10-6 #UncertaintyFear : SK Hynix will reportedly cut capital expenditures by 70-80% next year; Samsung is not considering a cut in production of its memory chips; CATL is considering a third factory in Europe; etc.

Qualcomm has announced that the Company’s automotive design-win pipeline has grown to USD30B, driven by increased adoption of its Snapdragon/ Digital ChassisTM solutions across the auto industry. The increase represents a greater than USD10B expansion since the Company’s fiscal 3Q22r results were announced. Specifically, the expanded pipeline is a result of significant design wins with automakers and Tier-1 suppliers as Qualcomm Technologies, Inc. becomes the automotive industry’s partner of choice for next-generation vehicles. Qualcomm has also estimated that automotive TAM expansion to USD100B by 2030. (Laoyaoba, Qualcomm, Reuters)

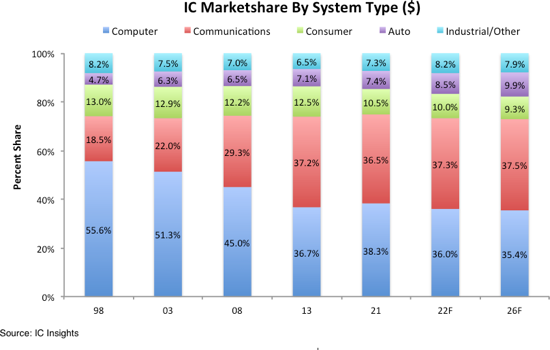

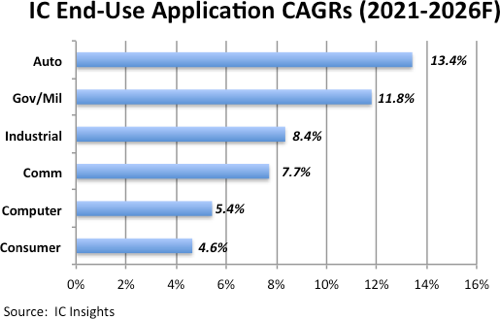

According to IC Insights, the automotive IC marketshare has steadily increased since 1998 growing from 4.7% of total IC sales that year to 7.4% in 2021. Marketshare gains are forecast to continue for the auto segment, with an 8.5% share expected this year and 9.9% share by the year 2026. At the heart of this growth are the myriad number of new sensors, analog devices, controllers, and optoelectronics being incorporated into most new vehicles. Moreover, the rise of hybrid and all-electric vehicle sales worldwide is adding to this forecast growth. (Laoyaoba, IC Insights)

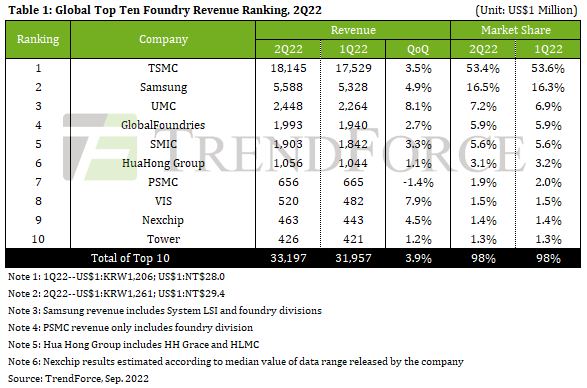

According to TrendForce research, due to steady weakening of overall demand for consumer electronics, inventory pressure has increased among downstream distributors and brands. Although there are still sporadic shortages of specific components, the curtain has officially fallen on a 2-year wave of shortages in general, and brands have gradually suspended stocking in response to changes in market conditions. However, stable demand for automotive and industrial equipment is key to supporting the ongoing growth of foundry output value. At the same time, since the creation of a marginal amount of new capacity in 2Q22 led to growth in wafer shipments and a price hike for certain wafers, this drove output value among top ten foundries to reach USD33.20B in 2Q22. Quarterly growth fell to 3.9% on a weakening consumer market. (Laoyaoba, TrendForce, TrendForce)

The Intel Labs and Components Research organizations have demonstrated the industry’s highest reported yield and uniformity to date of silicon spin qubit devices developed at Intel’s transistor research and development facility, Gordon Moore Park at Ronler Acres in Hillsboro, Oregon. The research was conducted using Intel’s second-generation silicon spin test chip. Through testing the devices using the Intel cryoprober, a quantum dot testing device that operates at cryogenic temperatures (1.7 Kelvin or -271.45 degrees Celsius), the team isolated 12 quantum dots and four sensors. This result represents the industry’s largest silicon electron spin device with a single electron in each location across an entire 300mm silicon wafer.(CN Beta, Intel, Hot Hardware)

