki, C114, Laoyaoba)

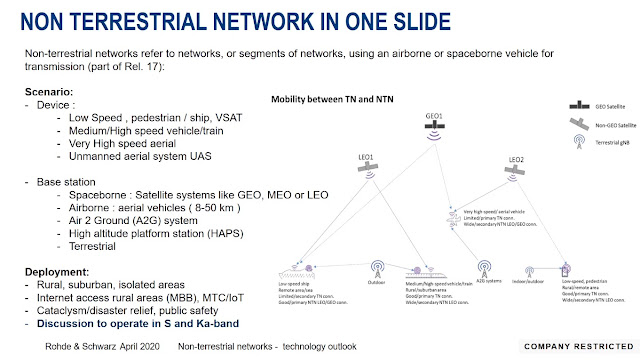

MediaTek has officially announced that it has completed the world’s first 5G NTN (non-terrestrial network) satellite mobile phone laboratory connection test. This allows smartphones to access the Internet directly through satellite signals. In the future, 5G mobile phones will work directly with satellite networks. The test was jointly completed by MediaTek and Germany’s Rohde & Schwarz. Based on the functions and procedures defined in the 3GPP Rel-17 specification, MediaTek’s mobile communication chips equipped with 5G NR NTN satellite network functions were used. Rohde Schwarz’s low-orbit satellite channel simulator and test base station are jointly complete. In the laboratory environment, the simulated satellite has an altitude of 600km and a speed of up to 27,000kmph, using the low-orbit satellite communication mode.(GizChina, CN Beta, My Drivers)

Foundries particularly second- and third-tier players continue to see their fabless clients scale back orders that will drag down further their fab capacity utilization in 4Q22, according to Digitimes. Sources say a rapid slowdown in demand in PC, mobile, TV and other consumer electronics end markets has prompted brand suppliers, distributors and IC design houses to significantly slow contract progress starting around mid-2Q22. Branded PC suppliers and their contract manufacturers are already struggling with excess inventory, which may take 3-4 quarters to drop to proper levels. At the same time, in mobile phones and TVs, declining end-market demand has also led to inventory adjustments across the industry’s supply chain. Sources say many pure-play foundries are still reporting strong sales and profits in 1H22, and their fab production plans are starting to ease. Globalfoundries, SMIC and Hua Hong Semiconductor, as well as PSMC in Taiwan, are expected to further decline in 4Q22 as customers reduce or delay construction starts. (Digitimes, ICCSZ, Inpai, ZOL)

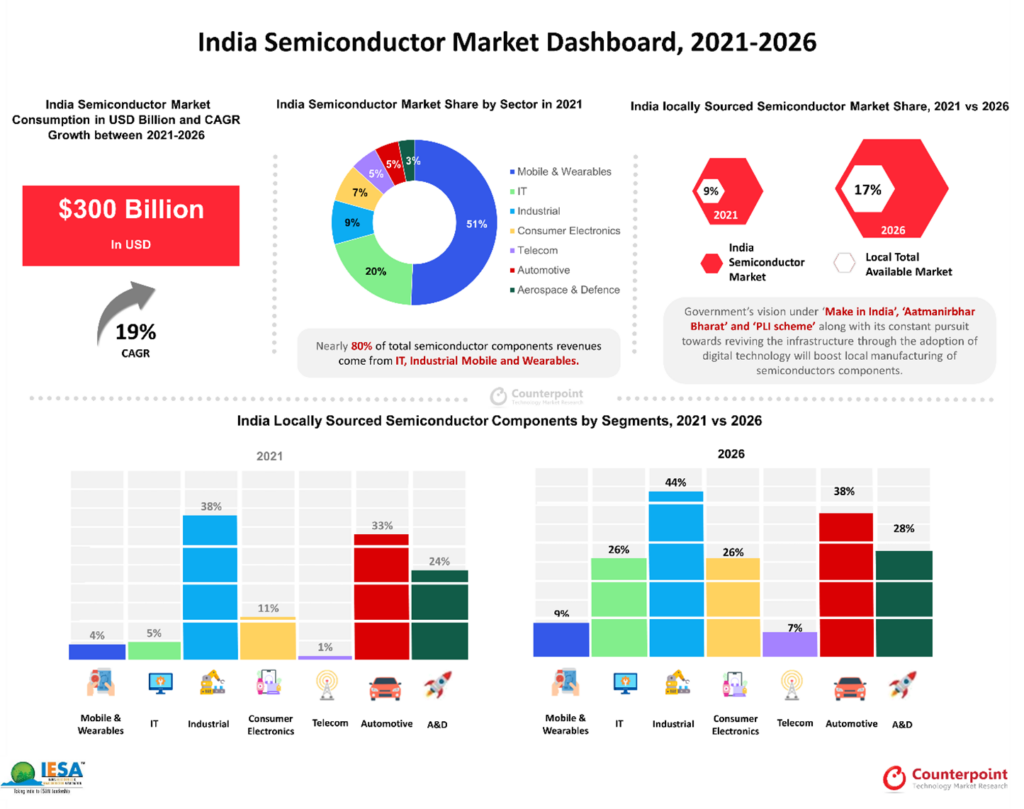

India’s semiconductor component market will see its cumulative revenues climb to USD300B during 2021-2026, according to the ‘India Semiconductor Market Report, 2019-2026’, conducted by India Electronics & Semiconductor Association (IESA) and Counterpoint Research. In 2021, India’s end equipment market stood at USD119B in terms of revenue. It is expected to grow at a CAGR of 19% from 2021 to 2026. The Electronic System Design and Manufacturing (ESDM) sector in India will play a major role in the country’s overall growth, from sourcing components to design manufacturing. While the country is becoming one of the largest consumers of electronic and semiconductor components, most components are imported, offering limited economic opportunities for the country. Currently, only 9% of this semiconductor requirement is met locally. (Counterpoint Research, Laoyaoba)

