11-23 #FFF : TSMC is developing a new USD12B investment in a new plant in Phoenix; TSMC’s wafer prices for 3nm topping USD20,000; Samsung halts Vietnam smartphone factory for a fortnight in Dec 2022; etc.

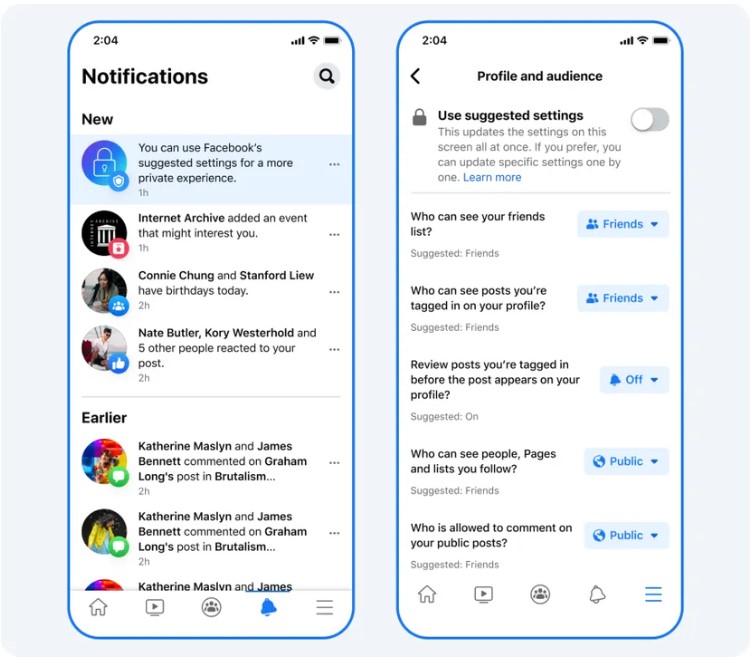

Facebook will enable more private settings by default for anyone under the age of 16 who signs up for the platform. As for teens who already have accounts, Facebook will display a prompt encouraging them to use these settings, as well as a toggle that turns them on in a single tap. What Facebook’s billing as “more private” settings restricts details on an account so that only a teen’s friends can view the posts they are tagged in, their friends list, and the pages, people, and lists they follow. They also require users to review the posts they’re tagged in and allow only friends to comment on their public posts.(The Verge, Facebook)

The U.K.’s Competition and Markets Authority (CMA) has formally launched a probe into potential market duopoly by Google and Apple involving their mobile web browsers, reinforcing concerns that their practices require government intervention. In Jun 2022, the CMA consulted on launching a probe into both companies’ duopoly in mobile ecosystems. The CMA cited industry concerns that Google and Apple have exercised a stranglehold over Android and iOS, app stores, and mobile web browsers. The consultation has resulted in “substantial support for a fuller investigation into the way that Apple and Google dominate the mobile browser market and how Apple restricts cloud gaming through its App Store”. The majority of responses came from browser vendors, web developers, and cloud gaming service providers. (Android Central, Apple Insider, UK Gov)

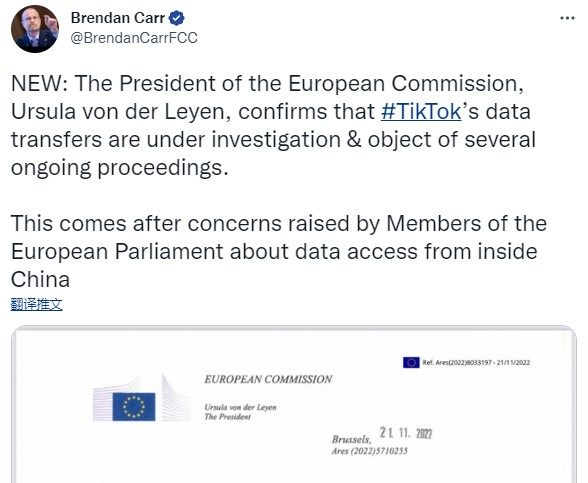

The president of the European Commission, the executive branch of the European Union, Ursula von der Leyen has confirmed there are multiple ongoing investigations into TikTok. The probes concern the transfer of EU citizens’ data to China and targeted advertising aimed at minors. Investigators are seeking to ensure that TikTok meets General Data Protection Regulation (GDPR) requirements. (Engadget, Twitter)

The Spotify-acquired podcast hosting platform Anchor is introducing the new one-tap Audio Enhancement feature, which will help podcast creators drown out the noise and improve their vocal clarity. Touted as a valuable audio editing tool, Audio Enhancement will help users create podcasts in a single tap by eliminating background noise and bringing the creator’s voice to the forefront after leveling it to acceptable standards.(Neowin, Anchor.fm)