Michelle Johnston Holthaus, Intel’s EVP of the Client Computing Group, has revealed that Intel has not given up hope of regaining Apple as a customer. In an Oct 2021 interview, Intel CEO Pat Gelsinger insisted that it will never give up hope of restoring Macs on Intel processors, but it will have to do it by creating better chips.(CN Beta, WebProNews, The Street, Twitter)

Taiwan-based IC design house Airoha Technology, a MediaTek spin-off, has announced that it has successfully landed in the US market with deployments of what it calls the world’s fastest XGS-PON broadband networks that ensure symmetric 8Gbps upload and download speeds with 3ms low latency. The Airoha chips for fiber optical broadband customer premise equipment (CPE) strictly observe standards set by the Federal Communications Commission (FCC) with a symmetric speed of 8 gigabits per second, which is the fastest so far in the real-world optical fiber networks verified by Speedtest. ß(CN Beta, PR Newswire, Digitimes)

E Ink, pioneer, and global leader in digital paper technology, and Sharp Display Technology Corporation (SDTC), a leading company in the field of displays, announced the collaboration with each other, and adopt SDTC’s indium gallium zinc oxide (IGZO) backplanes for ePaper modules using in eReader and eNote products. E Ink has been developing the use of oxide thin film transistors (TFTs) for electrophoretic technology for over 10 years, and will expand its ePaper product portfolio based on using oxide TFTs. ß(Printed Electronics, Good Reader, Sharp)