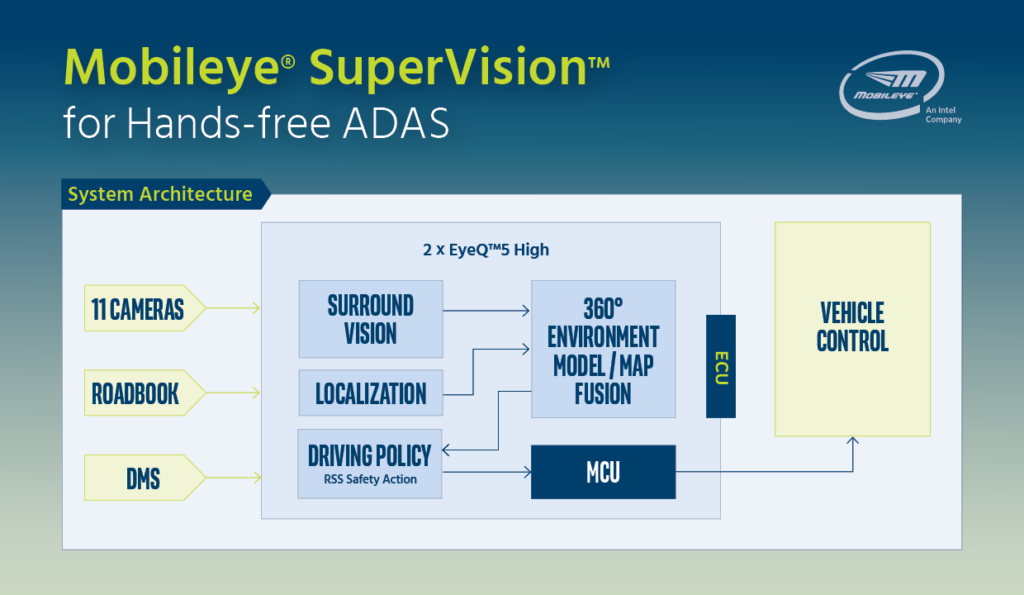

Intel has announced that its self-driving company Mobileye is testing its next-generation driver assistance system, Mobileye SuperVision, on a multi-day intercontinental road trip across southern Europe on roads the technology has only mapped but the test vehicles have never driven. and 6 Central European countries. A hybrid sedan was selected for the test with an upgraded 8Mp high-definition camera system. Mobileye plans to conduct more similar demos in other parts of the world in the coming weeks.(Laoyaoba, Fierce Wireless, 163.com, ZOL)

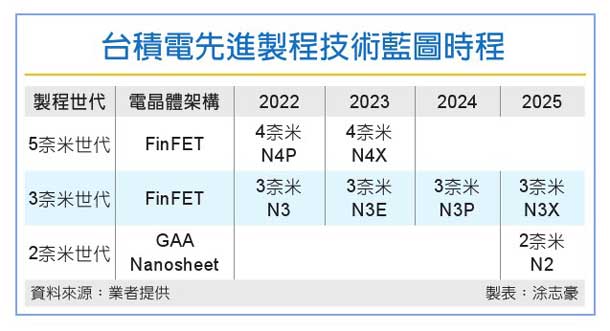

TSMC will reportedly begin production of 3nm chips for Apple by the end of 2022. TSMC will begin mass production of 3nm chips in Sept 2022. The M2 Pro chip may be the first to use TSMC’s advanced 3nm process. Apple’s A17 Bionic chip for next year’s iPhone 15 Pro models and the M3 chip, suitable for future MacBook Air and 13” MacBook Pro models, will also be manufactured based on TSMC’s 3nm process.(CN Beta, CTEE, UDN, MacRumors)

Chen Fangjin, deputy director of TSMC, has said that the 3nm chip will be mass-produced in 2H22, and has been delivered to some customers in the mobile and HPC (high-performance computing) fields. If customers who have mobile phones use 3nm chips now, products will be available in 2023. Semiconductor equipment manufacturers have stated that, judging from the trial production of TSMC’s N3 process, it is expected that after entering mass production in Sept 2022, the initial yield performance will be better than the initial stage of the previous 5-nanometer (N5) process.(Laoyaoba, Inside, UDN, CTEE, Mashdigi, Tom’s Hardware, 9to5Mac, WCCFTech)

MediaTek has announced the latest addition to its 5G portfolio, the T830 platform for 5G fixed wireless access (FWA) routers and mobile hotspot customer-premise equipment (CPE). The T830 is built with MediaTek’s M80 modem which supports advanced Release 16 capabilities for sub-6GHz band operations, making the platform ideal for 5G networks around the globe. The T830 platform includes a main SoC with a 3GPP Release-16 5G cellular modem integrated with a powerful quad-core Arm Cortex-A55 CPU, a sub-6GHz RF transceiver, a GNSS receiver and associated PMICs.(My Drivers, Gizmo China, MediaTek, XDA-Developers)

