9-3 #NewVocab : Meta and Qualcomm will cooperate in VR development; AMD and Nvidia have successively received notices to cut off the supply of high-end GPU chips to customers in China; Samsung Display transferred its patents in the US related to LCD to CSOT back in Jun 2022; etc.

Facebook parent company Meta and Qualcomm will cooperate in VR devices development. Meta and Qualcomm said in a statement that the companies’ engineering and product teams will work together to produce the chips. The chips will be powered by Qualcomm’s “Snapdragon” platform. (CN Beta, GizChina, IT Home, The Verge, Qualcomm)

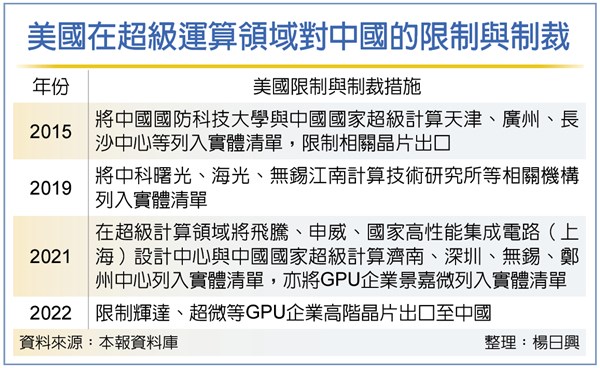

American chip manufacturers AMD and Nvidia have successively received notices from the headquarters to cut off the supply of high-end GPU chips to customers in China. This move by the United States not only affects the ecology of the semiconductor industry, but also may disrupt the wave of the top three server brands in the world and the largest server brand in mainland China, as well as the rhythm of cloud service providers (CSPs) Baidu, Ali and Tencent. According to statistics, currently the top 3 server brands in the world are Dell, HP and Inspur. Inspur is also a leading brand in mainland China, with a local market share of over 30%. In addition, industry insiders believe that related data center server supply chains such as Mitac, Wistron, Quanta, and Inventec should also be on alert. (Laoyaoba, CTEE, Yahoo, Fortune Insight, UDN, Yahoo, Engadget, NY Times)

Google has reportedly decided to produce the mobile application processors (APs) for its next-generation smartphone Pixel 8 at Samsung Electronics’ 3nm foundry lines. Google is developing the third-generation Tensor with Samsung Electronics’ System LSI Division. The mobile AP will be used for the Pixel 8 smartphone, scheduled to come out in 2H23. (Laoyaoba, Digitimes, SamMobile, Business Korea)

According to Benjamin Braun, chief marketing officer of Samsung Europe, the shipments of the Galaxy Z Fold 4 and the Galaxy Z Flip 4 doubled those of previous models in the European market, as the first sales figures of the new products reached an all-time high in Europe. The company has also noted that the Galaxy Z Flip 4 accounted for 60% of sales in Europe compared to the Galaxy Z Fold 4’s 40%. (Korea Times, Android Authority)

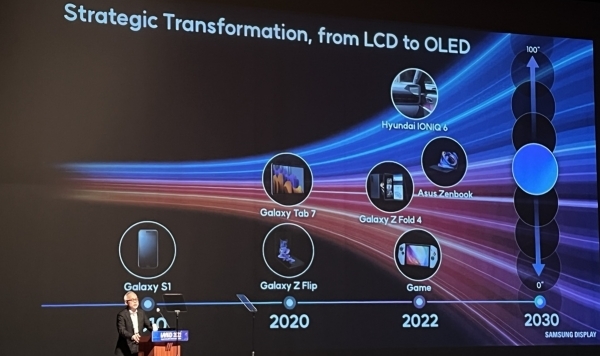

Samsung Display transferred its patents in the US related to liquid crystal display (LCD) to CSOT back in Jun 2022. It also transferred its patents in South Korea to the Chinese company in Aug 2022. A total of 577 patents in the US were given to CSOT, which bought Samsung Display’s LCD factory in Suzhou, China in 2020. Samsung Display is thought to have sold all its some 2,000 patents related to LCD around the world in the deal. The recent transfer signals the effective end of Samsung Display’s LCD business.(Laoyaoba, My Drivers, The Elec, Digitimes)