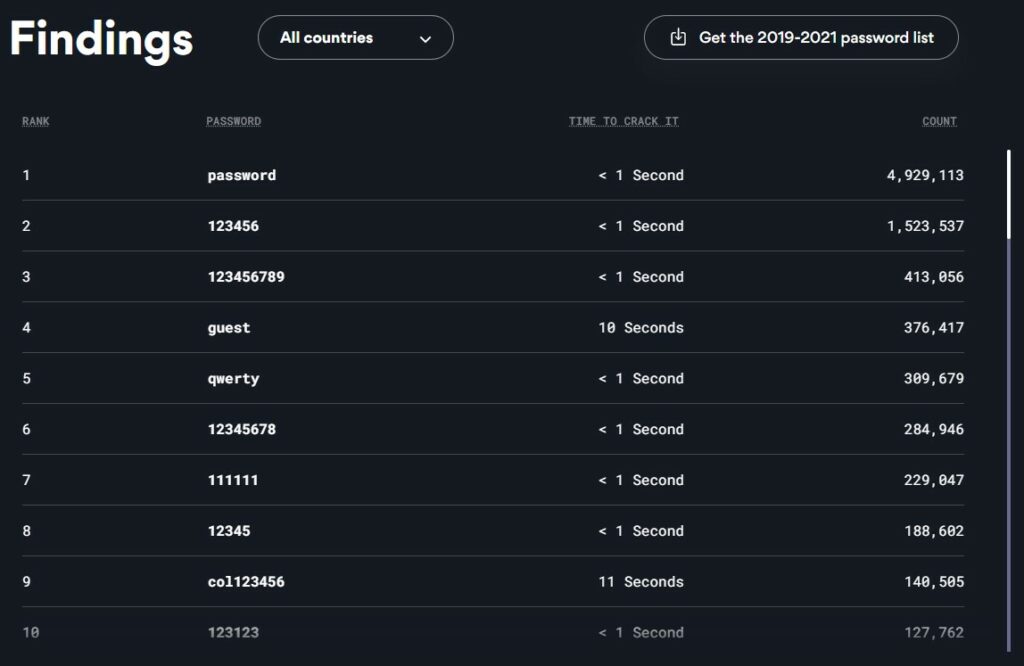

Password manager service NordPass has recently conducted a study to determine the weakest password of 2022. The company worked with independent cybersecurity researchers to evaluate a 3TB database and compile a list of commonly used passwords. The study covered 30 countries, including Australia, Brazil, Canada, France, Germany, India, Japan, Mexico, the UK, and the US. Topping this list from NordPass are the usual suspects — password, 123456, and 123456789. These are the three most commonly-used passwords around the world. (Android Headlines, Nordpass)

Samsung Electronics will be halting the operation of their smartphone factory in Vietnam for a fortnight in Dec 2022. Other than when the COVID-19 infection situation was at its peak, Samsung had never ceased operations in their smartphone factory for over 2 weeks. It is thought that they are adjusting inventory due to the lack of smartphone sales. Samsung Electronics is strongly considering stopping the operation of its 2 factories in the provinces of Thai Nguyên Province and Bắc Ninh province for over 2 weeks. Samsung’s smartphone factories in Vietnam are the world’s biggest smartphone manufacturing bases, responsible for half of all mobile devices from Samsung. It appears that these Vietnamese factories are due to stop operations from mid-Dec 2022 to 2 Jan 2023. Samsung plans to take a break to check inventory at the end of Nov 2022.(Laoyaoba, ET News, Digitimes, EMS Now)

Pegatron has stepped up the construction of its new plant in India at the request of customers, according to company chairman TH Tung. He said that due to China’s long-term and continuous zero-COVID dynamic adjustment policy, more and more customers are firmly asking suppliers to transfer production capacity to Southeast Asia or India. Pegatron has started producing smartphones at its new factory in India, albeit a small one, and will adjust its production lines to increase output, the sources said. However, he said it was too early to judge the extent of the increase. (Laoyaoba, UDN, Mirror Media, Digitimes)

