10-5 #CleanUp : Samsung is laying out its plans of chip manufacturing for the next 5 years; Micron plans to invest up to USD100B over the next 20-plus years; Tesla is removing ultrasonic sensors from Model 3 and Model Y vehicles; etc.

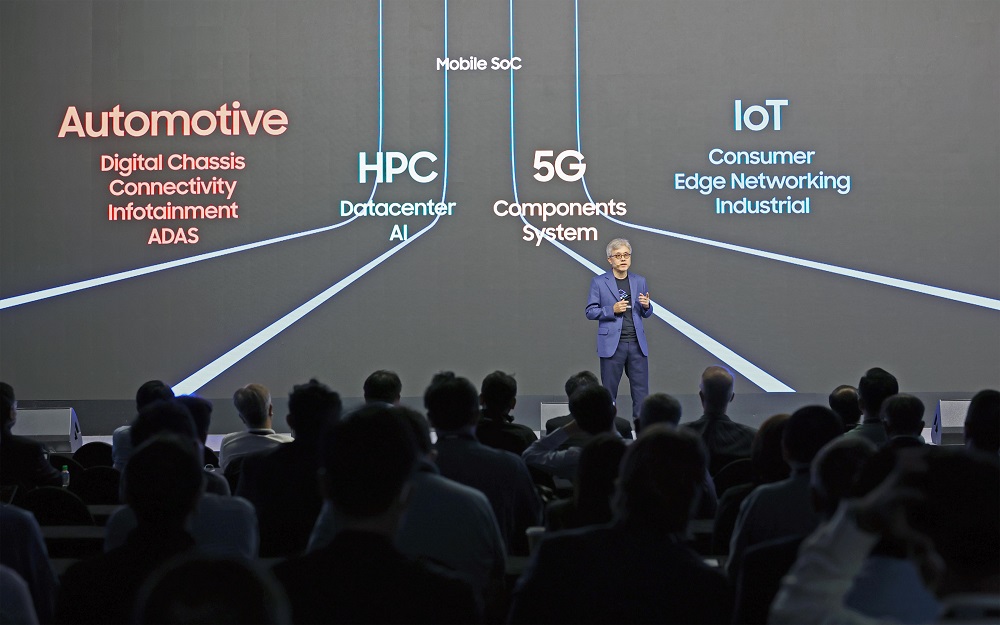

Earlier 2022 Samsung announced it had already begun manufacturing chips using a 3nm process node. Now the company is laying out its plans for the next 5 years. Samsung will be further enhancing gate-all-around (GAA) based technology and plans to introduce the 2nm process in 2025 and 1.4nm process in 2027. Samsung is also accelerating the development of 2.5D / 3D heterogeneous integration packaging technology to provide a total system solution in foundry services. Through continuous innovation, its 3D packaging X-Cube with micro-bump interconnection will be ready for mass production in 2024, and bump-less X-Cube will be available in 2026. (Liliputing, Samsung, GSM Arena)

