11-15 #VIP : TSMC’s plan to build an advanced 7nm fab in Kaohsiung is delayed; Samsung will continue to diversify its global production bases; Samsung will reportedly complete the construction of its new P3 foundry fab in 2023; etc.

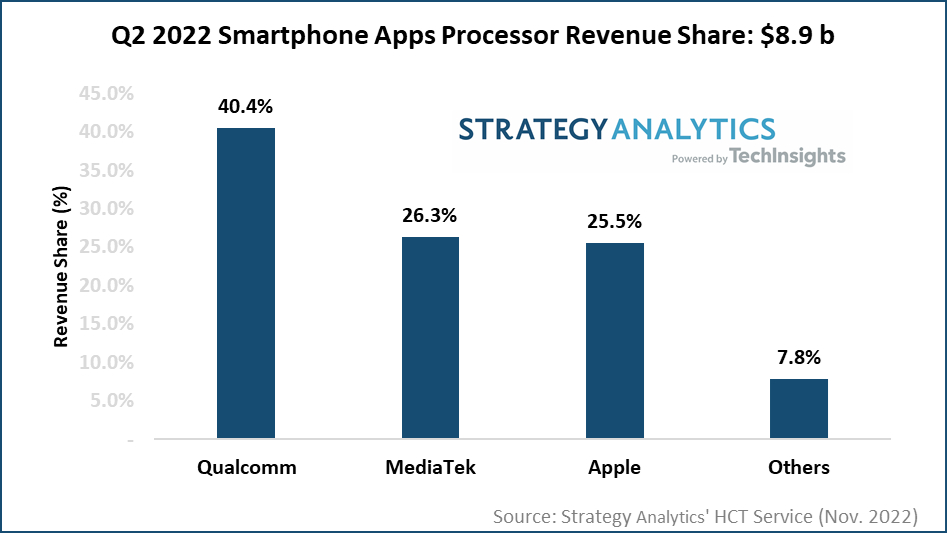

The global smartphone applications processor (AP) market grew 26% to USD8.9B in 2Q22. Strategy Analytics estimates that Qualcomm, MediaTek, Apple, Samsung LSI and Unisoc captured the top-5 revenue share rankings in the smartphone applications processor (AP) market in 2Q22. Qualcomm maintained its lead in the smartphone AP market with a 40% revenue share, followed by MediaTek with 26% and Apple with 25.5%. 5G-attached AP shipments accounted for 55% of total smartphone APs shipped in 2Q22. TSMC manufactured over 80% of smartphone APs shipped in 2Q22. Samsung Foundry’s key customer Qualcomm shifted orders to TSMC in recent quarters. Google and JLQ Technologies (a Leadcore and Qualcomm JV) shipped over 1M APs in 2Q22. (Strategy Analytics, Laoyaoba)

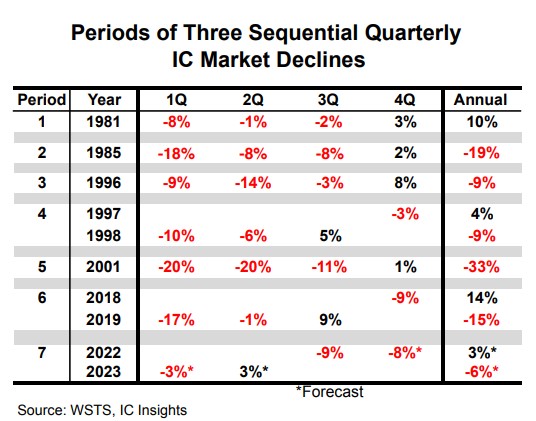

Over its 60-year history, the IC industry is well known for its cyclical behavior. Looking back to the mid-1970s, there has not been a period where the IC market declined for more than 3 quarters in a row. Following a 9% drop in the 3Q22 IC market, and assuming the 4Q22 and 1Q23 IC markets register a decline, the 3Q22-1Q23 timeperiod would mark the seventh three-quarter IC market drop on record. There has not been a 3-quarter decline in the IC market since 4Q18-2Q19. Moreover, the 3-quarter decline in 2001 was the steepest on record, with 3 double-digit declines, which led to a 33% annual decline—the most severe annual IC market drop in history. Given that the IC industry has never registered a 4-quarter sequential IC market decline, expectations are high for a return to IC market growth beginning in 2Q23. While the U.S. and China trade war is an unpredictable “wildcard” for near-term IC market growth scenarios, 2Q23 is currently expected to display modest 3% increase. However, even with a rebound in IC sales beginning in 2Q23, the total IC market is forecast to drop by 6% in 2023. (Laoyaoba, IC Insights)

