12-10 #VideoGames : TSMC’s overall fab capacity utilization rate in 1H23 is expected to drop to 80%; Dutch officials are allegedly planning new controls on exports of chipmaking equipment to China; Xiaomi, OPPO, and vivo have reportedly agreed to export devices made in India to their other markets; etc.

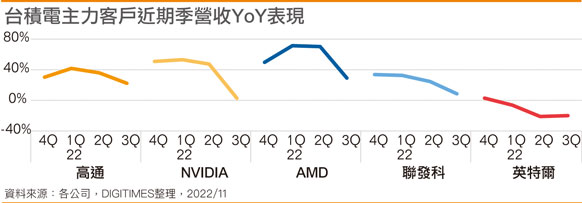

According to DigiTimes, TSMC’s overall fab capacity utilization rate in 1H23 is expected to drop to 80%, with the 7 / 6nm process capacity utilization rate falling further, and the 5 / 4nm capacity utilization rate declining MoM from Jan 2023. According to JPMorgan Chase, TSMC will fall into a deeper trough in 1H23, and its revenue in US dollars in 1Q23 and 2Q23 will drop by 9% and 12% from the previous quarter, respectively. TSMC’s 7 / 6nm process capacity utilization has been declining for most of 4Q22 as key customers such as AMD, MediaTek, Qualcomm, and Apple cut orders or shifted to 5 / 4nm processes. As a result, its 5 / 4nm process capacity will remain fully utilized in 4Q22, which will keep the foundry’s 4Q22 revenue performance flat compared to 3Q22. Yet major customers are cutting new orders for 5 / 4nm chips in 2023. In addition, it is reported that the utilization rate of TSMC’s 40 / 45nm, 28nm and 12 / 16nm process capacity is also declining. (Digitimes, Laoyaoba)

Dutch officials are allegedly planning new controls on exports of chipmaking equipment to China, potentially aligning their trade rules with US efforts to restrict Beijing’s access to high-end technology. The Dutch foreign trade ministry and the White House’s National Security Council declined to comment. The Dutch move, which would essentially codify and potentially expand its unofficial ban on some technology sales to China, is a step toward bulking up US efforts to limit Beijing’s chipmaking and military ambitions. The Netherlands and Japan are the world’s top suppliers, outside the US, of machinery and know-how needed to make advanced semiconductors, but Washington is yet to get those allies fully on board. The new export limits under consideration by the Netherlands could bar the sale of equipment capable of making chips designated as 14nm or those that are more advanced. (Laoyaoba, My Drivers, Digitimes, Reuters, Yahoo, NASDAQ)

South Korean chip foundries are seeing the operation rate of their fabs drop steeply. With the exception of Samsung, which is still seeing high demand from advanced nodes, local foundry companies such as DB Hitek, Key Foundry, Magnachip, and SK Hynix System IC are seeing their operation rate drop. This drop started in 4Q22 and is expected to dip more during 1H23. DB Hitek’s operation rate is currently in the 80% range, it was 95% during 3Q22. DB Hitek’s fab operation rate was 81.9% in 2017 and increased to 91% in 2018, 94.5% in 2019, and 97.9% in 2020. It marked 96.7% in 2021 and 97.9% during 1H22. The company benefitted from the chip shortage and high demand for consumer electronics during the pandemic. The operation rate of Key Foundry, Magnachip, and SK Hynix System IC has also dropped to around 70-80%. SK Hynix System IC, which has its fab in Wuxi, China, was especially seeing a steep decline. (My Drivers, The Elec, ETToday, TechNews, LTN)

With foundries’ price negotiations with IDMs and tier-1 suppliers for 2023 reaching an end, foundries are unlikely to cut their prices and the chip vendors will have difficulties passing the extra costs fully to their automaker clients, according to Digitimes. IDMs typically negotiate, sign and execute contracts with OEM partners on behalf of mainstream automakers and Tier1. In the past 2 years, they were able to repeatedly increase the quotations of chips shipped to downstream customers to reflect the increase in upstream costs amidst continued shortages in automotive and industrial applications. Many automotive IDM factories initially appealed to renegotiate contracts, strive for more automotive OEM production capacity, maintain or lower prices, etc., but it is estimated that most of them will be difficult to achieve. On the whole, the foundry prices of most automotive chips have not been reduced in 2023, nor have they maintained the level in 2022, but have accepted the rise according to the wishes of the foundries. Some IDMs have told foundry partners that they can accept any market price for foundry services, and even further quote increases, as long as the partners can commit to additional capacity support. (Digitimes, Digitimes, Laoyaoba)

