8-28 #Home : Samsung is reportedly testing two new chipsets; NVIDIA and AMD are reportedly planning to reduce the GPU pricing; Samsung Display aims to mass produce OLED microdisplays by 2024; etc.

Samsung is reportedly testing two new chipsets. One of them could be the successor to the Exynos 1280. It would be named the Exynos 1380. The model number of the other chipset is S5P9865, which may be the next-generation Google Tensor chipset. These assumptions are based on the guess that the model number of the first-generation Tensor processor is S5P9845. Samsung is also testing a chipset with model number S5E8835, which is going to be the follow-up chipset of the Exynos 1280. (GizChina, GalaxyClub)

In 2019, Samsung and AMD reached a cooperation and obtained AMD’s RDNA architecture GPU authorization, and the Exynos 2200 processor in 2022 will use AMD GPU technology. Samsung has officially confirmed that its future Exynos chipsets will continue to feature GPUs based on AMD’s RDNA architectures. According to GPU development VP Sungboem Park, they plan to continue to implement other features in the RDNA series by working closely with AMD going forward. The GPU of mobile devices is about 5 years behind the host. Through cooperation with AMD, Samsung can quickly integrate the latest gaming technology into the Exynos 2200 mobile processor. The Xclipse 920 GPU of the Exynos 2200 processor in 2022 has 6 computing units, 384 stream processor cores, and the RDNA2 architecture. The next-generation Exynos 2300 should use the Xclipse 930 GPU, which may have 8 computing units and 512 stream processor cores. I am not sure whether to upgrade to the RNDA3 architecture. The energy efficiency of the latter will increase by 50%, which is more conducive to mobile platforms. (CN Beta, SamMobile, Samsung, Tom’s Hardware)

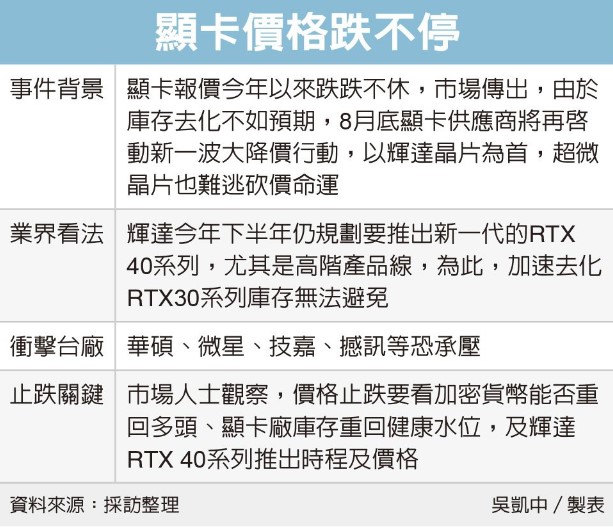

NVIDIA and AMD are reportedly planning to reduce the pricing for their “Ampere” and “RDNA2” GPUs. However, even such reductions have not led to a decrease in the pre-existing inventory that both giants have piled up. All AIB partners are ready to take required measures. (My Drivers, Digital Trends, PC Gamer, Appuals, 3DCenter, CNYES, UDN)