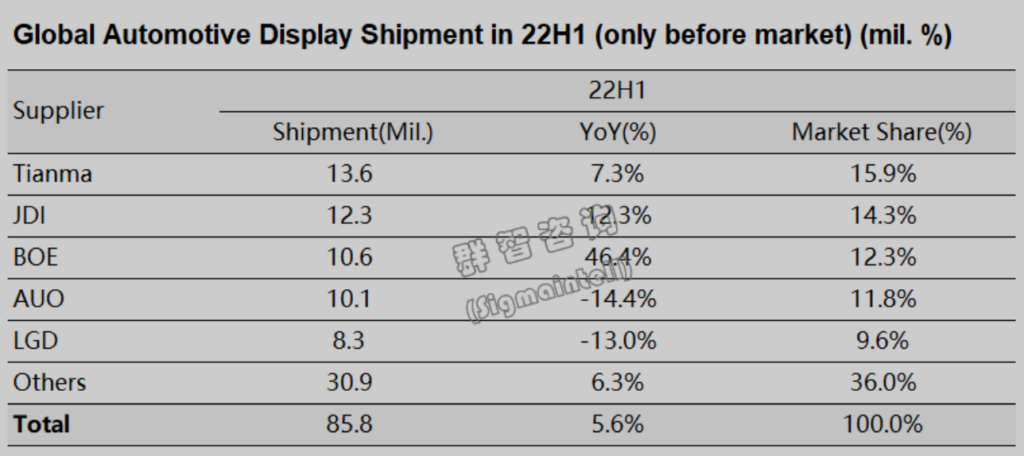

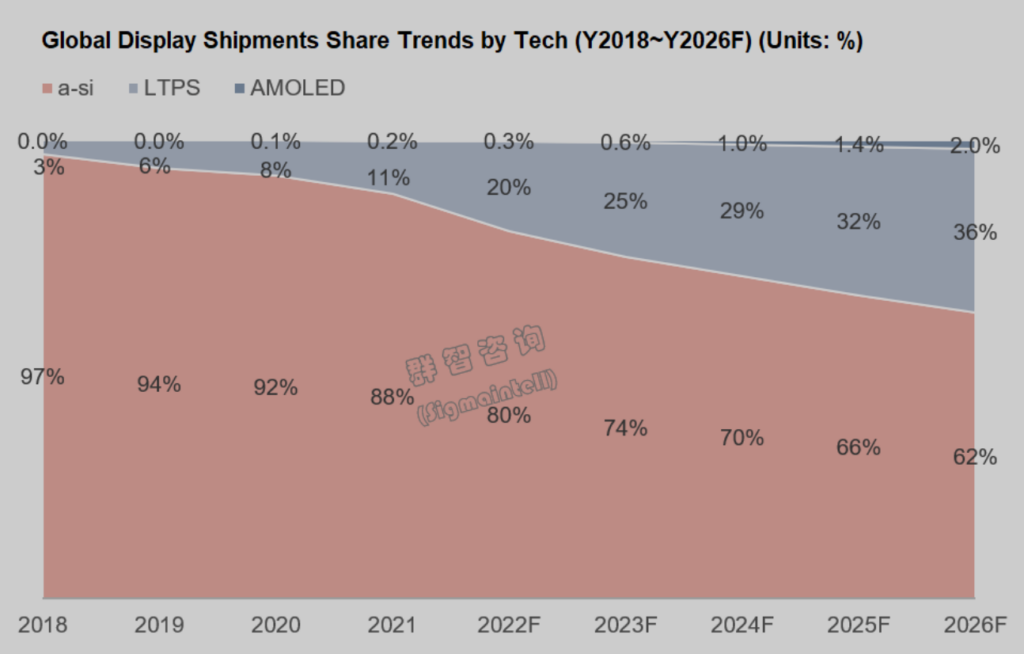

According to Sigmaintell, in 1H22, the global vehicle sales volume was approximately 37.66M units, a YoY decrease of about 10.7%, and the global shipment of front-mounted vehicle display panels was approximately 85.81M units (front-mounted only), a YoY increase of approximately 5.6%. Sigmaintell estimates that in 2022, the global LTPS LCD vehicle display panel shipments will be approximately 35.1M units, and the penetration rate will increase to approximately 19.6%. Sigmaintell predicts that the global demand for front-mounted vehicle display panels will reach 180M in 2022, a YoY increase of about 10.0%, and will maintain a compound growth rate of more than 6.0% in the next 5 years. (Sigmaintell, Laoyaoba)

According to Display Supply Chain Consultants (DSCC), there will be no spending on equipment related to the production of large OLED panels used in TVs and monitors in 2023. DSCC said spending on equipment related to these panels was USD3B in 2019 but dropped every following year. Spending on equipment was USD2.049B in 2020 and USD1.47B in 2021. In 2022, spending by companies on large OLED panel equipment is expected to mark USD1.42B. While spending in 2023 will be zero, companies are expected to resume spending the following USD2.011B in 2024 and USD1.51B in 2025. Spending on inkjet printing OLED equipment will take up 76% of the spending in 2024, while all spending in 2025 will be on inkjet printing OLED equipment. (The Elec, Laoyaoba, OLED-Info)

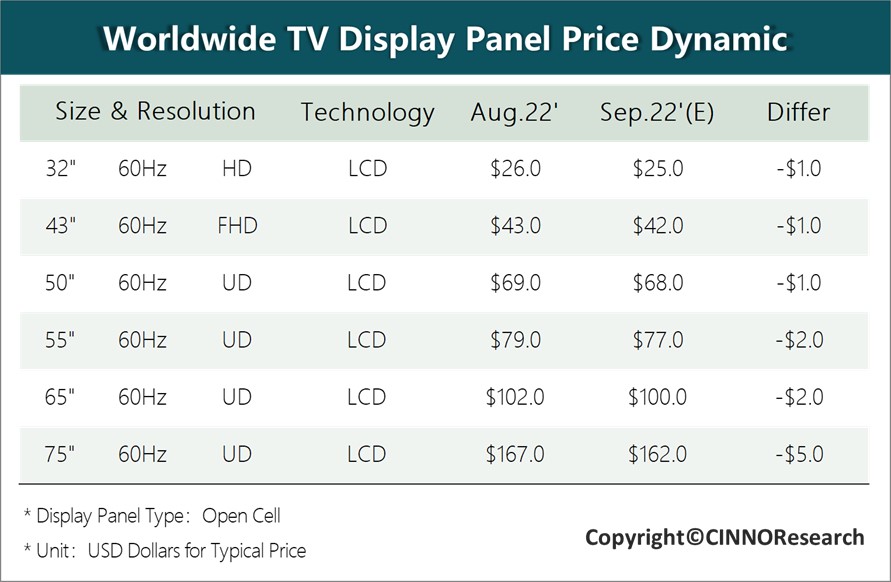

The average utilization rate of the 3 major panel factories in China dropped to below 70%, which to a certain extent successfully alleviated the problem of overstocking and reduced the decline in panel prices. The low utilization rate will remain for a period of time to ensure that the remaining inventory is digested as soon as possible and lay a good market foundation for the new production capacity in 2023. CINNO Research predicts that in Sept 2022, the price drop of LCD panels of various sizes will be significantly narrowed, and panel prices are expected to reach the bottom of this round in 4Q22. According to CINNO Research, the current LCD TV panel inventory level of several major panel manufacturers has dropped to about 3~3.5 weeks, and the problem of inventory backlog has been significantly alleviated. Therefore, the decline in LCD panel prices in Sept 2022 has slowed down significantly, and the decline is in line with previous expectations. (Laoyaoba, CINNO)