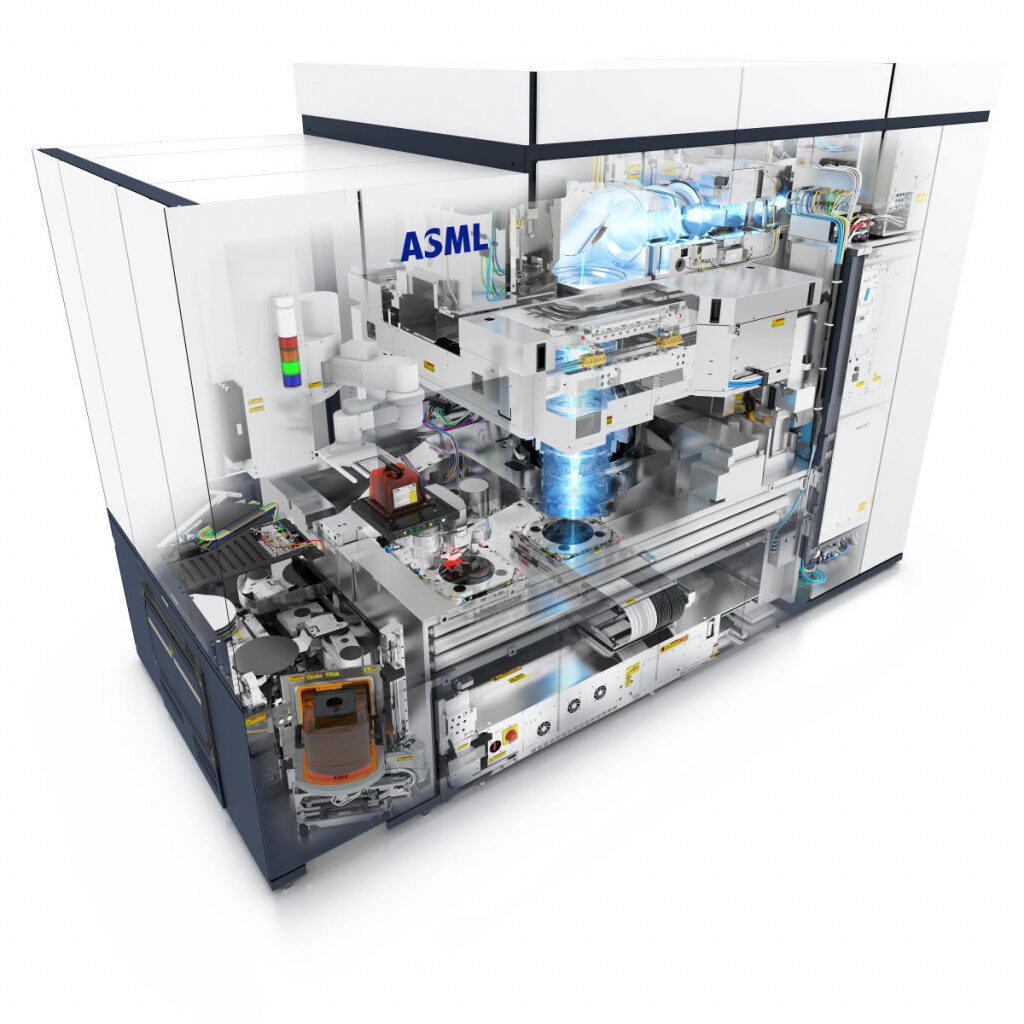

ASML has recently pointed out that the number of ASML’s EUV equipment production has increased from 22 in 2019 to 42 in 2021. It is expected that there will be more than 50 units in 2022, and the number of production units will increase further next year. Initial versions of High-NA EUV equipment will be available late 2023, with production models due in late 2024 or early 2025.(Laoyaoba, Posten, IT Home, Techgoing)

The next instalment of the Samsung Galaxy Z Flip will reportedly feature a bigger outer display and a new hinge mechanism. The ongoing Galaxy Z Flip 4 has a 1.9” cover display with fairly good usability. The Galaxy Z Flip 5, to be launched in 2023, will reportedly have a cover display larger than 3”. In other words, the cover display will be around 60% larger or more. The phone will have a new hinge that should bring at least one benefit: a less visible horizontal crease on the inner foldable display. Samsung aims to ship 26M foldable Galaxy phone in 2023. (Android Headlines, Twitter, Digital Trends, SamMobile)