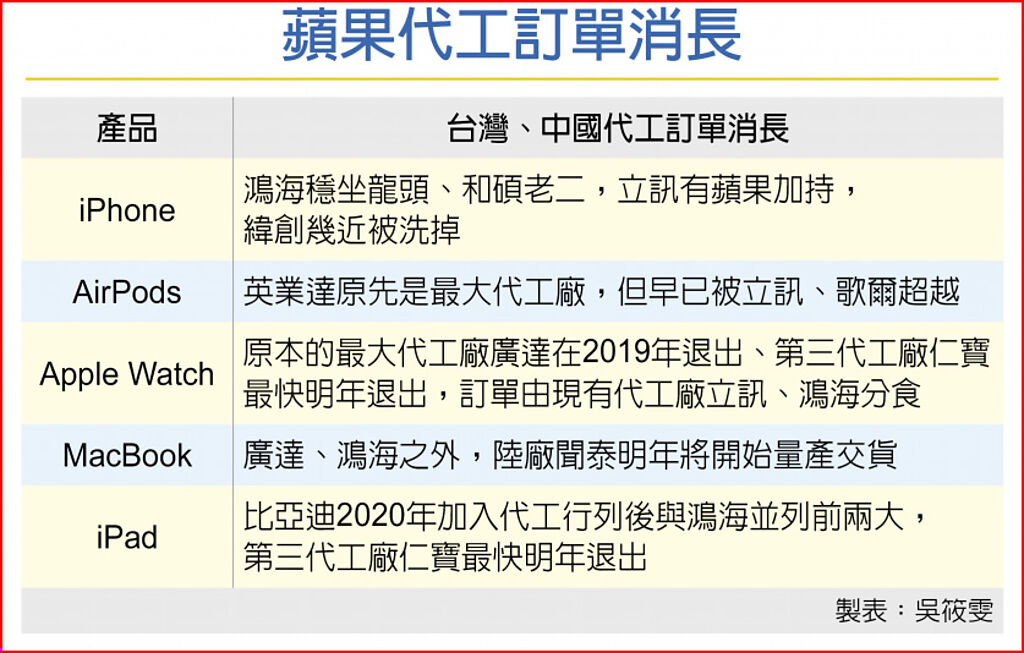

Apple’s Chinese supplier Luxshare Precision has recently acquired part of the iPhone assembler Pegatron’s factory in Kangqiao Industrial Zone, Shanghai’s Pudong district. In 2011, Luxshare Precision entered the Apple supply chain for the first time through acquisitions and became an iPad cable supplier. In 2017, the company obtained the AirPods manufacturing qualification, and then became the largest AirPods assembler. In 2020, it expanded its assembly business through the acquisition of Kunshan Weixin, and become Apple’s third largest iPhone assembly company. (Laoyaoba, Laoyaoba, UDN, China Times)

Samsung Electronics’ and LG Electronics’ inventory assets increased in 3Q22. This is because they increased raw material procurement in order to reduce supply chain risks, and the global demand for their products is not recovering amid the ongoing recession. Those of Samsung Electronics totaled more than KRW57T in 3Q22 with a YoY increase of 51.6%. Its inventory assets have continued to increase since the outbreak of COVID-19. Specifically, the figure was approximately KRW6.9T in 3Q19, KRW5.8T in 4Q19, KRW32T in 4Q20, and KRW41T in 4Q21. In 3Q22, the inventory assets of LG Electronics increased 12.5% YoY to KRW11.2T. Those of this company were less than KRW5.9T at the end of 2019 but increased to KRW7.4T and KRW9.7 T at the ends of 2020 and 2021, respectively. (Laoyaoba, Business Korea)