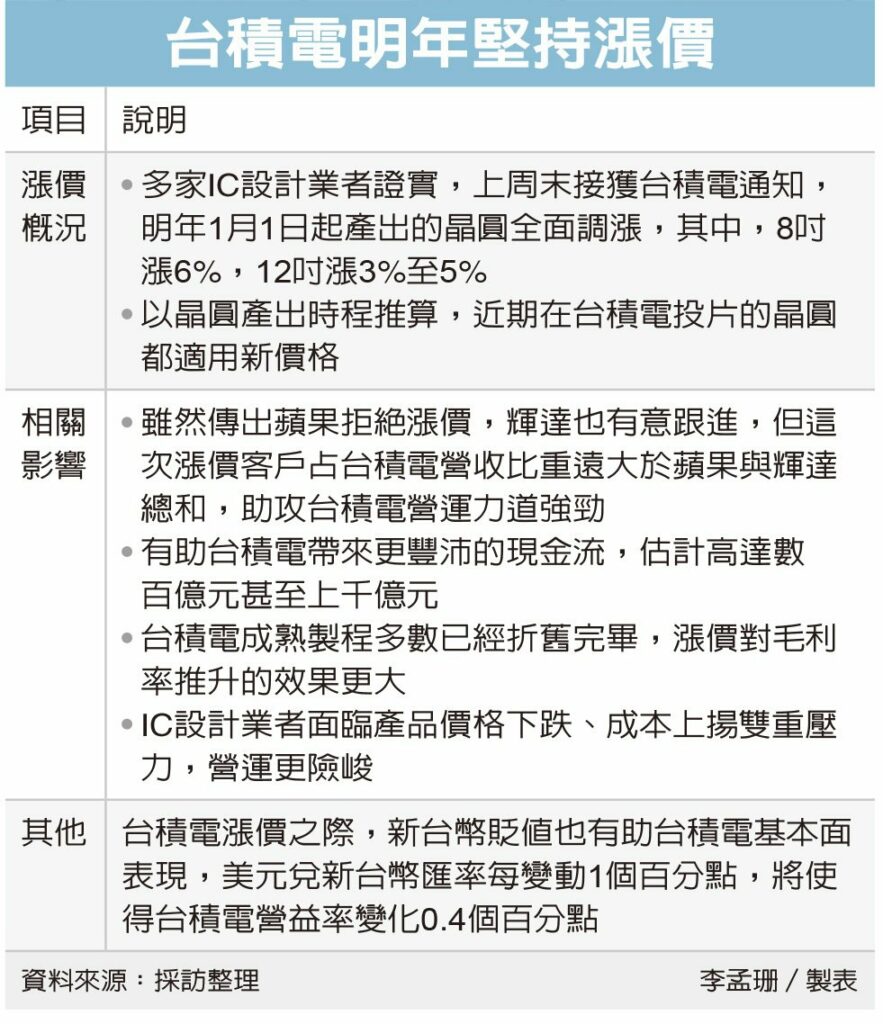

TSMC will allegedly increase the price of 8” wafers by 6% in 2023, and increase the price of 12” wafers by 3% to 5%. Apple is TSMC’s largest customer, and Apple orders are said to account for 25% of overall revenue. However, Apple cannot shake TSMC’s decision to increase prices, and Apple still accepts TSMC’s price increase. This may impact Nvidia, which also refused to raise prices, to agree, as a single customer is unlikely to make TSMC withdraw its decision to raise prices. (Apple Insider, UDN, TechNews)

Micron Technology plans to invest up to USD100B over the next 20-plus years to build a computer chip factory complex in upstate New York, with the first phase investment of USD20B planned by the end of this decade, in a bid to boost domestic chip manufacturing. The announcement comes after the passage of the CHIPS and Science Act of 2022, a federal law that allocates USD52B to encourage more domestic semiconductor production.(CN Beta, Micron, CNBC, Reuters)

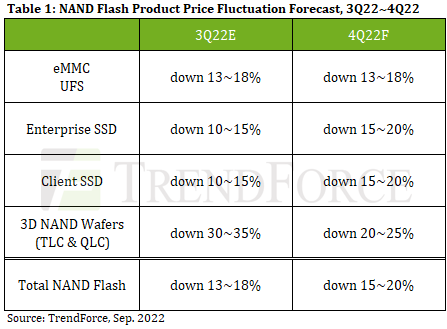

According to TrendForce research, NAND Flash is currently oversupplied. Buyers started focusing on destocking and greatly reducing purchases in 2H22 while sellers began offering rock-bottom prices to shore up purchase orders, causing wafer pricing to drop by 30-35% in 3Q22. All types of NAND Flash end products remain weak and factory inventory increased rapidly, resulting in a 15-20% decline in NAND Flash pricing in 4Q22. Most manufacturers’ NAND Flash product sales will also officially cross over into loss territory before the end of 2022, which means that certain suppliers under pressure from operating at a loss will likely reduce production as a way to reduce losses. (TrendForce, TrendForce)