Samsung TV’s destocking took the lead in achieving results. The inventory has recently dropped to about 8 weeks, and it is approaching 6 weeks. The supply chain has been notified to gradually resume normal shipments. It is rumored that Samsung TV is negotiating with Huike, TCL Huaxing Optoelectronics, etc. to resume the purchase of LCD panels, but given the current oversupply of LCD panels, Samsung TV may take the opportunity to further reduce prices. The source of the supply chain of Samsung TV LCD panels was originally Samsung Display and other panel manufacturers, but in Jun 2022, Samsung Display officially closed the last Gen-8.5 LCD panel production line in South Korea and completely withdrew from the LCD panel industry. Samsung TV LCD panels can only be purchased externally. At present, Samsung TV LCD panel suppliers include TCL Huaxing, Huike, BOE, AUO, Sharp, Innolux, LG Display, Caihong Display.(Laoyaoba, Sina, EET-China)

The space between the two cutouts on Apple’s new “iPhone 14” will be used to show privacy indicators for the microphone and camera. The change will also help with a redesign for the Camera app itself. The pill and hole-shaped cutouts in the iPhone 14 Pro display will be bridged by software. Apple will essentially black out the area between the two cutouts. This will give the illusion that it’s “one wide pill-shaped cutout”. The company will use this space to make its privacy indicators for the camera and microphone more visible. Currently, Apple places a very small orange dot in the upper-right corner of the display when an application is using your iPhone’s microphone. A green dot appears when an app is using iPhone’s camera. On the iPhone 14 Pro, Apple will move these indicators and make them far more visible.(GSM Arena, 9to5Mac, MacRumors, Twiitter)

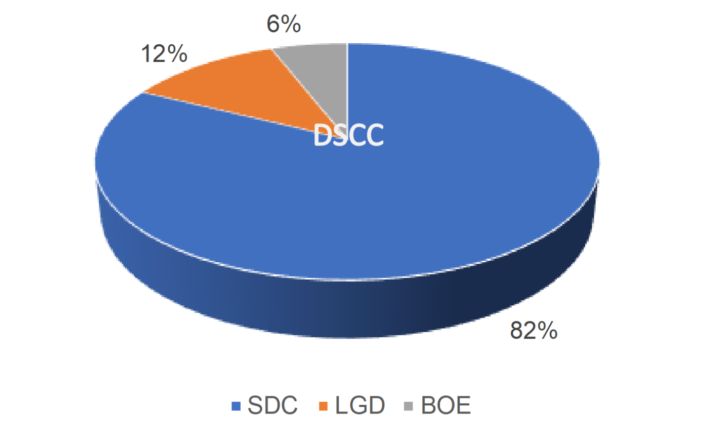

According to DSCC, Samsung Display has secured over 80% of shipments to Apple throughout the past 3 months. Apple aims to secure a total of 34M iPhone 14 panels from its suppliers, including Samsung, LG Display, and BOE. Apple bought 1.8M iPhone 14 panels in June, 5.35M in Jul, and more than 10M units in Aug 2022. Apple is expected to order another 16.5M panels in Sept 2022. LG Display came in second with 12% of orders. More specifically, LG will start shipping iPhone screens in Sept 2-22. Its production capacity can’t meet Apple’s demand due to “technical challenges”. (GizChina, GSM Arena, SamMobile, DSCC, IT Home)

Micron Technology has said it will use “anticipated” government grants and credits to help it invest USD40B by the end of the decade to build out US semiconductor manufacturing capacity. The company expects to begin producing chips after 2025 and said it will create as many as 40,000 jobs. The investment is being funded with subsidies it believes will be awarded from the Chips and Science Act.(The Verge, Bloomberg, Yahoo, TechNews, WSJ)