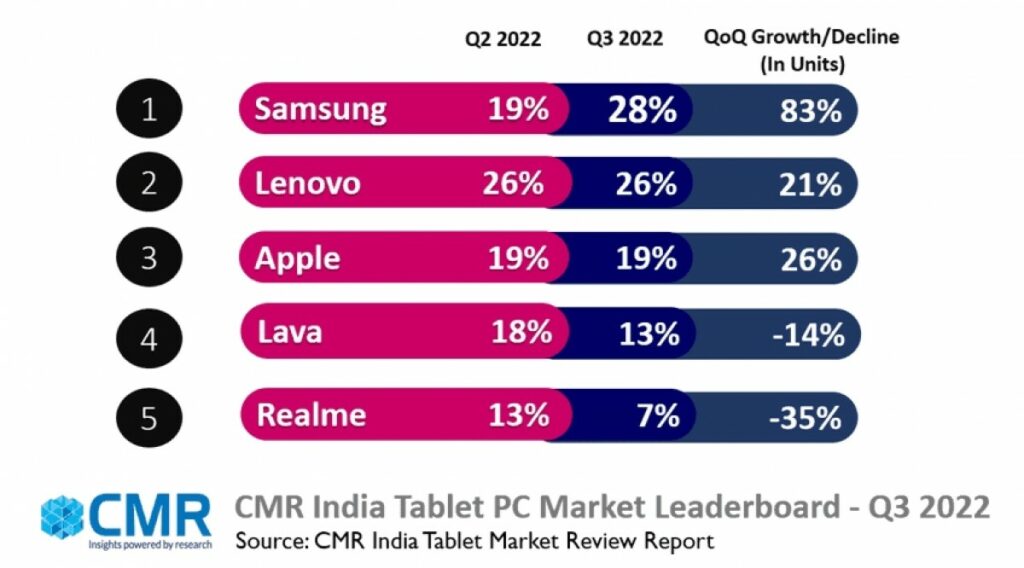

According to CMR India, the India Tablet market grew 22% QoQ, with 5G-capable tablet shipments picking-up steam in the run-up to the festive season. Shipments of 5G tablets continued to gain strength in 3Q22. This is driven by the recent 5G auctions, and the beginning of a 5G era. The growth in 5G Tablets is consistent with the trends seen in the 5G smartphone market. Shipment of Tablets with 8-inch display constituted 43% of the overall shipments in the Indian market. Samsung (28%), Lenovo (26%) and Apple (19%) captured the top 3 spots in the tablet leaderboard in 3Q22. (GSM Arena, CMR India)

Motional, the autonomous vehicle joint venture between Hyundai and Aptiv, is bringing its robotaxis to Los Angeles, where they will be available to hail through the Lyft app. The service is comprised of Motional’s fleet of Hyundai Ioniq 5 electric vehicles, which will be fully autonomous at the time of launch and not require a human safety driver behind the wheel. (The Verge, Reuters, Lyft)

Nuro, the autonomous delivery startup, is laying off 20% of its staff, or about 300 employees. The company founders founders Jiajun Zhu and Dave Ferguson have said the company grew too rapidly in the past year thanks to an abundance of capital and a growing sense of competition. However, Nuro has since run into economic headwinds that are challenging the entire tech industry, and it could no longer sustain the size of its workforce. (The Verge, Medium, TechCrunch)

Adalberto Maluf, director of marketing and sustainability for BYD’s Brazilian subsidiary, said BYD is in talks with the Brazilian state government of Bahia about acquiring the plant that Ford will stop operating in Jan 2021. Maluf said the state government still has issues to resolve and has yet to develop a national electric vehicle travel plan and minimum sales targets to justify the decision to nationalize production. The Bahia state government said BYD would build electric bus and truck chassis, as well as electric and hybrid cars, at three plants with an investment of BRL3B (USD550M), and would also process Brazilian lithium for vehicle batteries for export to China. (Laoyaoba, Reuters, Techgoing)

Boston Dynamics alleges that two models of robotic dogs made by Ghost Robotics infringe as many as 7 patents for “core technology” used in Boston Dynamics’ four- and two-legged robots such as Spot, designed for industrial and commercial uses. The lawsuit targets Ghost Robotics’ quadrupedal unmanned ground vehicles, or Q-UGVs—specifically its Vision 60 and Spirit 40 products—according to a complaint filed 11 Nov 2022 and docketed Monday in the US District Court for the District of Delaware. (TechCrunch, Twitter, Bloomberg Law)

John Neuffer, President and CEO of the US Semiconductor Industry Association (SIA), has pointed out that the resilience of the global semiconductor supply chain can be demonstrated in many ways. For example, consumer electronics is currently in a weak state to a certain extent, and the new energy vehicle industry is a significant growth point. In the future, since the development of new energy vehicles and autonomous driving will rely heavily on the integration of the semiconductor industry, the chip industry will remain the most dynamic industry. He said that at present, the “self-sufficiency” and “localization” of the semiconductor supply chain have become the focus of global discussions, but no country can independently complete the upgrade of the entire industrial chain and ecosystem. The vigorous development of the global semiconductor industry is precisely the result of the global division of labor. Among them, Japan has established its position in equipment and materials, South Korea’s memory, and Taiwan’s foundry are also very distinctive. At the same time, the development of China’s semiconductor industry has also come a long way and has become the world’s largest consumer of electronics. (Sohu, China.org, Laoyaoba)

TSMC is reportedly receiving orders for vehicles, and it is reported that it has replaced Samsung and won a large order for Tesla’s new generation of fully automatic driver assistance (FSD) chips, which will be produced at 4nm / 5nm. Tesla is expected to become one of TSMC’s top 7 customers in 2023. It is the first time that TSMC’s main customer has a pure electric car factory, which will help resist the impact of consumer electronics boom adjustments. (My Drivers, Electrek, Benzinga, AAStock, UDN)