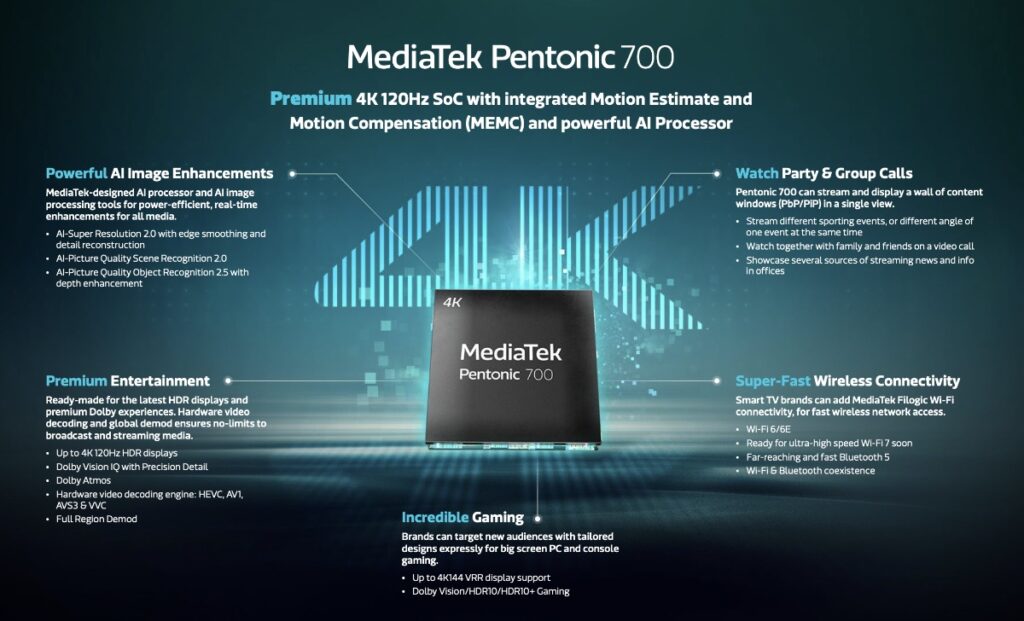

MediaTek has announced the Pentonic 700, a smart TV system-on-chip (SoC) with a powerful AI processing engine for premium 120Hz 4K TVs. With AI-powered picture quality enhancements, support for Dolby Vision IQ with Precision Detail, integrated 4K120 MEMC and TCON, and gaming optimizations, the Pentonic 700 lets global TV brands elevate the all-around viewing experience for consumers. While Pentonic 700 is designed for 120Hz smart TVs, the chipset also supports variable refresh rate (VRR) up to 144Hz to give brands the ability to customize TVs for gaming applications so players can enjoy games without screen tearing and stuttering.(My Drivers, MediaTek, XDA-Developers)

Samsung Electronics has broken ground for a new semiconductor research and development complex in Giheung, Korea, aiming to extend its leadership in state-of-the-art semiconductor technology. Samsung Electronics plans to invest about KRW 20 trillion by 2028 for the complex in an area covering about 109,000 square meters within its Giheung campus. The new facility will lead advanced research on next-generation devices and processes for memory and system semiconductors, as well as development of innovative new technologies based on a long-term roadmap.(Laoyaoba, Samsung, Yahoo, Benzinga)

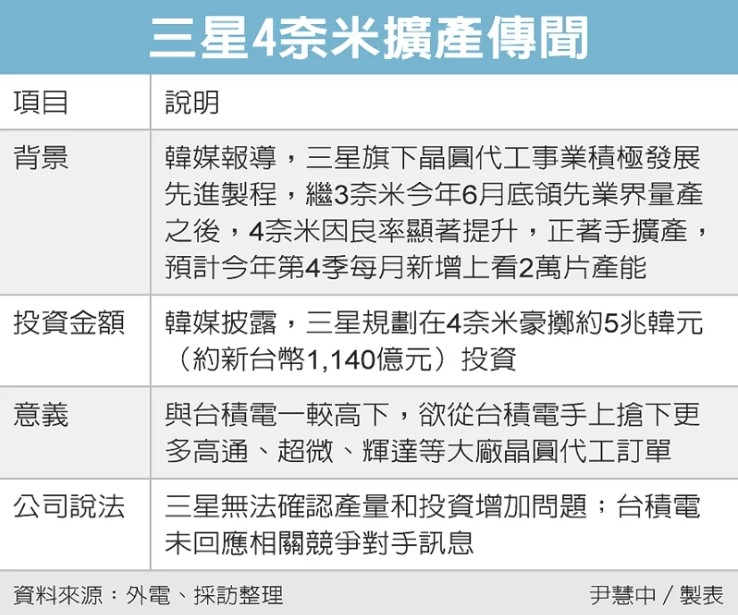

Samsung is taking the opportunity to reduce its losses by attempting to increase 4nm chip production. Samsung reportedly aims to invest around KRW5T (USD3.8B) in its facilities. With Samsung already supplying 3nm GAA chips to customers in a limited capacity, this may have been the opportune time to increase 4nm production and get back its lost clientele. The investment amounts to KRW5T, and with this injection, Samsung will reportedly attempt to grab orders away from TSMC given to the latter by Qualcomm, Supermicro, Huida, and other big names.(CN Beta, WCCFtech, UDN)

Qualcomm is allegedly preparing to re-enter the Arm server market, based on technology the company gained from its acquisition of startup Nuvia in 2021. Nuvia was an Arm processor startup established in 2019. Amazon Web Services (AWS) has agreed to evaluate the processor. AWS, the industry’s leading cloud provider, is a major buyer of chips and other data center hardware. (CN Beta, Silicon Angle, Protocol, The Register)