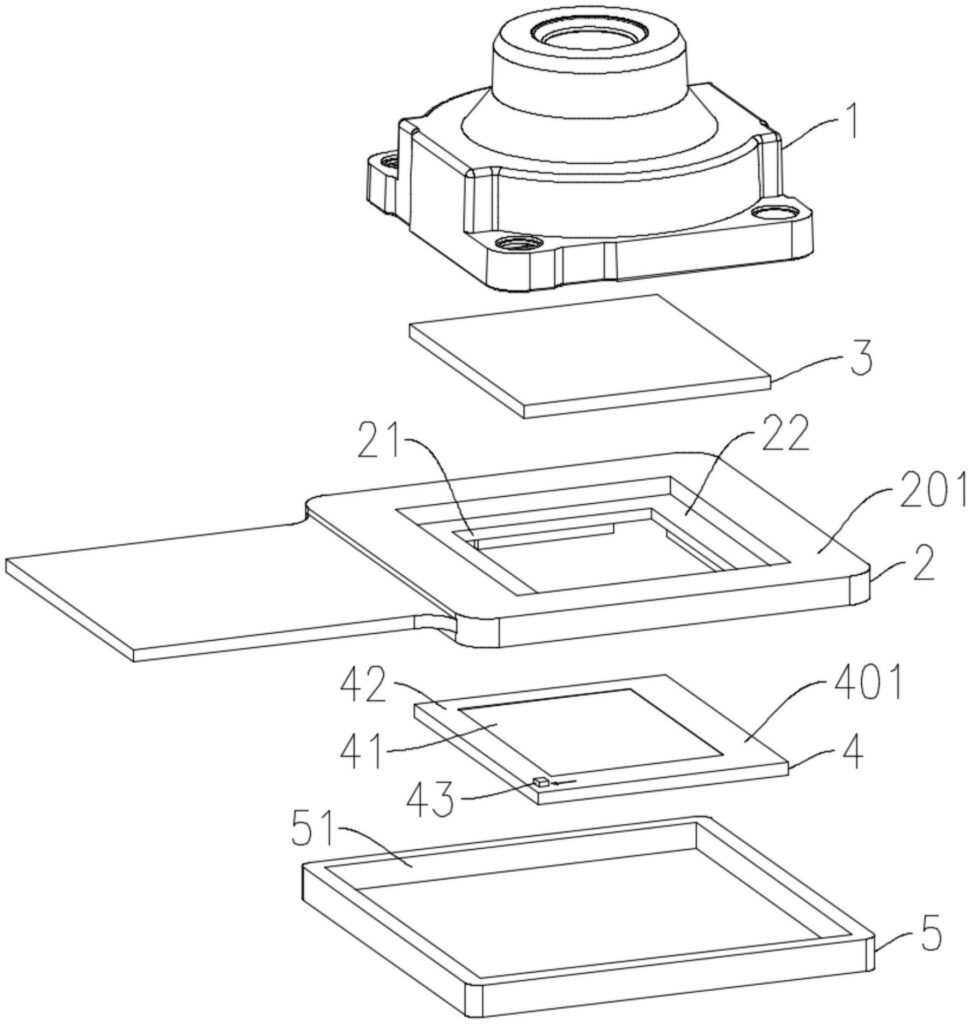

Xiaomi’s patent titled “camera module and terminal device” tries to solve the camera bump issue. The patent redesigns the structure of the existing cell phone camera module on the basis of its structure, and successfully reduces the overall height of the module by adding a large number of recess nesting structures. However, among the other patents, Xiaomi has disclosed together with this patent, there is also a patent related to lens infinitely zoom, and the addition of more mechanical structures will inevitably affect the overall thickness of the module. (CN Beta, Techgoing)