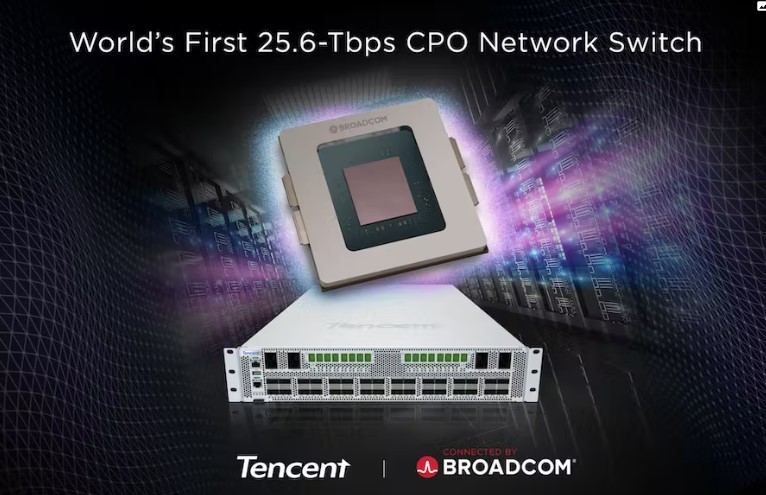

Broadcom has announced that it has formed a strategic partnership with Tencent to accelerate the adoption of high bandwidth co-packaged optics (CPO) network switches for supporting cloud infrastructure. Under this partnership, Broadcom will provide the 25.6-Tbps Humboldt CPO switch device that features its StrataXGS Tomahawk 4 switch chip, directly co-packaged with the four 3.2-Tbps Silicon Photonics Chiplets In Package (SCIP) optical engines.(Yahoo, Light Wave, Laoyaoba)

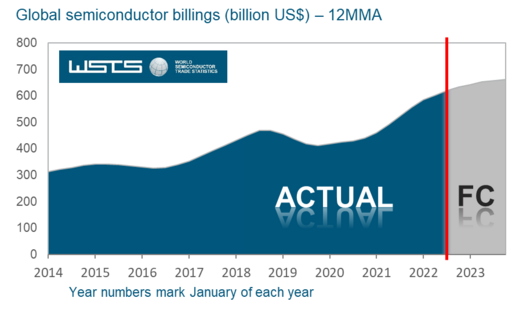

According to World Semiconductor Trade Statistics (WSTS), the global semiconductor market is expected to increase 13.9% in 2022, continuing to grow by 4.6% in 2023. Following a strong growth year of 26.2% in the year 2021, WSTS expects another year of double-digit growth for the worldwide semiconductor market in 2022 with a forecast of USD633B, up 13.9%. WSTS forecasts strong chip demand for another consecutive year, with most major categories expected to see high teens year-over-year growth in 2022, led by Logic with 24.1% growth, Analog with 21.9% growth, and Sensors with 16.6% growth. Optoelectronics remains the weakest category in the forecast and is expected to be roughly flat (+0.2%) YoY. (Laoyaoba, WSTS)

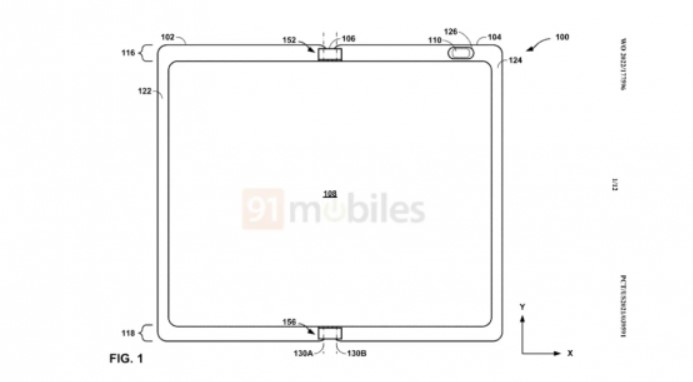

Google has filed a patent of foldable phone at WIPO (World Intellectual Property Organisation). The Google foldable folds in half like a notebook but the bezels around the screen look fairly thick. The patent indicates a camera having an aperture located in a bezel of the second assembly that borders the flexible continuous display.(CN Beta, Android Authority, 91Mobiles)

Samsung Display will be increasing its QD-OLED production capacity by 30% before the end of 2022. The company will be able to quickly bring the equipment online that it needs to ramp up production. Samsung Display’s Q1 line, where it manufactures the QD-OLED panels, currently has a capacity of 30,000 Gen 8.5 (2200x2500mm) substrates per month. The company is aiming to increase to late-30,000 substrates per month by the end of 2022. Samsung Display has also increased the yield rate of QD-OLED by 85% recently, which will help it to meet its goal. Samsung Display can achieve the desired result by shortening the equipment tact time without requiring a significant investment. Samsung has also announced that it plans to start producing 77” and 49” QD-OLED panels in 2023. This is in addition to the current 34”, 55” and 65” panels. (CN Beta, SamMobile, The Elec, OLED-Info)