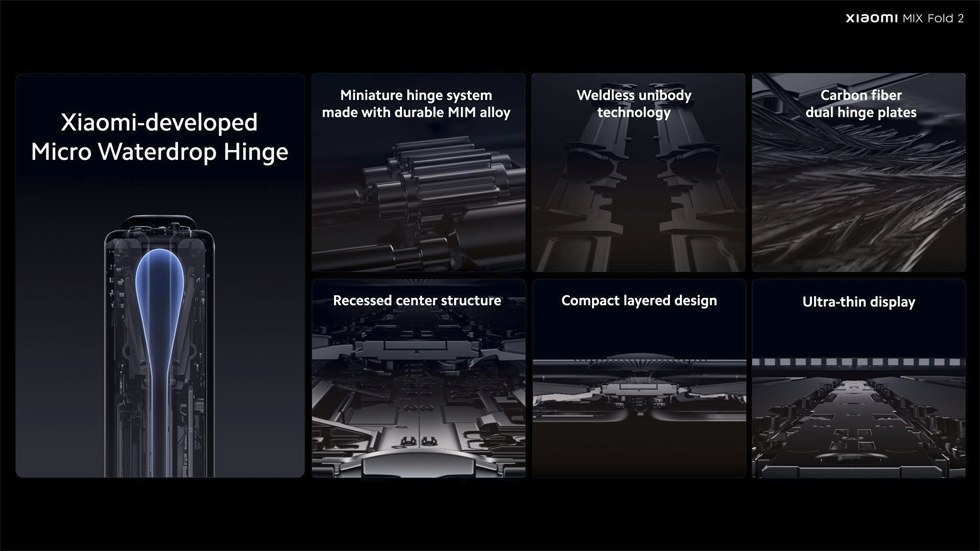

The waterdrop hinge allows a foldable phone to fold flat and is believed to be the reason why the display’s crease is also less visible. With the Xiaomi Mix Fold 2, the hinge has also been credited for allowing the foldable phone to be thinner, as well. Display Supply Chain Consultant’s Ross Young has revealed that Samsung did test something similar to a waterdrop hinge design during its R&D phase. It found out, however, that adopting this kind of hinge would mean dropping Samsung’s prized IPX8 rating for something that’s just “water-resistant”.(My Drivers, SlashGear, SamMobile)

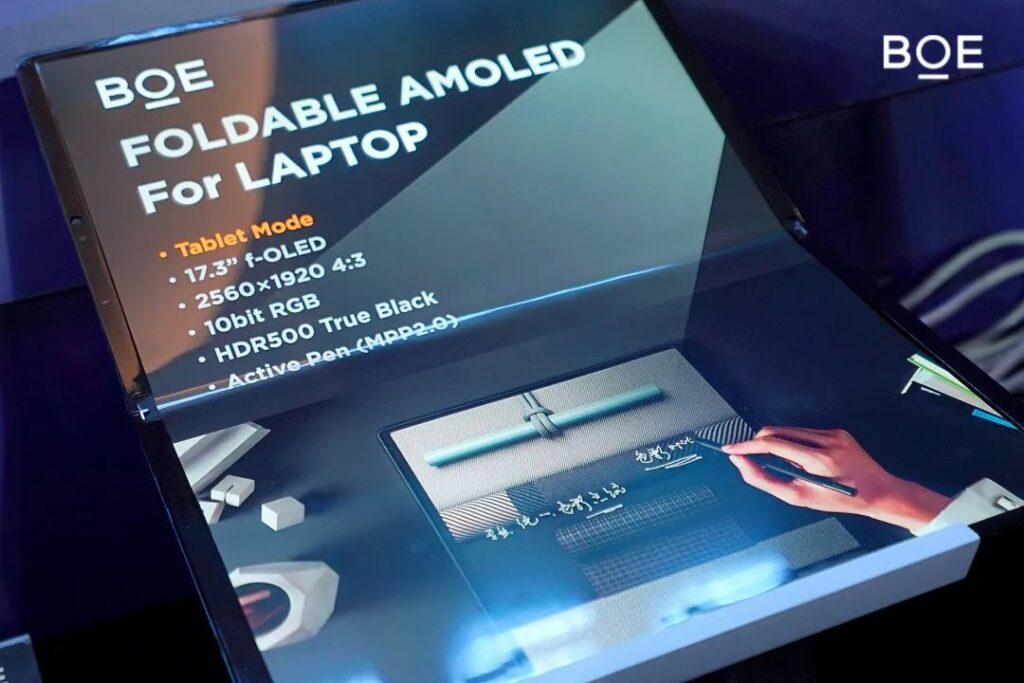

BOE has unveiled new blue diamoond pixel arrangement for OLED that optimizes the underlying logic structure of pixel display. BOE claims that the comprehensive visual effect greatly improves by 20%. In addition, the pixel aperture ratio of the display screen determines the service life of the OLED device. The newly released blue diamond pixel arrangement aperture ratio can reach 26.16%. This is a 30% increase in service life relative to other diamond-like solutions. BOE has also revealed that its flexible OLED screen shipments will reach 80M units in 2022, and will sprint to 100M-level shipments in the future.(GizChina, 163, Leikeji)

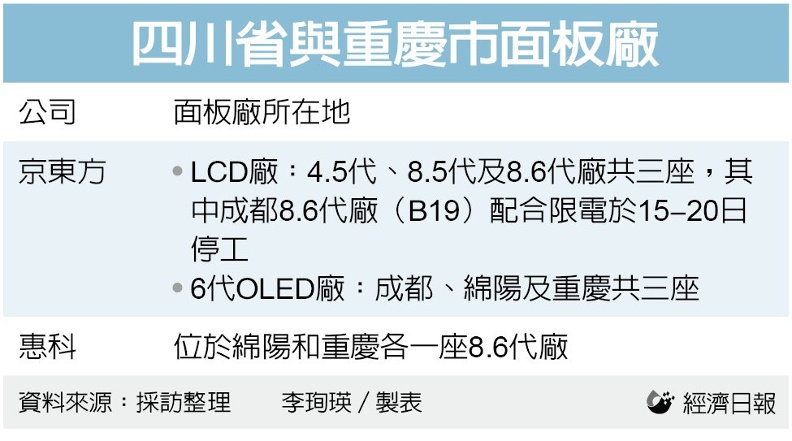

BOE Technology will “make adjustments” at its operations in Sichuan due to power rationing in the region. The company said that it was communicating with authorities and expected “no major impact on its overall operating performance”. It added that it has four production lines making displays for hardware devices in the region – two lines producing LCD screens, and two producing AMOLED screens.(Phone Arena, Reuters, Sina, IT Home, GVM)