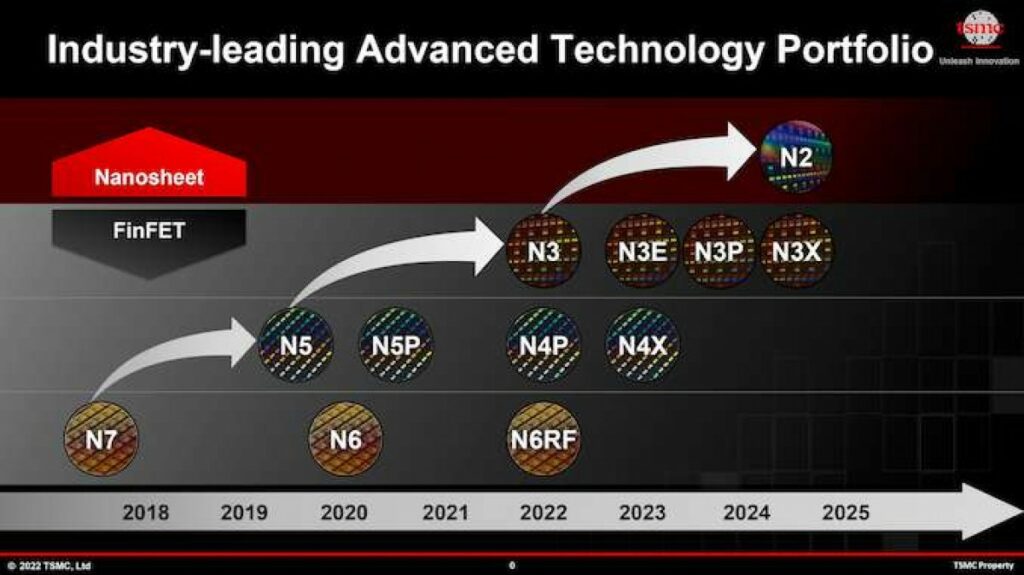

Taiwan Semiconductor Manufacturing Co (TSMC) founder Morris Chang has confirmed his company is developing a new USD12B investment in a new plant in Phoenix, Arizona. The plant will focus on 3nm chip production and will be located in close proximity to the Pheonix wafer fab complex which currently fabs 5nm chip designs. TSMC is already rumored to supply its 3nm chips based on the N3 process for the next-gen Apple iPhone chipsets and Apple silicone SoCs for iPad and Mac computers. The list of potential customers is only expected to grow with time.(My Drivers, TechCrunch, Reuters, GSM Arena, TSMC)