According to Samsung Display CEO Choi Joo-sun, the company will put more resources into developing and producing organic light-emitting diode (OLED) panels for notebooks and PCs. Samsung Display plans to build a production line for the eighth-generation OLED panels, 2200x2500mm, for IT products, with a goal to start production in 2024, adding the OLED market could grow to a USD100B industry by 2030 from around USD40-45B in 2022. He has said the company has set a goal of reaching USD50B in annual sales.(Laoyaoba, Korea Bizwire)

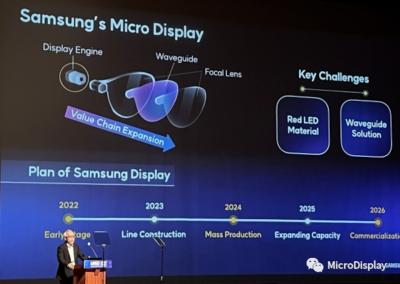

Samsung Display aims to mass produce OLED microdisplays by 2024, full commeriability by 2026. Samsung admits it is still at an early stage of development, and it says it will start building its first line (with likely limited capacity) in 2023. By 2024 it will mass produce displays, and in 2025 it will expand capacity so that by 2026 it will achieve full commercialization.(OLED-Info, OLED Industry)

According to TrendForce, as technology and materials evolve, the penetration rate of OLED folding mobile phones is estimated to reach 1.1% in 2022. While mobile phone brands successive launch new flagship folding devices, penetration rate is expected to exceed 2.5% post-2024 driven by improved specifications and increasingly competitive pricing. In addition, there is an opportunity to provide a breath of fresh air to a market steeped in sluggish consumer sentiment led by inflation and drive folding mobile phones into the mainstream. (GizChina, TrendForce)

According to TrendForce, 4” wafers for Micro LED Large-Sized displays will reach approximately 1.14M units by 2026. The chip market is expected to reach USD2.7B with a compound annual growth rate (CAGR) of approximately 241% from 2021 to 2026. Large-Sized displays are currently the most anticipated products among a number of Micro LED display applications. However, the greater Micro LED market remains at a R&D and experimental stage as branded manufacturers have yet to launch mass-produced products. There are still technical and cost bottlenecks that need to be completely overcome before mass production and commercialization are feasible including improvement of wafer wavelength uniformity, increasing mass transfer production capacity, and improvement of glass backplane metallization yield rate. Therefore, future efforts to surmount technical bottlenecks will focus on wafers, mass transfer, and glass backplane metal processes. (Laoyaoba, TrendForce)

OmniVision has announced the industry’s first and only three-layer stacked BSI global shutter (GS) image sensor. The OG0TB is the world’s smallest image sensor for eye and face tracking in AR/VR/MR and Metaverse consumer devices, with a package size of just 1.64mm x 1.64mm, it has a 2.2µm pixel in a 1/14.46-inch optical format (OF). The CMOS image sensor features 400×400 resolution and ultra-low power consumption, ideal for some of the smallest and lightest battery-powered wearables, such as eye goggles and glasses. Ultra-low power consumption is critical for these battery-powered devices, which can have 10 or more cameras per system. Their OG0TB BSI GS image sensor consumes less than 7.2mW at 30 frames per second (fps).(CN Beta, Yahoo, Business Wire)

LG Innotek is in talks with Tesla over a camera module supply deal worth KRW1T (about USD749M). If purchased, the modules will be integrated into Tesla vehicles, including the Model Y and Model 3. Yet-to-be released trucks like the Semi and Cybertruck could also be equipped with the modules. (CN Beta, Business Korea, Korea JoongAng Daily)