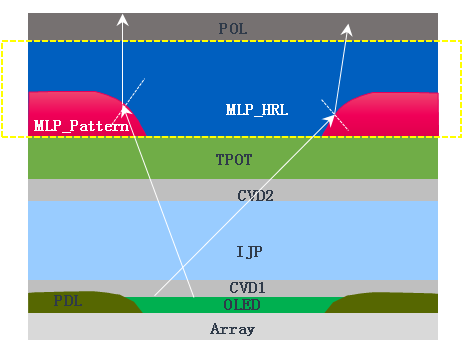

Tianma has introduced its latest HTD (Hybrid TFT Display) and MLP (Micro Lens Panel) technologies. Among them, HTD technology can intelligently and dynamically adjust the screen refresh rate, automatically reduce the refresh rate when the screen displays text and other content, and automatically increase the refresh rate when games or page scrolling. This technology can reduce the screen drive power consumption by more than 40% . MLP is an OLED micro-lens integration technology. It changes the transmission path of light by adding a lens structure to each light-emitting pixel, so that the originally divergent light can be focused on the screen. Through this technology, the forward direction of OLED is The light output rate has been increased by more than 15%. (My Drivers, IT Home, Sina)

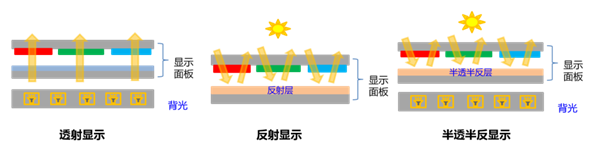

TCL CSOT has developed a new transflective screen, which can reduce the power consumption of outdoor display by 90% and has a faster response time. According to TCL Huaxing, the transflective display (TRD) technology is actually a display that can be switched between transmissive display mode or reflective display mode according to changes in ambient brightness. In a bright environment, the ambient light is used as the light source to realize the display, and in the dark environment, the backlight is used to provide the light source to realize the display. At the same time, it combines the advantages of the reflective display mode, such as energy saving, eye protection, high contrast in the bright environment, high-definition transmission display, and fast dynamic response. , so it can be applied to outdoor high-bright environment billboards, bus stops and student education tablets, etc.(My Drivers, IT Home)

STMicroelectronics’ latest FlightSense Time-of-Flight (ToF) multi-zone sensors continuously scan their field of view to map the scene and gather intelligence without using a camera or recording images. By using ToF technology, the sensors can detect and track multiple targets, calculating at high speed their X/Y/Z coordinates and motion. The latest VL53L5CP FlightSense multi-zone sensor can detect multiple targets in 64 (8×8) zones within a wide 61-degree field of view. The sensor comes with Presence Premium PLUS, ST’s proprietary third generation of algorithms dedicated to PC applications, supporting its advanced and innovative features and enhancing data protection. Interacting with native aspects of the PC hardware and OS, this turnkey solution is certified at the highest level by Intel. Lenovo is integrating ST’s presence solution in select laptops.(Laoyaoba, Sohu, CTimes, EE Times)

Samsung Electronics will reportedly install a 200Mp camera on the Galaxy S23 that is scheduled to be released in 2023. The flagship model, Galaxy S23 ultra, will be the only lineup equipped with a 200Mp camera. The vanilla Galaxy S23 and the Galaxy S23+ will likely stay at 50Mp, or upgrade to 108Mp at best. Samsung Electro-Mechanics and Samsung Electronics are producing 200Mp cameras in a ratio of 7 to 3. The supply chain is expected to expand to other parts suppliers, when 200 million pixel cameras are applied to lower end products. (GSM Arena, ET News, Android Headlines)

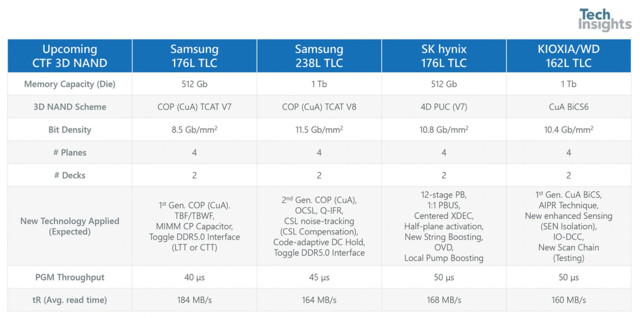

Samsung is getting ready to start mass production of its 8th Generation V-NAND memory, which will feature over 200 layers and bring higher performance and bit densities for solid-state storage devices. Samsung’s 7th generation V-NAND modules, which were released in 2021, featured 176 layers and supported speeds of up to 2.0 GT/s, and it is fair to expect these speeds to increase with the introduction of 8th generation V-NAND.(CN Beta, Guru3D, Tom’s Hardware, Techspot)

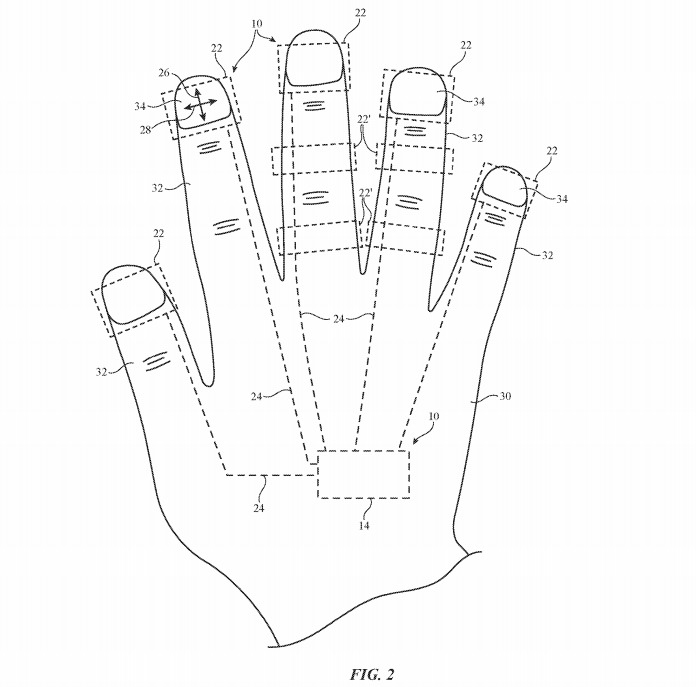

Apple has filed a patent that relates to finger sensor devices that will provide accurate hand feedback allowing users to work with content seen on the display of a headset using three-dimensional air gestures and more. Apple invention covers a finger-mounted device that may include finger-mounted units coupled to control circuitry. The control circuitry may wirelessly transmit information gathered with the finger mounted units to an external device to control the external device. The control circuitry may also use the finger-mounted units to provide a user’s fingers with feedback such as haptic feedback. (Apple Insider, Patently Apple)