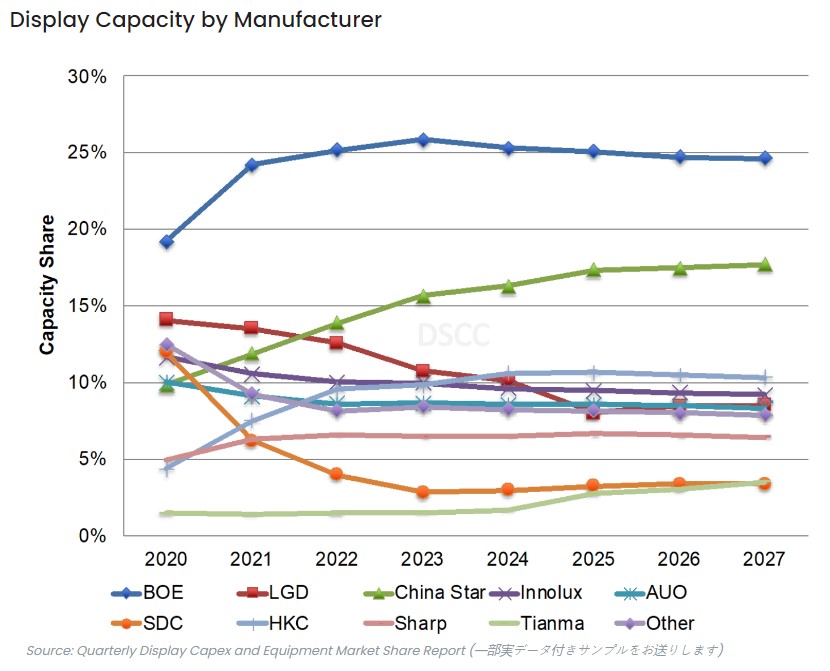

After upgrading display capacity for 6 straight issues on improved market conditions in LCDs, DSCC has now lowered its display capacity forecast for 4 consecutive quarters on delays and cancellations as conditions worsen and remain weak. Prices were recently at marginal costs for LCD TV panels and it is projected that it will take until 2H23 for prices to rise above cash costs. As indicated by DSCC, 2021-2026 display capacity CAGR was downgraded from 3.3% to 2.5%. Both OLED and LCD capacity forecasts came down on fab cancellations and delays. Their latest capacity forecast for 2026 is down 4% vs. their previous forecast and is down 12% vs. peak levels. DSCC has lowered LCD 2021-2026 CAGR from 2.5% to 1.8% with OLEDs reduced from 11.2% to 9.5%. (DSCC, DSCC, press)

Universal Display Corporation (UDC), enabling energy-efficient displays and lighting with its UniversalPHOLED technology and materials, has announced the signing of long-term OLED material supply and license agreements with Samsung Display (SDC), a global display manufacturing leader. These agreements affirm that UDC will continue to supply its proprietary UniversalPHOLED phosphorescent OLED materials and technology to SDC for use in its OLED displays. The agreements are scheduled to run through 31 Dec 2027, and may be extended for an additional 2-year period. Financial terms of the agreements have not been disclosed.(Laoyaoba, Business Wire, OLED-Info)

Beijing-based Dasung has announced the Paperlike U – the world’s first 25.3” curved E Ink screen that the company has to offer this time. The basic specs however remain the same as that of the Paperlike 253, which includes the 25.3” E Ink display though it’s slightly curved this time. The company stated the display comes with 4000R curvature and has 3K 3200 x 1800 ultra-high-definition resolution, and a 16:9 aspect ratio. Dasung has further stated the Paperlike U features the company’s Turbo Ink screen high-brush technology which it said makes the display have similar attributes as that of an LCD display. The Paperlike U offers independent controls for adjusting color temperature and brightness. Plus, the monitor features three front light modes which include warm light, cold light, and mixed light. (Laoyaoba, iFeng, PC Home, Good Reader)

Neuralink, the brain implant company founded by Tesla CEO Elon Musk, is reportedly facing a federal probe over the treatment of animals used in its experiments. A probe was recently opened by the US Department of Agriculture’s (USDA) inspector general and focuses on potential violations of the Animal Welfare Act. Neuralink’s aim is to develop ways for the human brain to interface directly with computers to help treat a range of neurological conditions and even help paralyzed people walk. (The Verge, Reuters)