Panasonic, a supplier to electric-car maker Tesla, is in talks to build an additional electric vehicle (EV) battery plant in the United States at a cost of around USD4B. Panasonic is looking at Oklahoma as the location for its new plant. (TechCrunch, WSJ, Reuters, Financial Express)

Contemporary Amperex Technology (CATL), China’s world-leading manufacturer of automobile batteries, is stepping up preparations to launch battery rental services for electric vehicles. “Battery as a service” (BaaS) will allow drivers to rent and swap out batteries under a subscription pricing model. A depleted battery can be swapped for get a fresh one in as little as a minute. CATL announced a decision in Jan 2022 to offer a system for swapping modular batteries under the brand of Evogo through its wholly owned subsidiary Contemporary Amperex Energy Service Technology. A standard station takes up around 40 square meters of land and keeps 48 “chocolate” replacement lithium-ion battery packs, shaped like chocolate bars, each offering a driving range of around 200km. Users of CATL’s battery service are allowed to swap up to three packs per visit, and replacing a pack takes about a minute. To use the Evogo service, electric vehicles should be configured to hold chocolate batteries; doing so does not require changes to their bodies.(CN Beta, IT Home, TechWire Asia, Asia Nikkei)

Lunar Energy is announcing the company and its mission to electrify the home and provide energy independence to homeowners worldwide. Led by former Tesla Energy executive, Kunal Girotra, Lunar was founded in Aug 2020 and has raised USD300M in funding over two rounds by Sunrun, the nation’s leading residential solar and battery storage provider, and South Korea’s SK Group. Lunar also acquired Moixa, the leading global software company for distributed energy resources (DER) management. ITOCHU and Honda, previous investors in Moixa, now also join Lunar’s team of investors.(CN Beta, CleanTechnica, Electrek, PR Newswire)

T-Mobile and SpaceX have announced that T-Mobile customers can get satellite coverage via the Starlink satellite fleet. The two companies noted that over half a million square miles of the US are still uncovered by any cellular provider, pointing to land-use restrictions, terrain challenges, or the sheer size of the country in general. T-Mobile is now tapping Starlink’s satellite constellation for coverage in the continental US, Hawaii, Alaska, Puerto Rico, and territorial waters. This coverage — which uses T-Mobile’s mid-band spectrum — is limited to texting only right now though. More specifically, the announcement notes that only SMS, MMS, and “participating” messaging apps are supported.(T-Mobile, Android Authority)