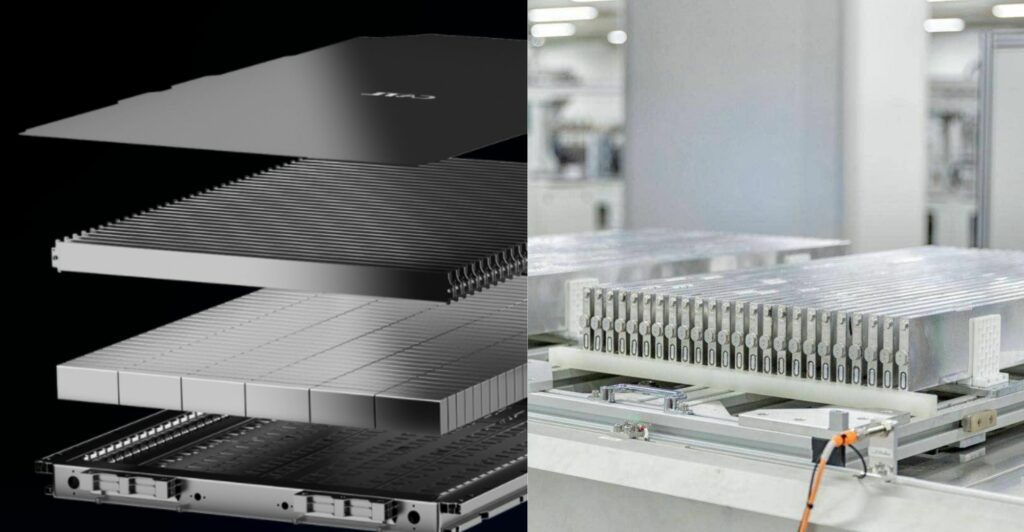

Samsung SDI has announced that it has established new research and development hubs in the U.S. and Germany. It will work with universities, research institutes and startups in various regions to improve the performance of batteries and develop a new generation as demand for electric vehicles grows. Samsung SDI also has plans for a research institute in China in 2023, but no city has yet been announced for it. The company will secure its own patents for solid-state batteries, the mainstays of future power storage, following Toyota Motor, Panasonic and others. In 2021, Samsung SDI invested KRW877.6B (USD668M) in research and development, an increase of 9% over 2020, and is now installing the capacity needed to mass produce next-generation batteries.(CN Beta, Samsung SDI, Asia Nikkei, Korea Times)

CATL’s factory in Yibin, Sichuan Province, stopped production due to power brownouts, and the duration of power brownouts rationing lasted from 15 Aug to 20 Aug 2022. CATL’s Sichuan Yibin Factory is located in Sanjiang New District, Yibin City, Sichuan Province. It is one of the main lithium battery production bases in China. On 16 Aug 2022, the Yibin government announced the implementation plan of industrial enterprises for peak summer in 2022. CATL announced the construction of its new lithium battery factory in Yibin, Sichuan Province in 2019. The project was divided into six phases with an investment of over CNY30B (USD4.42B).(Reuters, Pandaily, Taipei Times, China Star Market, EET China, Bloomberg)

SK On has turned to domestic private equity firms to raise up to KRW2T (USD1.5B) after talks with four big global funds have dried up amid a wide gap over its valuation. The battery unit of energy group SK Innovation has been in talks with a local private equity consortium which includes EastBridge Partners, Korea Investment Partners and Stella Investment. Of the total, it had planned to raise KRW3T from two overseas investors and another KRW1T from domestic funds under the same terms and conditions. (Laoyaoba, Reuters, KED Global, Business Korea)

BMW is poised to begin its shift to cylindrical EV battery cells by partnering with China’s EVE Energy. EVE has signed contracts to be BMW’s primary supplier of battery cells in Europe for a new line of EVs debuting in 2025. The cells will be similar in size to Tesla’s large format 4680 cells. These cells are 46mm in diameter and 80mm in length, compared to the 21mm diameter and 70mm length of Tesla’s current 2170 cells. Tesla believes this new format will lower production costs and increase range. (CN Beta, Reuters, Green Car Reports, Auto News)