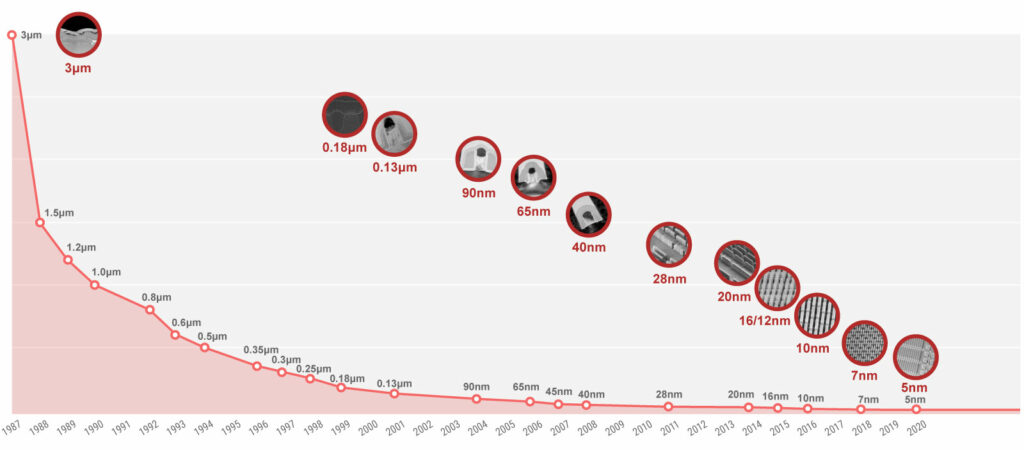

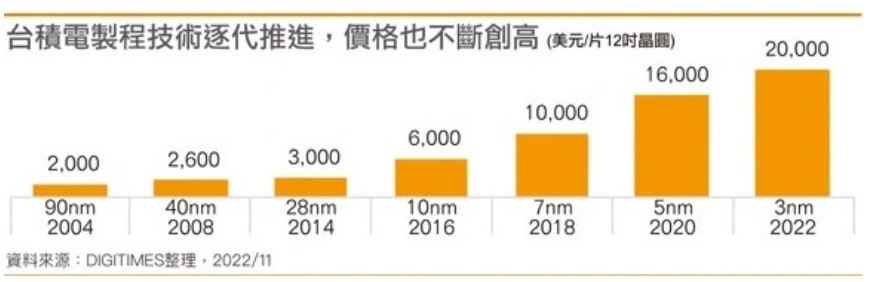

TSMC has seen its sale price per wafer rise exponentially starting from sub-10nm process nodes, with wafer prices for 3nm topping USD20,000, according to Digitimes. Generally, a 12” large wafer can cut at least hundreds of complete and usable finished chips, that is, the foundry quotation of a 3nm chip is at least hundreds or thousands. If the costs of research and development, tape-out, packaging, loss reporting, and marketing are added later, it will be even more expensive. TSMC has prepared at least five processes on 3nm, followed by N3E, N3P, N3X and N3S. Among them, N3E is the second generation of 3nm. The performance is 18% higher than that of 5nm, the power consumption is reduced by 34%, and the density is increased by 70%. The mass production time is expected to be in 2Q23-3Q23. (Digitimes, My Drivers)

Silicon Frontline Technology has announced that they have been accepted as a partner in Samsung Foundry SAFE Program. Through in-depth collaboration, Silicon Frontlines’ ESRA CDM has been certified in Samsung Foundry process to down to 4nm technology. Samsung Foundry had yield-related issues with its 4nm and 5nm process nodes, and Samsung does not want that to happen with its 3nm process node. Silicon Frontline will reportedly help Samsung Foundry with the front-end process and chip performance improvement.(My Drivers, Design Reuse, Donews, SamMobile, Naver)

Several companies and institutions in China have discussed utilizing graphene-based technology that should replace existing silicon-based chips and have created a consortium to tackle these issues domestically. With the limitations of silicon-based semiconductor technology looming each year, companies are devising ways to produce more robust and more efficient chip technology in the future. The Chint Group, Shanghai Electric Cable Institute, Shanghai Graphene Industry Technology Functional Platform, and many other institutions will work together to usher in graphene-based chips in the future. Graphene comprises an individual layer positioned “in a hexagonal lattice of carbon atoms”. Graphene is 200 times stronger than steel. The strength is unmatched compared to silicon. At the same time, thermal and electrical conductivity is better than copper, which would be essential in the development of not only semiconductor chips, but thermal heat dissipation, efficient batteries, and more. Lastly, graphene is lightweight, measuring less than one milligram per square meter. (Digital Trends, WCCFtech, My Drivers)

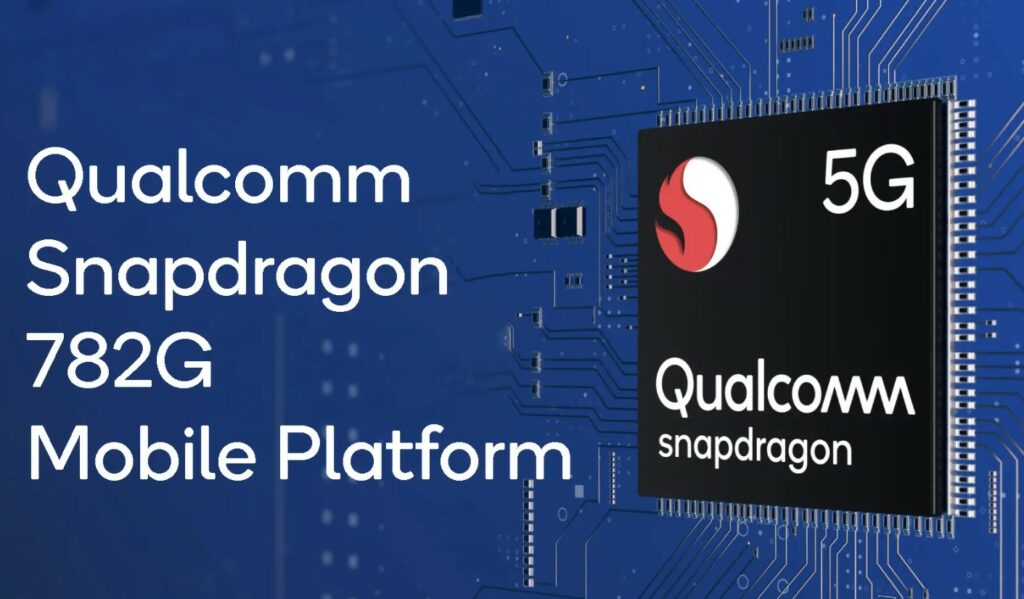

Qualcomm has announced Snapdragon 782G, which brings improvements to the CPU, raising performance from 2.5GHz to 2.7GHz when compared to its predecessor. In addition to a 5% improvement in CPU performance, Qualcomm claims its GPU is 10% faster than the Snapdragon 778G Plus. It is a 6nm chip with a Kryo 670 processor and an Adreno 642L, like the 778G Plus. Some other benefits include amplified performance, improved AI, simultaneous capture from three cameras with processing up to two gigapixels per second, and smooth connectivity support for mmWave and Sub-6 GHz frequencies.(My Drivers, Android Authority, Qualcomm)

