8-25 #GreenCode : Apple will be the first customer to use TSMC’s 3nm chips by the end of 2022; Samsung to expand semiconductor production capacity in South Korea; GF plans to raise prices for some of its manufacturing processes by up to 8% in 2023; etc.

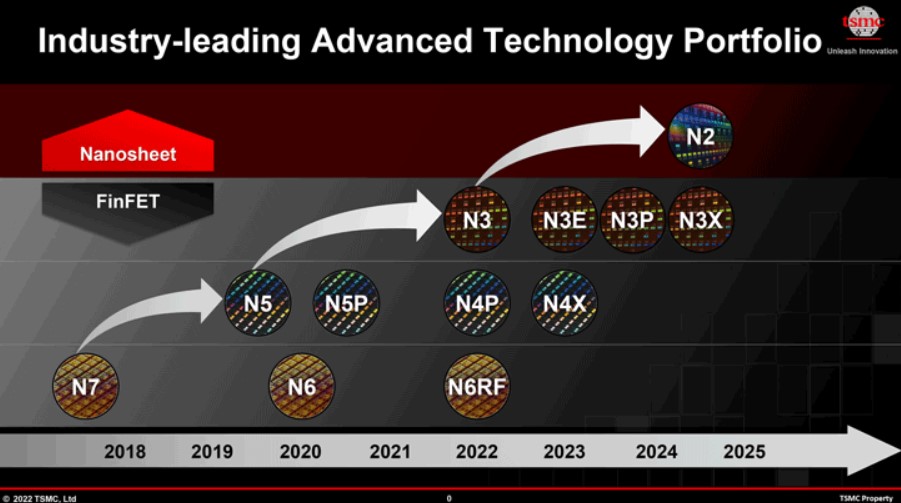

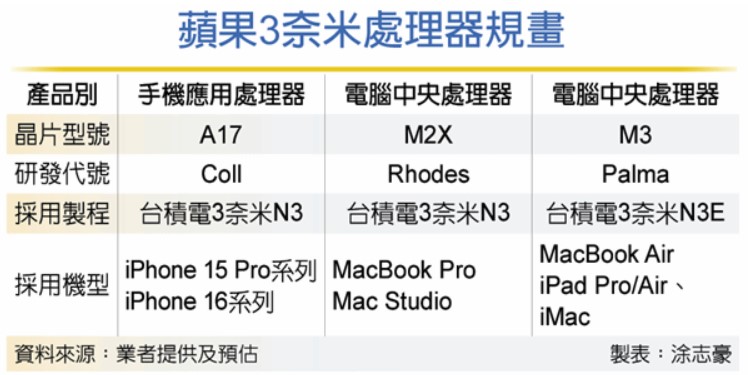

Full-scale mass production of the 3nm node is not projected to begin until 2H23, and TSMC will also begin their N3E later in 2023. mportant customers for the 3nm node besides Apple include AMD, Broadcom, Intel, MediaTek, NVIDIA, and Qualcomm. TSMC, the largest wafer foundry, has said the 3nm expansion will continue as planned despite reports to the contrary. Apple will be the first customer to use 3nm chips by the end of 2022, and Intel will expand the use of 3nm chips in the second half of next year to produce processor chips. Super Micro, Huida, Qualcomm, MediaTek, Broadcom, etc. will complete the opening of new 3nm chips in 2023 and 2024. TSMC’s sophisticated manufacturing process prioritizes Apple. Apple will use TSMC’s 3nm wafers for the first time in 2H23, say equipment makers and Apple’s production chain. First up may be the M2 Pro, followed by the iPhone-specific A17 in 2023. TSMC’s 3nm production will include M2 and M3 application processors.(CN Beta, CTEE, CTEE, Digitimes, Guru3D)

Samsung Electronics is expected to invest some USD74B to expand semiconductor production capacity in South Korea to meet growing global demand in the long term. Samsung has allegedly notified the local government of a plan to operate six production lines at its Pyeongtaek complex. The company could spend about KRW100T (USD74.3B) to add 3 new production lines as it usually costs some KRW30T to build one. In the Pyeongtaek complex, Samsung is set to manufacture the industry’s smallest 14-nanometer DRAM chips using extreme ultraviolet (EUV) technology, and system semiconductors with 5 nm or smaller-size process nodes. (CN Beta, KED Global)