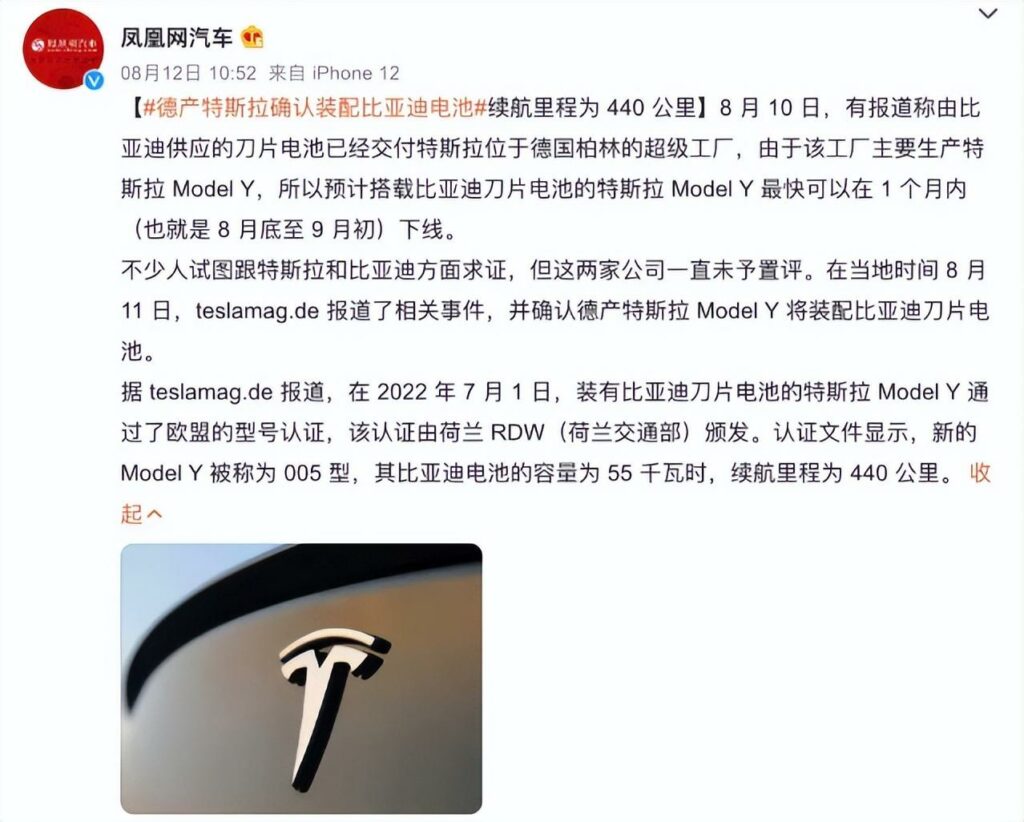

BYD reportedly will be supplying blade batteries for Tesla Berlin. the BYD-powered Model Ys were allegedly approved by the EU at the beginning of Jul 2022. The car model, referred to as the Type 005, reportedly has a 440km of range. CATL remains Tesla’s largest EV battery supplier. It supplies 70% of the batteries used by Tesla Shanghai, the US-carmaker’s largest production site, while 30% of the batteries used were supplied by South Korea-based battery supplier LGES. Tesla Berlin reportedly has been using only LGES’s 2170 cylindrical batteries and testing locally-produced 4680 cylindrical batteries. (Digitimes, iFeng, East Money, 163.com)

Xiaomi has reportedly finalized two battery suppliers for its eletric vehicles, CATL and FinDreams Battery, which is owned by BYD. Xiaomi will deliver its first EV in 1H24. Xiaomi Auto will provide both a high-end and a low-end configuration for its first vehicle. Specifically, the low-end version will be packed with a 400V voltage platform and the higher-end version will have a 800V voltage platform. Accordingly, the lower-end models will be equipped with BYD’s ferrous lithium phosphate blade battery, while the higher-end models will be equipped with the latest Kirin battery made by CATL. (CN Beta, IT Home, Sina, OfWeek, Electrive, Pandaily, 36Kr)

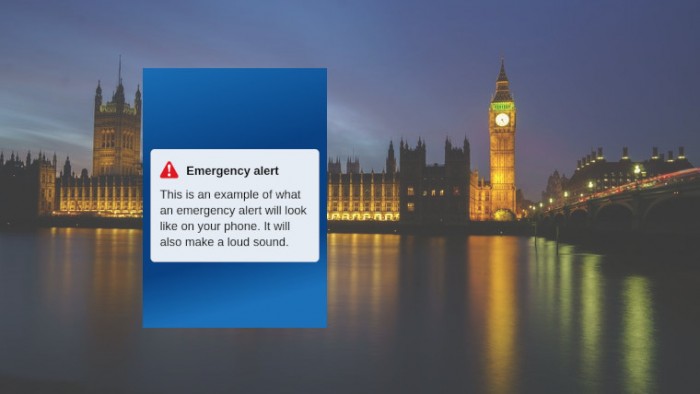

An emergency warning system, allowing alerts about severe weather and other life-threatening events to be sent to mobile phones, will go live in Oct 2022 in England, Scotland and Wales. The messages will be sent automatically to any smartphone which is switched on, although it is possible to opt out by changing a mobile phone setting. A government publicity campaign will begin in Sept 2022, and every phone in England, Scotland and Wales, will receive a “welcome message” in Oct 2022. The system will eventually cover the whole of the UK, says the government. The system works by sending a message and a distinctive warning tone to mobiles directly via cell towers, rather than accessing a list of mobile numbers. An alert can be sent to a single tower, meaning anyone in the vicinity could pick it up, even, for example, when travelling through the area. (CN Beta, BBC, Gov.UK, Express)

Apple is in talks to make Apple Watches and MacBooks in Vietnam for the first time, marking a further win for the Southeast Asian country as the U.S. tech giant looks to diversify production away from China. Apple suppliers Luxshare Precision Industry and Foxconn have started test production of the Apple Watch in northern Vietnam with the aim of producing the device outside of China for the very first time.(Apple Insider, Asia Nikkei)

Samsung has dropped its smartphone shipment target for 2022 from the previous 300M units to 260M units. Earlier in 2022, Samsung had planned to manufacture a total of 334M units of smartphones with the goal of shipping around 300M units of them. Out of the 334M units it had planned to manufacture in 2022, 284M units would have been manufactured in its own facilities while 50M units were to be given to its joint development manufacturers in China.(CN Beta, Gizmo China, The Elec)

realme CEO Sky Li has stated that realme is entering its second stage of growth. During this period, the brand will be focusing on refining its goals for long term growth and launch even more “exceptional Number Series smartphones” in the market soon. These new models will arrive with a stylish package but with an accessible price tag to better appeal to the youth demographic. realme is expanding its research and development by 58% compared to 2021.(Gizmo China, Twitter)

