9-5 #Nephew : TSMC plans to build 23 plants in 2020-2023; TSMC and UMC will see full capacity utilization for 22/28nm processes persist at least throughout 2022; Aurora may consider sell to Apple or Microsoft; etc.

OPPO announces Pantanal cross-platform system. Pantanal is claimed to be the first cross-platform system designed for different devices and systems to connect and collaborate. OPPO says that with cross-device sensing and computing capabilities, Pantanal can better understand and anticipate users’ needs and provide services at the right time in the right way. It is a cross-platform system, making it easier for developers to develop and deploy services across multiple platforms, which increases efficiency as well as lowers cost.(Gizmo China, 163.com, Sina, My Drivers)

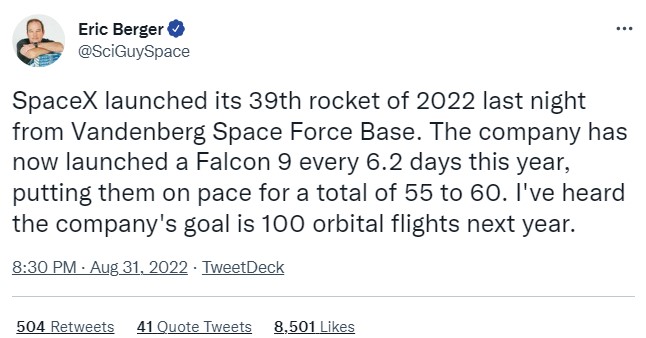