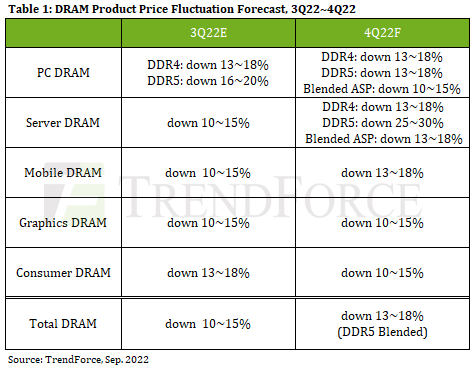

According to TrendForce, rising inflation has weakened demand for consumer products, flattening the peak of peak season. In 3Q22, memory bit consumption and shipments continued to exhibit quarterly decline. Due to a significant decline in memory demand, terminal buyers also delayed purchases, leading to further escalation of supplier inventory pressure. At the same time, the strategies of various DRAM suppliers to increase their market share remain unchanged. There have been cases of “consolidated 3Q22 / 4Q22 price negotiations” or “negotiating quantity before pricing” in the market, which are the reasons leading to a ballooning of declining DRAM prices to 13%~18% in 4Q22. (Laoyaoba, TrendForce, TrendForce)

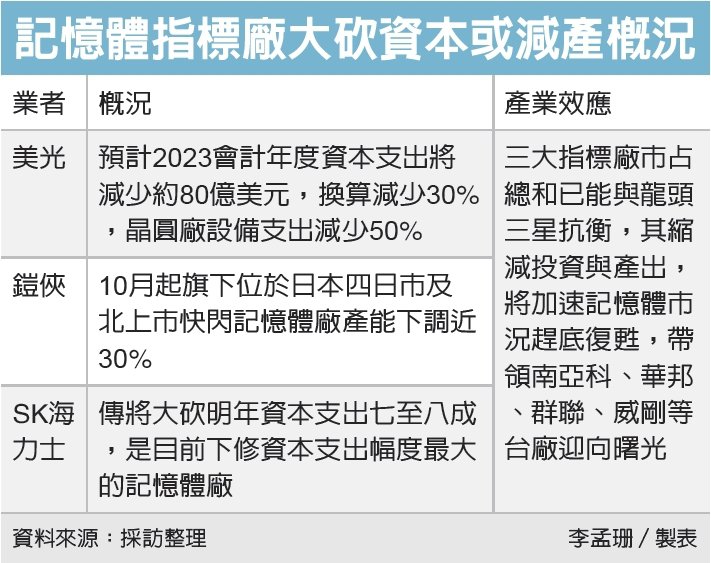

SK Hynix will reportedly cut capital expenditures by 70-80% in 2023. In addition, Micron and Kioxia have previously disclosed plans to reduce capital expenditures or significantly reduce production. The combined market share of these 3 indicators has been able to compete with the leading Samsung. Its reduction in investment and output will accelerate the recovery of the memory market and lead to Taiwanese factories such as Nanya, Winbond, Phison, and ADATA are welcoming the dawn. Previously, Micron took the lead in announcing 30% of the annual capital expenditure. Later, Kioxia has also revealed the news of a 30% reduction in production in the Japanese factory. SK Hynix is the memory factory with the largest capital expenditure revision.(My Drivers, Techgoing, CNYES, UDN)

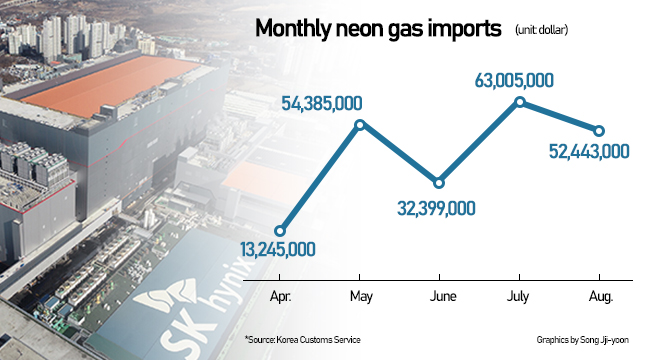

SK Hynix has succeeded in using neon gas from local suppliers for 40% of its chip production. The chip giant said it was aiming to use wholly sources from South Korea for neon gas in 2024. SK Hynix had up to recently wholly relied on import for neon gas, which is used during the lithography process in wafer fabrication. Neon gas is mixed with other gases to make excimer laser gas; excimer laser is a short wave infrared lasers use to draw the circuit patterns on the laser. SK Hynix also said it plans to localize the supply of krypton and xeon gases used in etching processes starting in Jun 2023. (The Elec, Business Korea, KED Daily, Pulse News)

Han Jin-man, senior vice president of Samsung’s memory chip business division, has revealed that the company is not considering a cut in production of its memory chips despite slowing demand amid concerns over a global economic recession. His comments came as Micron Technology has said it would cut capital spending by up to 30% and chip equipment spending up to 50% to slow supply growth in fiscal year 2023.(Korea Times, YNA, Korea Herald)