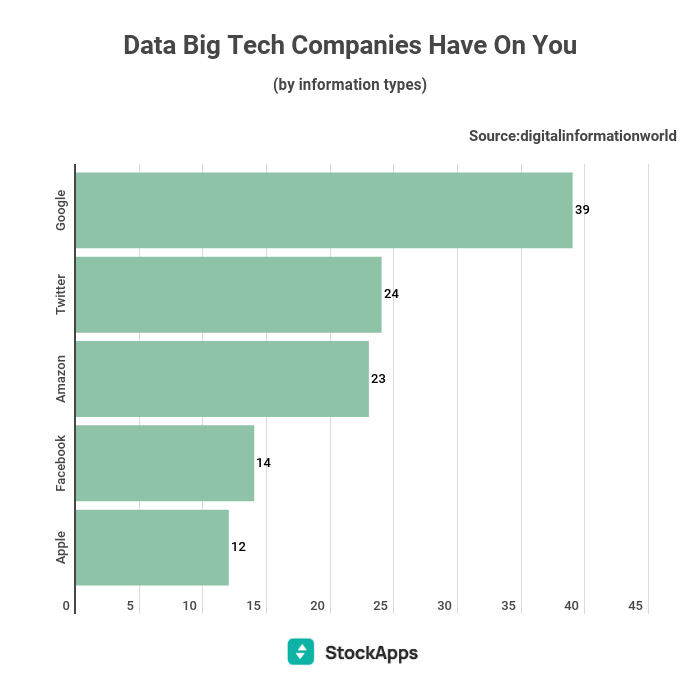

According to an analysis by StockApps.com, out of the 5 major digital firms (Google, Twitter, Apple, Amazon, and Facebook), Google harvests the most data on its users. Google collects 39 data points for each user. Besides users’ information, Google stores a significant amount of data on several domains. If it is data, there is a strong probability that Google is collecting it. This includes anything from users’ specific location to user’s browser history. Moreover, it stores user activity on third-party websites or apps and the emails on users’ Gmail accounts. (Apple Insider, Live Mint, StockApps.com)

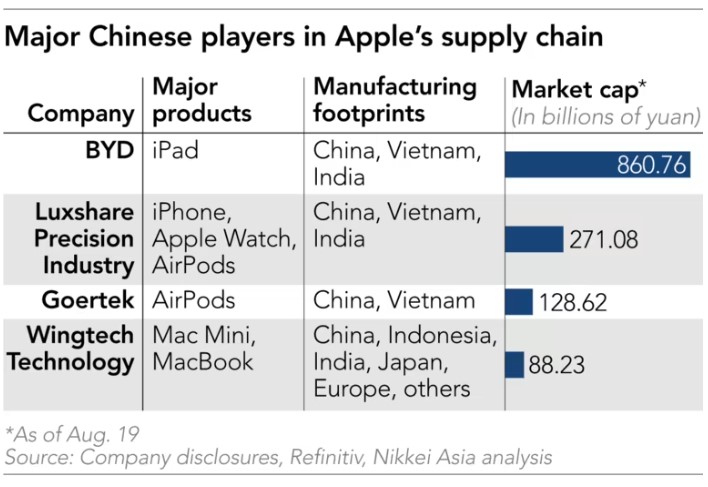

A 40km drive south from Kunming, the capital of China’s southwestern Yunnan Province, recruiters are scrambling to find tens of thousands of workers to staff Wingtech Technology’s expanded production facility. Covering more than 427,000 square meters the Kunming facility has produced tens of billions of yuan worth of smartphones and other products for China’s Vivo, Oppo and others since operations began in Jul 2021. Phase two of the complex, with a total investment of about CNY3B (USD437M), is currently under construction. It will make notebook computers and smartphones. It has started supplying Apple less than 1 year ago after buying component maker O-Film Technology, and has already progressed to making Apple’s Mac Mini desktop computer. It recently won orders to build an older generation of MacBooks at its Kunming facility. (TechNode, Asia Nikkei, Sohu, EET-China)

Susquehanna analyst Mehdi Hosseini has expected that Apple is continuing to increase its build plans for the iPhone 14. He has explained that the increase in units is due to “continued market share gains”, and has caused Apple to boost its plans for the Dec 2022 quarter and 2H22 to 100M units, up from a prior 88M. Hosseini has now estimated that Apple partners are set to build 52M iPhones in the September quarter, up 12% sequentially and 8% year-over-year. The iPhone 13 continues to see strong demand, with estimates of 23.5M builds, up from a prior estimate of 21.5M, due in part to higher builds for iPhone 13 Pro and iPhone 13 Pro Max. Builds for the iPhone 14 are sill tracking towards 23M. He has further added that Apple is now set to build 228M iPhones in 2022, up 8% YoY. (Seeking Alpha, McDaily News, CN Beta)