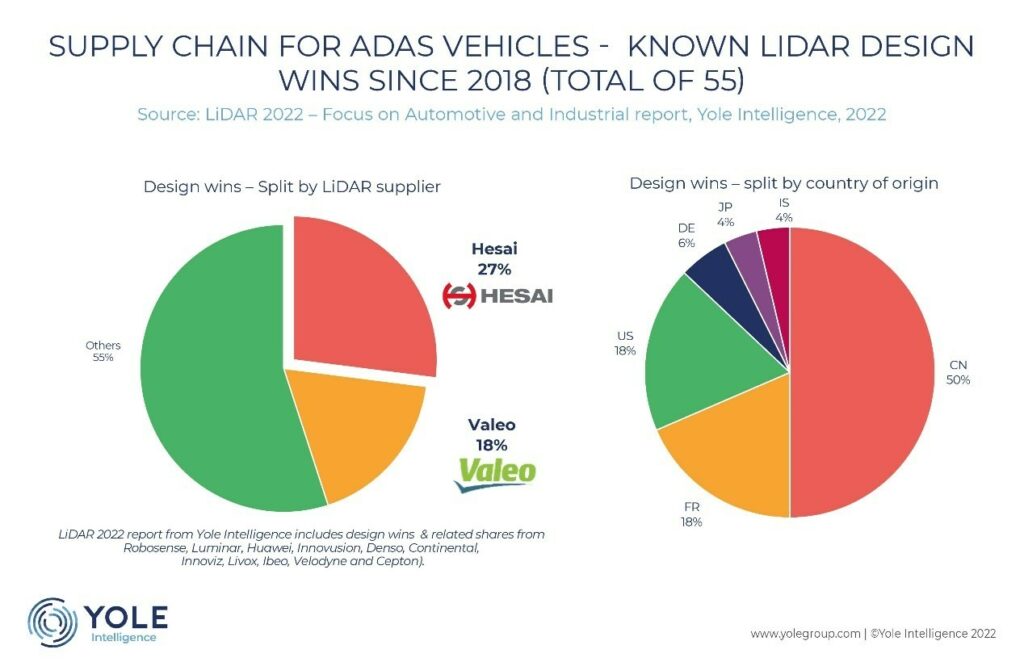

Xiaomi has identified Hesai Technology as the lidar supplier for its first car, which will come at a price exceeding CNY300,000 (USD43,460). The lidar firm for autonomous driving and ADAS has previously received investment from Xiaomi. Xiaomi‘s first vehicle will adopt Hesai’s hybrid solid-state lidar AT128 as the main lidar installation, while several all-solid-state lidars will be used as supplementary sensors.(CN Beta, Weibo, Wallstreet CN, 163, Auto News, Pandaily)

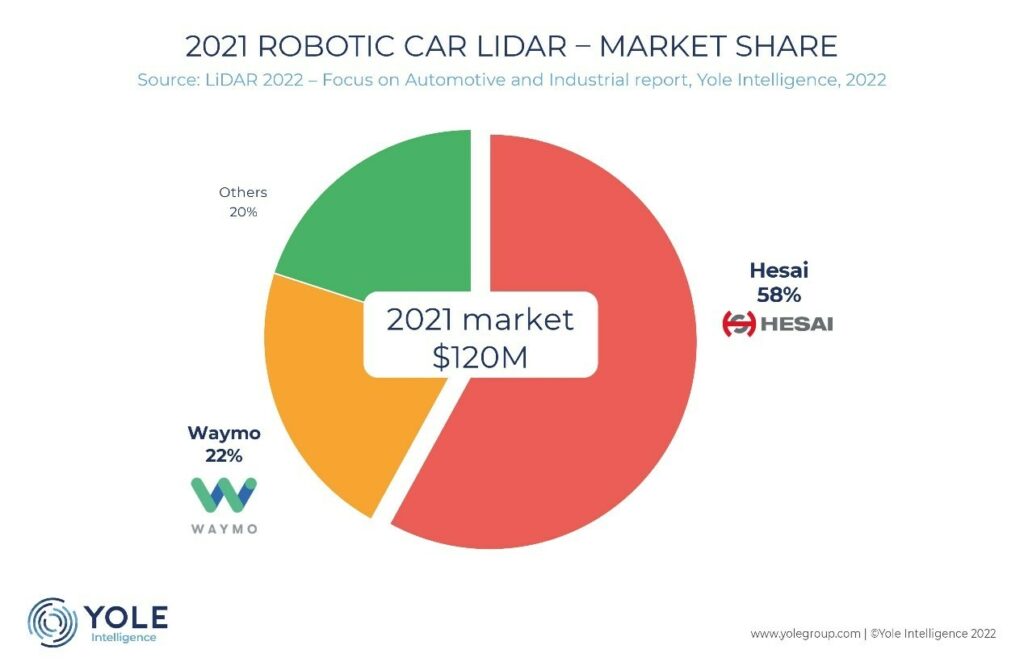

According to Yole Intelligence, with a strong emergence of the intelligent driving industry in China, Chinese manufacturers such as Hesai have become important players in the global LiDAR market. Among the LiDAR manufacturers, Hesai ranks first in ADAS design wins, L4 autonomous driving LiDAR market share, and total revenue for automotive LiDAR. With 27% of the existing design wins, Hesai now ranks first in the global ADAS market. Designed for ADAS applications in mass production passenger and commercial vehicles, Hesai’s AT128 is an automotive grade, long-range hybrid solid-state LiDAR. The sensor has already won multiple contracts from world’s leading automakers, officially disclosed partners including Li Auto, JiDU, HiPhi, and Lotus. AT128 will be installed on various car models, and it has already entered the mass production and delivery stage in 2022. Comparing to 2020, L4 autonomous driving LiDAR market had an 11% increase in 2021, reaching USD120M. The total market size of LiDAR for automotive and industrial applications in 2021 reached USD2.1B in 2021, an 18% increase compared to total market size in 2021. (Laoyaoba, Yole Group, PRN Asia, PR Newswire)