Taiwan Semiconductor Manufacturing Co (TSMC) is still planning to build an advanced 7nm fab in Kaohsiung, but the project will be delayed, according to the company’s CEO C.C. Wei. TSMC intends to build 7nm and 28nm fabs in the new Nanzih Technology Industrial Park in Kaohsiung, but has yet to break ground on either project. CC says that plans for the 7nm process factory had not changed, but that it would be delayed. Wei did note, however, that the plan to build the 28nm fab would proceed on schedule and said it could even be expanded in the future. Weakening demand for smartphones and PCs and delays in new product launches by clients meant that capacity utilization for the 6nm and 7nm processes would slow down in 4Q22 and remain softer into 1H23.(Laoyaoba, UDN, TechNews, Yahoo, Taipei Times, Focus Taiwan)

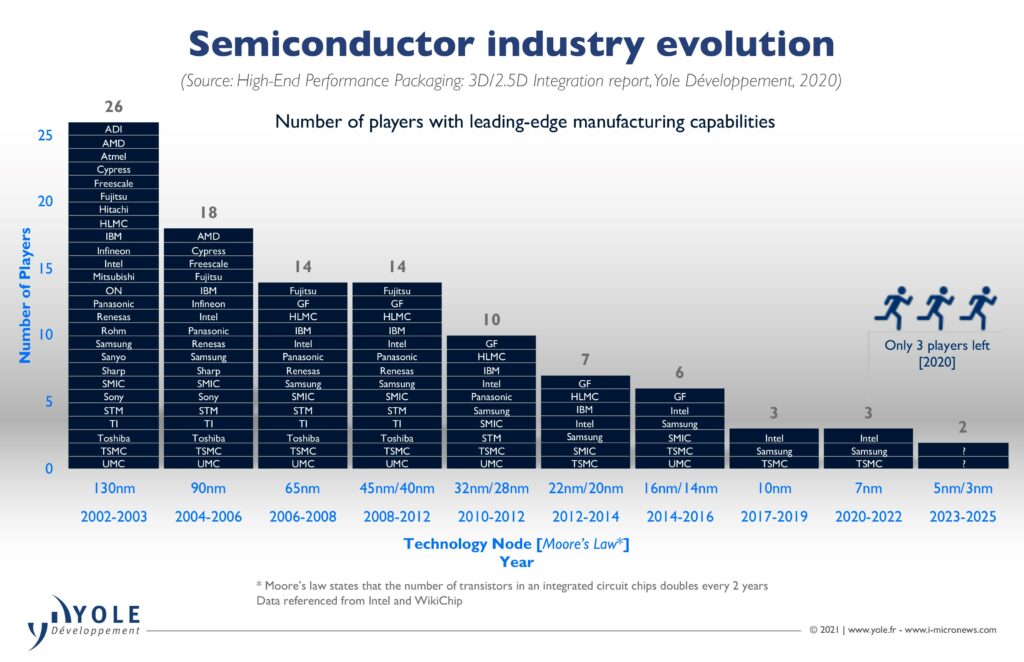

Japanese technology conglomerate Fujitsu has mentioned that its power-saving CPU will be produced with the 2nm processing node technology, and will be manufactured by TSMC. Fujitsu aims to complete the energy-saving central processing unit (CPU) equipped with the chip as soon as 2026. TSMC currently plans to mass-produce2nm chips in 2025. The company’s advanced process technology blueprint has only been revealed to 2nm, while rival Samsung Electronics has announced that it will mass-produce 1.4nm chips in 2027. In addition, Intel also revealed that the Intel 18A (equivalent to 1.8nm) test chip will be trial-produced before the end of 2022. (Laoyaoba, Sina, Digitimes, Techgoing)