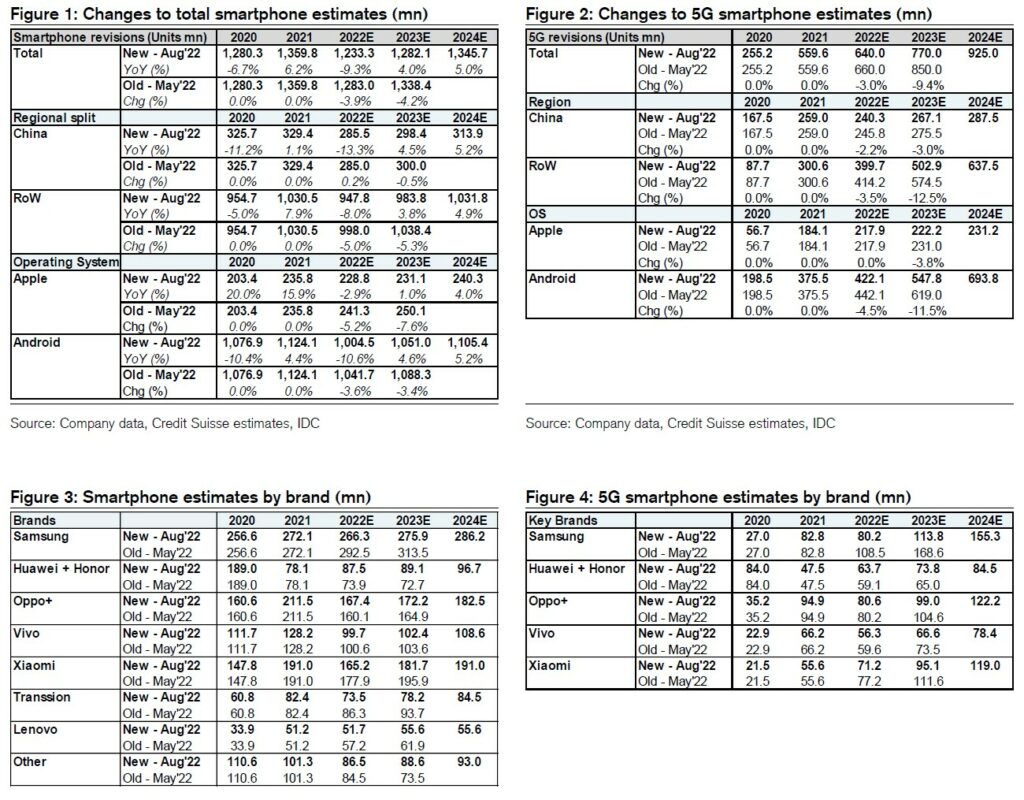

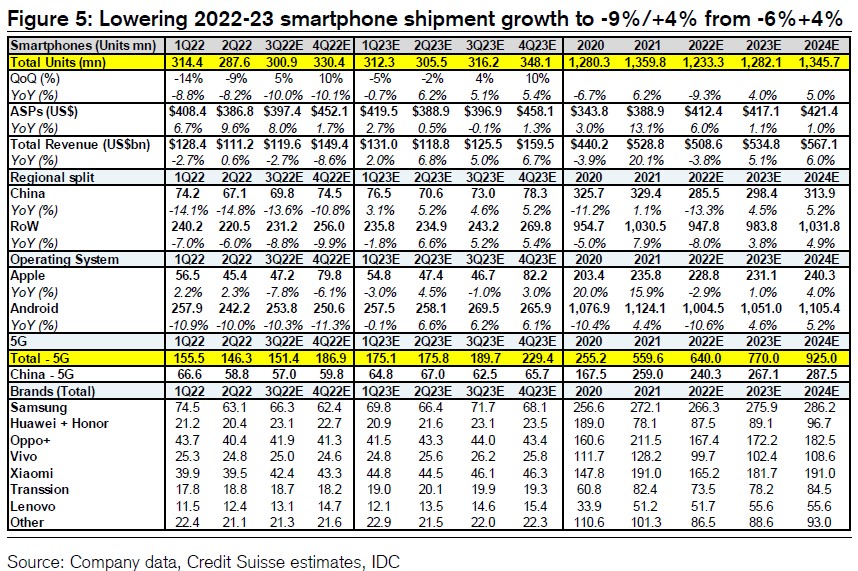

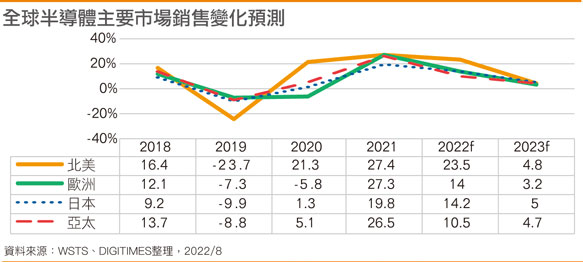

Credit Suisse looks for 1,233M units (−9% YoY) in 2022 and 1,282M (+4%) in 2023, down from their previous 1,283M / 1,338M (−6% / +4%). They also introduce their 2024 forecast of 1,346M units (+5% YoY). The size of downward revisions for Samsung are notable for both 2022 and 2023. The overall downward revision for 2022 mainly reflects sluggish consumer demand due to an uncertain macro environment and evolutionary upgrades to smartphone specs. In 2023, they expect a gradual recovery as the smartphone replacement cycle stabilizes, while pandemic restrictions, supply constraints, and inflation-driven BOM-cost increases ease. They also expect YoY recovery in 2024 due to economic recovery. (Credit Suisse report)