SK Hynix has demonstrated its upcoming 48GB and 96GB DDR5-6400 registered memory modules for next-generation servers. The RDIMMs use the company’s latest 24Gb DDR5 SDRAM devices and bring together high performance and high capacity. SK Hynix has shown off a variety of memory modules for next-generation servers, including 32GB, 64GB, 128GB, and 256GB DDR5-5600 RDIMMs based on 16Gb DDR5 ICs as well as 48GB, and 96GB DDR5-6400 and DDR5-5600 RDIMMs featuring its 24Gb DDR5 ICs. (CN Beta, Tom’s Hardware, WCCFTech)

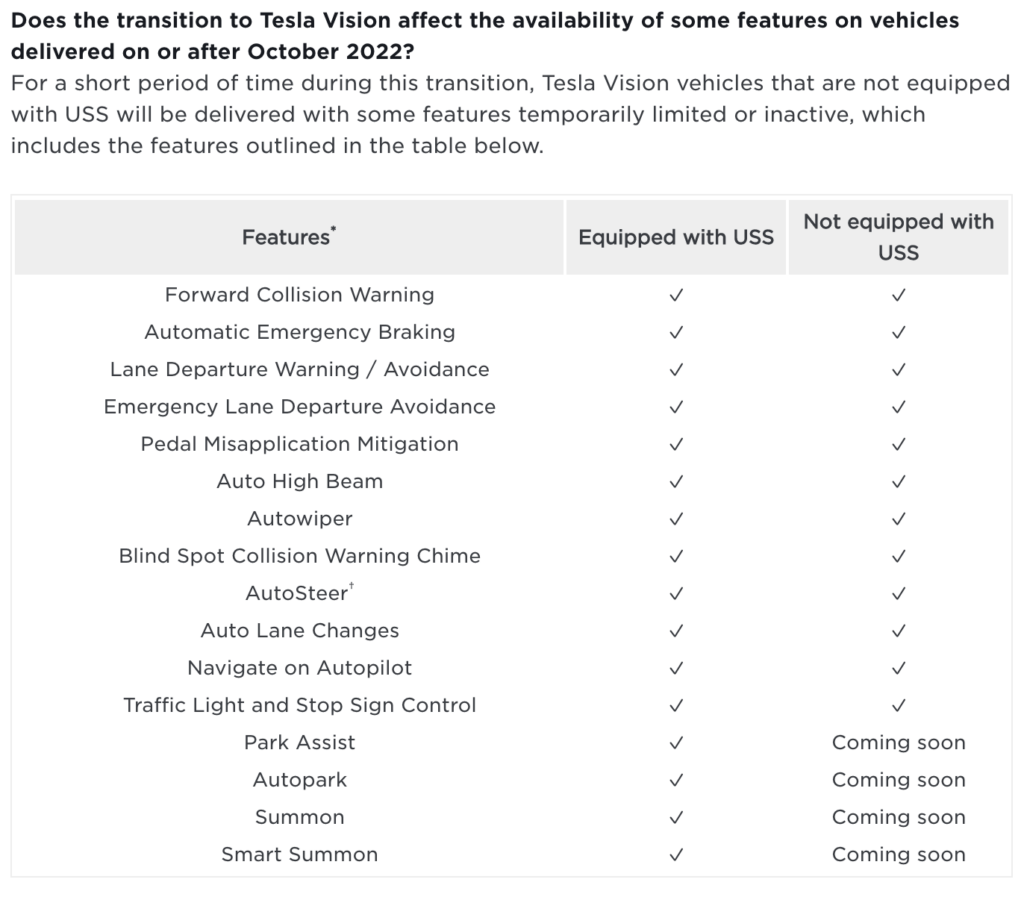

Tesla is removing ultrasonic sensors from Model 3 and Model Y vehicles, the next step in CEO Elon Musk’s plan to only use cameras and software to support its advanced driver assistance system and other active safety features. Starting Oct 2022, all Model 3 and Model Y vehicles built for North America, Europe, the Middle East and Taiwan will no longer include the 12 ultrasonic sensors typically found on the front and rear bumpers of its vehicles. Ultrasonic sensors, which measure distance by using ultrasonic waves, are generally used as proximity sensors to support anti-collision safety systems, particularly in low-speed applications like parking.(TechCrunch, Tesla)

Nio has started in sourcing raw materials directly from mines rather than its own battery suppliers as soaring prices of lithium, a critical component of EV batteries, hurt manufacturers’ supply chain stability and bottom lines. Lithium carbonate prices in China hit a record CNY501,500 per tonne in Sept 2022, tripling the number from a year ago. The surge is so dramatic that regulators summoned key industry players for a meeting in Mar 2022 and called for a return to rational pricing. Nio, an 8-year-old premium EV maker, has agreed to pay AUD12M (USD7.8M) for a 12.16% stake in Greenwing Resources, an Australian lithium mining company.(TechCrunch, Electrive, Caixing Global, Sina)

The EU has formally approved legislation to make USB-C charging mandatory. Smartphones, tablets, and cameras will need to offer USB-C ports by the end of 2024. Laptops will be required to offer USB-C charging from “spring 2026”. The EU will also push for a common wireless charging standard. (Android Authority, Europa)