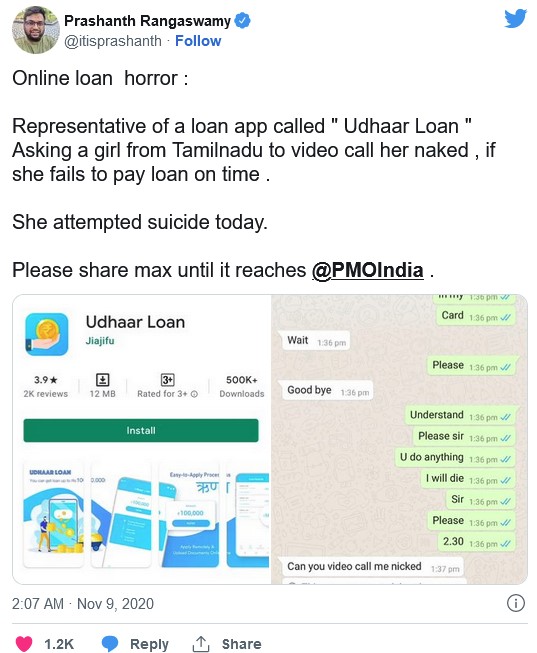

Google says it has pulled more than 2,000 personal loan apps from its Play Store in India, and is working to make some changes to its policy at a time when the local central bank is increasingly cracking down on predatory practices. Saikat Mitra, senior director and head of Trust and Safety at Google Asia-Pacific, has said that the aforementioned apps were targeting Indian users and that it pulled the apps after consulting with local law enforcement agencies.(CN Beta, Outlook India, Yahoo)