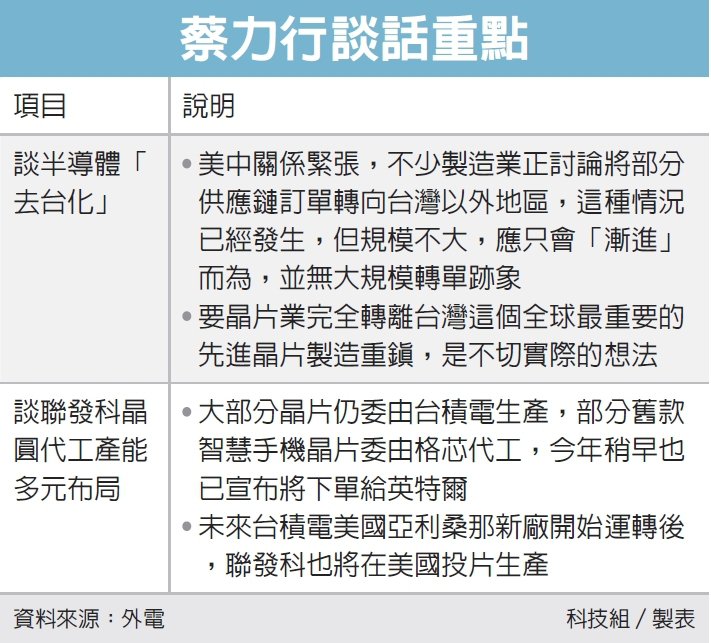

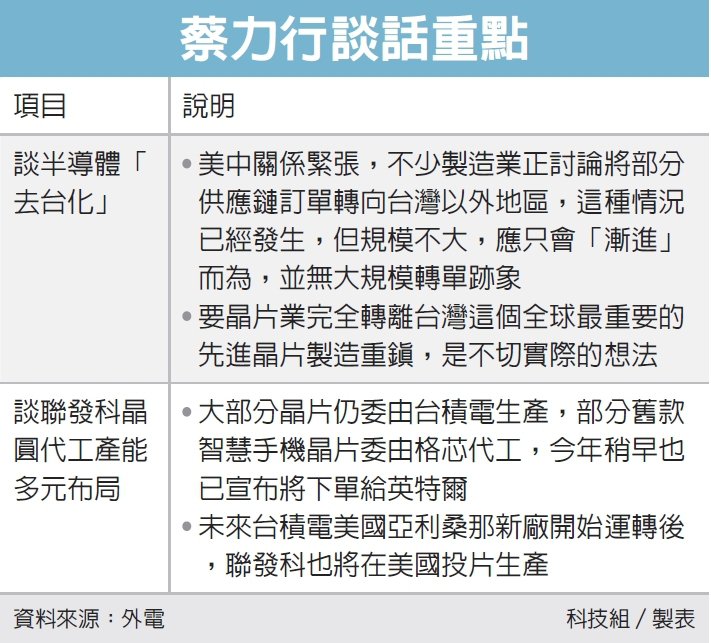

MediaTek Chief Executive Rick Tsai has revealed that some of the “very large (equipment manufacturers) will require their chip suppliers to have multiple sources, like from Taiwan and from U.S., or from Germany or from Europe. Tensions between China and the United States are pushing some manufacturing companies to talk about expanding some of their supply chain beyond Taiwan, although it is “incremental”. While MediaTek’s most advanced smartphone chips are made at Taiwan Semiconductor Manufacturing Co (TSMC) in Taiwan, Tsai has said some older smartphone chips are made by GlobalFoundries, which has factories in places like the U.S. and Singapore, and pointed to an announcement earlier 2022 to make its chips at Intel’s fabrication facilities. He said that MediaTek will also be producing chips in TSMC’s Arizona’s fab when that is up and running.(Phone Arena, Channel News Asia, Reuters, Taipei Times, UDN, TechNews, China Times)

Advanced Semiconductor Engineering (ASE) plans to expand its factory site in Malaysia with total investment estimated at USD300M. ASE broke ground recently on the phase-four and phase-five facilities of its site in Penang. Construction of new facilities at the Penang site is scheduled to complete in 2025, said ASEH, adding that the additional facilities will satisfy robust copper clip packaging demand and demand for image sensors. ASE and Siliconware Precision Industries (SPIL) are both owned by ASE Technology (ASEH), a holding company formed as a result of the two’s merger.(EET-China, TechNews, Business Wire, Digitimes)