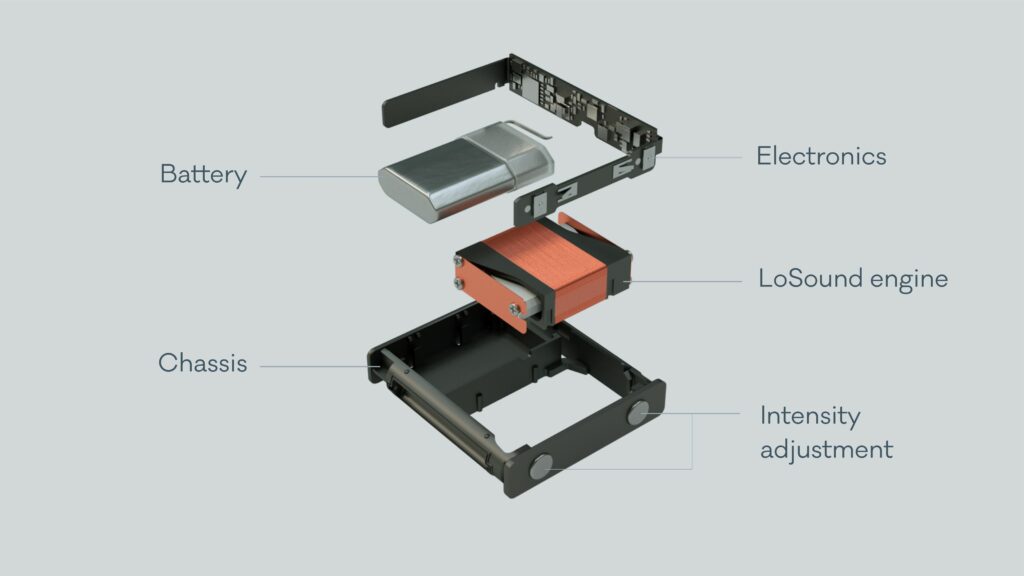

Facebook parent Meta Platforms has acquired Lofelt, a Berlin startup whose technology aims to replicate the illusion of touch in virtual reality (VR). Lofelt had previously worked on tools for haptic tech in mobile and PlayStation 5 games, but announced it was ending support for those products in Jul 2022.(CN Beta, WSJ, Market Watch, Reuters)

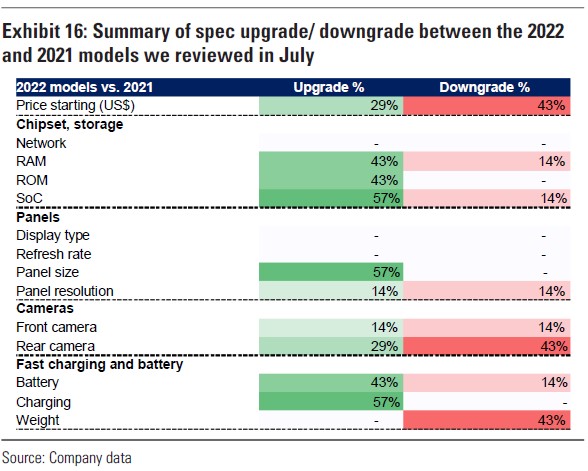

Goldman Sachs has reviewed new models released by leading China smartphones in Jul-Aug 2022 and compared them to their previous generation in 2021. They have found the upgrade is mainly in fast charging, stronger SoC and larger panel size. (Goldman Sachs report)

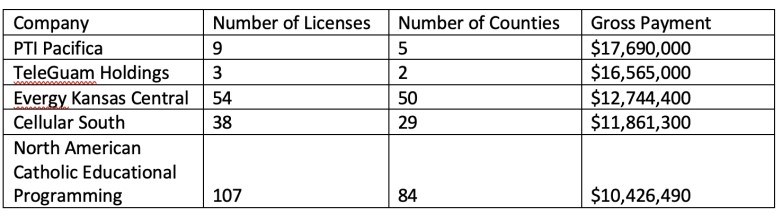

No other company even came close to bidding as much for 2.5 GHz spectrum as T-Mobile, which bid USD304,325,290 in Auction 108. Of 63 bidders winning a total of 7,872 licenses, T-Mobile won 7,156 licenses in 2,724 counties. In total, Auction 108 raised USD428M after 73 rounds of bidding. At the close of the auction, 7,872 licenses were sold, and 145 licenses were unsold. Only 82 bidders qualified to participate in the auction, which was largely viewed as an opportunity for T-Mobile to fill in the “swiss-cheese” holes in its 2.5 GHz spectrum across the U.S. Other qualified bidders included AT&T, Verizon (under the name Cellco partnership) and Dish Network (under the name Carbonate Wireless). AT&T and Dish won USD0 bids. Verizon garnered 12 licenses in 9 counties for USD1,515,300. (Phone Arena, Fierce Wireless)