Fueled by booming electric-vehicle demand and the long-term goal of semiconductor self-sufficiency, China is committed to developing power electronics based on silicon carbide (SiC). To power EVs, China still procures its SiC devices from manufacturers in the United States, Europe and Japan. These include Onsemi, Infineon, STMicroelectronics, Wolfspeed and Rohm. It is anyone’s guess how soon China might be able to flip the supply flow. (Laoyaoba, Yole Group, OJO-Yoshida Report)

Ericsson and Apple have reached a multi-year, global patent license agreement between the two companies. The agreement includes a cross-license relating to patented cellular standard-essential technologies and grants certain other patent rights. Furthermore, Ericsson and Apple have mutually agreed to strengthen their technology and business collaboration, including in technology, interoperability and standards development.(MacRumors, Ericsson)

Microsoft has announced it has acquired Lumenisity, a leader in next-generation hollow core fiber (HCF) solutions. Lumenisity’s innovative and industry-leading HCF product can enable fast, reliable and secure networking for global, enterprise and large-scale organizations. The acquisition will expand Microsoft’s ability to further optimize its global cloud infrastructure and serve Microsoft’s Cloud Platform and Services customers with strict latency and security requirements. The technology can provide benefits across a broad range of industries including healthcare, financial services, manufacturing, retail and government.(TechCrunch, Microsoft)

E-Space, a global space company focused on bridging Earth and space with the world’s most sustainable low Earth orbit (LEO) network, has announced it entered into a definitive agreement to acquire CommAgility from the Wireless Telecom Group. CommAgility is the largest stand-alone developer of embedded signal processing and Radio Frequency (RF) modules, with its own LTE PHY/stack source code for commercial grade 4G and 5G mobile networks, air-to-ground (ATG), satellite communications (satcom) and related applications. Integrating CommAgility’s custom 3GPP 5G NTN (Non-Terrestrial Networks) source code into E-Space’s vertically integrated capabilities will enable E-Space to accelerate 5G NTN, 5G-Advanced and 6G innovation, speed its satellite payload and customer use case development and continuously advance its space-based connectivity solutions. (Laoyaoba, E-Space, PR Newaswire)

Chinese smartphone brands, Xiaomi, OPPO, and vivo have reportedly agreed to export devices made in India to their other markets — a move that could cut a major chunk of manufacturing output from their Chinese facilities. Meanwhile, it will be a boost to the Indian government’s Make in India programme, which has so far attracted leading global manufacturers. The potential overseas markets for the India-made phones of Xiaomi, OPPO, and vivo would be Africa, the Middle East, Latin America, and some parts of Europe, in addition to India’s neighbouring countries like Pakistan. There is a combination of factors that could be driving the move of the three Chinese companies. These factors include more stringent policies against Investments from China and the Production-Linked Incentive (PLI) scheme. In addition, Chinese telecommunication companies are not on the preferred list of suppliers with several of them facing tax investigations. (Gizmo China, India Times, BGR)

Huawei and OPPO have announced the signing of a global patent cross-licensing agreement, which covers cellular standard essential patents, including 5G. OPPO said that they has agreed to a “patent cross-licensing” deal covering technologies including 5G. The deal comes as Huawei accelerates efforts to make money from its assets, including its patent pool.(My Drivers, Huawei, SCMP, Asia Nikkei)

Smart accessories and audio brand Gizmore has announced that it is partnering up with Tres Care. The new collaboration would have both firms launch a unified application that will be for IoT (Internet of Things) products and smartwatches. Tres Care is an AI based health tracking solution and works on providing real time access to health monitoring. The Tres Connect app will be available with Gizmore’s best selling smartwatches. This includes the likes of the GizFit Slate and GizFit Ultra. Furthermore, the company is set to make this application available for these smartwatches. The brand is a known name in the Indian smartwatch market, so the new collaboration aims to offer an improved experience for its customers with more comprehensive data related to health and fitness. (Gizmo China, India Times)

Kodiak Robotics, a leading self-driving trucking company, has announced it has been awarded a USD49.9M, 24-month United States Department of Defense (DoD) agreement to help automate future U.S. Army ground vehicles led by the Army’s Robotic Combat Vehicle (RCV) program. This effort will be in support of vehicles designed for reconnaissance, surveillance, and other high-risk missions. (TechCrunch, PR Newswire, CNBC)