GlobalFoundries (GF) plans to raise prices for some of its manufacturing processes by up to 8% in 2023, according to Digitimes. GF has just received a new USD4.2B order from Qualcomm, which has inspired GF to raise offers for some of its process products. GF will receive USD7.4B in total orders from Qualcomm through 2028. It is reported that TSMC intends to maintain its planned price increase of 6-8% from 2023, although IC design companies are actively renegotiating quotations for foundry in 2023 with foundries recently. (Laoyaoba, Digitimes)

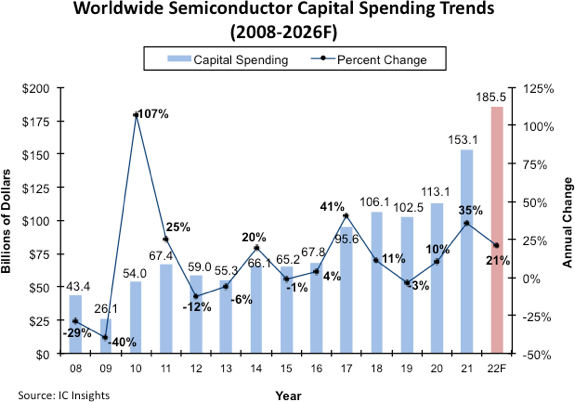

IC Insights has adjusted its 2022 worldwide semiconductor capital-spending forecast that now shows a 21% increase in 2022, to USD185.5B. The revised outlook represents a decrease from USD190.4B and 24% growth that was forecast at the beginning of 2022. Though lowered, the revised capex forecast still represents a new record high level of spending. In fact, if industry capital spending rises as forecast by a double-digit amount in 2022, it will mark the first 3-year period of double-digit capital expenditure gains in the semiconductor industry since 1993-1995. Wafer fab utilization rates at many integrated device manufacturers (IDMs) remained well above 90% through 1H22 and many semiconductor foundries operated at 100% utilization rates, as orders remained robust during the economic recovery from the Covid-19 pandemic. (Laoyaoba, IC Insights)

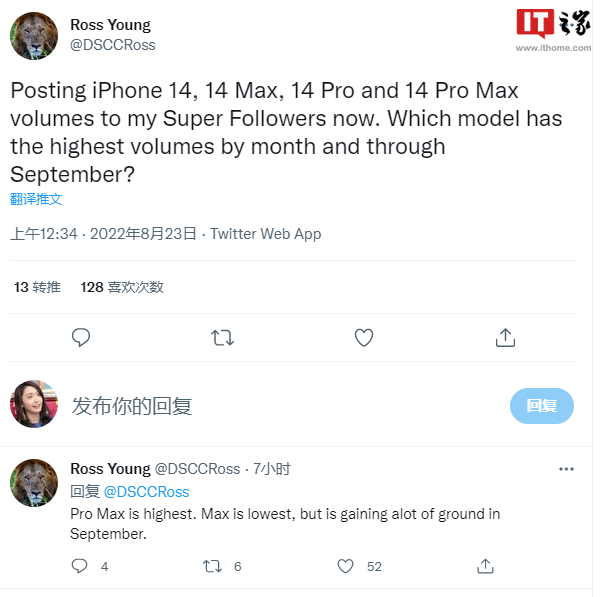

Panel shipments indicate that Apple is focusing on the iPhone 14 Pro Max and iPhone 14 Pro production for when it announces the new smartphones in Sept 2022, according to DSCC’s Ross Young. He has indicated that from Jun-Sept 2022, iPhone 14 Pro Max has the highest share of panel productions with a 29% and 28% share respectively. During this quarter, the iPhone 14 Max had the smallest share at 21% of production and 19% of shipments, although Young expects this phone to “make up a lot of ground in Sept”. (GizChina, 9to5Mac, Apple Insider, Twitter)

LG Display and SK Hynix join forces to produce micro organic light emitting diodes (OLEDs). Micro OLED refers to the core display of extended reality (XR) devices. They are expected to emerge as the global ‘Big Two Alliance’ in the metaverse era, where XR devices will be in the spotlight as a next-generation device that will surpass smartphones. SK Hynix designs wafers and draws circuits. LG Display is likely to be in charge of OLED deposition onto wafers to the final completion stages. The ultimate goal is to supply displays for XR devices to global big tech companies. (Laoyaoba, OLED-Info, ET News)