Contemporary Amperex Technology Co Limited (CATL), a global leader of new energy innovative technologies, has announced it has executed a Master Supply Agreement with FlexGen Power (FlexGen), the leading energy storage technology platform and energy storage solution provider to supply 10GWh of CATL’s leading energy storage equipment over a 3 year period. CATL will supply FlexGen with EnerC, a containerized liquid-cooling battery system. EnerC’s energy density can reach 259.7 kWh per square meter, almost a 200% increase over traditional air-cooling systems. (Laoyaoba, QQ, PR Newswire)

The company’s present in Eiurope ,Matthias Zentgraf has revealed that China’s Contemporary Amperex Technology Co Ltd (CATL) is considering a third factory in the region. The company announced in Aug 2022 plans to build a second European plant in Hungary, investing EUR7.3B (USD7.2B) in partnership with Mercedes-Benz. The facility has a planned output of 100 gigawatt hours and will also supply Volkswagen Group, BMW and Stellantis. CATL expects it to be ready within 5 years. (Laoyaoba, Sohu, Auto News)

Elli, the Volkswagen subsidiary that manages all activities related to charging and energy for the Group in Europe, the Elia Group and its start-up re.alto have signed a memorandum of understanding (MoU). The MoU underscores the signatories’ shared vision of integrating electric cars into the electricity system. The signatories Elli, Elia and re.alto encourage that the increasing amount of e-vehicles can create tremendous opportunities to counteract climate change in the coming decade: The batteries of electric vehicles can help stabilise grids as the share of volatile, renewable energies rises.(CN Beta, Volkswagen, Reuters, Electrek)

PowerCo, the new battery company of the Volkswagen Group, and Umicore, the Belgian circular materials technology group, have announced the founding of a joint venture for precursor and cathode material production in Europe. From 2025 onwards, the joint venture will supply PowerCo’s European battery cell factories with key materials. By the end of the decade, the partners aim to produce cathode material and their precursors for 160 GWh cell capacity per year, which compares to an annual production capacity capable of powering about 2.2M full electric vehicles.(CN Beta, Volkswagen, Reuters)