Apple’s iPhone exports from India crossed USD1B in the 5 months since Apr 2022, signalling India is making progress with its bid to become a force in electronics manufacturing. At the current rate, outbound shipments of India-made iPhones, mainly to Europe and the Middle East, are set to reach USD2.5B in the 12 months through Mar 2023. That is almost double the USD1.3B worth of iPhones India exported in the year through Mar 2022. India is still far behind China. About 3M iPhones were made in India in 2021, compared with 230M in China, according to Bloomberg Intelligence estimates. The devices exported from India in Apr-Aug 2022 comprise iPhone 11, 12 and 13 models, and exports of the new 14 line will begin soon. (MacRumors, Bloomberg, The Star)

Apple suppliers added manufacturing operations close to the Cupertino, Calif.-based tech company in fiscal 2021, a sign of how the pandemic and geopolitics are beginning to reshape supply chains. Of Apple’s more than 180 suppliers, 48 had manufacturing sites in the U.S. as of Sept 2021, up from 25 a year earlier, according to a supplier list released by Apple. More than 30 sites were in California, compared with fewer than 10 a year earlier. Many major suppliers such as chip makers Qualcomm and Taiwan Semiconductor Manufacturing Co (TSMC), product assembler Foxconn Technology Group, and image sensor provider Sony, added production sites in the U.S. during the year, the list shows.(Apple Insider, WSJ, Market Watch, Apple, Sina, UDN)

Tesla CEO Elon Musk has offered to complete his proposed USD44B acquisition of Twitter in a dramatic U-turn on his decision to walk away from the deal. Lawyers for Musk have confirmed in a court filing that he is prepared to push ahead with the transaction on the agreed terms following months of legal drama. (The Guardian, NY Times, Washington Post, TechCrunch, SEC)

Apple is asking suppliers to move some AirPods and Beats headphone production to India for the first time, in a win for India as it attempts to rise in the global supply chain. Apple has allegedly been talking with a number of its suppliers about increasing production in India, including of key acoustics devices, as early as 2023. In response, iPhone assembler Foxconn is preparing to make Beats headphones in the country, and hopes to eventually produce AirPods there as well. Luxshare Precision Industry and its affiliates, which already produce AirPods in Vietnam and China, also plan to help Apple make the popular wireless earphones in India. However, Luxshare is focusing more on its Vietnamese AirPods operations for now and could be slower than its competitors in starting meaningful production of Apple products in India. India plans to spend USD30B to further strengthen its electronics supply chain, from semiconductors and materials to displays and electronics manufacturing, to attract more investment. (CN Beta, Asia Nikkei, CNA)