The sudden decline in foundry demand is due to the collapse of the downstream industry. For system semiconductors manufactured by foundries, the main markets are finished products such as smartphones, PCs, servers, home appliances, and automobiles. TSMC’s orders have been on the decline since the end of Sept 2022. The decline in orders is expected to continue through 1Q23. This is largely due to the fact that core customers such as Nvidia, MediaTek, and AMD reduced their order volume. About 40-50% of orders for 3nm process semiconductors, which TSMC is preparing for mass production at the end of 2022, have also been canceled. Samsung Electronics, the world’s second-largest foundry, has also predicted a market recession in 2023. Some are expecting a turnaround in the foundry market in 2H23. (Laoyaoba, ET News)

GlobalFoundries is reportedly planning job cuts to reduce overhead amid weakening demand for semiconductors. The company has confirmed the job cuts and a hiring freeze. GlobalFoundries has previously discussed plans to create savings of approximately USD200M in operational expenditure. GlobalFoundries said it was seeing slower chip demand, and some customers had already asked to adjust their 2023 shipments downward. It also expected to see little or no growth in revenue for the current quarter running to the end of 2022. (Laoyaoba, WCAX, Bloomberg, Times Union, The Register, The Layoff)

LG Display (LGD) has reportedly started supplying displays to Apple’s new iPhone 14 Pro series models. The portion of Samsung Display’s shipments is expected to decrease with the addition of LG Display joining the market. China’s BOE is supplying OLED panels only to the iPhone 14 general series. The regular iPhone models are equipped with low-temperature polycrystalline silicon (LTPS) OLEDs. Samsung Display will supply all four models of iPhone 14, LG Display will supply two models of iPhones, including regular and Pro Max, and BOE will supply OLEDs for regular iPhones. (Gizmo China, ET News)

Ennostar’s subsidiary, LED epitaxial wafer and chip maker Epistar will invest NTD600M (USD18.8M) to acquire manufacturing equipment of 6” micro LED epitaxial wafers from PlayNitride Display, a subsidiary of micro LED maker PlayNitride. Ennostar estimates that in 2025 there will be a demand for 100,000 sets of Micro LED large-scale displays per month, and the annual demand will exceed 1M sets. Therefore, the layout of Micro LED production capacity in advance is currently in accordance with the company’s plan. The company hopes to use PlayNitride’s rich experience in Micro LED mass production in the past few years to assist Epistar in reducing technology and mass production risks to be ready in 2023, 2024.(Laoyaoba, CTEE, EET-China, UDN, Digitimes)

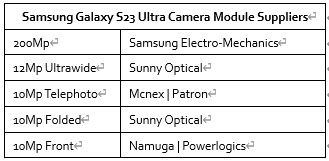

China’s Sunny Optical will be supplying two camera modules that will be used as rear cameras on Samsung’s Galaxy S23 Ultra launching in 2023. Sunny Optical will be supplying the folded zoom module and ultra-wide module. Galaxy S23 Ultra is to have four cameras on its back; 200MP main, 12MP ultra-wide, 10MP telephoto, and 10MP folded zoom telephoto. The front camera will be 12MP. Meanwhile, Sunny Optical willl not be supplying any camera modules for the Galaxy S23 and Galaxy S23 Plus. Samsung Electro-Mechanics, Partron, Cammsys, and Powerlogics will be providing the two models with cameras. (Android Headlines, The Elec)

Samsung will reportedly complete the construction of its new P3 foundry fab in 2023. The company has originally planned to finish construction within 2022. Samsung only started construction of the cleanroom of the fab late Oct 2022. This reflects the delay that began when the construction of the NAND production line was also pushed back by a month earlier 2022. That month’s delay has pushed back the timeline for the other phases, the sources added. Construction of P3 began in mid-2020 and it is Samsung’s largest to date, taking up a space of 700,000 meter square. It is a mixed fab, meaning it will manufacture both memory and logic chips. The cleanroom for the DRAM line inside the fab has already been completed. The cleanroom for the NAND line will likely be completed and turned on during 1Q23. (Laoyaoba, The Elec)