Netherlands-based ASML Holding NV, a leading global supplier of chipmaking machinery, has announced plans for a factory in New Taipei City to support international customers and the development of the semiconductor industry. The first phase investment amounts to NTD30B, with about 2000 employees. ASML is building a USD181M chip cluster in Hwaseong, about 40km south of Seoul, which would include a local repair center, training center, research and development center for parts, and education and experience center. (Laoyaoba, Focus Taiwan, Taiwan News, Taipei Times)

LG Display (LGD) has announced a new superthin sound technology that can turn any surface inside car into “invisible” speakers, dubbed “Thin Actuator Sound Solution (TASS)”. LGD calls it “film-type exciter technology” that comes in passport-sized panels (150mm x 90mm x 2.5mm) that can be embedded into a car’s interior, such as dashboards, headliners, pillars, and headrests. LGD says that the thin TASS can vibrate off of almost any surface inside the car to create sound. And at just 30% of the weight and 10% of the thickness of conventional car speakers, this can open up all kinds of options for placement, which will lead to a more immersive sound experience, while also freeing up space inside door panels and other traditional automotive speaker placement locations.(Engadget, Digital Trends, LG Display)

Google is reportedly still developing its first foldable device. The foldable device is expect to feature “usual Pixel-esque performance”, as well as camera technology that are present on Google’s current phones. Google’s foldable phone will be available in Chalk (white) and Obsidian (black). It will also reportedly cost USD1,799. The device’s release is set for May 2023. (Neowin, Front Page Tech)

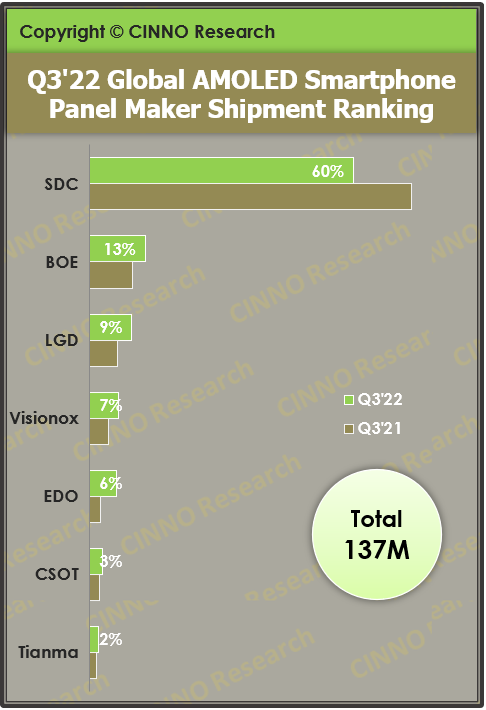

According to the survey data of CINNO Research, in 3Q22, the shipment of AMOLED smartphone panels in the global market was about 140M pieces, a YoY decrease of 4.8%, and a QoQ increase of 9.1%. The YoY decline continues, and the shipments of AMOLED smartphones in the global market in the first three quarters of 2022 all showed negative growth. Samsung Display (SDC) shipped about 82.5M AMOLED smartphone panels, down 21.9% YoY and 6.2% MoM, and its market share narrowed from 73.3% in the same period in 2021 to 60.1%. First, but its regional industry status is not unshakable, especially in the Chinese market, whether it is rigid or flexible AMOLED panels, Samsung Display’s shipments to domestic mainstream Android brands have dropped sharply. (Laoyaoba, CINNO Research)