AmazeVR, a Los Angeles-based virtual concert platform, has said it has raised a USD17M funding round to create immersive music experiences through virtual reality (VR) concerts. AmazeVR offers a VR-based concert platform and became especially popular during the pandemic. According to AmazeVR, the company plans to expand its relationships with artists and hire more employees (the company currently has 62) in preparation for future VR headset releases. (VentureBeat, TechCrunch, Dot.LA)

The parent company of Facebook and Instagram was found guilty of infringing on two patents held by the walkie talkie messaging app – Voxer. Meta was ordered to pay USD175M in damages. Launched in 2011, The Voxer app was awarded the Best overall app in the Silicon Valley Business App Awards 2013. In 2012, Facebook had approached Voxer about a potential collaboration, during a series of meetings where various possibilities were considered, including a license to Voxer’s patented technologies. (The Verge, Times Now, Engadget)

ASUS has announced its entry into the metaverse, establishing “ASUS Metaverse Co. “The NFT platform will enable more people to create personalized characters, spaces, and even unattainable dream collectibles in the metaverse through NFT by using content and IPs related to art, photography, fashion, audio and video, and games. (CN Beta, Techgoing, TechNews)

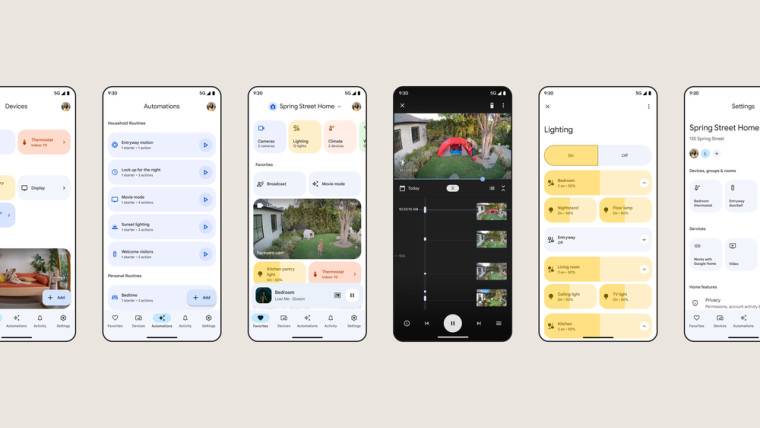

Google has announced that it is working on a new Google Home app with support for the Matter connectivity standard. Google previewing a completely new Home app for controlling its smart home devices and the many more gadgets it anticipates people will add to their homes once the new smart home standard Matter arrives. When Google adds Matter support later 2022, billions of Android devices, Google Nest smart speakers, smart displays, and routers will be able to control Matter devices.(Neowin, Google, Google, The Verge)

German car rental company Sixt has signed a long-term partnership agreement with China’s EV leader BYD (Build Your Dreams) to purchase approximately 100,000 electric vehicles through 2028. Sixt has committed to an initial order for “several thousands” of pure-electric BYD cars, the first of which will be delivered in 4Q22. Over the next 6 years, Sixt anticipates it will further supplement this preliminary order with an additional 100,000 BYD electric vehicles. (CN Beta, TechCrunch, Reuters, InsideEVs)

Block, the company behind Square and Cash App, now supports Apple’s Tap to Pay for iPhone feature for merchants. Existing Square users or new businesses wanting to use Square can now use their iPhones to receive payments while using Block’s financial management software. The company has said that merchants can open the Square POS app, initiate the sale and present the iPhone to customers to complete the payment. (The Verge, Business Wire, TechCrunch)