According to Eugene Investment & Securities, the global DRAM market posted USD17.973B in sales in 3Q22, down 29.3% from USD25.427B in 2Q22. Samsung Electronics’ DRAM sales fell 33.7% from USD11.121B in 2Q22 to USD7.371B in 3Q22. The drop eclipsed the overall market decline. As a result, its market share in terms of sales also fell by 2.7 percentage points from 43.7% in 2Q22 to 41.0% in 3Q22. This marked the lowest share in 8 years since 3Q14 based on IDC data. On the other hand, SK Hynix and Micron Technology, which rank second and third in terms of market shares, showed relatively modest declines compared to Samsung Electronics. (Laoyaoba, Pulse News, Business Korea)

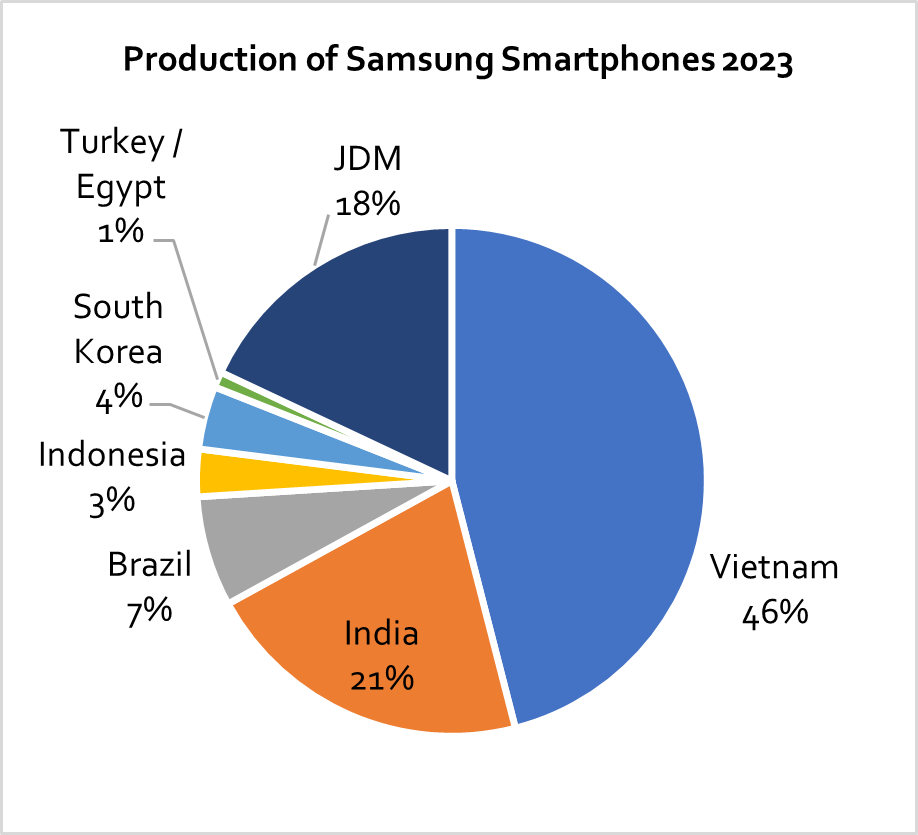

Samsung will continue to diversify its global production bases. It is reportedly to reduce the proportion of its smartphone production in its Vietnam factory from 50% in 2022 to 46% in 2023. In 2021, Samsung Vietnam even accounted for 60% of its total smartphone production. Samsung’s Vietnam production usually supplies the markets in North America and Europe. The reason for reducing the proportion of Vietnam and distributing production around the world is to minimize damage in the event of uncontrollable external factors such as an epidemic. The goal is to create a system that enables rapid replacement production in other regions even if a specific factory is shut down. In the future, Samsung’s production base in India will account for 21% or 68M units of Samsung’s total smartphone production India is the second largest producer of smartphones. India accounts for 21%, Brazil (Manaus, Campinas) 7%, Indonesia 3%, and Turkey 1%. The Gumi (South Korea) plant is responsible for 3% of the total mobile volume and continues its role as the flagship production control tower. Samsung’s joint development manufacturer (JDM) in China aims to increase its production volume to account for 18% of the total with 60M units. (Laoyaoba, EMS Now, Digitimes, ET News)