Reliance Jio Infocomm, India’s top telecom mobile operator, has earmarked a spending of USD25B on the rollout of its 5G services that it plans to debut in key cities this Diwali in Oct 2022. The company, which has amassed more than 421M telecom subscribers, will extend its 5G network to “every town” in India by the end of 2023. Reliance Industries’ Mukesh Ambani has said Jio will deploy a standalone 5G architecture that does not rely on existing 4G network and hence offers superior performance. The company can connect 100M homes with its 5G network and further accelerate its connectivity ambitions with fixed broadband services, without sharing tariff details. The company has unveiled the AirFiber, a wireless plug-and-play 5G hotspot that does not require fiber cables to reach homes. (Laoyaoba, TechCrunch, Indian Express)

Google reportedly plans to shift assembly of its Pixel phones from Foxconn facilities in southern China over to Vietnam where it’ll begin producing the Pixel 7. Google expects Vietnam to provide as much as half of high-end Pixel phones in 2023. Google has a foldable device in the pipeline that may possibly be released in 2023, and its production may stay in China. This is due to the newser screen and hinge technology that would require its production to be closer to key suppliers in China. (GSM Arena, NY Times, GizChina)

Honor has announced its new Dual Flagship strategy – Honor is launching its foldable phones internationally. And since the company is “Embracing the Connected Future”, it teased the upcoming MagicOS 7.0, which aims to connect smartphones, PCs and IoT devices together. Honor will bring “upcoming foldable flagship smartphones and all-round flagship smartphones” to Europe and other regions around the world for a two-pronged approach to the premium market. As for the “all-round flagship”, that role will continue to be filled by the Magic4 series and its sequels. The new OS will let users control an Honor laptop, smartphone and tablet with the same keyboard and mouse. Also, there will be seamless file sharing between the devices.(GSM Arena, PR Newswire, Gizmo China)