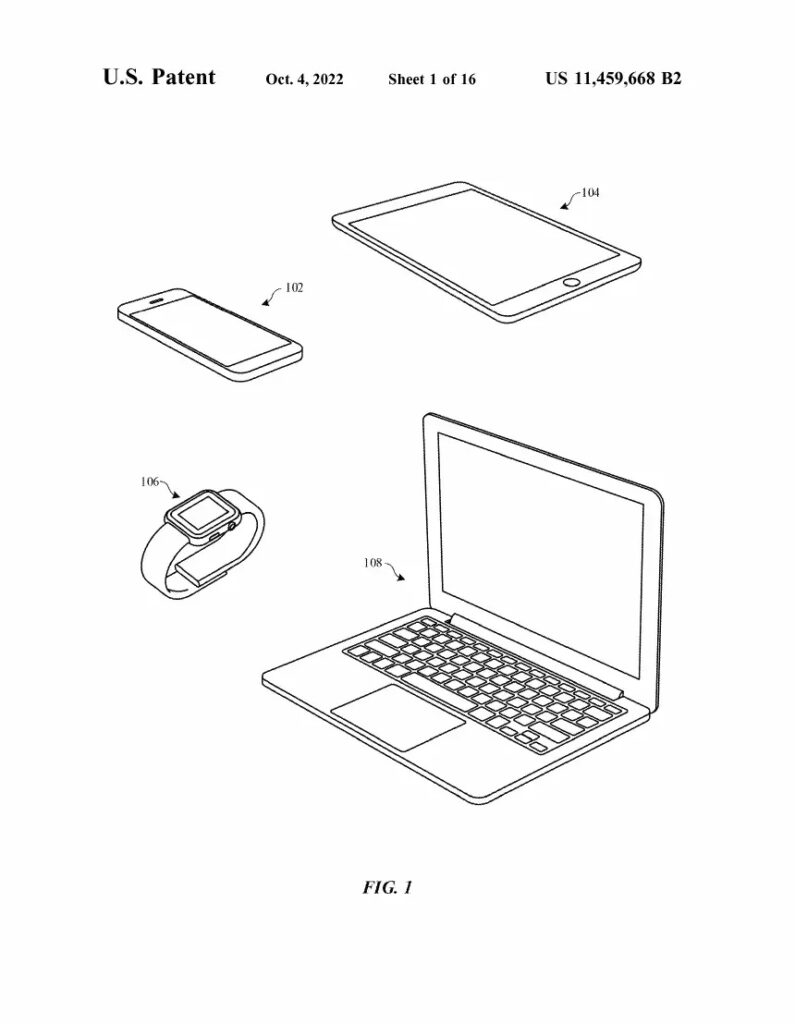

The U.S. Patent Office has granted Apple Patent 11459668 B2 titled “Titanium part having an anodized layer”. Apple’s granted patent covers an enclosure for a portable electronic device that can include a titanium substrate defining a textured surface and a nominal surface. Apple has been reported on multiple occasions to bring titanium alloy to a multitude of products. First and foremost, titanium alloy will allow future products like iPhones, iPads, and Macs to become more scratch-resistant. Additionally, their durability will increase, making the devices less prone to bending compared to others. (CN Beta, WCCFTech)

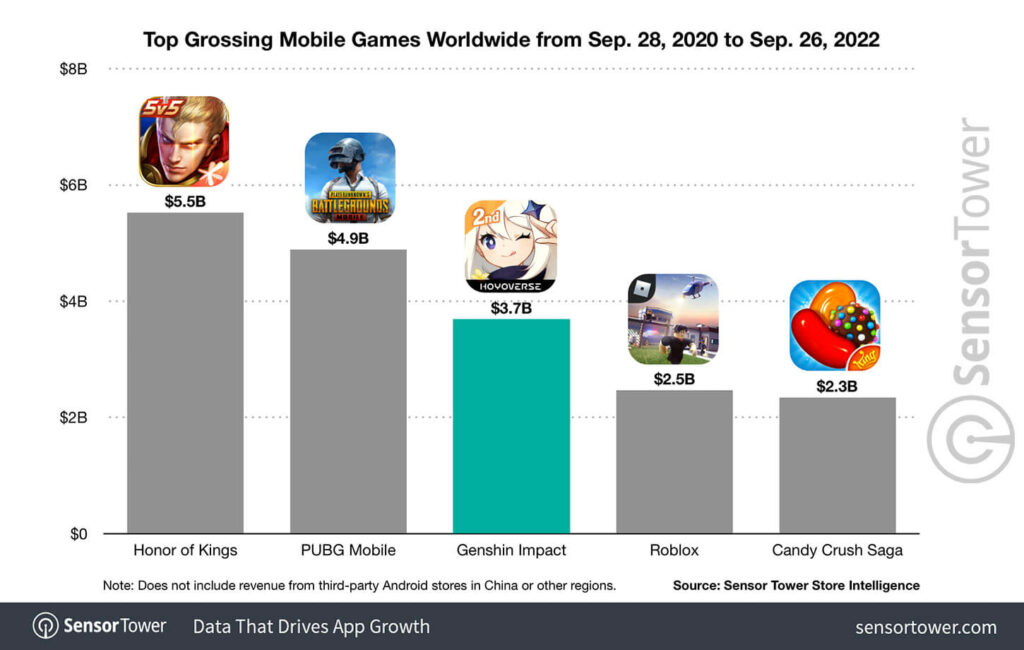

Genshin Impact from miHoYo has generated USD3.7B from player spending worldwide across the App Store and Google Play since it was first launched on 28 Sept 2020, Sensor Tower Store Intelligence data reveals. It sits behind PUBG Mobile from Tencent at No. 2, which has accumulated USD4.9B over the past 2 years, and Honor of Kings, also from Tencent, at No. 1, which has picked up USD5.5B. Outside of China, Genshin Impact ranks No. 2 for mobile game player spending, racking up USD2.5B internationally across the App Store and Google Play. (SensorTower, CN Beta)