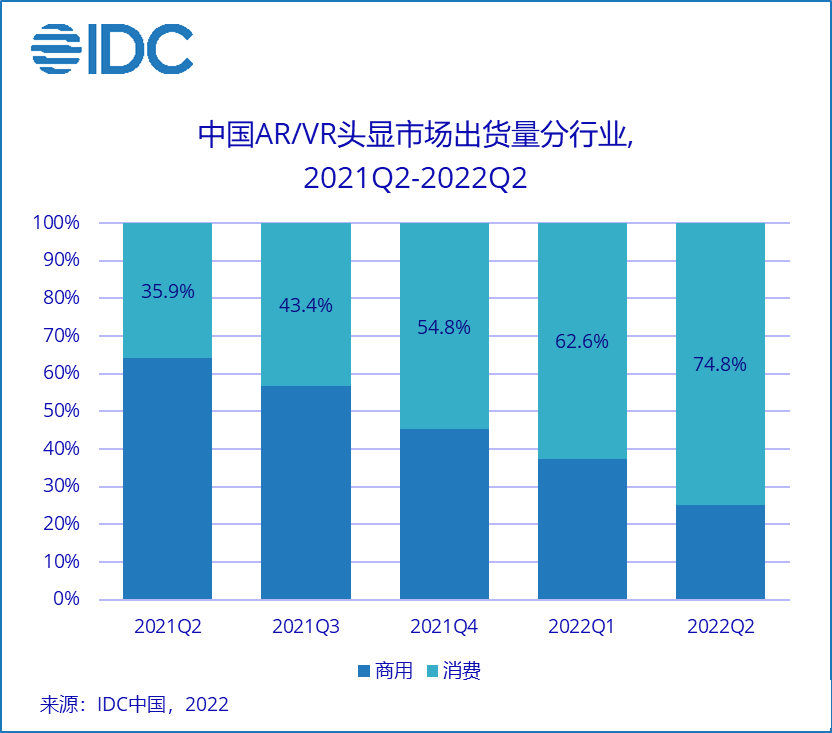

According to IDC, China shipped 309,000 AR/VR headsets in 2Q22 (12,000 AR and 297,000 VR). In the VR segment, Standalone VR shipped 273,000 units, up 19.2% from the previous month; Tethered VR shipped 24,000 units, down 22.1% from the previous month. In 1H22, with the large-scale deployment of offline retail by leading manufacturers and the strong efforts of online marketing, the overall AR/VR market shipments reached 586,000 units (AR shipments reached 28,000 units, and VR shipments were 558,000 units). The proportion of shipments in the consumer market continues to increase. (Laoyaoba, CN Beta, IDC)

Apple is reportedly working on at least 3 augmented-reality and virtual-reality headset devices, the first of which will likely launch with the name “Apple Reality Pro”. Bloomberg’s Mark Gurman explains that there are a minimum of 3 Apple headsets actively in development that he is aware of, under the codes “N301”, “N602”, and “N421”. (Apple Insider, MacRumors, Power-On)

An electric sports utility vehicle (SUV) jointly developed by Hon Hai Precision (Foxconn) and Yulon Motor has seen strong market acceptance with over 10,000 consumers having placed pre-orders in two days, according to Digitimes. The electric SUV, dubbed Luxgen n7, is based on the Model C prototype electric SUV developed by Foxtron and the Foxconn-initiated MIH Consortium. The first batch of shipments will not be delivered until 2H23. The company has unveiled three EV prototypes including the Model E passenger car and the Model T, in addition to Model C SUV. (Digitimes, IT Home, iFeng)

Aurora Innovation CEO Chris Urmson has recently laid out a range of options for the self-driving company to respond to worsening market conditions and partners pushing out timelines, including a possible sale to Apple or Microsoft. He has also outlined cost cuts and floated measures including taking the company private, spinning off or selling assets and pursuing a small capital raise. (CN Beta, Bloomberg, Reuters, CNA)

LG Electronics has launched its own non-fungible token (NFT) platform, LG Art Lab. Now available in the U.S. on the company’s TVs running webOS 5.0 or later, and accessible directly from the home screen, the new platform enables users to buy, sell and enjoy high-quality digital artwork. LG says it has built the platform to make it convenient and accessible to use NFTs. It includes the LG Art Lab Drops feature, which profiles artists and previews new works coming soon to the platform. Meanwhile, the real-time Live Drops countdown ensures users can acquire a “just dropped” NFT.(Engadget, VentureBeat, TechCrunch, LG Art Lab)

SK Siltron CSS, a semiconductor wafer manufacturer, today celebrated the ribbon cutting of its new manufacturing facility in Bay City, Michigan, with state officials including Governor Gretchen Whitmer and U.S. Rep. Dan Kildee in attendance. The new facility is part of a USD300M expansion the company announced in Jul 2021 with critical support from the Michigan Economic Development Corporation. The expansion will both double the company’s Michigan workforce and quadruple its manufacturing capacity over the next several years. (Laoyaoba, PR Newswire, Michigan)