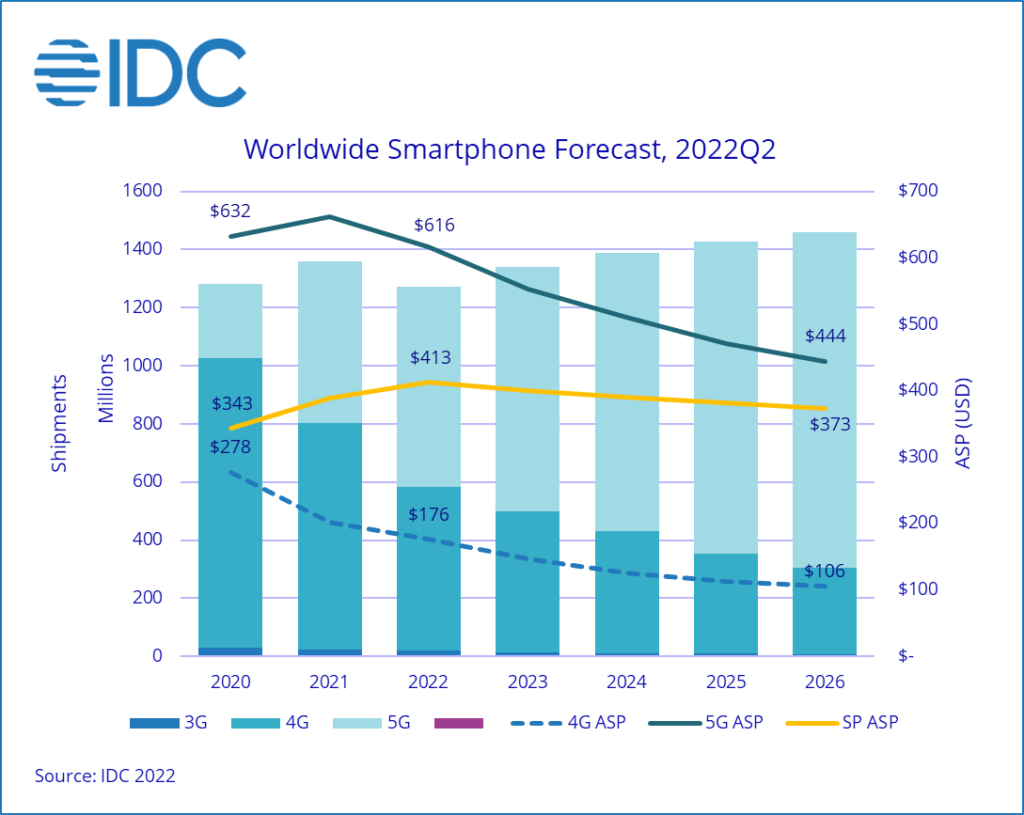

According to IDC’s forecast, shipments of smartphones will decline 6.5% to 1.27B units in 2022. The decline is due to record-breaking inflation, geopolitical tensions, and other macroeconomic challenges that have significantly dampened consumer demand. As a result, the latest forecast figures represent a reduction of 3 percentage points from previous projections. However, IDC expects the setback to be short term and the market to rebound in 2023 with 5.2% growth year over year and, in the long term, a 5-year compound annual growth rate (CAGR) of 1.4%. The supply constraints pulling down on the market since 2021 have eased and the industry has shifted to a demand-constrained market. High inventory in channels and low demand with no signs of immediate recovery has OEMs panicking and cutting their orders drastically for 2022. (IDC, IT Home, GizChina)

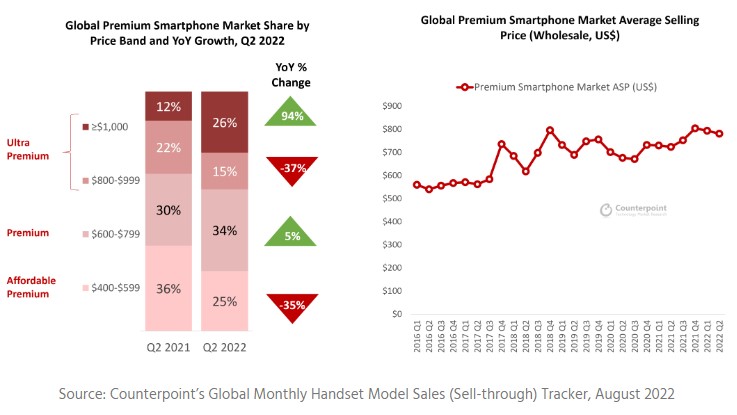

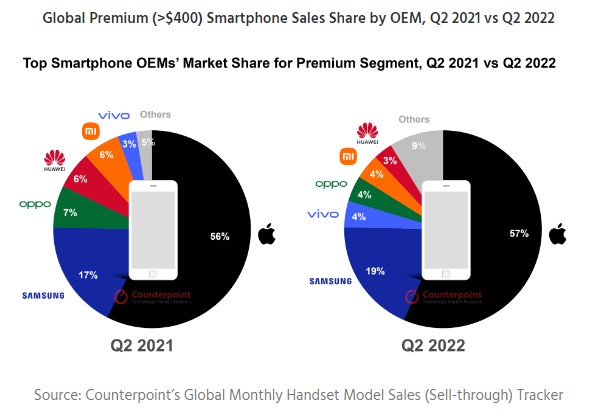

The global premium smartphone market (USD400 and above wholesale price) average selling price (ASP) grew 8% YoY to reach USD780, a second-quarter record, in 2Q22, according to Counterpoint Research. This was mainly driven by the 94% YoY sales growth in the USD1,000 and above price segment. The segment alone contributed to over 1/4 of premium smartphone sales and over 1/5 of global smartphone revenues in 2Q22. The growth of the segment also drove the global smartphone ASP to its highest second quarter ever. Apple continued to lead the premium segment with a 57% share as the 4G iOS installed base continued to upgrade. Samsung’s sales grew 2% YoY and its share also increased as the S22 Ultra continued to be the best-selling Android smartphone in the premium segment for the second consecutive quarter. (Counterpoint Research, CN Beta)