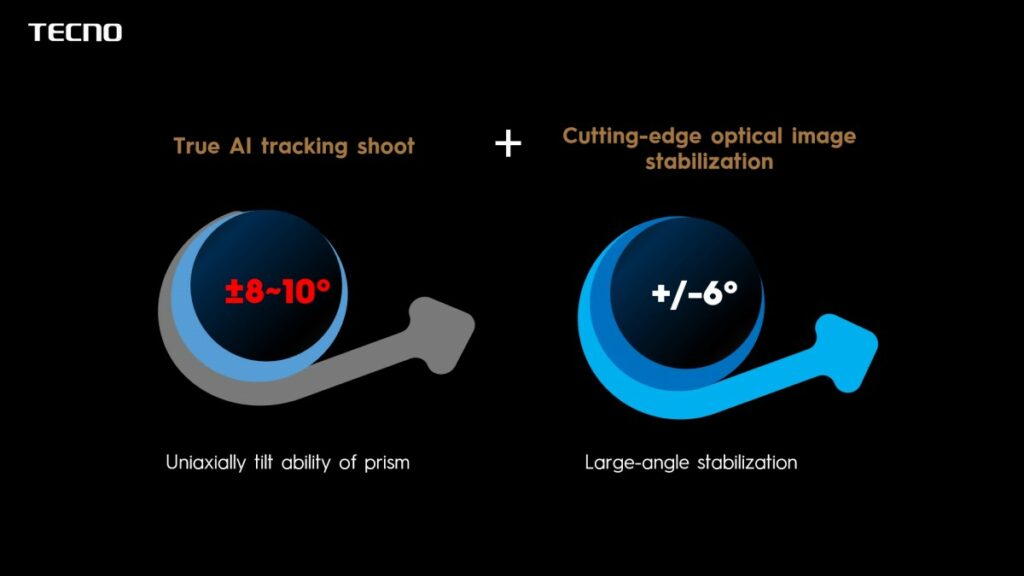

Tecno unveils Eagle Eye Lens, which is a system of two prism instead of one. Each prism can rotate along one axis – one can do +/-8°, the other +/-10°. With the two prisms combined the camera is able to automatically track an object – by as much as +/-16° on one axis and +/-20° on the other. The system also handles optical stabilization of course, correcting movements in the +/-6° range. Both OIS and object tracking are automated by AI. Tecno is working on premium smartphones with the Eagle Eye tech, which will debut in 2023. (GSM Arena, SBenny)

Lyft is partnering with Redwood Materials, a battery recycling company, to ensure its fleet of shared e-bikes and scooters have a second life. It is a noteworthy deal considering Lyft’s status as the largest electric bike-share operator in North America thanks to its bike-share business, including the extremely popular Citi Bike in New York City. In addition to breaking down scrap from Tesla’s battery-making process with Panasonic, Redwood also recycles EV batteries from Ford, Toyota, Nissan, Specialized, Amazon, and others.(The Verge, The Register, Teslarati)

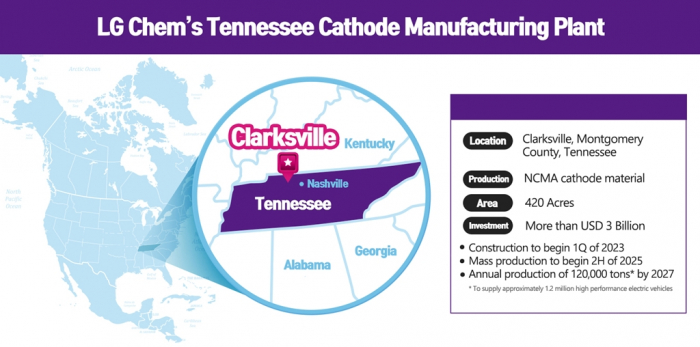

LG Chem, South Korea’s largest chemicals maker, has said that it is building a USD3.2B cathode plant in Tennessee, its first factory for the battery component in the US, to meet growing demand and respond to the rapidly changing business conditions in North America. The company will establish a factory capable of producing 120,000 tons of cathode materials per year, which can source batteries to power about 1.2M units of all-electric performance vehicles over a space of 1.7M square meters (420.08 acres) in Clarksville, Tennessee. Construction will begin in the first quarter of next year to start mass production by the end of 2025. Through expansion, capacity would be raised to 120,000 tons by 2027. LG Chem aims to expand its revenue from battery materials business to KRW20T by 2027 from an estimated KRW5T in 2022.(My Drivers, Inside EVs, Electrek, KED Global, Pulse News)

VinES Energy Solutions (a member of Vingroup) and Gotion (a wholly owned subsidiary of Gotion High-Tech), held the Groundbreaking Ceremony the LFP battery cell factory in Vung Ang Economic Zone (Ha Tinh). The project has a total investment of more than VND6,329B (USD275M), a scale of 14 hectares (34.5 acres) with a design capacity of 5GWh/year, equivalent of approximately 30M battery cells per year. The factory’s products are rechargeable LFP (Lithium Iron Phosphate) battery cells, mainly used for EV batteries and energy storage systems (ESS). The facility will be the first LFP battery plant in Vietnam and will begin mass production in 3Q24. (Laoyaoba, Electrek, Batteries News, Electrive)