NAND flash memory prices are set to fall further in 2H22, as suppliers face mounting pressure to deal with excess inventory, according to Digitimes. NAND flash chip suppliers are reportedly now facing 4-5 months of inventory. Chip prices will drop rapidly in 2H22, with a quarterly price drop of nearly 20%. NAND flash prices may continue to decline in 1H23. At present, suppliers are becoming more cautious about data center demand, and the overall demand in the end market is still sluggish. (Digitimes, Digitimes, CN Beta, Benzinga)

Samsung has announced the latest addition to its SSD family. The 990 PRO is a high-performance NVMe PCIe 4.0 solid-state drive “optimized for graphically demanding games and other intensive task”. Samsung also claims the 990 PRO is currently the fastest PCIe 4.0-based SSD. The Samsung 990 PRO uses the latest V-NAND memory and a proprietary controller to get as close as possible to the theoretical limit of the PCIe 4.0 interface, which is 8,000 MB/s. According to Samsung, the SSD reaches 7,450 MB/s read and 6,900 MB/s write speeds (sequential). Random speeds peak at 1400K and 1550K IOPS.(Engadget, Sammy Hub, Neowin, Samsung)

German carmakers Volkswagen and Mercedes-Benz have struck battery materials cooperation agreements with mineral-rich Canada intensifying efforts to secure access to lithium, nickel and cobalt. The move comes as automakers roll out their electric-vehicle expansion strategies globally in a bid to challenge sector leader Tesla. These strategies depend on sufficient supplies of vital battery materials. Volkswagen aims to build, with partners, six large battery cell factories in Europe by 2030 with a capacity of around 240 gigawatt-hours, as well as a dedicated factory in North America for which it is currently examining potential sites. Mercedes-Benz will explore a strategic partnership with Rock Tech Lithium under which the Canadian firm would supply the German carmaker and its battery partners with up to 10,000 tonnes of lithium hydroxide a year from 2026. (CN Beta, Yahoo, Euro News, Mining)

Gogoro, a global technology leader in battery swapping ecosystems that enable sustainable mobility solutions for cities, today announced it had surpassed 500,000 monthly battery swapping subscribers in Taiwan. Launched in 2015, Gogoro battery swapping has become the refueling leader for electric two-wheel vehicles with more than 92% market share in Taiwan in 1H22. Gogoro’s open battery swapping ecosystem currently supports ten different vehicle brands, accounting for more than 25% of all two-wheelers sold in Taipei in 1H22. (CN Beta, PR Newswire, Gogoro)

Samsung SDI plans to invest KRW2T in Europe to expand its electric vehicle battery production. It will expand its existing Hungarian EV battery plant and increase the production capacity. By doing so, it is expected to secure a battery production capacity for 1M EV installations per year. Samsung SDI’s board of directors finally confirmed its plan to invest KRW2T in expanding Hungary’s EV battery production capacity. In addition to expanding the Hungary plant, it will expand the production capacity to 60GWh per year by 2H23.(CN Beta, ET News)

UK-based global telecom giant Vodafone Group has agreed to sell its Hungarian subsidiary to BSE-listed ITC company 4iG and state-holding Corvinus for HUF715bn in cash (EUR1.8B). The transaction, expected to close by the end-2022, subject to due diligence and regulatory approval, will give 4iG 51% in Vodafone Magyarorszag and the state a 49% stake. 4iG already holds 25% of Hungary’s third-largest mobile operator Telenor indirectly, after it bought a majority stake last year in state telecommunications company Antenna Hungaria. (CN Beta, Reuters, Digital TV, RCR Wireless, Intelli News, Vodafone)

Apple supplier Foxconn has signed a USD300M memorandum of understanding with Vietnamese developer Kinh Bac City to expand its facility in the north of the country to diversify and boost production. Foxconn, which has been in Bac Giang for 15 years, has moved part of its iPad and AirPods production to Bac Giang’s Quang Chau Industrial Park, Tuoi Tre reported. It did not say which type of products would be produced at the new factory or its capacity. The Vietnamese government said in 2021 Foxconn has invested USD1.5B in the Southeast Asian country.(Apple Insider, Reuters, CN Beta, The Saigon Times)

Apple will reportedly manufacture some of its iPhone 14 models in India in a bid to diversify its smartphone production from China. Foxconn will not be able to start immediate production of the iPhone 14 in India and will reportedly have to wait at least 2 months after the initial iPhone 14 series production starts in China. This means that the first batch of iPhone 14 models made in India will likely be ready around late Oct – early Nov 2022. Apple and Foxconn are also hard at work at shortening manufacturing lead times from the current 9 to 6 months. (GSM Arena, Bloomberg, Reuters, 91Mobiles)