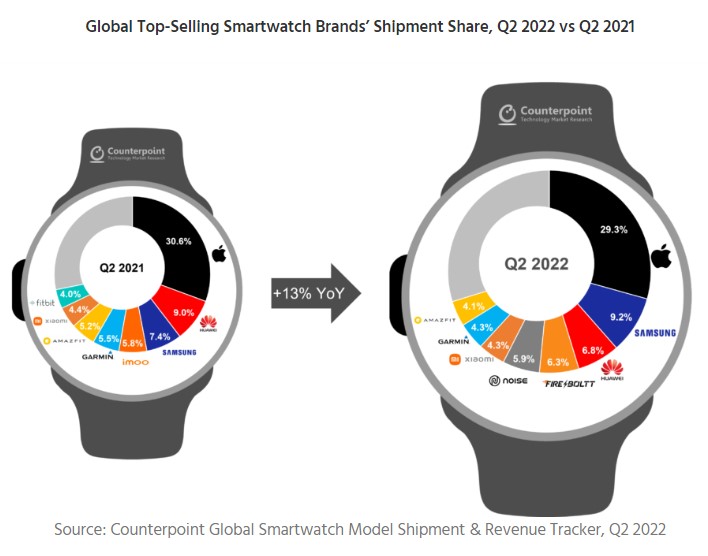

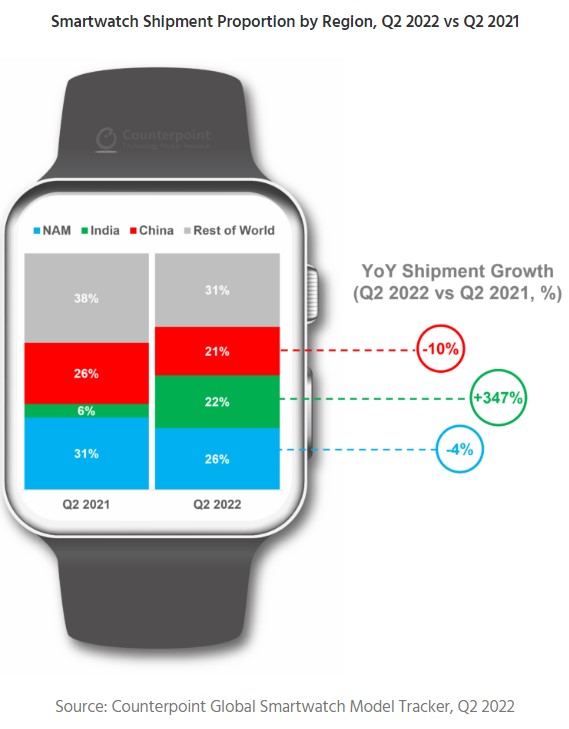

The global smartwatch market’s shipments grew 13% YoY in 2Q22 amid macro uncertainties such as inflation and geopolitical conflicts, according to Counterpoint Research. In particular, India’s smartwatch market grew by more than 300% YoY to overtake China for the second spot. Indian OEMs such as Fire-Boltt and Noise took top spots in global market share. The market performed relatively well in the second quarter compared to the downtrend they expected 3 months ago. However, as expected, China’s economic slowdown resulted in a YoY decline in its market, with major Chinese brands such as Huawei, imoo and Amazfit seeing limited YoY growth or decline. Nevertheless, given that the smartphone market declined 9% YoY during the same period, we believe that the smartwatch market is on the right track to healthy growth. (Counterpoint Research, Apple Insider)

Sonos is allegedly at work on a completely new high-end speaker codenamed Optimo 2. The new device will be positioned as the best-sounding speaker that Sonos has ever produced. It includes an arsenal of drivers, including several that fire in different directions from beneath the shell between the front speaker grille and backplate. Optimo 2 includes twice as much RAM and as much as eight times more flash memory than any previous Sonos speaker. (The Verge)

Chinese leading auto manufacturer SAIC Group and its software subsidiary Z-ONE are teaming up with OPPO to establish a joint laboratory and co-launch a software platform for vehicle-smartphone integration, which are named as “Ecological Domain”. According to Z-ONE, the Ecological Domain is a brand-new IoT concept. It integrates its “Galaxy full-stack solution” and OPPO’s intelligent cross-terminal system “Pantanar.” Based on the smart car, the largest mobile IoT platform, auto electronic architecture, and service-oriented software platform, the Ecological Domain will be deeply integrated with smartphones and connected to other IoT devices to cover home, travel, and office scenarios.(Laoyaoba, Laoyaoba, Huanqiu, My Drivers)