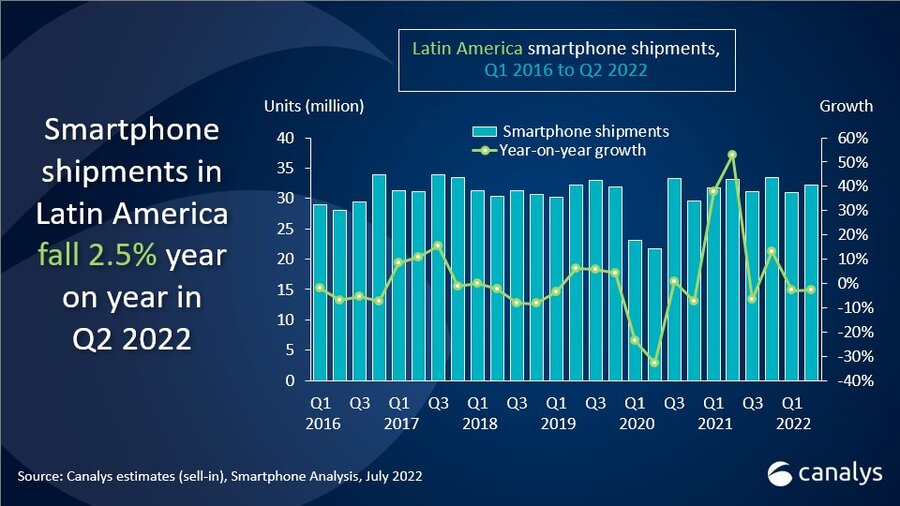

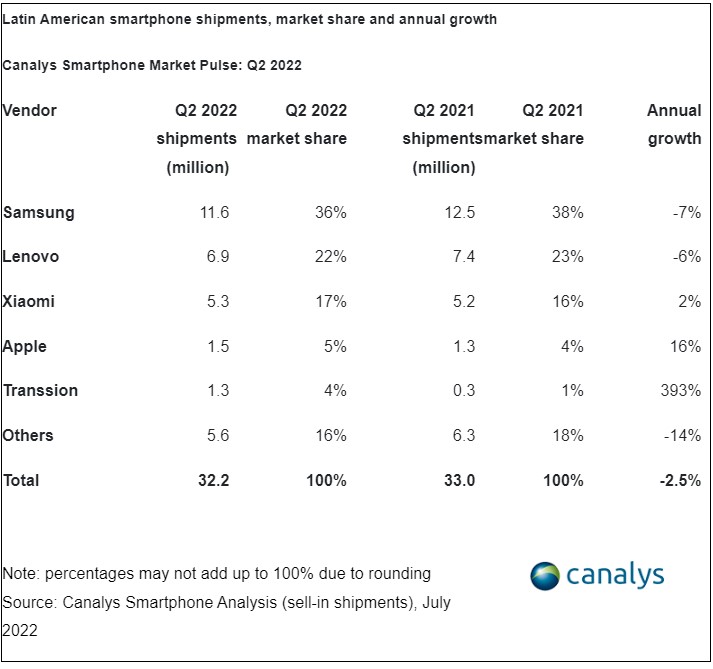

Latin American smartphone shipments fell 2.5% year on year in 2Q22, coming in at 32.2M units. This follows a 2.5% drop in the last quarter, making the first 2 consecutive declines in the Latin American region since the beginning of the pandemic in 1Q20 / 2Q20. But Latin America’s 2Q22 figure beats the overall global YoY decline (-9%), though there are growing concerns about specific markets, such as the Peru and Chile, which suffered double-digit falls during the quarter. The 2Q22 deepened the trend of polarization, with both the sub-USD100 and USD500-plus price bands strengthening. (Canalys, Laoyaoba)

Geely and Meizu will deploy high-end mobile phone business and wearable mobile terminal business in Wuhan Economic and Technological Development Zone, promote the deep integration of consumer electronics and automobile industries, strengthen the ecosystem, and provide users with a multi-screen interactive life experience of the Internet of Everything. It is expected that in 2023, Geely will release new high-end smart phones, and the industrial layout of Wuhan Economic and Technological Development Zone will expand to the fields of high-end smart phones and wearable smart devices.(My Drivers, iFeng, Auto Home)