Google has agreed to pay USD391.5M settlement to 40 US states over a location tracking dispute. Google has misled its users into believing that they have turned location tracking off. However, Google still continued to collect the users’ location information. As part of the settlement, Google has also agreed to improve its location tracking disclosures and user controls significantly starting 2023.(Android Authority, Apple Insider, Neowin, DOJ, The Register, TechCrunch)

Meta Platforms is exiting its Portal smart display business and will wind down work on smartwatch projects. The Facebook parent has aimed to shed costs as it refocuses on metaverse technologies and concedes to a global slowdown in advertising sales.(MacRumors, Android Authority, Android Central, Reuters)

Geely Holding, Geely Automobile and Renault Group have signed a non-binding framework agreement to create a new global leader to develop, manufacture and supply best-in-class hybrid powertrains and highly efficient ICE powertrains. The new company will be a standalone global supplier of propulsion system solutions, producing next generation hybrid propulsion systems, and developing carbon free and low-emission technologies from five global R&D centres. At launch, the new company is expected to supply multiple industrial customers including Renault, Dacia, Geely Auto, Volvo Cars, Lynk & Co, Proton, and also Nissan and Mitsubishi Motors Company. In future, the partnership could also offer powertrain technologies to third-party car brands. (Laoyaoba, WSJ, Sohu, Jiemian, Globe Newswire, Reuters)

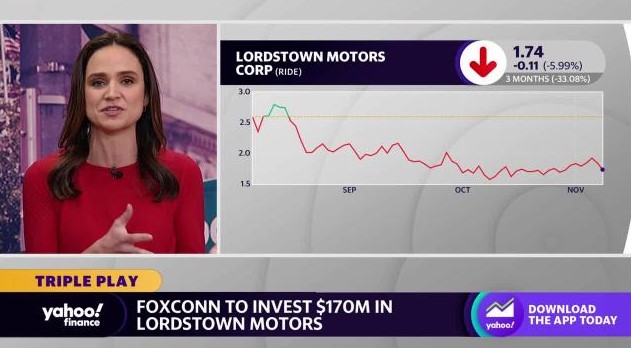

Lordstown Motors has entered into a deal under which Foxconn Ventures, an affiliate of Foxconn, would invest up to USD170M in the electric vehicle maker, which would make the Taiwanese contract manufacturer its largest shareholder. Lordstown will use the proceeds from the share sales to fund development and design activities for a new electric vehicle program in collaboration with Foxconn, scrapping its earlier joint venture deal with the manufacturer. Foxconn started manufacturing Lordstown’s Endurance pickup trucks in Sept 2022 after buying the U.S. company’s Ohio facility. The deal was prompted by the need to clinch funds essential for the start of production of Endurance.(Laoyaoba, Lordstown Motor, Reuters, Bloomberg, TechCrunch, CNBC)

The MIH Consortium, an alliance organized by Foxconn Electronics specifically for promoting development of electric vehicles (EVs), cooperated with US-based accelerator Techstars has introduced 10 international EVs. According to MIH, among the relevant startups selected from the first batch of programs, the top three will be awarded MIH Entrepreneurship Ambassadors. The three ambassadors are Israel’s C2A Security, which focuses on IoV (Internet of Vehicles) network security, Germany’s DeepDrive, which is engaged in EV powertrain development, and American EV developer Olympian Motors. They will be selected as MIH contributing members, participate in MIH working groups, and have the opportunity to discuss PoC (Proof of Concept) project opportunities with MIH, as well as investment opportunities from Foxconn.(Laoyaoba, PR Newswire, Reuters, Digitimes)

Alibaba’s logistics arm Cainiao has announced a development plan for Brazil on Monday, including the proposed opening of a Latin American headquarters in Sao Paulo. The company said in a press release that it plans to launch nine distribution centers in the country and add 1,000 smart lockers across ten key cities for package and food delivery. Cainiao claims its local express delivery network covers over 1,000 Brazilian cities, offering customers one-day delivery in Sao Paulo and several major hubs in partnership with local delivery companies.(TechCrunch, CNBC, TechNode, SCMP, Sohu)

New York-based venture platform Modus has launched Modus Africa, a venture capital fund for AI and blockchain startups across sub-Saharan Africa. The fund is expected to reach its first close in 1Q23. Modus says that its entry into Africa creates an “additional conduit of market access for Modus portfolio companies while also enabling African startups to scale into the MENA region”. (TechCrunch, TechNext, Modus)