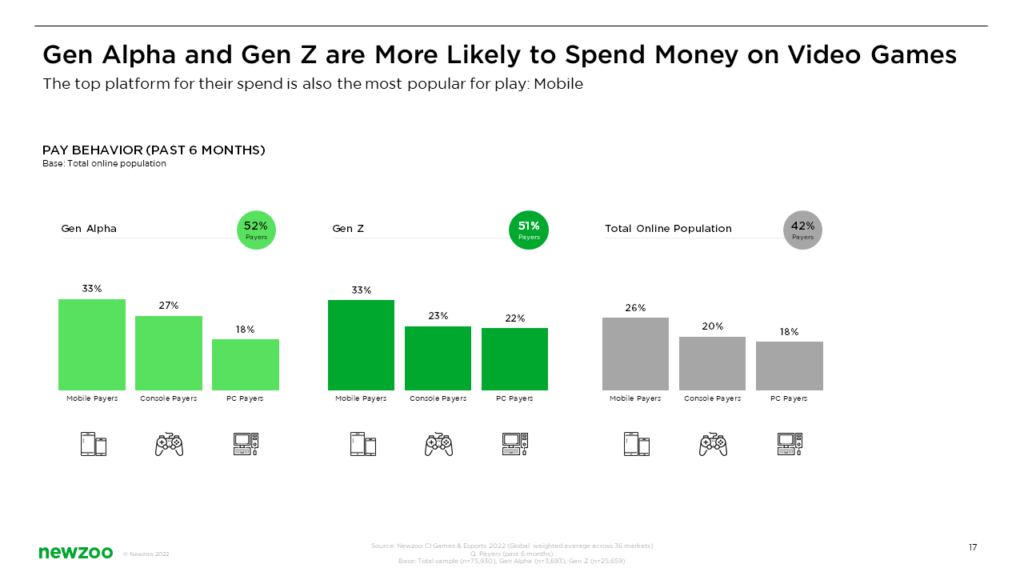

According to Newzoo, the youngest generations are very engaged with games, but not always with the act of playing them. Newzoo defines “game enthusiast” as one who engages with games either through playing or viewing. This means that not all game time equals actually playing a game — it could mean watching someone else play a game on Twitch or YouTube. Newzoo’s report draws information from 75,930 respondents across 36 countries. It defines Gen Z as those born between 1995-2009, and Gen Alpha as those born in 2010 or later. Roughly 70% of those surveyed across both generations report having watched gaming content. The appetite for esports is not huge — about 33% across both generations). However, both generations report watching gaming content for guidance on what and how to play, or to see what high-level gameplay looks like. (Newzoo, VentureBeat)

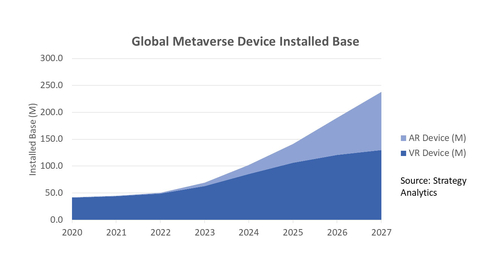

Strategy Analytics predicts that the installed base of dedicated metaverse devices (VR and AR headsets) to double by 2024, from 50M today. Reaching an installed base of 100M in 2024 will be a significant milestone for this relatively new category of consumer electronics, helping to drive further growth and investment. AR will grow from just over 1% of shipments of the metaverse devices market in 2021 to a 64% shipment share of metaverse devices by 2027. (Strategy Analytics, Laoyaoba)

Japanese electric helicopter startup SkyDrive has unveiled its electric helicopter that they hope to use as an air taxi service by 2025. SkyDrive, an Osaka, Japan-based company, plans to introduce a “sky taxi” service to Osaka Bay by 2025, just in time for the World Expo being held there in 2025. The SkyDrive SD-05, which is still very much in development, holds only two passengers and is designed for short city transport. It uses a combination of 12 electric motors to maneuver throughout the city at a maximum speed of 100km/h. (CN Beta, Design Boom, Teslarati)

General Motors (GM) will invest USD760M at its Toledo, Ohio, propulsion manufacturing operations to prepare the facility for production of drive units that will be used in future Ultium-based battery electric trucks, including the Chevrolet Silverado EV, GMC Sierra EV and GMC Hummer EVs. Toledo Propulsion Systems will be GM’s first U.S. powertrain or propulsion-related manufacturing facility transformed for EV-related production. Once the plant is converted, it will produce GM’s family of EV drive units, which convert electric power from the battery pack to mechanical motion at the wheels. GM’s EV drive units will cover front-wheel drive, rear-wheel drive and all-wheel drive propulsion combinations.(CN Beta, Forge, InsideEVs, GM)

TF Securities analyst Ming-Chi Kuo believes that after some years of relative silence, the Apple Car team is said to be restarting work, with a potential reformation of the group before the end of 2022. Kuo has said a vehicle launch from Apple is unlikely to happen before 2025. Currently, Kuo’s TF Securities expects a launch between 2025 and 2027. Apple could work with Kia to manufacture the vehicle, and the company has approached other manufacturers such as Nissan and Hyundai. (Apple Insider, Twitter, CN Beta)