TSMC will mass-produce the 3nm process in Sept 2022. This generation will continue to use FinFET transistors. The new-generation 2nm process that will be mass-produced in 2025 and will use GAA transistor technology. They will also use American manufacturers’ EDA technology. EDA electronic design automation is not a very valuable market in the semiconductor industry. The scale in 2020 is about USD11.5B, and it is expected to reach USD13.4B in 2022, but EDA technology can affect the total value of more than USD600B in the semiconductor market, chip design, manufacturing and packaging are inseparable from EDA. At present, the global EDA market is mainly controlled by 3 major American manufacturers, including Synopsys, Cadence and Siemens EDA, with a combined share of more than 78%, while other manufacturers, such as ANSYS and Keysight Technologies, have less than 5% share.(My Drivers, CN Beta, UDN, EET-China)

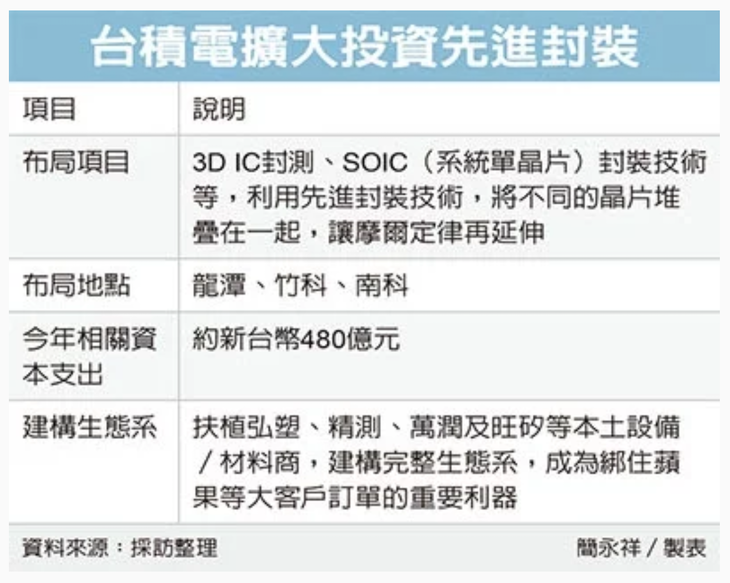

Y.L. Wang, a TSMC vice president, has said that the company built an average of 2 factories a year from 2017 to 2019, but the pace has now increased to at least 5 a year. All told, the company plans to build 23 plants in 2020-2023. TSMC expects to have its 3D chip stacking technology, known as SOIC (system on integrated chips), enter mass production in 2022, and aims to boost its initial capacity 20 times by 2026. TSMC has maintained its previous announcement that 2nm chip production will be ready by 2025. Apple and Intel will be the first wave of TSMC to customers use 3nm chips. (Asia Nikkei, The Siasat Daily, IT Home)

TSMC and UMC will see full capacity utilization for 22nm / 28nm processes persist at least throughout 2022, as their capacities vacated by some consumer chip clients are soon filled by other customers including Sony and Infineon, according to Digitimes. Faced with large orders cut by end customers, IC designers whose inventories have soared to a new high in 2H22 are not allowed to scale up their foundry orders. Therefore, the overall capacity utilization rates of such as PowerChip, SMIC, and VIS have begun to decline since 3Q22. It is estimated that by the end of 2022, it will reach about 80-90%. Wafer foundries in the 12nm / 16nm process are faced with large and small customers cutting orders, delaying shipments or canceling long-term contracts. They would rather breach the contract and pay compensation than suffer from inventory burns. The average capacity utilization rate can still be maintained at more than 95%, and even some processes can still reach 100%. The main reason is the capacity gap released by customers who cut orders. Immediately, other customers raised their hands to ask for it, which also made the foundry price quite stiff. (Digitimes, Digitimes, press)