LG Electronics and Apple have likely entered a long-term patent use agreement of up to 10 years as is standard for large conglomerates. The patents in question also likely included many standard essential patents. LG Electronics has allegedly received KRW890B and Apple has paid over KRW800B out of that total with the other company of paying the rest.(GSM Arena, The Elec)

OPPO halted sales in Germany in Aug 2022 after losing a patent lawsuit to the Finnish telecoms giant Nokia, which alleged that OPPO’s use of certain 4G and 5G signaling technologies had infringed on its patents. Billy Zhang, VP of overseas sales and services, has said there was limited information he could disclose regarding the lawsuit with Nokia, but reiterated it would continue to invest in the country. The executive has added he “firmly believed” the issue would be “properly resolved”.(TechCrunch, Mobile World Live)

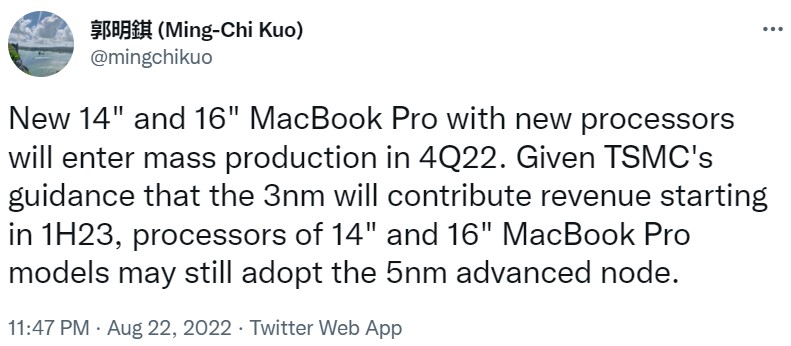

Apple’s next-generation 14” and 16” MacBook Pro models will enter mass production in 4Q22, according to TF Securities analyst Ming-Chi Kuo. Kuo has said that given TSMC’s guidance indicated that revenue from 3nm chip production will not begin until 2023, the new 14” and 16” MacBook Pro models may still have chips based on TSMC’s latest 5nm process. (GSM Arena, CN Beta, MacRumors, Twitter)

Apple has announced Self Service Repair will be available for MacBook Air and MacBook Pro notebooks with the M1 family of chips, providing repair manuals and genuine Apple parts and tools through the Apple Self Service Repair Store. Self Service Repair for iPhone launched earlier 2022 and the program will expand to additional countries — beginning in Europe — as well as additional Mac models later in 2022.(Engadget, Apple)

Sony has announced that the company is releasing the Playstation VR2 (PSVR 2) early 2023. PSVR 2 will feature an OLED display with 2000×2040 pixels per eye and a refresh rate of up to 120Hz. It utilizes inside out eye tracking and will have 110 degree field of view. Sony also announced that PSVR 2 will have over 20 games at launch.(CN Beta, IGN.com, GamesRadar, Push Square, Instagram)

Nreal, a consumer-grade AR glasses brand, has officially launched three hardware products for the Chinese market, including two AR glasses: Nreal X, the world’s first full-featured AR glasses in the form of glasses, which explores the infinite application of augmented reality technology; NrealAir is the AR glasses with the best display effect among XR devices, lightweight and fashionable, and opening the trend of life with giant screens anytime, anywhere. (CN Beta, China Daily, DoNews)