Saigon-Bac Giang Industrial Park Corporation, a subsidiary of Kinh Bac Urban Development Corporation, has signed an MoU with Foxconn to lease 50.5 hectares of land in Quang Chau Industrial Park in Bac Giang province. Foxconn plans to pour additional USD300M into a new factory in Vietnam. Foxconn wants to develop a new project with a total investment of more than USD300M, which will create 30,000 jobs for the local workers. In April 2021, Foxconn announced to invest an additional $700 million to expand its production scale with a view to generating export revenue of USD10B dollars per year. Foxconn is currently the most significant foreign company in Quang Chau Industrial Park with a total leased area of almost 70ha. The group has a total registered investment capital of USD773M. Apple suppliers Foxconn and Luxshare Precision Industry have started test production of the Apple Watch in northern Vietnam to produce the device outside of China for the first time. It is said that Apple is considering making its MacBook and Apple Watch in Vietnam.(CN Beta, Postsen, VIR)

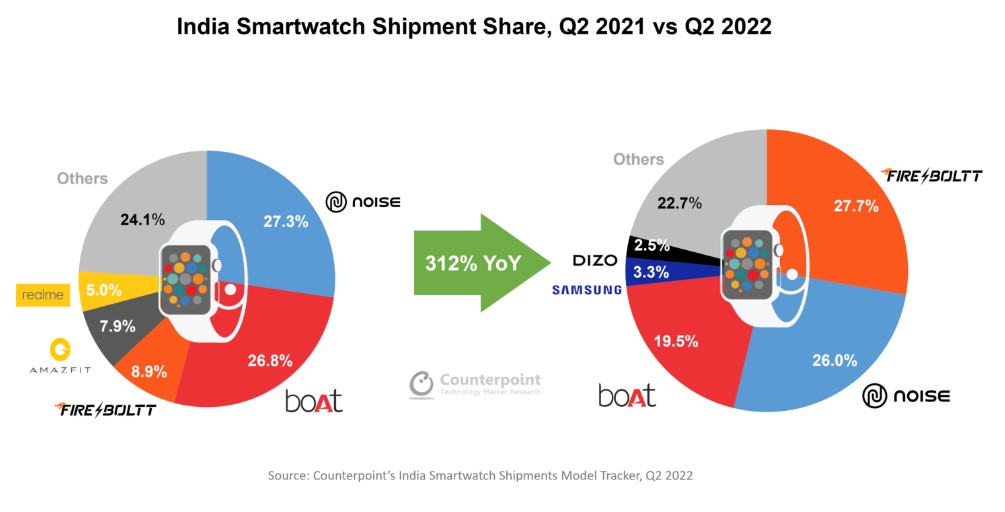

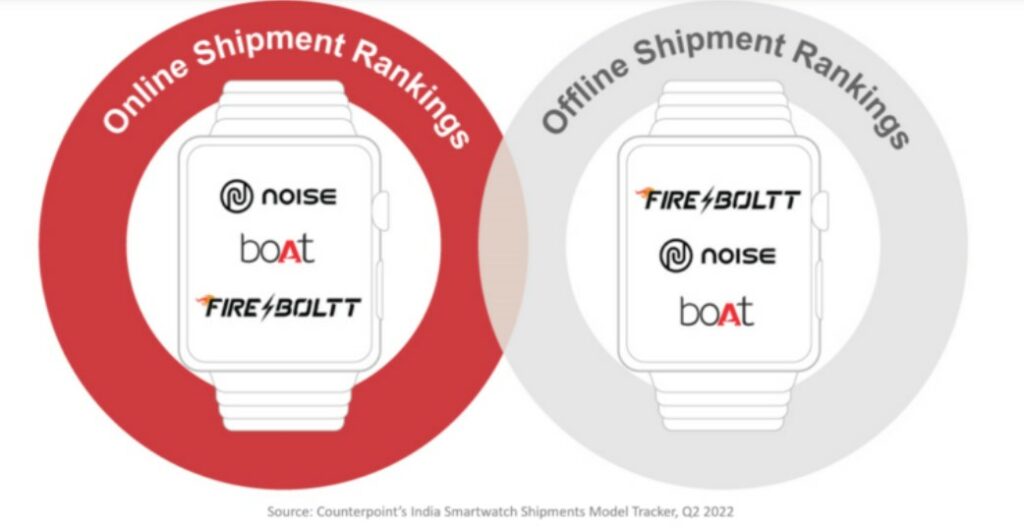

India’s smartwatch market grew 312% YoY in 2Q22, according to Counterpoint Research. This growth can be attributed to growing consumer interest in smartwatches as an accessory and as a fitness tracker. There were numerous product launches throughout the quarter as brands sought to grow their offline presence across the country. Fire-Boltt led the market and had the most product launches in 2Q22. Its increasing offline presence and good product features at affordable prices helped the brand to take the lead. Noise captured the second spot with 26% share and registered 293% YoY growth. A total of 50 new smartwatch models were launched during the period and half of all sales were in the sub-INR3,500 (USD44) price category. (GSM Arena, Counerpoint Research)

Google Research and Everyday Robots join hands to create new robotics algorithm PaLm-SayCan, a joint effort utilizing Google’s Pathways Language Model (PaLm) and an Everyday Robots helper robot.. The new efforts should assist robots in better understanding humans through language via voice or text. The companies are also using “chain of thought prompting” to help robots understand a task and the tools to complete it. Google says this effort “is the first implementation that uses a large-scale language model to plan for a real robot”. (Google, TechCrunch, Android Central)

Snap is allegedly sunsetting future development of its Pixy flying selfie camera less than 4 months after launching the product publicly. Pixy is a small drone that takes off and lands in the user’s hand. It was introduced at the end of Apr 2022 during Snap’s annual partner summit with a USD230 starting price. Snap will continue to sell the current iteration of Pixy. (CN Beta, Digital Trends, WSJ)