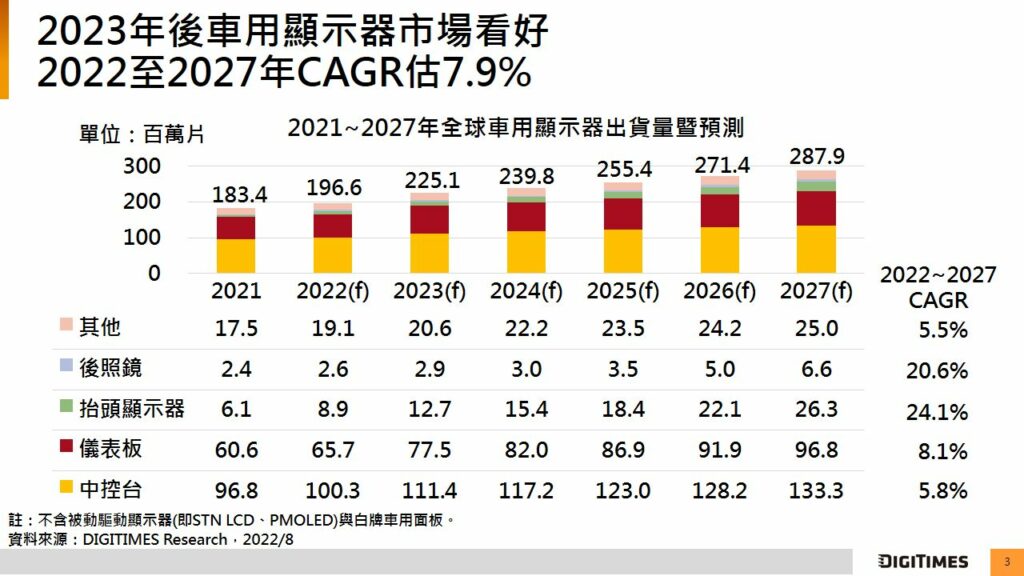

Global automotive display shipments are expected to reach 197M units in 2022, up 7.2% on year, and will continue to grow to 288M units by 2027 with a CAGR of 7.9% over the 5-year period, according to DIGITIMES Research. Cars that are natively equipped with a HUD and a digital rearview mirror will mostly be mid-range to high-end models in the foreseeable future, but the two applications’ penetration rates will continue picking up. Augmented-reality (AR) HUDs will become high-end equipment for many advanced driver assistance systems (ADAS) in 2022-2023 as they will be able project the information gathered by ADAS directly onto the windshield. In the past, AR-HUDs could only use DLP displays by Texas Instruments (TI), but many companies have already achieved the effect of AR-HUD with TFT LCD panel, which is expected to further boost the penetration of HUDs. (Digitimes, press, Digitimes, iFeng)