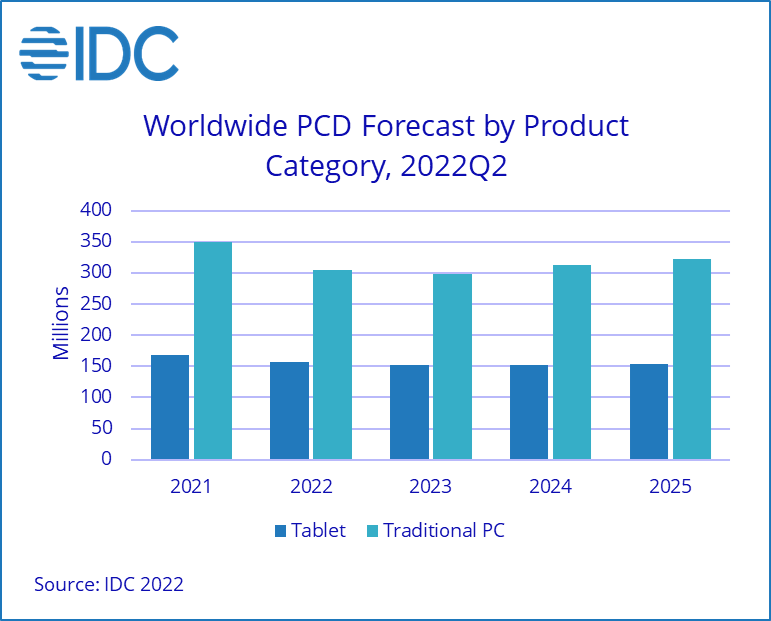

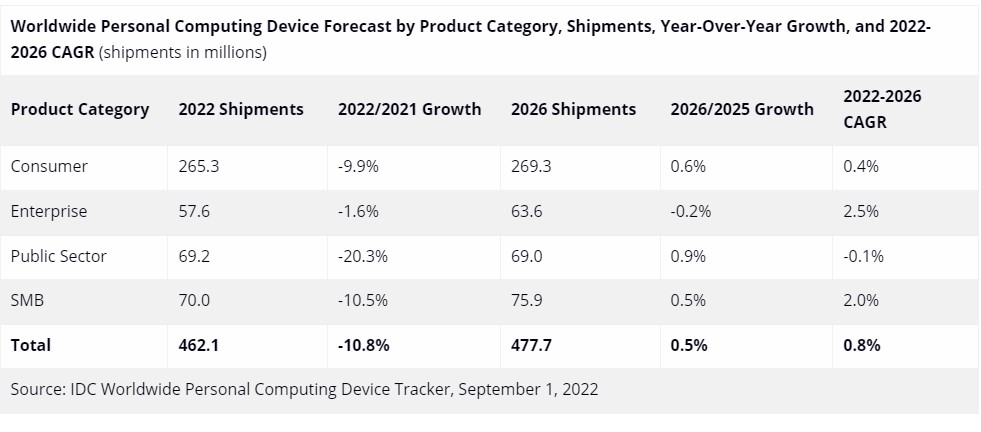

Tumultuous times are ahead for the PC and tablet markets according to a new forecast from IDC. Global shipments of traditional PCs are forecast to decline 12.8% in 2022 to 305.3M units while tablet shipments will fall 6.8% to 156.8M. Inflation, a weakening global economy, and the surge in buying over the past two years are the leading causes for the reduced outlook. Further contraction is also expected in 2023 as consumer demand has slowed, the education demand has been largely fulfilled, and enterprise demand gets pushed out due to worsening macroeconomic conditions. The combined market for PCs and tablets is forecast to decline 2.6% in 2023 before returning to growth in 2024. (IDC, IT Home)

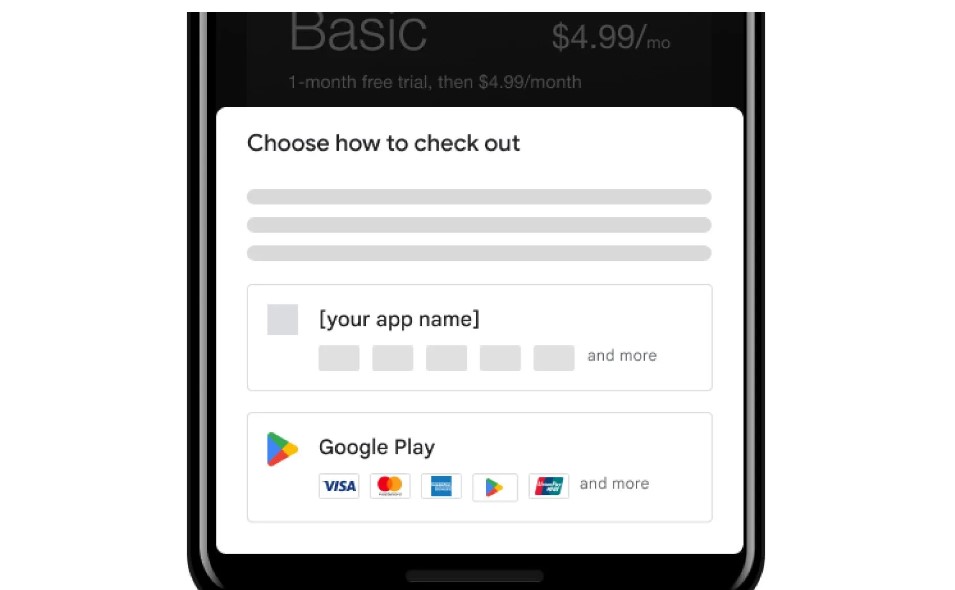

Google has opened the enrollment for its user choice billing program, allowing developers to offer alternative payment methods in their apps alongside the contentious Play Store billing system. Developers need to be based in the European Economic Area (EEA) countries, Australia, India, Indonesia, and Japan to be eligible. This means U.S.-based developers will need to wait a while longer, with Google keeping silent on when the program will launch in the United States.(Android Central, 9to5Google, Google)