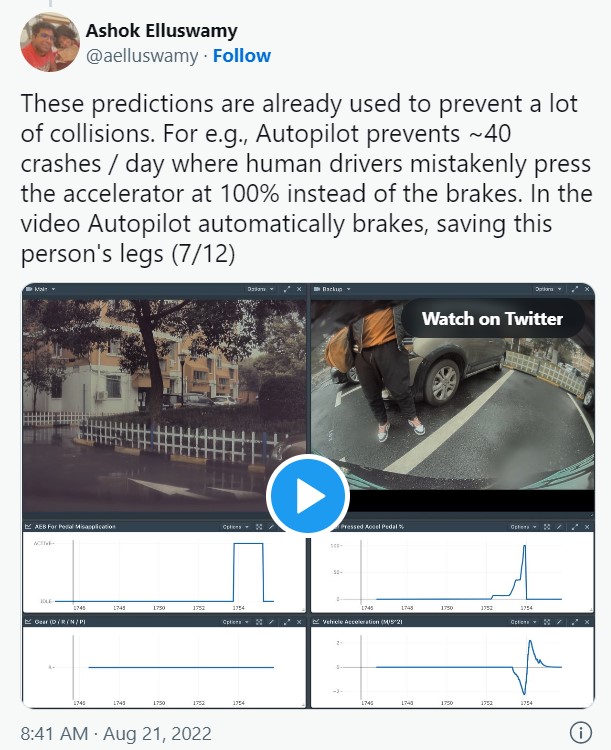

According to Tesla’s director of Autopilot software Ashok Elluswamy, Tesla is preventing about 40 crashes a day for just this one reason alone. Elluswamy’s claim comes just as Tesla CEO Elon Musk announced that the company was jacking the price of Full Self Driving from USD12,000 to USD15,000 in Sept 2022. The accidents he claims autopilot can prevent are those associated with sudden unexpected acceleration (SUA). In about 40 crashes, human drivers mistakenly pressed the accelerator instead of the brakes, he said. But Autopilot realizes they are doing this and a collision is imminent, and automatically stops accelerating and applies the brakes to prevent a human collision.(GizChina, IT Home, Auto Evolution, Forbes, Teslarati)

Chinese automaker Great Wall Motor has announced at a new energy strategy conference in Beijing that its sub-brand HAVAL will stop selling fuel-powered vehicles before 2030. The brand also revealed that by 2025, new energy vehicles will account for 80% of its sales. In order to better develop and plow deeper into the new energy field, Great Wall Motor says it will set up the HAVAL New Energy company in the future.(CN Beta, Sohu, Sina, Pandaily, CarExpert, Great Wall Motor)

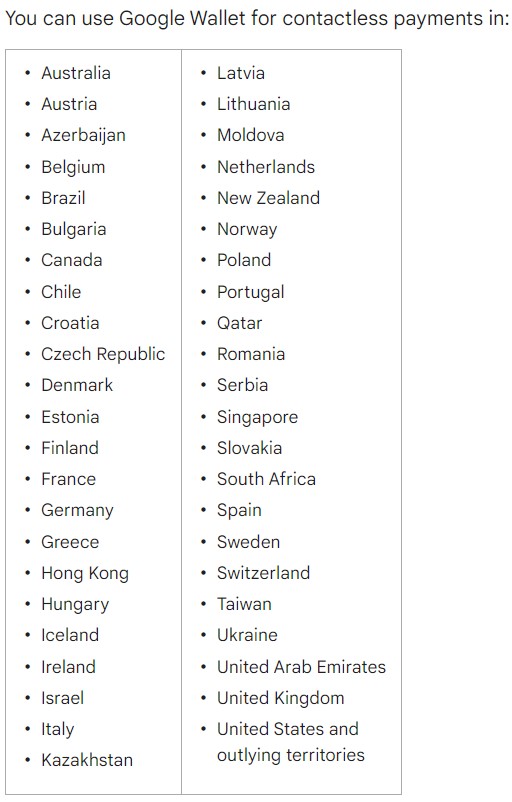

Google has announced that Google Wallet has expanded its reach to more regions, bringing the total number of supported countries / regions to 45. The newly added countries/regions include Azerbaijan, Iceland, Moldova, Qatar, Serbia, and South Africa.. The app is not yet supported on Wear OS in these newly added countries/regions.(Android Authority, Android Police, Google)

Samsung Securities is reportedly working on launching its own crypto exchange platform early 2023. Samsung already offers a Blockchain Wallet for Galaxy users to securely store their virtual assets. Other South Korean companies include Mirae Asset Securities have also set their focus on the crypto industry and plan to set up digital asset exchanges. This new push into the crypto market by various domestic companies is in large part driven by President Yoon Suk-yeol’s stance on cryptocurrencies and virtual asset trading. (Android Headlines, Newspim, Crypto Potato, SamMobile)

eBay and TCGplayer, a trusted marketplace for collectible card game enthusiasts, have announced they have entered into an agreement for eBay to acquire TCGplayer for about USD295M. Trading cards are an attractive category, which has seen substantial growth. TCGplayer is a leading technology platform for the collectibles industry, and will continue to operate autonomously as one of the largest online marketplaces for trading card games.(Engadget, The Verge, TechCrunch, PR Newswire)