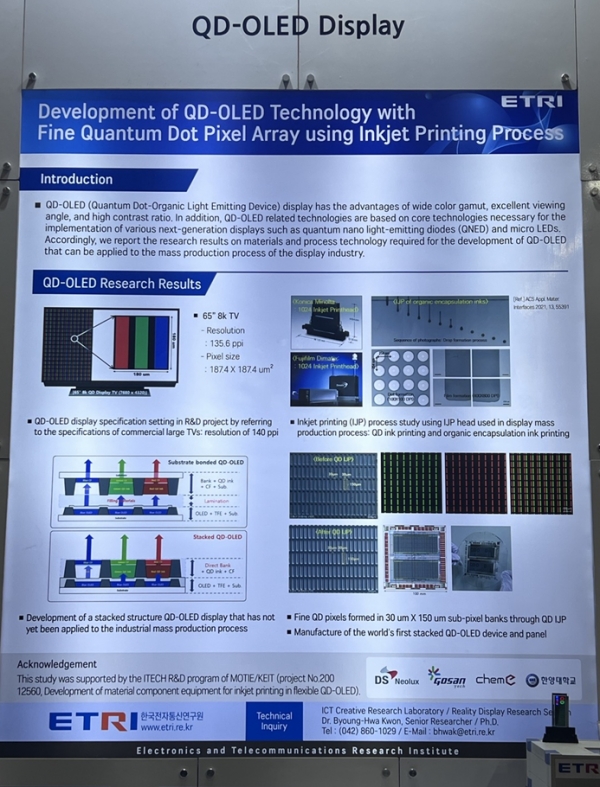

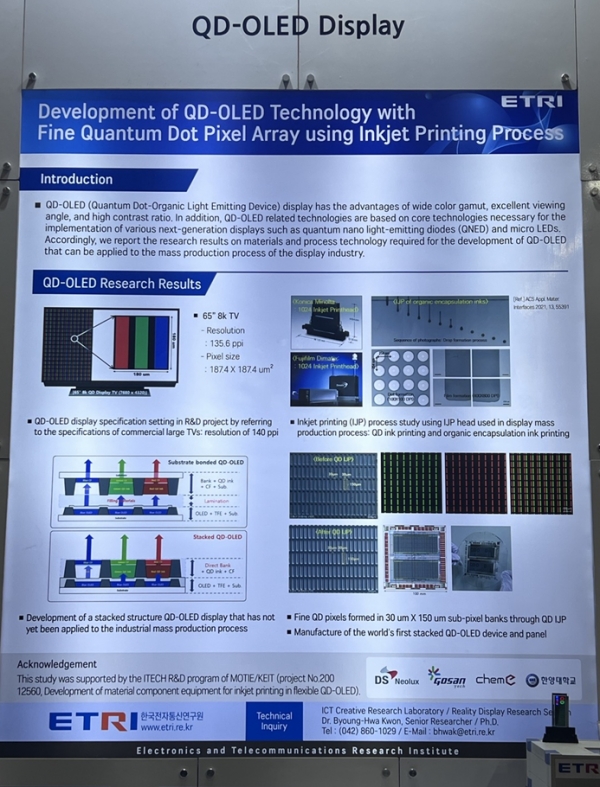

Samsung launched its own competitor to the best OLED TVs – the Samsung S95B in 202, which uses a next-gen “QD-OLED” display. The Electronics and Telecommunications Research Institute (ETRI) has indicated that Samsung Display is working on a QD-OLED panel that removes one of the two glass substrates. The company currently uses 2 glass substrates on its QD-OLED panel, one for the thin-film transistors (TFT) and another for the QD color conversion layer. ETRI has called the new technology Samsung Display was developing stacked QD-OLED, where the QD color conversion layer is printed directly above the emission layer stacked on top of the TFT glass substrate. ETRI confirmed that it was co-developing the technology with Samsung Display with other suppliers and universities. Removing the substrate will allow Samsung Display to reduce production costs and also make their QD-OLED panel rollable. However, the technology will likely be commercialized sometime after 2024. (CN Beta, DisplaySpecifications, TechRadar, The Elec)

Macroblock has supplied miniLED driver ICs used in a 13.3” HD HUD (head-up display) for Li L9, a smart electric SUV unveiled by China-based electric vehicle (EV) vendor Li Auto, according to Macroblock. For the Li L9, Li Auto is targeting the same market segment as the BMW X7 and Mercedes-Benz GLS. A 13.3” miniLED-backlit LCD HUD, combined with a safe-driving touch-bar screen, projects all the information the driver needs onto the front windshield instead of a traditional dashboard.(Digitimes, Digitimes, MoneyDJ, CTEE, LEDInside)

The next generation of Xiaomi Mi 12S Ultra will reportedly be equipped with 100W fast charging. In 2023, there will be many models with hundreds of watts of fast charging, and there may even be new breakthroughs, which implies that Xiaomi may launch models with over 200W of fast charging. (GizChina, IT Home)

Galloping prices of power battery materials are heaping heavy cost pressures on both EV and battery makers, fueling a new wave of materials recycling development in China, with even top battery maker Contemporary Amperex Technology (CATL) also joining the bandwagon, according to Digitimes. Statistics released by Shanghai Ganglian E-Commerce show the average quote for cathode material lithium carbonate hit a high of CNY493,000 (USD71,449) per tonne as of 29 Aug 2022 more than nine times the figure of CNY53,000 registered in early 2021. CATL has seen its recovery rates for nickel, cobalt and manganese hit a high of 99.3%, and that for lithium is also over 90%. In 1Q22, a total of 21,300 tonnes of waste batteries were recycled and used by the company to manufacture 18,000 tonnes of battery precursors. (Digitimes, Laoyaoba)

SpaceX has launched 39 orbital missions so far in 2022. The company intends to launch 100 missions in 2023. In 1H21, SpaceX launched a total of 20 satellites, a 50% increase over the launch rate for the whole of 2020. In 2H21, the company had two blank periods, so SpaceX launched 11 more times in 2H21. SpaceX completed 6 launches in the 4 weeks before the end of the year, proving itself capable of 78 launches per year.(GizChina, IT Home, Space, Twitter, Twitter)