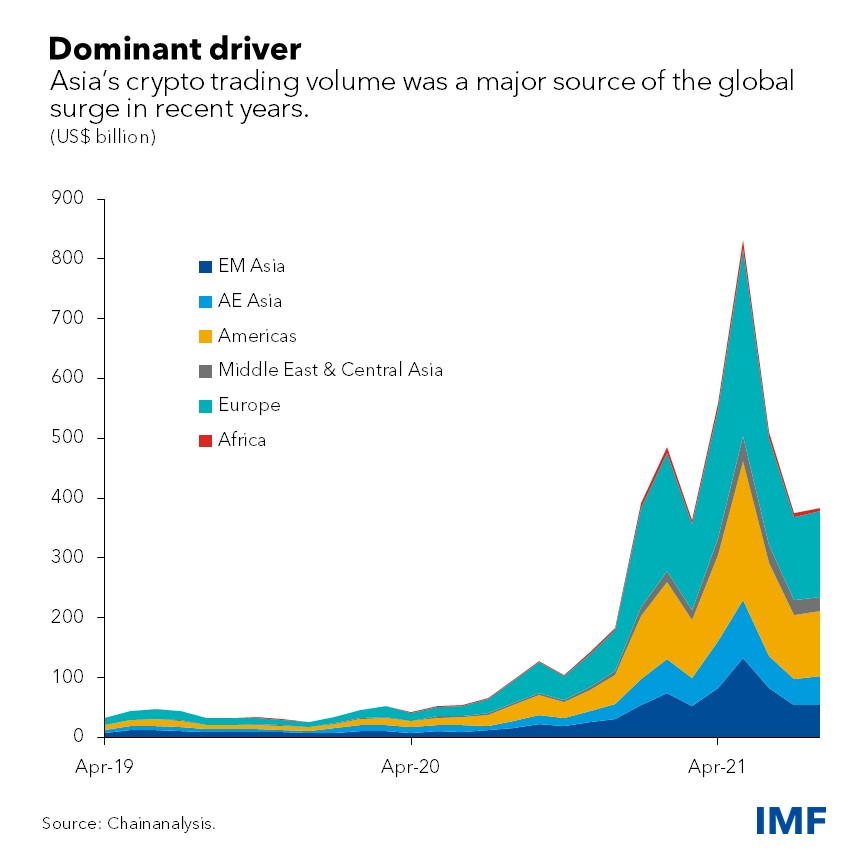

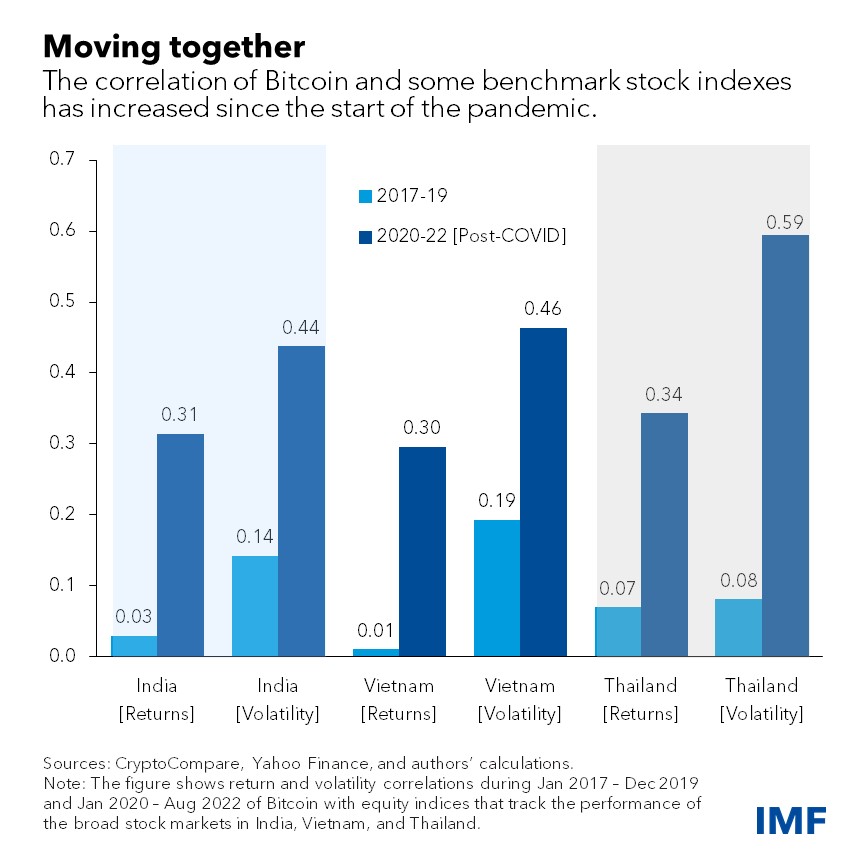

According to IMF, Few parts of the world have embraced crypto assets like Asia, where top adopters include individual and institutional investors from India to Vietnam and Thailand. This raises the important issue of the extent of integration of crypto into the financial system in Asia. While digitalization can aid in the transition to an environmentally-conscious payment system and also foster financial inclusion, crypto can pose financial stability risks. Before the pandemic, crypto seemed insulated from the financial system. Bitcoin and other assets showed little correlation with Asian equity markets, which helped diffuse financial stability concerns. Crypto trading, however, soared as millions stayed home and received government aid, while low interest rates and easy financing conditions also played a role. The total market value of the world’s crypto assets surged 20-fold in just a year and a half to USD3T in Dec 2021. Then it plunged to less than USD1T in Jun 2022 as central bank interest rate increases to contain inflation ended easy access to cheap borrowing. (CN Beta, Seeking Alpha, IMF)

Peloton has struck a partnership with Amazon in a bid to broaden its customer base and win back investors’ confidence, as revenue growth slows from pandemic highs and its stock price plunges. In its first foray outside of its core direct-to-consumer business, Peloton will be hawking a selection of its connected-fitness equipment and accessories on Amazon’s website in the U.S.(Engadget, CNBC)